U.S. News

- U.S. Trade Balance

- The U.S. international trade deficit widened by 1.9% to $68.9 billion in February, marking the third consecutive month of increase and the largest imbalance since last April

- Exports in February rose 2.3% to $263 billion, while imports increased by 2.2% to $331.9 billion

- The widening trade deficit is expected to slightly drag on the first-quarter GDP growth, amidst overall weak global trade due to geopolitical tensions

- Construction Spending

- Construction spending in the U.S. fell by 0.3% in February to $2.1 trillion, contrary to expectations of a 0.7% increase

- Over the past year, construction spending has increased by 10.7%

- Private residential construction rose 0.7%, with single-family construction up 1.4% and multifamily construction down 0.2%; public residential construction decreased by 1.2%

- U.S. Auto Sales

- U.S. new car and truck sales decreased by 2% in March, with an annual sales rate of 15.5 million, down from 15.8 million in February

- The auto industry hasn’t returned to pre-pandemic levels of sales, with 2016 recording a peak of 17.5 million

- High vehicle prices, particularly for electric vehicles, and high loan rates averaging around 7% or more have significantly impacted demand

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 221,000 in the week ended March 29, up 9,000 from the prior week

- The four-week moving average was 214,250, up 2750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – decreased by 19,000 to 1.791 million in the week ended March 22. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.440 trillion in the week ended April 5, down $45.2 billion from the prior week

- Treasury holdings totaled $4.597 trillion, down $21.2 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.39 trillion in the week, down $14.3 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.60 trillion as of April 5, an increase of 10.0% from the previous year

- Debt held by the public was $24.68 trillion, and intragovernmental holdings were $7.09 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.2% in February year over year

- On a monthly basis, the CPI increased 0.4% in February on a seasonally adjusted basis, after increasing 0.3% in January

- The index for all items less food and energy (core CPI) rose 0.4% in February, after rising 0.4% in January

- Core CPI increased 3.8% for the 12 months ending February

- Food and Beverages:

- The food at home index increased 1.0% in February from the same month a year earlier, and decreased 0.0% in February month over month

- The food away from home index increased 4.5% in February from the same month a year earlier, and increased 0.1% in February month over month

- Commodities:

- The energy commodities index increased 3.6% in February after decreasing (3.2%)

- The energy commodities index fell (4.1%) over the last 12 months

- The energy services index 0.1% in February after increasing 2.5% in January

- The energy services index rose 0.5% over the last 12 months

- The gasoline index fell (3.9%) over the last 12 months

- The fuel oil index fell (5.4%) over the last 12 months

- The index for electricity rose 3.6% over the last 12 months

- The index for natural gas fell (8.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $2,835.51 per 40ft

- Drewry’s composite World Container Index has increased by 65.8% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in February after increasing 0.6% in January

- The rent index increased 0.4% in February after increasing 0.6% in January

- The index for lodging away from home increased 3.1% in February after increasing 4.3% in January

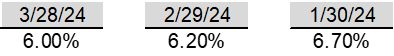

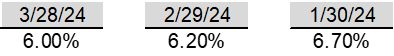

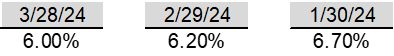

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel

- CIA Director William Burns is participating in cease-fire talks in Cairo, aiming to halt fighting in Gaza and address the humanitarian situation as the conflict enters its seventh month

- Israeli Prime Minister Benjamin Netanyahu insists on the release of hostages for a cease-fire, while Hamas demands the return of Gazans to northern Gaza and the withdrawal of Israeli troops

- An airstrike in Syria, allegedly carried out by Israel, targeted an Iranian consulate, killing top Iranian military officials, which risks escalating tensions between Israel and Iran

-

China

- The U.S. and EU, along with emerging economies like Brazil, India, Mexico, and Indonesia, are responding to a surge of cheap Chinese imports by considering raising trade barriers and initiating antidumping investigations

- Treasury Secretary Janet Yellen, during her visit to China, emphasized the risks of China’s economic strategy focused on exporting cheap goods without fostering domestic demand, indicating it could lead to negative global spillovers

- Governments worldwide have announced over 70 import-related measures targeting China since the start of the previous year, showcasing a global effort to protect domestic industries from the influx of cheap Chinese products

-

Russia

- More than 4,000 people, including 885 children, have been evacuated in the Orenburg region of Russia due to flooding caused by the bursting of a dam and the overflow of the Ural River

- A criminal investigation has been launched into suspected construction violations that may have led to the dam’s failure, with water levels reaching about 9.7 meters, significantly above the dam’s capacity

-

Germany

- German manufacturing orders marginally increased by 0.2% in February, a slower growth than the expected 0.5%, following a sharp 11.4% drop in January, with significant fluctuations driven by sectors like aerospace in previous months.

- The car industry in Germany saw a notable decline in orders by 8.1% in February, whereas orders in the chemical and pharmaceutical industries rose by 3.1% and 6.6%, respectively, indicating varied performance across different sectors.

-

Canada

- Canada’s goods-trade surplus widened more than expected in February, driven by record gold shipments and marking the strongest export growth in six months

-

South Korea

- South Korea’s exports grew for a sixth consecutive month in March, driven by strong demand for semiconductors and ships, with a 3.1% increase from the previous year to $56.56 billion

-

Taiwan

- A magnitude-7.4 earthquake, the strongest to hit Taiwan in 25 years, killed at least nine people, injured more than 900, and caused significant structural damage including the collapse of buildings

-

Japan

- The Bank of Japan ended negative interest rates and unwound most of its unconventional monetary easing policies, moving its key target for short-term rates to a range of 0% to 0.1%, its first rate increase since 2007

-

Australia

- Australian officials have unveiled a new policy aimed at reducing migration by 14% over the next four years in an effort to address housing affordability issues in cities like Sydney, where prices have reached record highs

-

Argentina

- President Javier Milei drives privatization despite congressional resistance, cutting costs by 456 billion pesos ($535 million) in February 2024. Companies like Aerolíneas Argentinas and YPF undergo restructuring, facing hurdles in Congress and valuation challenges in YPF’s state shares

-

South Africa

- Markus Jooste, former CEO of Steinhoff International, died from a self-inflicted gunshot wound a day after receiving a record fine for his role in the company’s collapse due to massive corporate fraud

Commodities

-

Oil Prices

- WTI: $86.74 per barrel

- +4.29% WoW; +21.06% YTD; +7.48% YoY

- Brent: $90.92 per barrel

- +3.93% WoW; +18.02% YTD; +6.81% YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended March 29, down 0.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 620, down 1 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 451.4 million barrels, down (3.9%) YoY

- Refiners operated at a capacity utilization rate of 88.6% for the week, down from 88.7% in the prior week

- U.S. crude oil imports now amount to 6.702 million barrels per day, down (7.4%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.58 per gallon in the week of April 5,

up 0.0% YoY

- Gasoline prices on the East Coast amounted to $3.49, up 0.9% YoY

- Gasoline prices in the Midwest amounted to $3.44, down (0.5%) YoY

- Gasoline prices on the Gulf Coast amounted to $3.21, down (0.8%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.47, down (3.3%) YoY

- Gasoline prices on the West Coast amounted to $4.68, up 4.0% YoY

- Motor gasoline inventories were down by 4.3 million barrels from the prior week

- Motor gasoline inventories amounted to 227.8 million barrels, up 2.4% YoY

- Production of motor gasoline averaged 9.98 million bpd, up 1.3% YoY

- Demand for motor gasoline amounted to 9.236 million bpd, down (0.6%) YoY

-

Distillates

- Distillate inventories decreased by -1.3 million in the week of April 5

- Total distillate inventories amounted to 116.1 million barrels, up 2.7% YoY

- Distillate production averaged 4.606 million bpd, down (2.8%) YoY

- Demand for distillates averaged 3.495 million bpd in the week, down (17.6%) YoY

-

Natural Gas

- Natural gas inventories decreased by 37 billion cubic feet last week

- Total natural gas inventories now amount to 2,259 billion cubic feet, up 23.4% YoY

Credit News

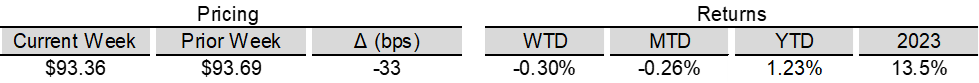

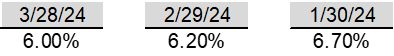

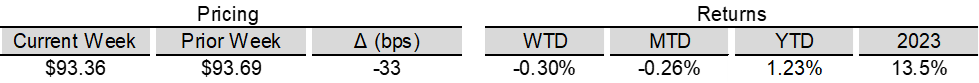

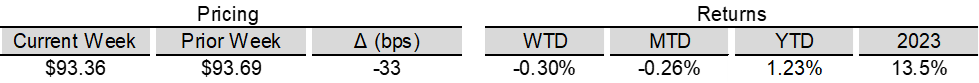

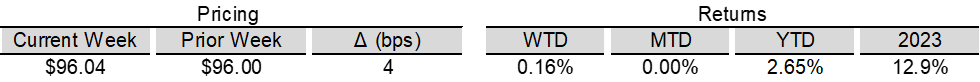

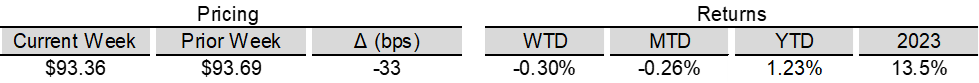

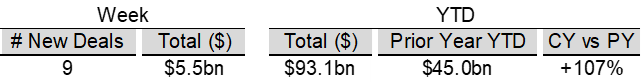

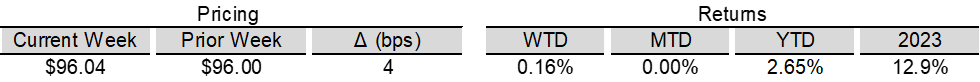

High yield bond yields increased 16bps to 7.76% and spreads increased 4bps to 331bps. Leveraged loan yields increased 7bps to 9.34% and spreads decreased 6bps to 503bps. WTD Leveraged loan returns were positive 16bps. WTD high yield bond returns were negative 30bps. 10yr treasury yields increased 11bps to 4.31%. For the week, yields and spreads widened as investors absorbed an equity sell-off, rising commodity prices, and a strong payroll report that reaffirmed the resilience of

the economy.

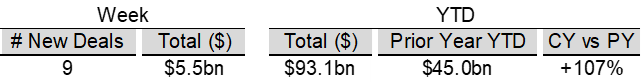

High-yield:

Week ended 04/05/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

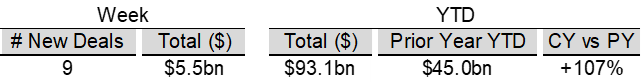

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

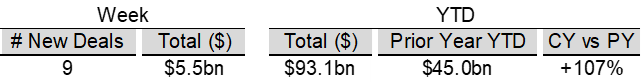

Leveraged loans:

Week ended 04/05/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: JoAnn Stores ($658mn, 3/18/24), New Insight Holdings ($1.2bn, 3/13/24), Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), Careismatic ($700mn, 1/22/24), Enviva Partners ($750mn, 1/15/24), Ligado Networks ($4.2bn, 11/1/23), and Air Methods ($1.7bn, 10/24/23).

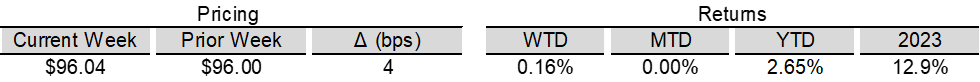

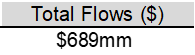

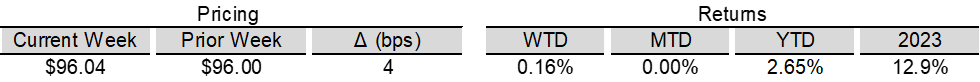

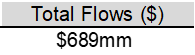

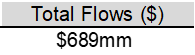

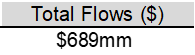

CLOs:

Week ended 04/05/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

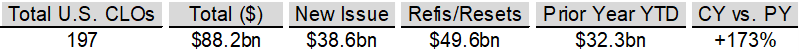

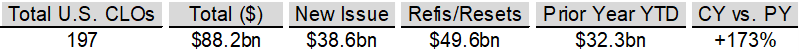

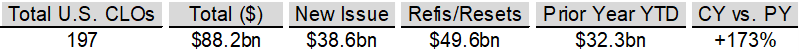

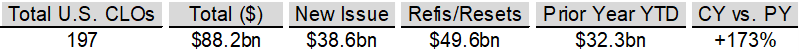

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

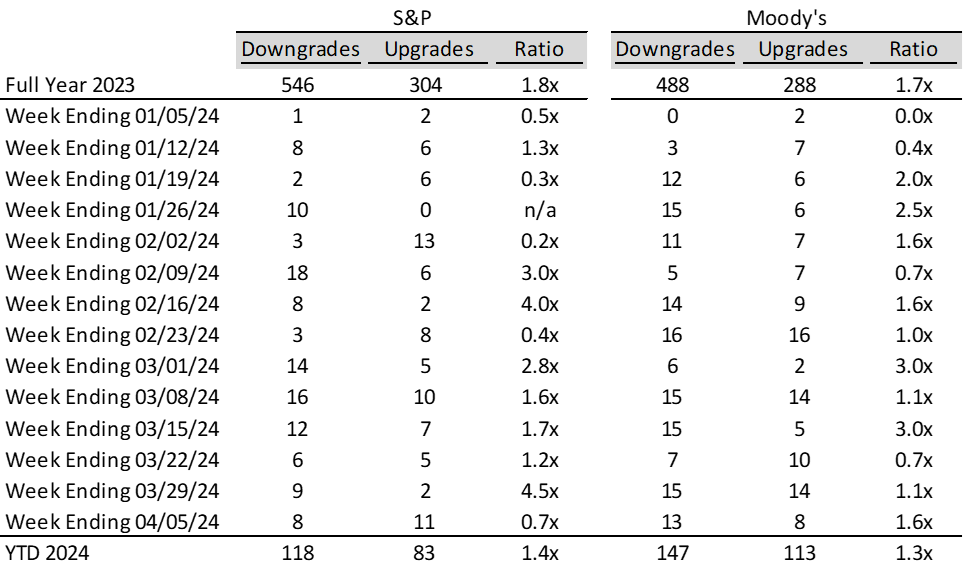

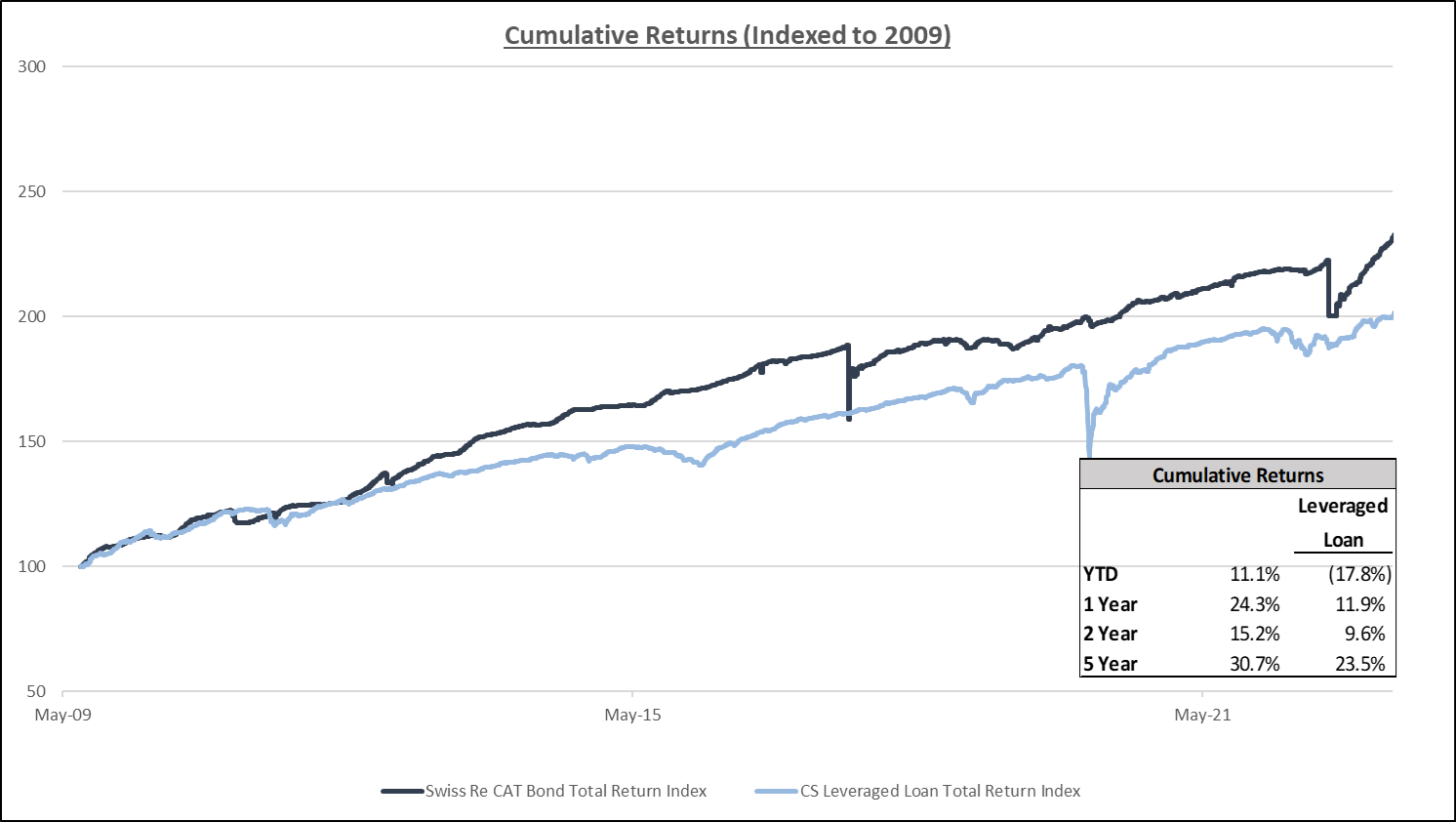

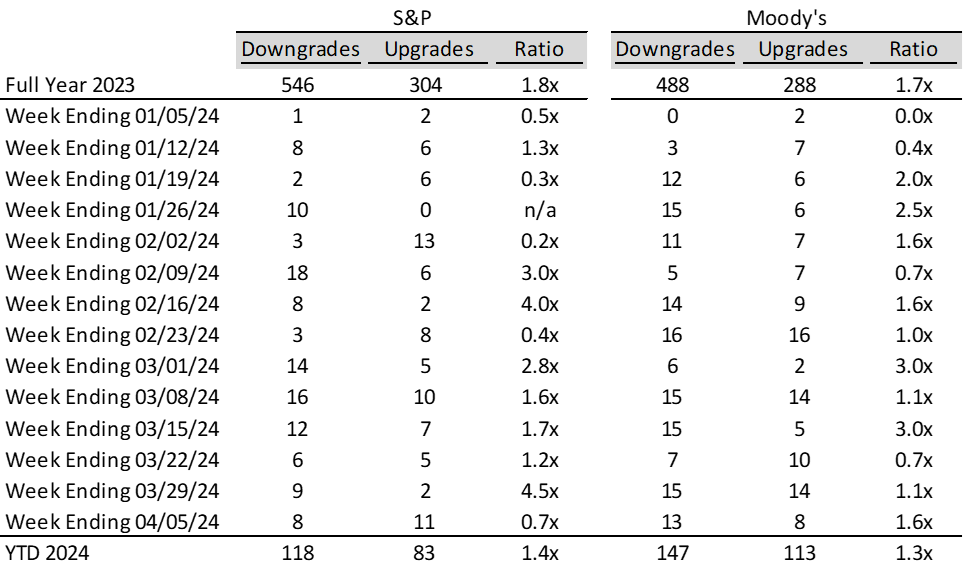

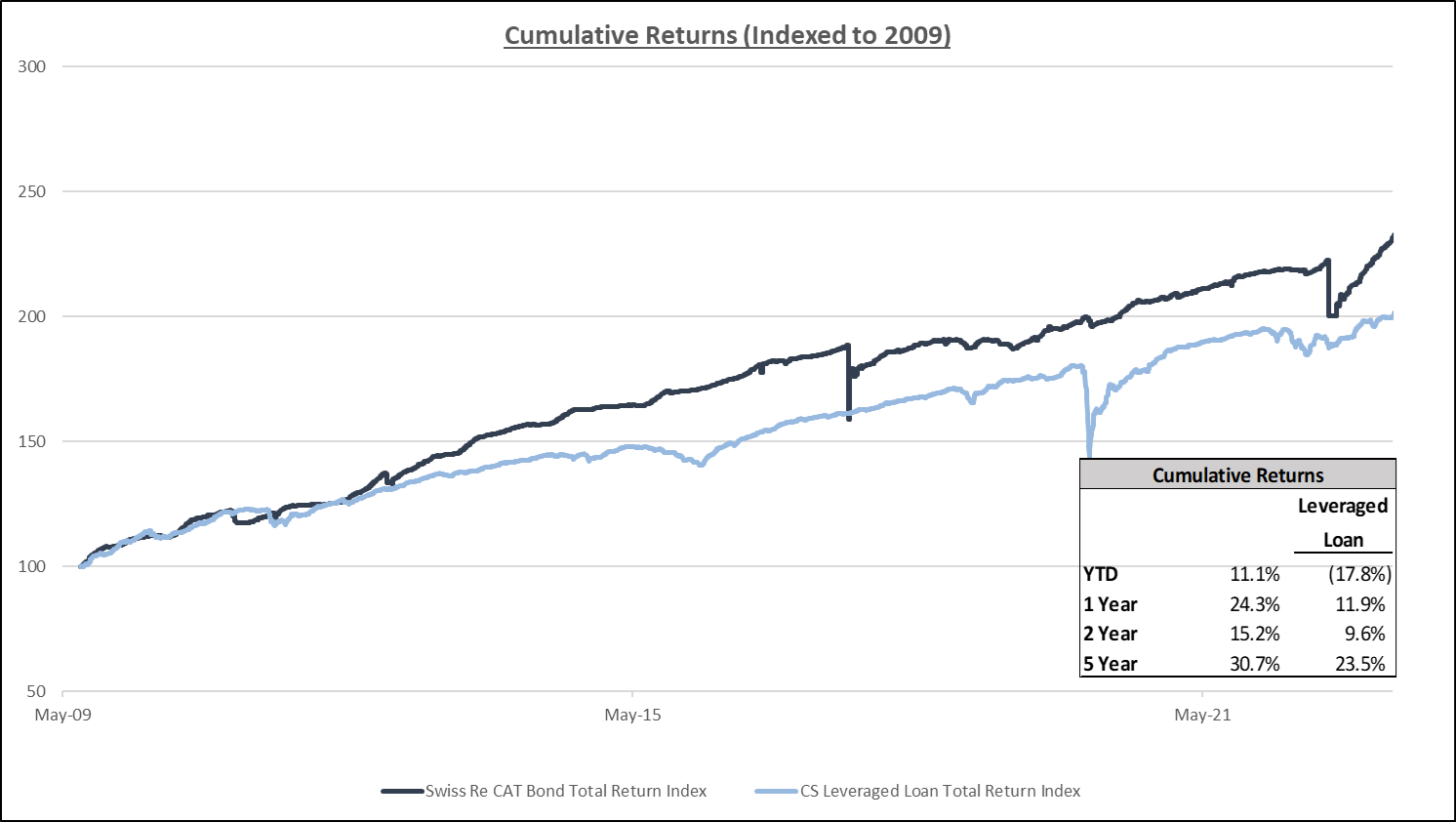

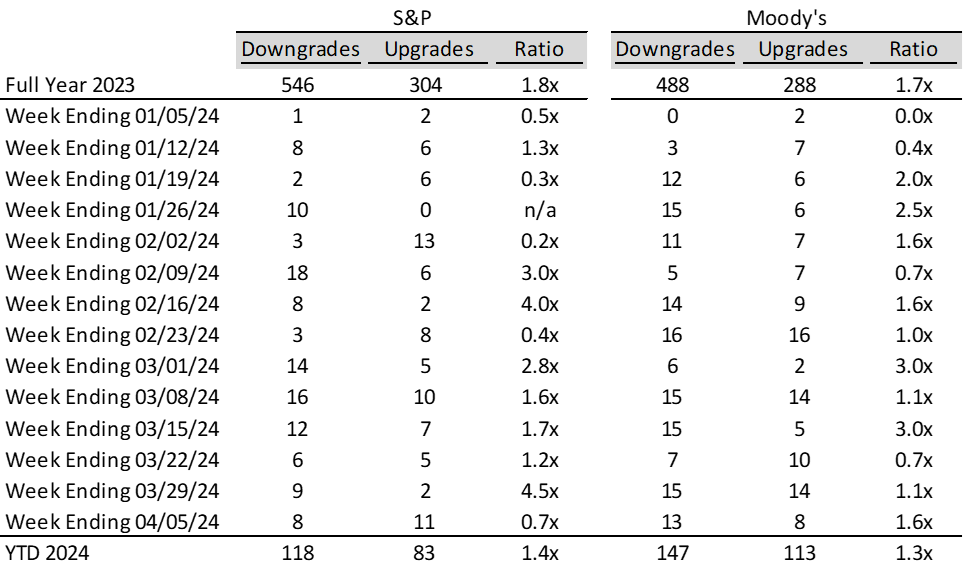

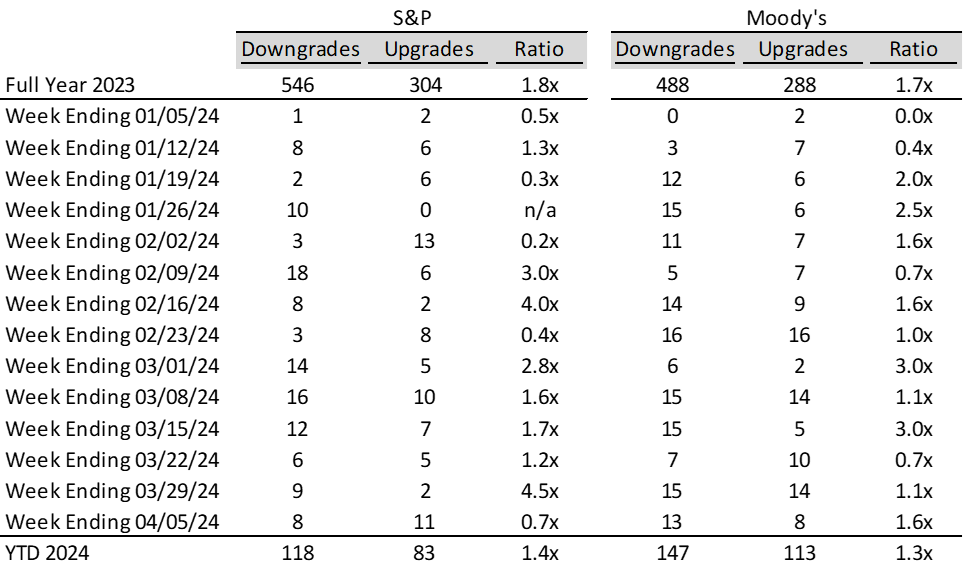

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Diagram V: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

U.S. News

- U.S. Trade Balance

- The U.S. international trade deficit widened by 1.9% to $68.9 billion in February, marking the third consecutive month of increase and the largest imbalance since last April

- Exports in February rose 2.3% to $263 billion, while imports increased by 2.2% to $331.9 billion

- The widening trade deficit is expected to slightly drag on the first-quarter GDP growth, amidst overall weak global trade due to geopolitical tensions

- Construction Spending

- Construction spending in the U.S. fell by 0.3% in February to $2.1 trillion, contrary to expectations of a 0.7% increase

- Over the past year, construction spending has increased by 10.7%

- Private residential construction rose 0.7%, with single-family construction up 1.4% and multifamily construction down 0.2%; public residential construction decreased by 1.2%

- U.S. Auto Sales

- U.S. new car and truck sales decreased by 2% in March, with an annual sales rate of 15.5 million, down from 15.8 million in February

- The auto industry hasn’t returned to pre-pandemic levels of sales, with 2016 recording a peak of 17.5 million

- High vehicle prices, particularly for electric vehicles, and high loan rates averaging around 7% or more have significantly impacted demand

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 221,000 in the week ended March 29, up 9,000 from the prior week

- The four-week moving average was 214,250, up 2750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – decreased by 19,000 to 1.791 million in the week ended March 22. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.440 trillion in the week ended April 5, down $45.2 billion from the prior week

- Treasury holdings totaled $4.597 trillion, down $21.2 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.39 trillion in the week, down $14.3 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.60 trillion as of April 5, an increase of 10.0% from the previous year

- Debt held by the public was $24.68 trillion, and intragovernmental holdings were $7.09 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.2% in February year over year

- On a monthly basis, the CPI increased 0.4% in February on a seasonally adjusted basis, after increasing 0.3% in January

- The index for all items less food and energy (core CPI) rose 0.4% in February, after rising 0.4% in January

- Core CPI increased 3.8% for the 12 months ending February

- Food and Beverages:

- The food at home index increased 1.0% in February from the same month a year earlier, and decreased 0.0% in February month over month

- The food away from home index increased 4.5% in February from the same month a year earlier, and increased 0.1% in February month over month

- Commodities:

- The energy commodities index increased 3.6% in February after decreasing (3.2%)

- The energy commodities index fell (4.1%) over the last 12 months

- The energy services index 0.1% in February after increasing 2.5% in January

- The energy services index rose 0.5% over the last 12 months

- The gasoline index fell (3.9%) over the last 12 months

- The fuel oil index fell (5.4%) over the last 12 months

- The index for electricity rose 3.6% over the last 12 months

- The index for natural gas fell (8.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $2,835.51 per 40ft

- Drewry’s composite World Container Index has increased by 65.8% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in February after increasing 0.6% in January

- The rent index increased 0.4% in February after increasing 0.6% in January

- The index for lodging away from home increased 3.1% in February after increasing 4.3% in January

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel

- CIA Director William Burns is participating in cease-fire talks in Cairo, aiming to halt fighting in Gaza and address the humanitarian situation as the conflict enters its seventh month

- Israeli Prime Minister Benjamin Netanyahu insists on the release of hostages for a cease-fire, while Hamas demands the return of Gazans to northern Gaza and the withdrawal of Israeli troops

- An airstrike in Syria, allegedly carried out by Israel, targeted an Iranian consulate, killing top Iranian military officials, which risks escalating tensions between Israel and Iran

-

China

- The U.S. and EU, along with emerging economies like Brazil, India, Mexico, and Indonesia, are responding to a surge of cheap Chinese imports by considering raising trade barriers and initiating antidumping investigations

- Treasury Secretary Janet Yellen, during her visit to China, emphasized the risks of China’s economic strategy focused on exporting cheap goods without fostering domestic demand, indicating it could lead to negative global spillovers

- Governments worldwide have announced over 70 import-related measures targeting China since the start of the previous year, showcasing a global effort to protect domestic industries from the influx of cheap Chinese products

-

Russia

- More than 4,000 people, including 885 children, have been evacuated in the Orenburg region of Russia due to flooding caused by the bursting of a dam and the overflow of the Ural River

- A criminal investigation has been launched into suspected construction violations that may have led to the dam’s failure, with water levels reaching about 9.7 meters, significantly above the dam’s capacity

-

Germany

- German manufacturing orders marginally increased by 0.2% in February, a slower growth than the expected 0.5%, following a sharp 11.4% drop in January, with significant fluctuations driven by sectors like aerospace in previous months.

- The car industry in Germany saw a notable decline in orders by 8.1% in February, whereas orders in the chemical and pharmaceutical industries rose by 3.1% and 6.6%, respectively, indicating varied performance across different sectors.

-

Canada

- Canada’s goods-trade surplus widened more than expected in February, driven by record gold shipments and marking the strongest export growth in six months

-

South Korea

- South Korea’s exports grew for a sixth consecutive month in March, driven by strong demand for semiconductors and ships, with a 3.1% increase from the previous year to $56.56 billion

-

Taiwan

- A magnitude-7.4 earthquake, the strongest to hit Taiwan in 25 years, killed at least nine people, injured more than 900, and caused significant structural damage including the collapse of buildings

-

Japan

- The Bank of Japan ended negative interest rates and unwound most of its unconventional monetary easing policies, moving its key target for short-term rates to a range of 0% to 0.1%, its first rate increase since 2007

-

Australia

- Australian officials have unveiled a new policy aimed at reducing migration by 14% over the next four years in an effort to address housing affordability issues in cities like Sydney, where prices have reached record highs

-

Argentina

- President Javier Milei drives privatization despite congressional resistance, cutting costs by 456 billion pesos ($535 million) in February 2024. Companies like Aerolíneas Argentinas and YPF undergo restructuring, facing hurdles in Congress and valuation challenges in YPF’s state shares

-

South Africa

- Markus Jooste, former CEO of Steinhoff International, died from a self-inflicted gunshot wound a day after receiving a record fine for his role in the company’s collapse due to massive corporate fraud

Commodities

-

Oil Prices

- WTI: $86.74 per barrel

- +4.29% WoW; +21.06% YTD; +7.48% YoY

- Brent: $90.92 per barrel

- +3.93% WoW; +18.02% YTD; +6.81% YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended March 29, down 0.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 620, down 1 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 451.4 million barrels, down (3.9%) YoY

- Refiners operated at a capacity utilization rate of 88.6% for the week, down from 88.7% in the prior week

- U.S. crude oil imports now amount to 6.702 million barrels per day, down (7.4%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.58 per gallon in the week of April 5,

up 0.0% YoY

- Gasoline prices on the East Coast amounted to $3.49, up 0.9% YoY

- Gasoline prices in the Midwest amounted to $3.44, down (0.5%) YoY

- Gasoline prices on the Gulf Coast amounted to $3.21, down (0.8%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.47, down (3.3%) YoY

- Gasoline prices on the West Coast amounted to $4.68, up 4.0% YoY

- Motor gasoline inventories were down by 4.3 million barrels from the prior week

- Motor gasoline inventories amounted to 227.8 million barrels, up 2.4% YoY

- Production of motor gasoline averaged 9.98 million bpd, up 1.3% YoY

- Demand for motor gasoline amounted to 9.236 million bpd, down (0.6%) YoY

-

Distillates

- Distillate inventories decreased by -1.3 million in the week of April 5

- Total distillate inventories amounted to 116.1 million barrels, up 2.7% YoY

- Distillate production averaged 4.606 million bpd, down (2.8%) YoY

- Demand for distillates averaged 3.495 million bpd in the week, down (17.6%) YoY

-

Natural Gas

- Natural gas inventories decreased by 37 billion cubic feet last week

- Total natural gas inventories now amount to 2,259 billion cubic feet, up 23.4% YoY

Credit News

High yield bond yields increased 16bps to 7.76% and spreads increased 4bps to 331bps. Leveraged loan yields increased 7bps to 9.34% and spreads decreased 6bps to 503bps. WTD Leveraged loan returns were positive 16bps. WTD high yield bond returns were negative 30bps. 10yr treasury yields increased 11bps to 4.31%. For the week, yields and spreads widened as investors absorbed an equity sell-off, rising commodity prices, and a strong payroll report that reaffirmed the resilience of

the economy.

High-yield:

Week ended 04/05/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 04/05/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: JoAnn Stores ($658mn, 3/18/24), New Insight Holdings ($1.2bn, 3/13/24), Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), Careismatic ($700mn, 1/22/24), Enviva Partners ($750mn, 1/15/24), Ligado Networks ($4.2bn, 11/1/23), and Air Methods ($1.7bn, 10/24/23).

CLOs:

Week ended 04/05/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Diagram V: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index