S&P 500

Dow Jones

Nasdaq

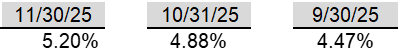

10-Year US Treasury Yield

British Pound per USD

Euro per USD

USD per Yen

Swiss franc per EUR

Listen to this briefing

U.S. News

Consumer Sentiment

- Consumer sentiment increased to 52.9 in December, a near-record low but up from 51.0 in November. The lowest reading ever reported was 50.0 in June 2022

- The expectations index, a measure of consumers’ six-month outlook on the economy, reached 54.6 in December, up from 51.0 in November

- Year-ahead inflation expectations decreased from 4.6% in November to 4.2% in December, the fourth consecutive monthly decline

Housing Market Index

- Builder confidence in the market for newly built single-family homes rose one point to 39 in December

- Forty percent of builders reported cutting prices in December, the second consecutive month where the share was at 40% or higher

- In addition, the use of sales incentives was 67% in December, the highest percentage in the post-COVID era

Retail Sales & Inventories

- U.S. food and retail services sales for October 2025 was materially unchanged from September 2025 at $732.6 billion. Sales were up 3.5% from October 2024

- Nonstore retailers were up 9.0% from last year, while food service and drinking places were up 4.1% from October 2024

- The September 2025 percent change was revised to 0.2% when compared to August 2025, up from 0.1%

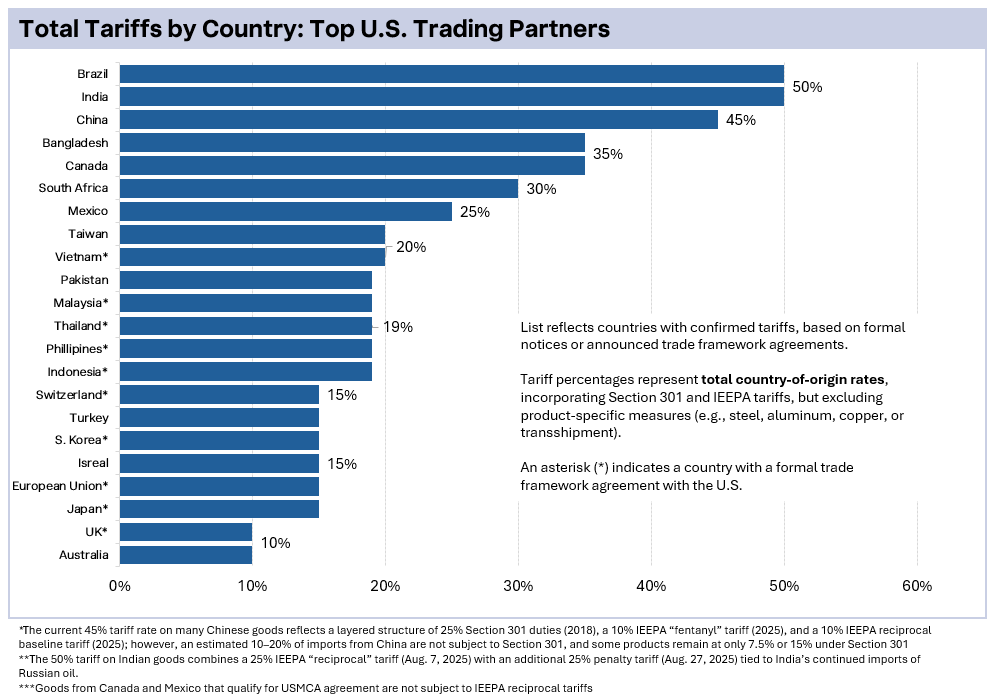

U.S. Tariff & Trade

- As the Supreme Court reviews the legality of IEEPA-based actions, Section 232 is emerging as one potential replacement tariff tool, with the trade community reporting a rise in CF-29 Notices of Action from U.S. Customs requiring steel-content duty calculations to include a broader share of processing, labor, and other costs — not just the base steel value — resulting in higher total duties on steel and aluminum derivative products for importers

- President Trump’s International Trade Administration announced the launch of a review in January to potentially expand Section 232 automotive tariffs to additional imported auto parts, with expectations that final determinations and any tariff scope changes would be issued within approximately 60 days

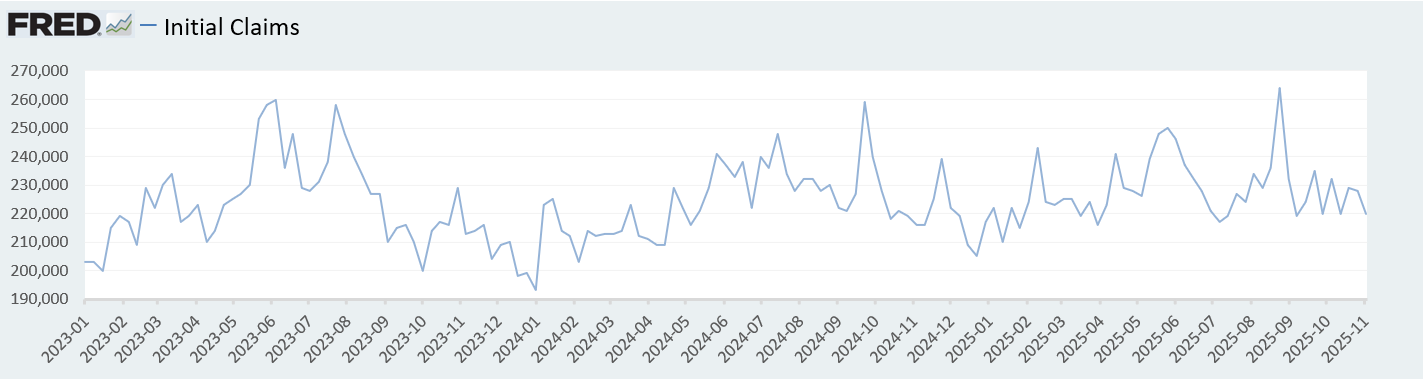

Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 224,000 in the week ended December 12, down 13,000 from the prior week.

- The four-week moving average was 217,500, up 500 from the prior week.

- Continuing claims - those filed by workers unemployed for longer than a week - increased at 1.897 million in the week ended December 5. This figure is reported with a one-week lag.

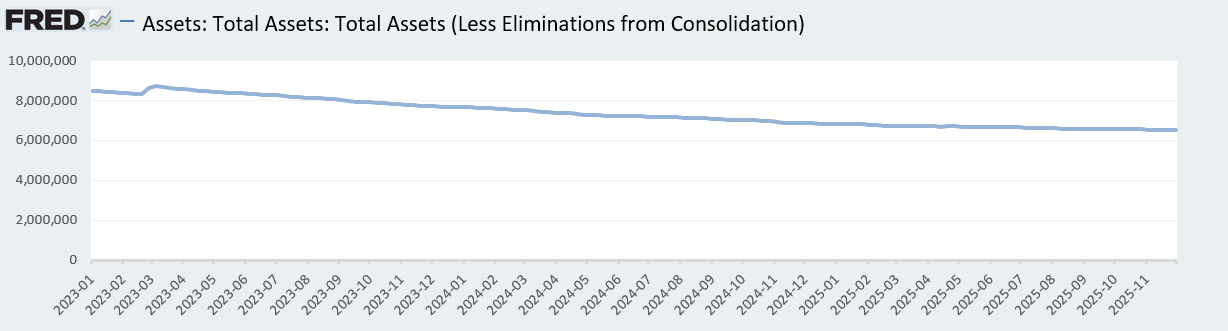

Fed’s Balance Sheet

- The Federal Reserve's assets totaled $6.557 trillion in the week ended December 19, up $17.6 billion from the prior week.

- Treasury holdings totaled $4.195 trillion, up $5.7 billion from the prior week.

- Holdings of mortgage-backed securities (MBS) were $2.05 trillion in the week, down $0.1 billion from the prior week.

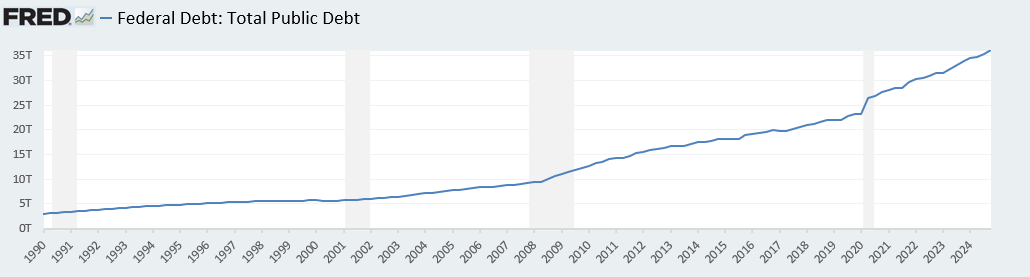

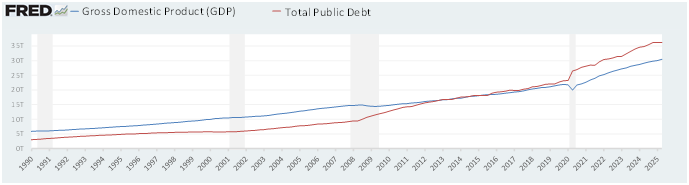

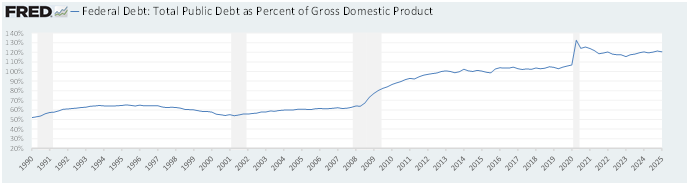

Total Public Debt

- Total public debt outstanding was $38.38 trillion as of December 19, an increase of 6.1% from the previous year.

- Debt held by the public was $30.81 trillion, and intragovernmental holdings were $7.62 trillion.

GDP

- The latest annualized U.S GDP stands at $30.49 trillion as of June 30, 2025, an increase of 1.48% from the previous quarter , & an increase of 4.59% from the previous year

- The total public debt-to-GDP ratio is at 118.78% as of June 30, a decrease of -0.72% from the previous year

Inflation Factors

CPI:

- The consumer-price index rose 3.0% in September year over year.

- On a monthly basis, the CPI increased 0.3% in September on a seasonally adjusted basis, after increasing 0.4% in August.

- The index for all items less food and energy (core CPI) rose 0.2% in September, after rising 0.3% in August.

- Core CPI increased 3.0% for the 12 months ending September.

Food & Beverages:

- The food at home index increased 2.7% in September from the same month a year earlier, and increased 0.3% in September month over month.

- The food away from home index increased 3.7% in September from the same month a year earlier, and increased 0.1% in September month over month.

Commodities:

- The energy commodities index increased 3.8% in September after increasing 1.7% in August

- The energy commodities index fell (0.4%) over the last 12 months

- The energy services index fell (0.8%) in September after decreasing (0.3%) in August

- The energy services index rose 6.4% over the last 12 months

- The gasoline index fell (0.5%) over the last 12 months

- The fuel oil index rose 4.1% over the last 12 months.

- The index for electricity rose 5.1% over the last 12 months.

- The index for natural gas rose 11.7% over the last 12 months.

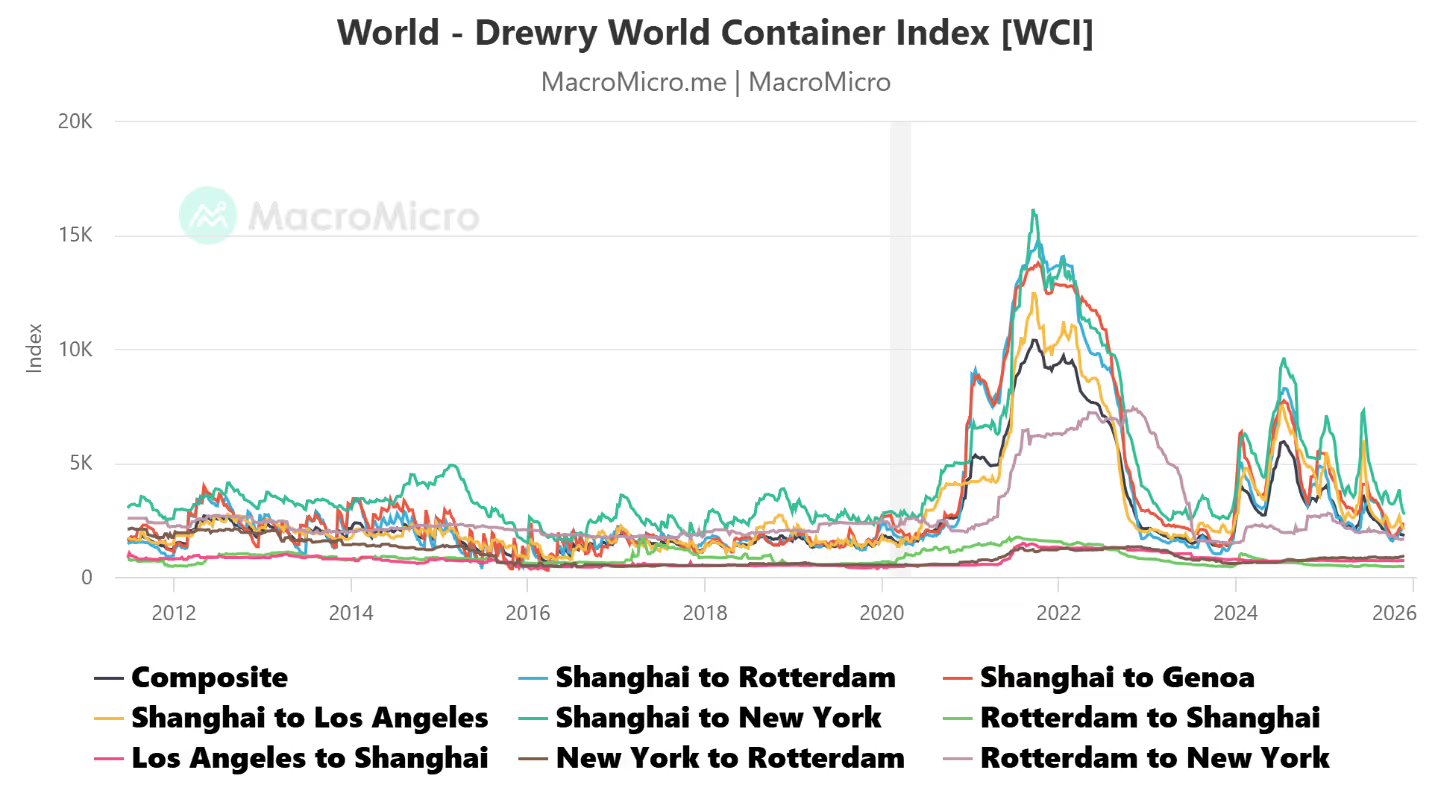

Supply Chain:

- Drewry’s composite World Container Index increased to $2181.93 per 40ft container for the week of December 19

- Drewry’s composite World Container Index has decreased by (42.6%) over the last 12 months.

Housing Market:

- The shelter index increased 0.2% in September after increasing 0.4% in August

- The rent index increased 0.2% in September after increasing 0.4% in August

- The index for lodging away from home decreased (1.4%) in September after increasing 0.3% in August.

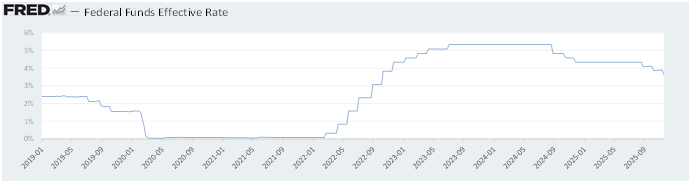

Federal Funds Rate

- The effective Federal Funds Rate is at 3.64% , down (0.69%) year to date.

ZCG – New York

16th Floor New York, NY 10019

ZCG – Arabia

Riyadh, 13523 Saudi Arabia

Additional affiliate office located in Pune, India.

World News

Middle East

- President Trump expressed frustration to Israeli President Benjamin Netanyahu over the killing of Raed Saad. Trump feared the strike could jeopardize his plans to progress the cease-fire in Gaza and rebuild the region

- President Trump has signaled interest in moving the cease-fire into its second phase, which would include the disarmament of Hamas, Israel’s exit from Gaza, and the assumption of security duties by an international stabilization force

- The U.S. launched an airstrike against more than 70 ISIS targets in Syria, in retaliation for an ambush last week that killed three Americans. The attack was the largest against ISIS since the fall of the Assad regime last year

- The ambush has put additional pressure on new Syrian President Ahmed al-Sharaa to remove hard-liners with extremist views from his ranks

Europe

- European leaders committed to a $105 billion loan to Ukraine for 2026-7. The bloc could not agree to use frozen Russian assets to finance the deal, largely due to opposition from Hungary and Belgium

- Without the loan, the EU expected Ukraine to run out of funds for buying weapons by April 2026. The loan covers two-thirds of Ukraine’s total financing need for 2026-7, according to the International Monetary Fund

- The EU postponed its free trade agreement with Mercosur countries to January 2026 to address concerns from some member countries—particularly France and Italy—over the removal of tariff protections on domestic European farmers

- The deal would remove tariffs on European automobiles and wine into the Mercosur countries (Argentina, Brazil, Paraguay, and Uruguay). In exchange, the deal would make it easier for beef products to enter the EU from Mercosur countries

China

- China’s Vanke shares fell after proposals to extend a bond payment were rejected by bondholders. Vanke is one of the country’s largest real estate companies

- Many of Vanke’s bondholders are state-owned. Thus, the rejection signaled to investors that the Chinese government may not rescue the beleaguered company

- The U.S. approved $11 billion in arms sales to Taiwan, including 82 Himars missile launchers and 60 howitzers. The sale is intended to increase Taiwan’s defensive capabilities and deter China from an invasion of the country

- Chinese Foreign Ministry spokesperson Guo Jiakun decried the deal, stating that the U.S. is “…turning Taiwan into a powder keg”

Canada

- British Columbia’s Supreme Court ruled that a group of indigenous tribes held the right to about 730 acres of privately held land. The ruling may open the doors for other indigenous groups to press their claims, causing uncertainty in the real estate market

Venezuela

- The U.S. seized two oil tankers off the coast of Venezuela, enacting a policy of blockade that is applying pressure on President Nicolás Maduro’s government

Australia

- At least 11 people were killed when two gunmen opened fire during a Hanukkah event at Sydney’s Bondi Beach in what authorities called a terrorist attack targeting the Jewish community; one suspect was killed and another is in critical condition

UK

- The U.K. economy shrank for a second straight month in October, contracting 0.1% as weakness in the services sector, including retail, dragged on growth

Thailand

- Fighting continued along the Thai-Cambodian border, with both governments reporting new attacks despite President Trump’s claim that the two sides had agreed to a cease-fire

India

- Russian President Vladimir Putin is visiting India to bolster ties by offering discounted Russian oil and military hardware, even as India faces U.S. tariffs over its Russian oil imports and seeks to maintain leverage with Washington while securing energy and defense needs

Israel

- Israel asked the International Criminal Court to nullify an arrest warrant against Prime Minister Benjamin Netanyahu because of sexual assault allegations facing the Chief Prosecutor Karim Khan, which Israel claims impacted Khan’s decision to seek the warrant

Argentina

- A planned $20 billion bailout for Argentina from U.S. banks was shelved as they shift to a smaller, short-term loan package. Banks are now considering a $5 billion solution to help Argentina meet a $4 billion debt payment in January

ZCG – New York

16th Floor New York, NY 10019

ZCG – Arabia

Riyadh, 13523 Saudi Arabia

Additional affiliate office located in Pune, India.

Commodities News

Oil Prices

- WTI: $56.66 per barrel

- (1.36%) WoW; (21.00%) YTD; (19.72%) YoY

- Brent: $60.47 per barrel

- (1.06%) WoW; (18.98%) YTD; (17.60%) YoY

US Production

- U.S. oil production amounted to 13.8 million bpd for the week ended December 12, down 0.0 million bpd from the prior week.

Rig Count

- The total number of oil rigs amounted to 542, down 6 from last week.

Inventories

Crude Oil

- Total U.S. crude oil inventories now amount to 424.4 million barrels, up 1.8% YoY.

- Refiners operated at a capacity utilization rate of 94.8% for the week, up from 94.5% in the prior week.

- U.S. crude oil imports now amount to 6.589 million barrels per day, down (0.8%) YoY.

Gasoline

- Retail average regular gasoline prices were $2.87 per gallon in the week of December 19, down (5.9%) YoY.

- Gasoline prices on the East Coast were $2.96, down (4.6%) YoY.

- Gasoline prices in the Midwest were $2.77, down (6.4%) YoY.

- Gasoline prices on the Gulf Coast were $2.59, down (2.6%) YoY.

- Gasoline prices in the Rocky Mountain region were $2.68, down (9.8%) YoY.

- Gasoline prices on the West Coast were $3.98, up 1.7% YoY.

- Motor gasoline inventories were up by 4.8 million barrels from the prior week.

- Motor gasoline inventories totaled 225.6 million barrels, up 0.9% YoY.

- Production of motor gasoline averaged 9.61 million bpd, down (3.2%) YoY.

- Demand for motor gasoline was 9.078 million bpd, up 0.8% YoY.

Distillates

- Distillate inventories decreased by 1.7 million in the week of December 19.

- Total distillate inventories were 118.5 million barrels, up (1.8%) YoY.

- Distillate production averaged 5.203 million bpd, down (1.3%) YoY.

- Demand for distillates averaged 3.786 million bpd in the week, down (11.0%) YoY.

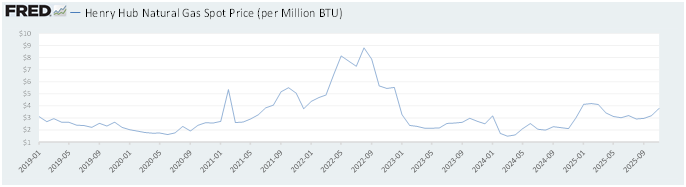

Natural Gas

- Natural gas inventories decreased by 167 billion cubic feet last week.

- Total natural gas inventories now amount to 3,579 billion cubic feet, up 1.4% YoY.

ZCG – New York

16th Floor New York, NY 10019

ZCG – Arabia

Riyadh, 13523 Saudi Arabia

Additional affiliate office located in Pune, India.

Credit News

High-yield:

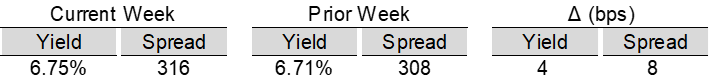

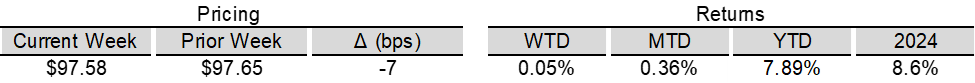

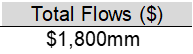

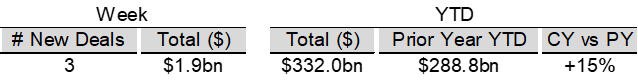

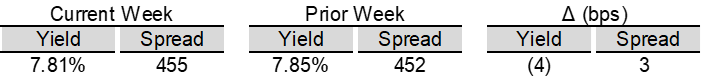

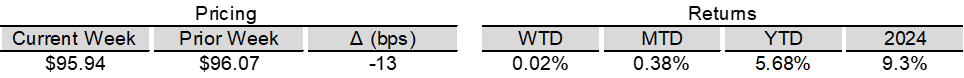

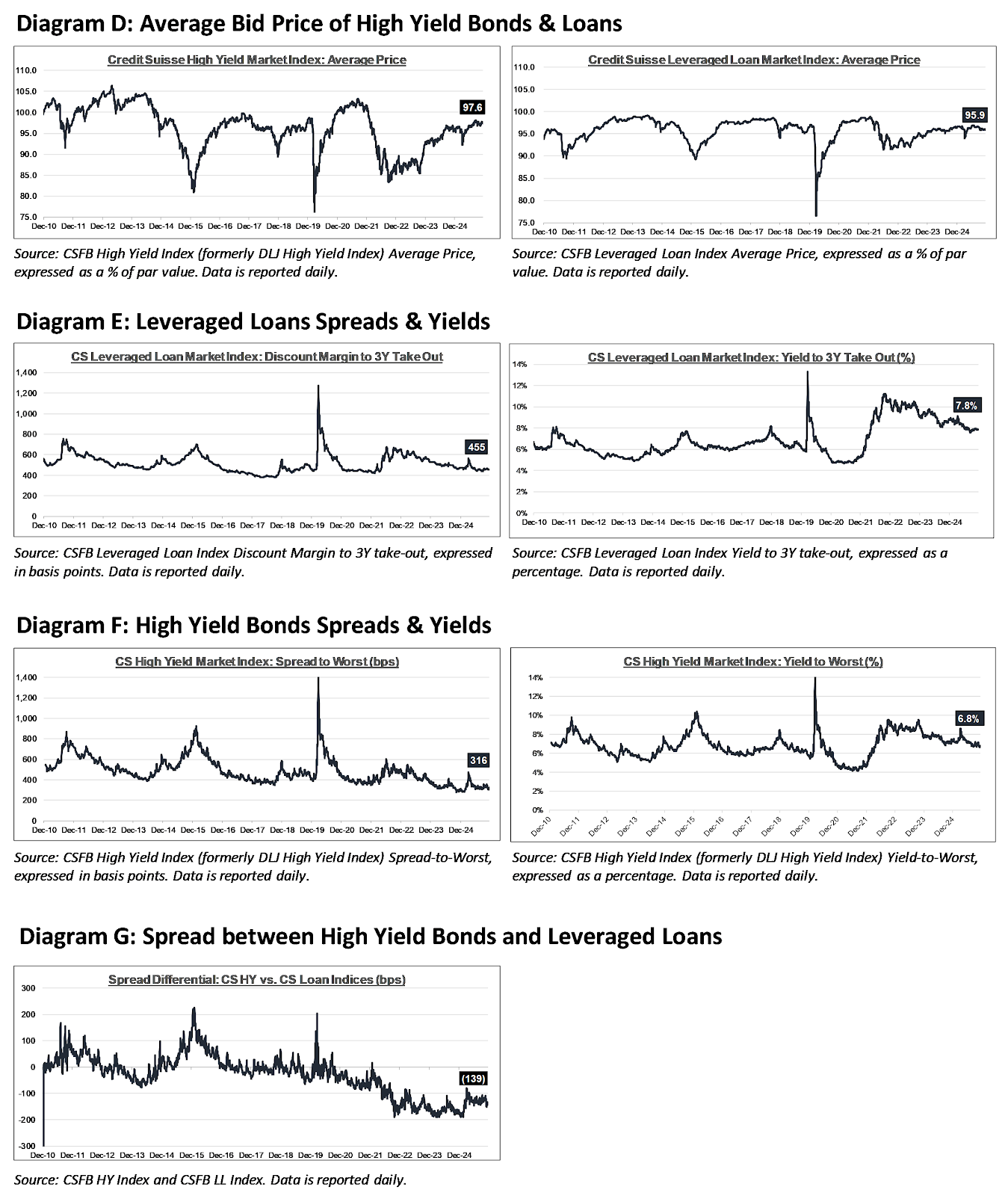

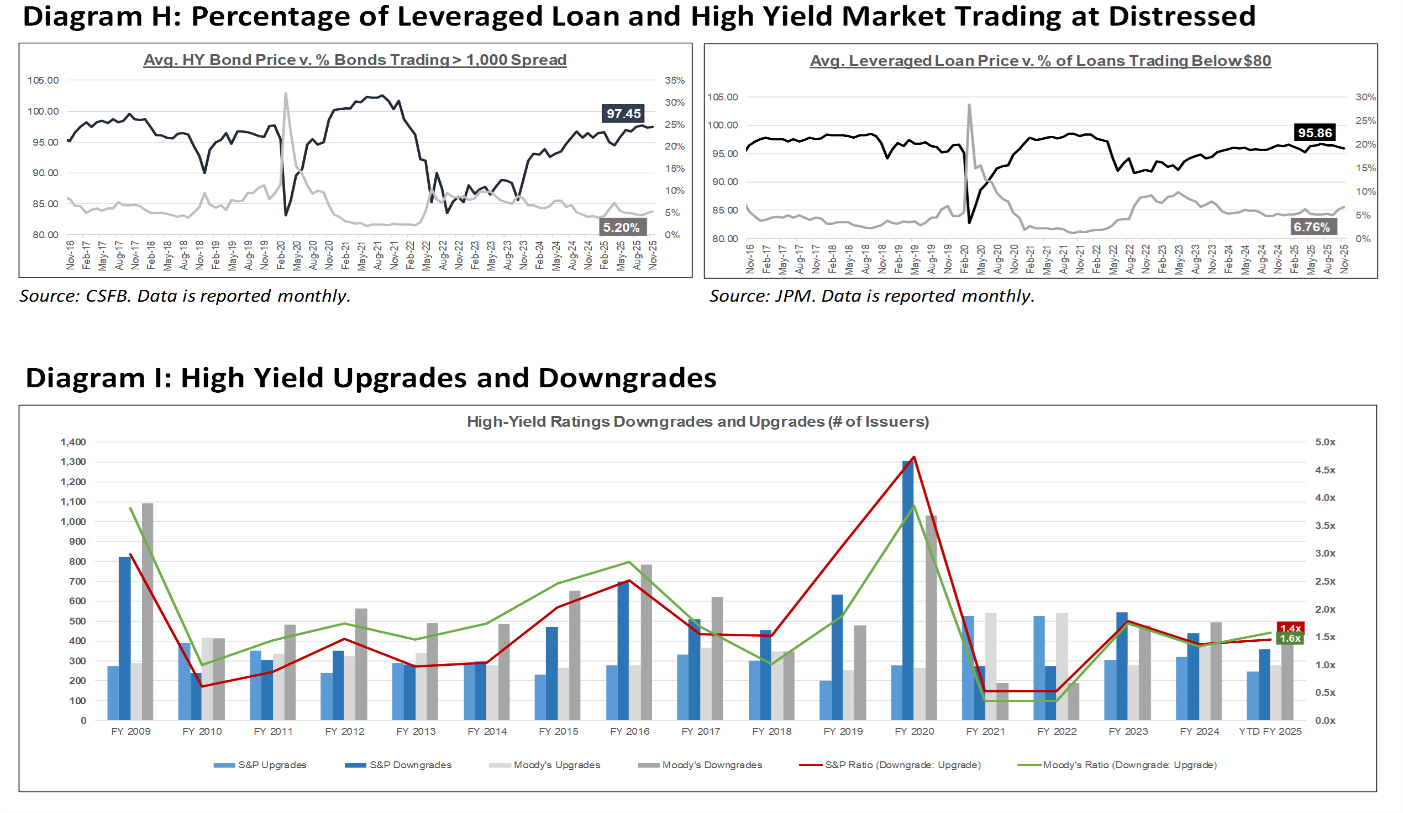

High yield bond yields increased 4bps to 6.75% while spreads increased 8bps to 316bps. Leveraged loan yields decreased 4bps to 7.81%, while spreads widened 3bps to 455bps. WTD high yield bond returns were positive 5bps. WTD leveraged loan returns were positive 2bps. 10yr treasury yields decreased 3bps to 4.11%. High yield and leveraged loan spreads drifted modestly wider as investors digested the final round of economic data releases ahead of the holiday slowdown, including payrolls, retail sales, PMIs, and CPI.

Week ended 12/19/2025

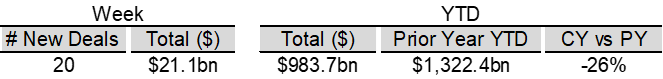

Yields & Spreads1

Pricing & Returns1

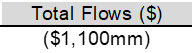

Fund Flows2

New Issue2

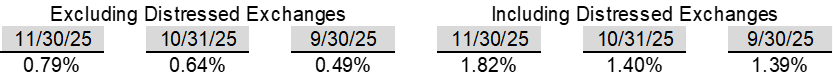

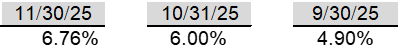

Distressed Level (trading in excess of 1,000 bps)2

Total HY Defaults

Leveraged loans:

Week ended 12/19/2025

Yields & Spreads1

Pricing & Returns1

Fund Flows2

New Issue2

Distressed Level (loan price below $80)1

Total Leveraged Loan Defaults

Default activity:

- Most recent defaults include: New Fortress Energy ($3.5bn, 11/15/2025), Packers Sanitation Services ($1.2bn, 11/5/2025), Office Properties Trust ($1.7bn, 10/31/25), GPS Hospitality ($400mn, 10/30/25), Jordan Health Services ($1.0bn, 10/15/25), Astra Acquisition ($1bn, 9/30/25), First Brands ($4.4bn, 9/29/25), Spirit Airlines ($852mn, 8/29/25), ModivCare ($1.1bn, 8/20/25), Anastasia Beverly Hills ($606mn, 8/11/25), Claire’s Stores ($506mn, 8/6/25).

CLOs:

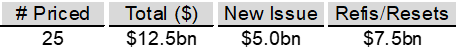

Week ended 12/19/2025

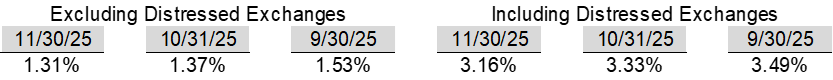

New U.S. CLO Issuance2

New U.S. CLO YTD Issuance2

Note: High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

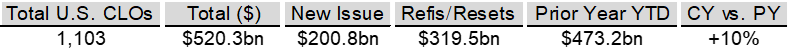

Ratings activity:

- S&P and Moody’s High Yield Ratings

Source: Bloomberg

Appendix:

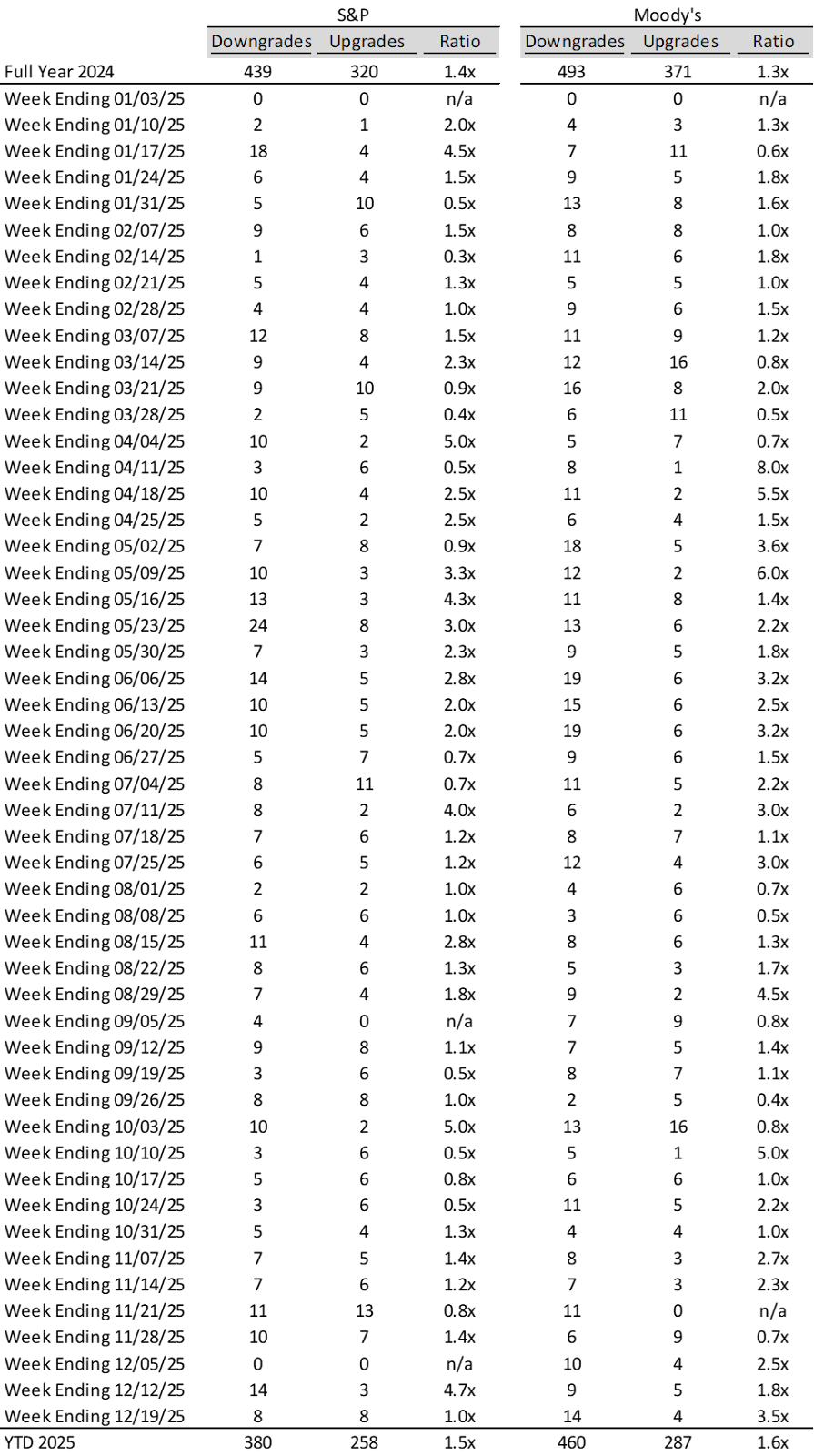

Diagram A: Leveraged Loan Trading Levels

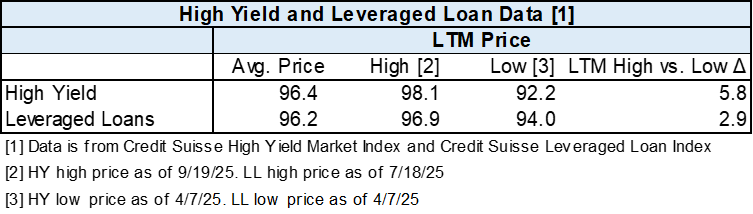

Diagram B: High Yield and Leveraged Loan LTM Price

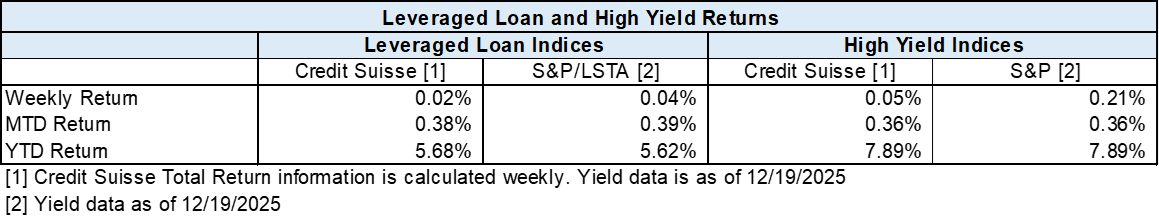

Diagram C: Leveraged Loan and High Yield Returns

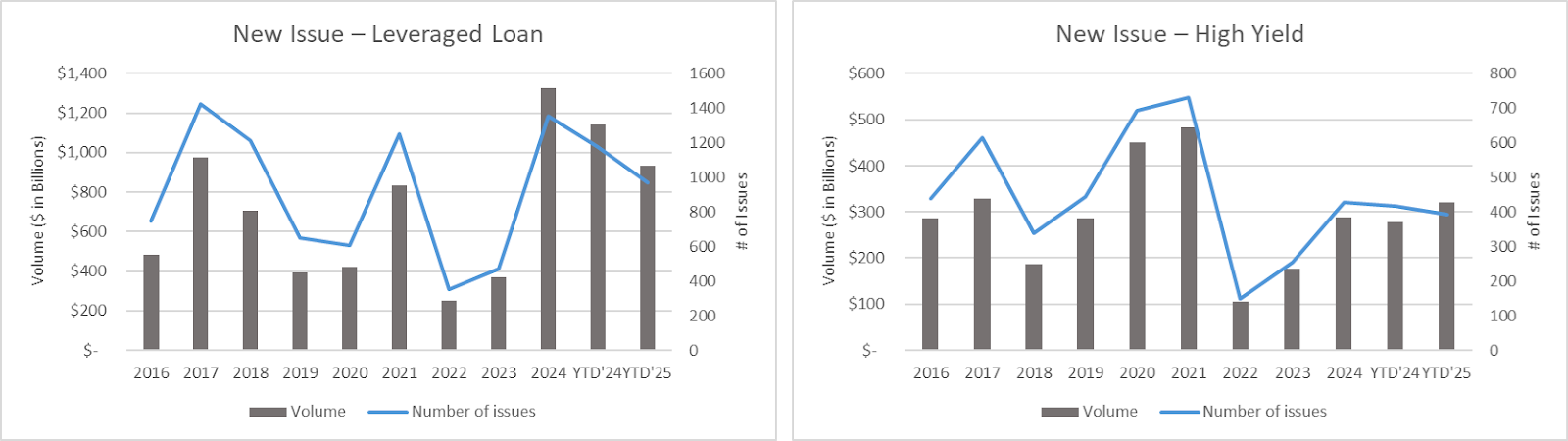

Diagram J: New Issue - Leveraged Loan and High Yield

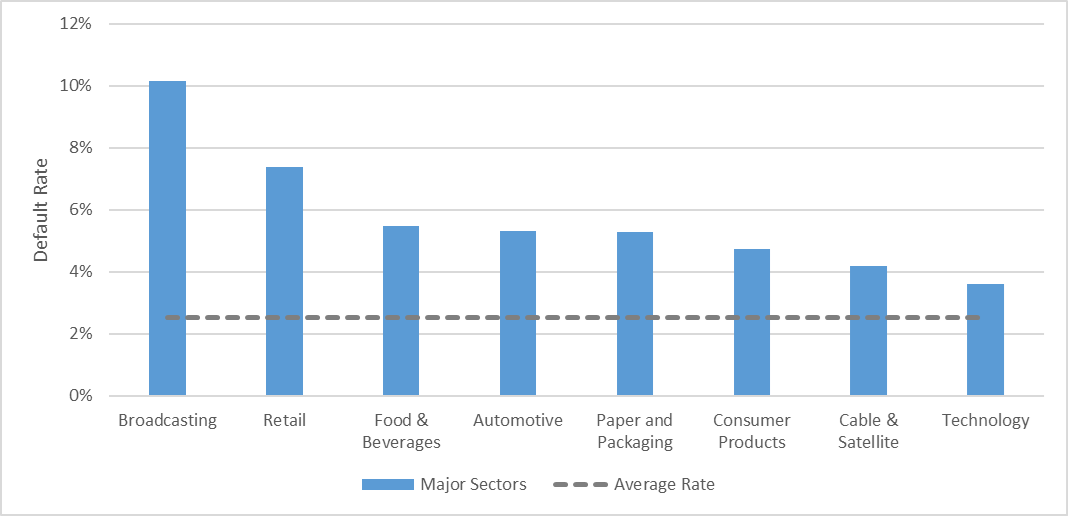

Diagram K: Leveraged Loan + HY Defaults by Sector – LTM

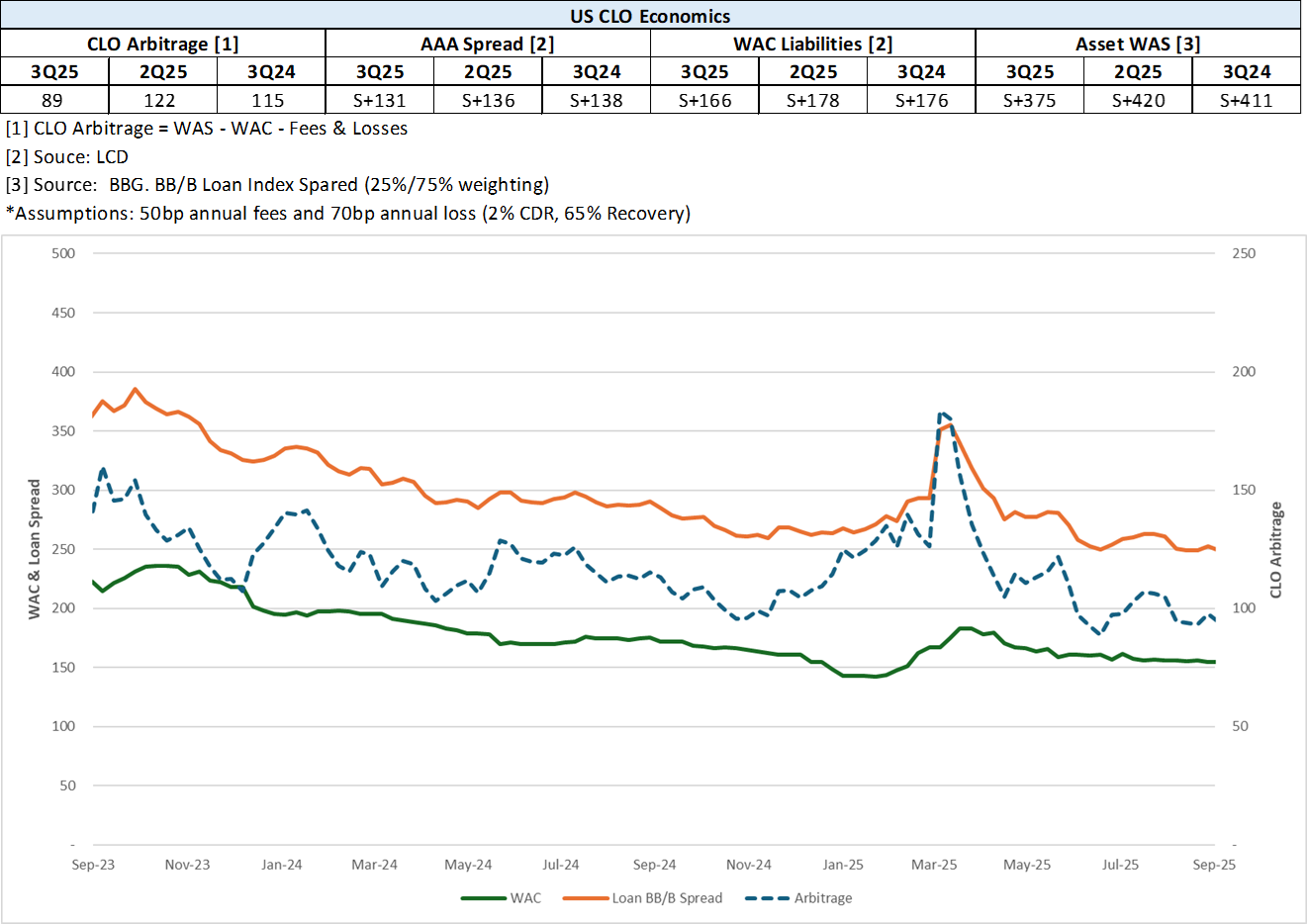

Diagram L: CLO Economics

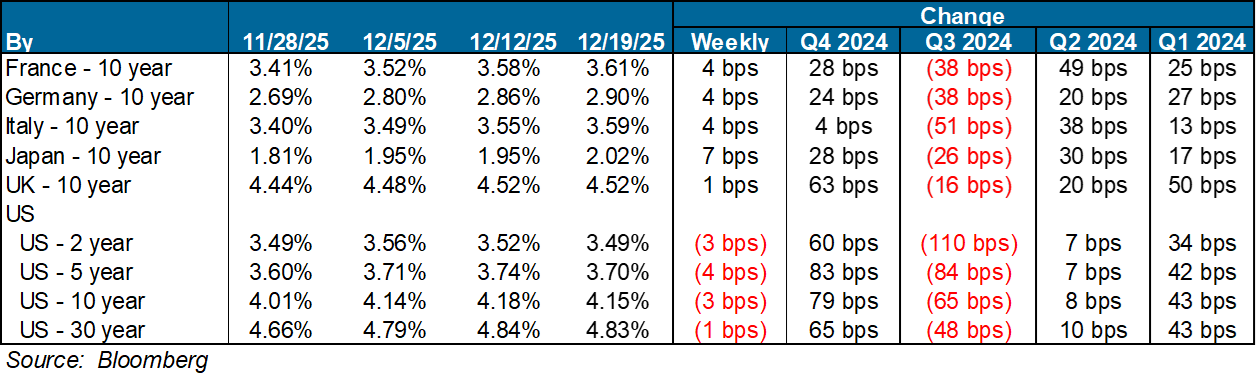

Diagram M: Developed Country Govt. Bond Yields (%)

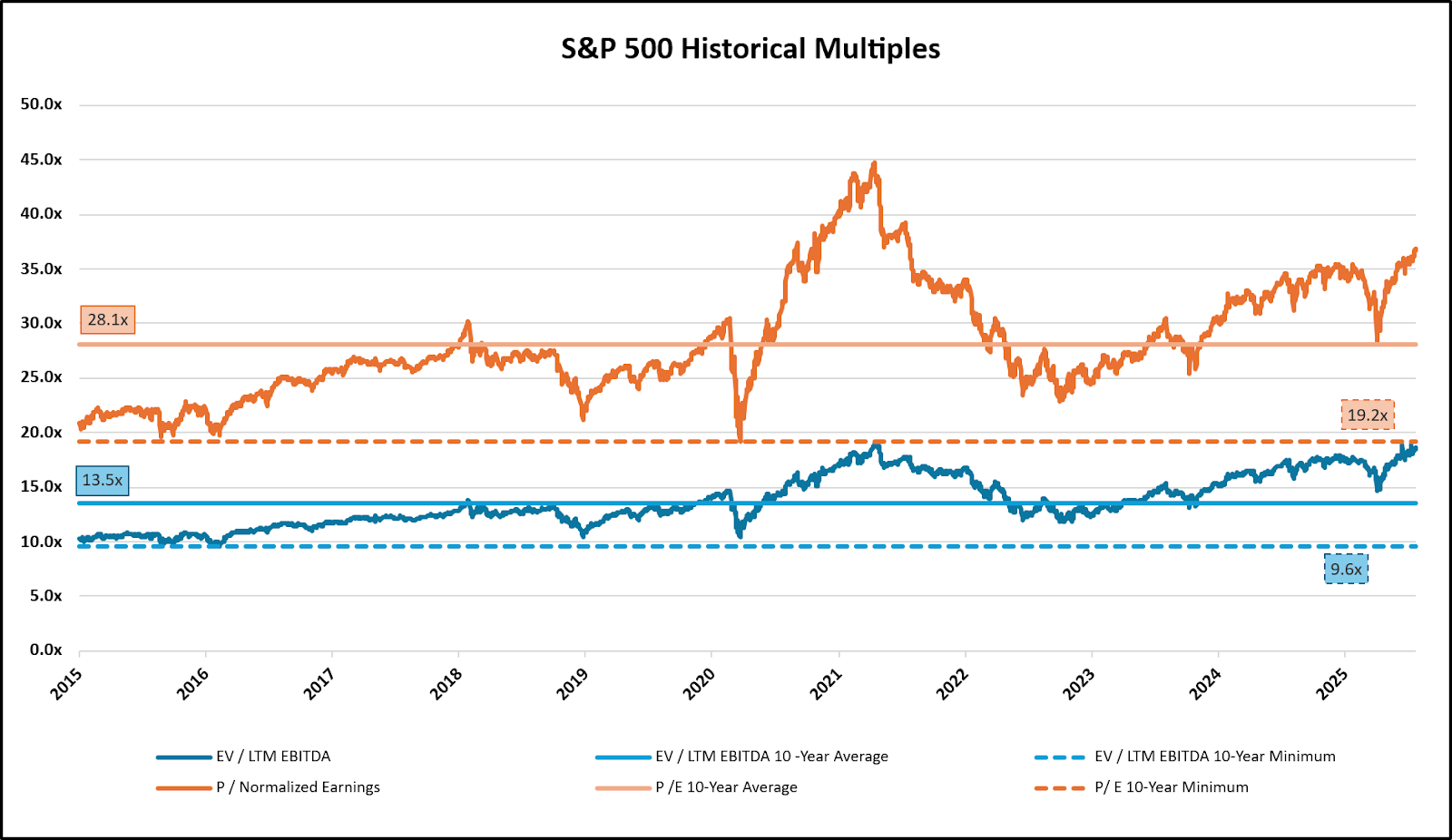

Diagram N: S&P 500 Historical Multiples

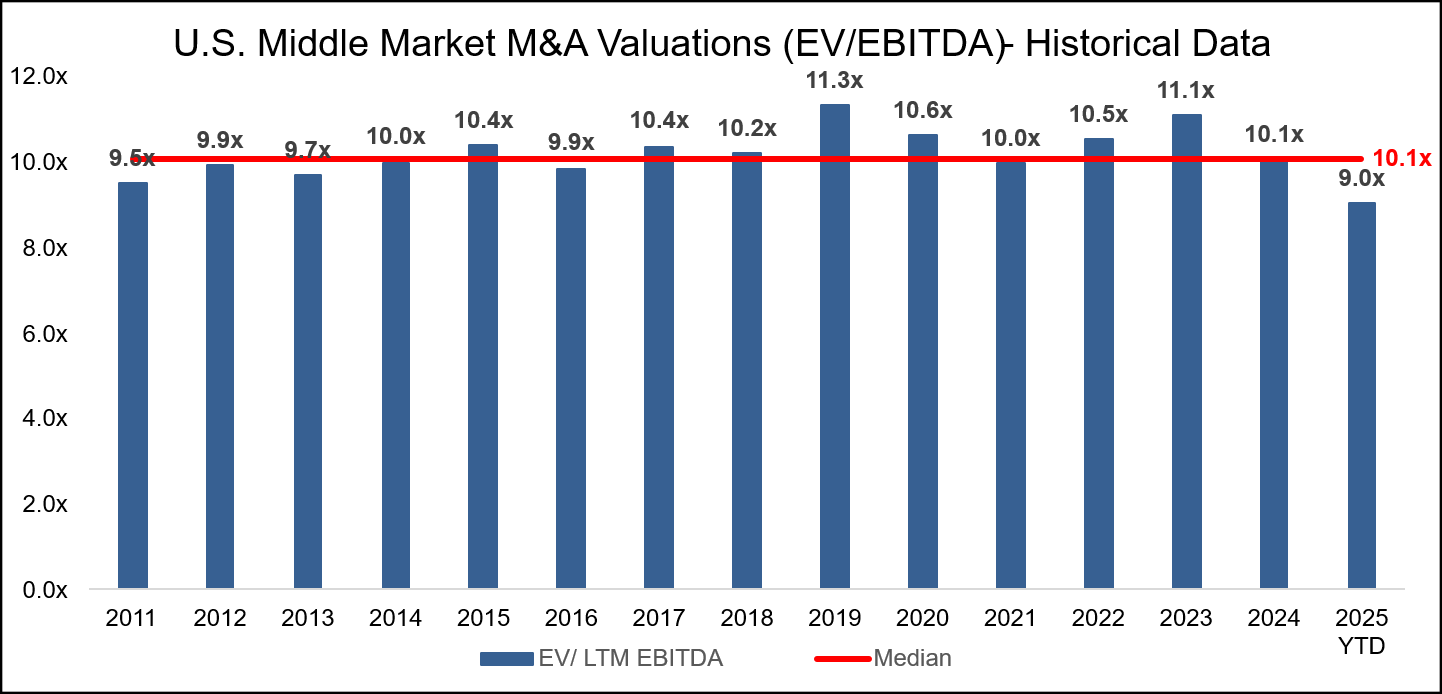

Diagram O: U.S. Middle-Market M&A Valuations (EV/EBITDA)

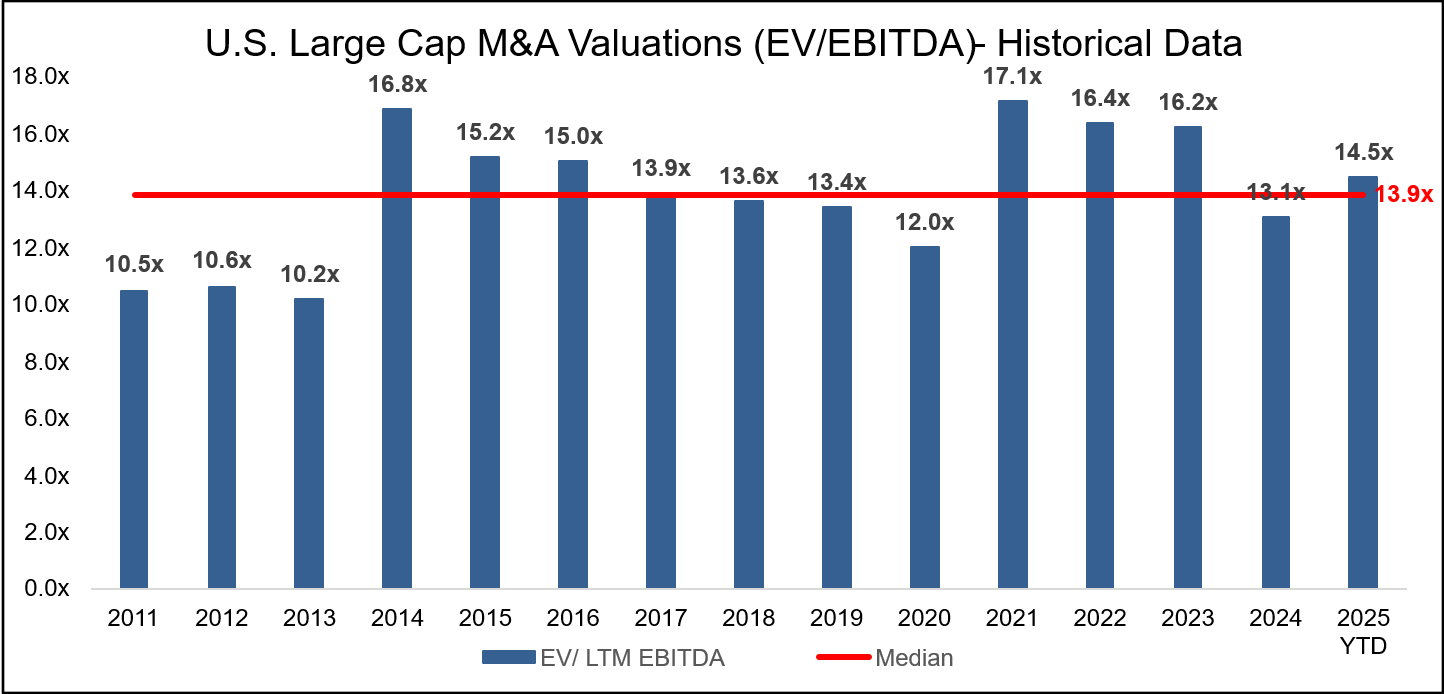

Diagram P: U.S. Large Cap M&A Valuations (EV/EBITDA)

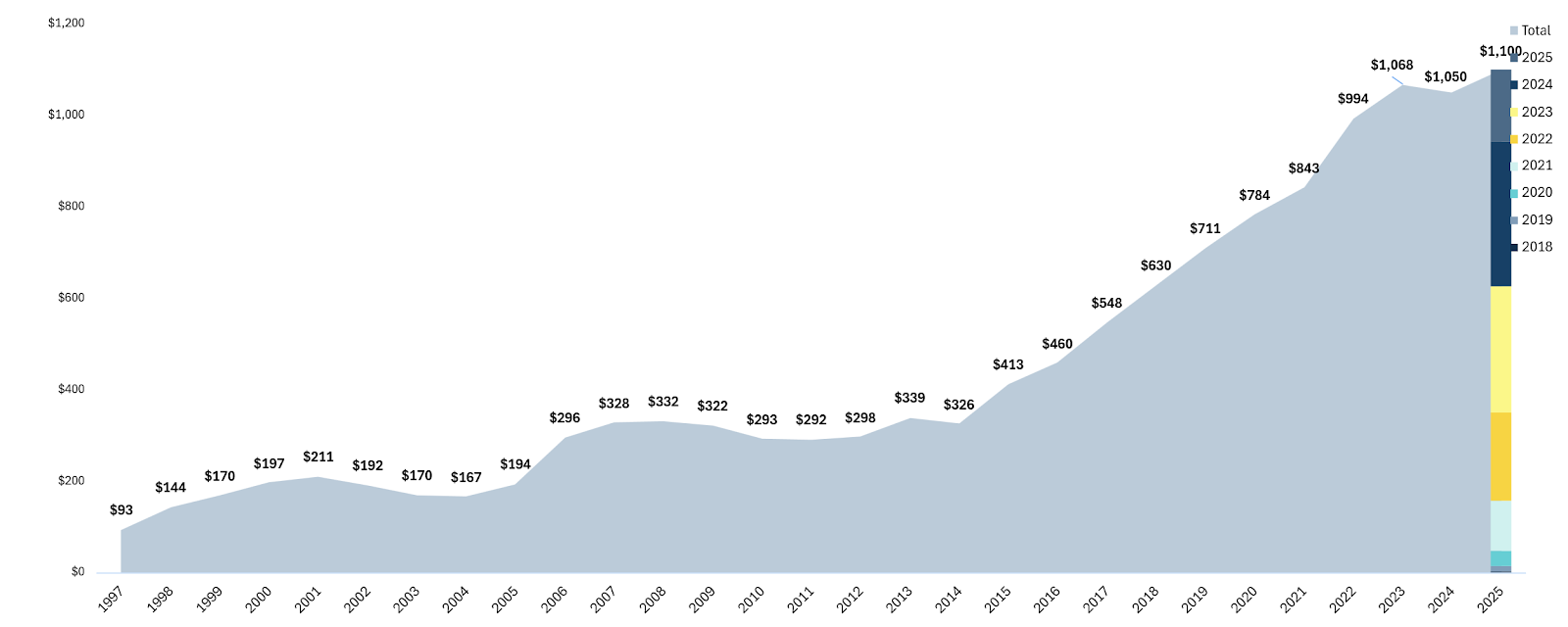

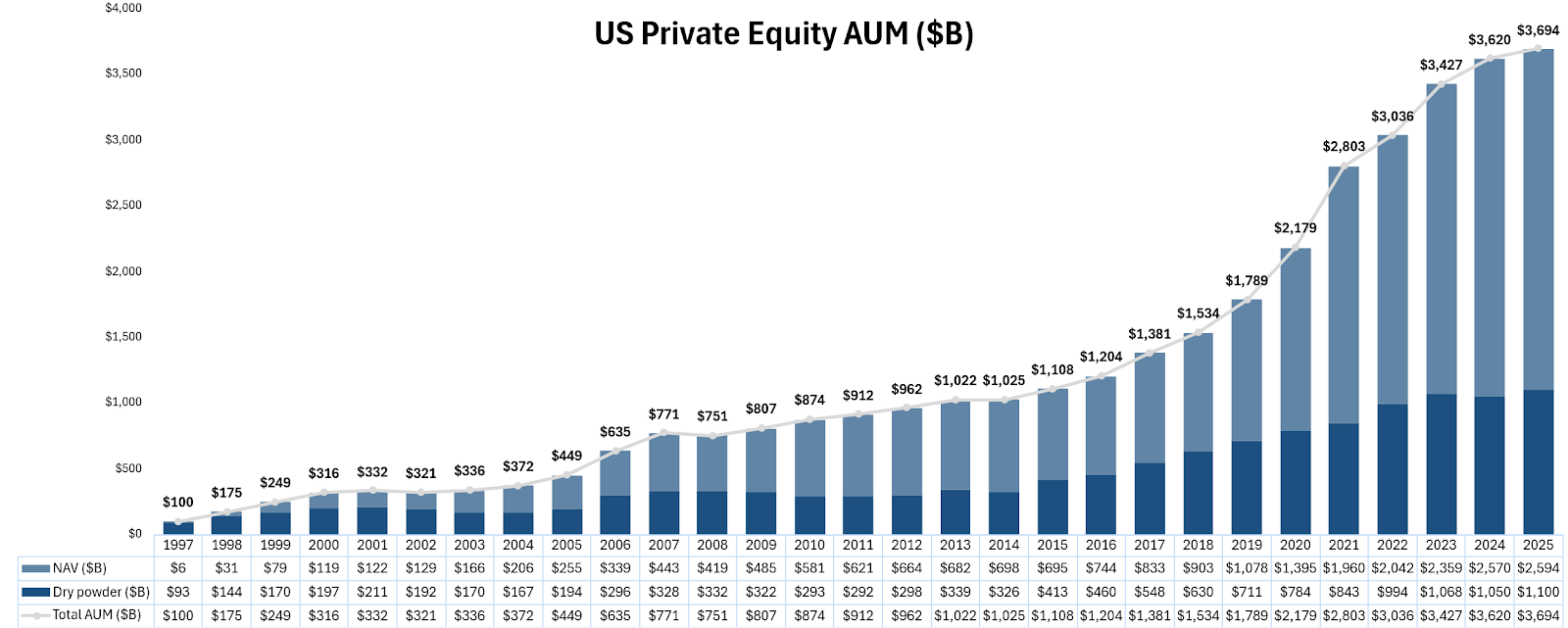

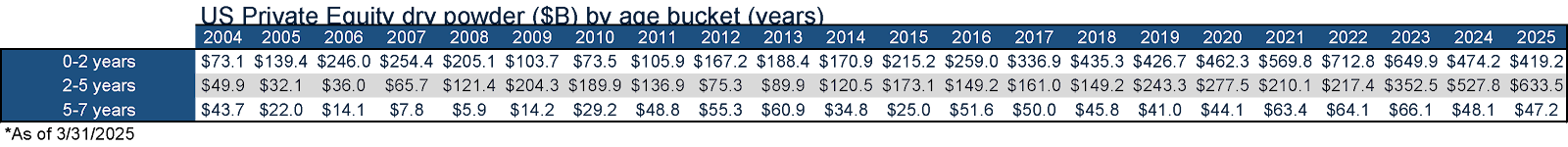

Diagram Q: Dry Powder for All Private Equity Buyouts ($B)

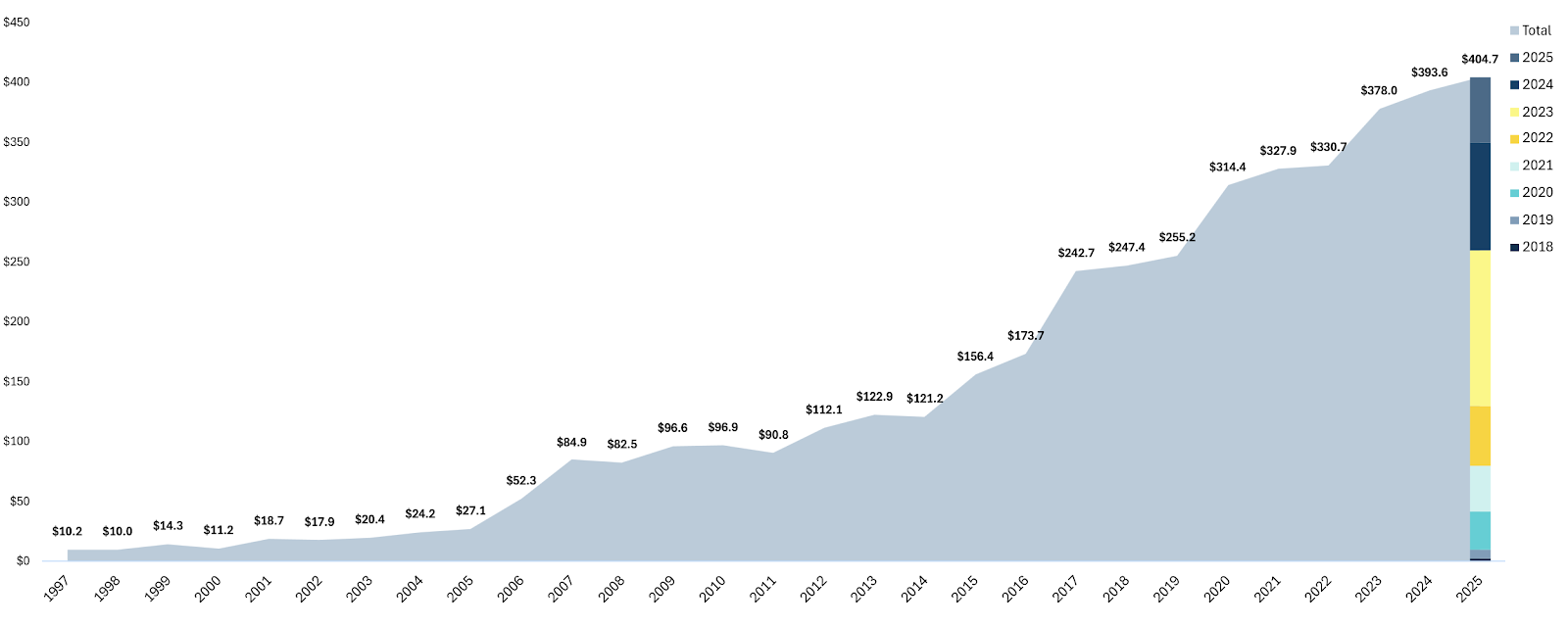

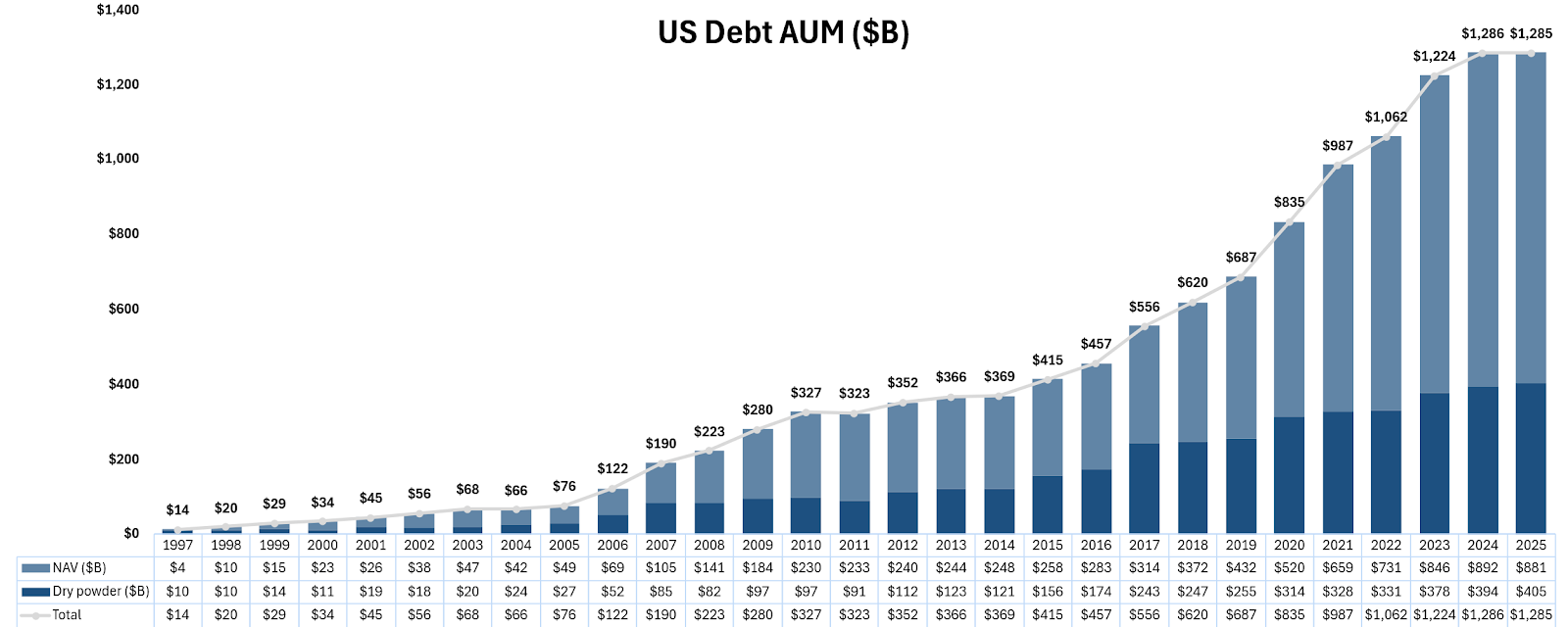

Diagram R: Dry Powder for All US Debt ($B)

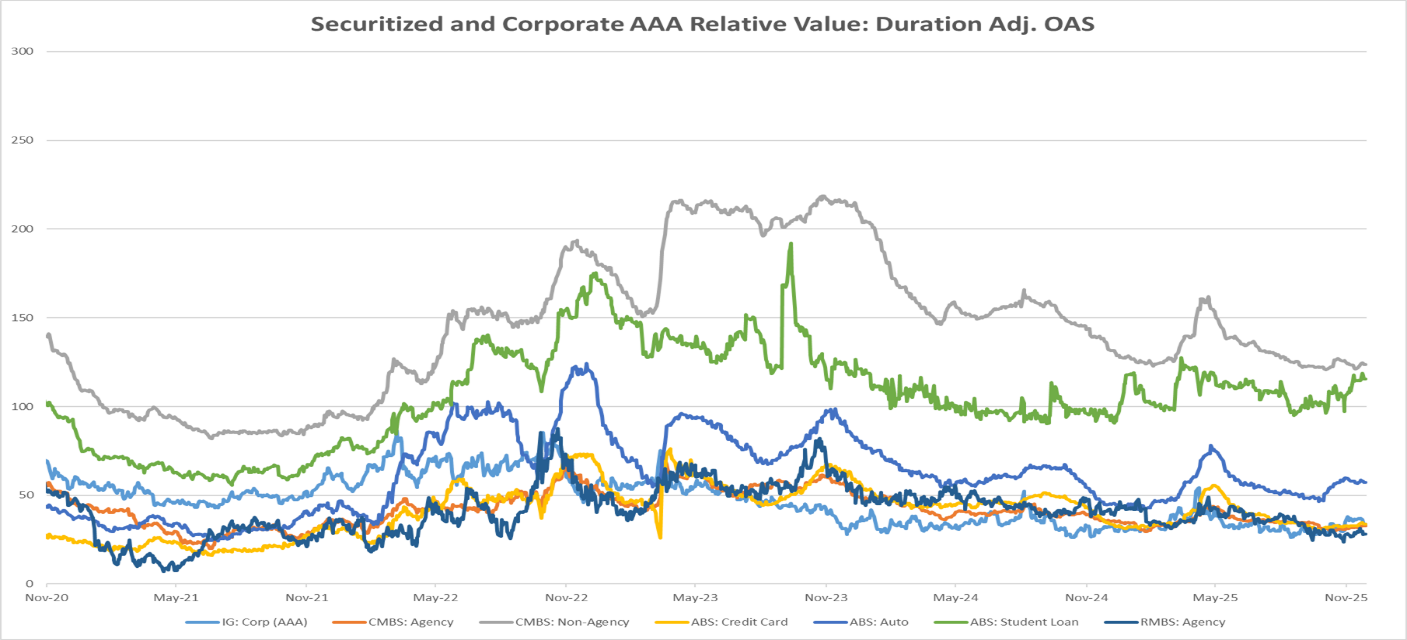

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

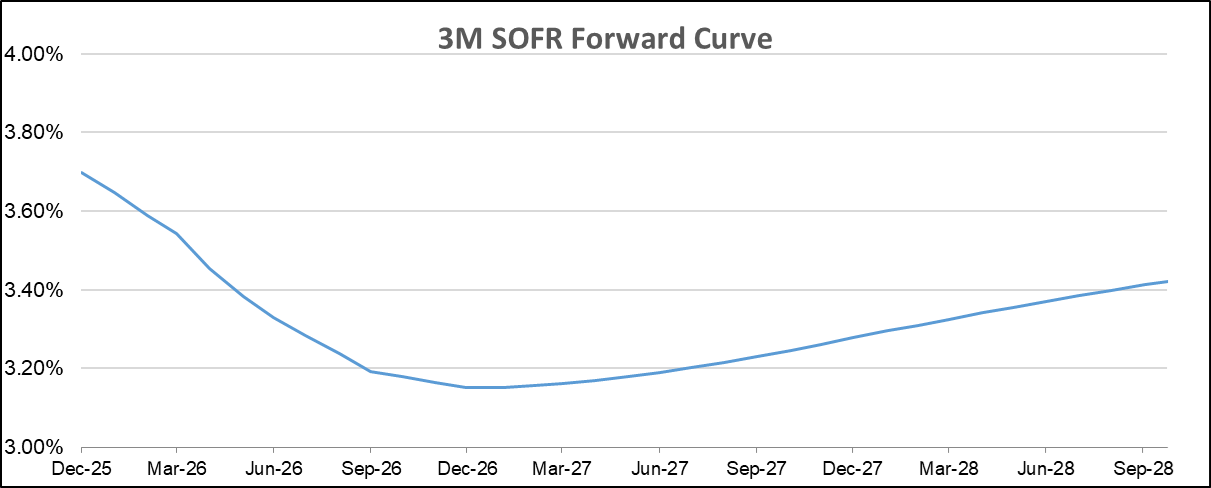

Diagram U: SOFR Curve

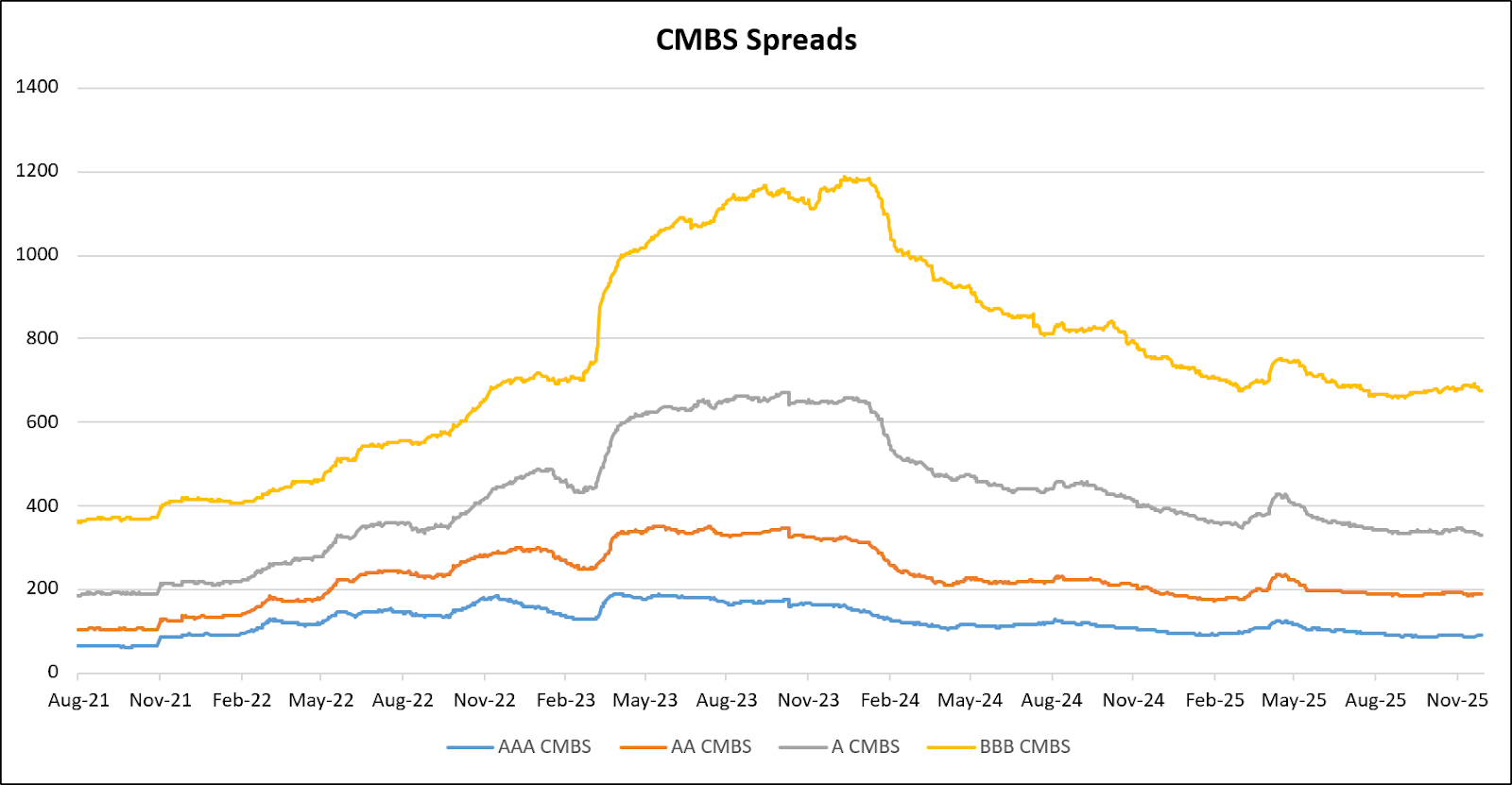

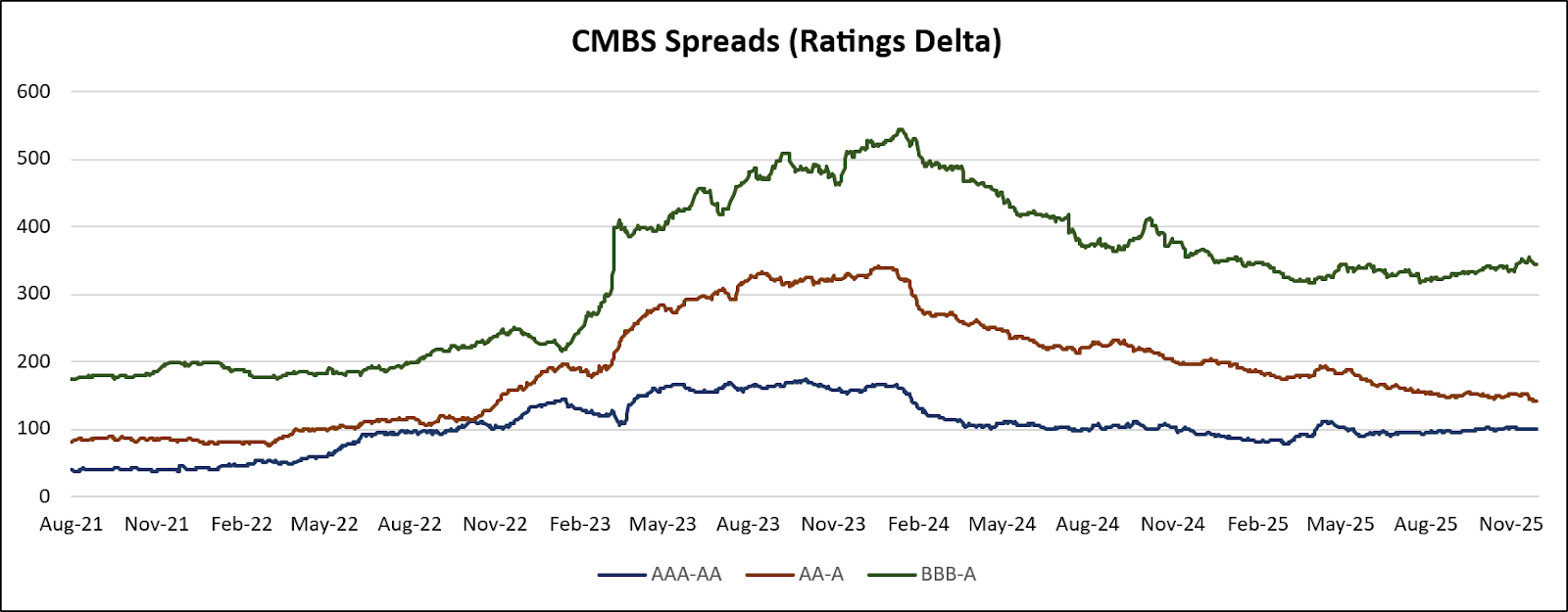

Diagram V: CMBS Spreads

ZCG – New York

16th Floor New York, NY 10019

ZCG – Arabia

Riyadh, 13523 Saudi Arabia

Additional affiliate office located in Pune, India.

Other News

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

ZCG – New York

16th Floor New York, NY 10019

ZCG – Arabia

Riyadh, 13523 Saudi Arabia

Additional affiliate office located in Pune, India.