U.S. News

- FOMC Interest Rate Decision

- FOMC keeps rates steady in target range of 5.25%-5.5%, a two-decade high, for fifth straight meeting

- 2024 PCE inflation forecast unchanged at 2.4%, core PCE up to 2.6%, economic growth revised to 2.1% from 1.4%

- The Fed maintains quantitative tightening, allowing up to $60 billion of Treasuries and $35 billion of mortgage-backed securities to roll off the balance sheet monthly, without signaling any changes to the program

- Home Builder Confidence Index

- Builder confidence rose for the fourth consecutive month in March, reaching a level of 51 on the National Association of Home Builders’ monthly confidence index

- About 24% of builders reduced home prices in March, marking the lowest share since July of the previous year, with the average price cut being 6%

- The three main components of the overall builder-confidence index (current sales conditions, future sales expectations, and traffic of prospective buyers) all showed improvement

- S&P Global Flash US Composite PMI

- U.S. manufacturing PMI hit a 17-month high at 51.5 in February, showing increased new orders

- U.S. services PMI dipped to 51.3, a three-month low, but still indicates growth

- Annualized GDP growth is projected at around 2% for the first quarter, signaling ongoing economic expansion

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., remained flat to 210,000 in the week ended March 8, flat 0,000 from the prior week

- The four-week moving average was 211,250, up 2750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 9,000 to 1.807 million in the week ended March 1. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.542 trillion in the week ended March 15, up $3.1 billion from the prior week

- Treasury holdings totaled $4.629 trillion, down $2.9 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.40 trillion in the week, down $6.3 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.54 trillion as of March 15, an increase of 9.8% from the previous year

- Debt held by the public was $24.65 trillion, and intragovernmental holdings were $7.09 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.2% in February year over year

- On a monthly basis, the CPI increased 0.4% in February on a seasonally adjusted basis, after increasing 0.3% in January

- The index for all items less food and energy (core CPI) rose 0.4% in February, after rising 0.4% in January

- Core CPI increased 3.8% for the 12 months ending February

- Food and Beverages:

- The food at home index increased 1.0% in February from the same month a year earlier, and decreased 0.0% in February month over month

- The food away from home index increased 4.5% in February from the same month a year earlier, and increased 0.1% in February month over month

- Commodities:

- The energy commodities index increased 3.6% in February after decreasing (3.2%)

- The energy commodities index fell (4.1%) over the last 12 months

- The energy services index 0.1% in February after increasing 2.5% in January

- The energy services index fell 0.5% over the last 12 months

- The gasoline index fell (3.9%) over the last 12 months

- The fuel oil index fell (5.4%) over the last 12 months

- The index for electricity rose 3.6% over the last 12 months

- The index for natural gas fell (8.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $3,161.83 per 40ft

- Drewry’s composite World Container Index has increased by 76.6% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in February after increasing 0.6% in January

- The rent index increased 0.4% in February after increasing 0.6% in January

- The index for lodging away from home increased 3.1% in February after increasing 4.3% in January

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Russia

- A terrorist attack on a concert hall in a Moscow suburb resulted in 133 deaths. Russian authorities have detained 11 people in connection to the attack, which was claimed by the Islamic State’s ISIS-K branch

- Russian President Vladimir Putin has vowed to punish those responsible, calling it “a premeditated mass killing.” Despite prior U.S. warnings about a potential threat, the incident deepens Russia’s domestic security challenges amid the Ukraine conflict

- Putin suggested, without evidence, that the attackers had connections to Ukraine, which Ukraine denies. The event underscores the ongoing threat from ISIS-K and raises tensions between Russia, Ukraine, and international security dynamics

-

Israel

- The U.S. is trying to dissuade Israel from launching a ground assault in Rafah, Gaza, but Israel insists that taking Rafah from Hamas is crucial to its strategy for winning the war

- Prime Minister Benjamin Netanyahu stated that Israel’s military would proceed with a ground operation in Rafah with or without U.S. support, aiming to defeat Hamas

- The planned Israeli ground assault in Rafah raises concerns about a humanitarian crisis, as around 1.4 million Palestinian civilians are currently sheltering there, many of whom are refugees from other parts of Gaza

-

Europe

- The European Union plans to impose steep tariffs on Russian grain imports to curb Moscow’s export revenue and protect European farmers from cheaper agricultural imports

- The proposed EU tariffs are expected to be set at around 95 euros ($103) per metric ton for most cereal products and 50% for oilseeds and derived products, effectively making imports of these products to the EU non-viable

- Joachim Nagel, head of Germany’s central bank and member of the European Central Bank’s governing council, stated that it is increasingly likely the ECB will cut its key interest rate before the summer break, with a move in June being more probable than in April

-

China

- China’s commerce minister met with top global executives from technology, finance and pharmaceutical industries ahead of a high-profile business forum in Beijing, in an attempt to boost slowing foreign investment amid geopolitical tensions

- Beijing is concerned that despite monetary policy efforts to boost liquidity, the excess funds in the banking system are not being loaned to businesses and consumers, leading to idle cash and diminished policy effectiveness in stimulating economic growth

- Treasury Secretary Janet Yellen plans a second trip to China in April to meet with senior Chinese leadership, continuing efforts to sustain stability in bilateral relations amid recent tensions and contentious issues such as the spy balloon incident and tensions across the Taiwan Strait

-

Japan

- The Bank of Japan ended negative interest rates and unwound most of its unconventional monetary easing policies, moving its key target for short-term rates to a range of 0% to 0.1%, its first rate increase since 2007

-

Taiwan

- Taiwan’s Defense Minister Chiu Kuo-cheng confirmed that U.S. troops have been training the Taiwanese military on outlying islands, including Kinmen, as part of mutual exchanges to improve Taiwan’s defense capabilities against potential conflicts with China

-

Australia

- Australian officials have unveiled a new policy aimed at reducing migration by 14% over the next four years in an effort to address housing affordability issues in cities like Sydney, where prices have reached record highs

-

Argentina

- President Javier Milei drives privatization despite congressional resistance, cutting costs by 456 billion pesos ($535 million) in February 2024. Companies like Aerolíneas Argentinas and YPF undergo restructuring, facing hurdles in Congress and valuation challenges in YPF’s state shares

-

India

- The Indian National Congress, the main opposition party in India, faced severe setbacks to its election campaign as tax authorities froze its accounts and seized its funds, hindering its ability to conduct campaign activities

-

South Africa

- Markus Jooste, former CEO of Steinhoff International, died from a self-inflicted gunshot wound a day after receiving a record fine for his role in the company’s collapse due to massive corporate fraud

-

Brazil

- Brazilian Federal Police seized the passport of former President Jair Bolsonaro and arrested four of his close allies as authorities narrowed in on the conservative and his aides over allegations that they plotted a military takeover as early as late-2022

Commodities

-

Oil Prices

- WTI: $81.04 per barrel

- +3.88% WoW; +13.11% YTD; +18.57% YoY

- Brent: $85.34 per barrel

- +3.97% WoW; +10.77% YTD; +14.24% YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended March 8, down 0.2 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 629, up 7 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 445.0 million barrels, down (7.3%) YoY

- Refiners operated at a capacity utilization rate of 86.8% for the week, up from 84.9% in the prior week

- U.S. crude oil imports now amount to 7.222 million barrels per day, down (11.7%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.46 per gallon in the week of March 15,

down (0.1%) YoY

- Gasoline prices on the East Coast amounted to $3.37, down (1.3%) YoY

- Gasoline prices in the Midwest amounted to $3.36, down (0.5%) YoY

- Gasoline prices on the Gulf Coast amounted to $3.03, down (4.3%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.19, down (17.1%) YoY

- Gasoline prices on the West Coast amounted to $4.43, down (2.0%) YoY

- Motor gasoline inventories were down by 5.7 million barrels from the prior week

- Motor gasoline inventories amounted to 234.1 million barrels, down (0.8%) YoY

- Production of motor gasoline averaged 9.65 million bpd, up 5.9% YoY

- Demand for motor gasoline amounted to 8.809 million bpd, up 2.5% YoY

-

Distillates

- Distillate inventories decreased by 0.9 million in the week of March 15

- Total distillate inventories amounted to 118.5 million barrels, down (1.0%) YoY

- Distillate production averaged 4.690 million bpd, up 5.9% YoY

- Demand for distillates averaged 3.786 million bpd in the week, up (1.3%) YoY

-

Natural Gas

- Natural gas inventories decreased by 9 billion cubic feet last week

- Total natural gas inventories now amount to 2,332 billion cubic feet, up 18.3% YoY

Credit News

High yield bond yields decreased 16bps to 7.58% and spreads decreased 13bps to 318bps. Leveraged loan yields unchanged at 9.32% and spreads increased 1bps to 506bps. WTD Leveraged loan returns were positive 10bps. WTD high yield bond returns were positive 60bps. 10yr treasury yields decreased 3bp to 4.27%. For the week, HY funds reported largest outflow since October (-$2bn) and HY yields and spreads tightened as many investors interpreted Powell’s press conference as dovish and absorbed strong housing market releases, mixed Manufacturing and Services reports, and solid labor market data.

High-yield:

Week ended 03/22/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 03/22/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), Careismatic ($700mn, 1/22/24), Enviva Partners ($750mn, 1/15/24), Ligado Networks ($4.2bn, 11/1/23), and Air Methods ($1.7bn, 10/24/23).

CLOs:

Week ended 03/22/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

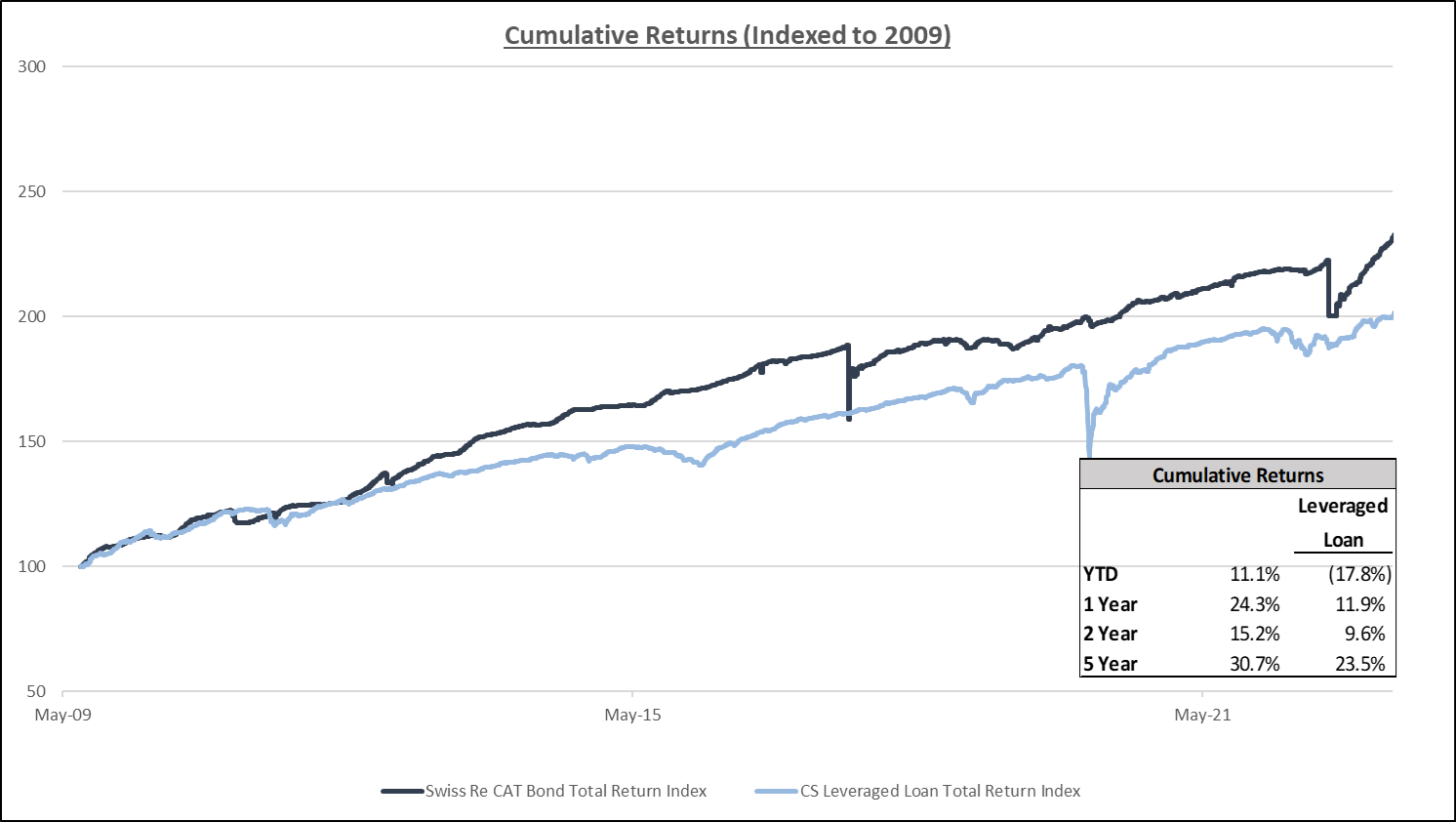

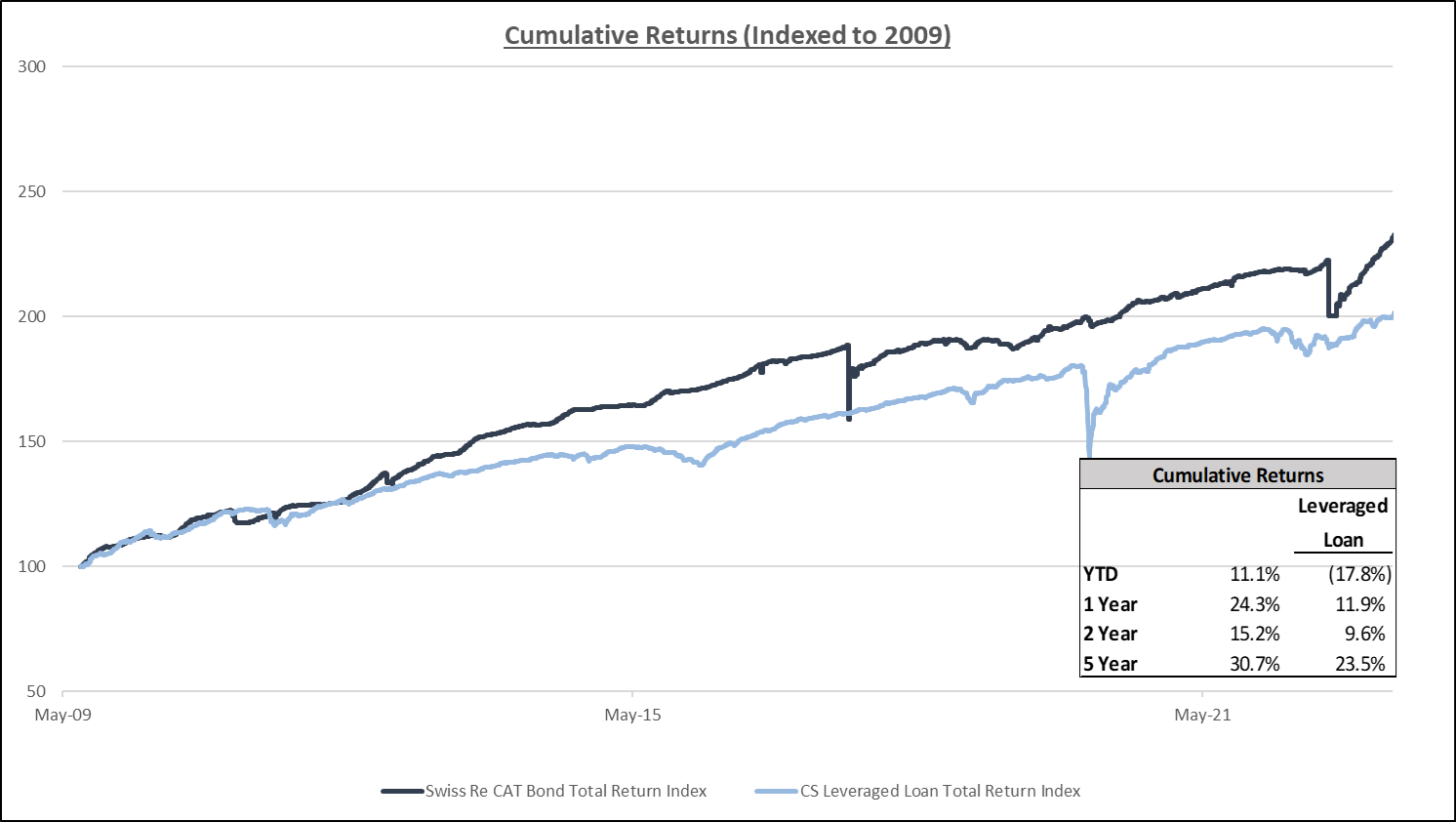

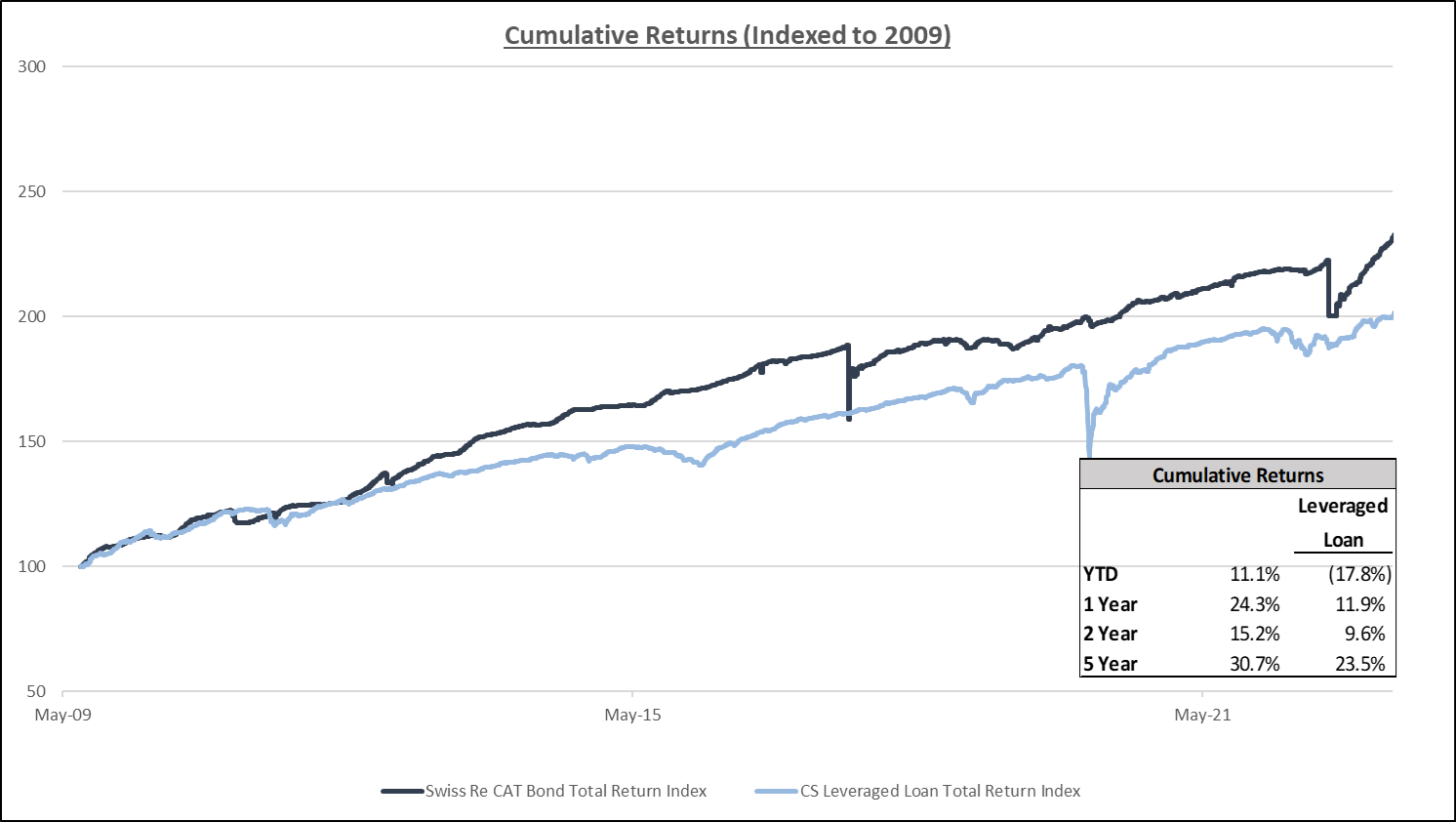

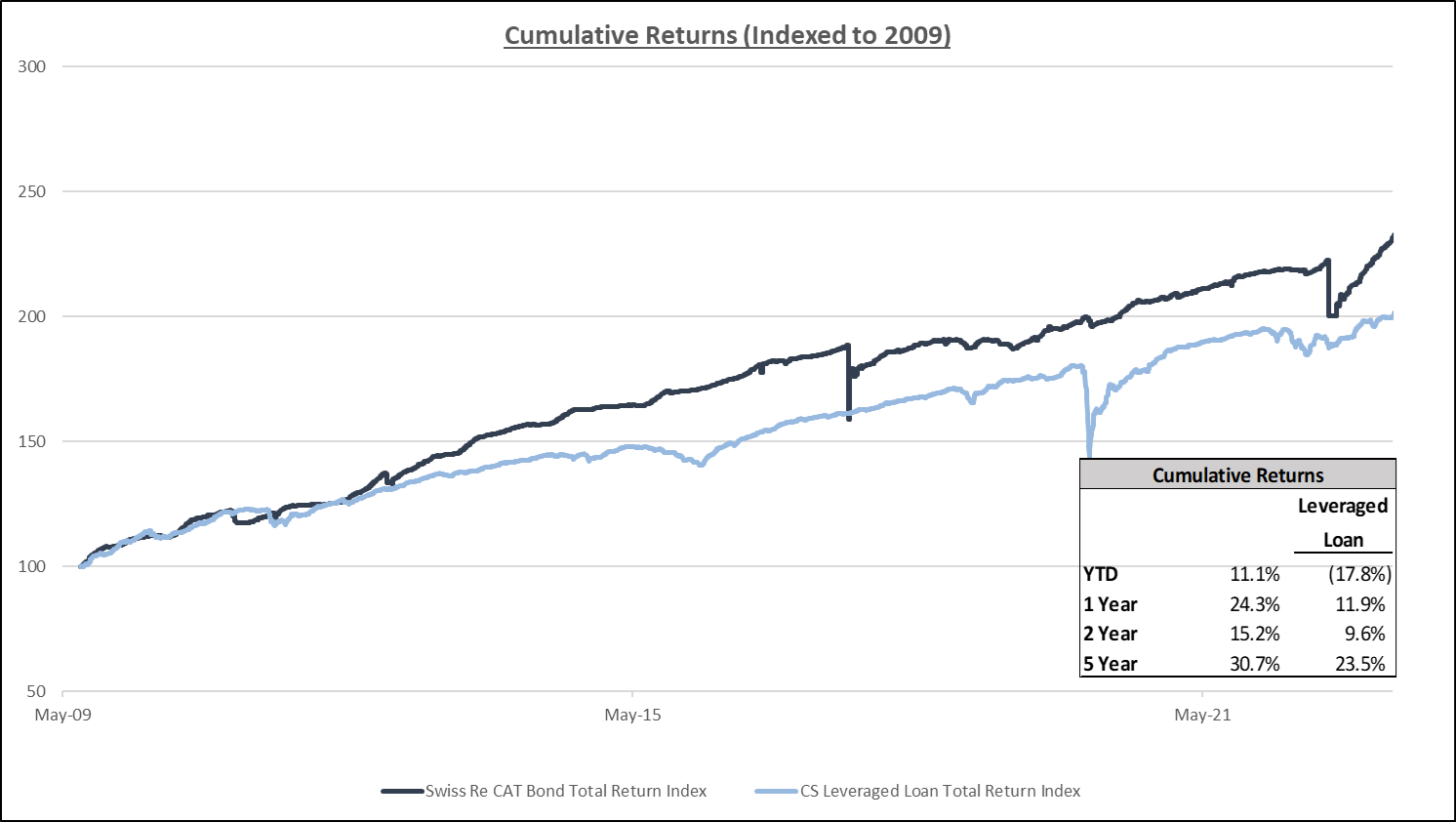

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Diagram V: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

ZCGC RE Research: Mortgage Rate Fluctuations

Source: Investopedia

- The Federal Reserve Wednesday announced its fifth rate hold in a row, after hikes in 2022 and 2023 raised the federal funds rates to almost a 23-year high.

- The Fed’s rate moves do not directly drive mortgage rates. But they can trigger dominoes that impact the rates lenders are willing to offer.

- Inflation is one of the biggest drivers of mortgage rates, and it remains stubbornly above the Fed’s 2% target level.

- Mortgage rates surged to a 20-year high in October but have since dropped more than a percentage point.

- Beyond the Fed’s benchmark rate, the mortgage lending market is affected by a complex mix of many economic factors. These include inflation, consumer demand, housing supply, the strength of the current economy, and the status of the bond market, especially 10-year Treasury yields.

- But given the historic speed and magnitude of the Fed’s 2022–2023 rate increases—raising the benchmark rate 5.25 percentage points over 16 months

- After sinking to historic lows in the 2–3% range in 2021, the next year saw 30-year rates shoot above 7%. The pace of 2022 increases was startling.

Source: Investopedia

- Though the 30-year average wavered in 6% territory for most of the first half of 2023, by October it had catapulted to an astonishing 8.45%—its highest mark in almost 23 years.

- But they’ve dropped considerably since October, even dipping into 6% territory five times since Christmas.

U.S. News

- FOMC Interest Rate Decision

- FOMC keeps rates steady in target range of 5.25%-5.5%, a two-decade high, for fifth straight meeting

- 2024 PCE inflation forecast unchanged at 2.4%, core PCE up to 2.6%, economic growth revised to 2.1% from 1.4%

- The Fed maintains quantitative tightening, allowing up to $60 billion of Treasuries and $35 billion of mortgage-backed securities to roll off the balance sheet monthly, without signaling any changes to the program

- Home Builder Confidence Index

- Builder confidence rose for the fourth consecutive month in March, reaching a level of 51 on the National Association of Home Builders’ monthly confidence index

- About 24% of builders reduced home prices in March, marking the lowest share since July of the previous year, with the average price cut being 6%

- The three main components of the overall builder-confidence index (current sales conditions, future sales expectations, and traffic of prospective buyers) all showed improvement

- S&P Global Flash US Composite PMI

- U.S. manufacturing PMI hit a 17-month high at 51.5 in February, showing increased new orders

- U.S. services PMI dipped to 51.3, a three-month low, but still indicates growth

- Annualized GDP growth is projected at around 2% for the first quarter, signaling ongoing economic expansion

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., remained flat to 210,000 in the week ended March 8, flat 0,000 from the prior week

- The four-week moving average was 211,250, up 2750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 9,000 to 1.807 million in the week ended March 1. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.542 trillion in the week ended March 15, up $3.1 billion from the prior week

- Treasury holdings totaled $4.629 trillion, down $2.9 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.40 trillion in the week, down $6.3 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.54 trillion as of March 15, an increase of 9.8% from the previous year

- Debt held by the public was $24.65 trillion, and intragovernmental holdings were $7.09 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.2% in February year over year

- On a monthly basis, the CPI increased 0.4% in February on a seasonally adjusted basis, after increasing 0.3% in January

- The index for all items less food and energy (core CPI) rose 0.4% in February, after rising 0.4% in January

- Core CPI increased 3.8% for the 12 months ending February

- Food and Beverages:

- The food at home index increased 1.0% in February from the same month a year earlier, and decreased 0.0% in February month over month

- The food away from home index increased 4.5% in February from the same month a year earlier, and increased 0.1% in February month over month

- Commodities:

- The energy commodities index increased 3.6% in February after decreasing (3.2%)

- The energy commodities index fell (4.1%) over the last 12 months

- The energy services index 0.1% in February after increasing 2.5% in January

- The energy services index fell 0.5% over the last 12 months

- The gasoline index fell (3.9%) over the last 12 months

- The fuel oil index fell (5.4%) over the last 12 months

- The index for electricity rose 3.6% over the last 12 months

- The index for natural gas fell (8.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $3,161.83 per 40ft

- Drewry’s composite World Container Index has increased by 76.6% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in February after increasing 0.6% in January

- The rent index increased 0.4% in February after increasing 0.6% in January

- The index for lodging away from home increased 3.1% in February after increasing 4.3% in January

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Russia

- A terrorist attack on a concert hall in a Moscow suburb resulted in 133 deaths. Russian authorities have detained 11 people in connection to the attack, which was claimed by the Islamic State’s ISIS-K branch

- Russian President Vladimir Putin has vowed to punish those responsible, calling it “a premeditated mass killing.” Despite prior U.S. warnings about a potential threat, the incident deepens Russia’s domestic security challenges amid the Ukraine conflict

- Putin suggested, without evidence, that the attackers had connections to Ukraine, which Ukraine denies. The event underscores the ongoing threat from ISIS-K and raises tensions between Russia, Ukraine, and international security dynamics

-

Israel

- The U.S. is trying to dissuade Israel from launching a ground assault in Rafah, Gaza, but Israel insists that taking Rafah from Hamas is crucial to its strategy for winning the war

- Prime Minister Benjamin Netanyahu stated that Israel’s military would proceed with a ground operation in Rafah with or without U.S. support, aiming to defeat Hamas

- The planned Israeli ground assault in Rafah raises concerns about a humanitarian crisis, as around 1.4 million Palestinian civilians are currently sheltering there, many of whom are refugees from other parts of Gaza

-

Europe

- The European Union plans to impose steep tariffs on Russian grain imports to curb Moscow’s export revenue and protect European farmers from cheaper agricultural imports

- The proposed EU tariffs are expected to be set at around 95 euros ($103) per metric ton for most cereal products and 50% for oilseeds and derived products, effectively making imports of these products to the EU non-viable

- Joachim Nagel, head of Germany’s central bank and member of the European Central Bank’s governing council, stated that it is increasingly likely the ECB will cut its key interest rate before the summer break, with a move in June being more probable than in April

-

China

- China’s commerce minister met with top global executives from technology, finance and pharmaceutical industries ahead of a high-profile business forum in Beijing, in an attempt to boost slowing foreign investment amid geopolitical tensions

- Beijing is concerned that despite monetary policy efforts to boost liquidity, the excess funds in the banking system are not being loaned to businesses and consumers, leading to idle cash and diminished policy effectiveness in stimulating economic growth

- Treasury Secretary Janet Yellen plans a second trip to China in April to meet with senior Chinese leadership, continuing efforts to sustain stability in bilateral relations amid recent tensions and contentious issues such as the spy balloon incident and tensions across the Taiwan Strait

-

Japan

- The Bank of Japan ended negative interest rates and unwound most of its unconventional monetary easing policies, moving its key target for short-term rates to a range of 0% to 0.1%, its first rate increase since 2007

-

Taiwan

- Taiwan’s Defense Minister Chiu Kuo-cheng confirmed that U.S. troops have been training the Taiwanese military on outlying islands, including Kinmen, as part of mutual exchanges to improve Taiwan’s defense capabilities against potential conflicts with China

-

Australia

- Australian officials have unveiled a new policy aimed at reducing migration by 14% over the next four years in an effort to address housing affordability issues in cities like Sydney, where prices have reached record highs

-

Argentina

- President Javier Milei drives privatization despite congressional resistance, cutting costs by 456 billion pesos ($535 million) in February 2024. Companies like Aerolíneas Argentinas and YPF undergo restructuring, facing hurdles in Congress and valuation challenges in YPF’s state shares

-

India

- The Indian National Congress, the main opposition party in India, faced severe setbacks to its election campaign as tax authorities froze its accounts and seized its funds, hindering its ability to conduct campaign activities

-

South Africa

- Markus Jooste, former CEO of Steinhoff International, died from a self-inflicted gunshot wound a day after receiving a record fine for his role in the company’s collapse due to massive corporate fraud

-

Brazil

- Brazilian Federal Police seized the passport of former President Jair Bolsonaro and arrested four of his close allies as authorities narrowed in on the conservative and his aides over allegations that they plotted a military takeover as early as late-2022

Commodities

-

Oil Prices

- WTI: $81.04 per barrel

- +3.88% WoW; +13.11% YTD; +18.57% YoY

- Brent: $85.34 per barrel

- +3.97% WoW; +10.77% YTD; +14.24% YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended March 8, down 0.2 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 629, up 7 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 445.0 million barrels, down (7.3%) YoY

- Refiners operated at a capacity utilization rate of 86.8% for the week, up from 84.9% in the prior week

- U.S. crude oil imports now amount to 7.222 million barrels per day, down (11.7%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.46 per gallon in the week of March 15,

down (0.1%) YoY

- Gasoline prices on the East Coast amounted to $3.37, down (1.3%) YoY

- Gasoline prices in the Midwest amounted to $3.36, down (0.5%) YoY

- Gasoline prices on the Gulf Coast amounted to $3.03, down (4.3%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.19, down (17.1%) YoY

- Gasoline prices on the West Coast amounted to $4.43, down (2.0%) YoY

- Motor gasoline inventories were down by 5.7 million barrels from the prior week

- Motor gasoline inventories amounted to 234.1 million barrels, down (0.8%) YoY

- Production of motor gasoline averaged 9.65 million bpd, up 5.9% YoY

- Demand for motor gasoline amounted to 8.809 million bpd, up 2.5% YoY

-

Distillates

- Distillate inventories decreased by 0.9 million in the week of March 15

- Total distillate inventories amounted to 118.5 million barrels, down (1.0%) YoY

- Distillate production averaged 4.690 million bpd, up 5.9% YoY

- Demand for distillates averaged 3.786 million bpd in the week, up (1.3%) YoY

-

Natural Gas

- Natural gas inventories decreased by 9 billion cubic feet last week

- Total natural gas inventories now amount to 2,332 billion cubic feet, up 18.3% YoY

Credit News

High yield bond yields decreased 16bps to 7.58% and spreads decreased 13bps to 318bps. Leveraged loan yields unchanged at 9.32% and spreads increased 1bps to 506bps. WTD Leveraged loan returns were positive 10bps. WTD high yield bond returns were positive 60bps. 10yr treasury yields decreased 3bp to 4.27%. For the week, HY funds reported largest outflow since October (-$2bn) and HY yields and spreads tightened as many investors interpreted Powell’s press conference as dovish and absorbed strong housing market releases, mixed Manufacturing and Services reports, and solid labor market data.

High-yield:

Week ended 03/22/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 03/22/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), Careismatic ($700mn, 1/22/24), Enviva Partners ($750mn, 1/15/24), Ligado Networks ($4.2bn, 11/1/23), and Air Methods ($1.7bn, 10/24/23).

CLOs:

Week ended 03/22/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Diagram V: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

ZCGC RE Research: Mortgage Rate Fluctuations

Source: Investopedia

- The Federal Reserve Wednesday announced its fifth rate hold in a row, after hikes in 2022 and 2023 raised the federal funds rates to almost a 23-year high.

- The Fed’s rate moves do not directly drive mortgage rates. But they can trigger dominoes that impact the rates lenders are willing to offer.

- Inflation is one of the biggest drivers of mortgage rates, and it remains stubbornly above the Fed’s 2% target level.

- Mortgage rates surged to a 20-year high in October but have since dropped more than a percentage point.

- Beyond the Fed’s benchmark rate, the mortgage lending market is affected by a complex mix of many economic factors. These include inflation, consumer demand, housing supply, the strength of the current economy, and the status of the bond market, especially 10-year Treasury yields.

- But given the historic speed and magnitude of the Fed’s 2022–2023 rate increases—raising the benchmark rate 5.25 percentage points over 16 months

- After sinking to historic lows in the 2–3% range in 2021, the next year saw 30-year rates shoot above 7%. The pace of 2022 increases was startling.

Source: Investopedia

- Though the 30-year average wavered in 6% territory for most of the first half of 2023, by October it had catapulted to an astonishing 8.45%—its highest mark in almost 23 years.

- But they’ve dropped considerably since October, even dipping into 6% territory five times since Christmas.