ZCG PE Insights: Rise in Carve-Out Transaction Activity

ZCG PE Insights: Rise in Carve-Out Transaction Activity

Private Equity Exit Activity Has Slowed Significantly

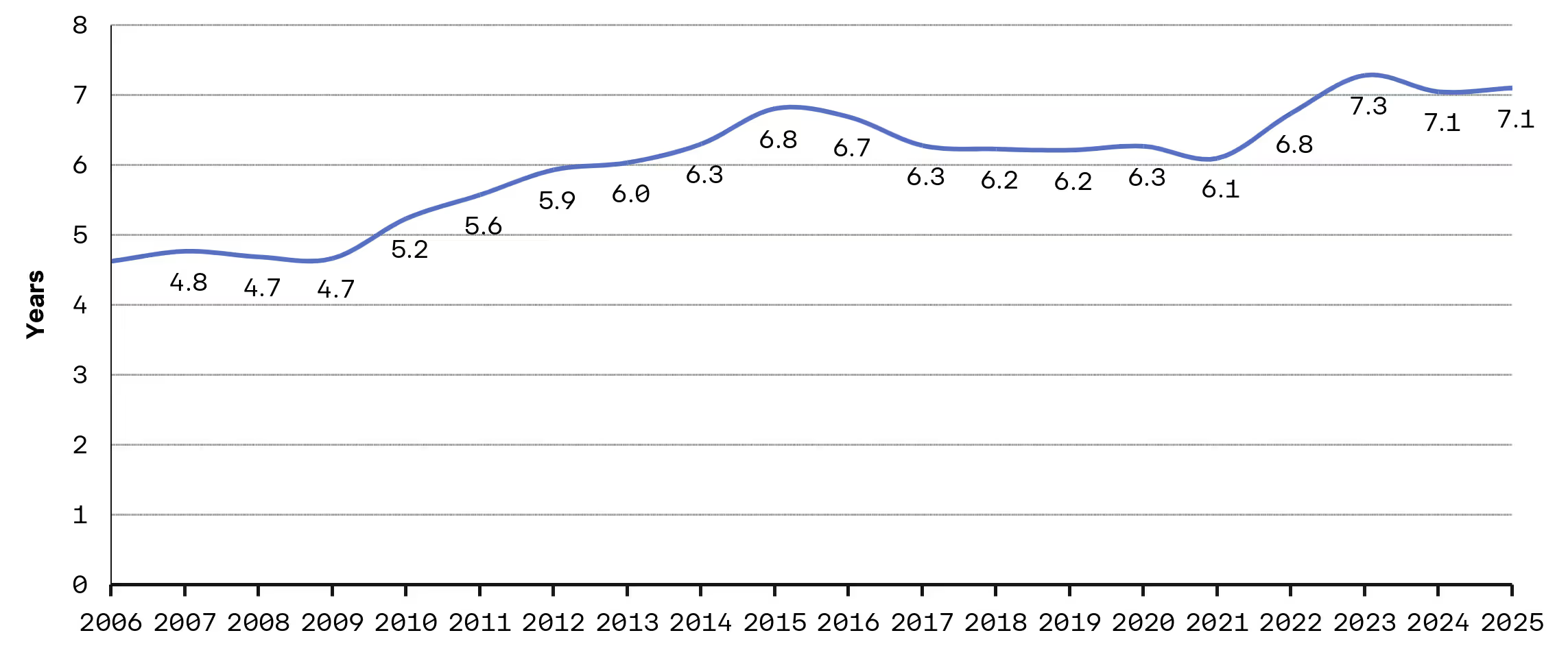

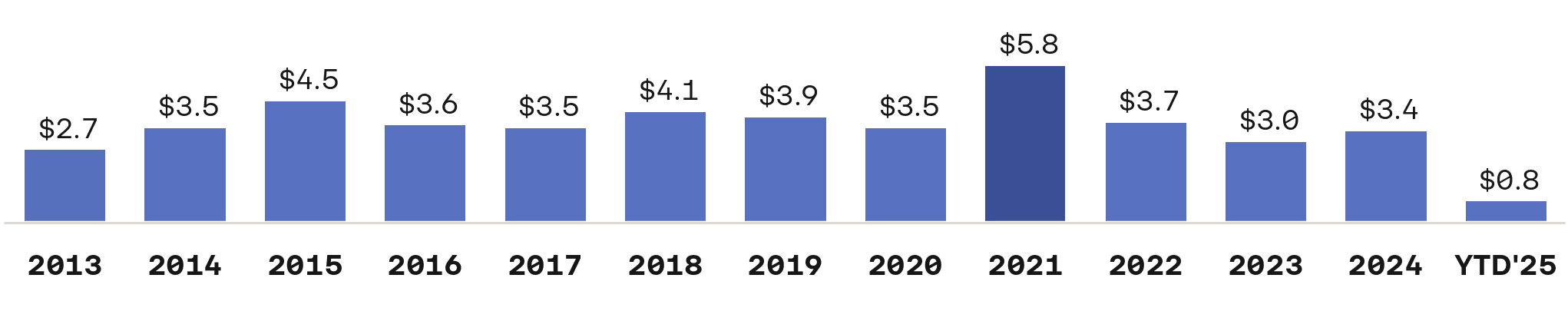

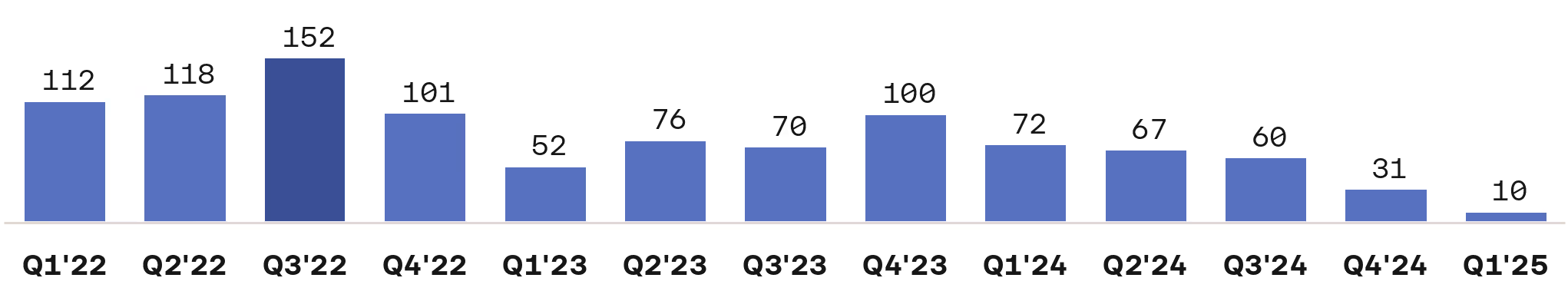

Increased market uncertainty (e.g., potential tariffs, supply chain disruptions, political risks) and high interest rates have significantly reduced private equity deal activity. Private equity firms are delaying exits and holding onto their portfolio companies for longer.

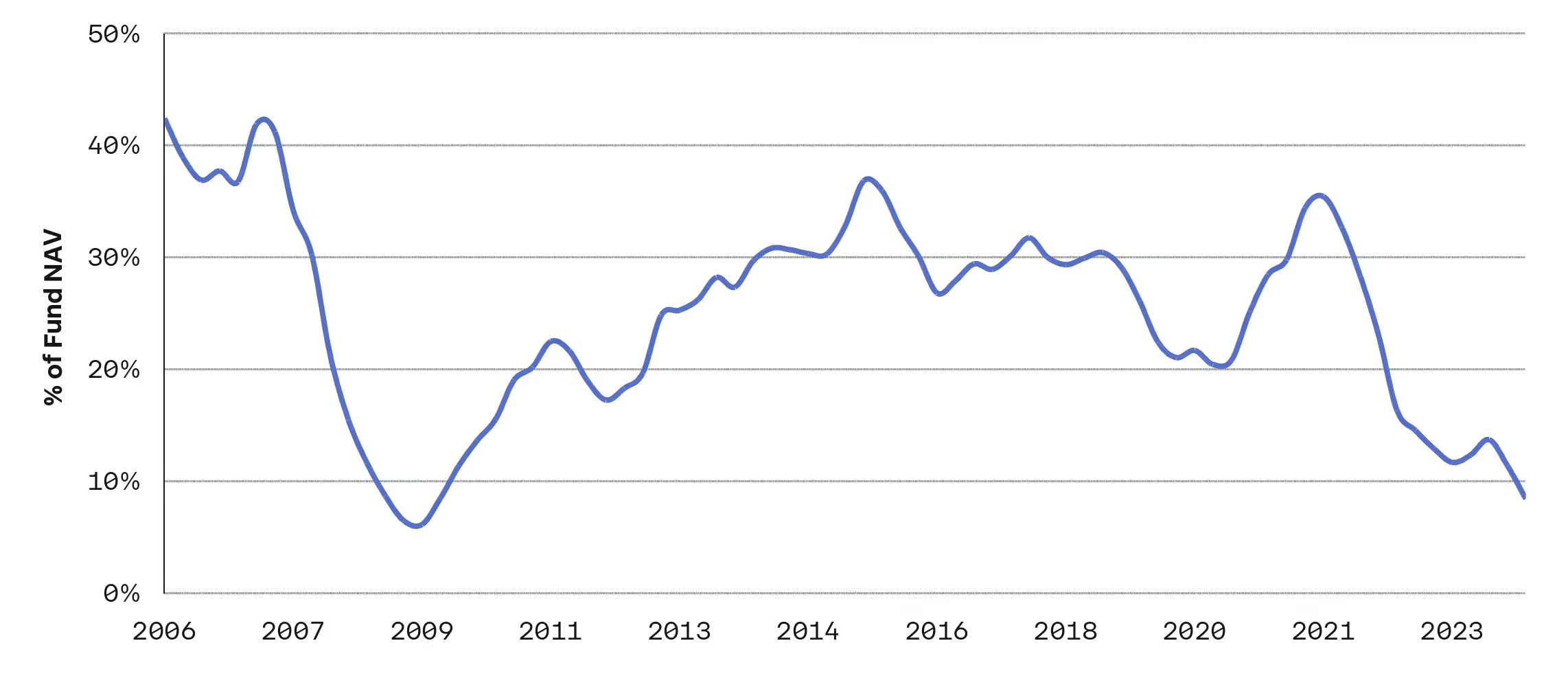

The rise in hold times and slowdown in exits has led to a sharp decline in fund distributions, prompting sponsors to explore alternative strategies to return capital to investors.

Figure 1: U.S. Private Equity Exit Trends (in Years)(1)

Figure 2: Global M&A Deal Volume ($ in Trillions)(2)

Figure 3: Private Market M&A Buyout Transactions Count(2)

Figure 4: TTM U.S. PE Buyout Fund Distributions as a % of Beginning NAV(1)

The Rise in Carve-Out Transactions

The sale of non-core assets or break-up transactions is a well-established strategy for private equity investors. This approach is becoming increasingly common as it offers a way to return capital to Limited Partners while preserving value in the core portfolio company. Additionally, private equity firms with heavily levered portfolio companies are increasingly using this strategy to reduce debt burdens.

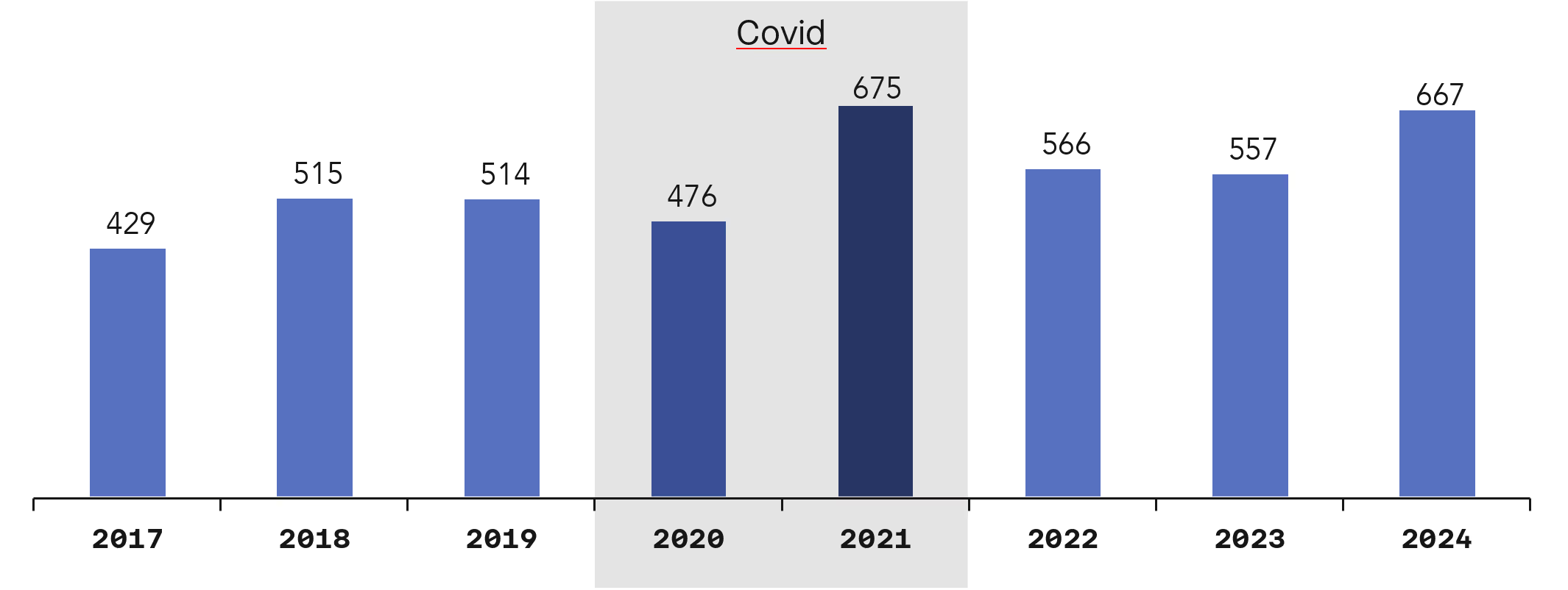

Figure 5: The Number of U.S. Carve-Out Transactions (1)

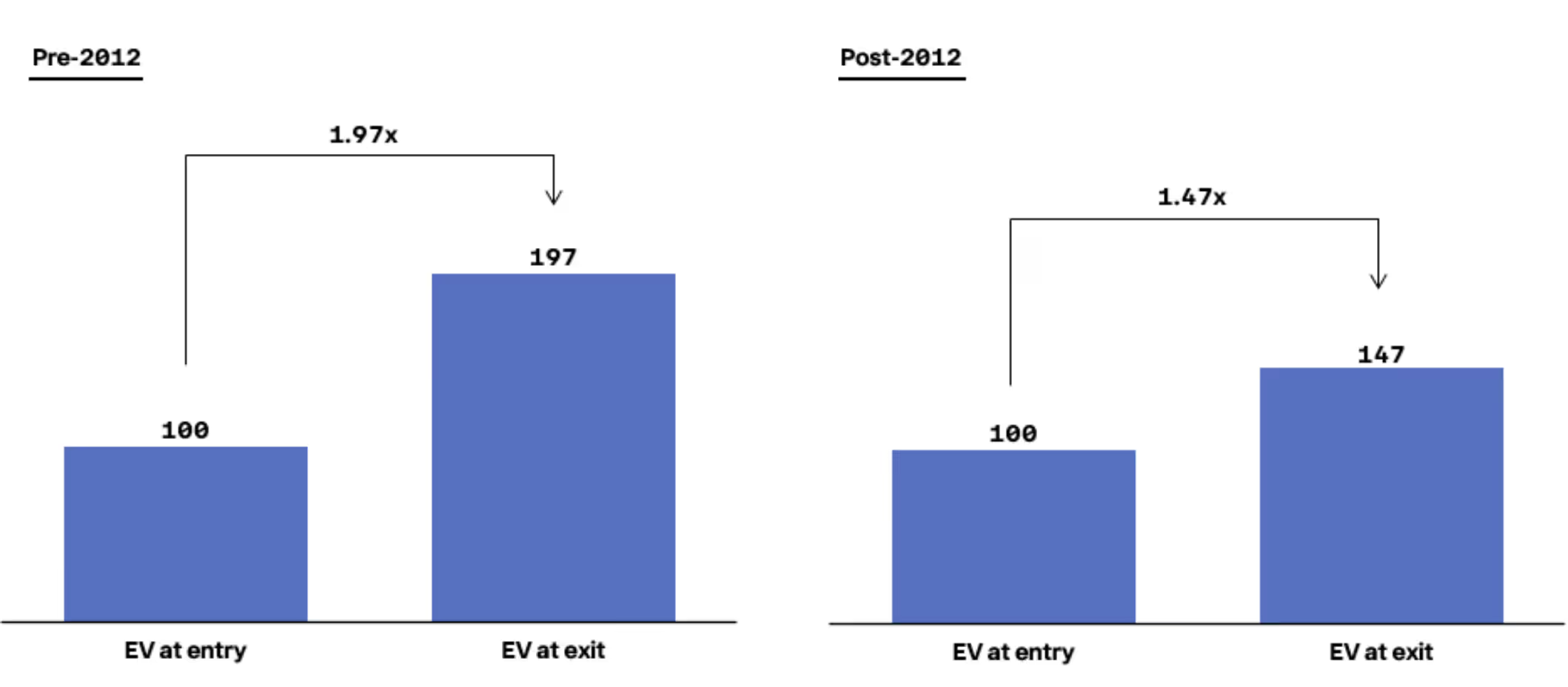

The recent rise in carve-out transactions presents an opportunity for sophisticated private equity investors to generate outsized returns. While carve-outs have long been attractive, more sponsors are pursuing this strategy, increasing competition for deals. As a result, there is greater pressure on post-acquisition execution to ensure value is realized.

Figure 6: Average Return from Carve-Out Transactions(2)

In today’s market, generating value from carve-outs demands more than capital and financial engineering. It requires close collaboration between deal teams, operating professionals, and management – and increasingly, technology enablement. Shared ownership across stakeholders enables faster, more informed decisions across both the P&L and balance sheet.

Technology and Operational Expertise: Key Drivers for PE Success

Private equity firms face growing pressure due to outdated business models and a lack of operational and technological expertise needed to compete today. Winning firms are evolving their business models to meet this challenge. This includes:

- Cross-functional operating talent with deep expertise in fields such as finance, supply chain, insurance, and HR

- Integrated technology platforms that deliver real-time visibility, automate workflows, and connect CRM, ERP, and pricing systems across the portfolio

Technology is no longer a support function – it’s central to value creation. Yet few mid-market companies have achieved the technology capabilities needed to compete effectively in today’s market. Organizations that are technology-enabled can achieve up to 35% higher revenue growth and 10% higher profit margins than their peers(3). These gains come from leveraging digital tools such as AI-powered pricing systems and predictive supply chain analytics.

Passive ownership is no longer viable. Without a flexible, tech-enabled approach to value creation, firms will struggle to remain competitive in today’s increasingly complex and fast-moving environment.

Sources

1 Pitchbook

2 Bain (https://www.bain.com/insights/pe-backed-carve-outs-global-private-equity-report-2025/)