U.S. News

- Consumer Credit

- Total consumer credit rose $19.5 billion in January, translating into a 4.7% annual rate. The annual rate was 0.2% in December

- The increase was almost double the $10 billion gain that economists were expecting

- Non-revolving credit, typically auto and student loans, rose 3.6% in January after a 0.6% in December

- Revolving credit, like credit cards, increased at a 7.7% rate after a 2.4% increase in December

- U.S. Jobs Report

- U.S. employers added 275,000 jobs in February, exceeding the 198,000 expected in January

- The unemployment rate ticked up to 3.9%, up 3.7% from January, representing a two-year high

- Average hourly earnings rose 0.1% in February, below 0.2% expectations and down from 0.5% in January

- Factory Orders

- U.S. factory orders fell 3.6% in January due to fewer contracts for Boeing passenger planes. Economics surveyed by the WSJ had forecasted a 3.1% decline.

- Excluding transportation, orders for manufactured goods decreased 0.8% in January

- Orders for durable goods decreased 6.2% last month

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 217,000 in the week ended March 1, up 15,000 from the prior week

- The four-week moving average was 212,250, down 750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 8,000 to 1.906 million in the week ended February 23. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.539 trillion in the week ended March 8, down $29.0 billion from the prior week

- Treasury holdings totaled $4.632 trillion, down $29.1 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.40 trillion in the week, down $13.1 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.44 trillion as of March 8, an increase of 9.5% from the previous year

- Debt held by the public was $24.65 trillion, and intragovernmental holdings were $7.09 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.1% in January year over year

- On a monthly basis, the CPI increased 0.3% in January on a seasonally adjusted basis, after increasing 0.2% in December

- The index for all items less food and energy (core CPI) rose 0.4% in January, after rising 0.3% in December

- Core CPI increased 3.9% for the 12 months ending January

- Food and Beverages:

- The food at home index increased 1.2% in January from the same month a year earlier, and increased 0.4% in January month over month

- The food away from home index increased 5.1% in January from the same month a year earlier, and increased 0.5% in January month over month

- Commodities:

- The energy commodities index decreased (3.2%) in January after decreasing (0.7%)

- The energy commodities index fell (6.8%) over the last 12 months

- The energy services index 2.5% in January after increasing 0.4% in December

- The energy services index fell (2.0%) over the last 12 months

- The gasoline index fell (6.4%) over the last 12 months

- The fuel oil index fell (14.2%) over the last 12 months

- The index for electricity rose 3.8% over the last 12 months

- The index for natural gas fell (17.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $3,287.34 per 40ft container

- Drewry’s composite World Container Index has increased by 82.0% over the last 12 months

- Housing Market:

- The shelter index increased 0.6% in January after increasing 0.4% in December

- The rent index increased 0.6% in January after increasing 0.4% in December

- The index for lodging away from home increased 4.3% in January after decreasing (1.1%) in December

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Haiti

- Pressure is mounting on Haiti’s Prime Minister, Dr. Ariel Henry, to step down and call for elections as large parts of the country are under the control of heavily armed gangs which are in control of 80% of the capital city. Additionally, thousands of inmates escaped the two biggest prisons over the weekend

- There is a global concern for a humanitarian crisis due to the closure of the airport and seaport. Food and medical supplies currently can’t enter the country via sea or air

-

Gaza

- An international plan to facilitate aid deliveries to the Gaza Strip via the Mediterranean Sea launched this past week. Countries including the U.A.E., Jordan, Egypt and the Netherlands have all airdropped aid into Gaza

- The airdrops followed weeks of failed attempts by the U.S. and Arab negotiators to mediate a cease-fire between Israel and Hamas

- The airdrop plan has some inherent risk, as demonstrated on Friday when an airdrop killed five Palestinians after a parachute failed to open and at least one parcel fell on them

- The U.S. is also planning to build a floating pier to increase the amount of humanitarian assistance entering Gaza

-

China

- A U.S. congressional probe of Chinese-built cargo cranes deployed at ports throughout the U.S. has found communications equipment that doesn’t appear to support normal operations, increasing concerns that the foreign machines may pose a national security risk

- The components include cellular modems that, in some cases, can be remotely accessed

- Last month, the Biden administration announced it would invest more than $20 billion over the next five years to replace foreign-built cranes with U.S.-manufactured cranes

-

Nigeria

- Jihadists kidnapped hundreds of children in Nigeria this past week. No group has claimed responsibility for the abduction, but it is likely the Islamic State West Africa Province or other factions of Boko Haram. Boko Haram abducted 200 schoolgirls back in 2014

-

Japan

- Japan’s consumer prices rose at the slowest pace in nearly two years in January, but came in above expectations, backing views that the central bank will exit its negative interest rate policy, albeit cautiously

-

Australia

- Australian home prices hit a high in what was already one of the world’s most expensive real-estate markets. Now, Australian officials say they have a plan that will help to make housing more affordable: curtailing migration

-

Canada

- Lynx Air, a budget airline based in Calgary, is shutting down due to rising costs, unfavorable exchange rates, and competitive tension in the Canadian aviation market

-

Argentina

- President Javier Milei of Argentina hosted U.S. Secretary of State Antony J. Blinken in Buenos Aires to discuss reshaping Argentina’s foreign policy in alignment with the United States, amidst economic challenges and the pursuit of stability

-

Brazil

- Brazilian Federal Police seized the passport of former President Jair Bolsonaro and arrested four of his close allies as authorities narrowed in on the conservative and his aides over allegations that they plotted a military takeover as early as late-2022

-

Nicaragua

- Nicaragua’s authoritarian government, which has expelled religious leaders, political opponents and journalists, has granted asylum to a former Panamanian president convicted of money laundering, the third former leader from the region to find refuge in Managua

Commodities

-

Oil Prices

- WTI: $77.86 per barrel

- (2.64%) WoW; +8.67% YTD; +2.83% YoY

- Brent: $81.90 per barrel

- (1.97%) WoW; +6.31% YTD; +0.38% YoY

-

US Production

- U.S. oil production amounted to 13.2 million bpd for the week ended March 1, down 0.1 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 622, down 7 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 448.5 million barrels, down (6.3%) YoY

- Refiners operated at a capacity utilization rate of 84.9% for the week, up from 81.5% in the prior week

- U.S. crude oil imports now amount to 6.385 million barrels per day, down 15.2% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.40 per gallon in the week of March 8,

down (2.1%) YoY

- Gasoline prices on the East Coast amounted to $3.35, up 0.1% YoY

- Gasoline prices in the Midwest amounted to $3.35, up 0.3% YoY

- Gasoline prices on the Gulf Coast amounted to $3.04, down (0.8%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.13, down (19.0%) YoY

- Gasoline prices on the West Coast amounted to $4.36, down (2.2%) YoY

- Motor gasoline inventories were down by 4.5 million barrels from the prior week

- Motor gasoline inventories amounted to 239.7 million barrels, up 0.7% YoY

- Production of motor gasoline averaged 9.63 million bpd, up 0.7% YoY

- Demand for motor gasoline amounted to 9.013 million bpd, up 5.3% YoY

-

Distillates

- Distillate inventories decreased by -4.1 million in the week of March 8

- Total distillate inventories amounted to 117.0 million barrels, down (4.3%) YoY

- Distillate production averaged 4.345 million bpd, down (4.0%) YoY

- Demand for distillates averaged 4.074 million bpd in the week, up 15.9% YoY

-

Natural Gas

- Natural gas inventories decreased by 40 billion cubic feet last week

- Total natural gas inventories now amount to 2,334 billion cubic feet, up 15.0% YoY

Credit News

High yield bond yields decreased 13bps to 7.67% and spreads increased 2bps to 343bps. Leveraged loan yields decreased 18bps to 9.21% and spreads decreased 9bps to 510bps. WTD Leveraged loan returns were positive 32bps. WTD high yield bond returns were positive 60bps. 10yr treasury yields decreased 16bp to 4.09%. For the week, Yields decreased due to limited surprises in this week’s labor market report and Powell’s Congressional testimony as well as supportive earnings season.

High-yield:

Week ended 03/08/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 03/08/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), Careismatic ($700mn, 1/22/24), Enviva Partners ($750mn, 1/15/24), Ligado Networks ($4.2bn, 11/1/23), and Air Methods ($1.7bn, 10/24/23).

CLOs:

Week ended 03/08/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

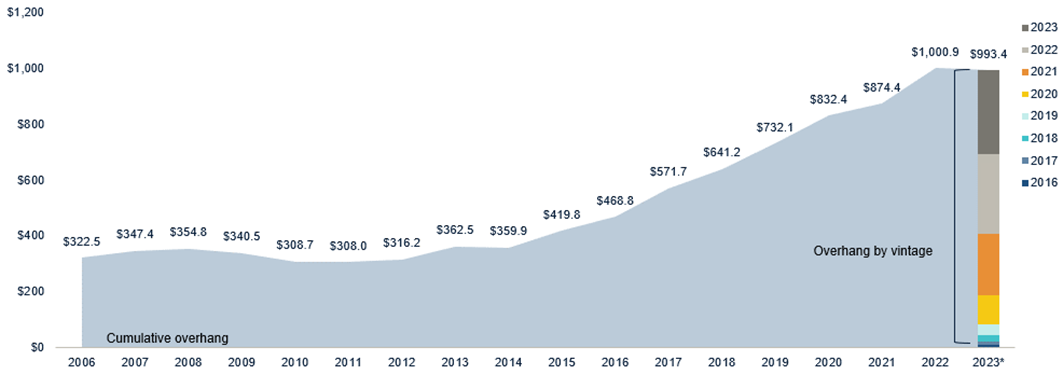

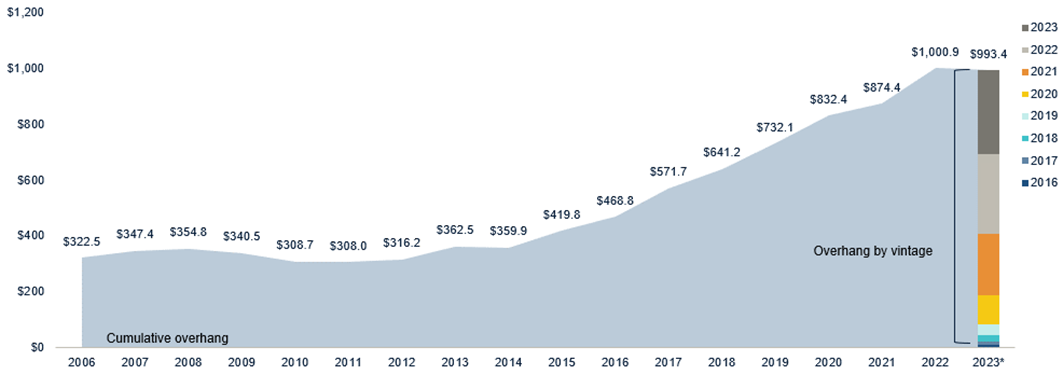

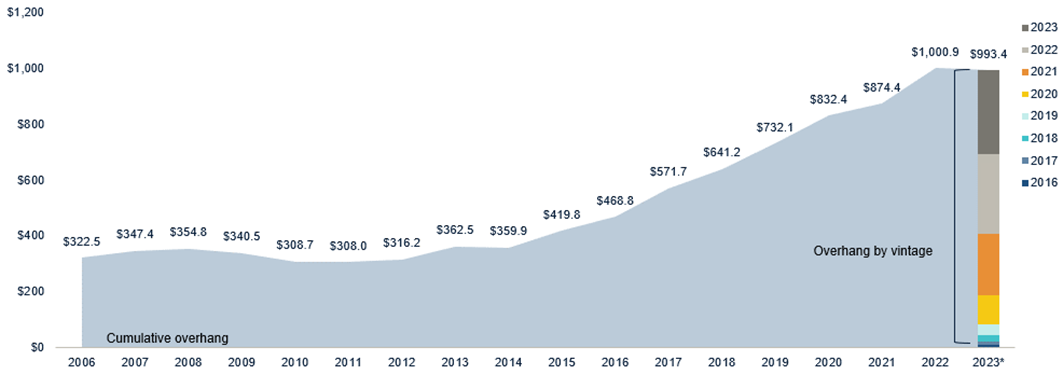

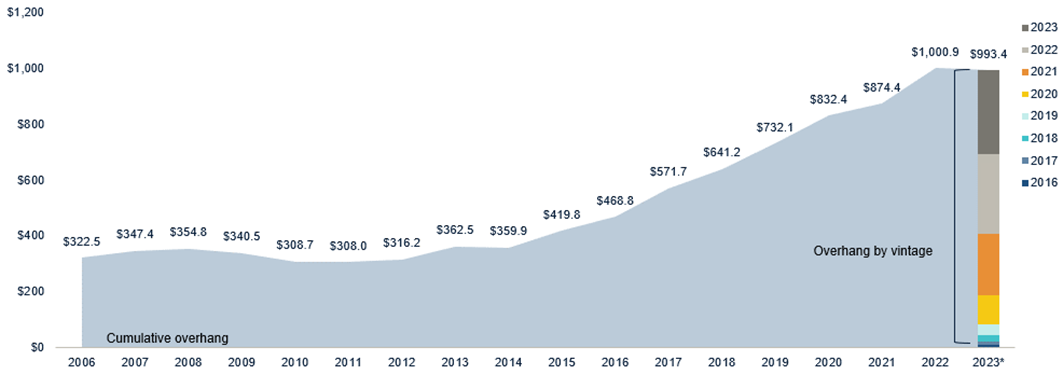

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Diagram V: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

UAE Office Q4 2023 Report:

Source: JLL MENA

https://www.jll-mena.com/content/dam/jll-com/do

- In 2023, Dubai saw 92,000 sq. m. of gross leasable area (GLA) added, mainly in Grade A specifications, bringing the total to 9.2 million sq. m.

- By 2024, Dubai plans to introduce an additional 44,000 sq. m., while Abu Dhabi expects to add approximately 112,000 sq. m. of new office space.

- A 15% year-on-year increase in Dubai’s Central Business District Grade A rents reached AED 2,425 per sq. m. per annum, a market record surpassing the previous high of 2016 by nearly 6%.

- Leasing activity rose, decreasing office vacancies in Dubai’s CBD to 8% and city-wide in Abu Dhabi to 22%.

- Due to space scarcity and high rents in Dubai, tenants are negotiating harder and looking beyond primary locations for better deals.

- The current market provides opportunities for developers to launch new projects, spurred by demand and proactive measures in free zones.

- Office market demand is driven by new entrants and expansion plans, with a preference for high-quality offices, indicating a shift toward sustainable practices and shaping the market’s future.

e: CBRE Research

- Limited quality stock in Free Zones is a challenge, with a trend toward medium-sized stock and first-come, first-served leasing.

- The last quarter saw high rental rates and strong sales in strata markets, notably in the DMC and Business Bay.

- Average occupancy rates rose to 92.6%, pushing rental rates up by 8.0%, 13.3%, 18.2%, and 20.3% for different office grades.

- Despite scarce available stock and pre-leased upcoming developments, rent growth is expected to stay strong, with high-quality assets leading the performance.

U.S. News

- Consumer Credit

- Total consumer credit rose $19.5 billion in January, translating into a 4.7% annual rate. The annual rate was 0.2% in December

- The increase was almost double the $10 billion gain that economists were expecting

- Non-revolving credit, typically auto and student loans, rose 3.6% in January after a 0.6% in December

- Revolving credit, like credit cards, increased at a 7.7% rate after a 2.4% increase in December

- U.S. Jobs Report

- U.S. employers added 275,000 jobs in February, exceeding the 198,000 expected in January

- The unemployment rate ticked up to 3.9%, up 3.7% from January, representing a two-year high

- Average hourly earnings rose 0.1% in February, below 0.2% expectations and down from 0.5% in January

- Factory Orders

- U.S. factory orders fell 3.6% in January due to fewer contracts for Boeing passenger planes. Economics surveyed by the WSJ had forecasted a 3.1% decline.

- Excluding transportation, orders for manufactured goods decreased 0.8% in January

- Orders for durable goods decreased 6.2% last month

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 217,000 in the week ended March 1, up 15,000 from the prior week

- The four-week moving average was 212,250, down 750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 8,000 to 1.906 million in the week ended February 23. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.539 trillion in the week ended March 8, down $29.0 billion from the prior week

- Treasury holdings totaled $4.632 trillion, down $29.1 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.40 trillion in the week, down $13.1 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.44 trillion as of March 8, an increase of 9.5% from the previous year

- Debt held by the public was $24.65 trillion, and intragovernmental holdings were $7.09 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.1% in January year over year

- On a monthly basis, the CPI increased 0.3% in January on a seasonally adjusted basis, after increasing 0.2% in December

- The index for all items less food and energy (core CPI) rose 0.4% in January, after rising 0.3% in December

- Core CPI increased 3.9% for the 12 months ending January

- Food and Beverages:

- The food at home index increased 1.2% in January from the same month a year earlier, and increased 0.4% in January month over month

- The food away from home index increased 5.1% in January from the same month a year earlier, and increased 0.5% in January month over month

- Commodities:

- The energy commodities index decreased (3.2%) in January after decreasing (0.7%)

- The energy commodities index fell (6.8%) over the last 12 months

- The energy services index 2.5% in January after increasing 0.4% in December

- The energy services index fell (2.0%) over the last 12 months

- The gasoline index fell (6.4%) over the last 12 months

- The fuel oil index fell (14.2%) over the last 12 months

- The index for electricity rose 3.8% over the last 12 months

- The index for natural gas fell (17.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $3,287.34 per 40ft container

- Drewry’s composite World Container Index has increased by 82.0% over the last 12 months

- Housing Market:

- The shelter index increased 0.6% in January after increasing 0.4% in December

- The rent index increased 0.6% in January after increasing 0.4% in December

- The index for lodging away from home increased 4.3% in January after decreasing (1.1%) in December

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Haiti

- Pressure is mounting on Haiti’s Prime Minister, Dr. Ariel Henry, to step down and call for elections as large parts of the country are under the control of heavily armed gangs which are in control of 80% of the capital city. Additionally, thousands of inmates escaped the two biggest prisons over the weekend

- There is a global concern for a humanitarian crisis due to the closure of the airport and seaport. Food and medical supplies currently can’t enter the country via sea or air

-

Gaza

- An international plan to facilitate aid deliveries to the Gaza Strip via the Mediterranean Sea launched this past week. Countries including the U.A.E., Jordan, Egypt and the Netherlands have all airdropped aid into Gaza

- The airdrops followed weeks of failed attempts by the U.S. and Arab negotiators to mediate a cease-fire between Israel and Hamas

- The airdrop plan has some inherent risk, as demonstrated on Friday when an airdrop killed five Palestinians after a parachute failed to open and at least one parcel fell on them

- The U.S. is also planning to build a floating pier to increase the amount of humanitarian assistance entering Gaza

-

China

- A U.S. congressional probe of Chinese-built cargo cranes deployed at ports throughout the U.S. has found communications equipment that doesn’t appear to support normal operations, increasing concerns that the foreign machines may pose a national security risk

- The components include cellular modems that, in some cases, can be remotely accessed

- Last month, the Biden administration announced it would invest more than $20 billion over the next five years to replace foreign-built cranes with U.S.-manufactured cranes

-

Nigeria

- Jihadists kidnapped hundreds of children in Nigeria this past week. No group has claimed responsibility for the abduction, but it is likely the Islamic State West Africa Province or other factions of Boko Haram. Boko Haram abducted 200 schoolgirls back in 2014

-

Japan

- Japan’s consumer prices rose at the slowest pace in nearly two years in January, but came in above expectations, backing views that the central bank will exit its negative interest rate policy, albeit cautiously

-

Australia

- Australian home prices hit a high in what was already one of the world’s most expensive real-estate markets. Now, Australian officials say they have a plan that will help to make housing more affordable: curtailing migration

-

Canada

- Lynx Air, a budget airline based in Calgary, is shutting down due to rising costs, unfavorable exchange rates, and competitive tension in the Canadian aviation market

-

Argentina

- President Javier Milei of Argentina hosted U.S. Secretary of State Antony J. Blinken in Buenos Aires to discuss reshaping Argentina’s foreign policy in alignment with the United States, amidst economic challenges and the pursuit of stability

-

Brazil

- Brazilian Federal Police seized the passport of former President Jair Bolsonaro and arrested four of his close allies as authorities narrowed in on the conservative and his aides over allegations that they plotted a military takeover as early as late-2022

-

Nicaragua

- Nicaragua’s authoritarian government, which has expelled religious leaders, political opponents and journalists, has granted asylum to a former Panamanian president convicted of money laundering, the third former leader from the region to find refuge in Managua

Commodities

-

Oil Prices

- WTI: $77.86 per barrel

- (2.64%) WoW; +8.67% YTD; +2.83% YoY

- Brent: $81.90 per barrel

- (1.97%) WoW; +6.31% YTD; +0.38% YoY

-

US Production

- U.S. oil production amounted to 13.2 million bpd for the week ended March 1, down 0.1 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 622, down 7 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 448.5 million barrels, down (6.3%) YoY

- Refiners operated at a capacity utilization rate of 84.9% for the week, up from 81.5% in the prior week

- U.S. crude oil imports now amount to 6.385 million barrels per day, down 15.2% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.40 per gallon in the week of March 8,

down (2.1%) YoY

- Gasoline prices on the East Coast amounted to $3.35, up 0.1% YoY

- Gasoline prices in the Midwest amounted to $3.35, up 0.3% YoY

- Gasoline prices on the Gulf Coast amounted to $3.04, down (0.8%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.13, down (19.0%) YoY

- Gasoline prices on the West Coast amounted to $4.36, down (2.2%) YoY

- Motor gasoline inventories were down by 4.5 million barrels from the prior week

- Motor gasoline inventories amounted to 239.7 million barrels, up 0.7% YoY

- Production of motor gasoline averaged 9.63 million bpd, up 0.7% YoY

- Demand for motor gasoline amounted to 9.013 million bpd, up 5.3% YoY

-

Distillates

- Distillate inventories decreased by -4.1 million in the week of March 8

- Total distillate inventories amounted to 117.0 million barrels, down (4.3%) YoY

- Distillate production averaged 4.345 million bpd, down (4.0%) YoY

- Demand for distillates averaged 4.074 million bpd in the week, up 15.9% YoY

-

Natural Gas

- Natural gas inventories decreased by 40 billion cubic feet last week

- Total natural gas inventories now amount to 2,334 billion cubic feet, up 15.0% YoY

Credit News

High yield bond yields decreased 13bps to 7.67% and spreads increased 2bps to 343bps. Leveraged loan yields decreased 18bps to 9.21% and spreads decreased 9bps to 510bps. WTD Leveraged loan returns were positive 32bps. WTD high yield bond returns were positive 60bps. 10yr treasury yields decreased 16bp to 4.09%. For the week, Yields decreased due to limited surprises in this week’s labor market report and Powell’s Congressional testimony as well as supportive earnings season.

High-yield:

Week ended 03/08/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 03/08/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), Careismatic ($700mn, 1/22/24), Enviva Partners ($750mn, 1/15/24), Ligado Networks ($4.2bn, 11/1/23), and Air Methods ($1.7bn, 10/24/23).

CLOs:

Week ended 03/08/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Diagram V: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

UAE Office Q4 2023 Report:

Source: JLL MENA

https://www.jll-mena.com/content/dam/jll-com/do

- In 2023, Dubai saw 92,000 sq. m. of gross leasable area (GLA) added, mainly in Grade A specifications, bringing the total to 9.2 million sq. m.

- By 2024, Dubai plans to introduce an additional 44,000 sq. m., while Abu Dhabi expects to add approximately 112,000 sq. m. of new office space.

- A 15% year-on-year increase in Dubai’s Central Business District Grade A rents reached AED 2,425 per sq. m. per annum, a market record surpassing the previous high of 2016 by nearly 6%.

- Leasing activity rose, decreasing office vacancies in Dubai’s CBD to 8% and city-wide in Abu Dhabi to 22%.

- Due to space scarcity and high rents in Dubai, tenants are negotiating harder and looking beyond primary locations for better deals.

- The current market provides opportunities for developers to launch new projects, spurred by demand and proactive measures in free zones.

- Office market demand is driven by new entrants and expansion plans, with a preference for high-quality offices, indicating a shift toward sustainable practices and shaping the market’s future.

e: CBRE Research

- Limited quality stock in Free Zones is a challenge, with a trend toward medium-sized stock and first-come, first-served leasing.

- The last quarter saw high rental rates and strong sales in strata markets, notably in the DMC and Business Bay.

- Average occupancy rates rose to 92.6%, pushing rental rates up by 8.0%, 13.3%, 18.2%, and 20.3% for different office grades.

- Despite scarce available stock and pre-leased upcoming developments, rent growth is expected to stay strong, with high-quality assets leading the performance.