U.S. News

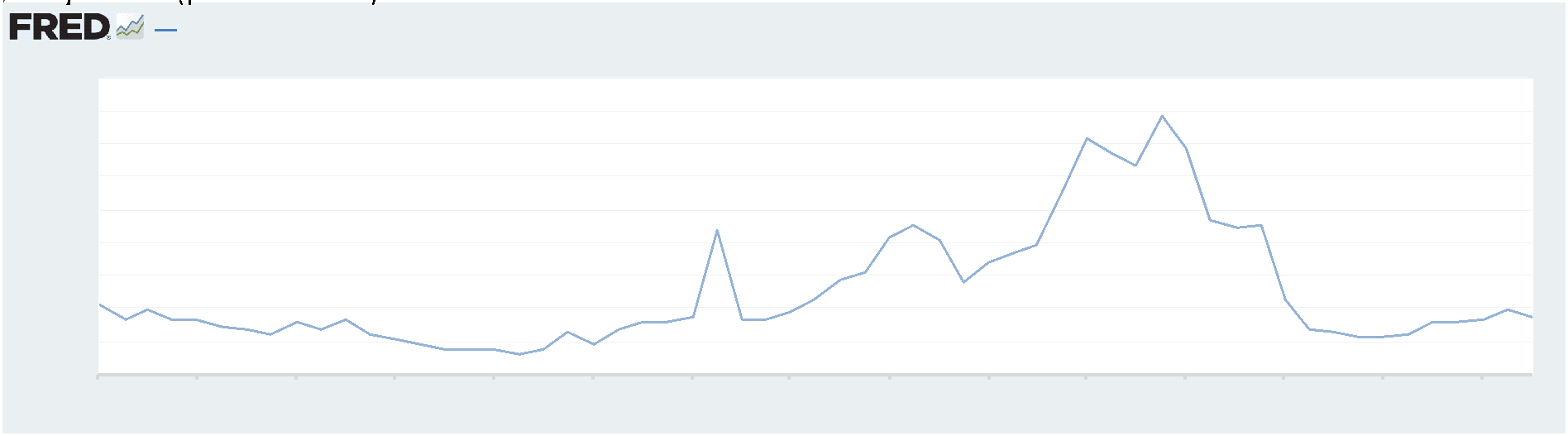

- Consumer Price Index

- The cost of consumer goods and services rose a sharp 0.4% in March, capping off a third straight month of elevated inflation readings that will make it hard for the Federal Reserve to cut interest rates soon

- The increase in the CPI over the past 12 months moved up to 3.5% from 3.2% and hit the highest level since September

- The cost of energy and shelter accounted for more than half of the increase in inflation

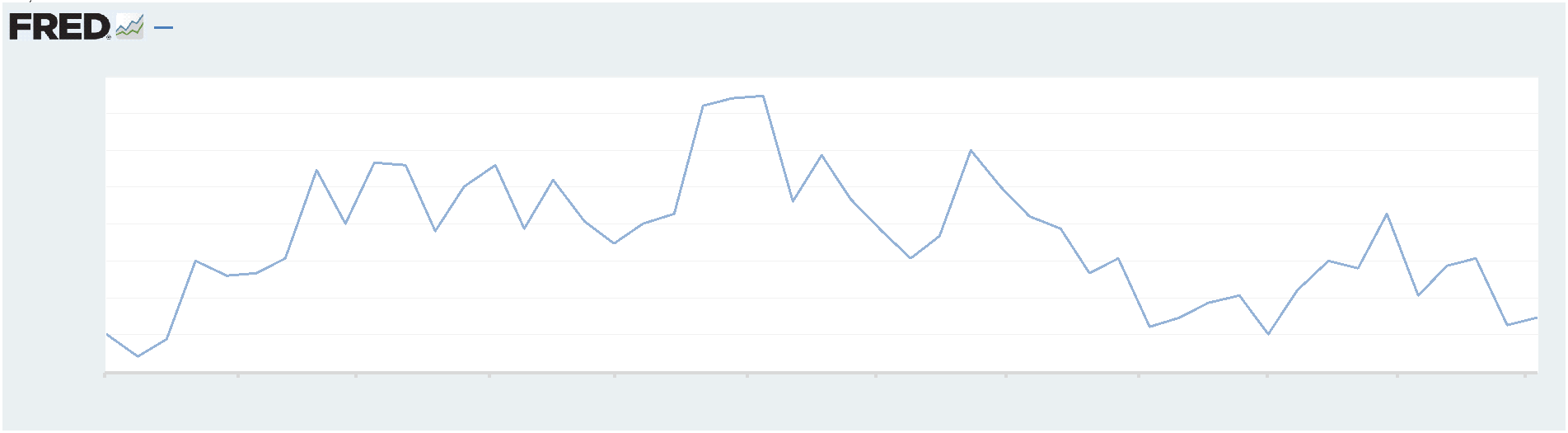

- Small Business Optimism Index

- The NFIB small business optimism index decreased last month to 88.5, the lowest level since December 2012

- Inflation continues to be most pestering to small businesses, who are facing challenges when it comes to both business and labor costs

- The net percentage of business owners raising prices because of inflation rose to 28% in February and a third of small businesses disclosed that they had planned for more price hikes in March

- Consumer Sentiment

- The consumer sentiment index dipped to 77.9 in April from 79.4 in March but remains in a range that it has been in since the start of 2024

- Consumers frustration that inflation has stopped dropping continues to hold down sentiment, but beyond that they see the economy still in pretty good shape

- Since January, sentiment has remained steady within a very narrow 2.5 index point range

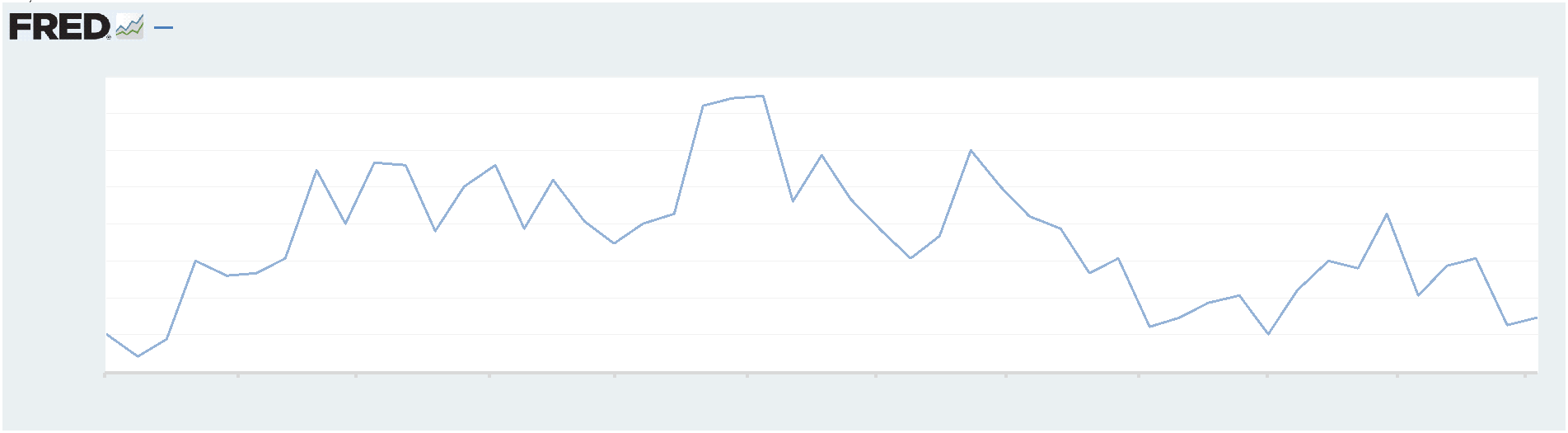

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 211,000 in the week ended April 5, down 11,000 from the prior week

- The four-week moving average was 214,250, up 250 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 28,000 to 1.817 million in the week ended March 29. This figure is reported with a one-week lag

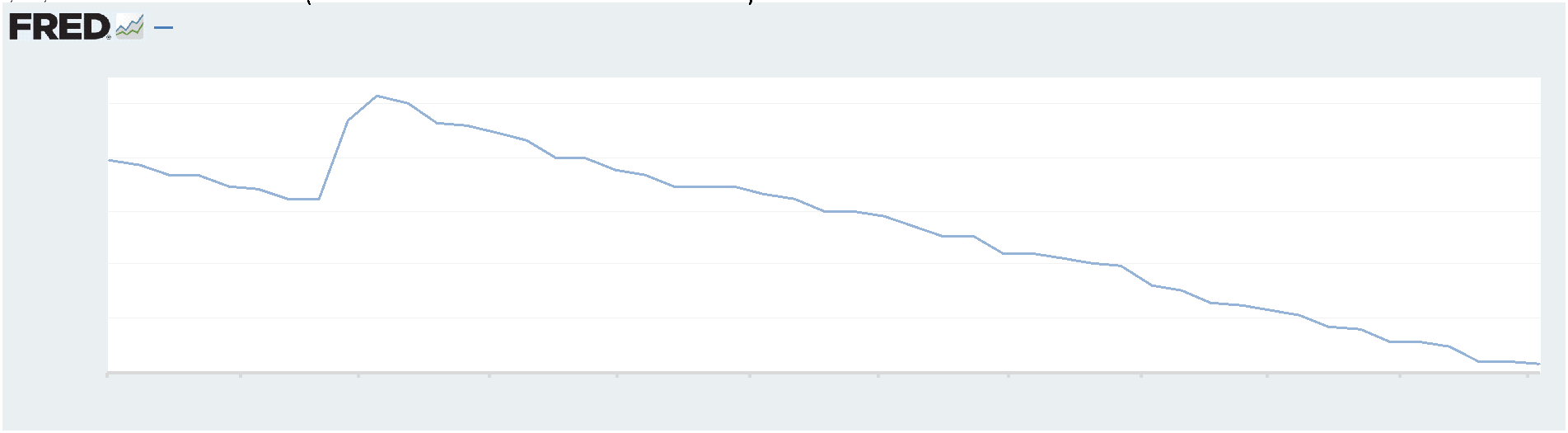

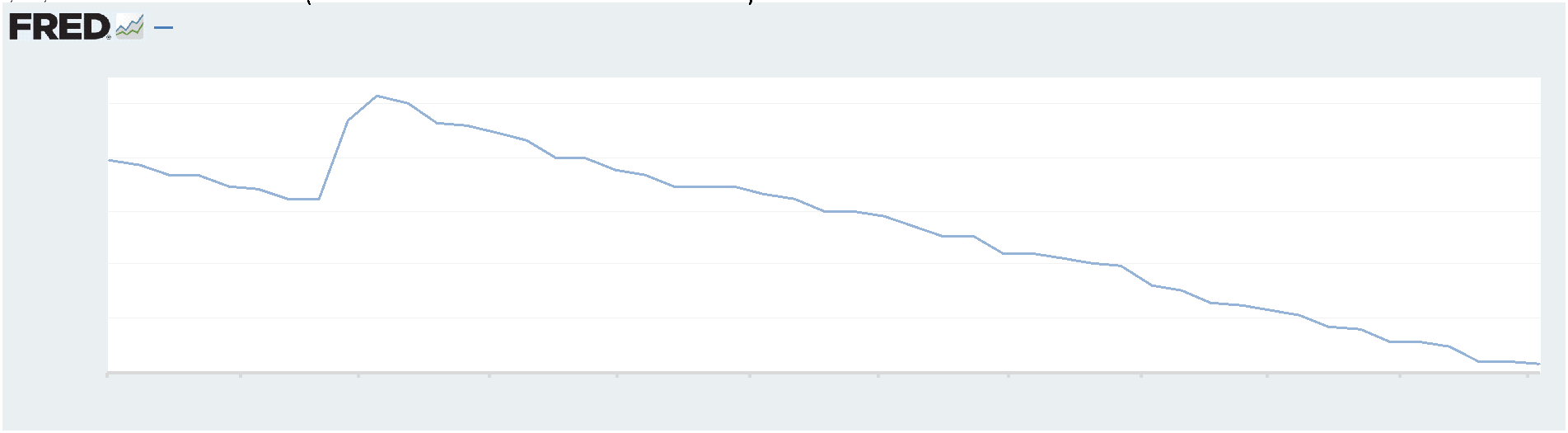

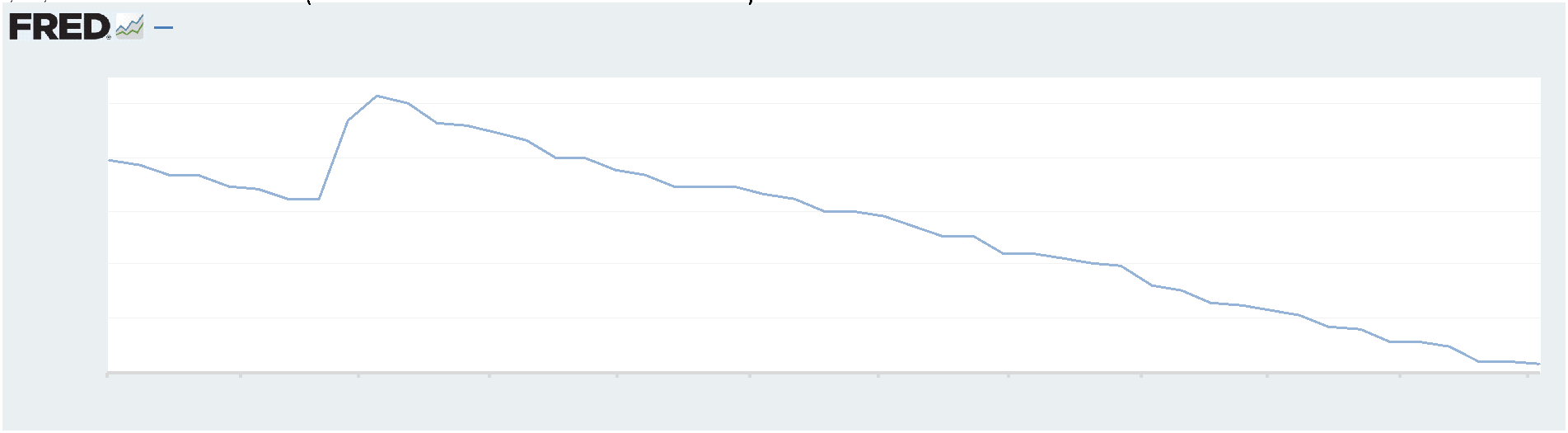

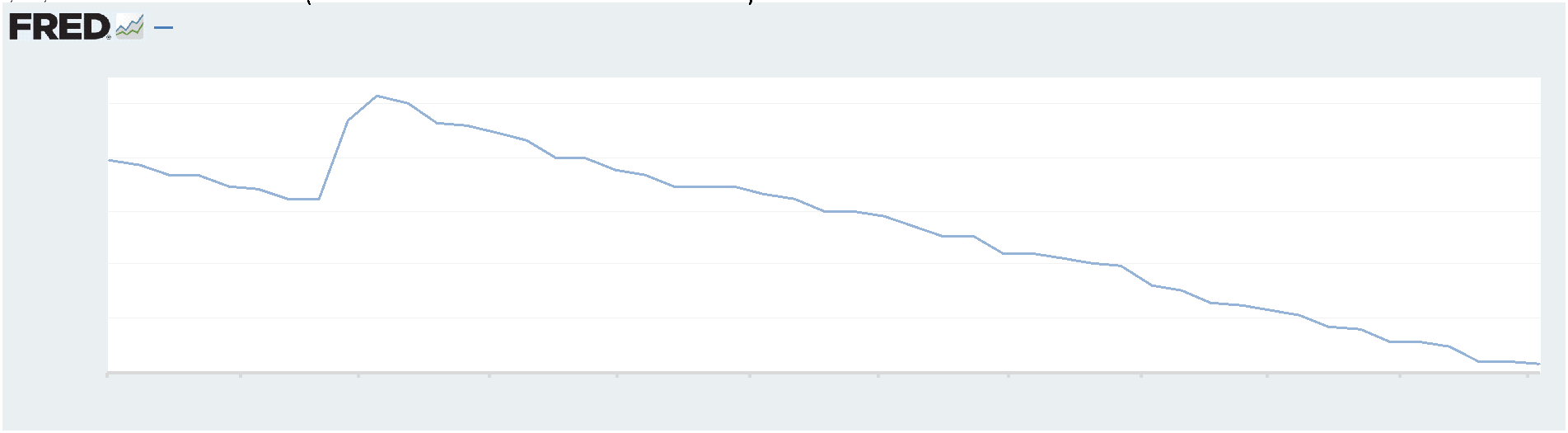

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.438 trillion in the week ended April 12, down $1.4 billion from the prior week

- Treasury holdings totaled $4.576 trillion, down $21.9 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.39 trillion in the week, down $6.6 billion from the prior week

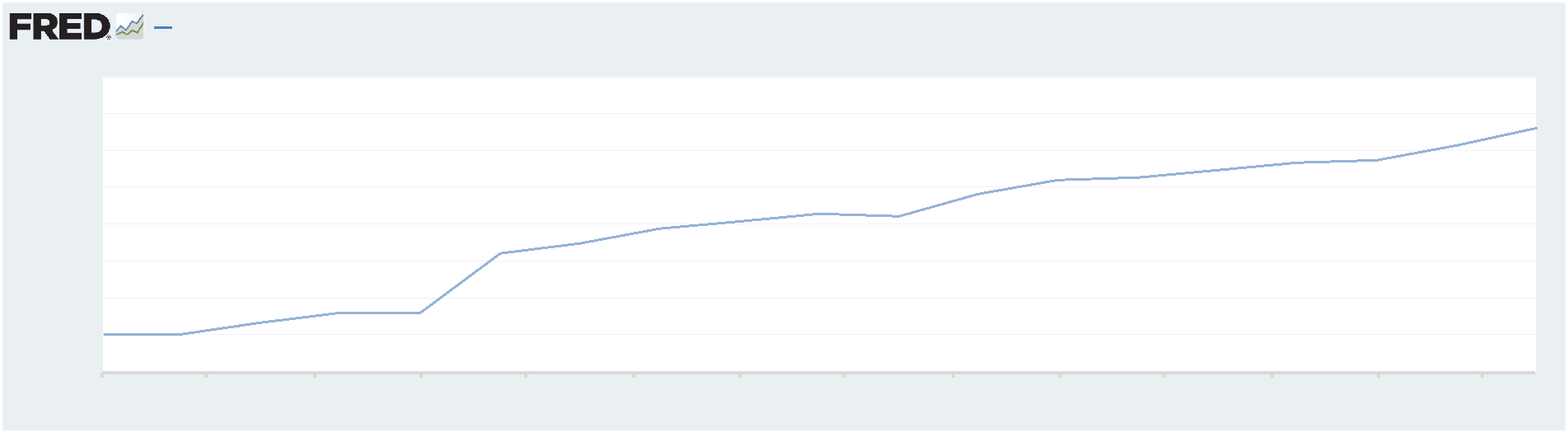

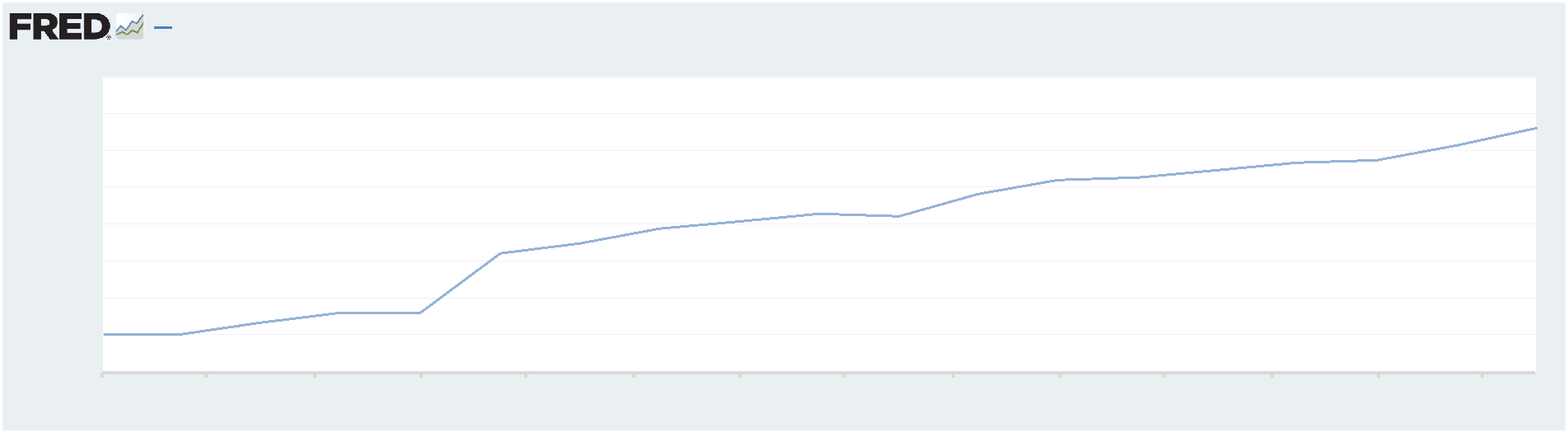

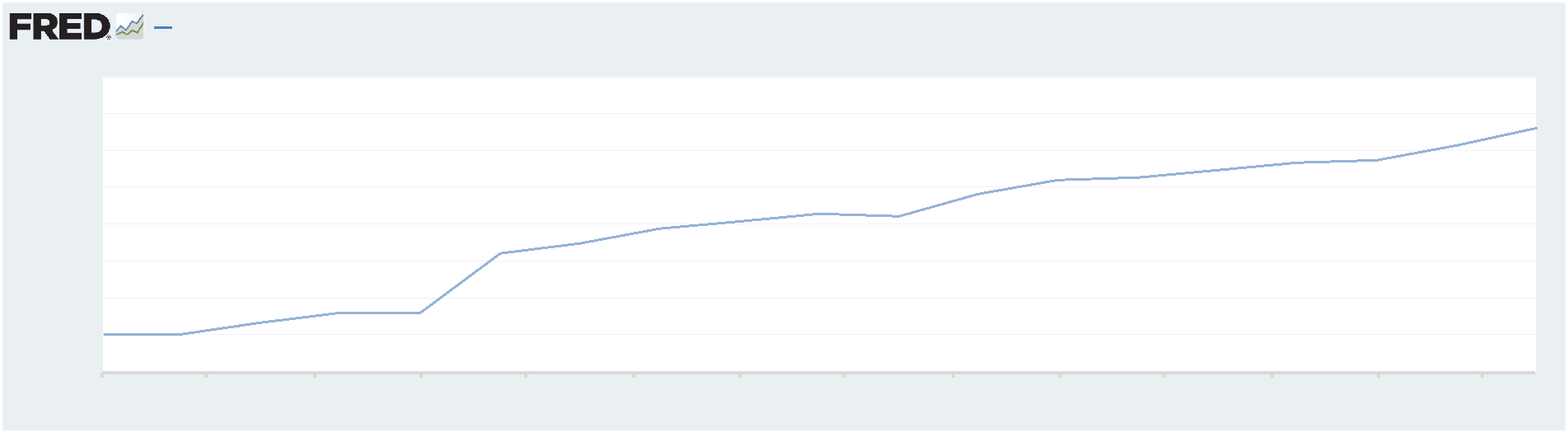

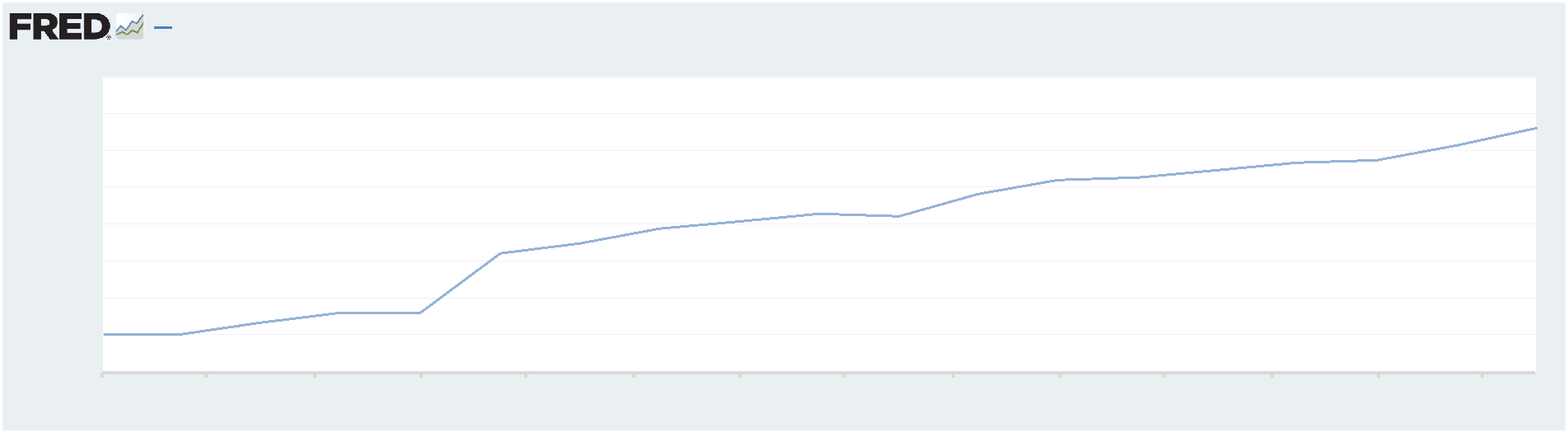

- Total Public Debt

- Total public debt outstanding was $34.56 trillion as of April 12, an increase of 9.9% from the previous year

- Debt held by the public was $24.67 trillion, and intragovernmental holdings were $7.08 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.5% in March year over year

- On a monthly basis, the CPI increased 0.4% in March on a seasonally adjusted basis, after increasing 0.4% in February

- The index for all items less food and energy (core CPI) rose 0.4% in March, after rising 0.4% in February

- Core CPI increased 3.8% for the 12 months ending March

- Food and Beverages:

- The food at home index increased 1.2% in March from the same month a year earlier, and decreased 0.0% in March month over month

- The food away from home index increased 4.2% in March from the same month a year earlier, and increased 0.3% in March month over month

- Commodities:

- The energy commodities index increased 1.5% in March after increasing 3.6%

- The energy commodities index fell 0.9% over the last 12 months

- The energy services index (0.0%) in March after increasing 0.1% in February

- The energy services index rose 3.1% over the last 12 months

- The gasoline index fell 1.3% over the last 12 months

- The fuel oil index fell (3.7%) over the last 12 months

- The index for electricity rose 5.0% over the last 12 months

- The index for natural gas fell (3.2%) over the last 12 months

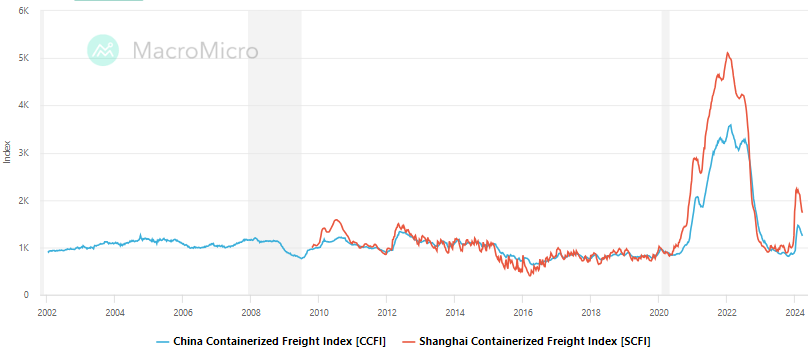

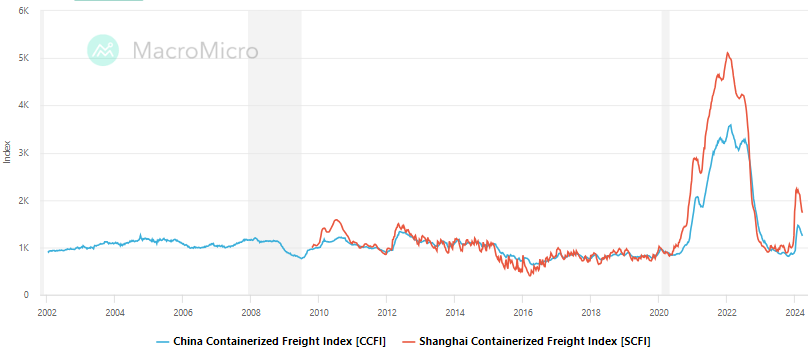

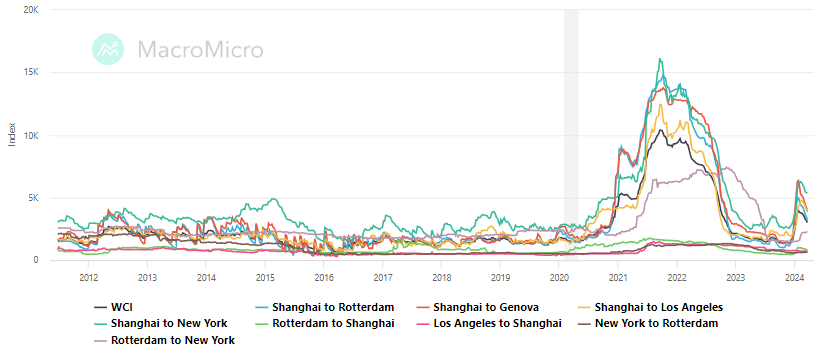

- Supply Chain:

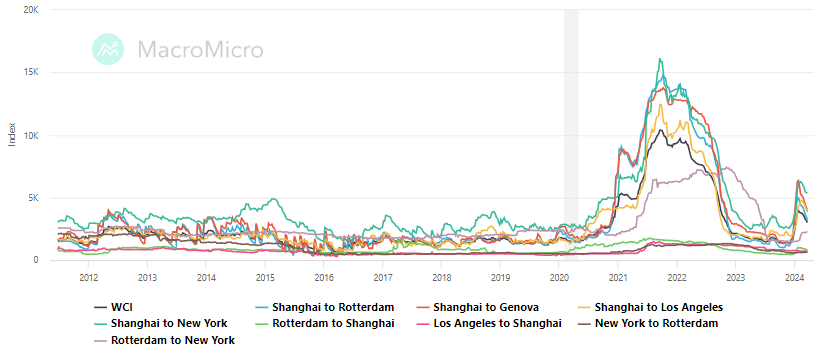

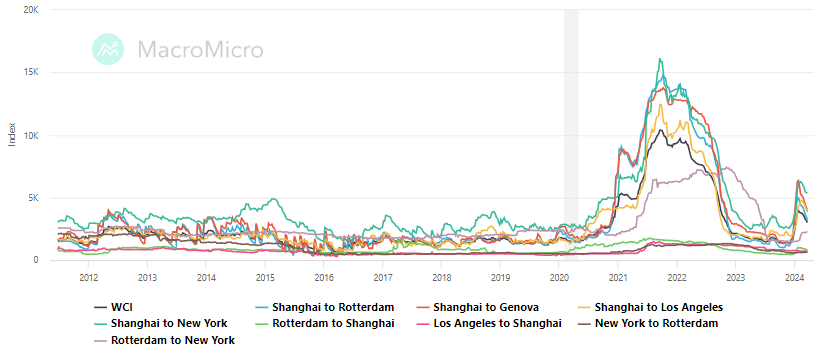

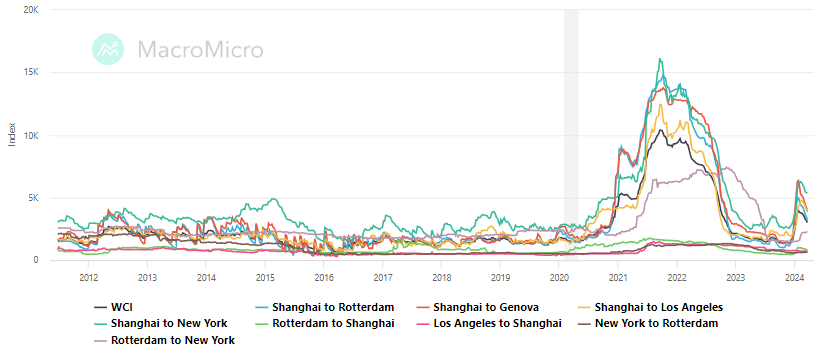

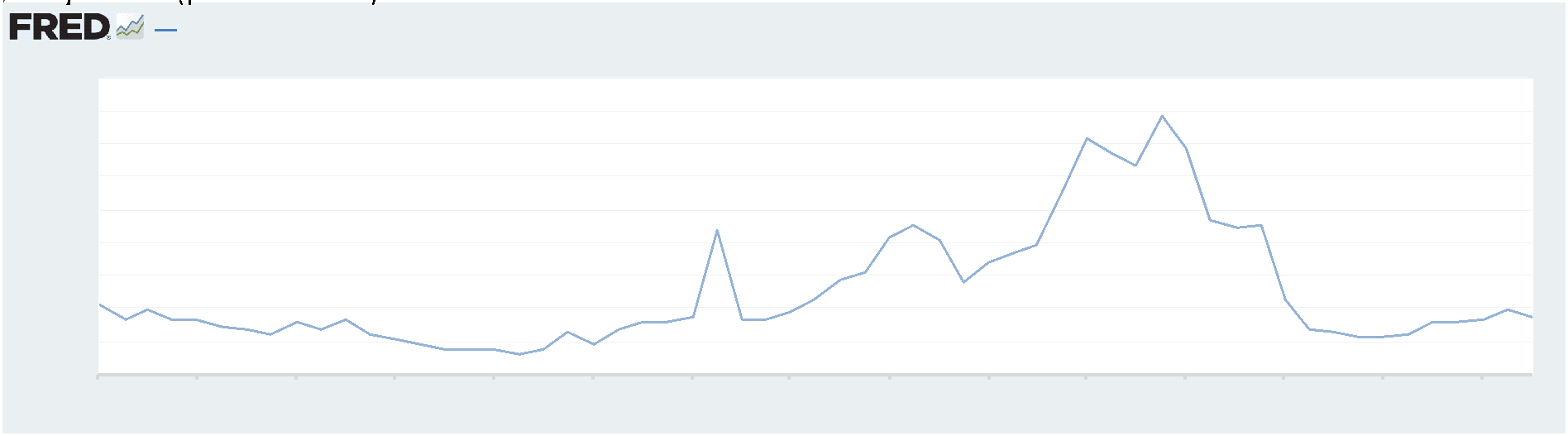

- Drewry’s composite World Container Index decreased to $2,795.10 per 40ft

- Drewry’s composite World Container Index has increased by 63.6% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in March after increasing 0.4% in February

- The rent index increased 0.5% in March after increasing 0.4% in February

- The index for lodging away from home increased 5.6% in March after increasing 3.1% in February

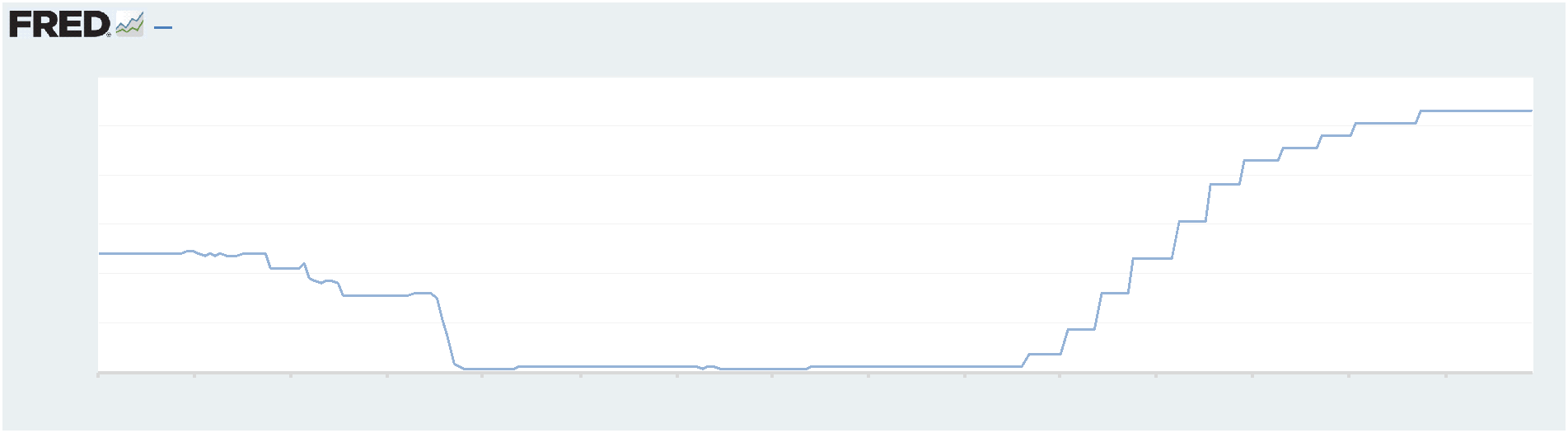

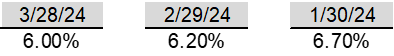

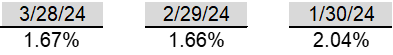

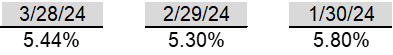

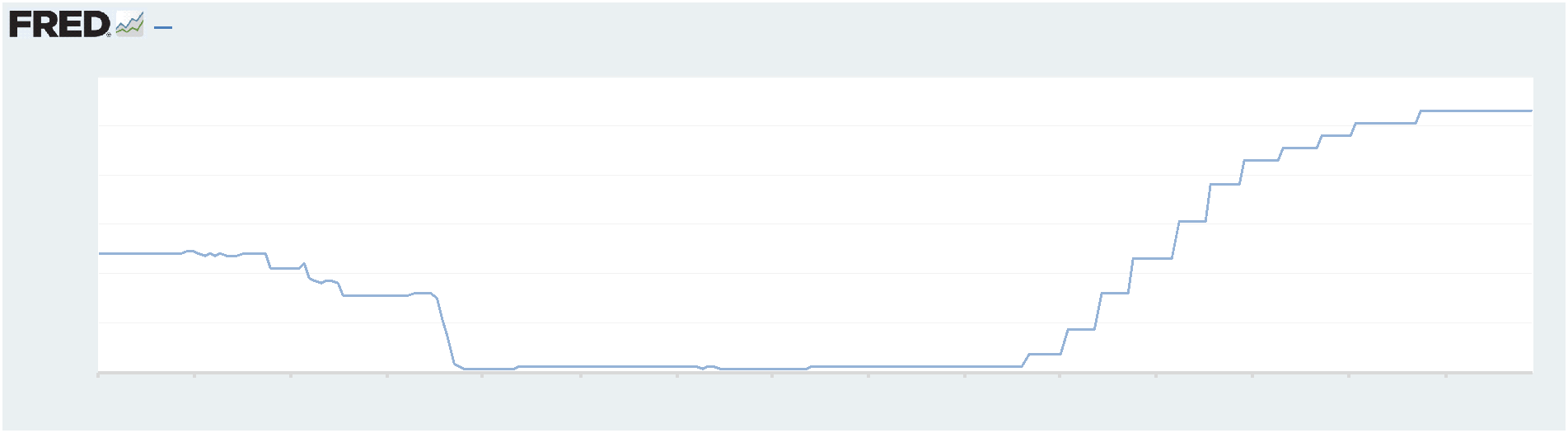

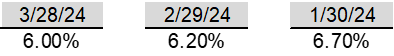

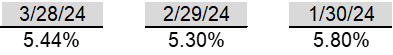

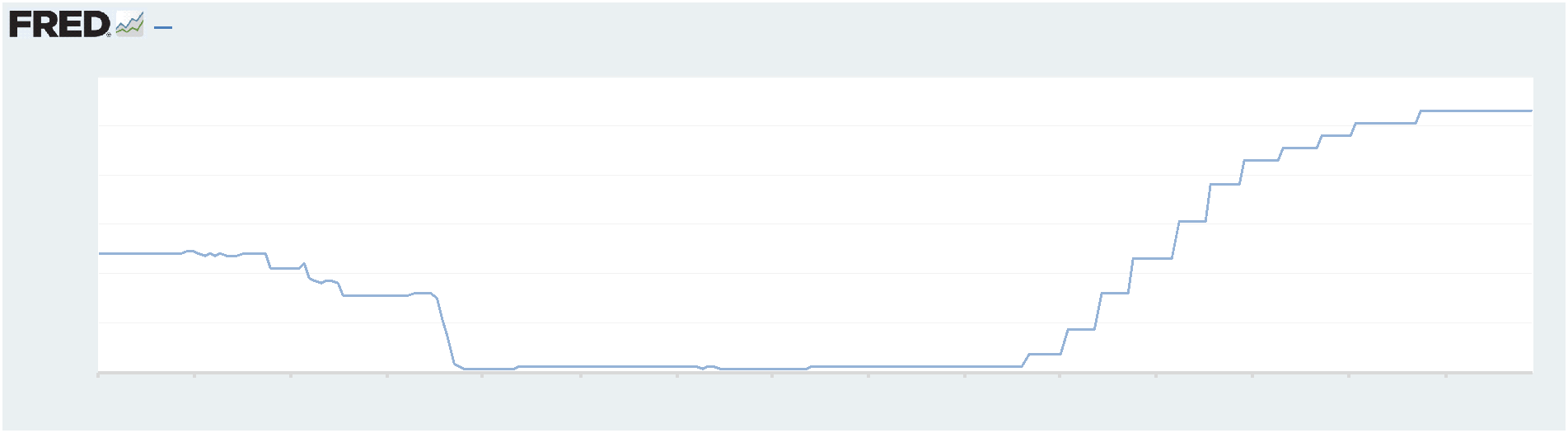

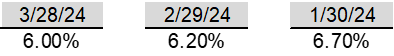

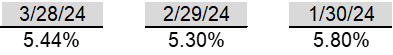

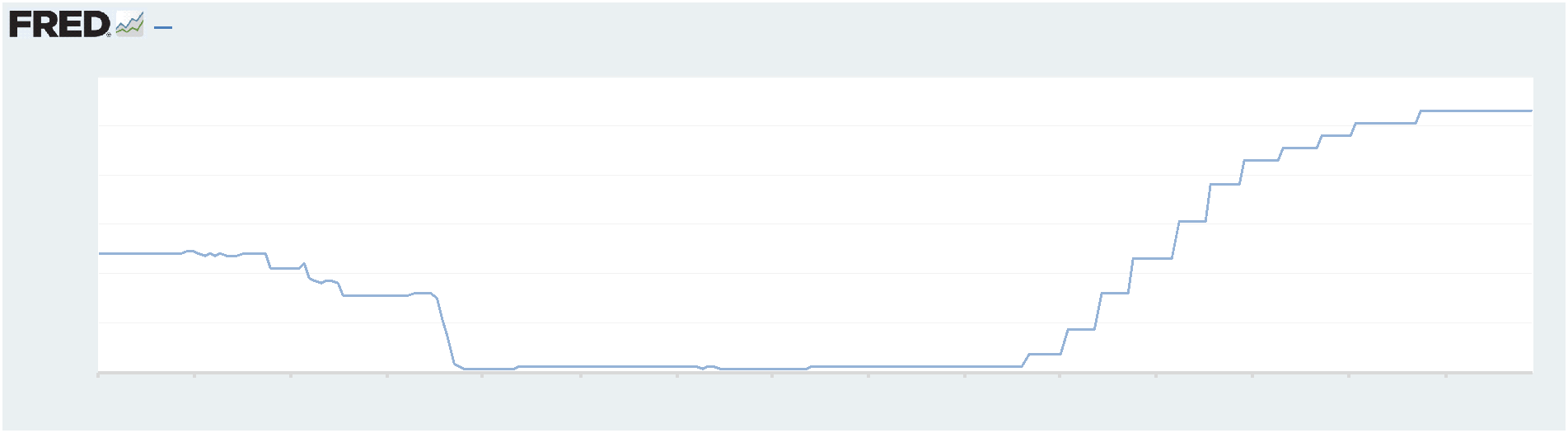

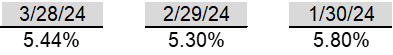

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel

- Last week Israel and Hamas were considering a new U.S. proposal for a cease-fire in the war in Gaza and the freeing of some hostages still held by the militant group, but mediators cautioned that the two sides remained far from a deal

- The plan, presented by Central Intelligence Agency Director William Burns to officials from Israel, Hamas, Qatar and Egypt in Cairo, calls for a six-week cease-fire in Gaza

- During the pause in fighting, according to the plan, Hamas would release 40 of the more than 100 hostages the group is holding in the enclave in exchange for 900 Palestinian prisoners from Israel’s jails, including 100 serving long sentences on terrorism-related charges

-

China

- On Wednesday of last week Fitch revised its outlook for China’s A+ credit rating from stable to negative. Fitch said the change to China’s rating outlook reflected rising risks to the country’s public finances a result of the uncertain economic outlook. China’s economy is being weighed down by a property slump, which has pushed dozens of companies to the brink of collapse, led to a sharp drop in home prices and dealt serious damage to consumer confidence

- The move followed a similar change by Moody’s Investors Service in December, who kept China’s long-term rating of A1 intact but changed the outlook from stable to negative

- China’s local governments are facing a mountain of liabilities, with some analysts putting their hidden debt as high as $11 trillion. They were squeezed by the real-estate slowdown, since for years land sales provided a steady stream of income to local governments and made up for shortfalls elsewhere. Local government-financing vehicles, which allowed regional governments to fund off their own balance sheets, compounded the pain

-

Russia

- The U.S. and Russia are using a confidential channel to discuss the issue of exchanging prisoners that could include the release of jailed Wall Street Journal reporter Evan Gershkovich, a senior Russian diplomat said Thursday

- Russian Deputy Foreign Minister Sergei Ryabkov told reporters that “dialogue on this topic is being conducted through a specialized closed channel,” but said he wasn’t authorized to comment on the exchange of information or “the signals that pass through this channel,” Russia’s state news agency TASS reported

- Thursday’s remarks from Moscow, though not new, are the latest signal that both sides are seriously engaged in negotiations to free the two men, the only Americans categorized by the State Department as wrongfully detained in Russia

-

Italy

- An explosion at a hydroelectric power plant owned by Rome-based energy group Enel killed at least three people. The explosion was likely caused by a fire in a turbine or a transformer at the plant

-

Germany

- Germany’s industrial production rose more than expected in February, helped by a recovery in the construction and car industry, as the country looks to exit a recent manufacturing slump

-

Canada

- Canada’s goods-trade surplus widened more than expected, driven by record gold shipments and marking the strongest export growth in six months

-

South Korea

- South Korea’s exports grew for a sixth consecutive month, driven by strong demand for semiconductors and ships, with a 3.1% increase from the previous year to $56.56 billion

-

Taiwan

- A magnitude-7.4 earthquake, the strongest to hit Taiwan in 25 years, killed at least nine people, injured more than 900, and caused significant structural damage including the collapse of buildings

-

Japan

- The Bank of Japan ended negative interest rates and unwound most of its unconventional monetary easing policies, moving its key target for short-term rates to a range of 0% to 0.1%, its first rate increase since 2007

-

Australia

- Australian officials have unveiled a new policy aimed at reducing migration by 14% over the next four years in an effort to address housing affordability issues in cities like Sydney, where prices have reached record highs

Commodities

-

Oil Prices

- WTI: $85.51 per barrel

- (1.61%) WoW; +19.34% YTD; +4.08% YoY

- Brent: $90.21 per barrel

- (1.05%) WoW; +17.10% YTD; +4.79% YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended April 5, down 0.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 617, down 3 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 457.3 million barrels, down (2.8%) YoY

- Refiners operated at a capacity utilization rate of 88.3% for the week, down from 88.6% in the prior week

- U.S. crude oil imports now amount to 6.618 million barrels per day, down 3.9% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.63 per gallon in the week of April 12,

down (0.8%) YoY

- Gasoline prices on the East Coast amounted to $3.50, down (1.8%) YoY

- Gasoline prices in the Midwest amounted to $3.54, down (1.4%) YoY

- Gasoline prices on the Gulf Coast amounted to $3.31, down (0.9%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.49, down (1.7%) YoY

- Gasoline prices on the West Coast amounted to $4.88, up 6.9% YoY

- Motor gasoline inventories were up by 0.7 million barrels from the prior week

- Motor gasoline inventories amounted to 228.5 million barrels, up 2.8% YoY

- Production of motor gasoline averaged 9.44 million bpd, down (3.8%) YoY

- Demand for motor gasoline amounted to 8.612 million bpd, down (3.6%) YoY

-

Distillates

- Distillate inventories decreased by 1.7 million in the week of April 12

- Total distillate inventories amounted to 117.7 million barrels, up 4.7% YoY

- Distillate production averaged 4.639 million bpd, up 1.2% YoY

- Demand for distillates averaged 2.985 million bpd in the week, down (20.7%) YoY

-

Natural Gas

- Natural gas inventories increased by 24 billion cubic feet last week

- Total natural gas inventories now amount to 2,283 billion cubic feet, up 23.1% YoY

Credit News

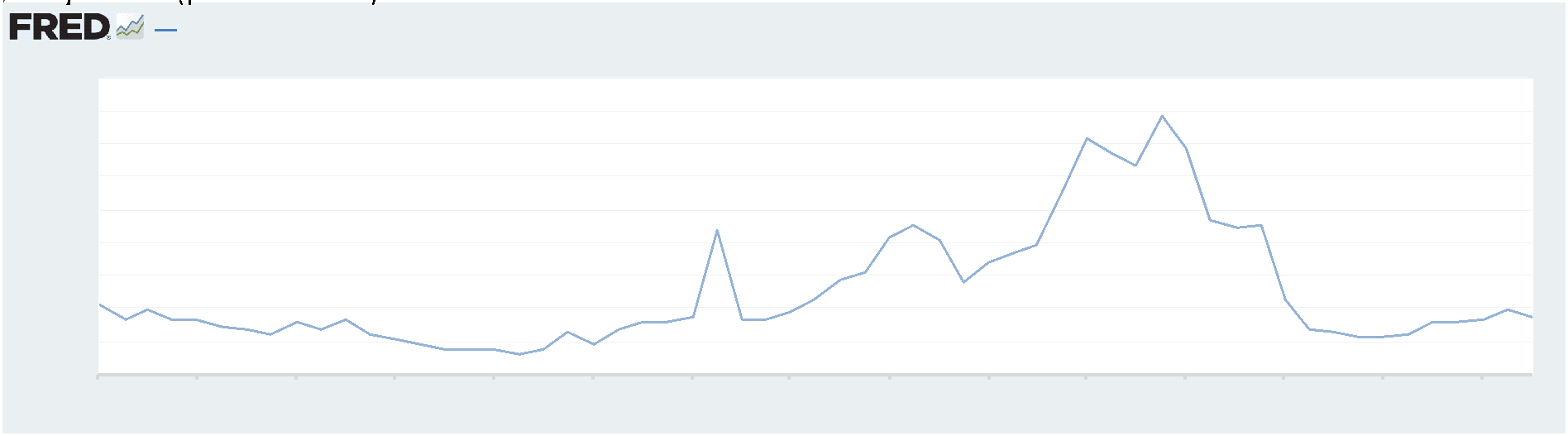

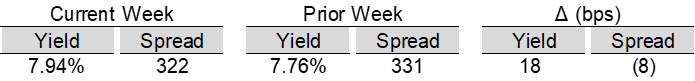

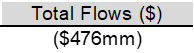

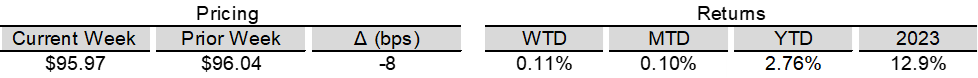

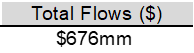

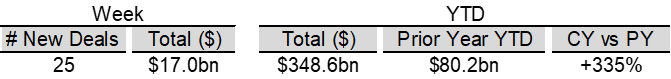

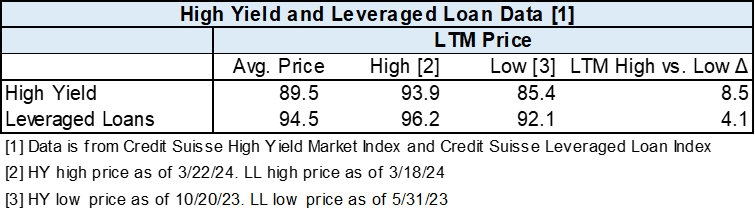

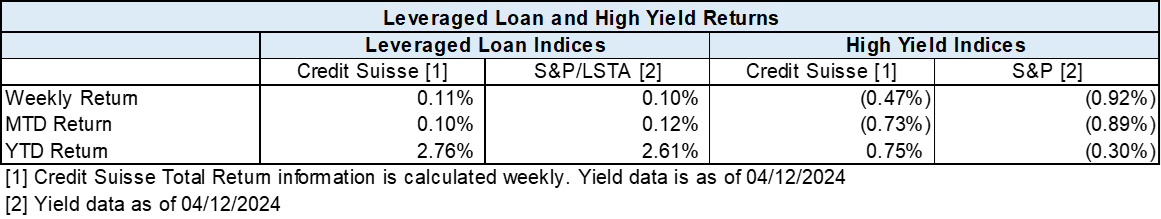

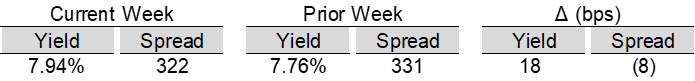

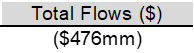

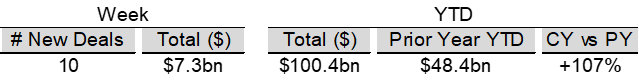

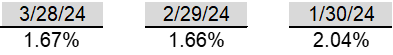

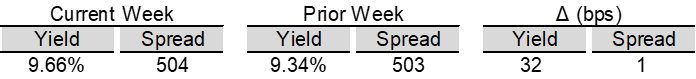

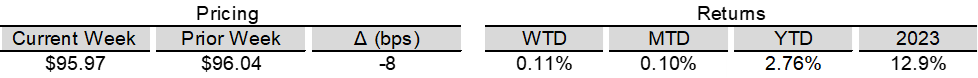

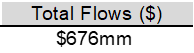

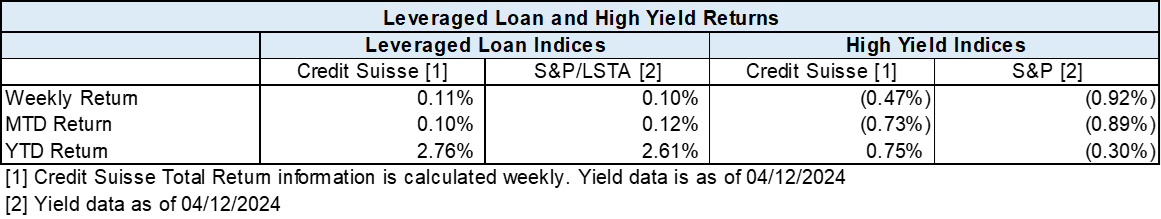

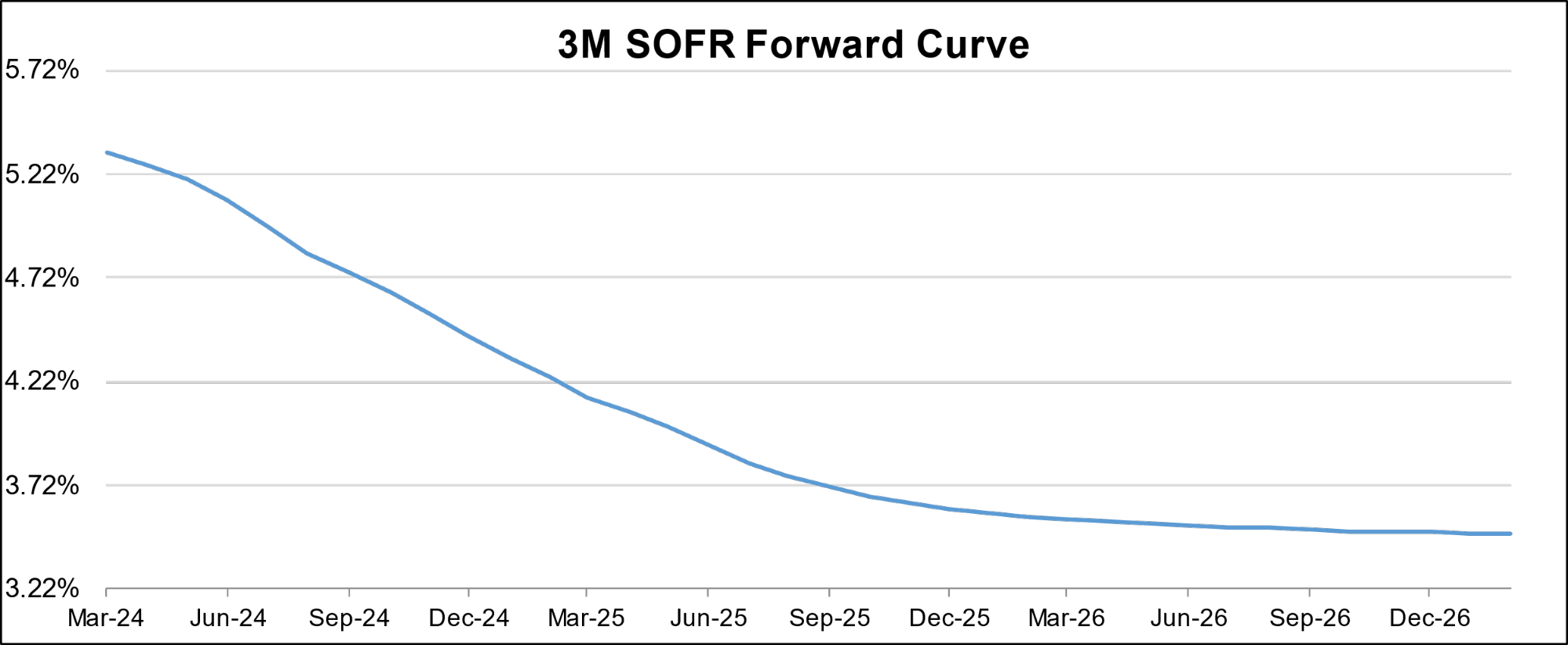

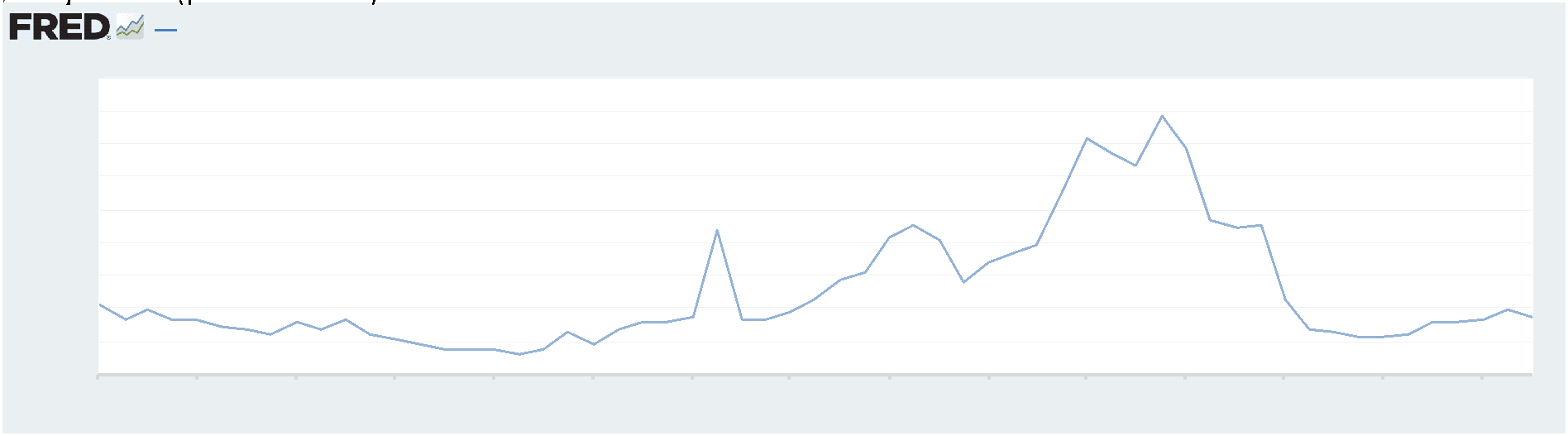

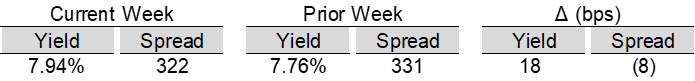

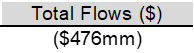

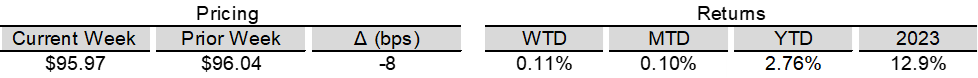

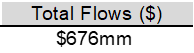

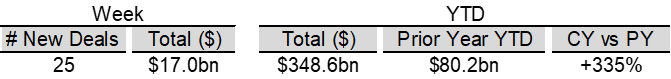

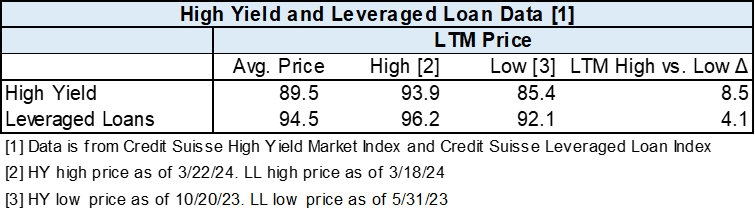

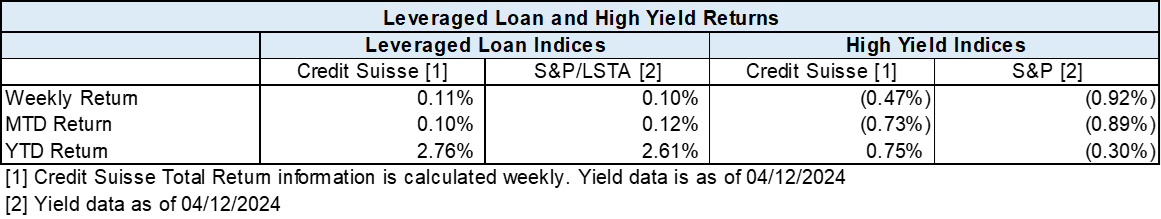

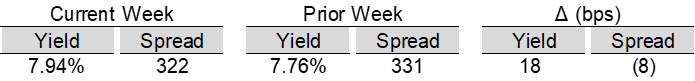

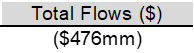

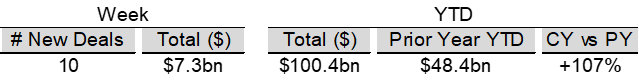

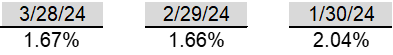

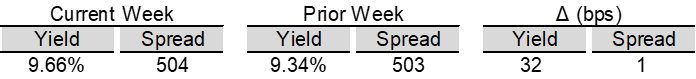

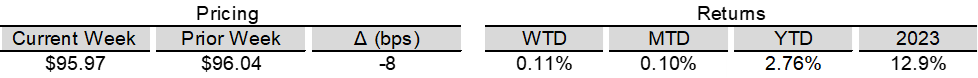

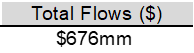

High yield bond yields increased 18bps to 7.94% and spreads decreased 8bps to 322bps. Leveraged loan yields increased 32bps to 9.66% and spreads increased 1bps to 504bps. WTD Leveraged loan returns were positive 11bps. WTD high yield bond returns were negative 47bps. 10yr treasury yields increased 27bps to 4.58%. For the week, HY yields rose and spreads tightened as markets repriced the Fed in response to another firmer-than-expected core CPI release. Resilient prices and a rising forward curve boosted loan yields to a high since December as markets now look for a later start and a shallower path of Fed easing.

High-yield:

Week ended 04/12/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 04/12/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

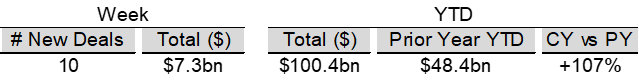

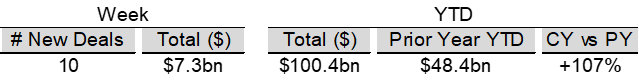

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: JoAnn Stores ($658mn, 3/18/24), New Insight Holdings ($1.2bn, 3/13/24), Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), Careismatic ($700mn, 1/22/24), Enviva Partners ($750mn, 1/15/24), Ligado Networks ($4.2bn, 11/1/23), and Air Methods ($1.7bn, 10/24/23).

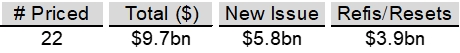

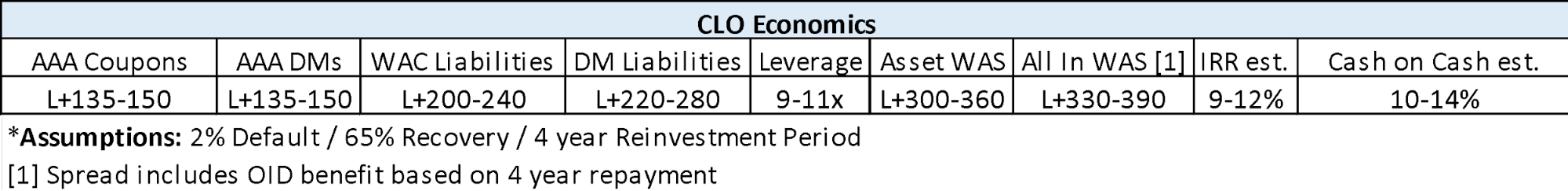

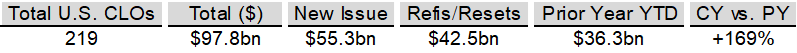

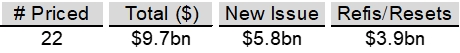

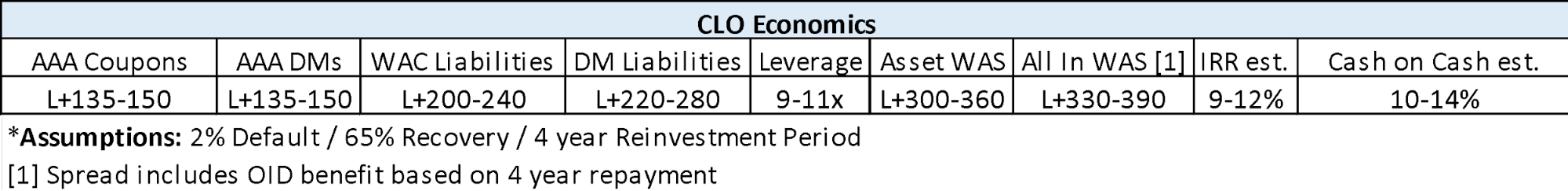

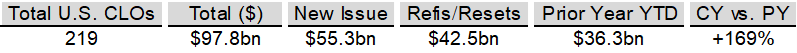

CLOs:

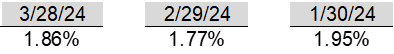

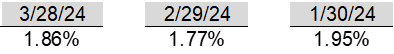

Week ended 04/12/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

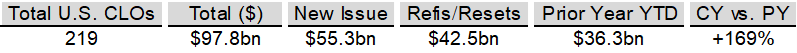

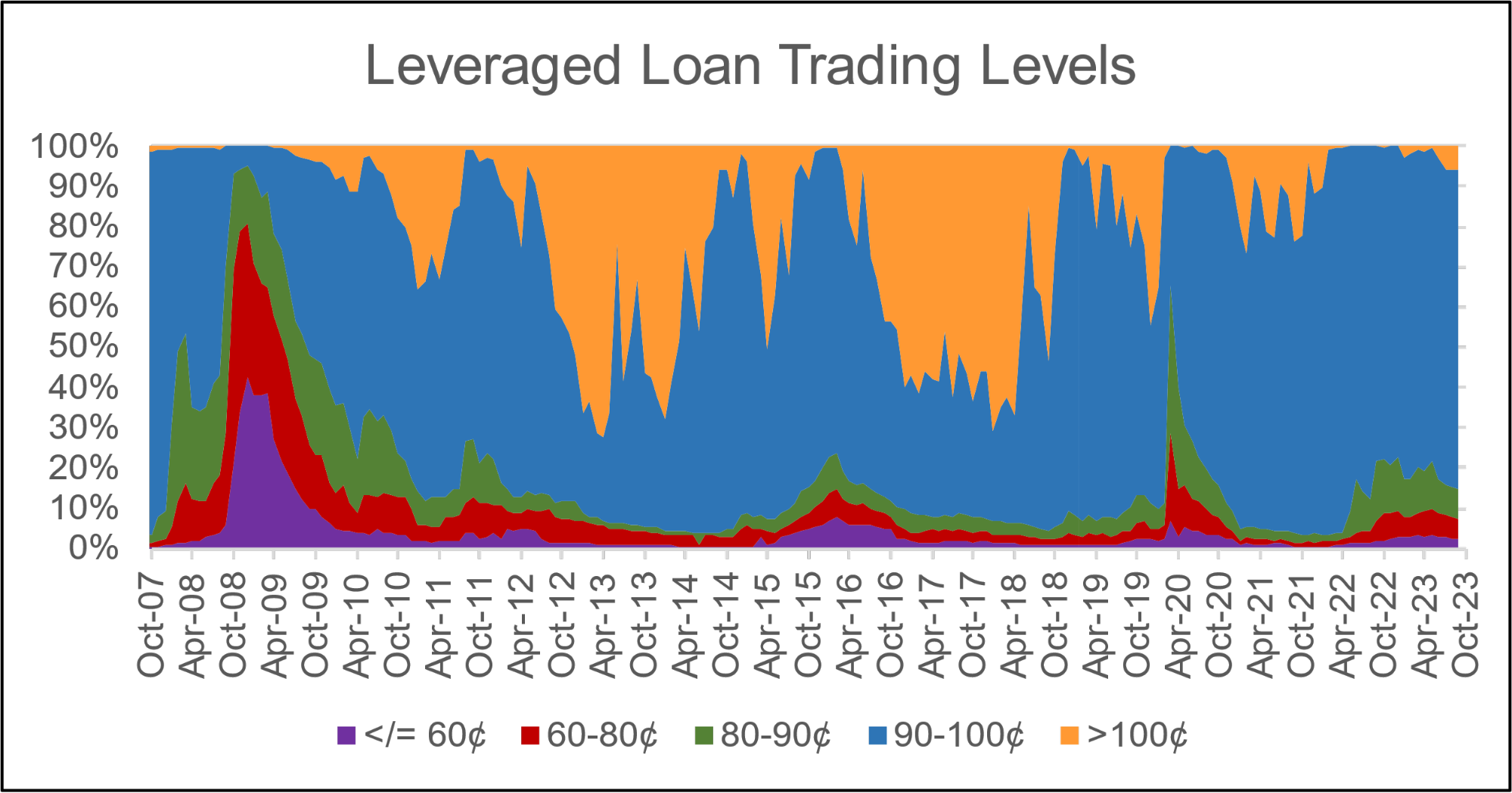

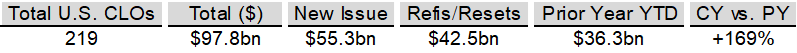

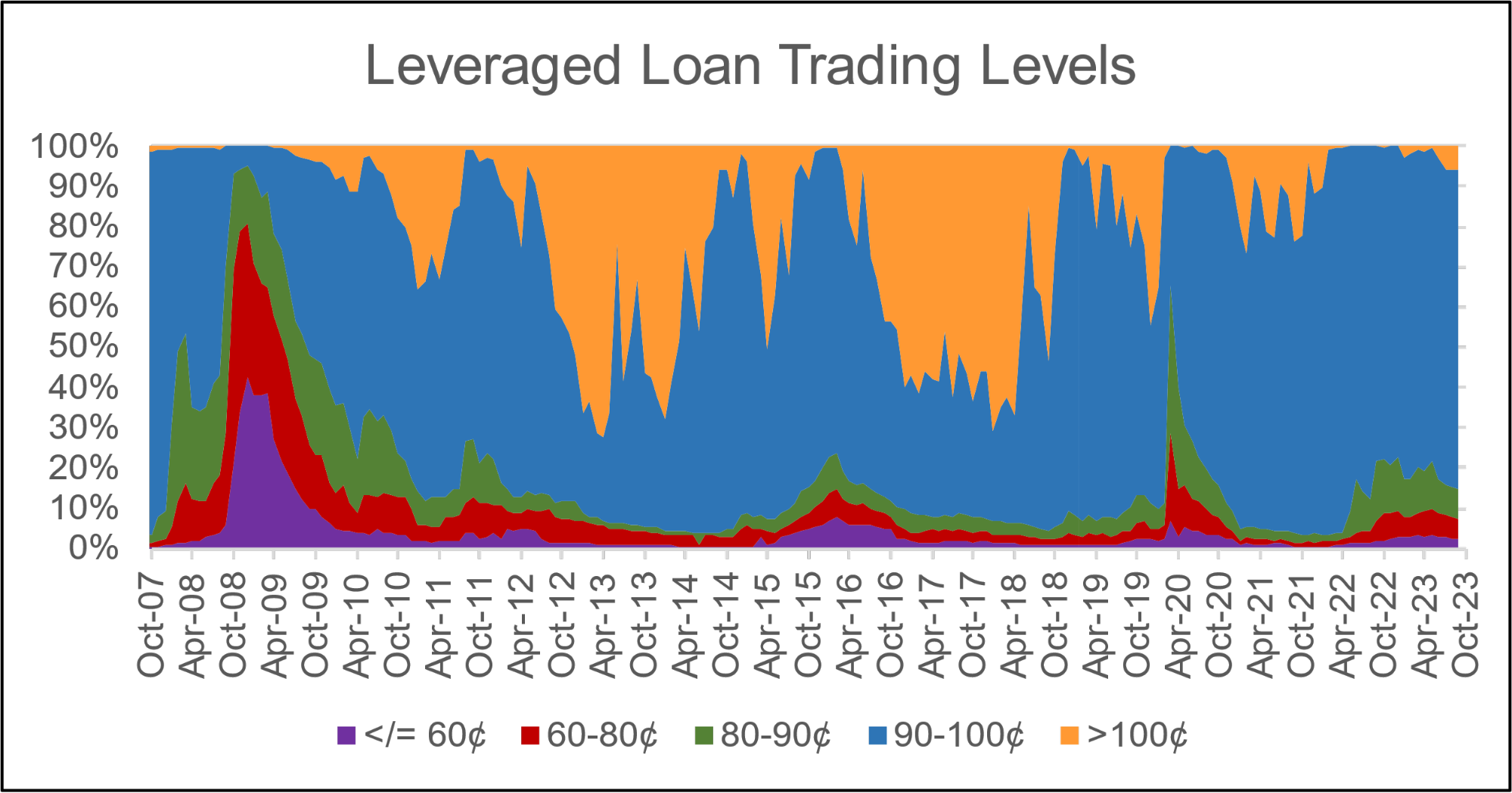

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

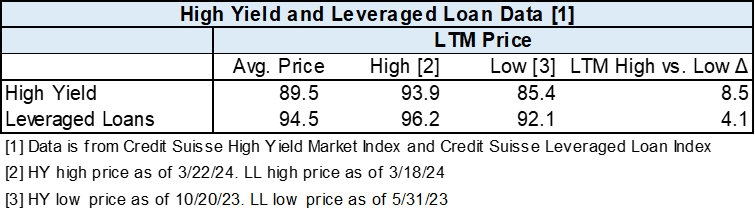

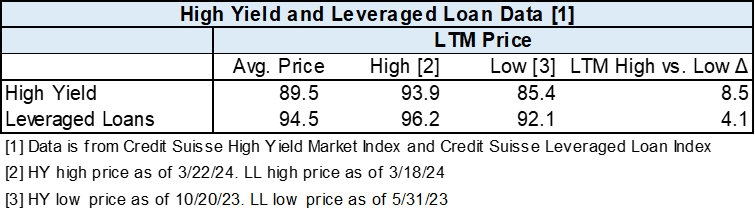

Diagram B: High Yield and Leveraged Loan LTM Price

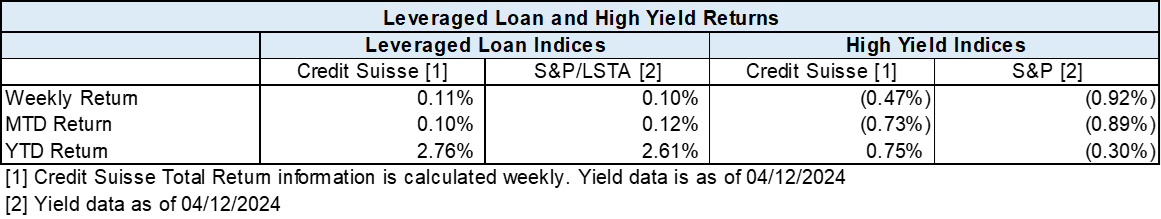

Diagram C: Leveraged Loan and High Yield Returns

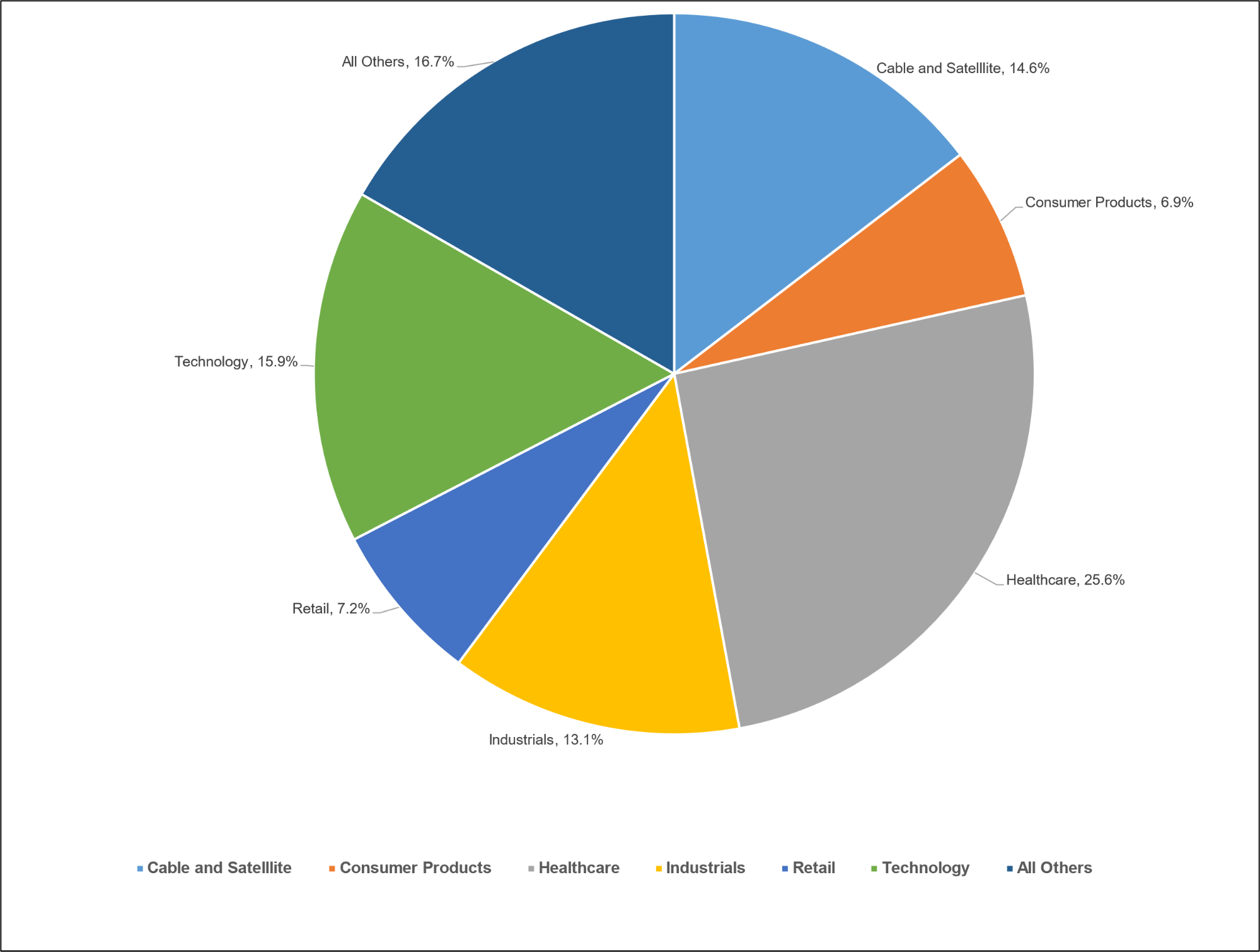

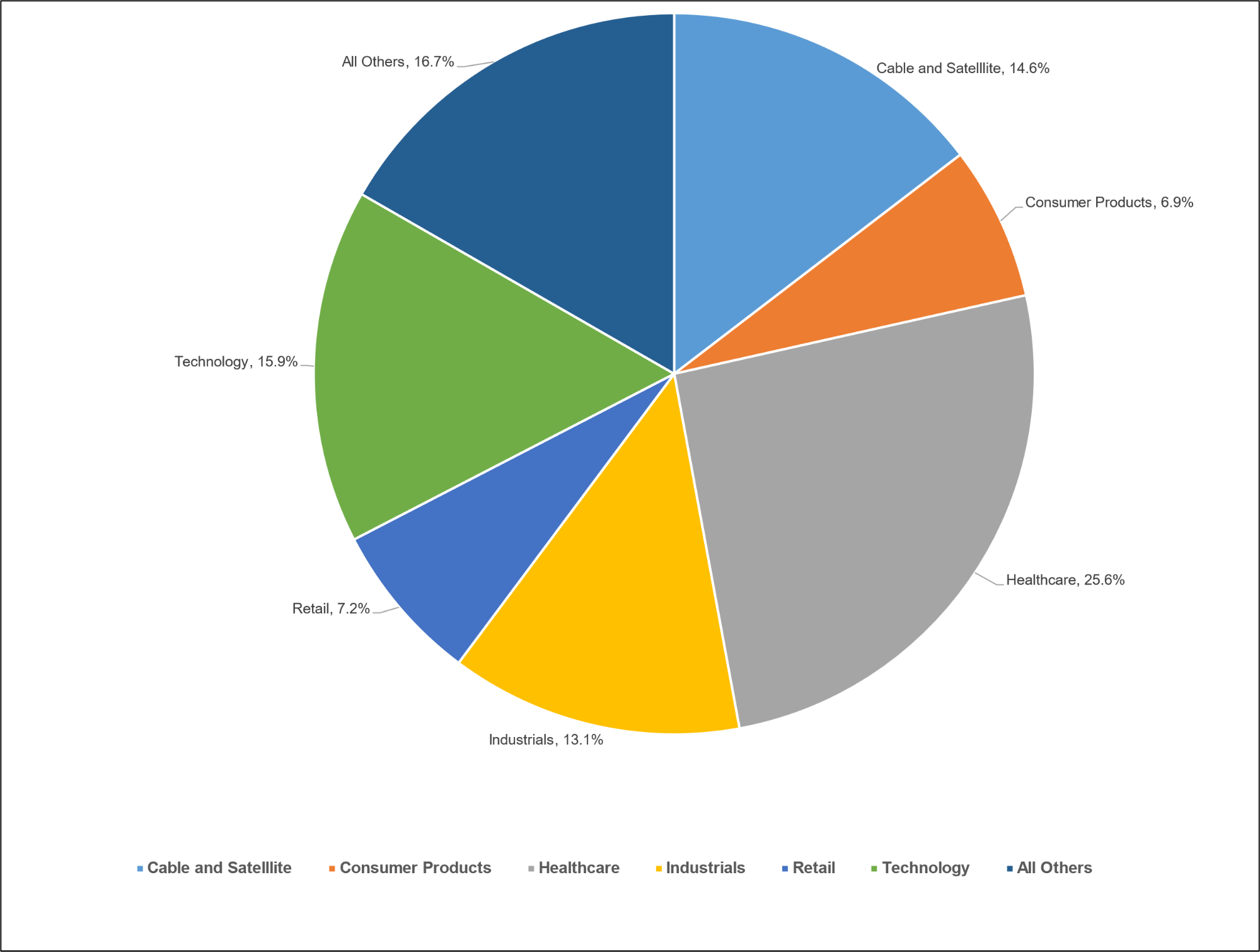

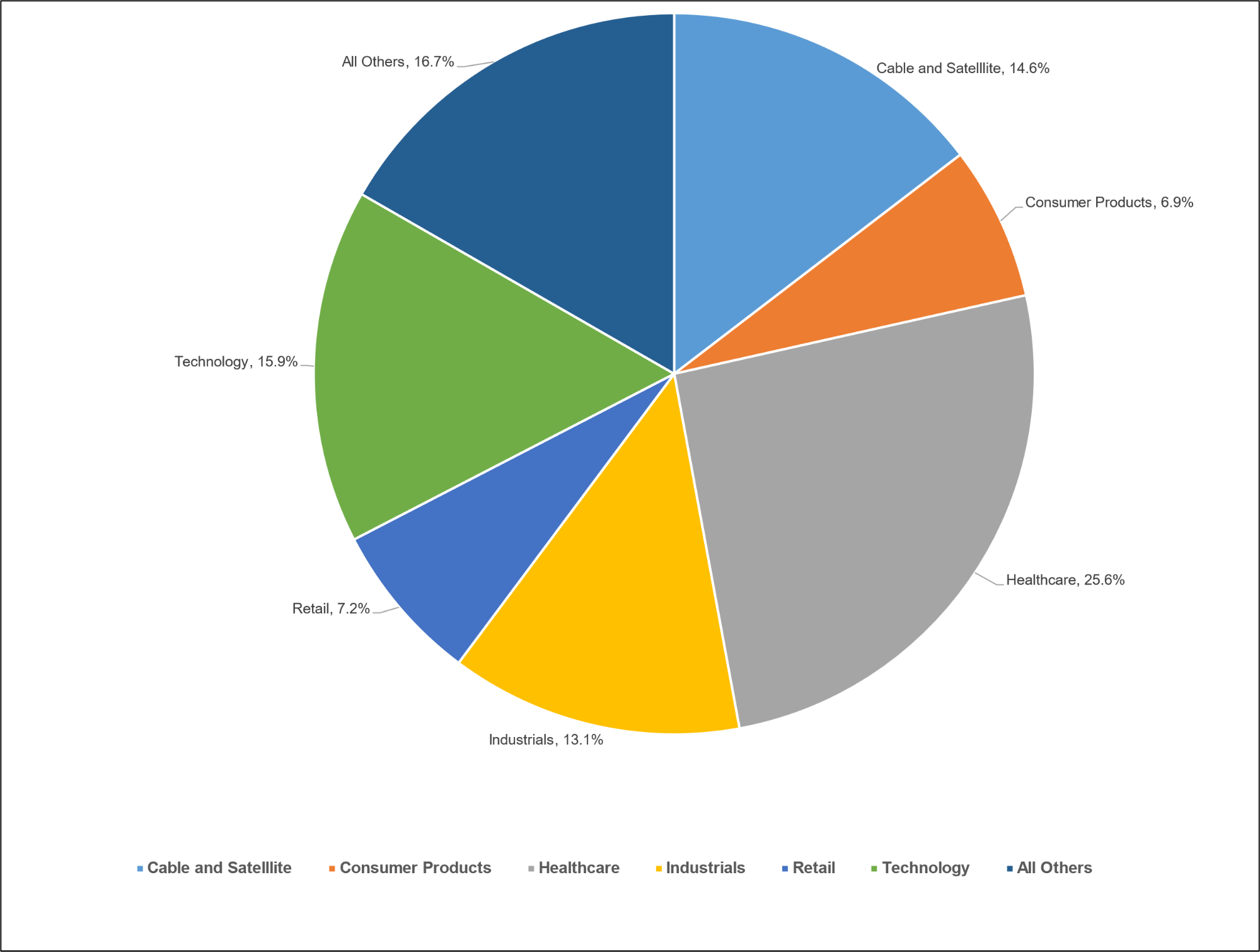

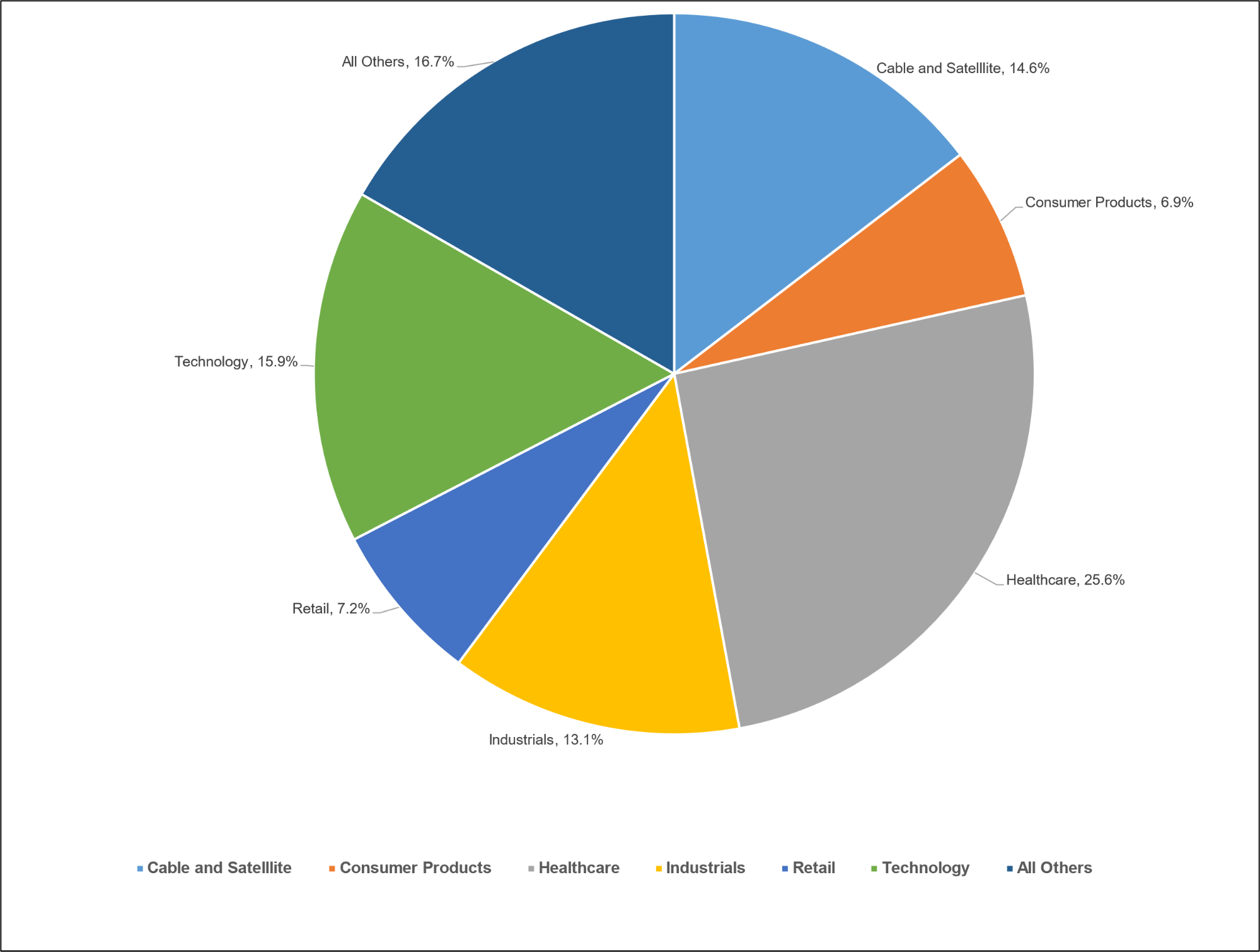

Diagram J: Leveraged Loan Defaults by Sector – Full Year

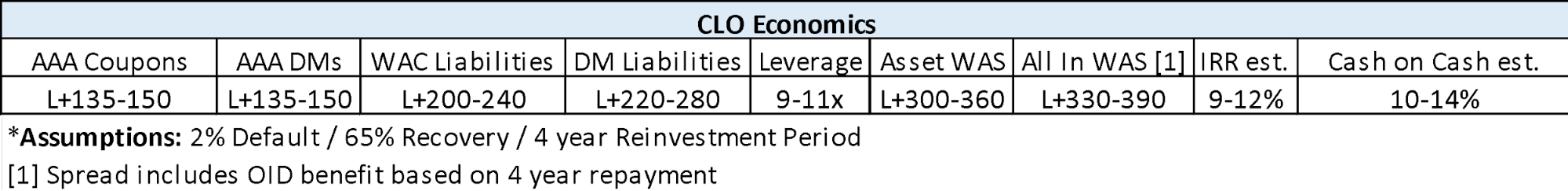

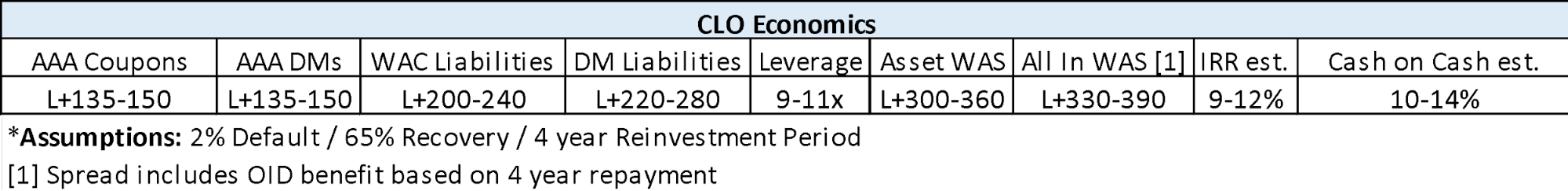

Diagram L: CLO Economics

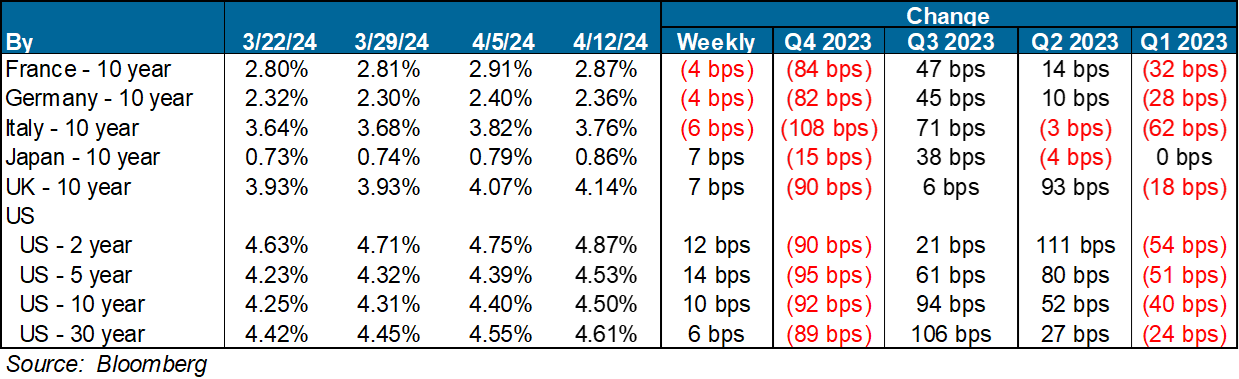

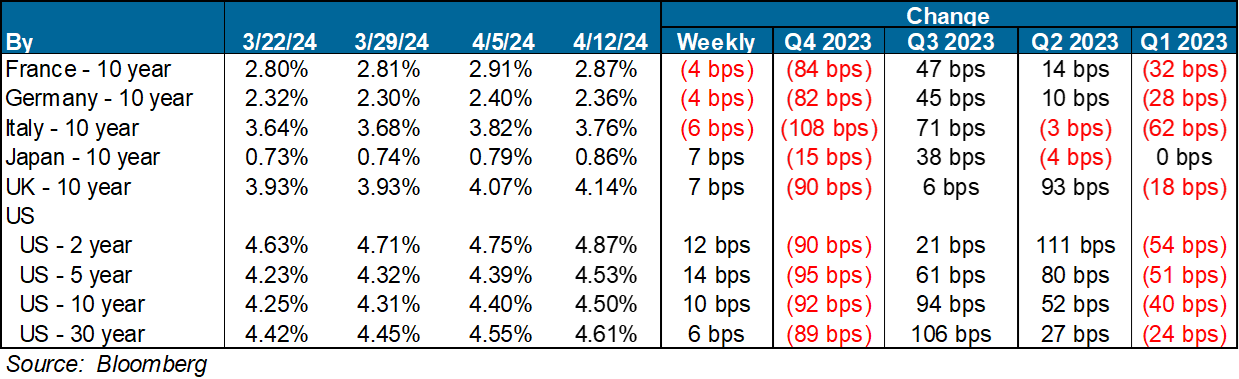

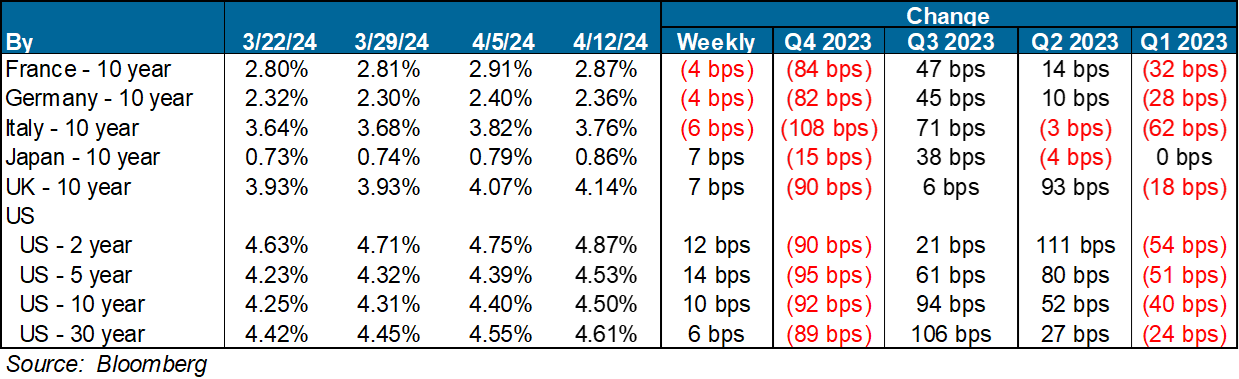

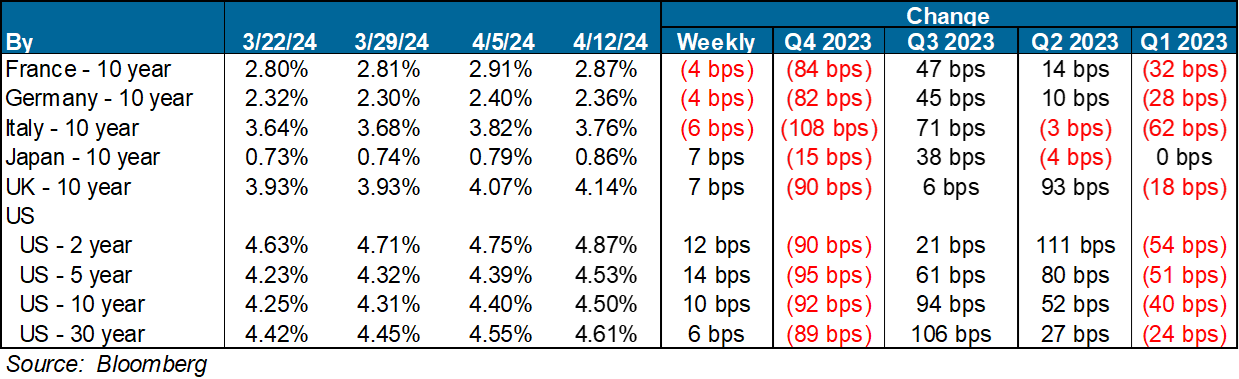

Diagram N: Developed Country GovBond Yields (%)

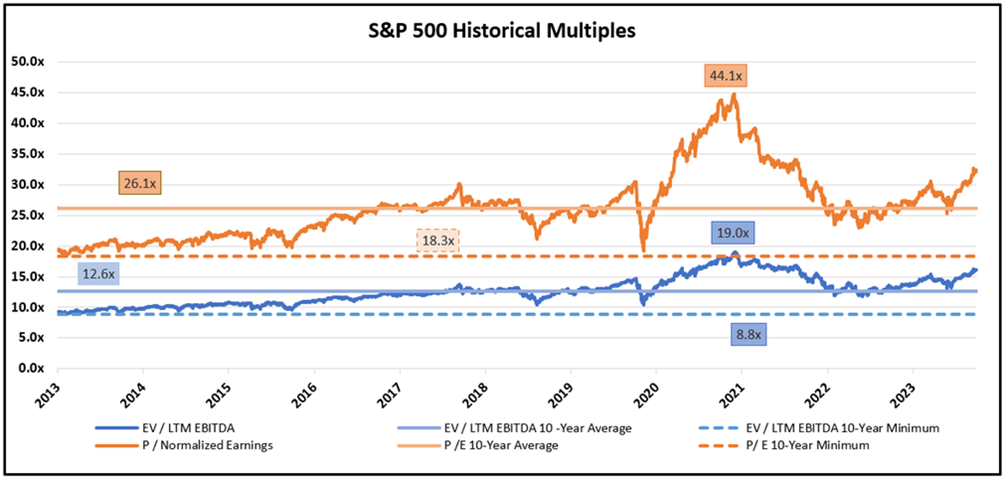

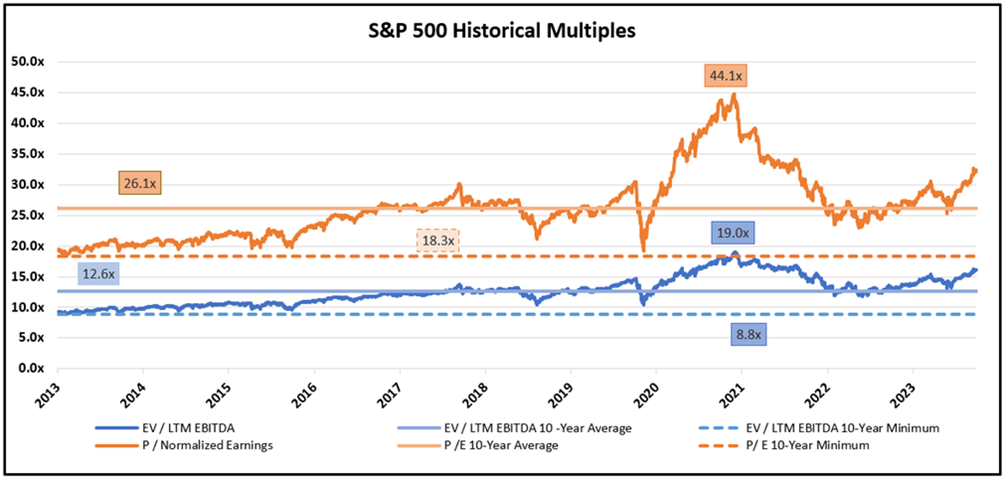

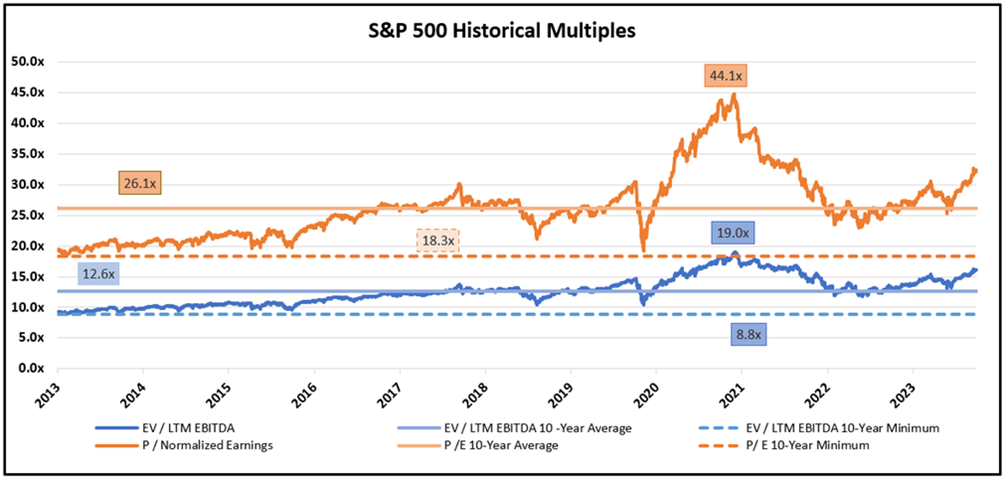

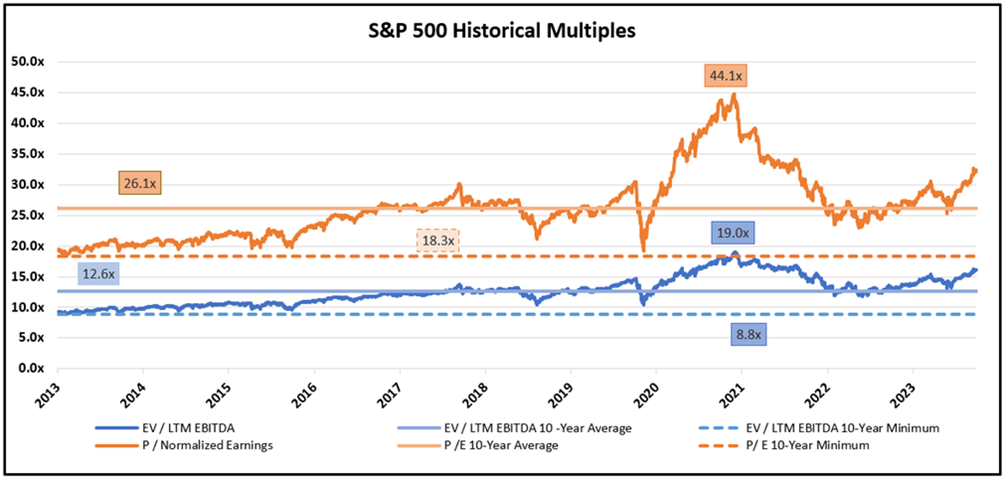

Diagram O: S&P 500 Historical Multiples

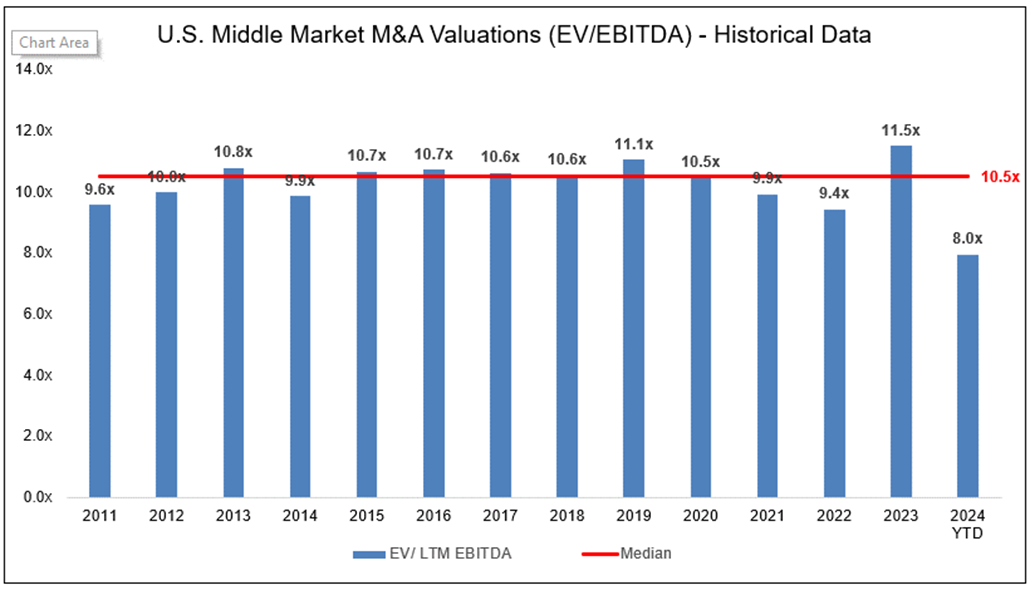

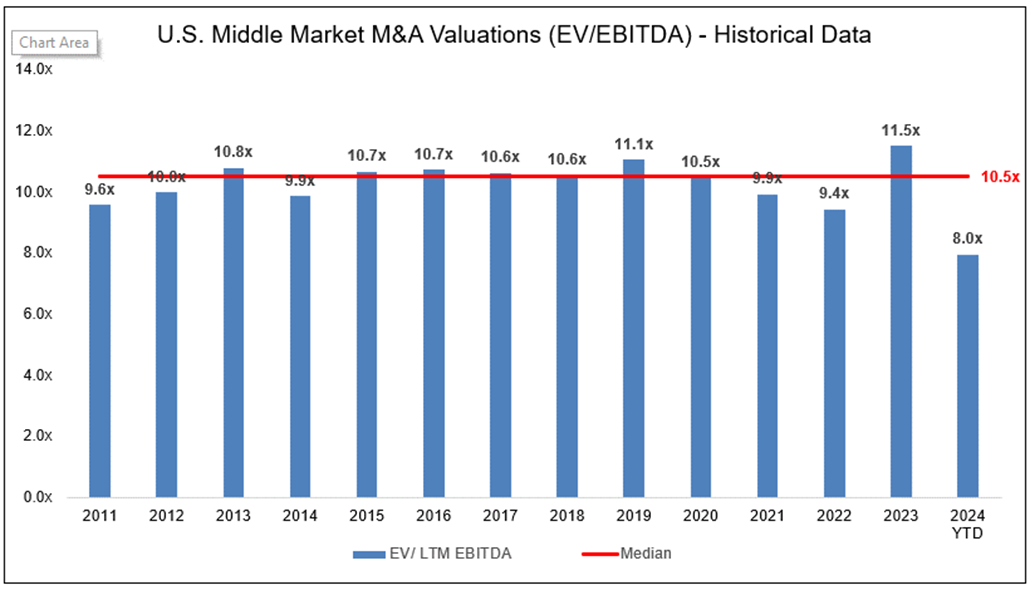

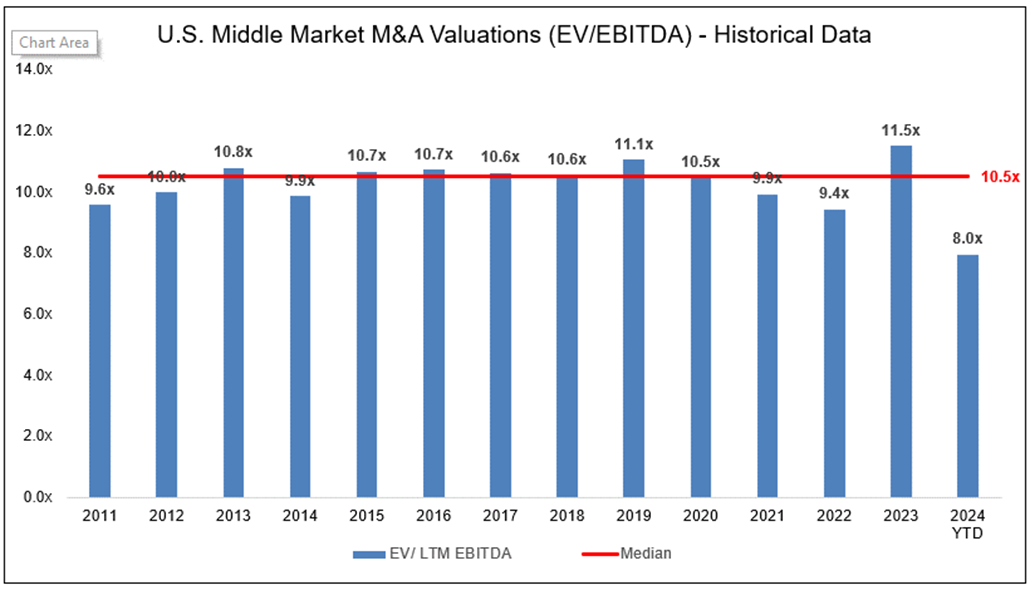

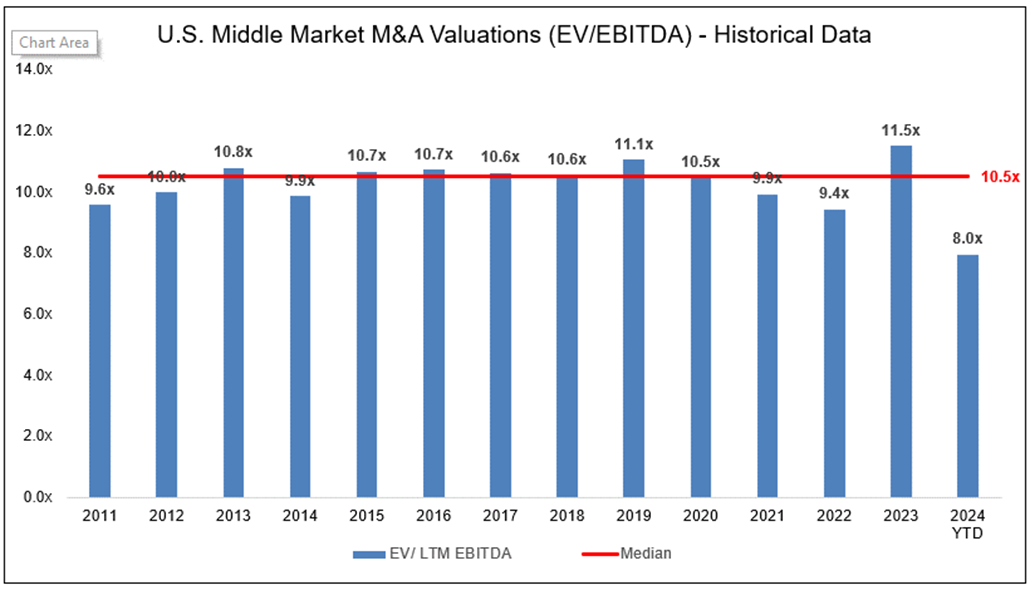

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

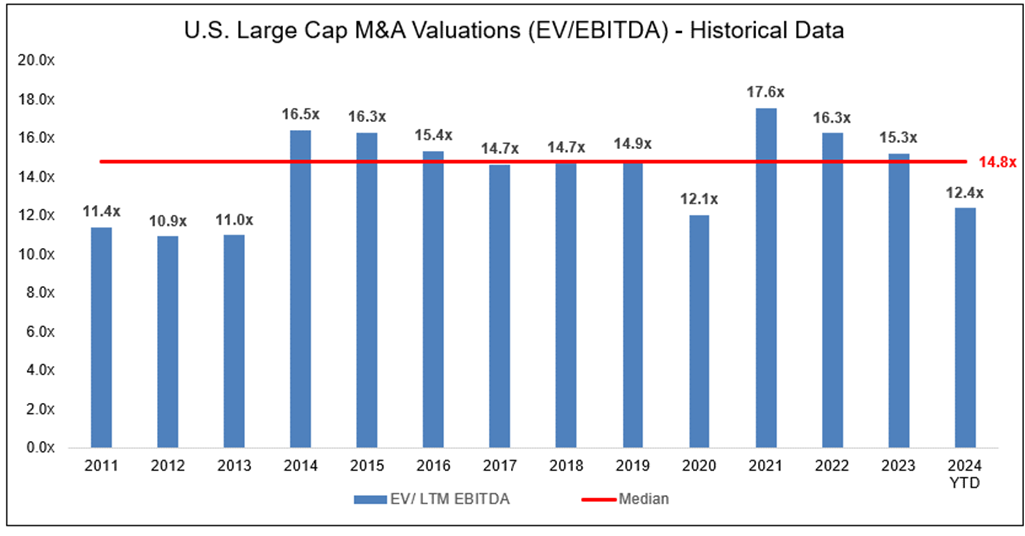

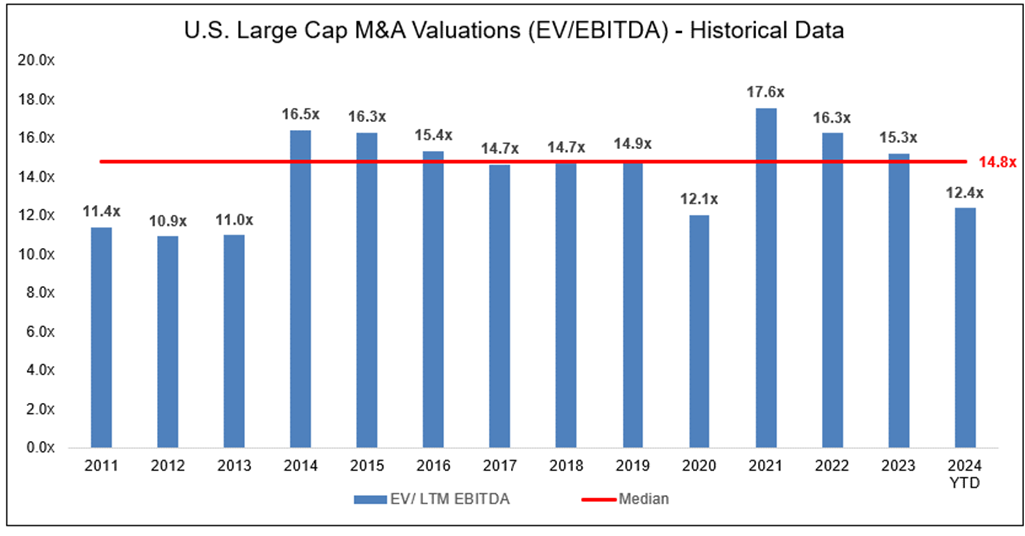

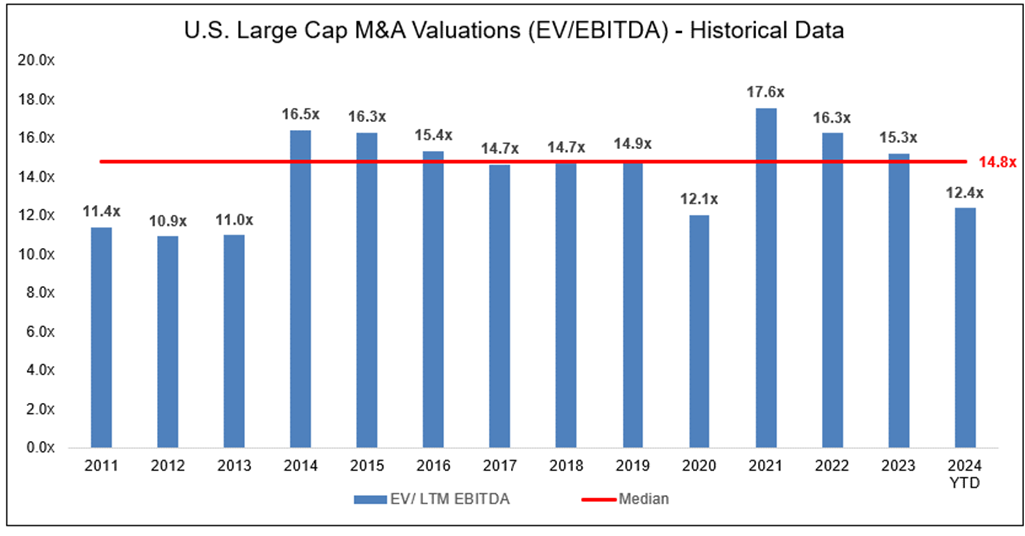

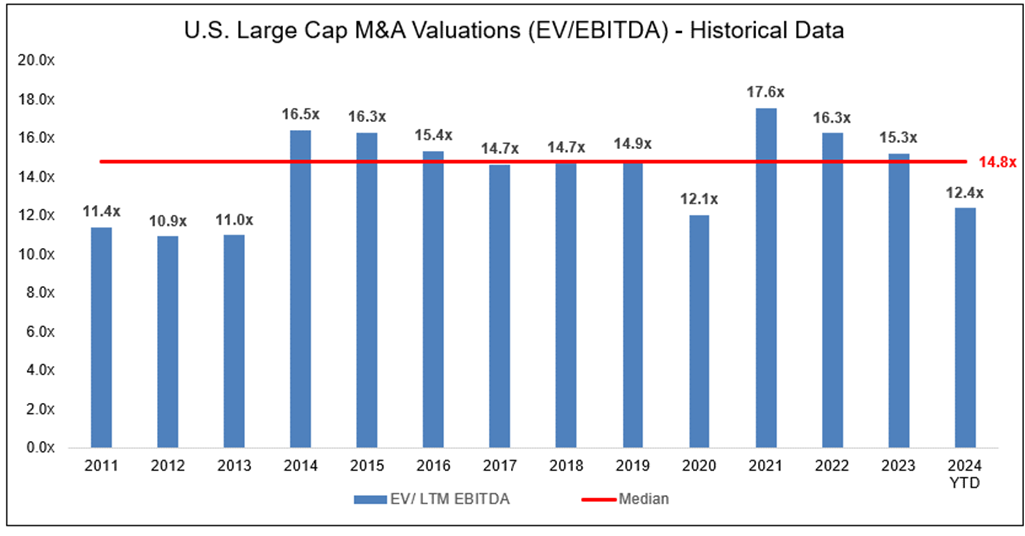

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

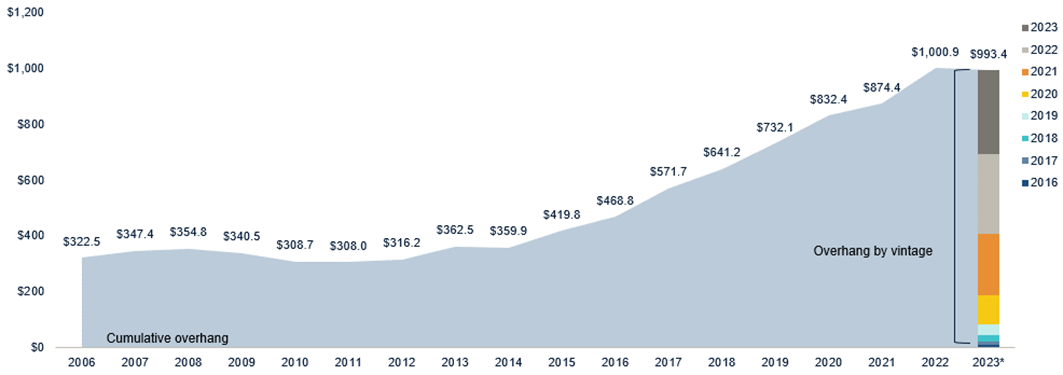

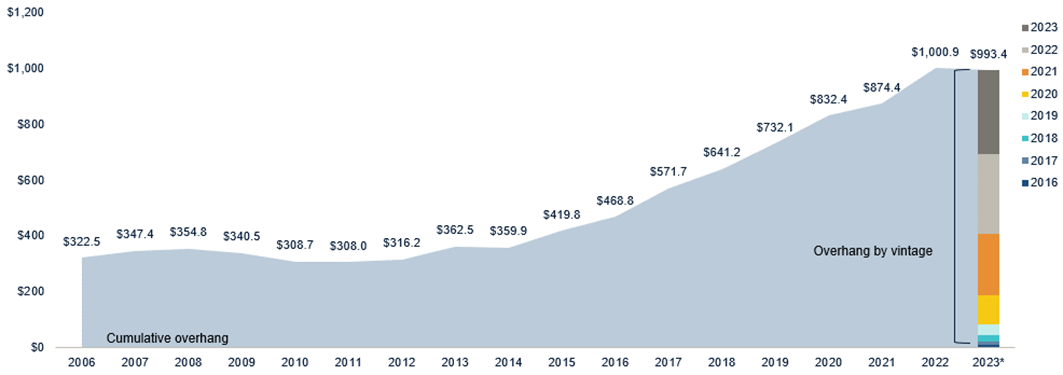

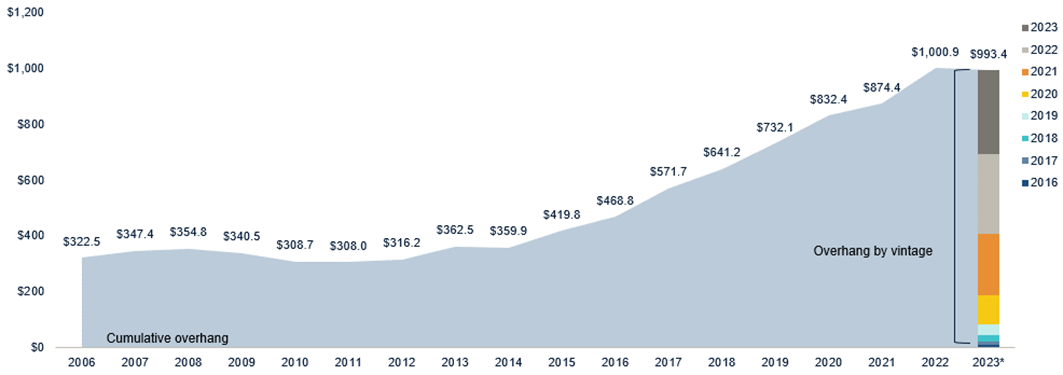

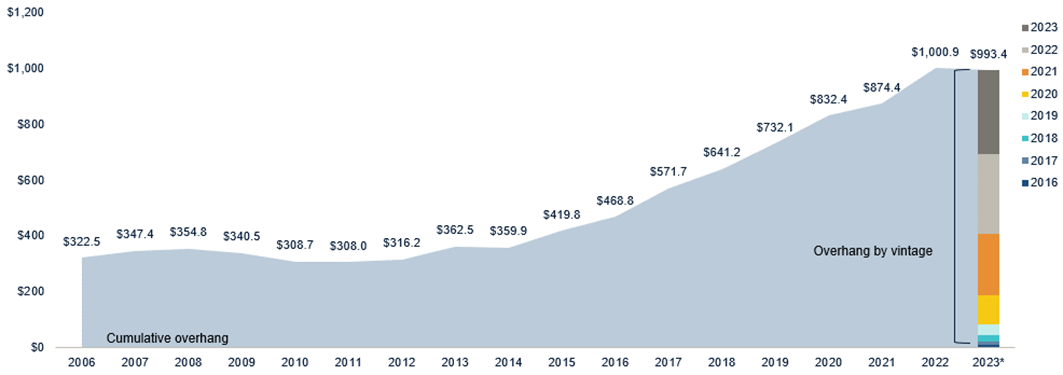

Diagram R: Dry Powder for All Private Equity Buyouts

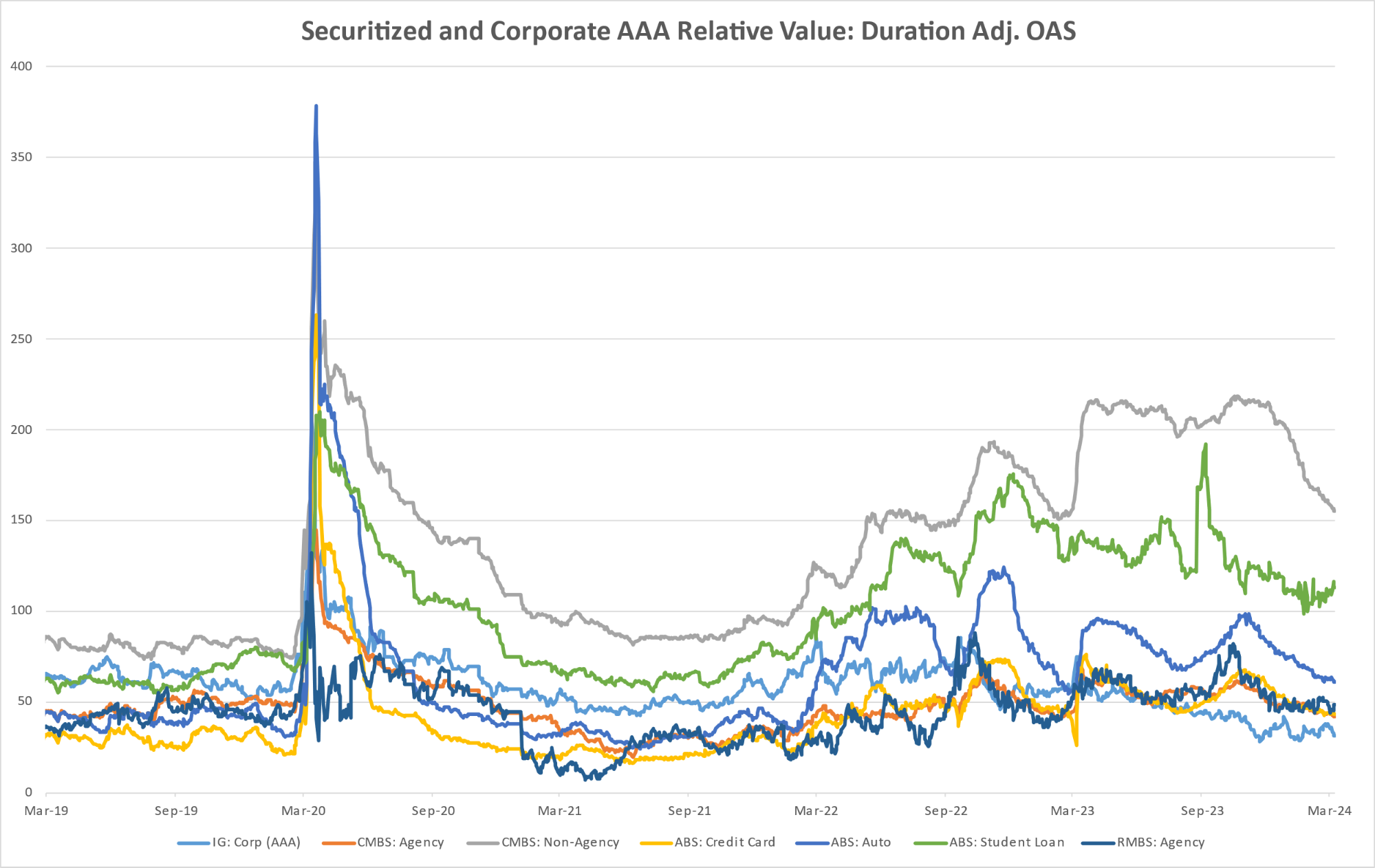

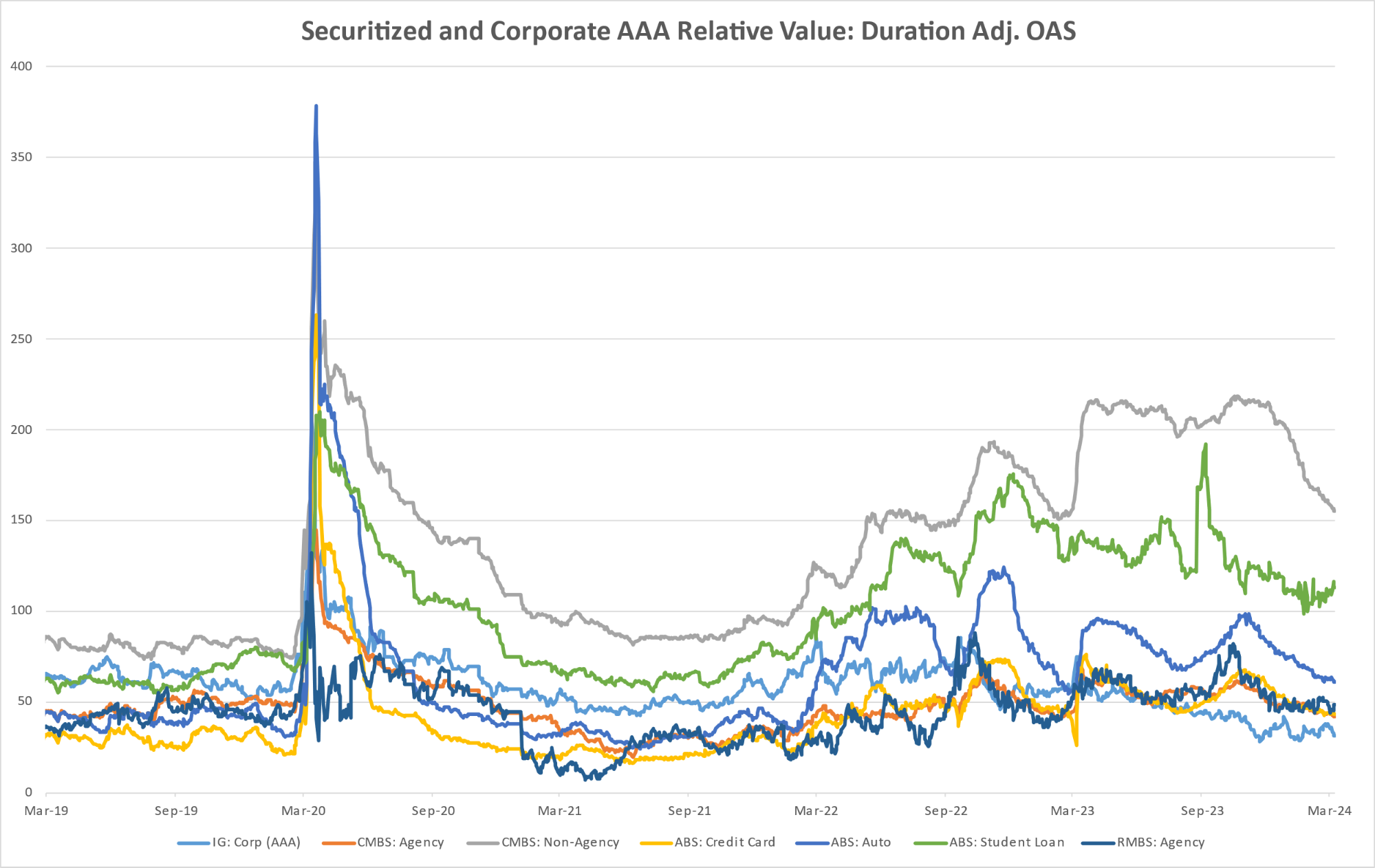

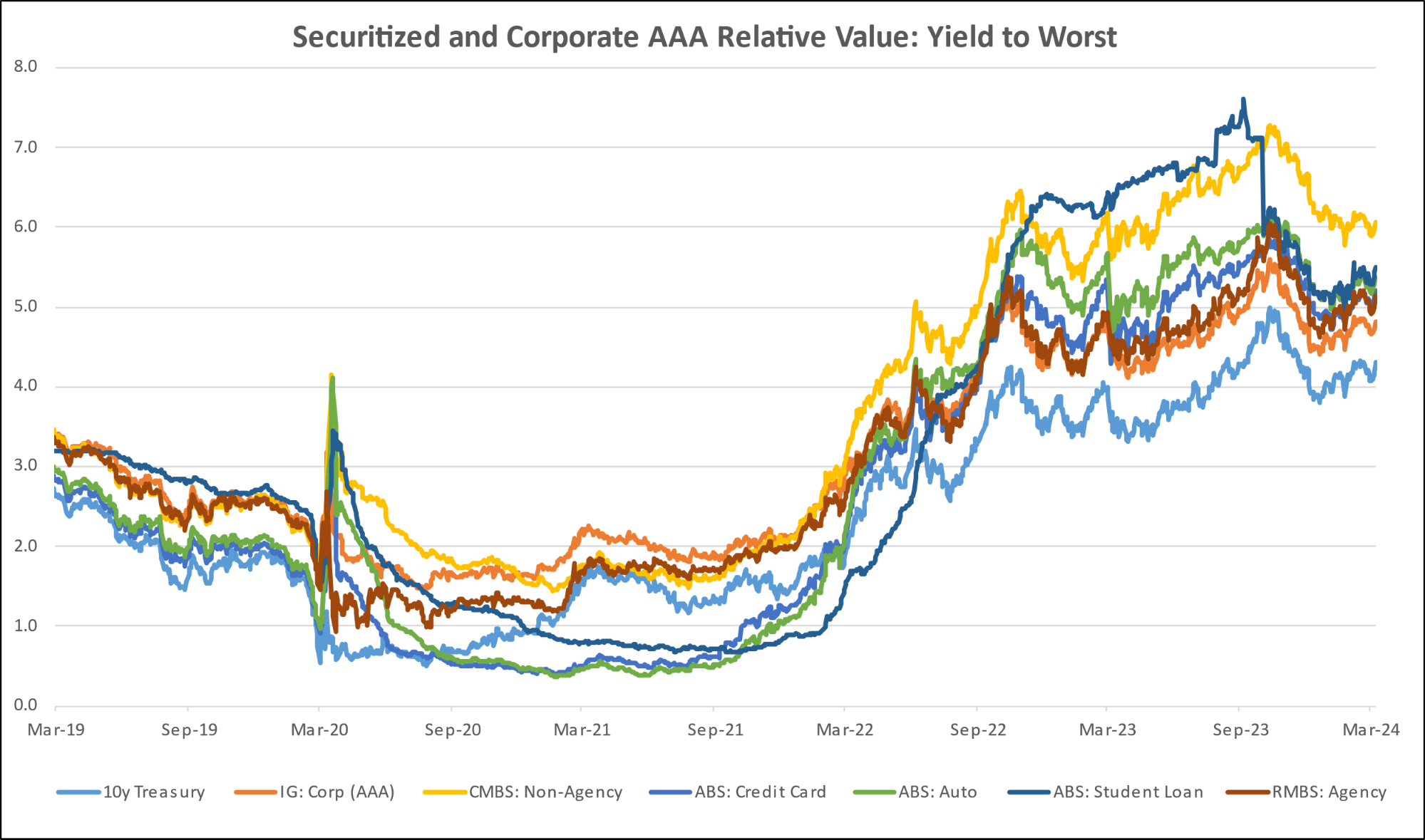

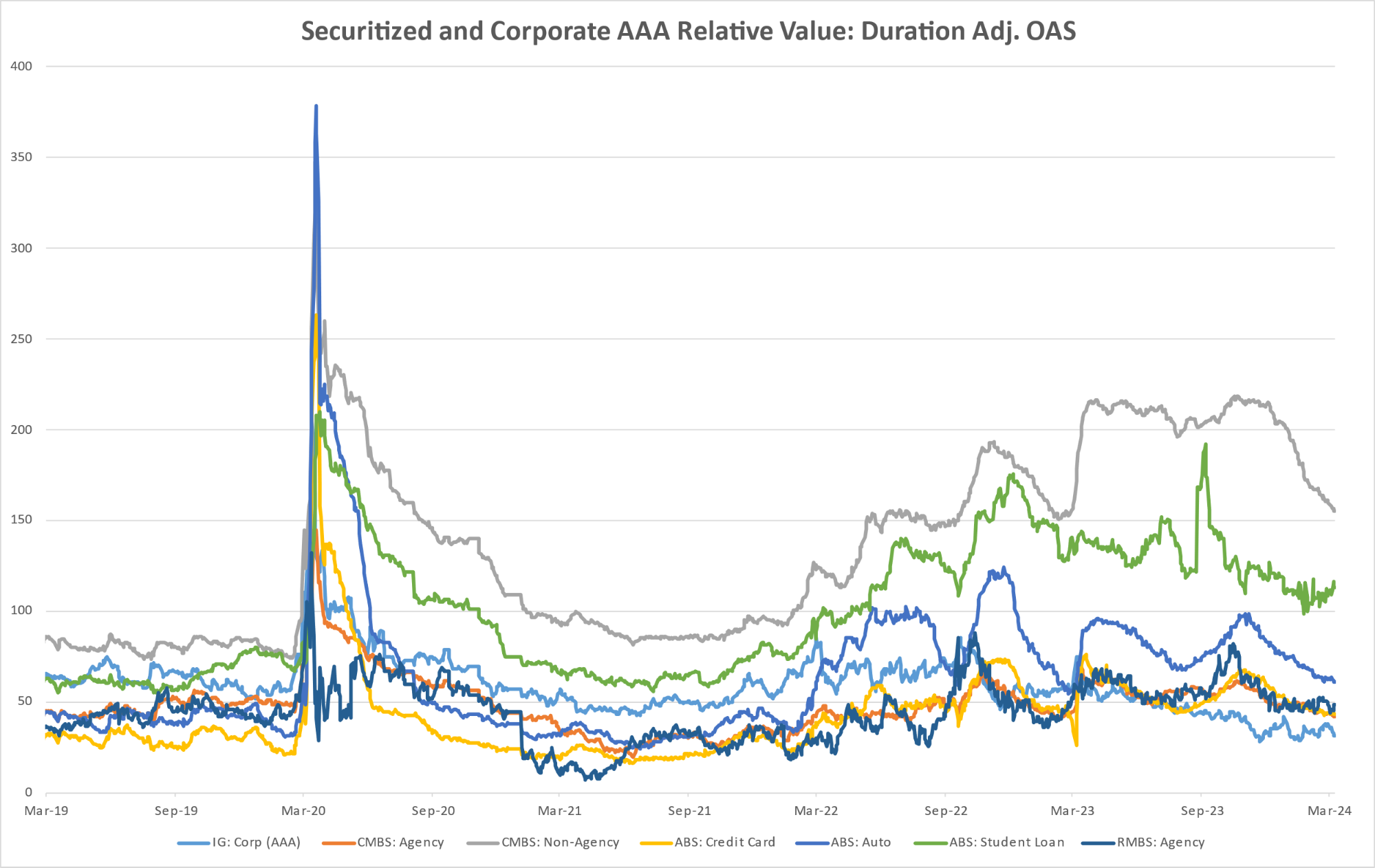

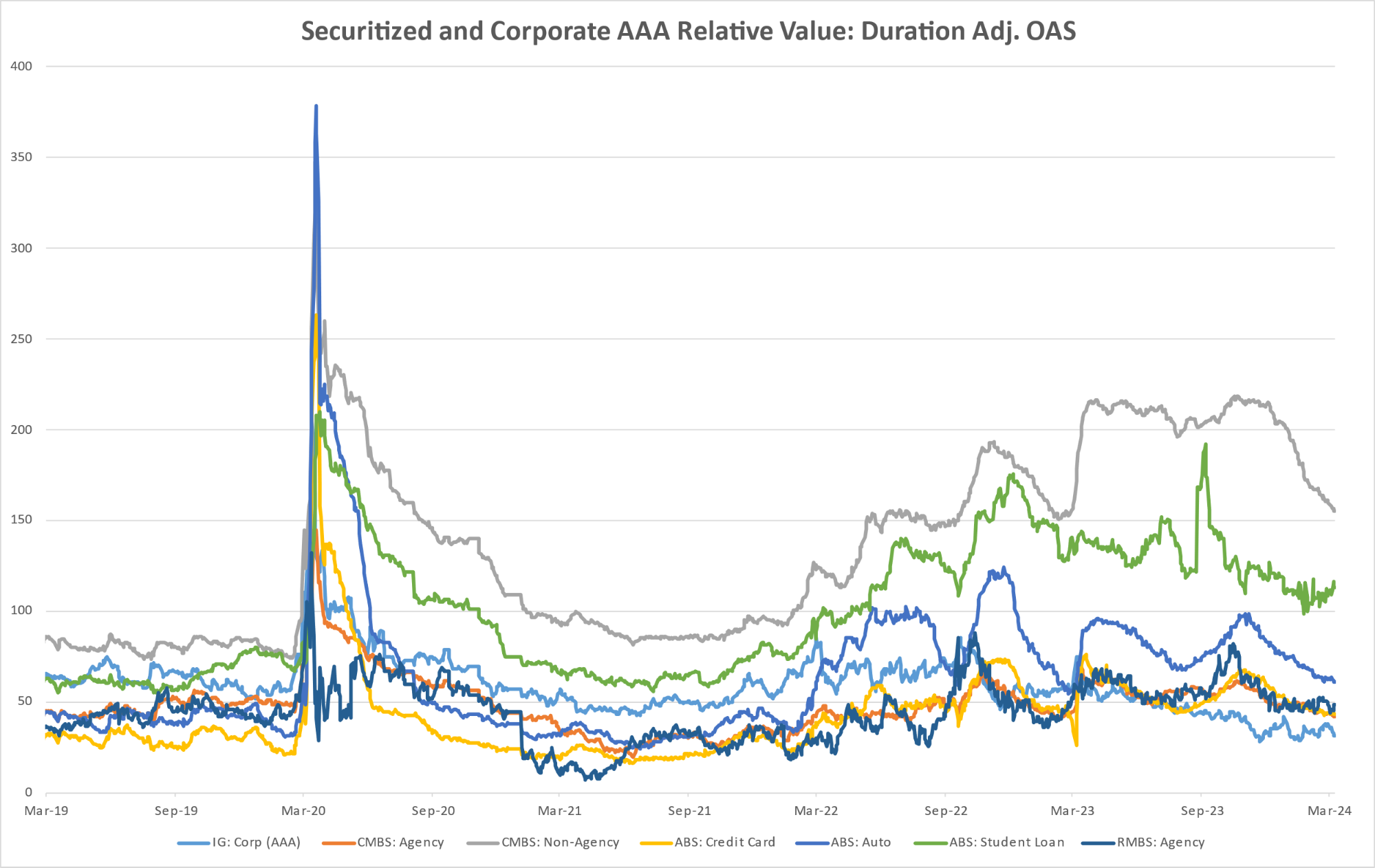

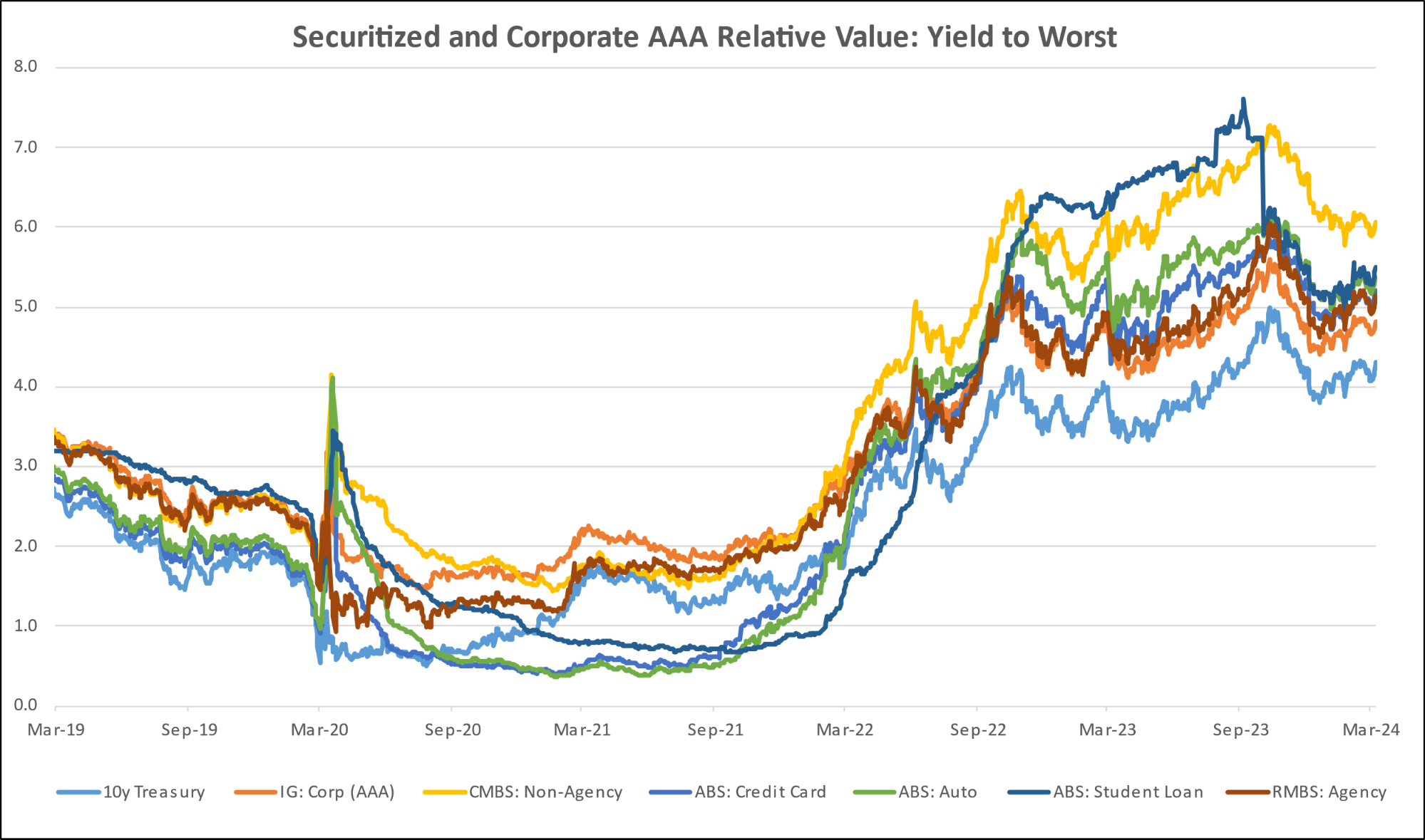

Diagram S: Structured Credit Spreads

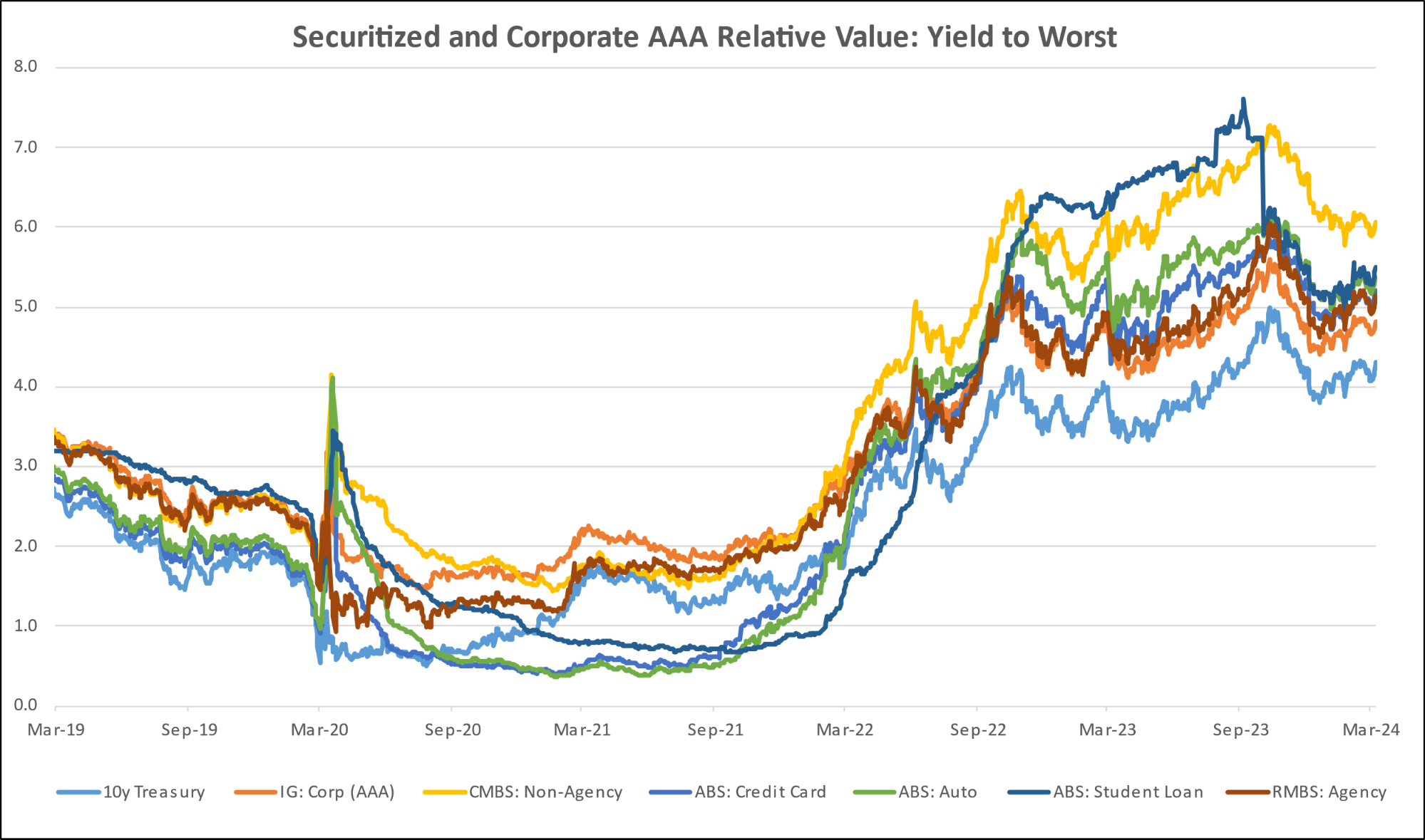

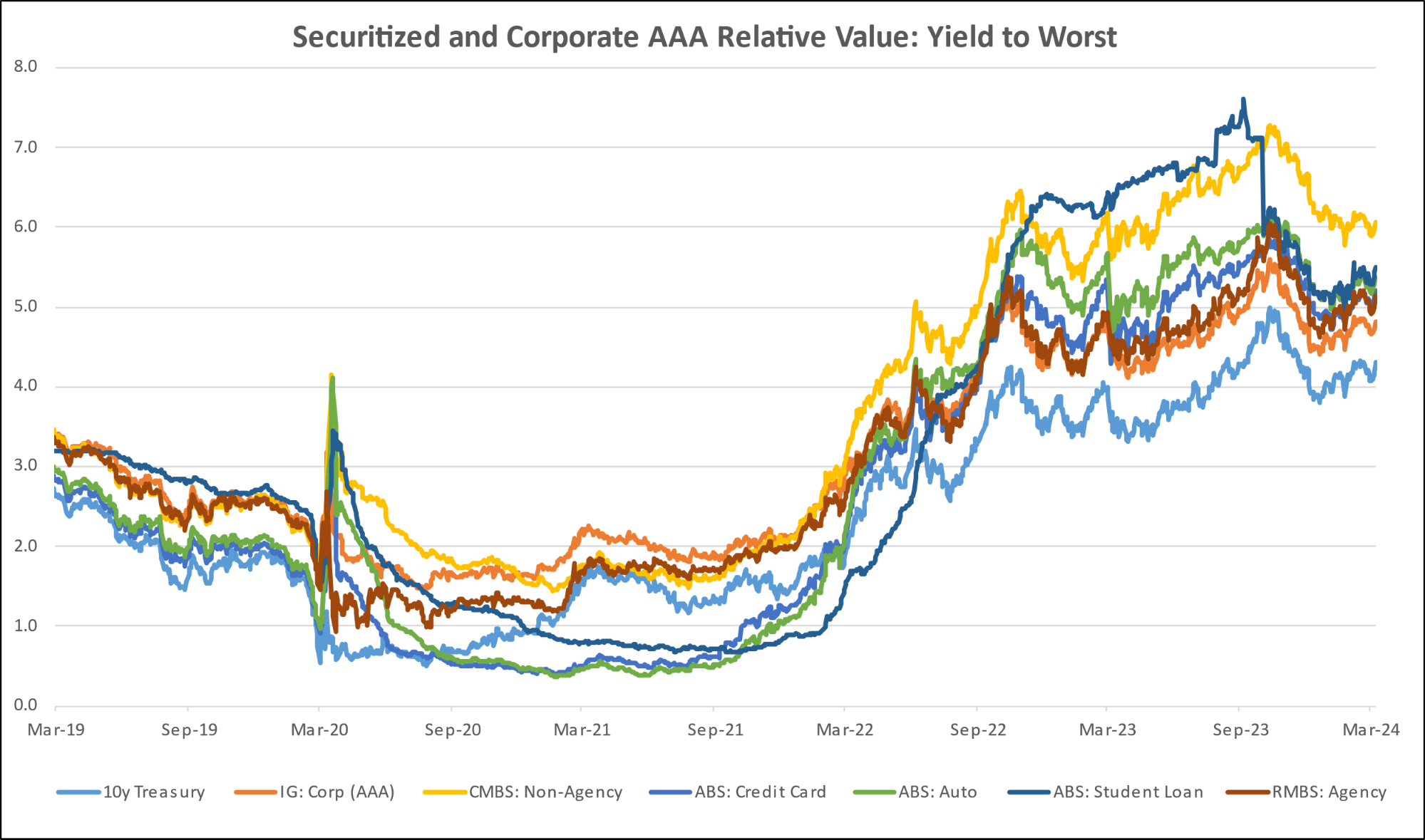

Diagram T: Structured Credit Yield

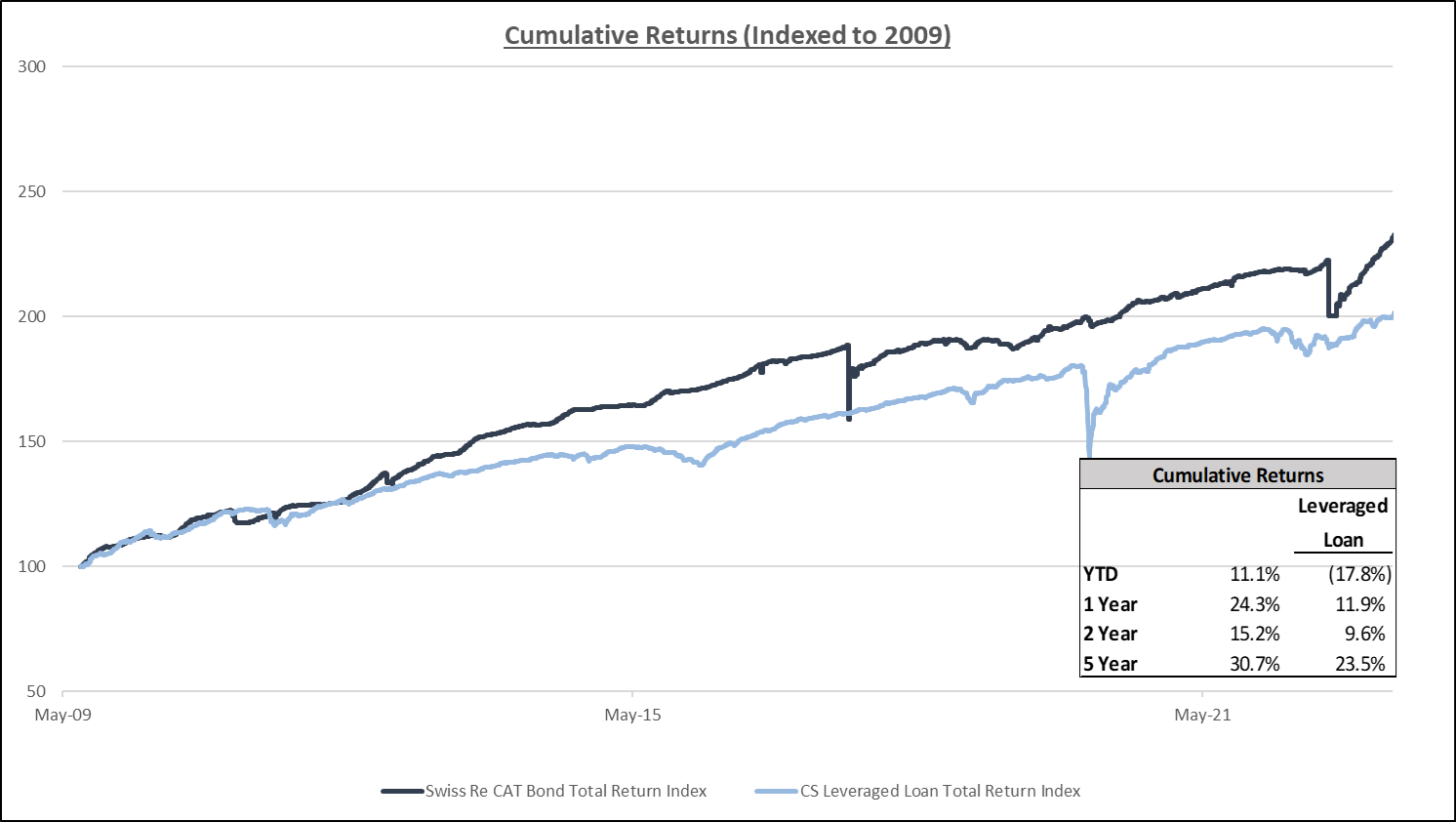

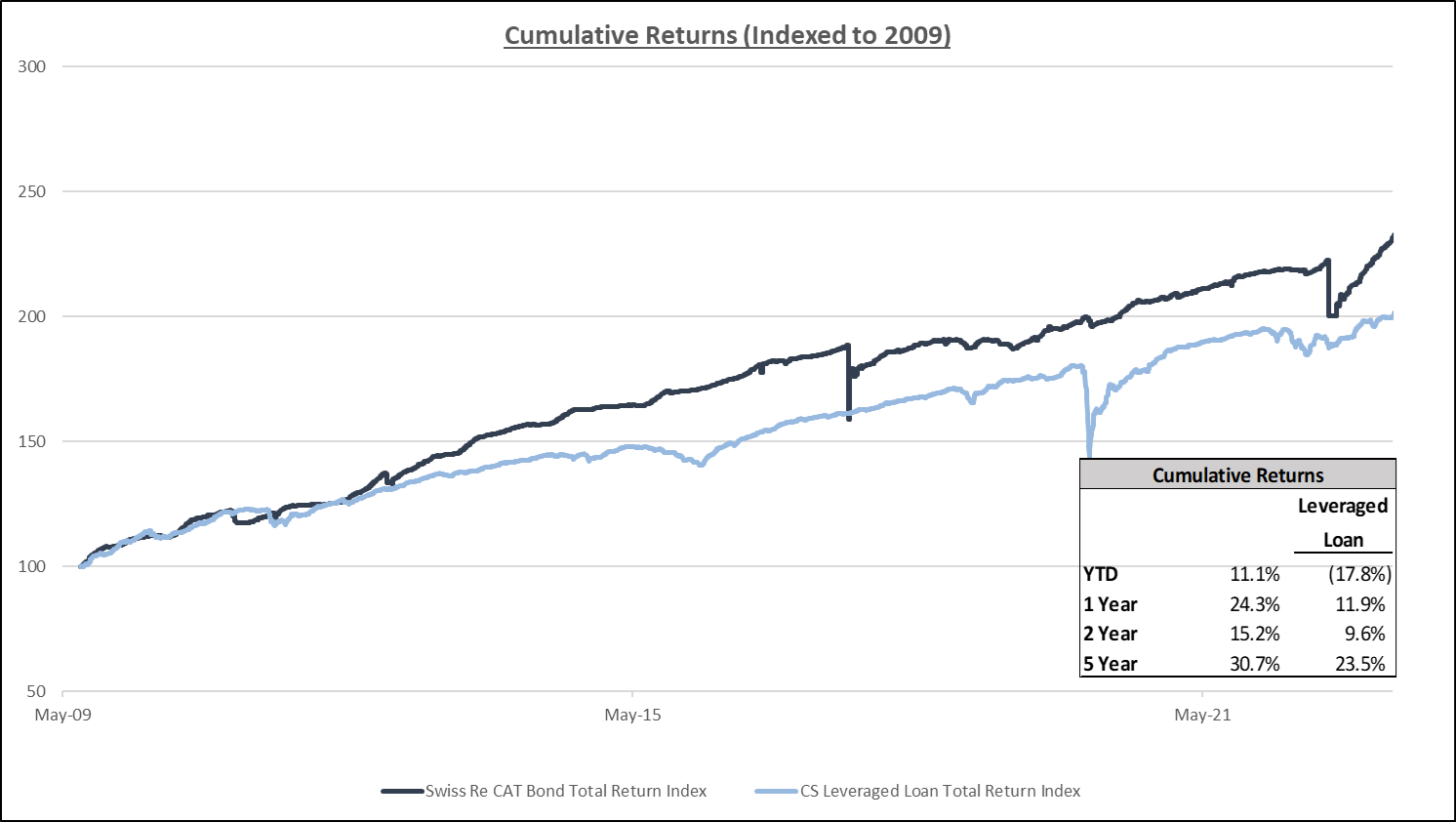

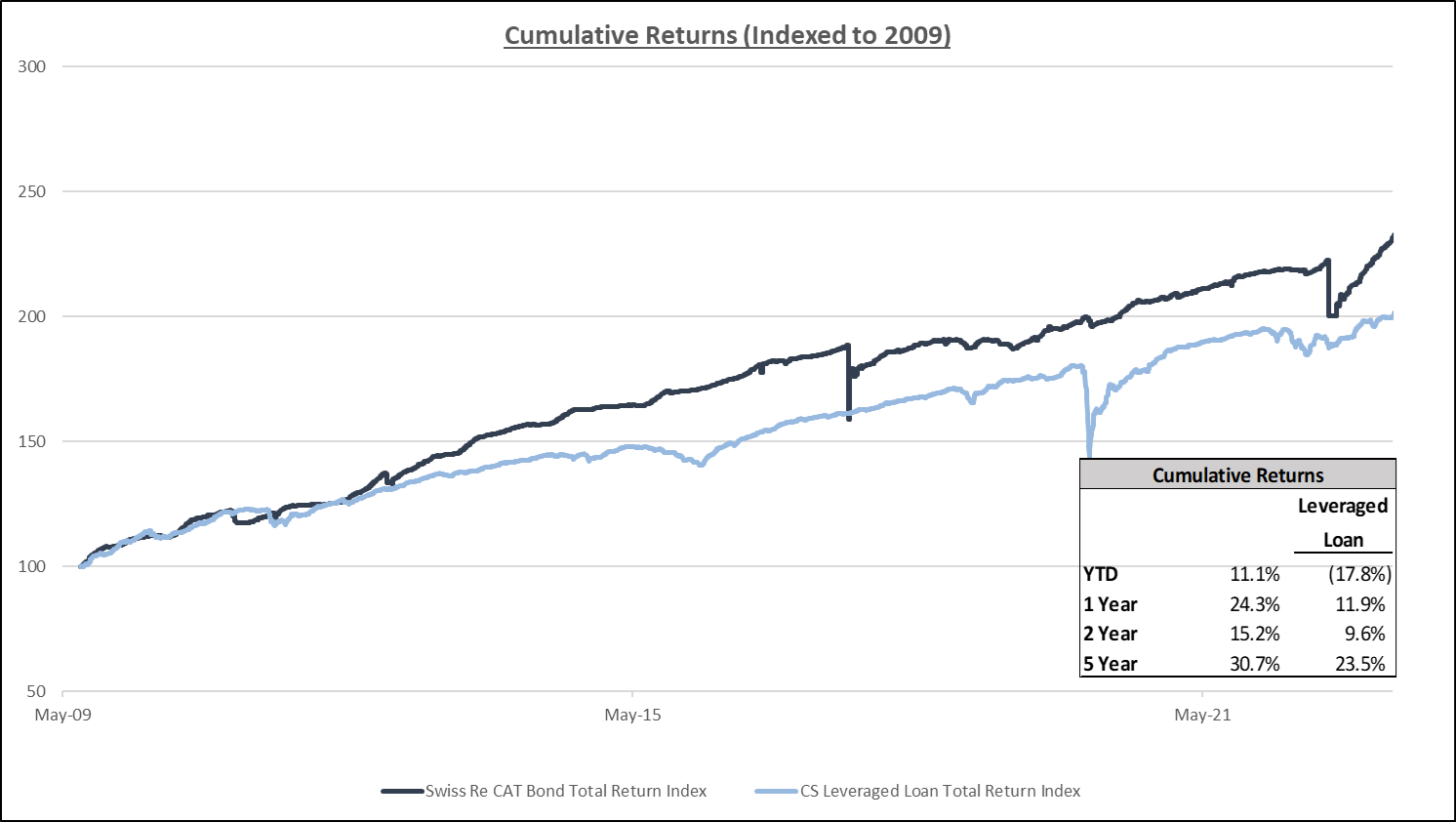

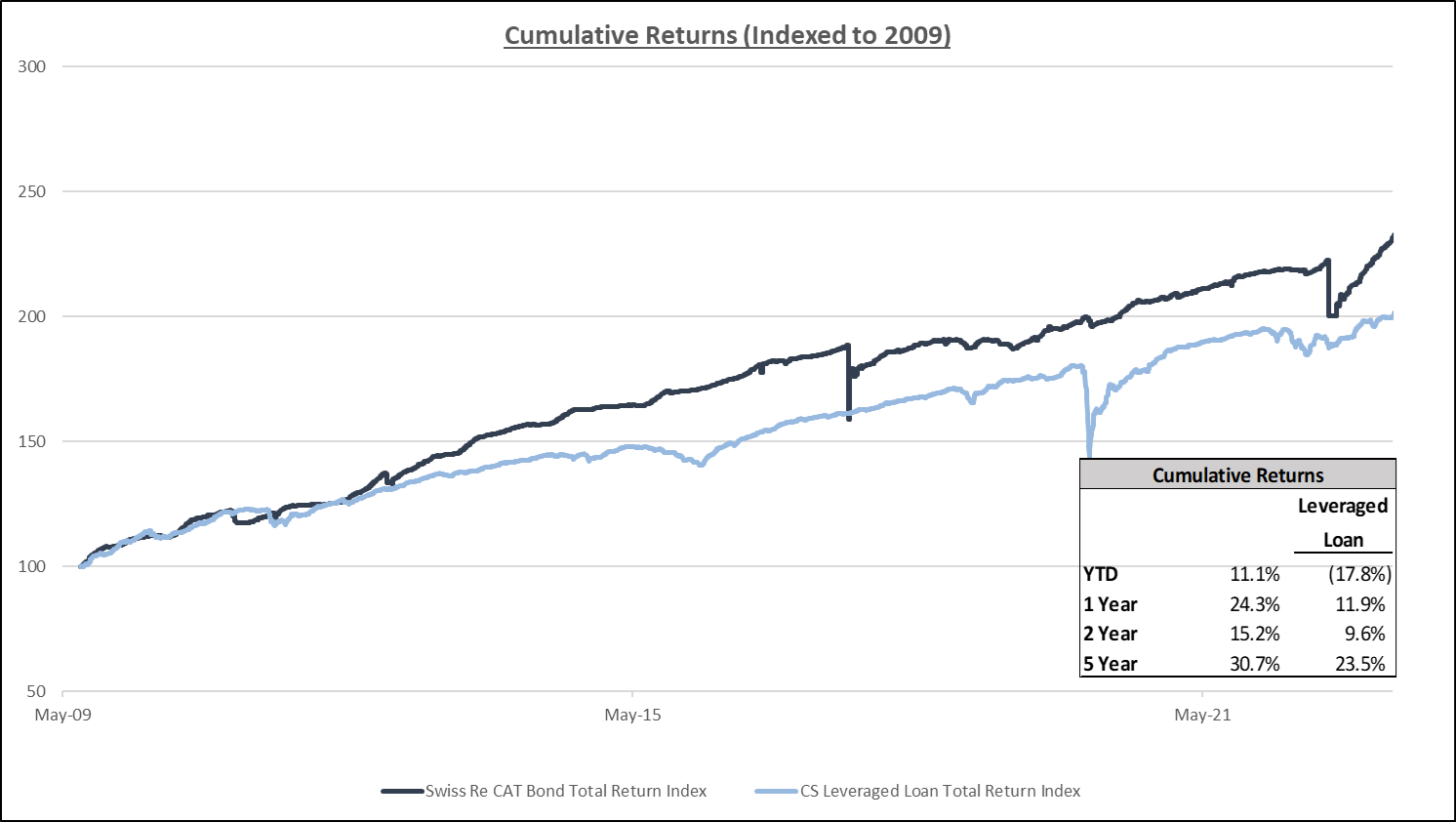

Diagram U: CAT Bonds – Cumulative Returns

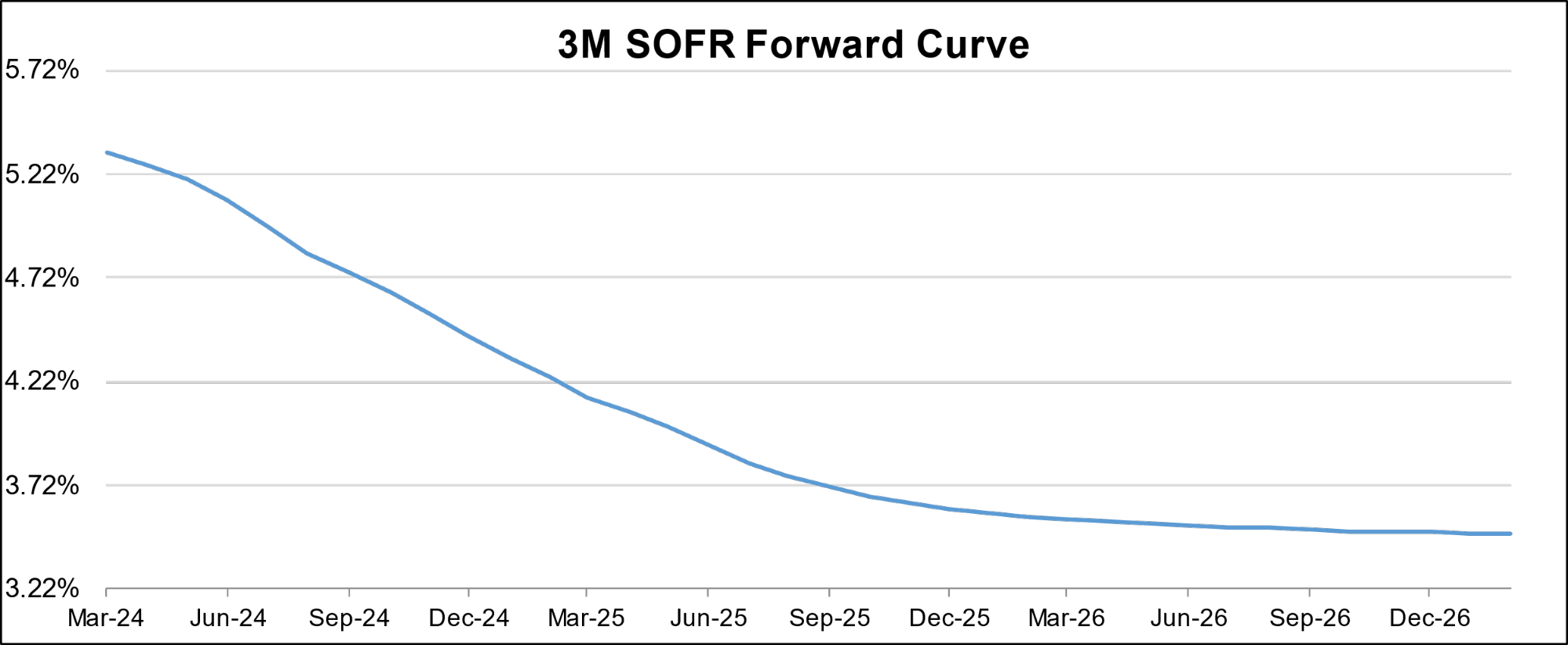

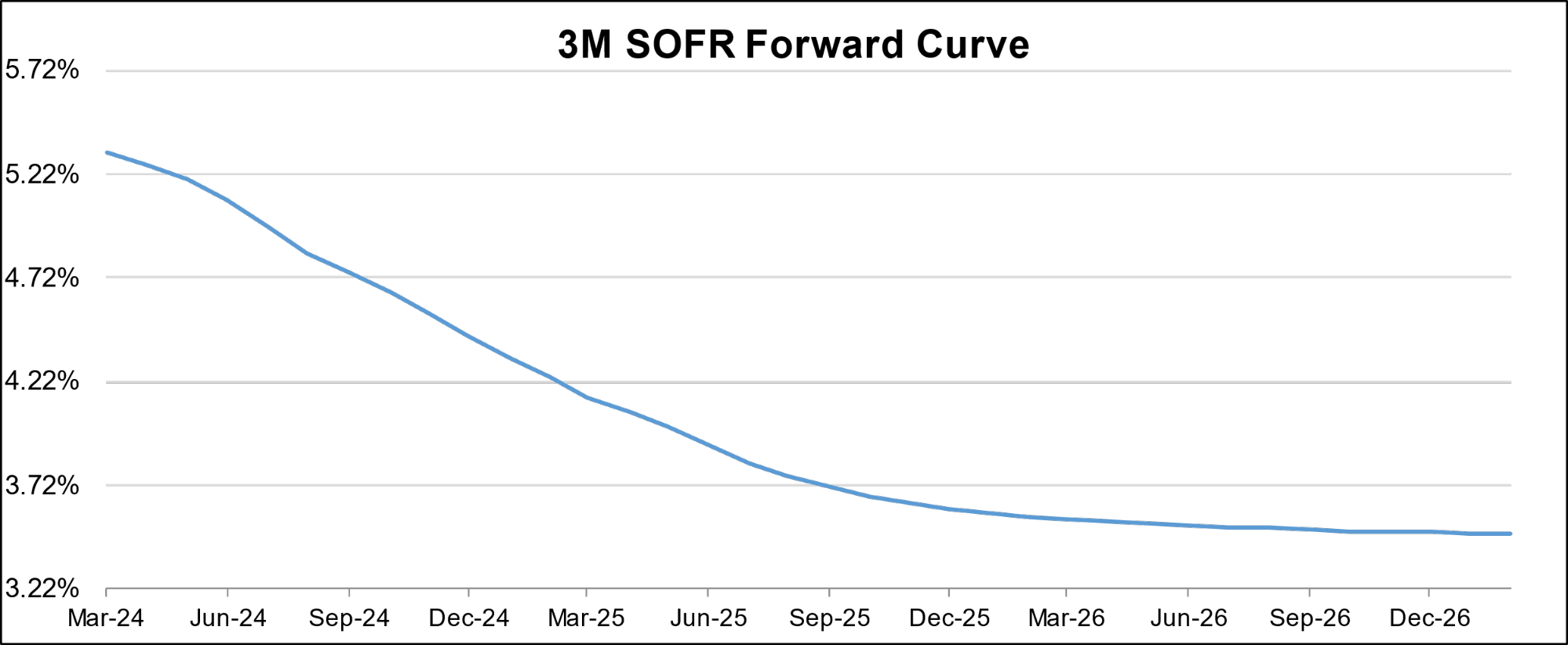

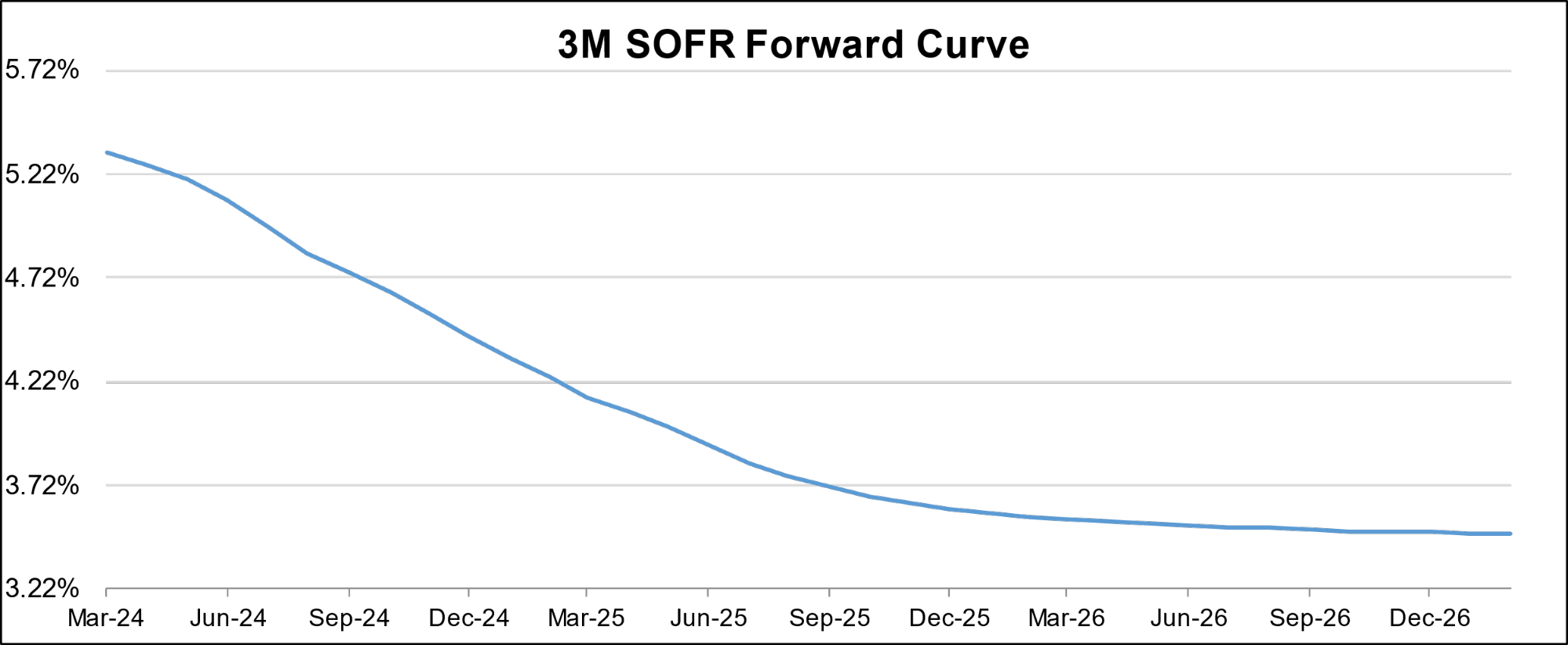

Diagram V: SOFR CURVE

Freight Rates

Drewry World Container Index

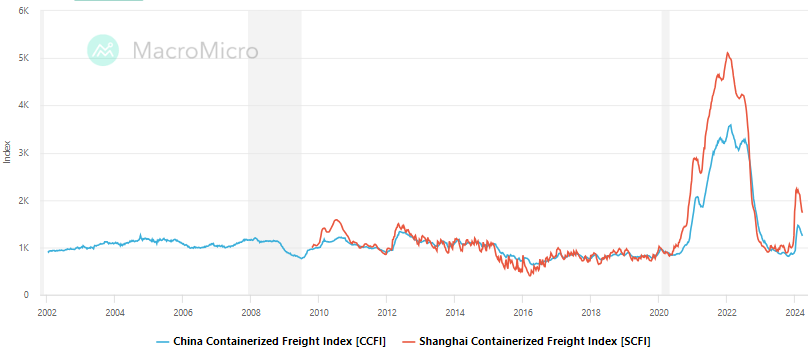

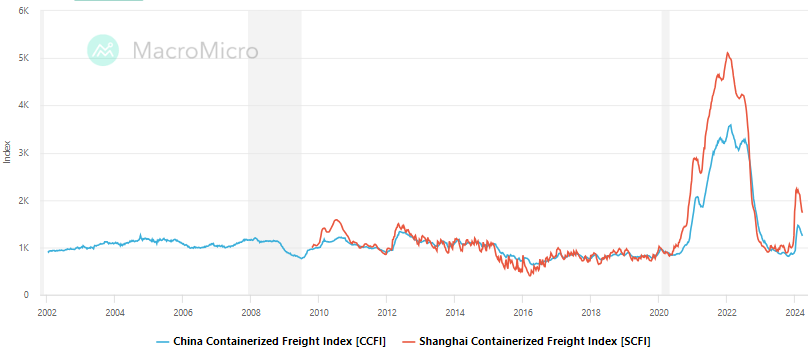

China-Global & Shanghai Export Container Freight Index

U.S. News

- Consumer Price Index

- The cost of consumer goods and services rose a sharp 0.4% in March, capping off a third straight month of elevated inflation readings that will make it hard for the Federal Reserve to cut interest rates soon

- The increase in the CPI over the past 12 months moved up to 3.5% from 3.2% and hit the highest level since September

- The cost of energy and shelter accounted for more than half of the increase in inflation

- Small Business Optimism Index

- The NFIB small business optimism index decreased last month to 88.5, the lowest level since December 2012

- Inflation continues to be most pestering to small businesses, who are facing challenges when it comes to both business and labor costs

- The net percentage of business owners raising prices because of inflation rose to 28% in February and a third of small businesses disclosed that they had planned for more price hikes in March

- Consumer Sentiment

- The consumer sentiment index dipped to 77.9 in April from 79.4 in March but remains in a range that it has been in since the start of 2024

- Consumers frustration that inflation has stopped dropping continues to hold down sentiment, but beyond that they see the economy still in pretty good shape

- Since January, sentiment has remained steady within a very narrow 2.5 index point range

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 211,000 in the week ended April 5, down 11,000 from the prior week

- The four-week moving average was 214,250, up 250 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 28,000 to 1.817 million in the week ended March 29. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.438 trillion in the week ended April 12, down $1.4 billion from the prior week

- Treasury holdings totaled $4.576 trillion, down $21.9 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.39 trillion in the week, down $6.6 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.56 trillion as of April 12, an increase of 9.9% from the previous year

- Debt held by the public was $24.67 trillion, and intragovernmental holdings were $7.08 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.5% in March year over year

- On a monthly basis, the CPI increased 0.4% in March on a seasonally adjusted basis, after increasing 0.4% in February

- The index for all items less food and energy (core CPI) rose 0.4% in March, after rising 0.4% in February

- Core CPI increased 3.8% for the 12 months ending March

- Food and Beverages:

- The food at home index increased 1.2% in March from the same month a year earlier, and decreased 0.0% in March month over month

- The food away from home index increased 4.2% in March from the same month a year earlier, and increased 0.3% in March month over month

- Commodities:

- The energy commodities index increased 1.5% in March after increasing 3.6%

- The energy commodities index fell 0.9% over the last 12 months

- The energy services index (0.0%) in March after increasing 0.1% in February

- The energy services index rose 3.1% over the last 12 months

- The gasoline index fell 1.3% over the last 12 months

- The fuel oil index fell (3.7%) over the last 12 months

- The index for electricity rose 5.0% over the last 12 months

- The index for natural gas fell (3.2%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $2,795.10 per 40ft

- Drewry’s composite World Container Index has increased by 63.6% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in March after increasing 0.4% in February

- The rent index increased 0.5% in March after increasing 0.4% in February

- The index for lodging away from home increased 5.6% in March after increasing 3.1% in February

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel

- Last week Israel and Hamas were considering a new U.S. proposal for a cease-fire in the war in Gaza and the freeing of some hostages still held by the militant group, but mediators cautioned that the two sides remained far from a deal

- The plan, presented by Central Intelligence Agency Director William Burns to officials from Israel, Hamas, Qatar and Egypt in Cairo, calls for a six-week cease-fire in Gaza

- During the pause in fighting, according to the plan, Hamas would release 40 of the more than 100 hostages the group is holding in the enclave in exchange for 900 Palestinian prisoners from Israel’s jails, including 100 serving long sentences on terrorism-related charges

-

China

- On Wednesday of last week Fitch revised its outlook for China’s A+ credit rating from stable to negative. Fitch said the change to China’s rating outlook reflected rising risks to the country’s public finances a result of the uncertain economic outlook. China’s economy is being weighed down by a property slump, which has pushed dozens of companies to the brink of collapse, led to a sharp drop in home prices and dealt serious damage to consumer confidence

- The move followed a similar change by Moody’s Investors Service in December, who kept China’s long-term rating of A1 intact but changed the outlook from stable to negative

- China’s local governments are facing a mountain of liabilities, with some analysts putting their hidden debt as high as $11 trillion. They were squeezed by the real-estate slowdown, since for years land sales provided a steady stream of income to local governments and made up for shortfalls elsewhere. Local government-financing vehicles, which allowed regional governments to fund off their own balance sheets, compounded the pain

-

Russia

- The U.S. and Russia are using a confidential channel to discuss the issue of exchanging prisoners that could include the release of jailed Wall Street Journal reporter Evan Gershkovich, a senior Russian diplomat said Thursday

- Russian Deputy Foreign Minister Sergei Ryabkov told reporters that “dialogue on this topic is being conducted through a specialized closed channel,” but said he wasn’t authorized to comment on the exchange of information or “the signals that pass through this channel,” Russia’s state news agency TASS reported

- Thursday’s remarks from Moscow, though not new, are the latest signal that both sides are seriously engaged in negotiations to free the two men, the only Americans categorized by the State Department as wrongfully detained in Russia

-

Italy

- An explosion at a hydroelectric power plant owned by Rome-based energy group Enel killed at least three people. The explosion was likely caused by a fire in a turbine or a transformer at the plant

-

Germany

- Germany’s industrial production rose more than expected in February, helped by a recovery in the construction and car industry, as the country looks to exit a recent manufacturing slump

-

Canada

- Canada’s goods-trade surplus widened more than expected, driven by record gold shipments and marking the strongest export growth in six months

-

South Korea

- South Korea’s exports grew for a sixth consecutive month, driven by strong demand for semiconductors and ships, with a 3.1% increase from the previous year to $56.56 billion

-

Taiwan

- A magnitude-7.4 earthquake, the strongest to hit Taiwan in 25 years, killed at least nine people, injured more than 900, and caused significant structural damage including the collapse of buildings

-

Japan

- The Bank of Japan ended negative interest rates and unwound most of its unconventional monetary easing policies, moving its key target for short-term rates to a range of 0% to 0.1%, its first rate increase since 2007

-

Australia

- Australian officials have unveiled a new policy aimed at reducing migration by 14% over the next four years in an effort to address housing affordability issues in cities like Sydney, where prices have reached record highs

Commodities

-

Oil Prices

- WTI: $85.51 per barrel

- (1.61%) WoW; +19.34% YTD; +4.08% YoY

- Brent: $90.21 per barrel

- (1.05%) WoW; +17.10% YTD; +4.79% YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended April 5, down 0.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 617, down 3 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 457.3 million barrels, down (2.8%) YoY

- Refiners operated at a capacity utilization rate of 88.3% for the week, down from 88.6% in the prior week

- U.S. crude oil imports now amount to 6.618 million barrels per day, down 3.9% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.63 per gallon in the week of April 12,

down (0.8%) YoY

- Gasoline prices on the East Coast amounted to $3.50, down (1.8%) YoY

- Gasoline prices in the Midwest amounted to $3.54, down (1.4%) YoY

- Gasoline prices on the Gulf Coast amounted to $3.31, down (0.9%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.49, down (1.7%) YoY

- Gasoline prices on the West Coast amounted to $4.88, up 6.9% YoY

- Motor gasoline inventories were up by 0.7 million barrels from the prior week

- Motor gasoline inventories amounted to 228.5 million barrels, up 2.8% YoY

- Production of motor gasoline averaged 9.44 million bpd, down (3.8%) YoY

- Demand for motor gasoline amounted to 8.612 million bpd, down (3.6%) YoY

-

Distillates

- Distillate inventories decreased by 1.7 million in the week of April 12

- Total distillate inventories amounted to 117.7 million barrels, up 4.7% YoY

- Distillate production averaged 4.639 million bpd, up 1.2% YoY

- Demand for distillates averaged 2.985 million bpd in the week, down (20.7%) YoY

-

Natural Gas

- Natural gas inventories increased by 24 billion cubic feet last week

- Total natural gas inventories now amount to 2,283 billion cubic feet, up 23.1% YoY

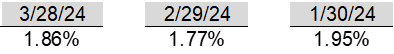

Credit News

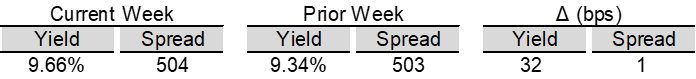

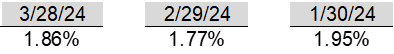

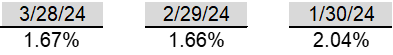

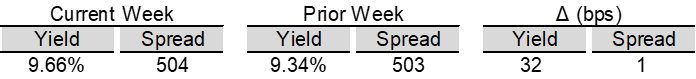

High yield bond yields increased 18bps to 7.94% and spreads decreased 8bps to 322bps. Leveraged loan yields increased 32bps to 9.66% and spreads increased 1bps to 504bps. WTD Leveraged loan returns were positive 11bps. WTD high yield bond returns were negative 47bps. 10yr treasury yields increased 27bps to 4.58%. For the week, HY yields rose and spreads tightened as markets repriced the Fed in response to another firmer-than-expected core CPI release. Resilient prices and a rising forward curve boosted loan yields to a high since December as markets now look for a later start and a shallower path of Fed easing.

High-yield:

Week ended 04/12/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

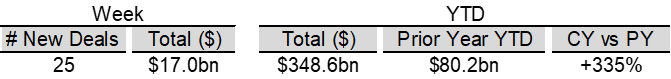

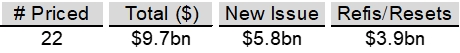

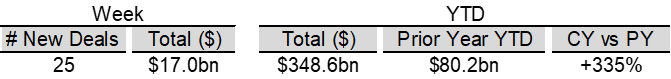

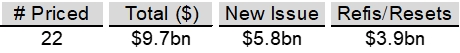

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 04/12/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: JoAnn Stores ($658mn, 3/18/24), New Insight Holdings ($1.2bn, 3/13/24), Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), Careismatic ($700mn, 1/22/24), Enviva Partners ($750mn, 1/15/24), Ligado Networks ($4.2bn, 11/1/23), and Air Methods ($1.7bn, 10/24/23).

CLOs:

Week ended 04/12/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Diagram V: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index