S&P 500

Dow Jones

Nasdaq

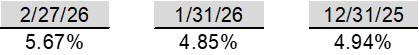

10-Year US Treasury Yield

British Pound per USD

Euro per USD

USD per Yen

Swiss franc per EUR

U.S. News

U.S. Productivity

- U.S. nonfarm business labor productivity rose at a 2.8% annualized rate in Q4 2025, slower than Q3’s revised 5.2% but stronger than the median forecast of 1.8%

- Annual average productivity increased 2.2% in 2025, suggesting that worker efficiency improved meaningfully over the year even as quarterly growth cooled in Q4

- Unit labor costs increased 2.8% in Q4 2025 after falling in Q3. Full-year 2025 unit labor costs rose 1.9%

U.S. Employment

- The U.S. lost 92,000 jobs in Febraury, well below the expected 50,000 increase forecasted by economists polled by the Wall Street Journal

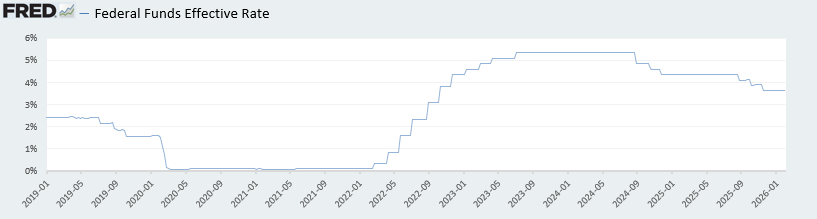

- The job losses increase expectations that the Federal Reserve will cut interest rates, which caused Treasury yields to fall

- The labor market slowed significantly due to federal workforce cuts, business caution, and potential AI impact on hiring plans

Auto Sales

- New light-vehicle sales ran at a 15.8 million seasonally adjusted annual rate in February, down 1.4% year over year. Winter storms in the Mid-Atlantic and Northeast weighed down on activity

- Electic vehicles made up 6.3% of the market year to date through February, down 1.5 points from last year. Hybrid vehicles reached 13.6% of the market, up 1.5 points year over year

- Average monthly payments rose to $811, and more buyers are using 84-month loans, showing that affordability remains a concern for U.S. consumers

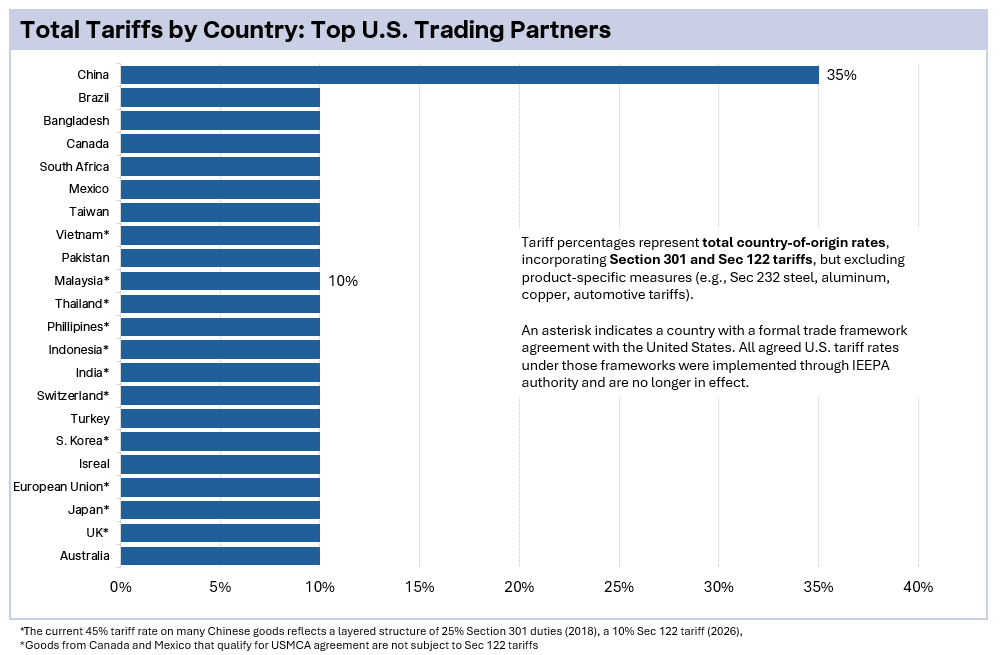

U.S. Tariff & Trade

- The U.S. Court of International Trade issued an order directing U.S. Customs and Border Protection (CBP) to liquidate and reliquidate entries without regard to the IEEPA duties; CBP informed the court its systems cannot currently process the scale of refunds and is developing a new automated process within the ACE portal that is expected to be operational within 45 days. The process would require importers to submit a declaration into the portal listing entries on which IEEPA duties were paid, after which the system would calculate refunds owed with interest and issue payments electronically

- CBP conveyed that “as of March 4, 2026, over 330,000 importers have made a total of over 53 million entries in which they have deposited, or paid duties imposed pursuant to the International Emergency Economic Powers Act.” The total amount of IEEPA duties and estimated duty deposits collected pursuant to IEEPA is approximately $166 billion.

- Only about 21,000 of the more than 330,000 importers eligible for IEEPA refunds are currently enrolled to receive electronic payments through the ACE portal

- A coalition of more than twenty U.S. states filed a lawsuit challenging the administration’s use of Section 122 to impose new global tariffs, arguing the authority is limited to temporary balance-of-payments emergencies and cannot be used to broadly replace the invalidated IEEPA tariffs

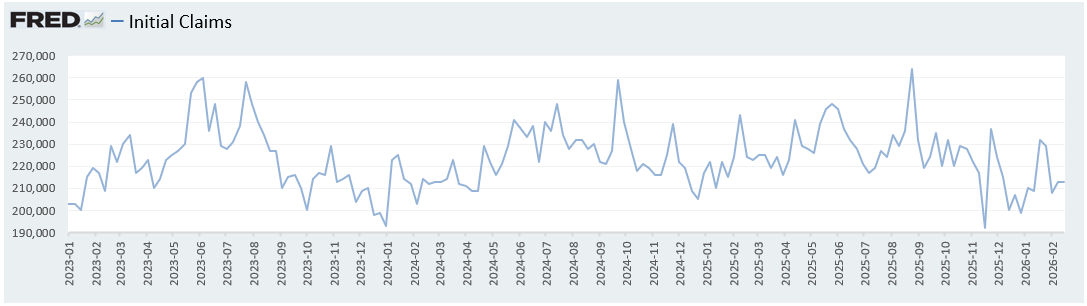

Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., remained flat to 213,000 in the week ended February 27, flat 0,000 from the prior week.

- The four-week moving average was 215,750 down 4,750 from the prior week.

- Continuing claims - those filed by workers unemployed for longer than a week - increased at 1.868 million in the week ended February 20. This figure is reported with a one-week lag.

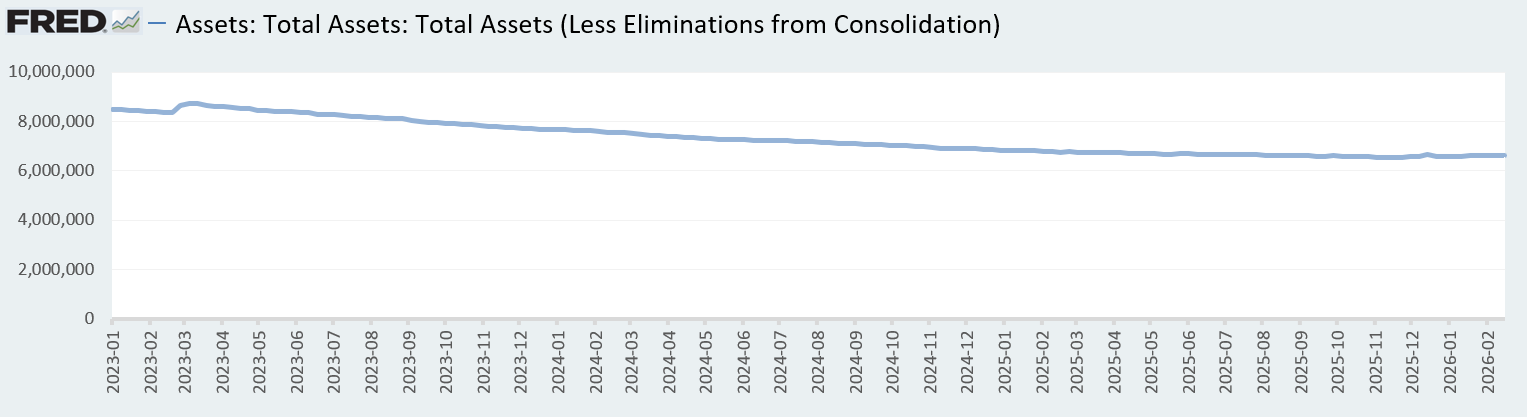

Fed’s Balance Sheet

- The Federal Reserve's assets totaled $6.629 trillion in the week ended March 6, up $15.1 billion from the prior week.

- Treasury holdings totaled $4.330 trillion, up $15.9 billion from the prior week.

- Holdings of mortgage-backed securities (MBS) were $2.01 trillion in the week, down $13.4 billion from the prior week.

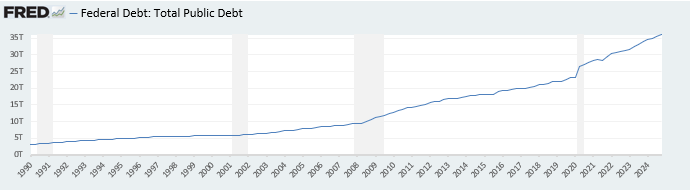

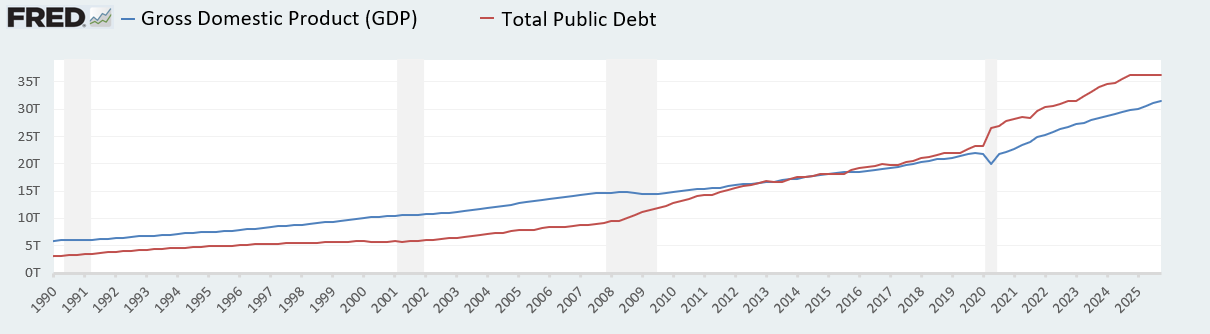

Total Public Debt

- Total public debt outstanding was $38.87 trillion as of March 6, an increase of 7.3% from the previous year.

- Debt held by the public was $31.28 trillion, and intragovernmental holdings were $7.58 trillion

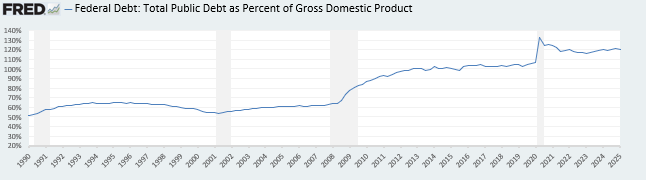

GDP

- The latest annualized U.S. GDP stands at $31.49 trillion as of December 31, 2025, an increase of 1.26% from the previous quarter , & an increase of 5.58% from the previous year

- The total public debt-to-GDP ratio is at 122.31% as of December 31, an increase of 0.87% from the previous year

Inflation Factors

CPI:

- The consumer-price index rose 2.4% in January year over year

- On a monthly basis, the CPI increased 0.2% in January on a seasonally adjusted basis, after increasing 0.3% in December

- The index for all items less food and energy (core CPI) rose 0.3% in January, after rising 0.2% in December

- Core CPI increased 2.5% for the 12 months ending January

Food & Beverages:

- The food at home index increased 2.2% in January from the same month a year earlier, and increased 0.2% in January month over month

- The food away from home index increased 4.0% in January from the same month a year earlier, and increased 0.1% in January month over month

Commodities:

- The energy commodities index decreased (3.3%) in January after decreasing (0.3%) in December

- The energy commodities index fell (7.3%) over the last 12 months

- The energy services index rose 1.4% in January after increasing 1.1% in December

- The energy services index rose 7.2% over the last 12 months

- The gasoline index fell (7.5%) over the last 12 months

- The fuel oil index fell (4.2%) over the last 12 months

- The index for electricity rose 6.3% over the last 12 months

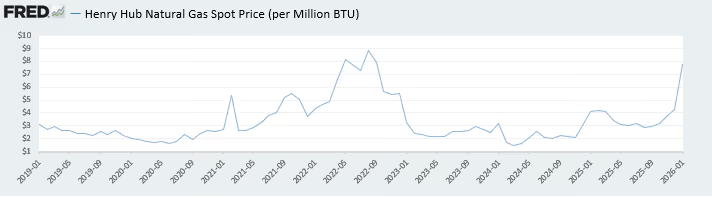

- The index for natural gas rose 9.8% over the last 12 months

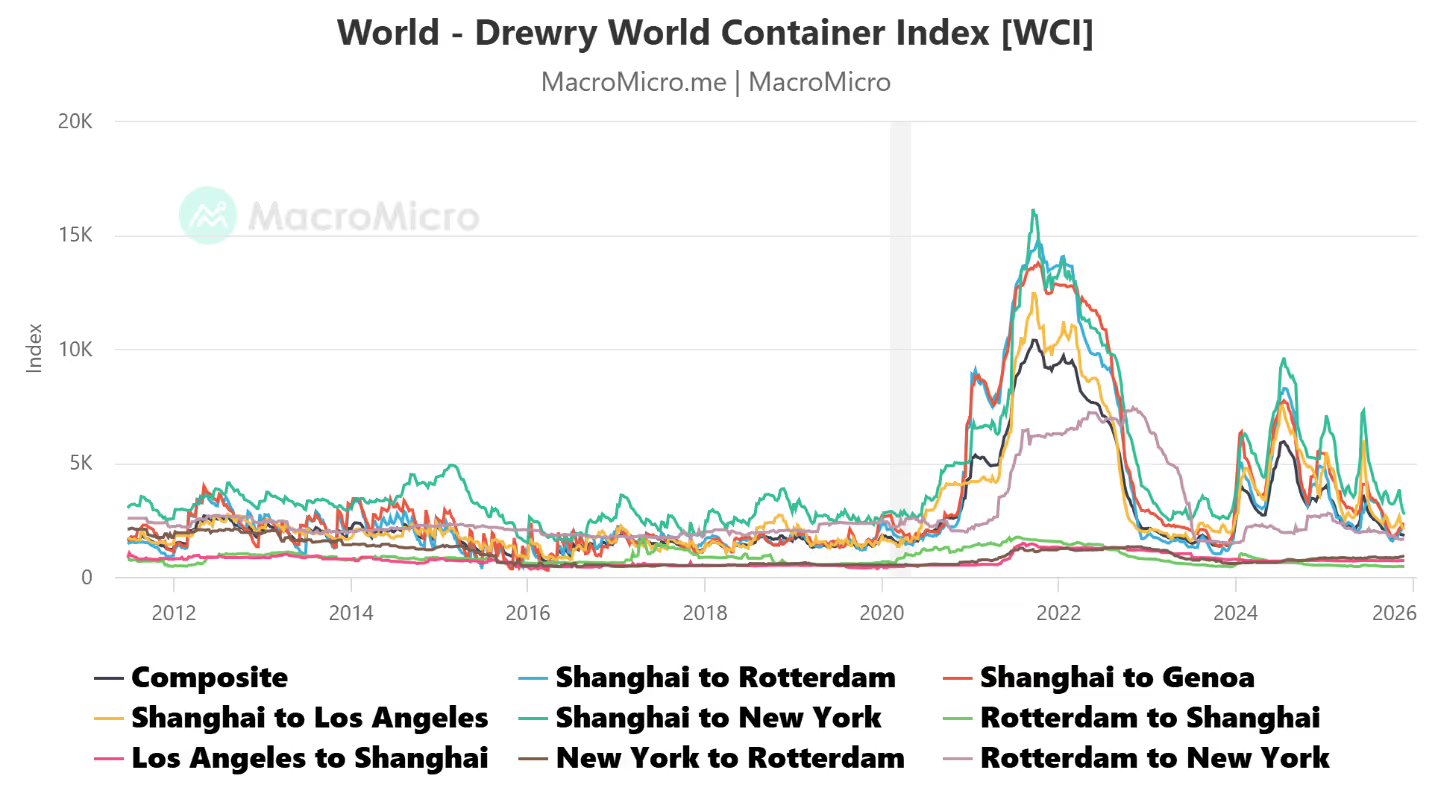

Supply Chain:

- Drewry’s composite World Container Index increased to $1,958.07 per 40ft container for the week of March 6

- Drewry’s composite World Container Index has decreased by (22.9%) over the last 12 months

Housing Market:

- The shelter index increased 0.2% in January after increasing 0.4% in December

- The rent index increased 0.2% in January after increasing 0.4% in December

- The index for lodging away from home increased 2.7% in January after increasing 1.2% in December

Federal Funds Rate

- The effective Federal Funds Rate is at 3.64%, flat 0.00% year to date

World News

Middle East

- Kuwait has started cutting oil production because storage is filling up, highlighting a broader regional storage crunch as exports through the Straight of Hormuz remain constrained. Saudi Arabia and the UAE are also nearing their storage limits

- The longer the disruption to oil production lasts, the greater the risk to global oil prices and supply—especially because shutting in wells is costly and slow to reverse. Analysts warn prices could climb further, potentially above $100 per barrel

- Israel carried out another major wave of strikes on Tehran and Hezbollah sites in Beirut, while Iran launched more missiles toward Israel and struck Azerbaijan, further widening the conflict and increasing the risk on civilians across the Middle East

- Governments and alliances are responding to the escalation with embassy closures, evacuations, stronger missile defenses, and added military deployments across the Gulf

Europe

- Eurozone retail sales unexpectedly dipped in January, falling 0.1% month over month versus 0.2% growth in December, missing expectations for a 0.3% increase. The data suggests that consumer spending remains fragile in Europe

- The weakness was driven mainly by Germany and softer discretionary spending, with lower nonfood and fuel sales offsetting gains in France, Spain, and Italy. Rising energy prices and geopolitical tensions could further pressure confidence

- Russia is benefiting strategically from the Iran war because it is draining the Patriot interceptor stockpiles that Ukraine urgently needs, worsening Ukraine’s air-defense shortfall and leaving the country more susceptible to Russian missile attacks

- Higher oil prices support Russia’s economy while the U.S. and Europe struggle to produce enough air-defense missiles to keep up with mass drone and ballistic-missile warfare

China

- China is signaling a structurally slower growth era, setting a 2026 GDP growth target of 4.5% to 5%, its lowest in decades, as policymakers acknowledge weaker household spending, soft investment, and a prolonged real-estate slump

- Beijing is balancing stabilization with long-term strategic priorities, using fiscal support and targeted stimulus to bolster demand while doubling down on advanced manufacturing, tech self-sufficiency, and export competitiveness amid rising geopolitical and trade uncertainty

- China’s February PMI showed continued contraction in both manufacturing (49.0) and nonmanufacturing (49.5), suggesting the economy remains under pressure despite a slight improvement in the services industry

- Private surveys were much stronger than the official readings, with both manufacturing and services showing expansion, indicating that smaller private firms may be seeing better momentum than larger state-linked sectors

Hungary

- Hungarian authorities briefly detained seven Oschadbank employees and confiscated over $80 million in cash and gold from trucks en route to Ukraine, escalating a conflict between the two countries over oil deliveries

Canada

- Canada and India signed agreements to deepen ties in critical minerals, energy, and trade, aiming to reduce Canada’s reliance on the United States

North Korea

- According to South Korean intelligence, Kim Jong Un’s daughter Kim Ju Ae is increasingly positioned to succeed her father as Supreme Leader of North Korea. Until recently, she was the only child of Kim Jong Un to never be shown in public

Congo

- Eastern Congo is sliding toward mass hunger not from a lack of food, but because M23’s control around Goma has disrupted farming, blocked imports and aid routes, and driven prices sharply higher for civilians

Venezuela

- The U.S. issued a broad license allowing major global energy companies to resume and expand oil and gas investments in Venezuela following reforms to its hydrocarbon law, with revenues structured through U.S.-supervised channels

Japan

- Prime Minster Sanae Takaichi won a landslide victory in parliamentary elections, securing a two-thirds majority in the lower house

Cuba

- Cuba’s President Miguel Diaz-Canel said his government is willing to engage with the Trump administration. The announcement comes during the country’s worst crisis since the fall of the Soviet Union

Egypt

- The Rafah border between Egypt and Gaza reopened, allowing limited two-way traffic. Israel proposed allowing 150 Palestinians to leave and 50 to enter the checkpoint daily

Russia

- Lt. Gen. Vladimir Alekseyev, deputy head of Russia’s GRU intelligence agency, was shot multiple times while in Moscow

Commodities News

Oil Prices

- WTI: $91.28 per barrel

- +36.20% WoW; +21.84% YTD; +37.66% YoY

- Brent: $92.82 per barrel

- +28.06% WoW; +18.17% YTD; +33.63% YoY

US Production

- U.S. oil production amounted to 13.7 million bpd for the week ended February 27, down 0.0 million bpd from the prior week.

Rig Count

- The total number of oil rigs amounted to 551, up 1 from last week.

Inventories

Crude Oil

- Total U.S. crude oil inventories now amount to 439.3 million barrels, up 0.9% YoY

- Refiners operated at a capacity utilization rate of 89.2% for the week, up from 88.6% in the prior week

- U.S. crude oil imports now amount to 6.659 million barrels per day, down 15.6% YoY

Gasoline

- Retail average regular gasoline prices amounted to $3.32 per gallon in the week of March 6, up 7.3% YoY

- Gasoline prices on the East Coast amounted to $3.00, down (2.9%) YoY

- Gasoline prices in the Midwest amounted to $2.88, down (2.8%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.75, up 0.4% YoY

- Gasoline prices in the Rocky Mountain region amounted to $2.89, down (6.2%) YoY

- Gasoline prices on the West Coast amounted to $4.29, up 0.3% YoY

- Motor gasoline inventories were down by 1.7 million barrels from the prior week

- Motor gasoline inventories amounted to 253.1 million barrels, up 5.0% YoY

- Production of motor gasoline averaged 9.33 million bpd, down (2.3%) YoY

- Demand for motor gasoline amounted to 8.292 million bpd, down (9.7%) YoY

Distillates

- Distillate inventories decreased by 0.4 million in the week of March 6

- Total distillate inventories amounted to 120.8 million barrels, up 2.7% YoY

- Distillate production averaged 4.812 million bpd, up 7.8% YoY

- Demand for distillates averaged 3.698 million bpd in the week, down (5.1%) YoY

Natural Gas

- Natural gas inventories decreased by 132 billion cubic feet last week

- Total natural gas inventories now amount to 1,886 billion cubic feet, up 11.1% YoY

Credit News

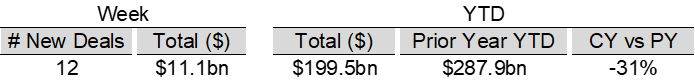

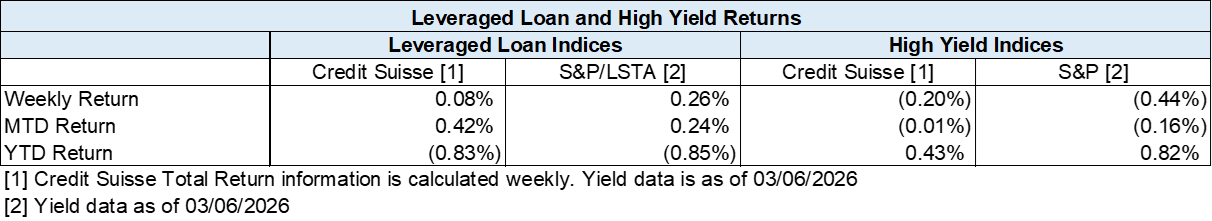

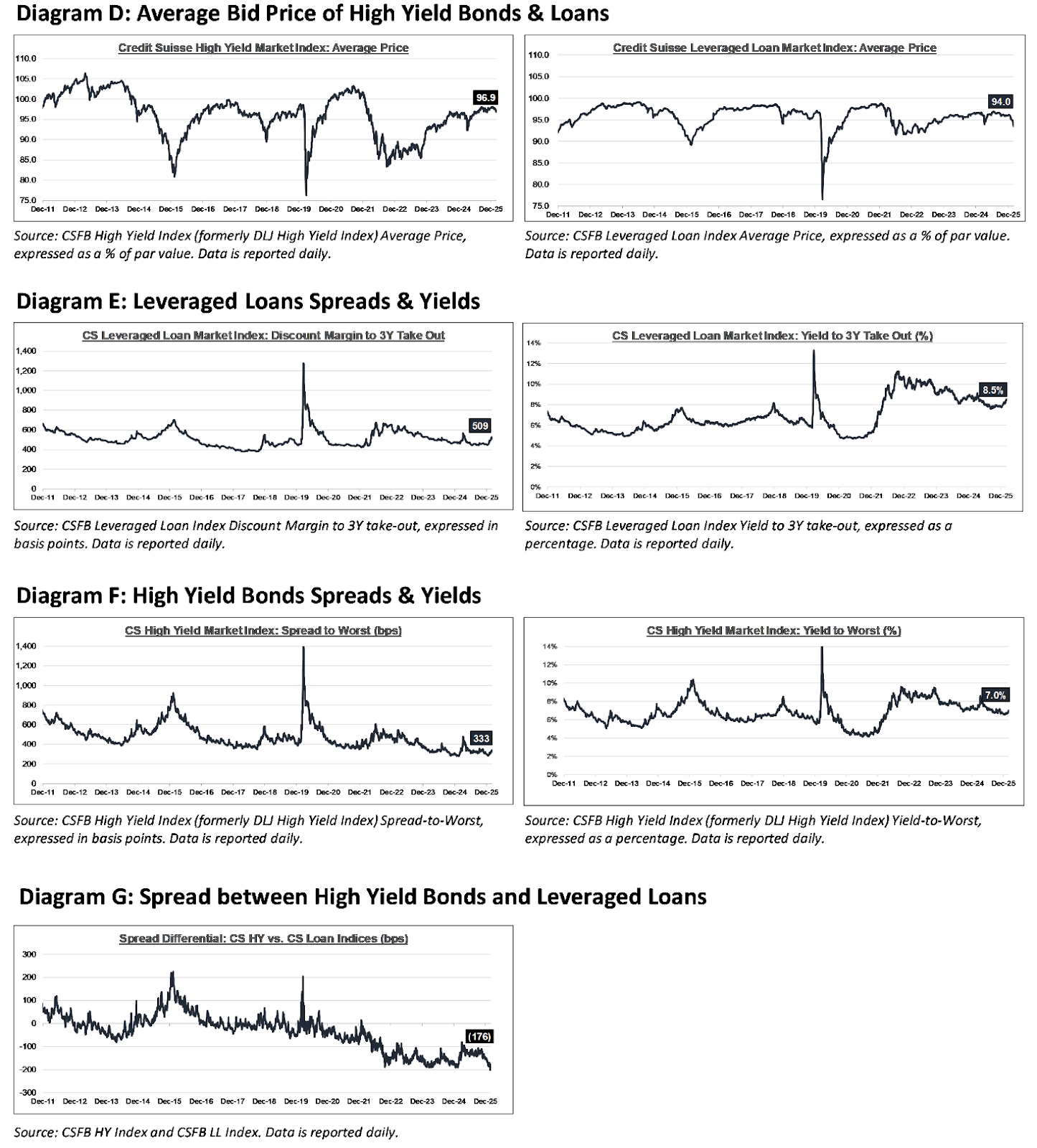

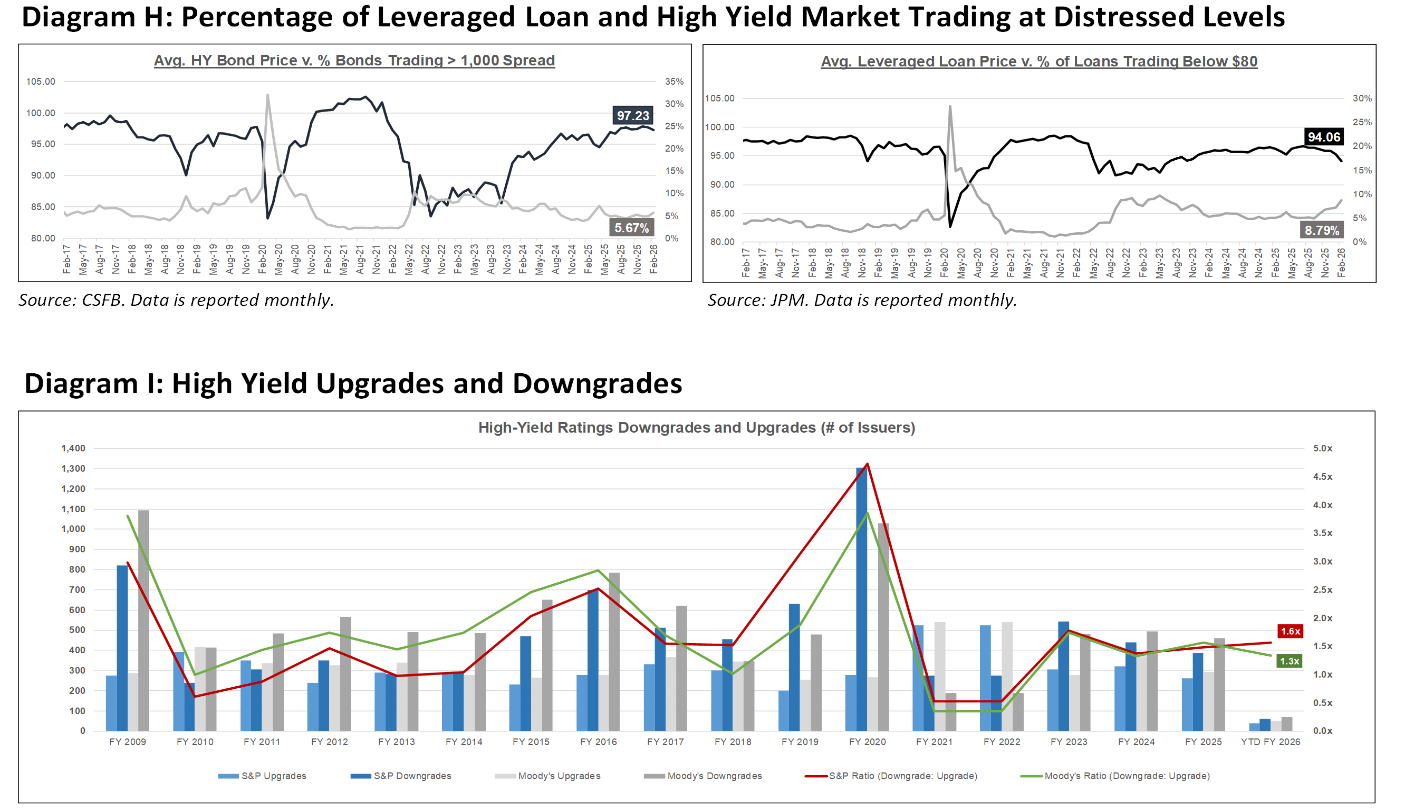

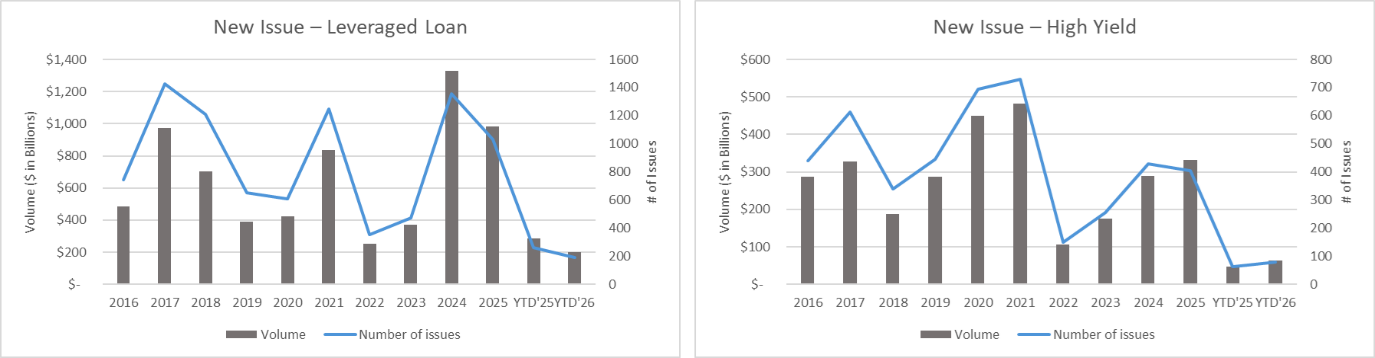

High-yield:

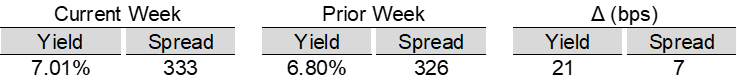

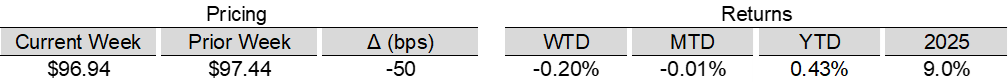

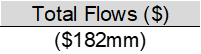

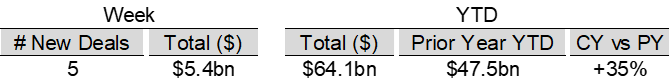

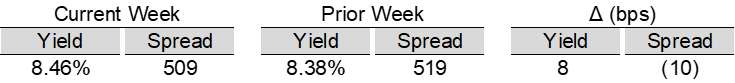

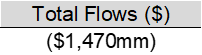

High yield bond yields increased 21bps to 7.01% and spreads widened 7bps to 333bps. Leveraged loan yields increased 8bps to 8.46% while spreads tightened 10 bps to 509bps. WTD high yield bond returns were negative 20bps. WTD leveraged loan returns were positive 8bps. 10yr treasury yields increased 14bps to 4.14%. High-yield spreads widened as investors reacted to increased market volatility, rising oil prices, and higher Treasury yields amid escalating tensions in the Middle East. Leveraged loans recorded another weekly outflow, driven by continued retail outflows, weakness in AI-exposed sectors, and ongoing geopolitical tensions in the Middle East.

Week ended 03/06/2026

Yields & Spreads1

Pricing & Returns1

Fund Flows2

New Issue2

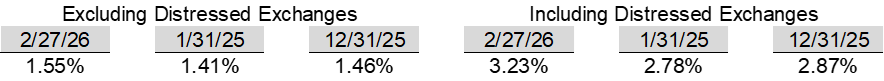

Distressed Level (trading in excess of 1,000 bps)2

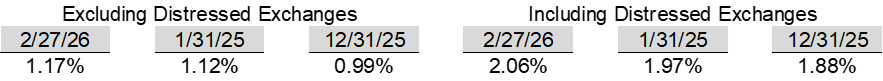

Total HY Defaults

Leveraged loans:

Week ended 03/06/2026

Yields & Spreads1

Pricing & Returns1

Fund Flows2

New Issue2

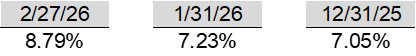

Distressed Level (loan price below $80)1

Total Leveraged Loan Defaults

Default activity:

Most recent defaults include: Cumulus Media ($641mn, 03/05/2026), Trinseo ($390mn, 02/17/2026), Beasley Broadcasting Group ($189mn, 02/01/2026), Nine Energy Service ($300mn, 02/01/2026), Multi-Color ($4.5bn, 01/29/2026), Pretium Packaging ($201mn, 01/28/2026), Saks Global Enterprises ($2.7bn, 12/30/2025), United Site Services ($2.6bn, 11/30/2025), and New Fortress Energy ($3.5bn, 11/15/2025).

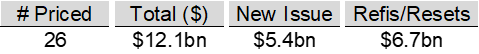

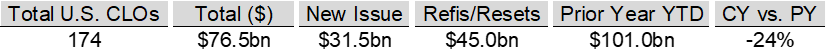

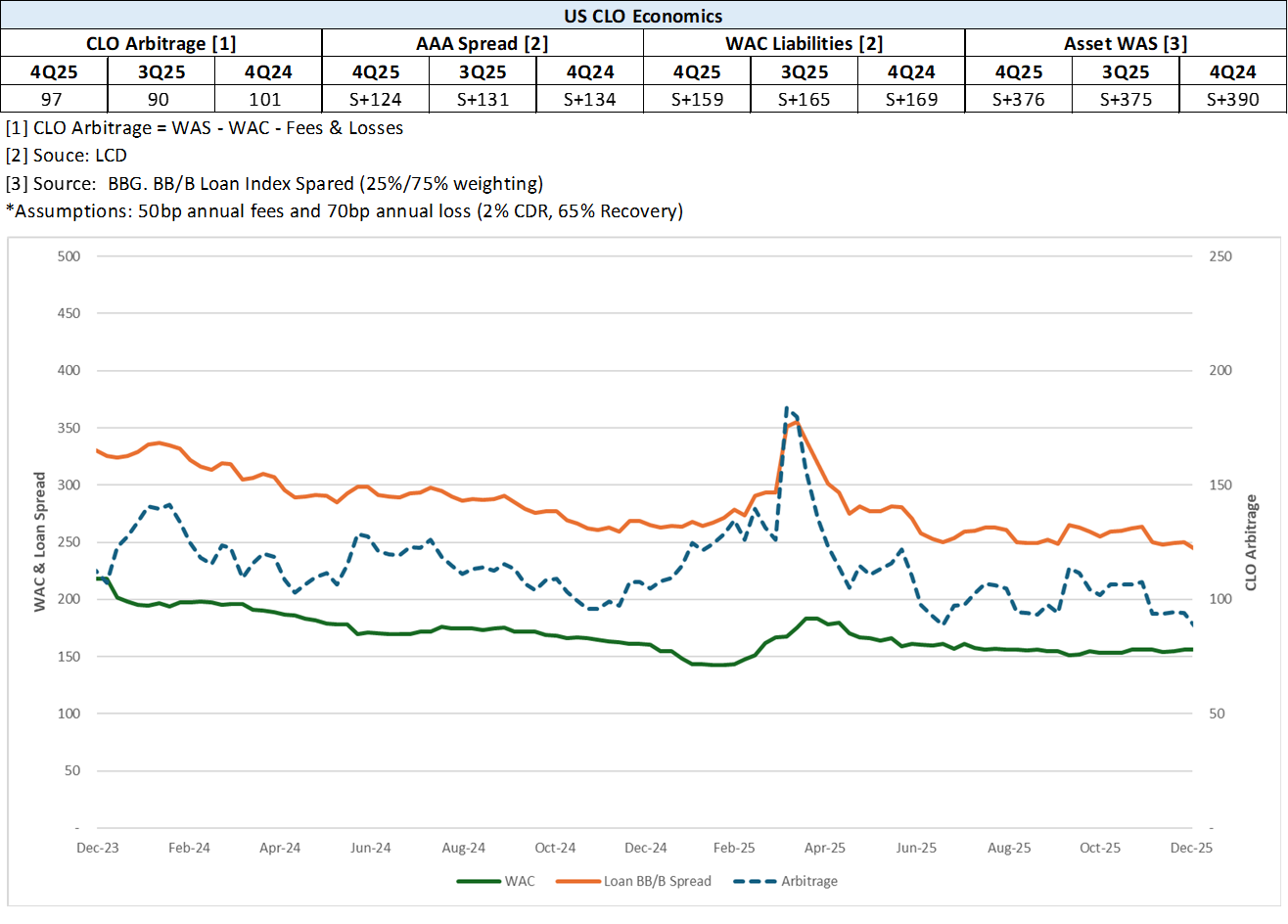

CLOs:

Week ended 03/06/2026

New U.S. CLO Issuance2

New U.S. CLO YTD Issuance2

Note: High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

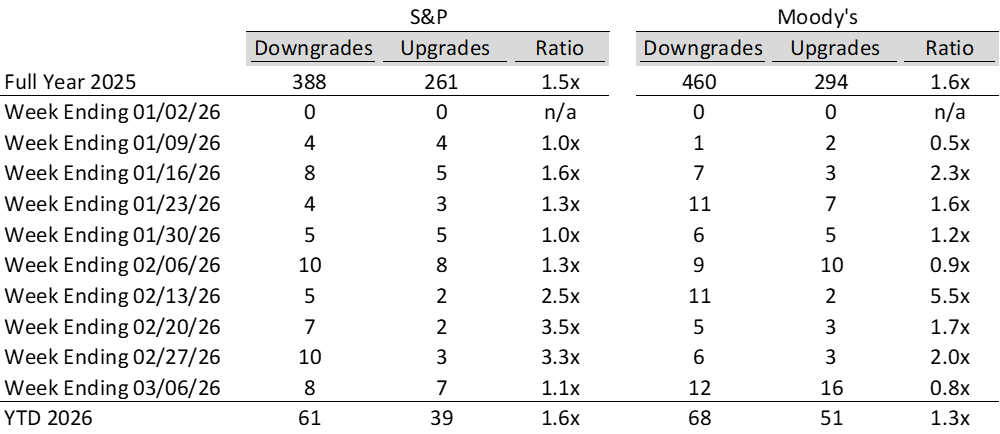

Ratings activity:

S&P and Moody’s High Yield Ratings

Appendix:

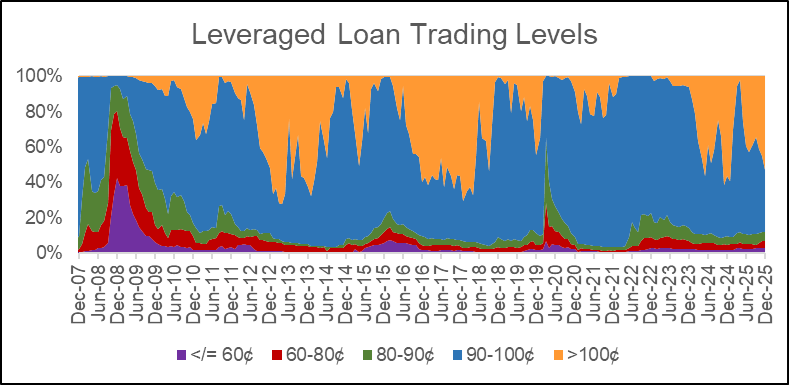

Diagram A: Leveraged Loan Trading Levels

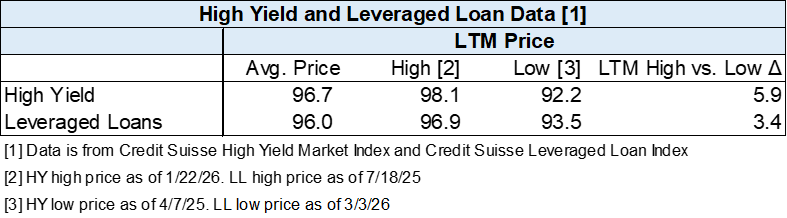

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: New Issue - Leveraged Loan and High Yield

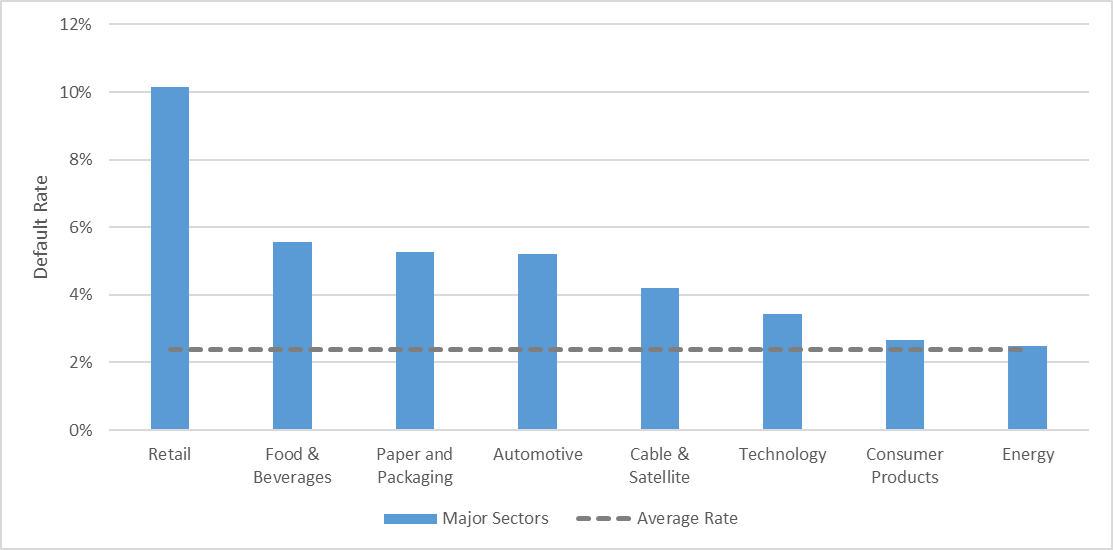

Diagram K: Leveraged Loan + HY Defaults by Sector – LTM

Diagram L: CLO Economics

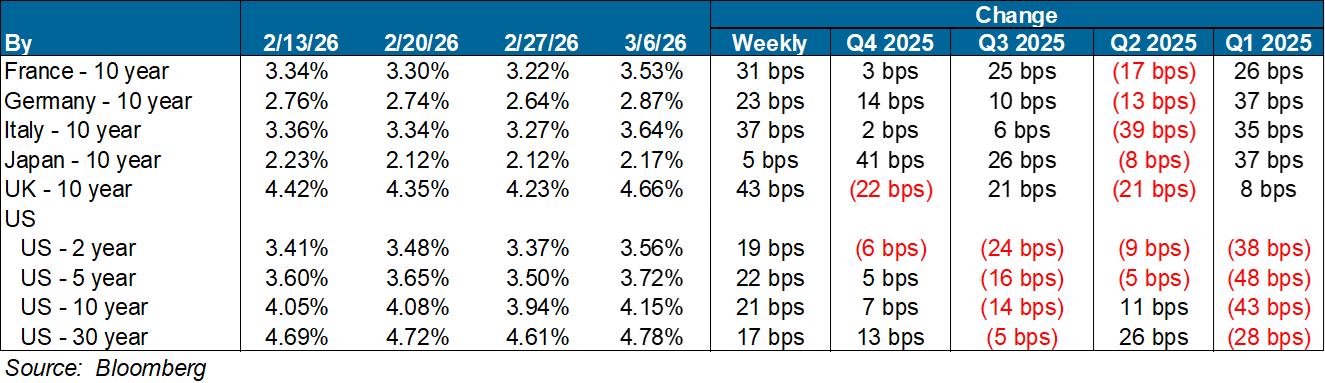

Diagram M: Developed Country Govt. Bond Yields (%)

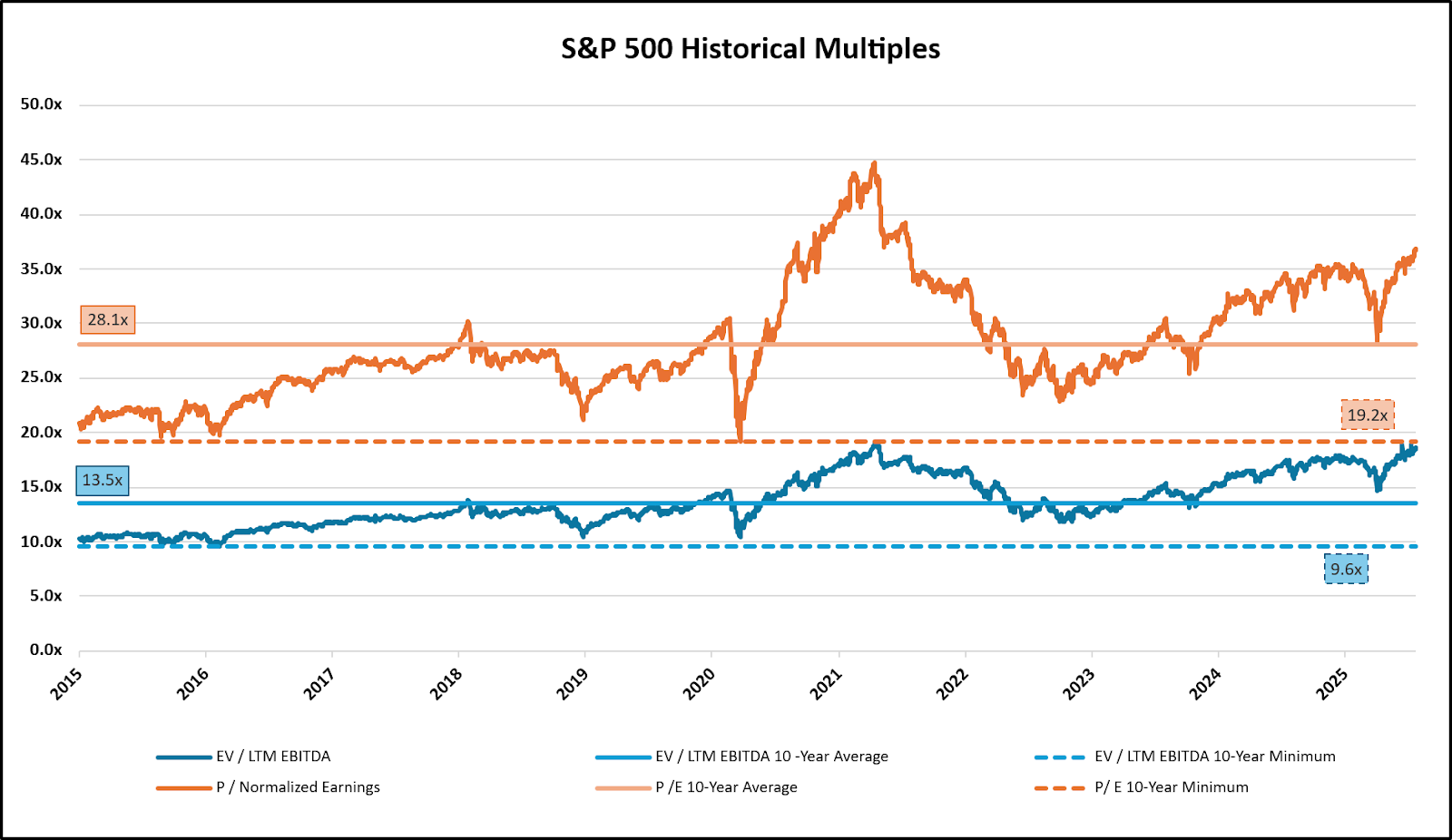

Diagram N: S&P 500 Historical Multiples

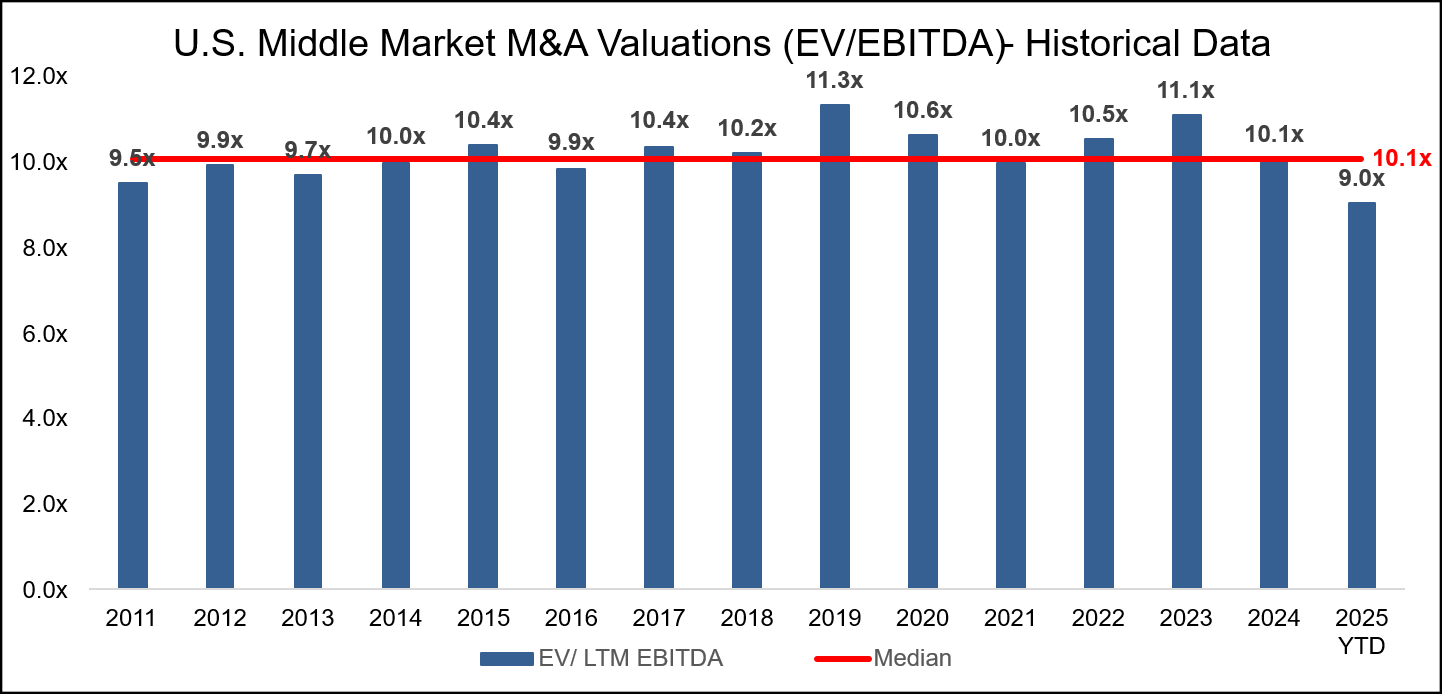

Diagram O: U.S. Middle-Market M&A Valuations (EV/EBITDA)

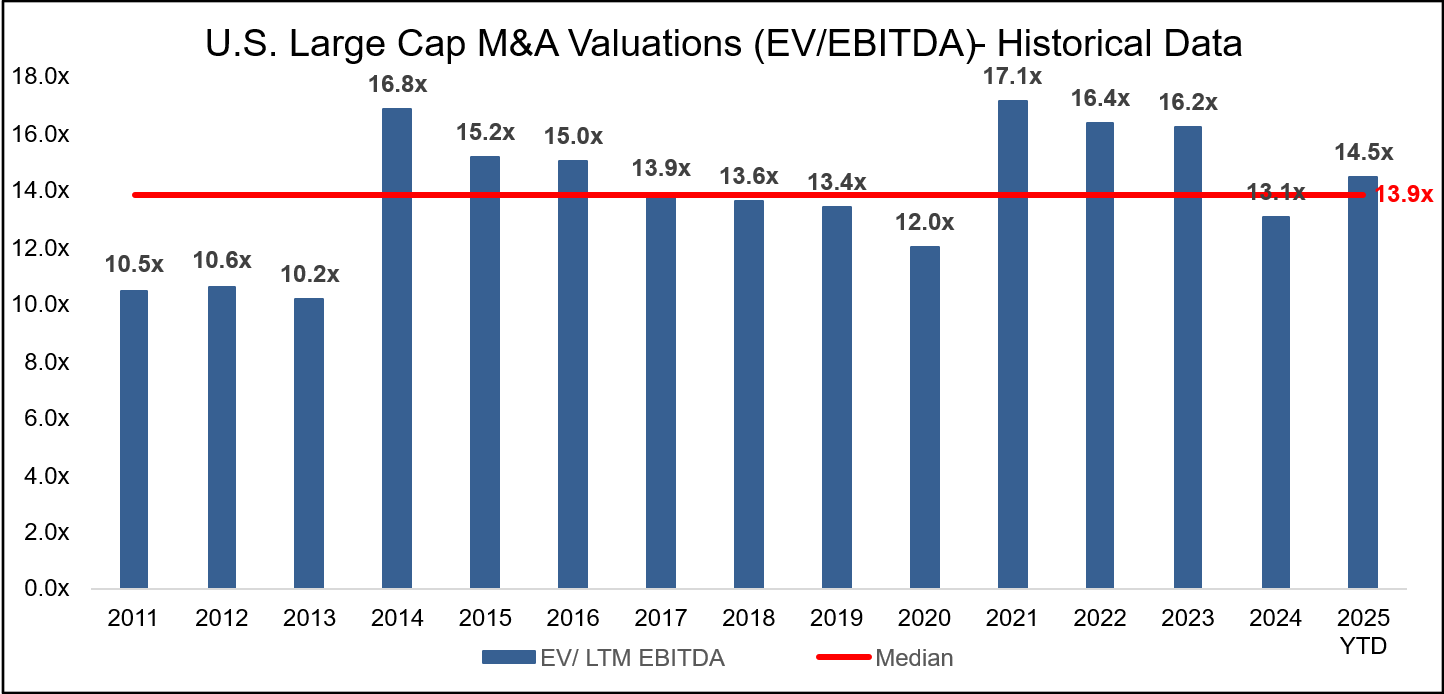

Diagram P: U.S. Large Cap M&A Valuations (EV/EBITDA)

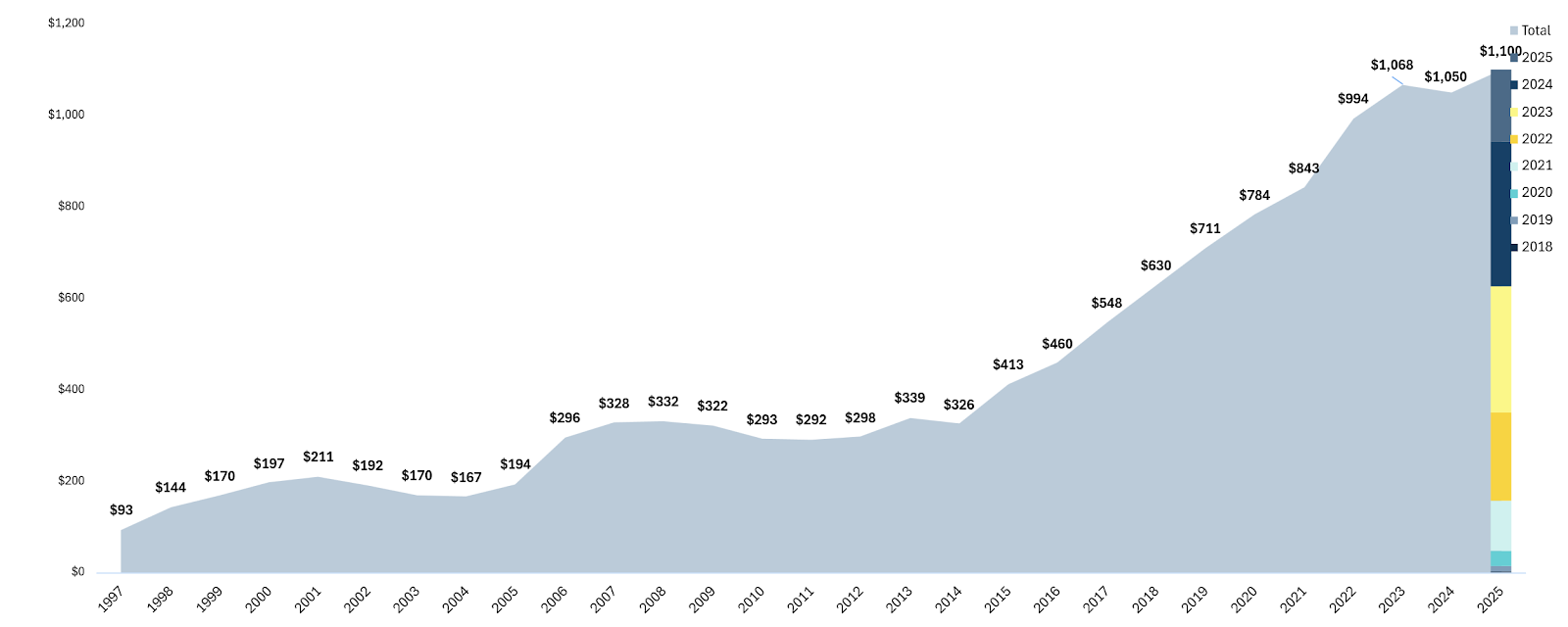

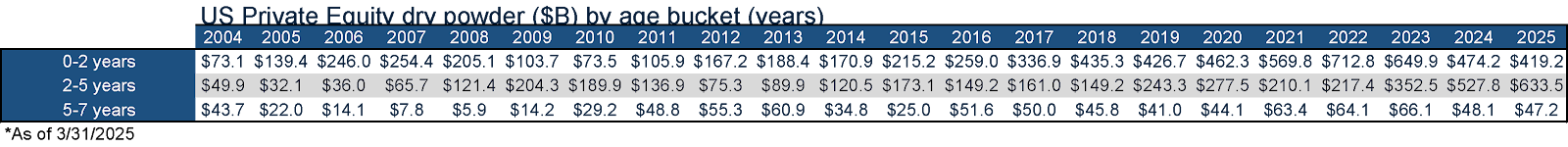

Diagram Q: Dry Powder for All Private Equity Buyouts ($B)

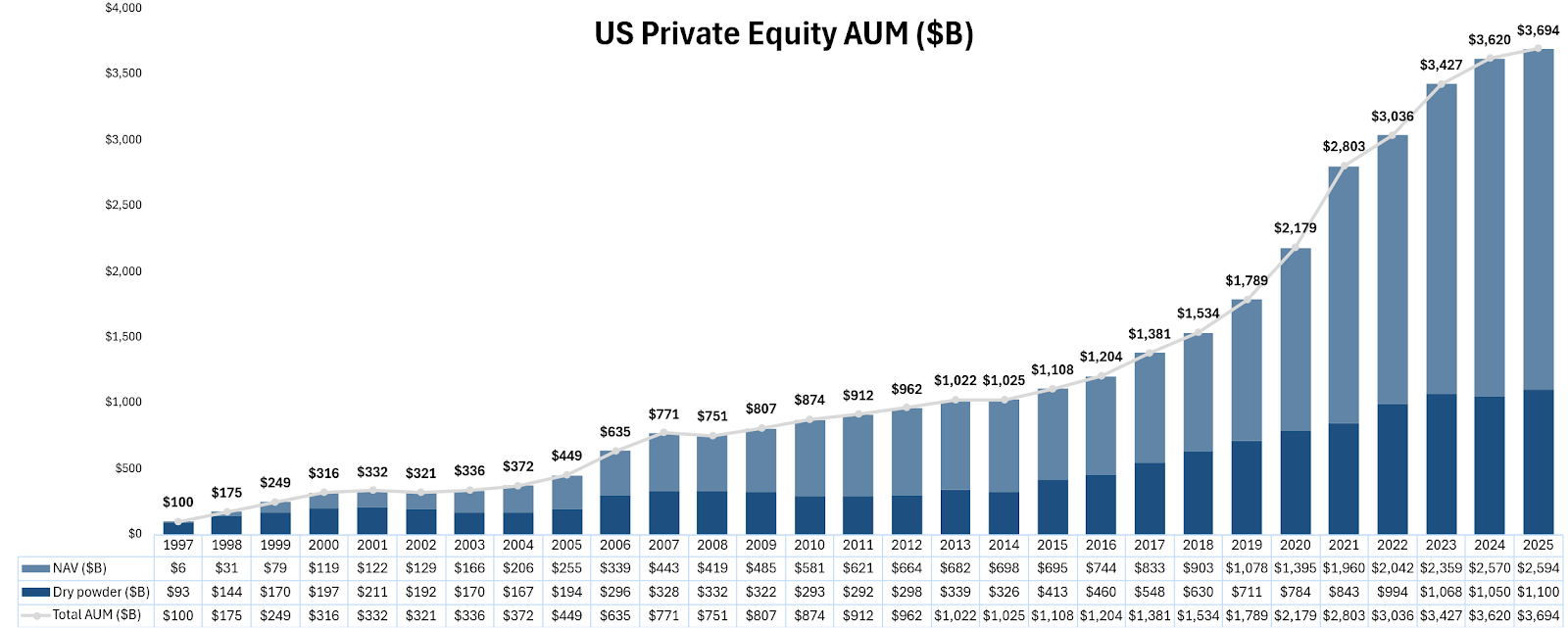

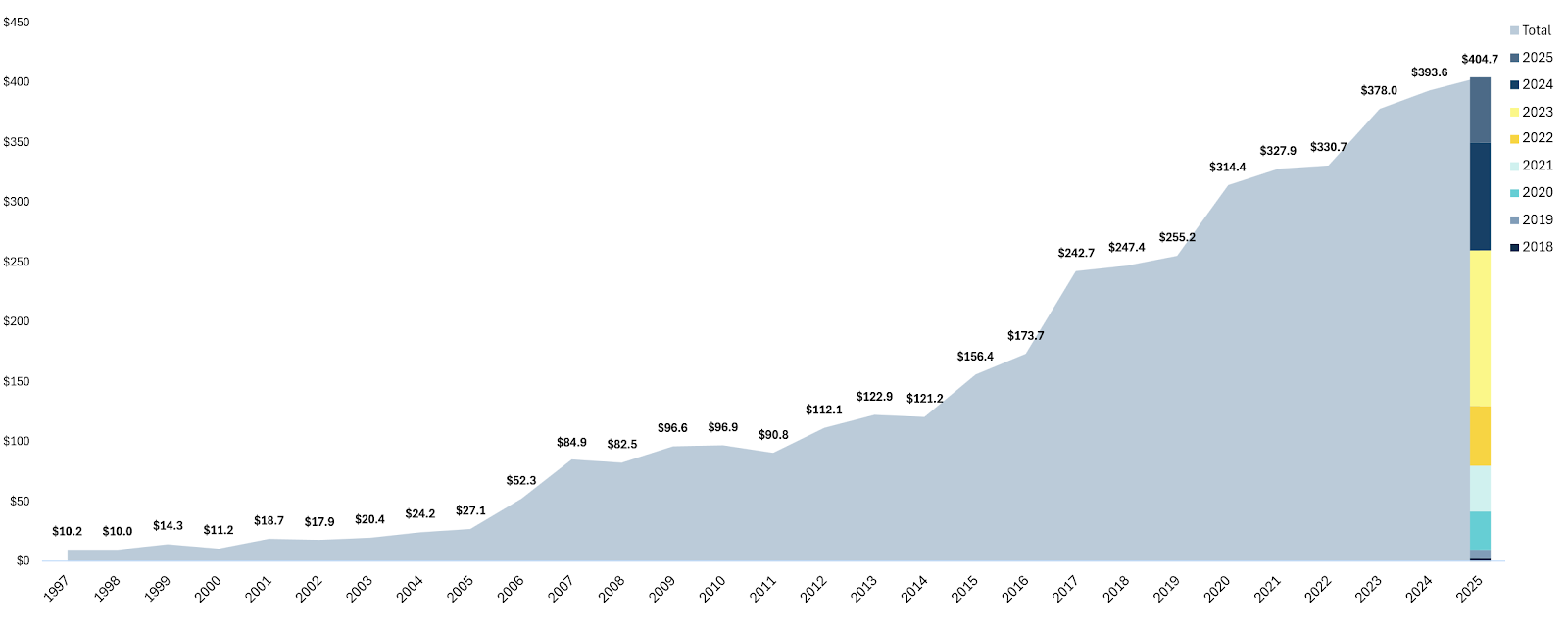

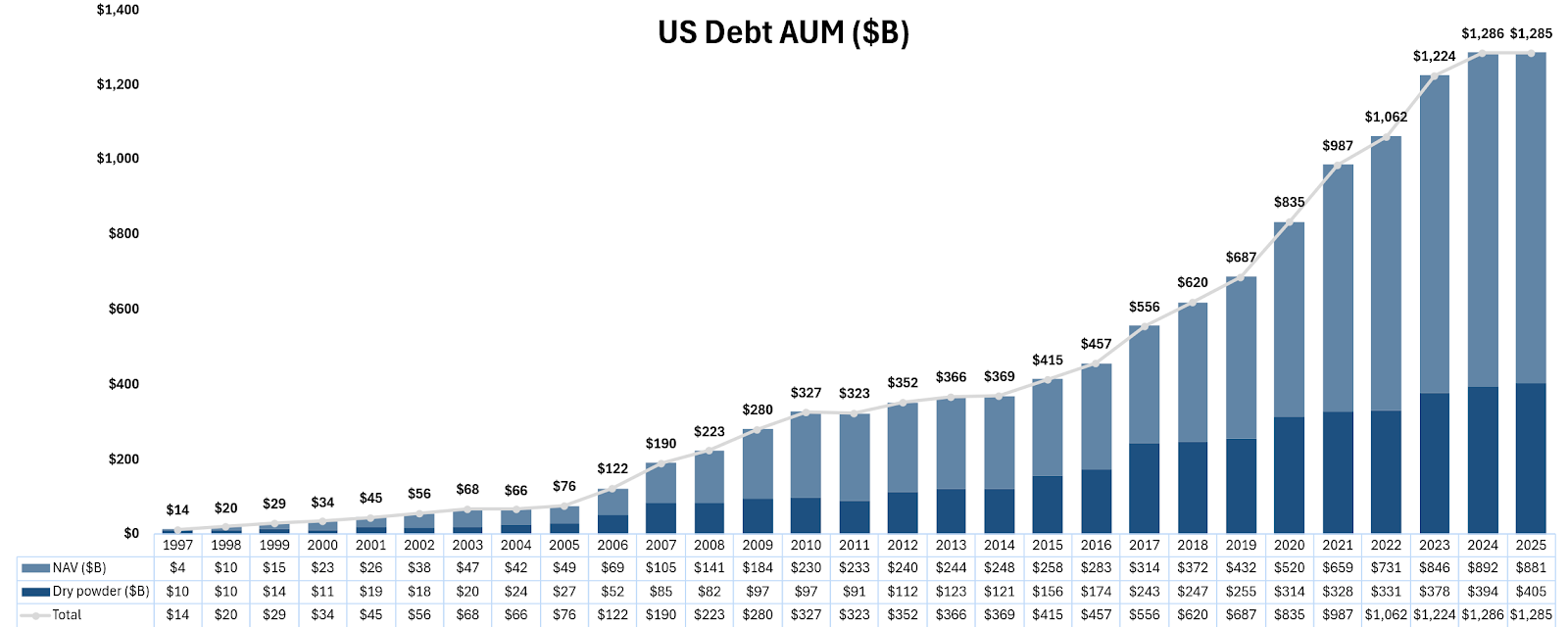

Diagram R: Dry Powder for All US Debt ($B)

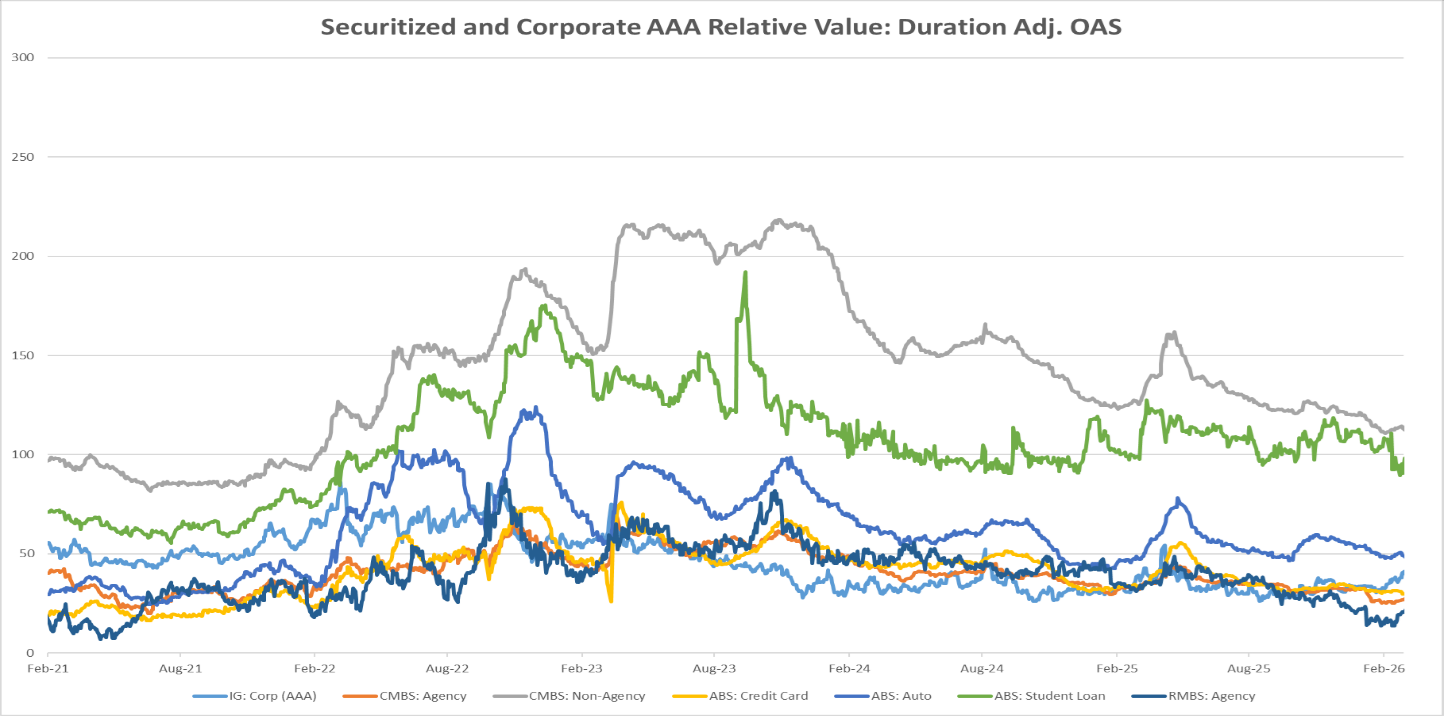

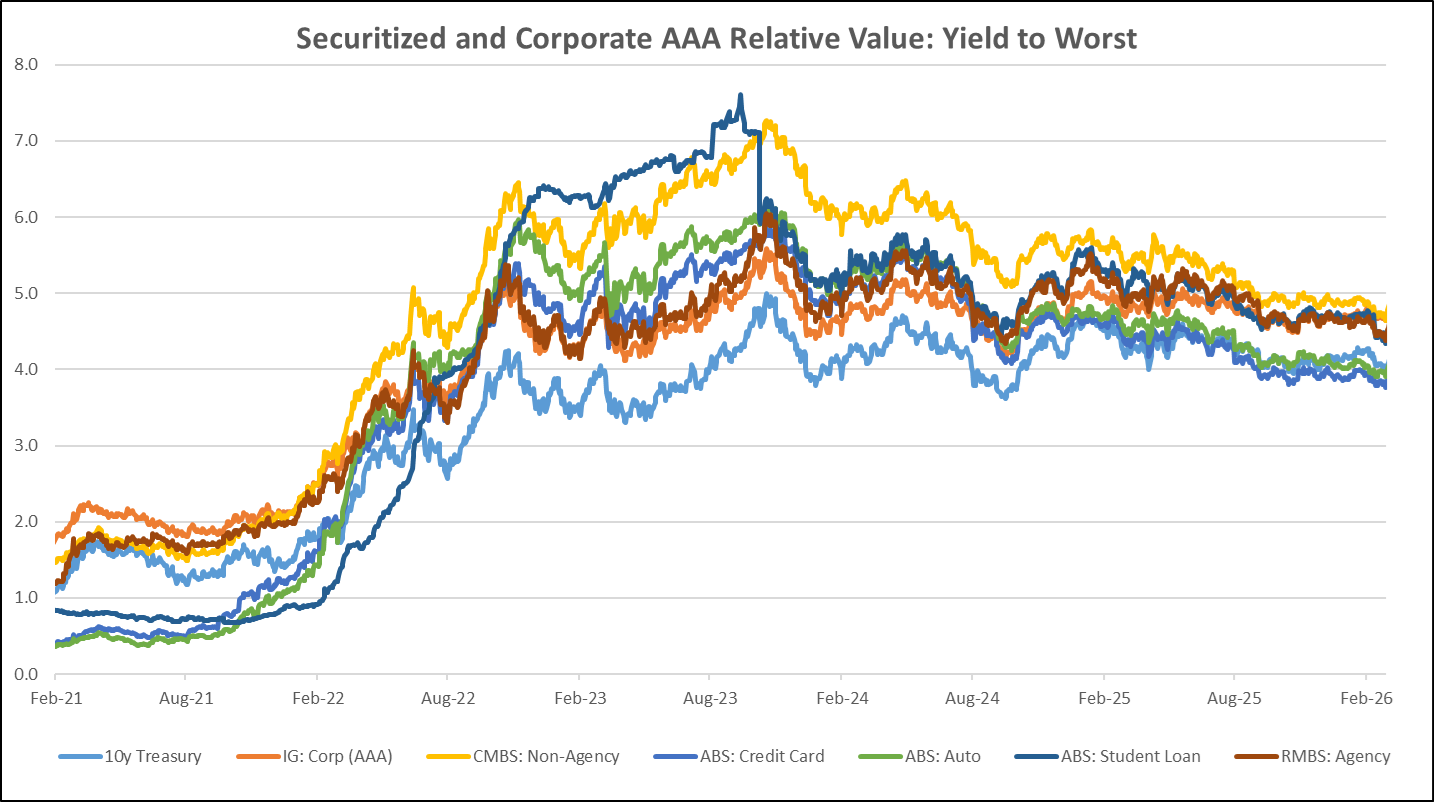

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

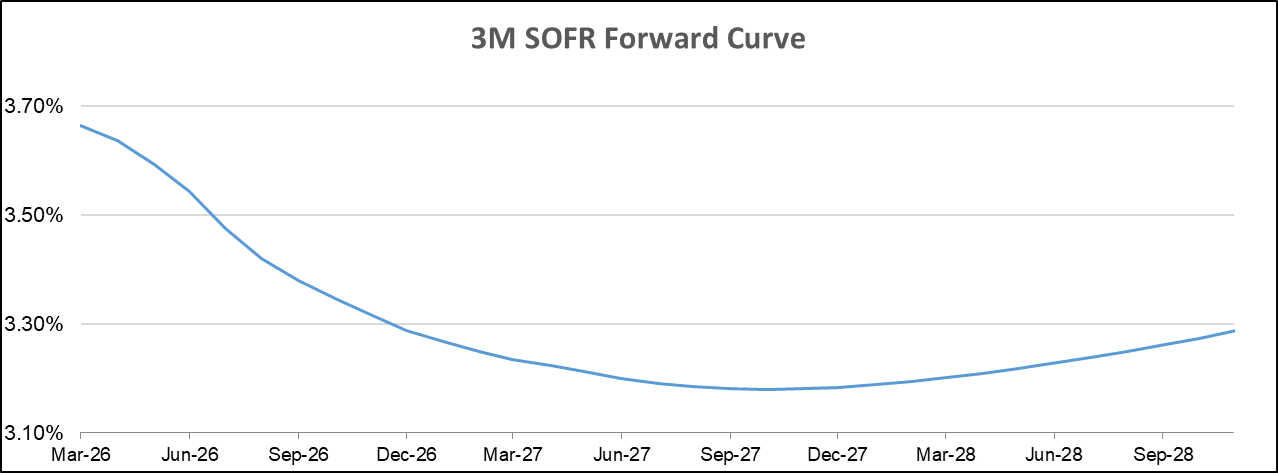

Diagram U: SOFR Curve

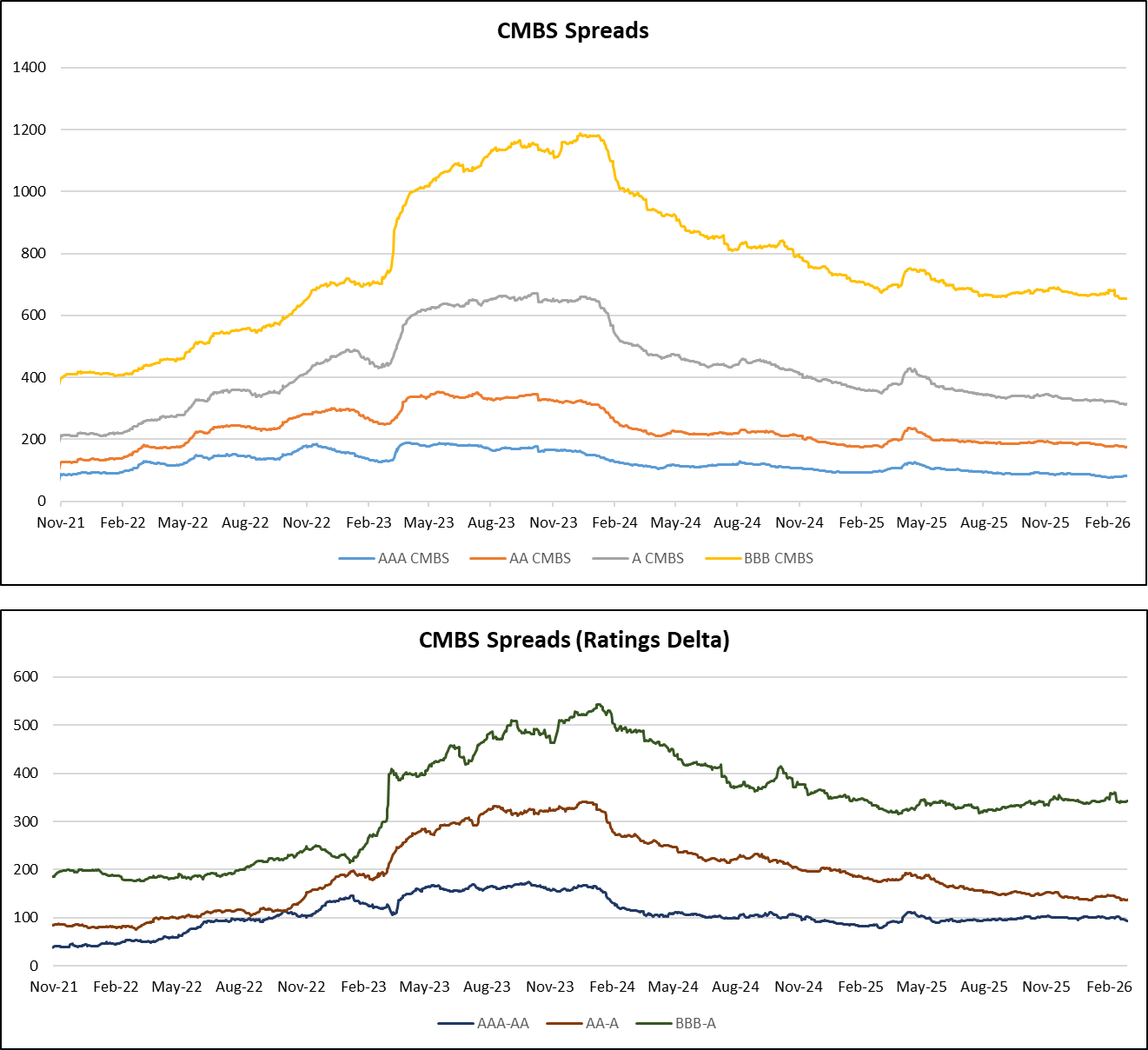

Diagram V: CMBS Spreads

Other News

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index