U.S. News

- GDP

- The U.S. GDP grew at a 1.6% annual rate in the first quarter of the year, below economists’ expectations of 2.4%

- Inflation remained firm with the PCE price index rising 3.7% in the first quarter, higher than the expected 3.4%

- U.S. stocks declined and the yield on the 10-year Treasury note rose to 4.706%, its highest level since November

- New Home Sales

- U.S. new-home sales rose by 8.8% in March 2024 to an annual rate of 693,000, marking the highest level since September 2023

- The median sales price of a new home in March 2024 increased to $430,700, up from $400,500 the previous month

- Sales were particularly strong in the Northeast, where new-home sales increased by 28%

- Personal consumption index

- PCE price index accelerated to 2.7% year-over-year in March, higher than the expected 2.6%

- Consumer spending remained strong in March, with a 0.8% increase from the previous month, exceeding the expected 0.5% rise

- Savings as a percentage of disposable income dropped to 3.2%, marking the lowest rate since October 2022

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 207,000 in the week ended April 19, down 5,000 from the prior week

- The four-week moving average was 213,250, down 1250 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – decreased by 15,000 to 1.781 million in the week ended April 12. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.402 trillion in the week ended April 26, down $3.1 billion from the prior week

- Treasury holdings totaled $4.540 trillion, down $20.7 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.39 trillion in the week, down $1.7 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.55 trillion as of April 26, an increase of 9.8% from the previous year

- Debt held by the public was $24.61 trillion, and intragovernmental holdings were $7.08 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.5% in March year over year

- On a monthly basis, the CPI increased 0.4% in March on a seasonally adjusted basis, after increasing 0.4% in February

- The index for all items less food and energy (core CPI) rose 0.4% in March, after rising 0.4% in February

- Core CPI increased 3.8% for the 12 months ending March

- Food and Beverages:

- The food at home index increased 1.2% in March from the same month a year earlier, and decreased 0.0% in March month over month

- The food away from home index increased 4.2% in March from the same month a year earlier, and increased 0.3% in March month over month

- Commodities:

- The energy commodities index increased 1.5% in March after increasing 3.6%

- The energy commodities index fell 0.9% over the last 12 months

- The energy services index (0.0%) in March after increasing 0.1% in February

- The energy services index rose 3.1% over the last 12 months

- The gasoline index fell 1.3% over the last 12 months

- The fuel oil index fell (3.7%) over the last 12 months

- The index for electricity rose 5.0% over the last 12 months

- The index for natural gas fell (3.2%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $2,705.54 per 40ft

- Drewry’s composite World Container Index has increased by 55.5% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in March after increasing 0.4% in February

- The rent index increased 0.5% in March after increasing 0.4% in February

- The index for lodging away from home increased 5.6% in March after increasing 3.1% in February

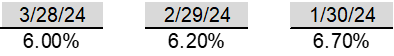

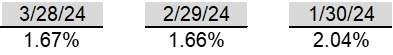

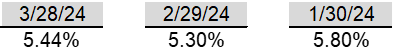

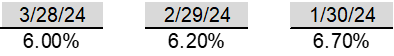

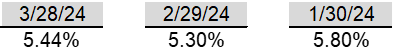

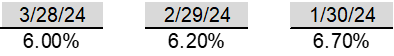

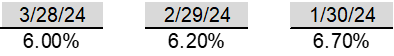

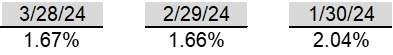

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel

- Egypt’s intelligence chief, Abbas Kamel, led a delegation to Israel to negotiate a cease-fire in Gaza and prevent a planned Israeli military offensive in Rafah

- The negotiations also aim to prevent a potential escalation in the region, particularly with fears that an offensive in Rafah could lead to mass Palestinian displacement into Egypt

- The ceasefire talks have been deadlocked for weeks, with significant disagreements remaining over the conditions of a ceasefire and the release of senior Palestinian prisoners

-

United Kingdom

- The UK’s Rwanda Deportation Bill, aimed at sending asylum seekers to Rwanda, has passed after prolonged legislative debates and is expected to receive royal assent

- The Home Office has prepared to deport a group of asylum seekers with weak legal claims as part of the bill’s implementation, with costs projected at £1.8 million for the first 300 deportees

- The bill has faced significant opposition and legal challenges, with criticisms focusing on its potential violation of international law and human rights.prisoners

-

China

- Secretary of State Antony Blinken urged Chinese leader Xi Jinping to reduce China’s support for Russia’s defense industry during a meeting in Beijing, warning of potential U.S. action if concerns were not addressed

- China has provided critical materials to Russia’s military industry, such as optics, microelectronics, and drone engines, strengthening Russia’s capabilities in its conflict with Ukraine, according to U.S. officials

- Chinese gold consumption rose by 5.94% year-on-year in the first quarter of the year, reaching 308.91 tons, driven by economic uncertainty

- Imports of gold raw materials into China surged by 78% during the same period, contributing to a 21.16% increase in the country’s total gold output

-

Europe

- The European Union is conducting new investigations into Chinese business practices, focusing on subsidies and economic policies that potentially harm European businesses

- One investigation involves Chinese procurement practices for medical devices, which the EU claims unfairly favor Chinese companies

- The EU also raided the Dutch and Polish offices of Chinese security equipment company Nuctech over potential unfair advantages from foreign subsidies

-

Finland

- Finland, sharing NATO’s longest border with Russia at 830 miles, has escalated its security measures, including constructing new fences and enhancing surveillance, in response to increased Russian aggression and hybrid warfare tactics

-

South Korea

- SK Hynix plans to invest an additional $14.6 billion to expand its semiconductor production capacity in South Korea, aiming to meet the increasing demand for artificial intelligence chips

-

Canada

- Honda is nearing a deal to build an electric vehicle assembly plant in Ontario, Canada, with the Canadian government agreeing to offset some of the capital costs through newly introduced tax breaks

-

Poland

- Russian missiles have breached Polish airspace several times since 2022, with the most recent incident occurring on March 24, 2024, when a Russian cruise missile entered Polish airspace for 39 seconds, posing a risk of wider conflict, according to Poland’s President Andrzej Duda

-

United Kingdom

- Vinci Airports acquired a 50.01% stake in Edinburgh Airport for GBP 1.27 billion ($1.58 billion), expanding its presence in the U.K. airport market

-

Germany

- Germany’s industrial production rose more than expected in February, helped by a recovery in the construction and car industry, as the country looks to exit a recent manufacturing slump

-

Japan

- The Bank of Japan ended negative interest rates and unwound most of its unconventional monetary easing policies, moving its key target for short-term rates to a range of 0% to 0.1%, its first rate increase since 2007

Commodities

-

Oil Prices

- WTI: $83.85 per barrel

- +0.85% WoW; +17.03% YTD; +12.16% YoY

- Brent: $89.36 per barrel

- +2.37% WoW; +15.99% YTD; +14.02% YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended April 19, down 0.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 613, down 6 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 453.6 million barrels, down (1.6%) YoY

- Refiners operated at a capacity utilization rate of 88.5% for the week, up from 88.1% in the prior week

- U.S. crude oil imports now amount to 6.461 million barrels per day, down 1.9% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.66 per gallon in the week of April 26,

up 0.9% YoY

- Gasoline prices on the East Coast amounted to $3.64, up 0.1% YoY

- Gasoline prices in the Midwest amounted to $3.54, down (2.3%) YoY

- Gasoline prices on the Gulf Coast amounted to $3.32, down (0.5%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.57, down (2.5%) YoY

- Gasoline prices on the West Coast amounted to $4.96, up 6.6% YoY

- Motor gasoline inventories were down by 0.6 million barrels from the prior week

- Motor gasoline inventories amounted to 226.7 million barrels, up 2.5% YoY

- Production of motor gasoline averaged 9.14 million bpd, down (8.7%) YoY

- Demand for motor gasoline amounted to 8.423 million bpd, up (11.4%) YoY

-

Distillates

- Distillate inventories decreased by 1.6 million in the week of April 26

- Total distillate inventories amounted to 116.6 million barrels, up 4.5% YoY

- Distillate production averaged 4.779 million bpd, up (2.4%) YoY

- Demand for distillates averaged 3.552 million bpd in the week, down (4.7%) YoY

-

Natural Gas

- Natural gas inventories increased by 92 billion cubic feet last week

- Total natural gas inventories now amount to 2,425 billion cubic feet, up 20.7% YoY

Credit News

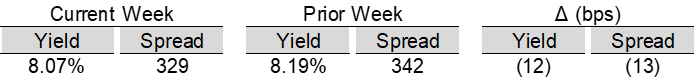

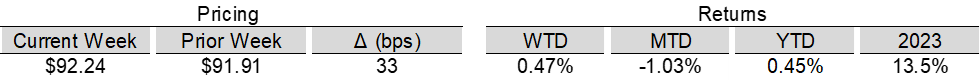

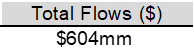

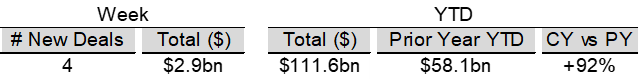

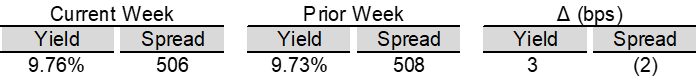

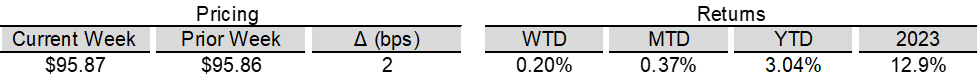

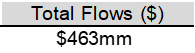

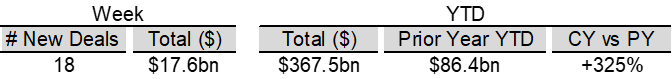

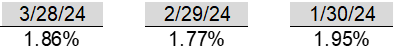

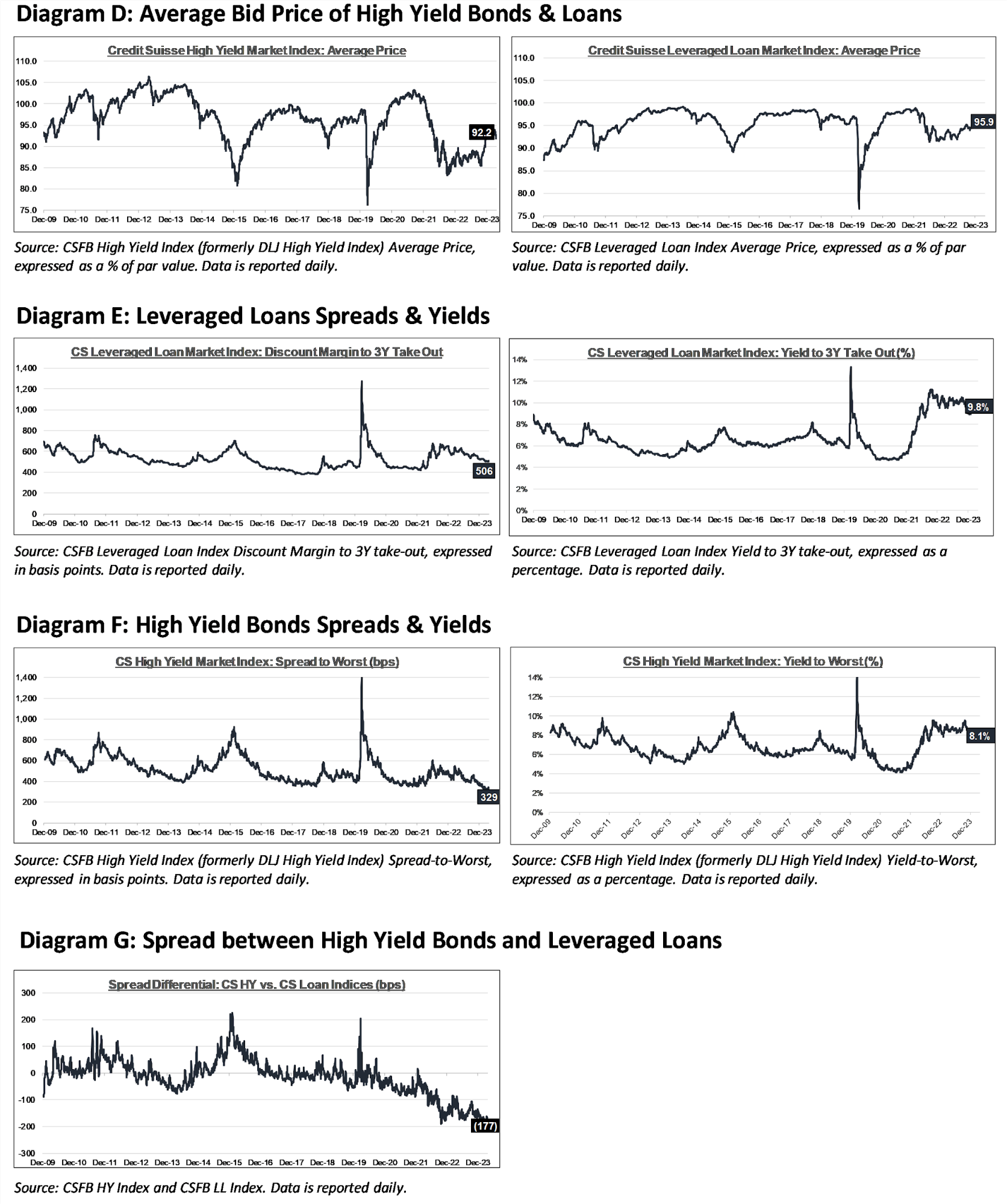

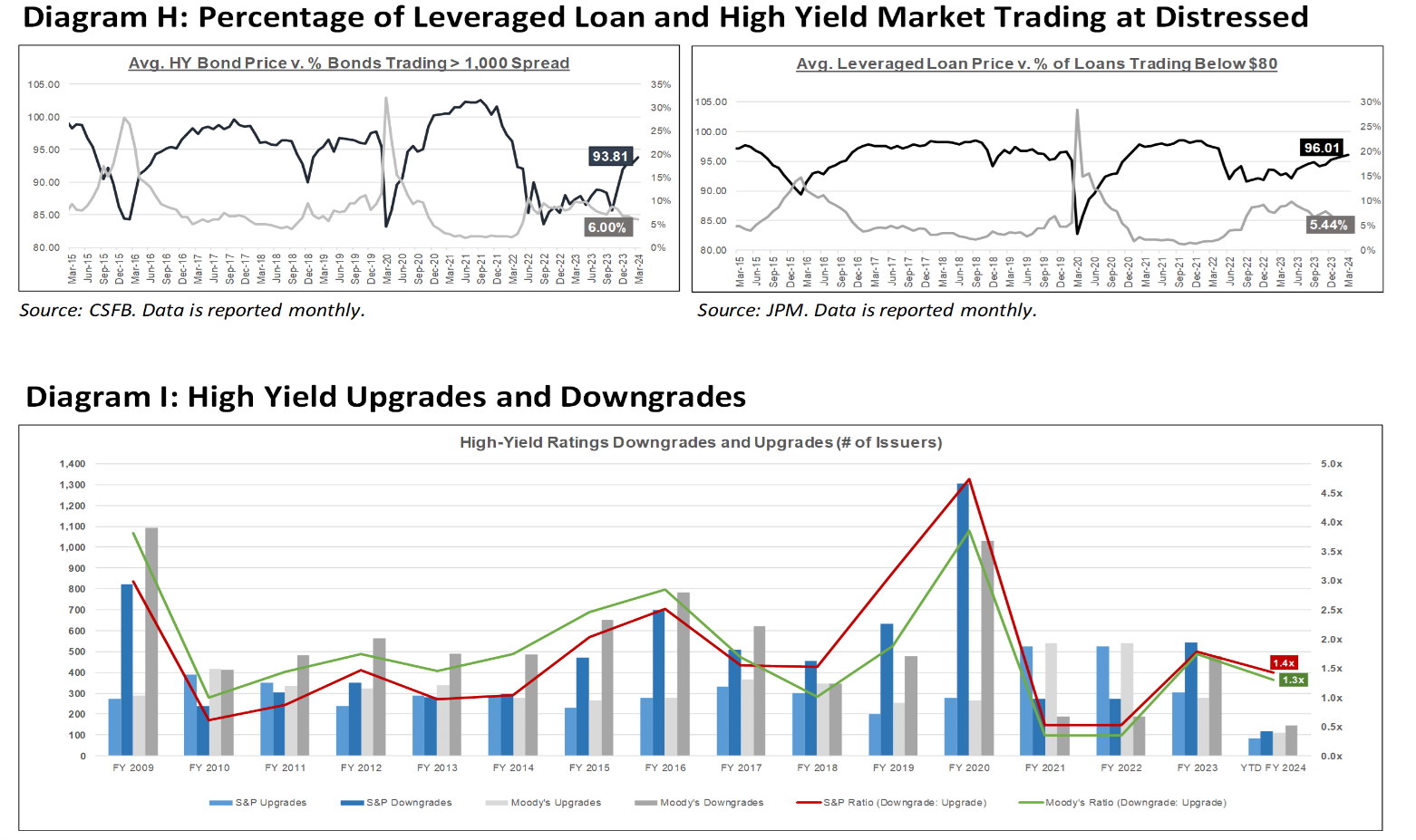

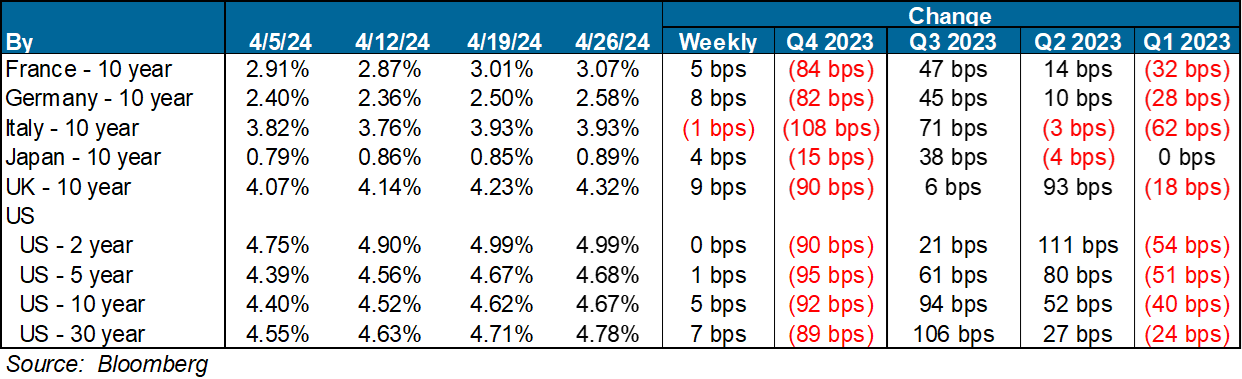

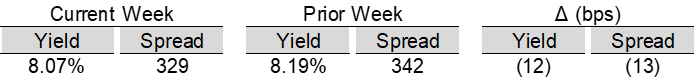

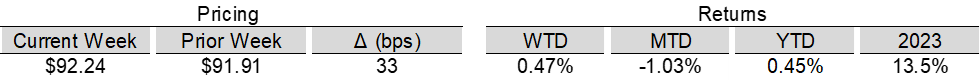

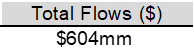

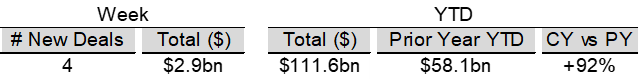

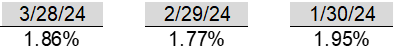

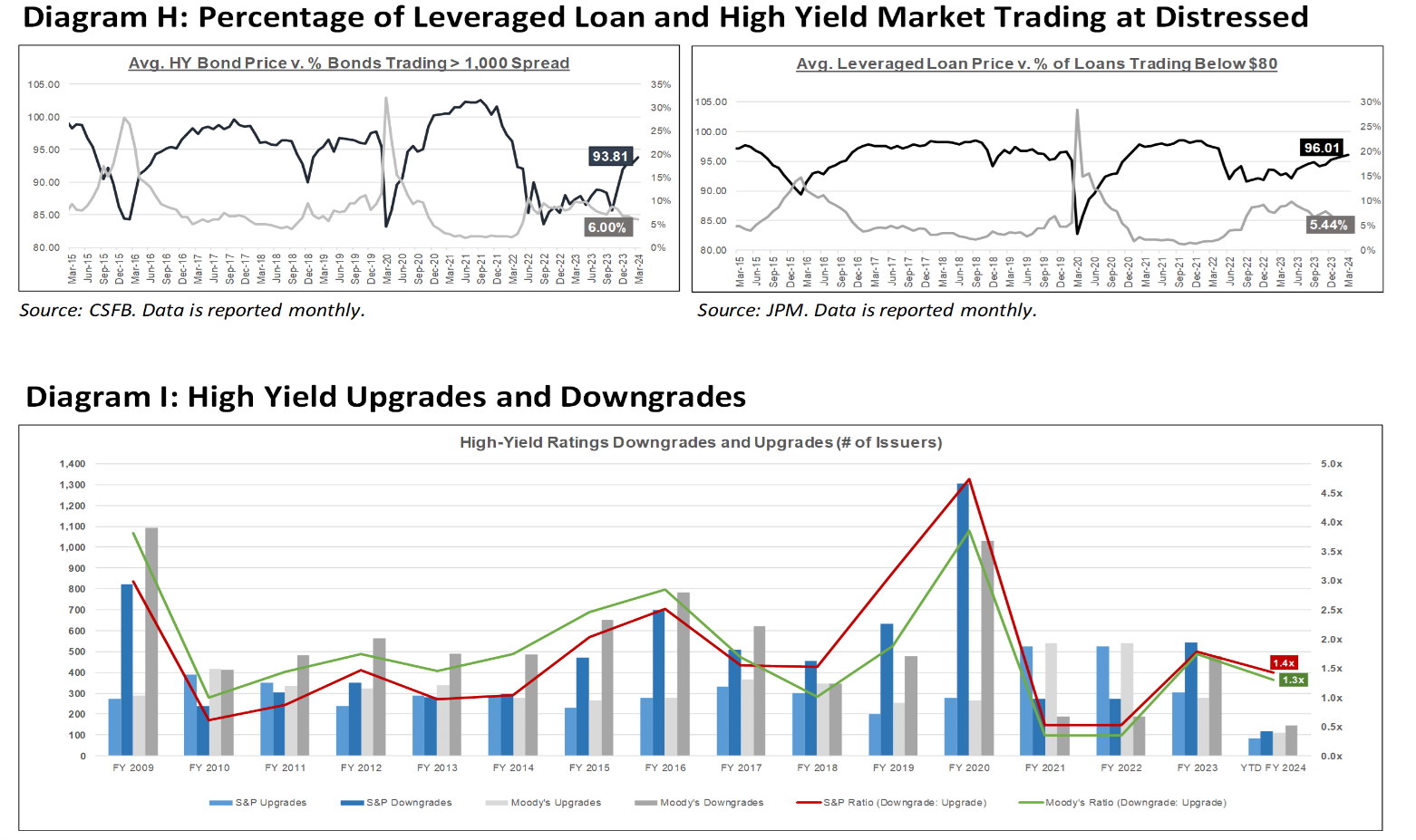

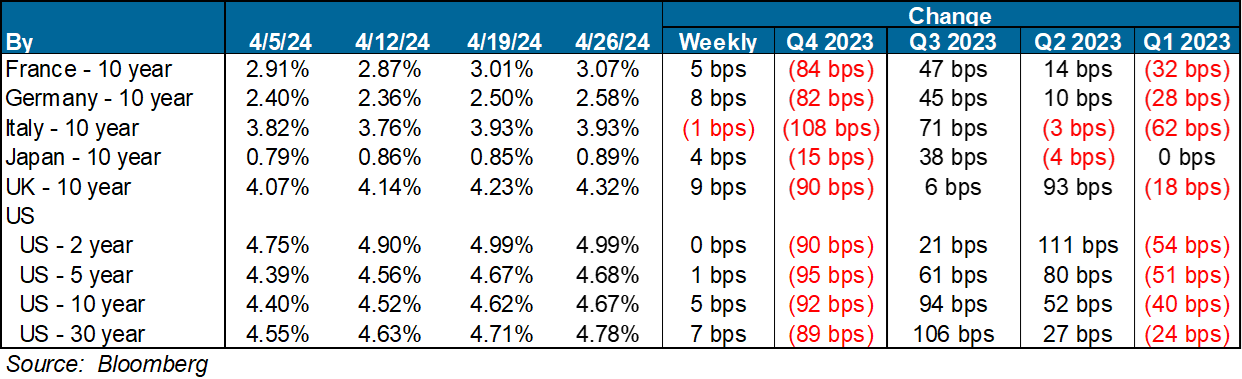

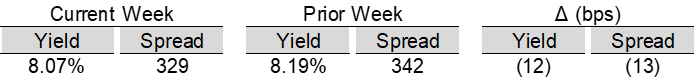

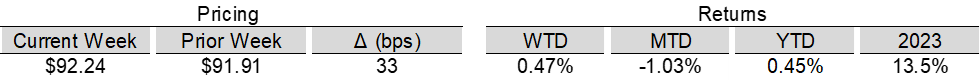

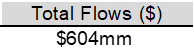

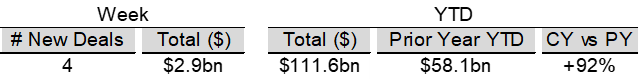

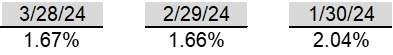

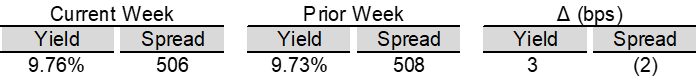

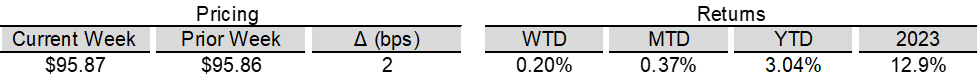

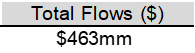

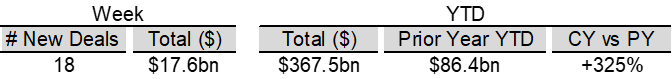

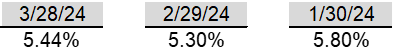

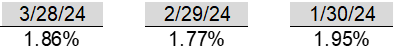

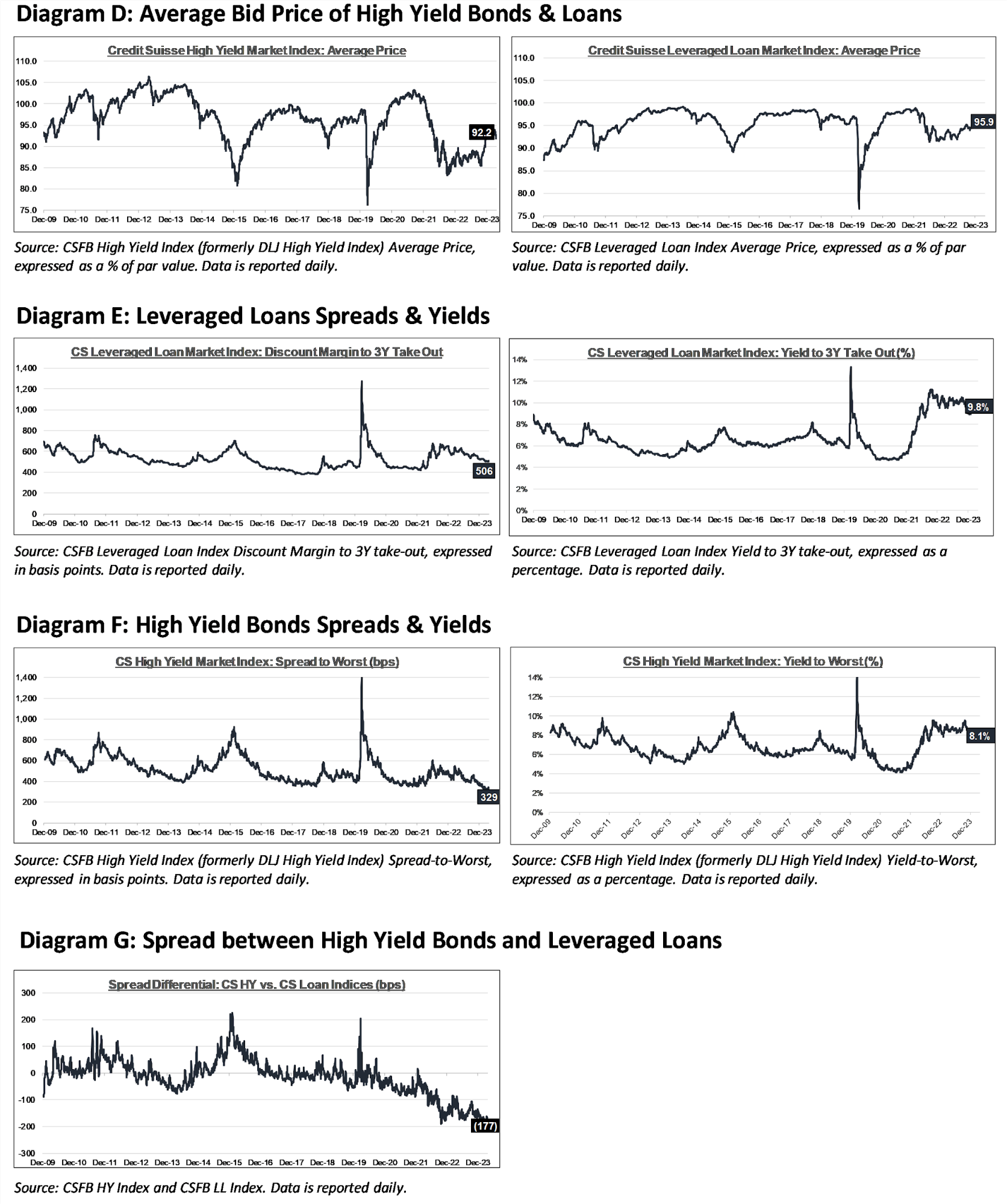

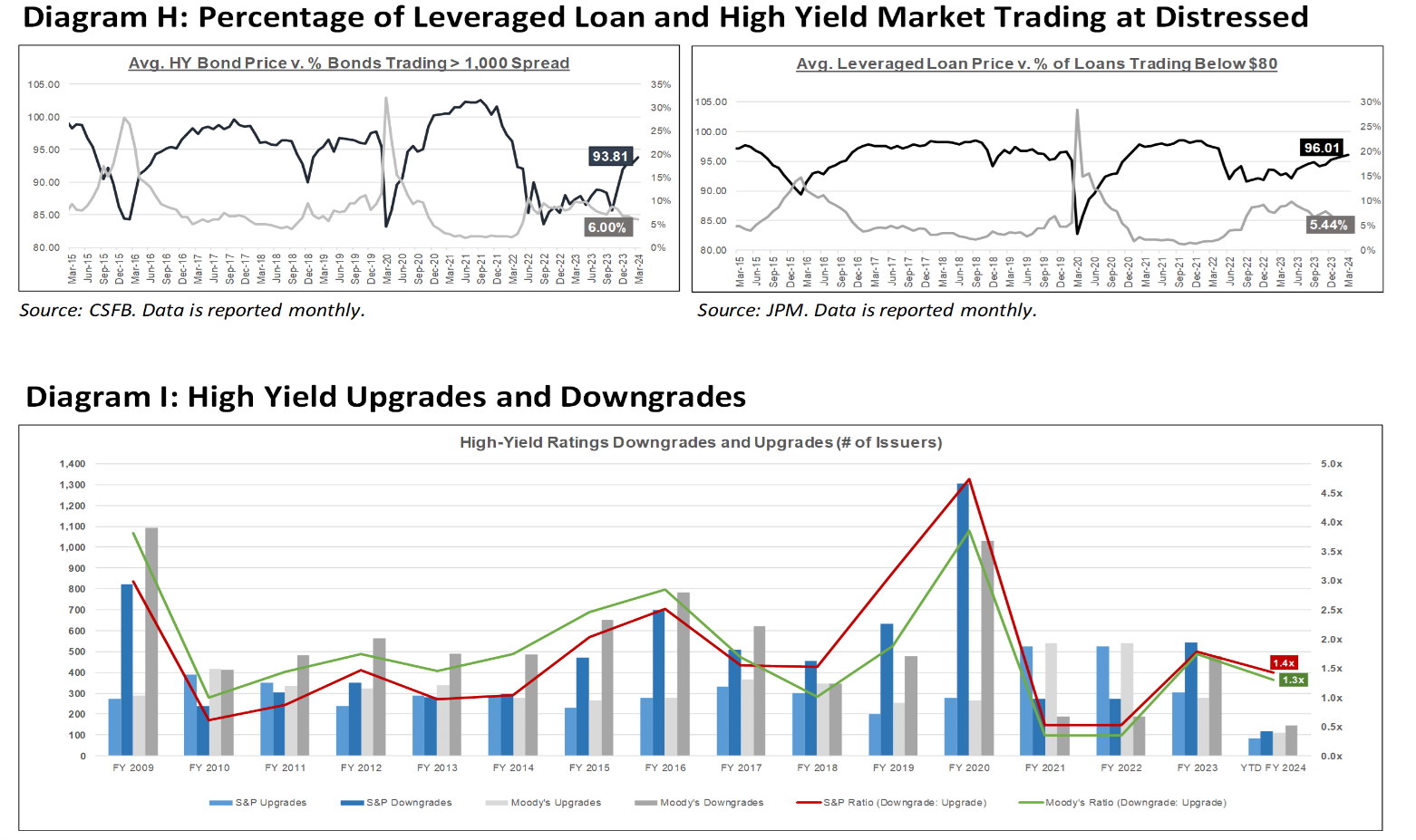

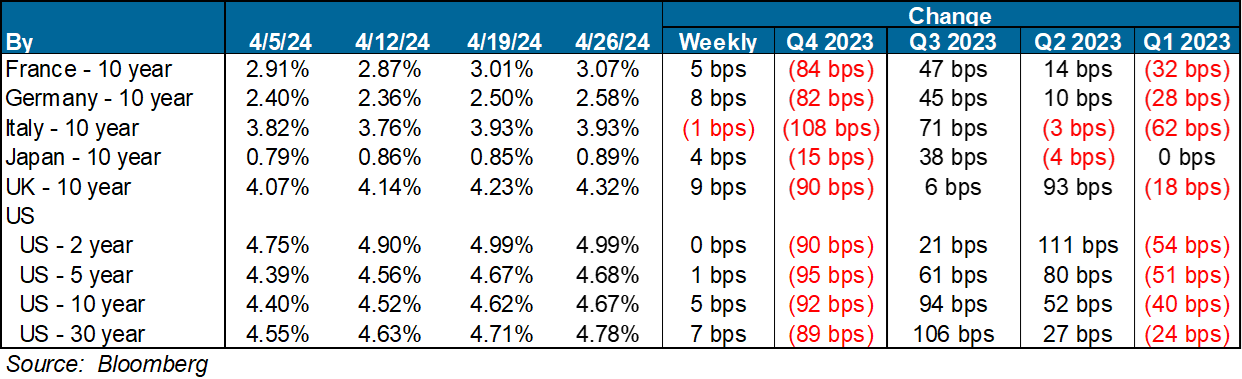

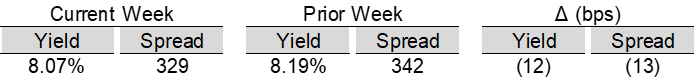

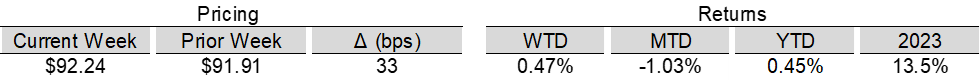

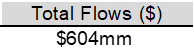

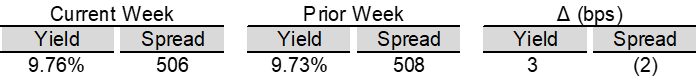

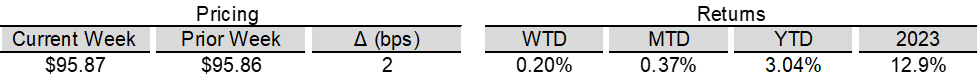

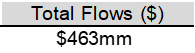

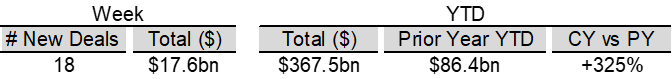

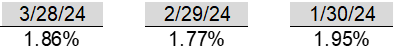

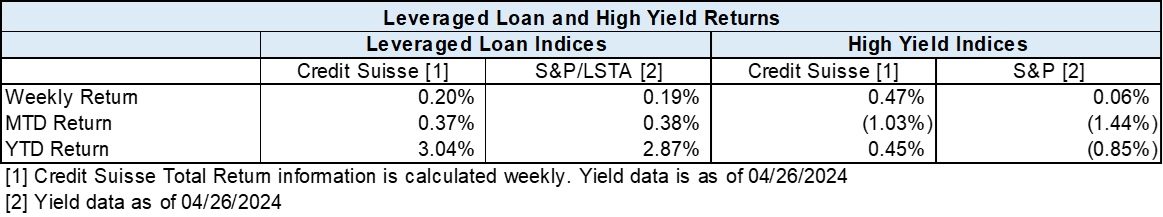

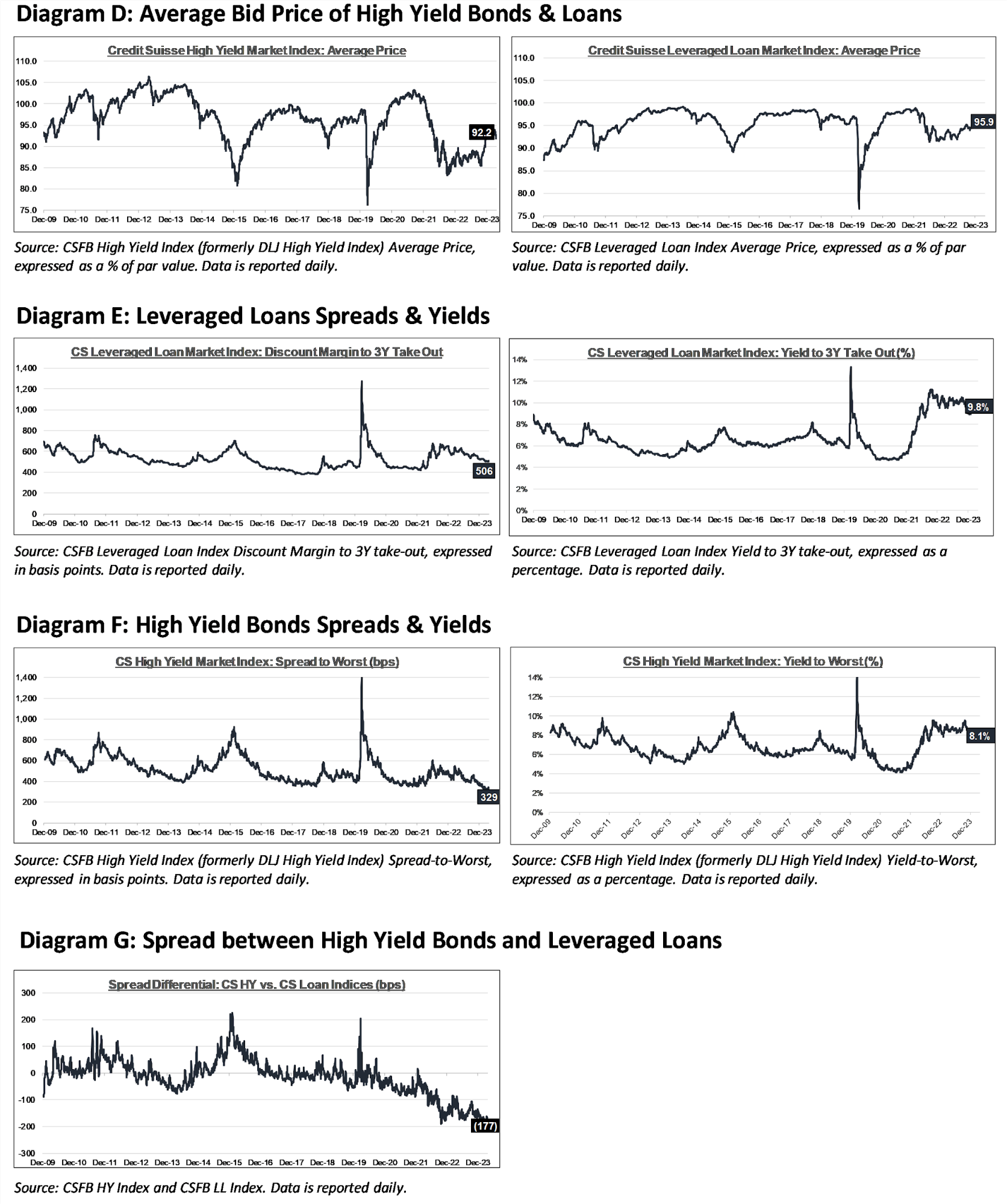

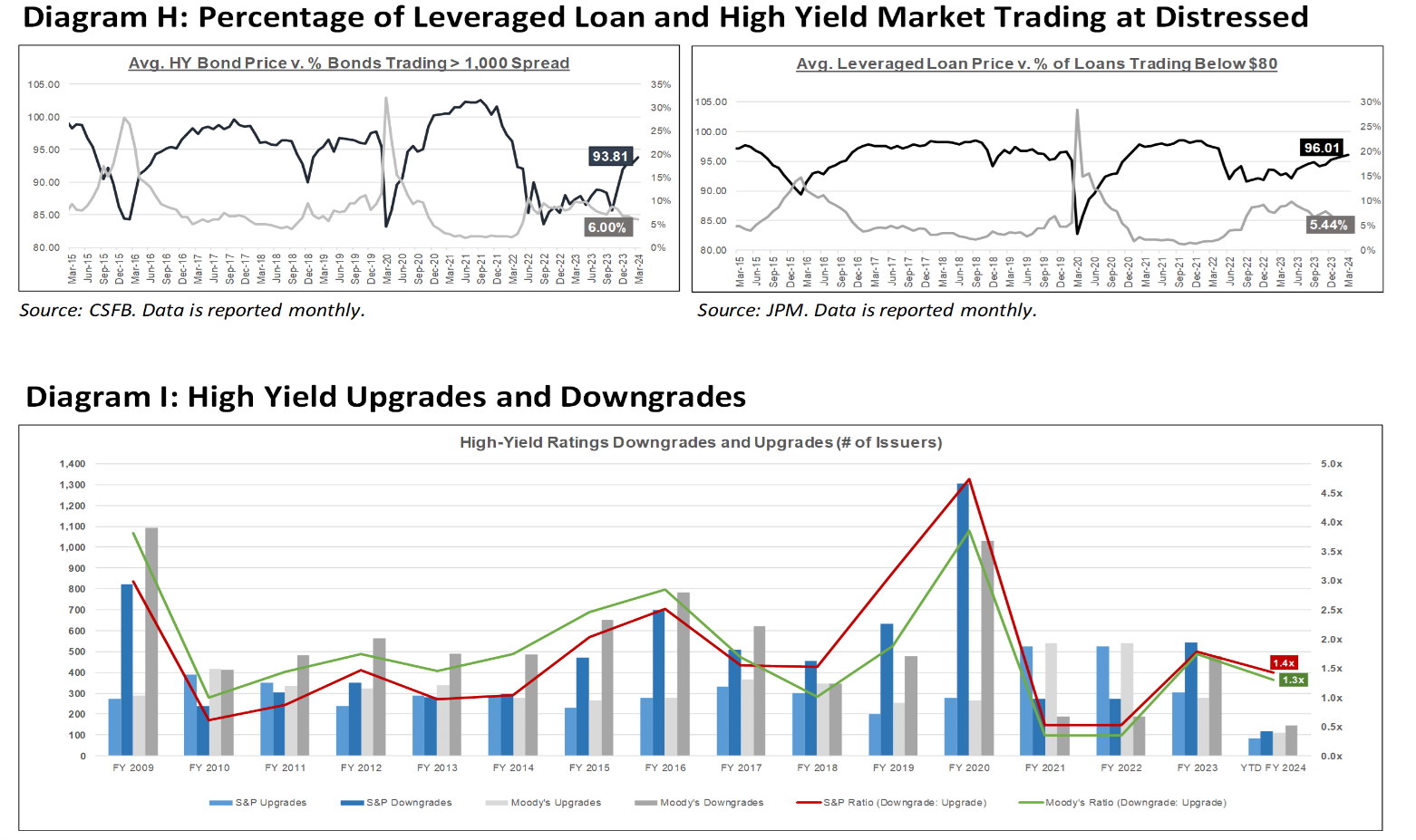

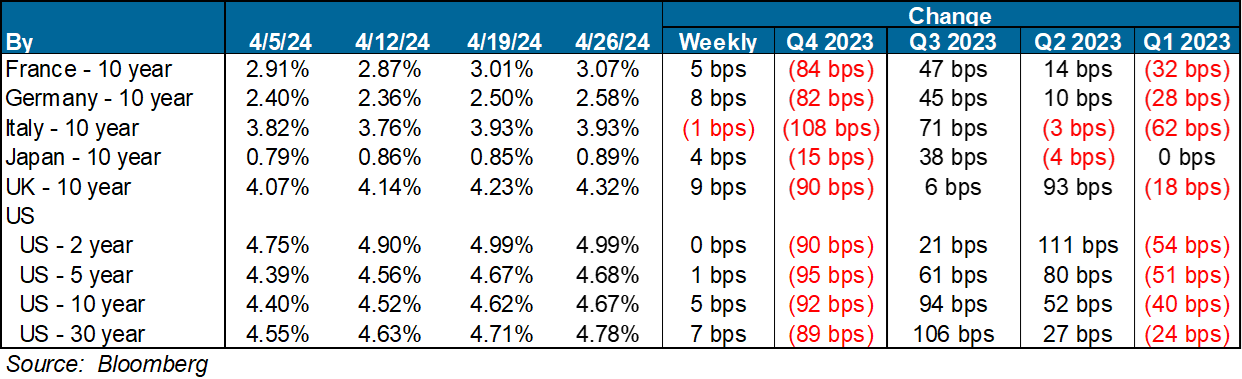

High yield bond yields decreased 12bps to 8.07% and spreads decreased 13bps to 329bps. Leveraged loan yields increased 3bps to 9.76% and spreads decreased 2bps to 506bps. WTD Leveraged loan returns were positive 20bps. WTD high yield bond returns were positive 47bps. 10yr treasury yields increased 6bps to 4.70%. For the week, yields and spreads recouped a portion of the prior week’s widening as investors absorbed earnings, resurfacing inflows, light capital market activity, and mixed data. Persistent inflation pressures have markets anticipating a later start and slower pace of Fed easing boosting yields.

High-yield:

Week ended 04/26/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

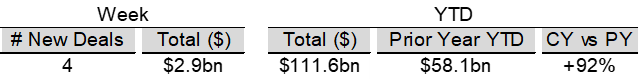

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 04/26/2024

- Yields & Spreads1

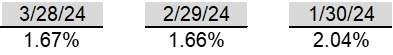

- Leveraged Loan Index1

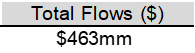

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: JoAnn Stores ($658mn, 3/18/24), New Insight Holdings ($1.2bn, 3/13/24), Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), Careismatic ($700mn, 1/22/24), Enviva Partners ($750mn, 1/15/24), Ligado Networks ($4.2bn, 11/1/23), and Air Methods ($1.7bn, 10/24/23).

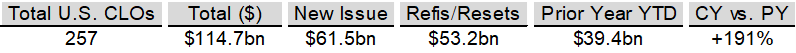

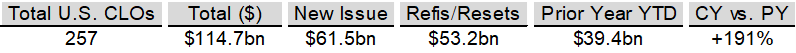

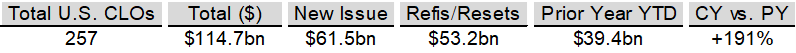

CLOs:

Week ended 04/26/2024

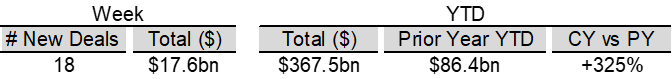

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

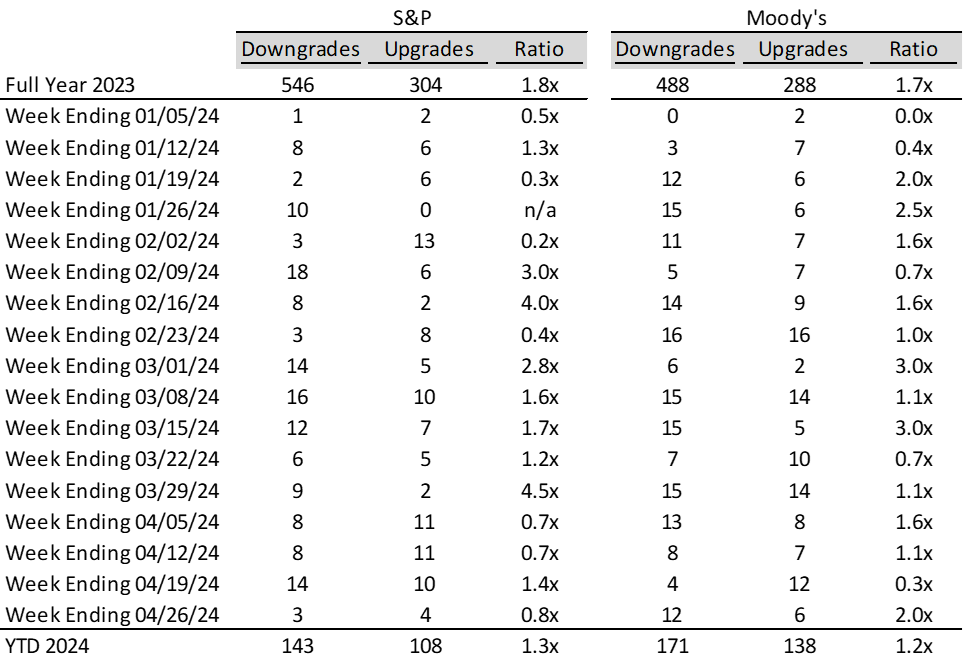

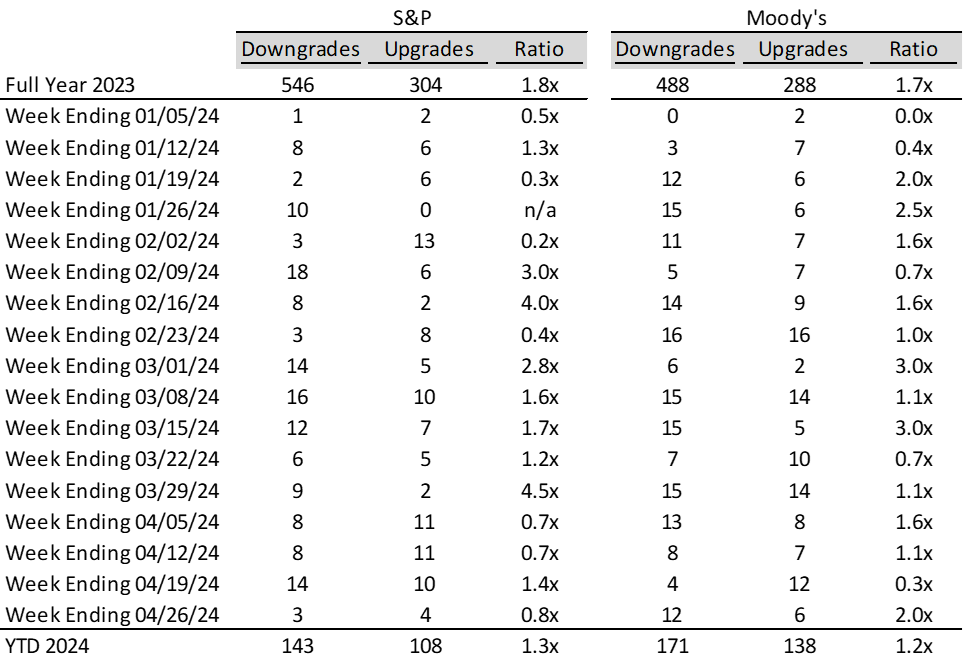

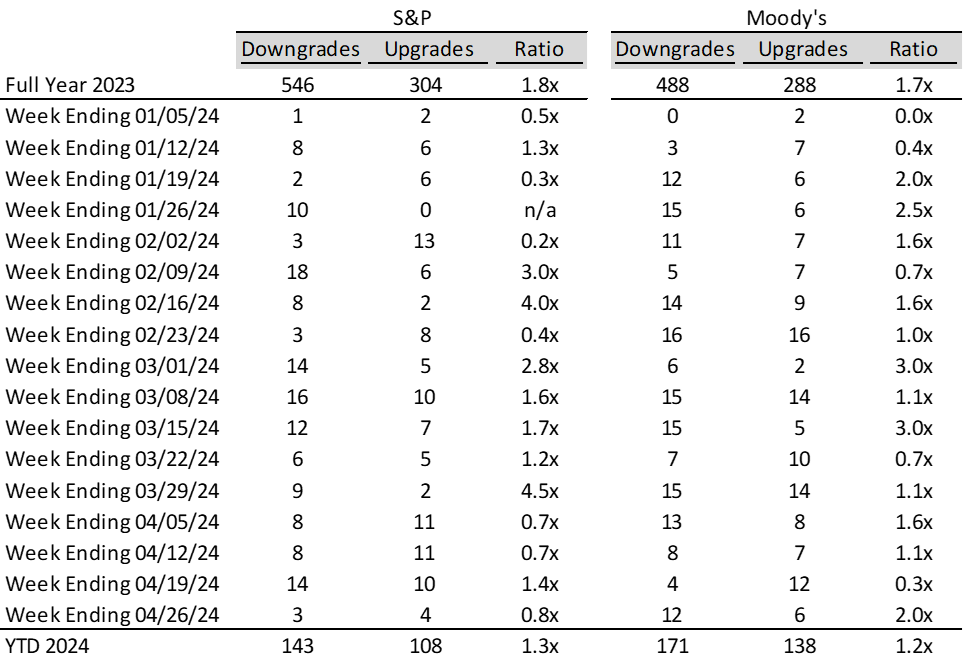

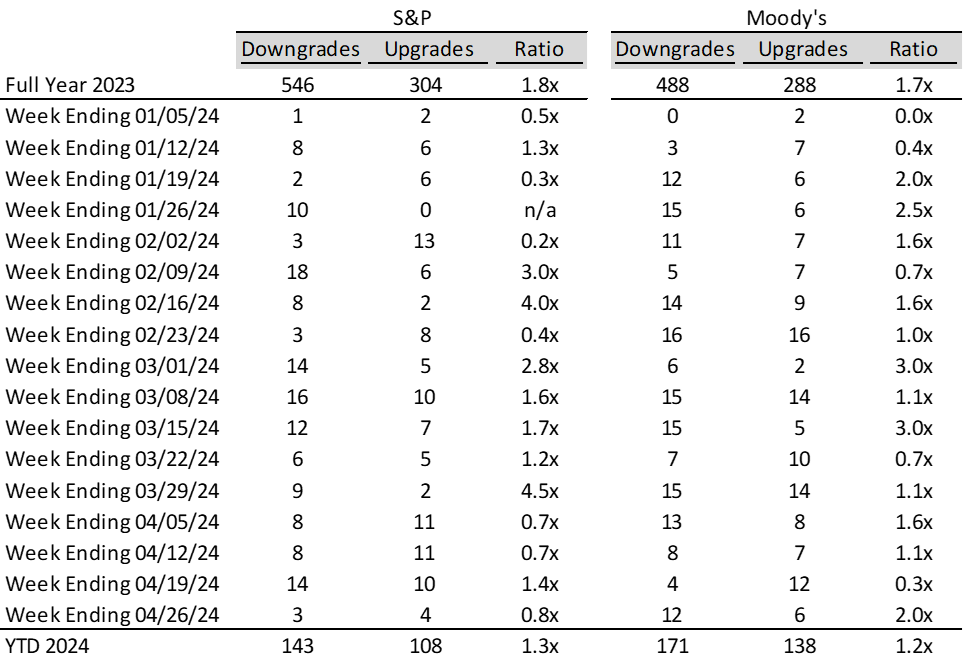

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

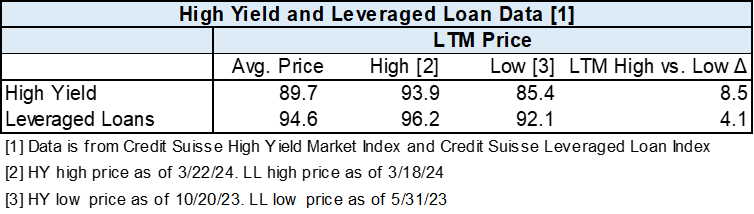

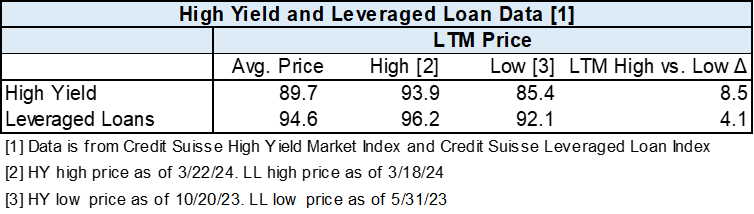

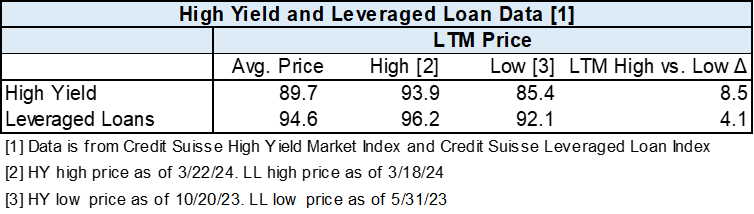

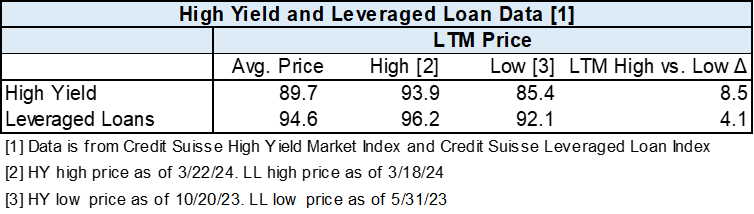

Diagram B: High Yield and Leveraged Loan LTM Price

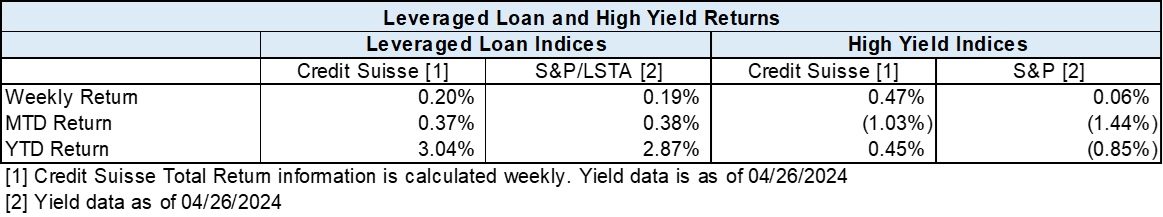

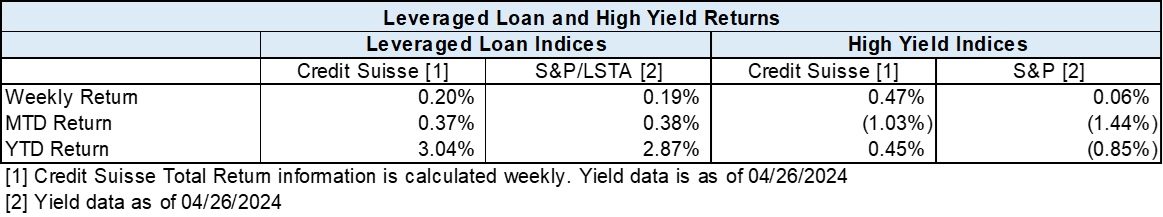

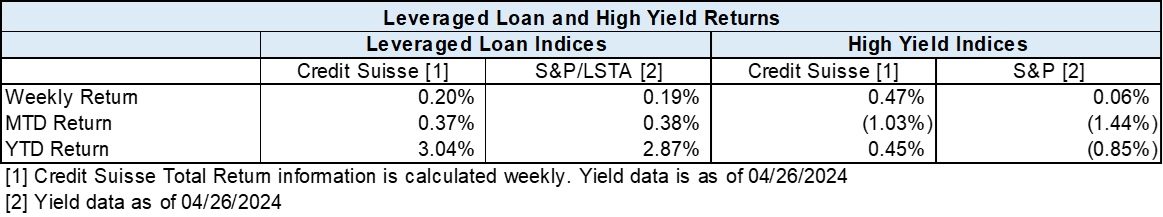

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

U.S. News

- GDP

- The U.S. GDP grew at a 1.6% annual rate in the first quarter of the year, below economists’ expectations of 2.4%

- Inflation remained firm with the PCE price index rising 3.7% in the first quarter, higher than the expected 3.4%

- U.S. stocks declined and the yield on the 10-year Treasury note rose to 4.706%, its highest level since November

- New Home Sales

- U.S. new-home sales rose by 8.8% in March 2024 to an annual rate of 693,000, marking the highest level since September 2023

- The median sales price of a new home in March 2024 increased to $430,700, up from $400,500 the previous month

- Sales were particularly strong in the Northeast, where new-home sales increased by 28%

- Personal consumption index

- PCE price index accelerated to 2.7% year-over-year in March, higher than the expected 2.6%

- Consumer spending remained strong in March, with a 0.8% increase from the previous month, exceeding the expected 0.5% rise

- Savings as a percentage of disposable income dropped to 3.2%, marking the lowest rate since October 2022

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 207,000 in the week ended April 19, down 5,000 from the prior week

- The four-week moving average was 213,250, down 1250 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – decreased by 15,000 to 1.781 million in the week ended April 12. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.402 trillion in the week ended April 26, down $3.1 billion from the prior week

- Treasury holdings totaled $4.540 trillion, down $20.7 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.39 trillion in the week, down $1.7 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.55 trillion as of April 26, an increase of 9.8% from the previous year

- Debt held by the public was $24.61 trillion, and intragovernmental holdings were $7.08 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.5% in March year over year

- On a monthly basis, the CPI increased 0.4% in March on a seasonally adjusted basis, after increasing 0.4% in February

- The index for all items less food and energy (core CPI) rose 0.4% in March, after rising 0.4% in February

- Core CPI increased 3.8% for the 12 months ending March

- Food and Beverages:

- The food at home index increased 1.2% in March from the same month a year earlier, and decreased 0.0% in March month over month

- The food away from home index increased 4.2% in March from the same month a year earlier, and increased 0.3% in March month over month

- Commodities:

- The energy commodities index increased 1.5% in March after increasing 3.6%

- The energy commodities index fell 0.9% over the last 12 months

- The energy services index (0.0%) in March after increasing 0.1% in February

- The energy services index rose 3.1% over the last 12 months

- The gasoline index fell 1.3% over the last 12 months

- The fuel oil index fell (3.7%) over the last 12 months

- The index for electricity rose 5.0% over the last 12 months

- The index for natural gas fell (3.2%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $2,705.54 per 40ft

- Drewry’s composite World Container Index has increased by 55.5% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in March after increasing 0.4% in February

- The rent index increased 0.5% in March after increasing 0.4% in February

- The index for lodging away from home increased 5.6% in March after increasing 3.1% in February

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel

- Egypt’s intelligence chief, Abbas Kamel, led a delegation to Israel to negotiate a cease-fire in Gaza and prevent a planned Israeli military offensive in Rafah

- The negotiations also aim to prevent a potential escalation in the region, particularly with fears that an offensive in Rafah could lead to mass Palestinian displacement into Egypt

- The ceasefire talks have been deadlocked for weeks, with significant disagreements remaining over the conditions of a ceasefire and the release of senior Palestinian prisoners

-

United Kingdom

- The UK’s Rwanda Deportation Bill, aimed at sending asylum seekers to Rwanda, has passed after prolonged legislative debates and is expected to receive royal assent

- The Home Office has prepared to deport a group of asylum seekers with weak legal claims as part of the bill’s implementation, with costs projected at £1.8 million for the first 300 deportees

- The bill has faced significant opposition and legal challenges, with criticisms focusing on its potential violation of international law and human rights.prisoners

-

China

- Secretary of State Antony Blinken urged Chinese leader Xi Jinping to reduce China’s support for Russia’s defense industry during a meeting in Beijing, warning of potential U.S. action if concerns were not addressed

- China has provided critical materials to Russia’s military industry, such as optics, microelectronics, and drone engines, strengthening Russia’s capabilities in its conflict with Ukraine, according to U.S. officials

- Chinese gold consumption rose by 5.94% year-on-year in the first quarter of the year, reaching 308.91 tons, driven by economic uncertainty

- Imports of gold raw materials into China surged by 78% during the same period, contributing to a 21.16% increase in the country’s total gold output

-

Europe

- The European Union is conducting new investigations into Chinese business practices, focusing on subsidies and economic policies that potentially harm European businesses

- One investigation involves Chinese procurement practices for medical devices, which the EU claims unfairly favor Chinese companies

- The EU also raided the Dutch and Polish offices of Chinese security equipment company Nuctech over potential unfair advantages from foreign subsidies

-

Finland

- Finland, sharing NATO’s longest border with Russia at 830 miles, has escalated its security measures, including constructing new fences and enhancing surveillance, in response to increased Russian aggression and hybrid warfare tactics

-

South Korea

- SK Hynix plans to invest an additional $14.6 billion to expand its semiconductor production capacity in South Korea, aiming to meet the increasing demand for artificial intelligence chips

-

Canada

- Honda is nearing a deal to build an electric vehicle assembly plant in Ontario, Canada, with the Canadian government agreeing to offset some of the capital costs through newly introduced tax breaks

-

Poland

- Russian missiles have breached Polish airspace several times since 2022, with the most recent incident occurring on March 24, 2024, when a Russian cruise missile entered Polish airspace for 39 seconds, posing a risk of wider conflict, according to Poland’s President Andrzej Duda

-

United Kingdom

- Vinci Airports acquired a 50.01% stake in Edinburgh Airport for GBP 1.27 billion ($1.58 billion), expanding its presence in the U.K. airport market

-

Germany

- Germany’s industrial production rose more than expected in February, helped by a recovery in the construction and car industry, as the country looks to exit a recent manufacturing slump

-

Japan

- The Bank of Japan ended negative interest rates and unwound most of its unconventional monetary easing policies, moving its key target for short-term rates to a range of 0% to 0.1%, its first rate increase since 2007

Commodities

-

Oil Prices

- WTI: $83.85 per barrel

- +0.85% WoW; +17.03% YTD; +12.16% YoY

- Brent: $89.36 per barrel

- +2.37% WoW; +15.99% YTD; +14.02% YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended April 19, down 0.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 613, down 6 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 453.6 million barrels, down (1.6%) YoY

- Refiners operated at a capacity utilization rate of 88.5% for the week, up from 88.1% in the prior week

- U.S. crude oil imports now amount to 6.461 million barrels per day, down 1.9% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.66 per gallon in the week of April 26,

up 0.9% YoY

- Gasoline prices on the East Coast amounted to $3.64, up 0.1% YoY

- Gasoline prices in the Midwest amounted to $3.54, down (2.3%) YoY

- Gasoline prices on the Gulf Coast amounted to $3.32, down (0.5%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.57, down (2.5%) YoY

- Gasoline prices on the West Coast amounted to $4.96, up 6.6% YoY

- Motor gasoline inventories were down by 0.6 million barrels from the prior week

- Motor gasoline inventories amounted to 226.7 million barrels, up 2.5% YoY

- Production of motor gasoline averaged 9.14 million bpd, down (8.7%) YoY

- Demand for motor gasoline amounted to 8.423 million bpd, up (11.4%) YoY

-

Distillates

- Distillate inventories decreased by 1.6 million in the week of April 26

- Total distillate inventories amounted to 116.6 million barrels, up 4.5% YoY

- Distillate production averaged 4.779 million bpd, up (2.4%) YoY

- Demand for distillates averaged 3.552 million bpd in the week, down (4.7%) YoY

-

Natural Gas

- Natural gas inventories increased by 92 billion cubic feet last week

- Total natural gas inventories now amount to 2,425 billion cubic feet, up 20.7% YoY

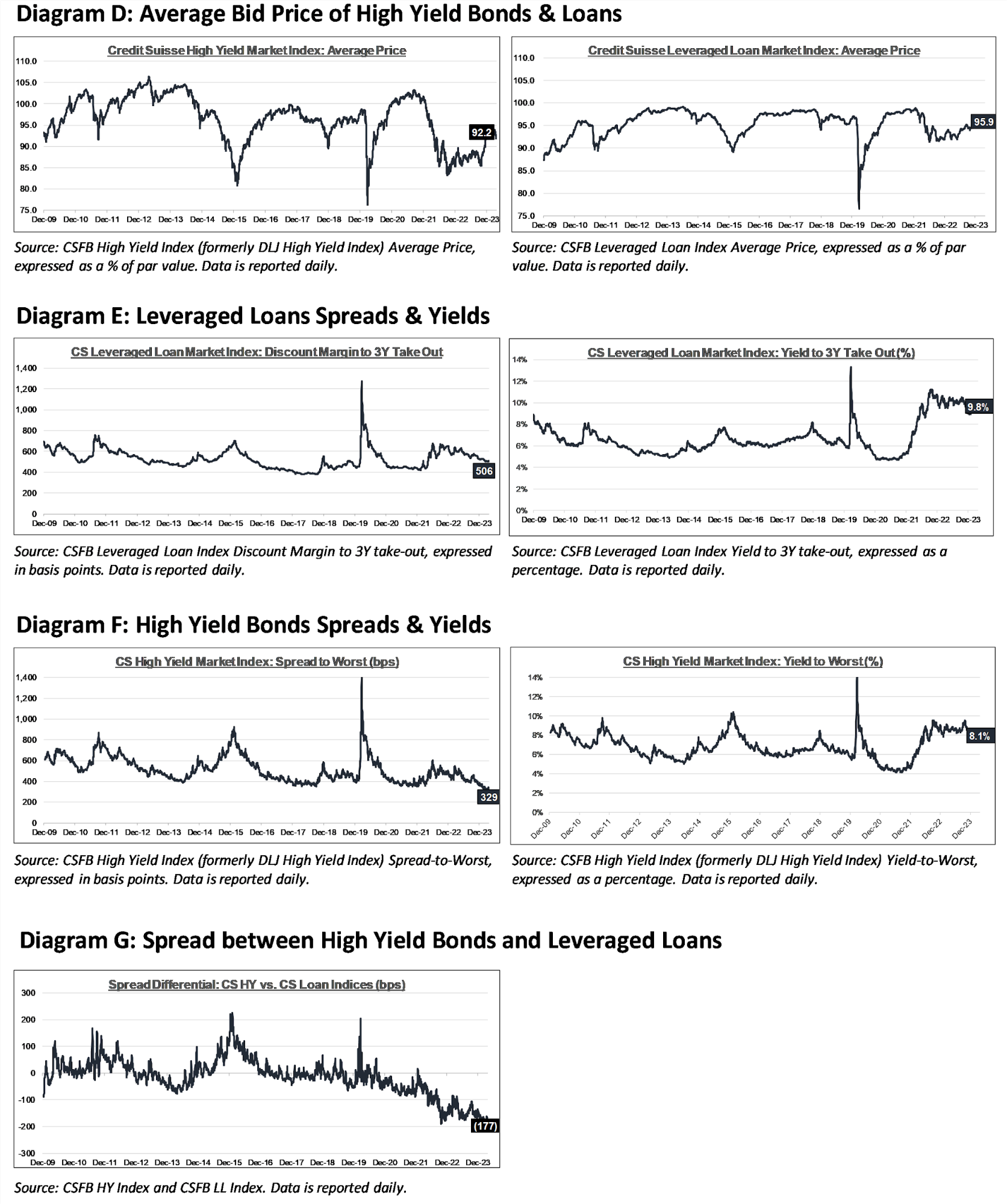

Credit News

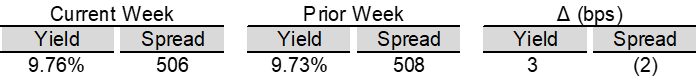

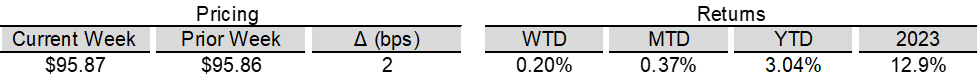

High yield bond yields decreased 12bps to 8.07% and spreads decreased 13bps to 329bps. Leveraged loan yields increased 3bps to 9.76% and spreads decreased 2bps to 506bps. WTD Leveraged loan returns were positive 20bps. WTD high yield bond returns were positive 47bps. 10yr treasury yields increased 6bps to 4.70%. For the week, yields and spreads recouped a portion of the prior week’s widening as investors absorbed earnings, resurfacing inflows, light capital market activity, and mixed data. Persistent inflation pressures have markets anticipating a later start and slower pace of Fed easing boosting yields.

High-yield:

Week ended 04/26/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 04/26/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: JoAnn Stores ($658mn, 3/18/24), New Insight Holdings ($1.2bn, 3/13/24), Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), Careismatic ($700mn, 1/22/24), Enviva Partners ($750mn, 1/15/24), Ligado Networks ($4.2bn, 11/1/23), and Air Methods ($1.7bn, 10/24/23).

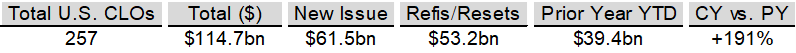

CLOs:

Week ended 04/26/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index