U.S. News

- Stock Buy Backs

- S&P 500 companies that have reported first quarter results as of Monday have disclosed buying back $181.2 billion of shares in the first quarter

- The amount represents a 16% increase from last year’s first quarter

- Meta Platforms repurchased $14.5 billion of shares in the first quarter, up about $5 billion from a year earlier

- Consumer Credit

- Total consumer credit rose at a 1.5% annual rate in March, down from a 3.6% annual rate in February

- Credit card borrowing rose 0.1% in March after a 9.7% gain in February, the slowest pace since April 2021

- Nonrevolving loans, mainly student and auto loans, rose 2% after a 1.4% gain in February

- Wholesale Inventories

- Wholesale inventories in the U.S. fell 0.4% in March and are down 2.3% over the past year

- The inventory-to-sales ratio fell 1.35x in March, down from 1.4x a year ago

- Private inventory investment cut 0.4% from GDP growth in the first quarter

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 231,000 in the week ended May 3, up 22,000 from the prior week

- The four-week moving average was 215,000, up 4,750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 17,000 to 1.785 million in the week ended April 26. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.353 trillion in the week ended May 10, down $9.1 billion from the prior week

- Treasury holdings totaled $4.518 trillion, down $15.4 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.37 trillion in the week, down $14.7 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.54 trillion as of May 10, an increase of 9.8% from the previous year

- Debt held by the public was $24.64 trillion, and intragovernmental holdings were $7.14 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.5% in March year over year

- On a monthly basis, the CPI increased 0.4% in March on a seasonally adjusted basis, after increasing 0.4% in February

- The index for all items less food and energy (core CPI) rose 0.4% in March, after rising 0.4% in February

- Core CPI increased 3.8% for the 12 months ending March

- Food and Beverages:

- The food at home index increased 1.2% in March from the same month a year earlier, and decreased 0.0% in March month over month

- The food away from home index increased 4.2% in March from the same month a year earlier, and increased 0.3% in March month over month

- Commodities:

- The energy commodities index increased 1.5% in March after increasing 3.6%

- The energy commodities index fell 0.9% over the last 12 months

- The energy services index (0.0%) in March after increasing 0.1% in February

- The energy services index rose 3.1% over the last 12 months

- The gasoline index rose 1.3% over the last 12 months

- The fuel oil index fell (3.7%) over the last 12 months

- The index for electricity rose 5.0% over the last 12 months

- The index for natural gas fell (3.2%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $3,158.60 per 40ft

- Drewry’s composite World Container Index has increased by 81.4% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in March after increasing 0.4% in February

- The rent index increased 0.5% in March after increasing 0.4% in February

- The index for lodging away from home increased 5.6% in March after increasing 3.1% in February

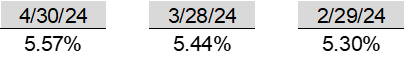

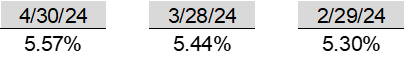

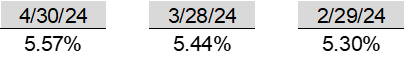

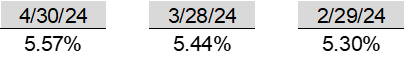

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel

- President Biden is withholding weapon deliveries to Israel after Israel launched an assault on the southern Gaza city of Rafah, where more than one million Palestinians are sheltering from the war

- Israel’s military is pressing deeper into the outskirts of Rafah after negotiations between Israel and Hamas about a cease-fire and hostage release hit another impasse

- Israel forces have not launched an all-out offensive yet but have moved into areas east of Rafah, including seizing the main border crossing to Egypt

- The U.S. is close to finishing a $320 million floating pier to receive aid for the Gaza Strip. The pier will enable up to 150 aid trucks to enter into Gaza each day

-

China

- In a new push to boost the Chinese economy, China’s leaders are resurrecting a policy familiar to many Americans from the 2008-09 financial crisis: cash for clunkers

- The trade-in program is a stimulus package aimed at lifting gross domestic product by allowing households to swap out old home appliances for new ones and for factories replace old equipment

- Officials hope the policy will encourage Chinese factories to expand and churn out more goods to boost GDP

-

Russia

- Russia launched armored attacks across the border in Ukraine’s northeast on Friday, opening a new front against Ukrainian forces that are struggling to hold the line as they wait for U.S. aid

- Attacks will force Ukraine to make hard choices on where to deploy troops with limited weaponry

- The U.S. recently restarted shipments following the passage last month of funding legislation, but significant deliveries will take time to reach Ukraine’s front-line troops

-

U.K.

- The U.K. central bank left its key rate unchanged at a 16-year high but indicated that it is on course to cut rates over the coming months and possibly as early as June

- Two of the nine members voted to lower the rate. A lowering of the interest rate could weaken the pound sterling against the U.S. dollar and push prices of imported goods and services higher

-

UK

- The U.K. government expelled a Russian diplomat it says was a spy. Additionally, it is removing diplomatic protection from several Russian government owned properties that it said was being used for intelligence gathering

-

Chad

- Chad’s state election body said interim Pesident Mahamat Idriss Derby had won the election with 61% of the vote. His opponent has also declared himself the winner, citing vote-rigging concerns.

-

France

- French President Emmanuel Macron is rekindling debate over whether France’s nuclear arsenal should play a role in deterring attacks against European allies, igniting criticism across the political spectrum from lawmakers who say any move to extend the country’s nuclear umbrella risks compromising a linchpin of national sovereignty

-

Germany

- German inflation held steady this month, adding to signs that price pressures have cooled sustainably in the eurozone’s most important economy. Consumer prices were on average 2.2% higher than in April of last year, the same rate booked in March, according to national-standard figures set out Monday by German statistics authority Destatis

-

Japan

- Japan has intervened to prop up the yen after it hit a multidecade low against the dollar. The currency has plummeted against the dollar this year, hurt by increasing doubts among traders about the timing of U.S. interest rate cuts

-

Finland

- Finland, sharing NATO’s longest border with Russia at 830 miles, has escalated its security measures, including constructing new fences and enhancing surveillance, in response to increased Russian aggression and hybrid warfare tactics

-

South Korea

- SK Hynix plans to invest an additional $14.6 billion to expand its semiconductor production capacity in South Korea, aiming to meet the increasing demand for artificial intelligence chips

-

Canada

- Honda is nearing a deal to build an electric vehicle assembly plant in Ontario, Canada, with the Canadian government agreeing to offset some of the capital costs through newly introduced tax breaks

Commodities

-

Oil Prices

- WTI: $78.37 per barrel

- +0.33% WoW; +9.38% YTD; +10.58% YoY

- Brent: $82.91 per barrel

- (0.06%) WoW; +7.62% YTD; +10.58% YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended May 3, down 0.1 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 603, down 2 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 459.5 million barrels, down (0.7%) YoY

- Refiners operated at a capacity utilization rate of 88.5% for the week, up from 87.5% in the prior week

- U.S. crude oil imports now amount to 6.772 million barrels per day, down 25.5% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.64 per gallon in the week of May 10,

up 2.7% YoY

- Gasoline prices on the East Coast amounted to $3.65, up 3.6% YoY

- Gasoline prices in the Midwest amounted to $3.47, up 0.2% YoY

- Gasoline prices on the Gulf Coast amounted to $3.34, up 6.6% YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.58, down (2.1%) YoY

- Gasoline prices on the West Coast amounted to $4.88, up 5.5% YoY

- Motor gasoline inventories were up by 0.9 million barrels from the prior week

- Motor gasoline inventories amounted to 228.0 million barrels, up 3.8% YoY

- Production of motor gasoline averaged 9.50 million bpd, down (3.3%) YoY

- Demand for motor gasoline amounted to 8.797 million bpd, down (5.4%) YoY

-

Distillates

- Distillate inventories decreased by 0.6 million in the week of May 10

- Total distillate inventories amounted to 116.4 million barrels, up 9.7% YoY

- Distillate production averaged 4.783 million bpd, up 3.8% YoY

- Demand for distillates averaged 3.489 million bpd in the week, down (13.5%) YoY

-

Natural Gas

- Natural gas inventories increased by 79 billion cubic feet last week

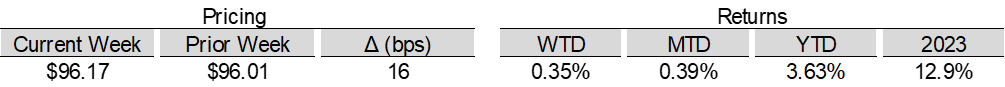

- Total natural gas inventories now amount to 2,563 billion cubic feet, up 19.7% YoY

Credit News

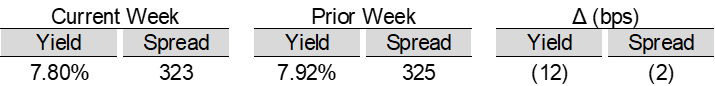

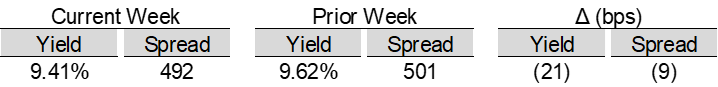

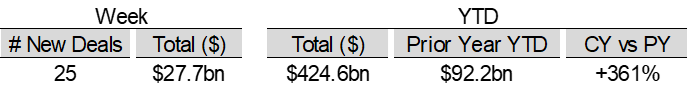

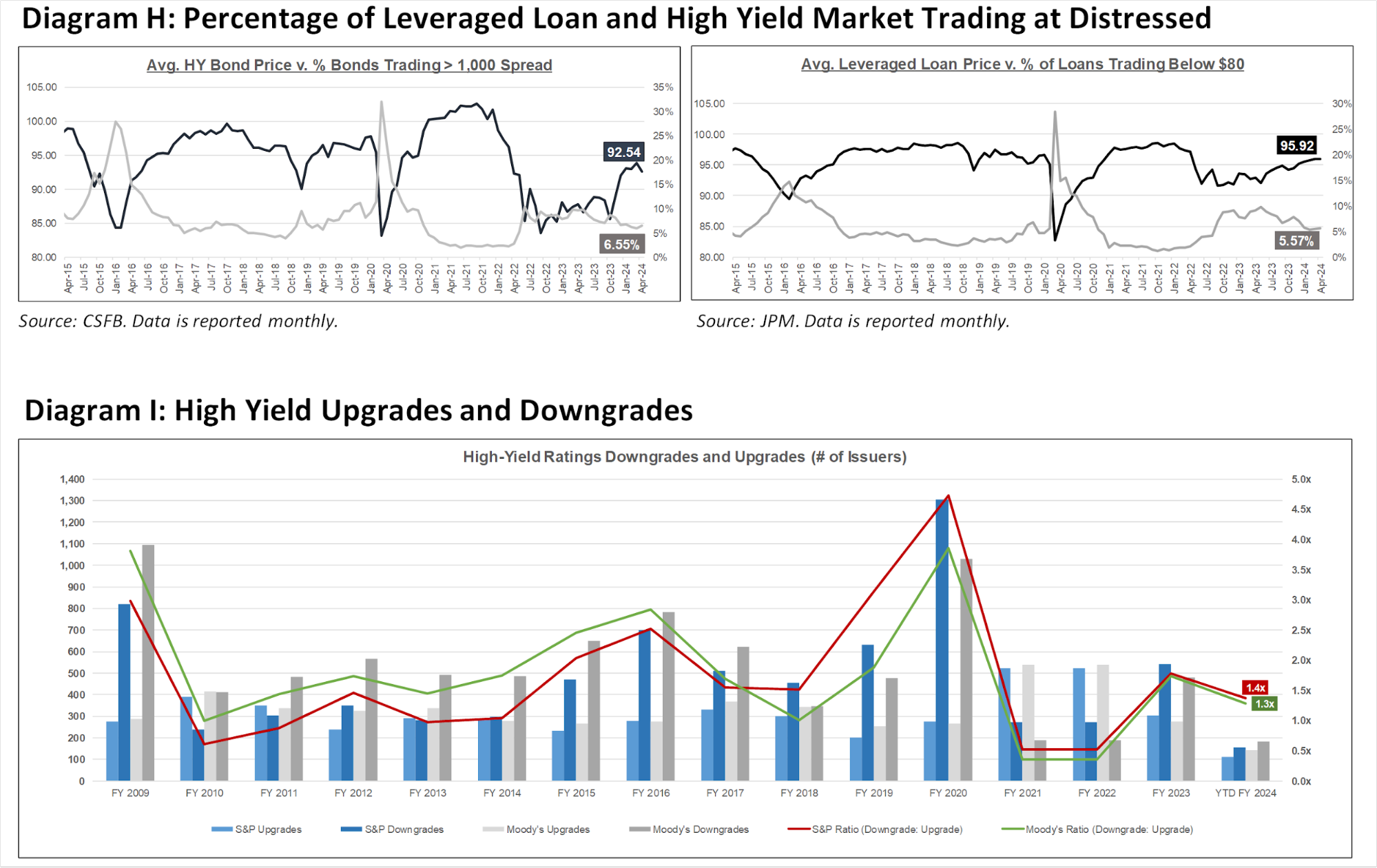

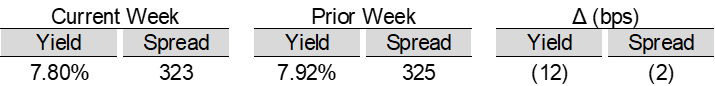

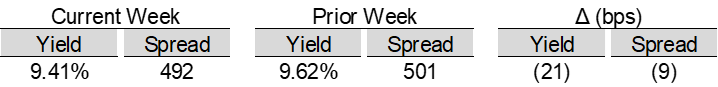

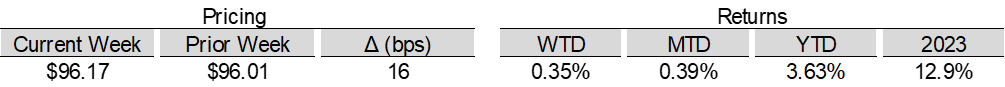

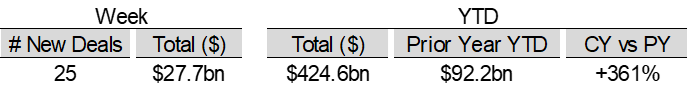

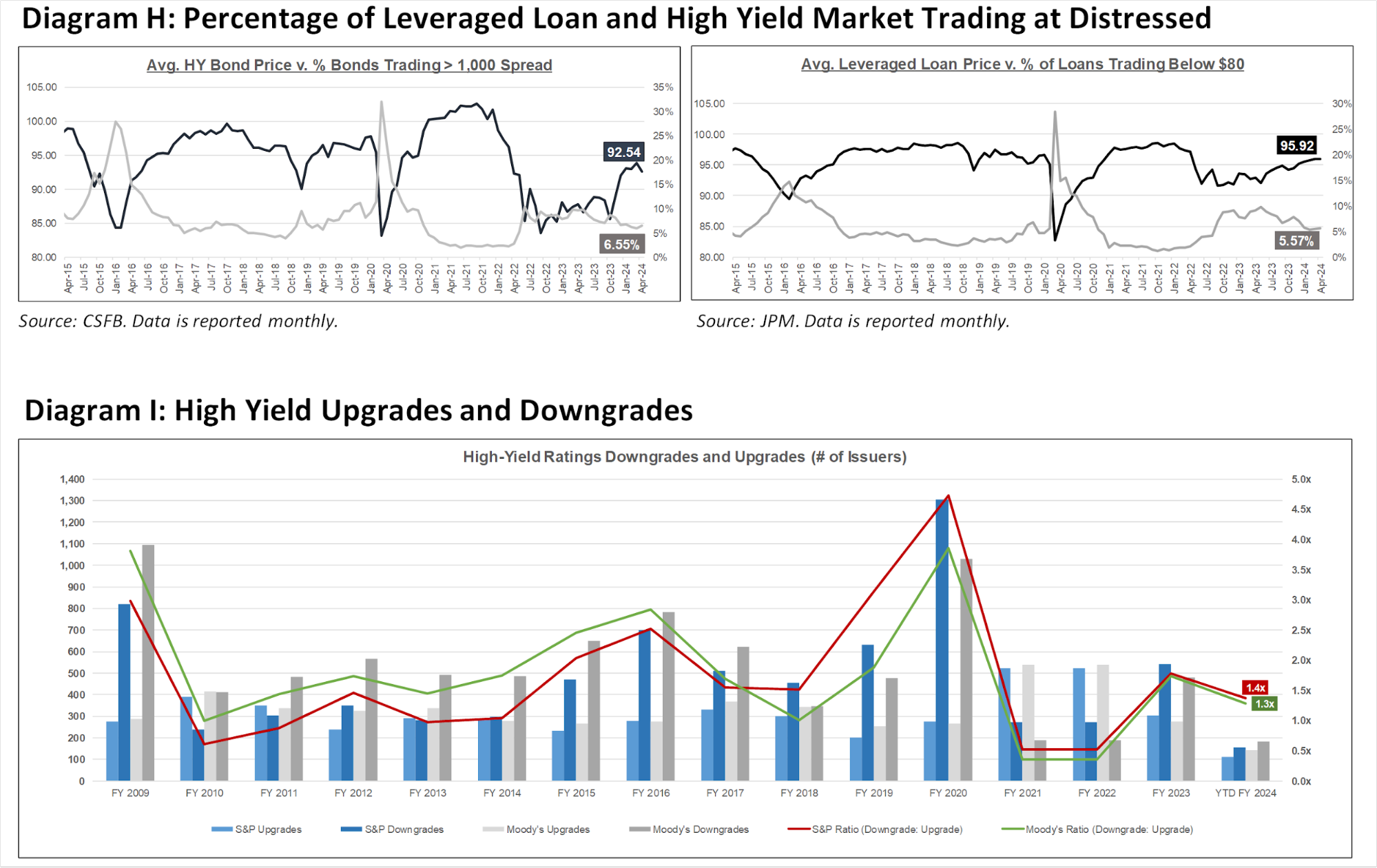

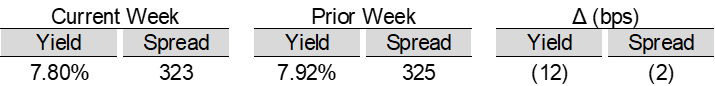

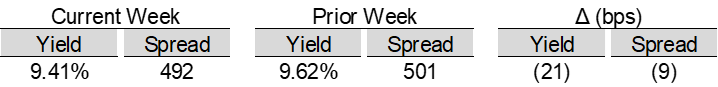

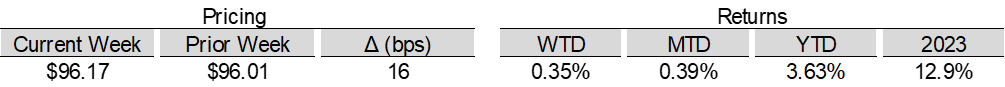

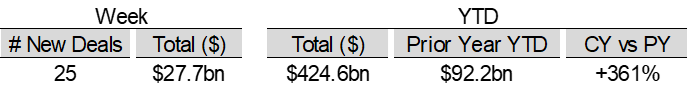

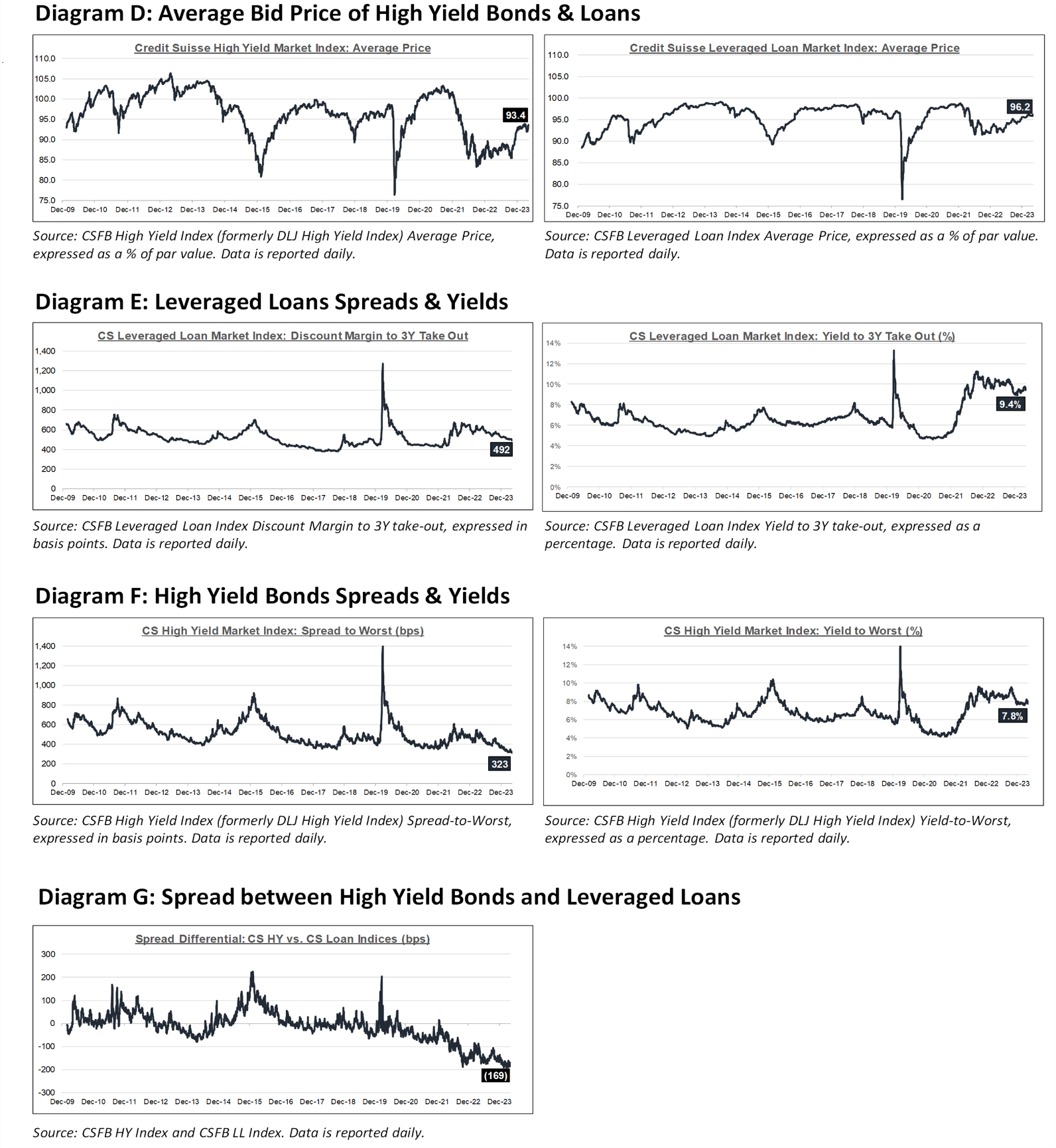

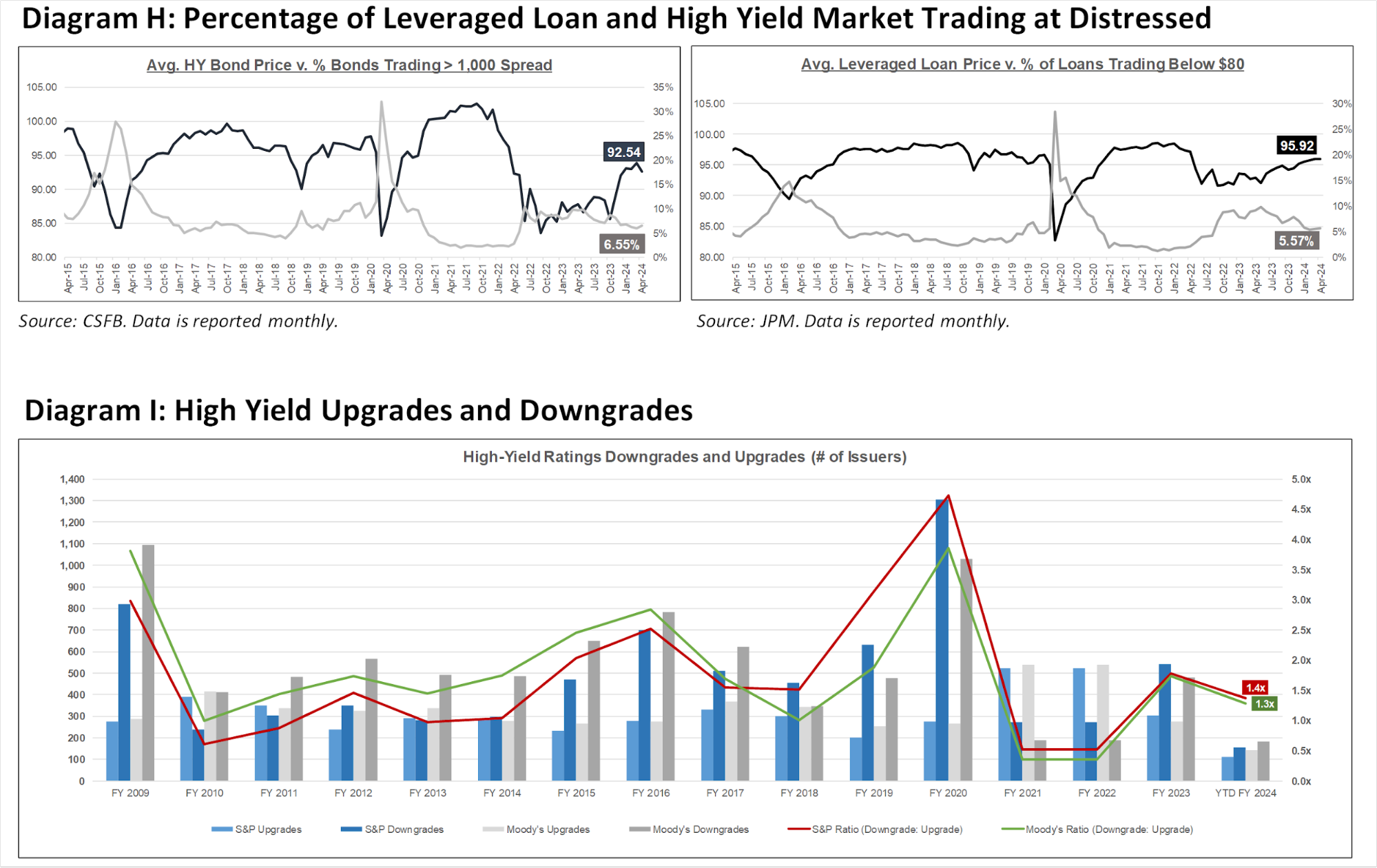

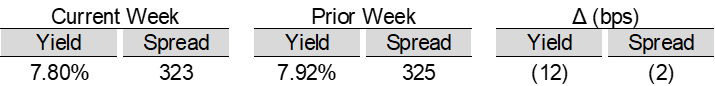

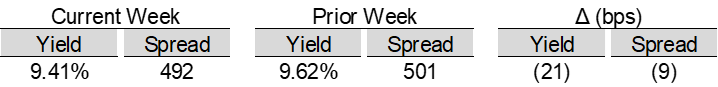

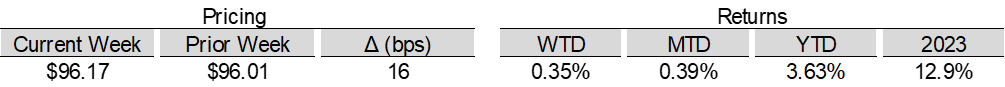

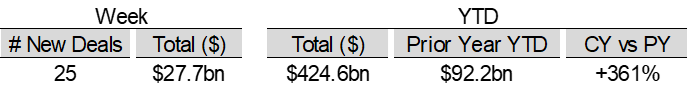

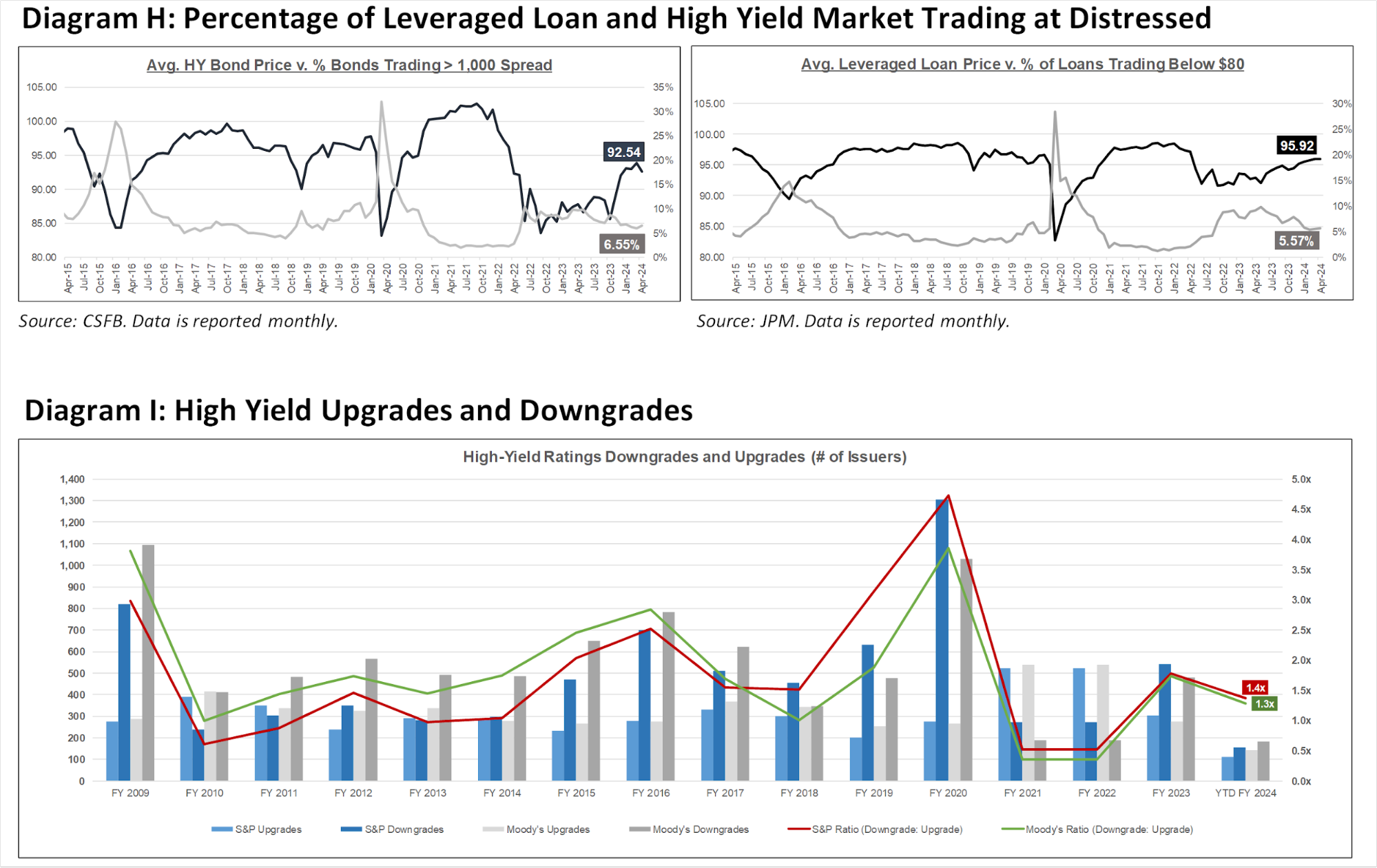

High yield bond yields decreased 12bps to 7.80% and spreads decreased 2bps to 323bps. Leveraged loan yields decreased 21bps to 9.41% and spreads decreased 9bps to 492bps. WTD Leveraged loan returns were positive 35bps. WTD high yield bond returns were positive 54bps. 10yr treasury yields decreased 12bps to 4.45%. For the week, yields and spreads tightened following last week’s less hawkish than expected FOMC meeting, softer payroll growth, this week’s rise in initial claims to a high since August, and one of the strongest earnings seasons in years continues.

High-yield:

Week ended 05/10/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 05/10/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: 99 Cents Only Stores ($350mn, 4/7/24), ConvergeOne ($1.3bn, 4/4/24), Xplornet Communications ($1.2bn, 3/31/24), JoAnn Stores ($658mn, 3/18/24), New Insight Holdings ($1.2bn, 3/13/24), Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), and Careismatic ($700mn, 1/22/24).

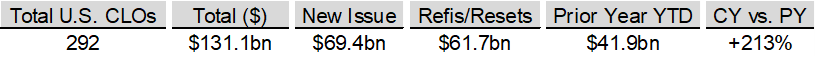

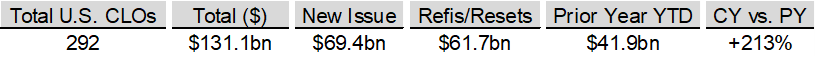

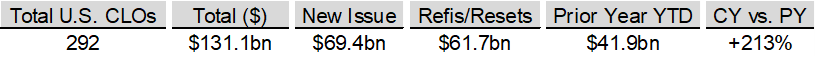

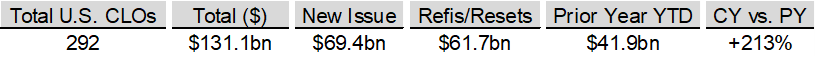

CLOs:

Week ended 05/10/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

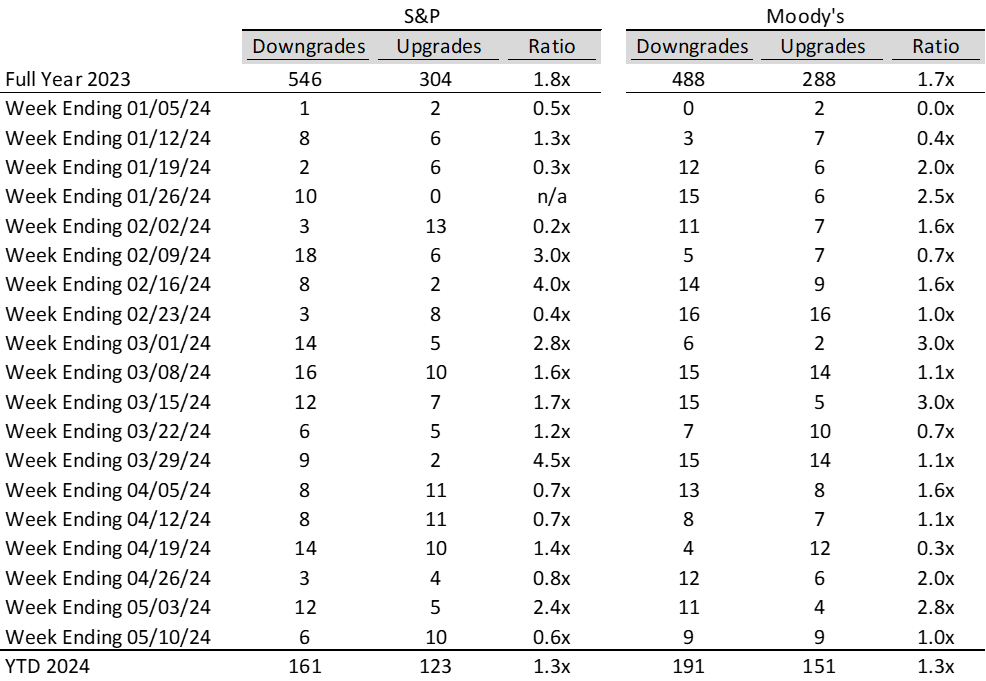

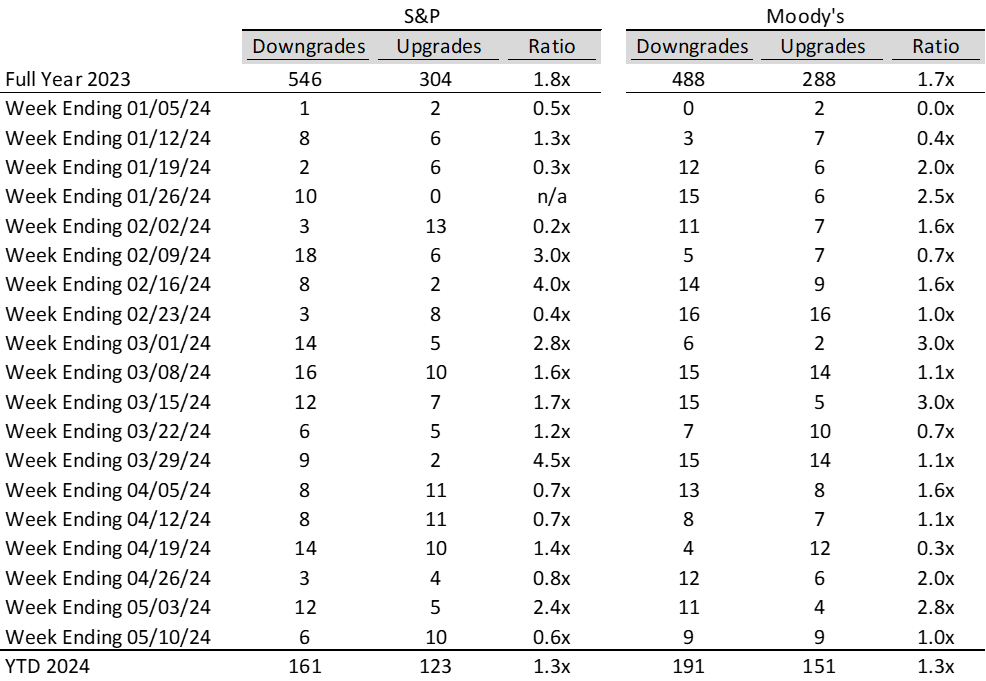

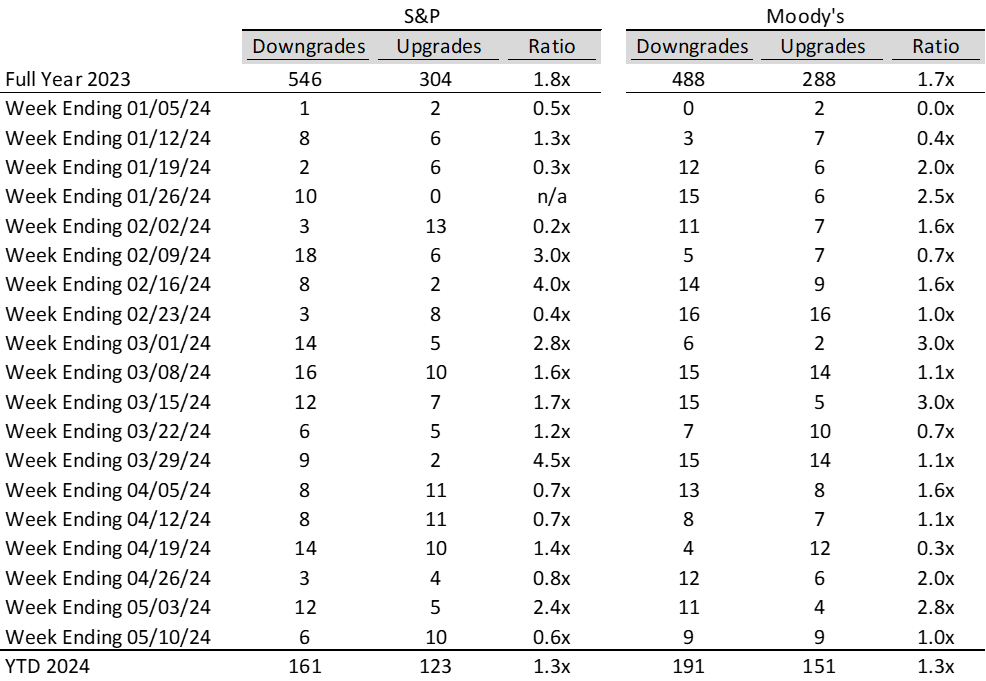

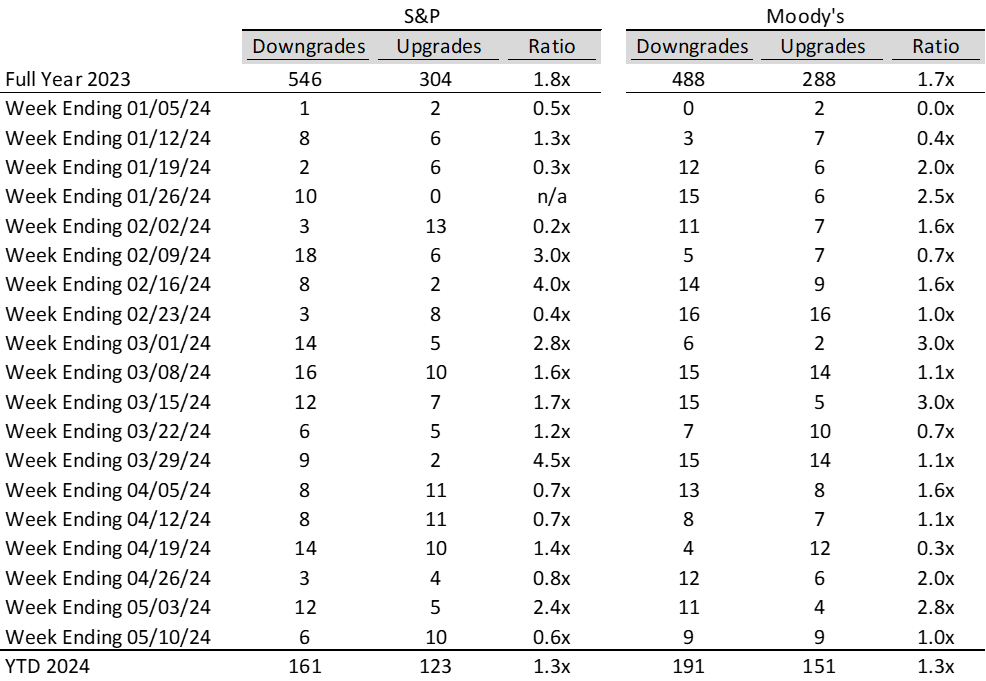

Ratings activity:

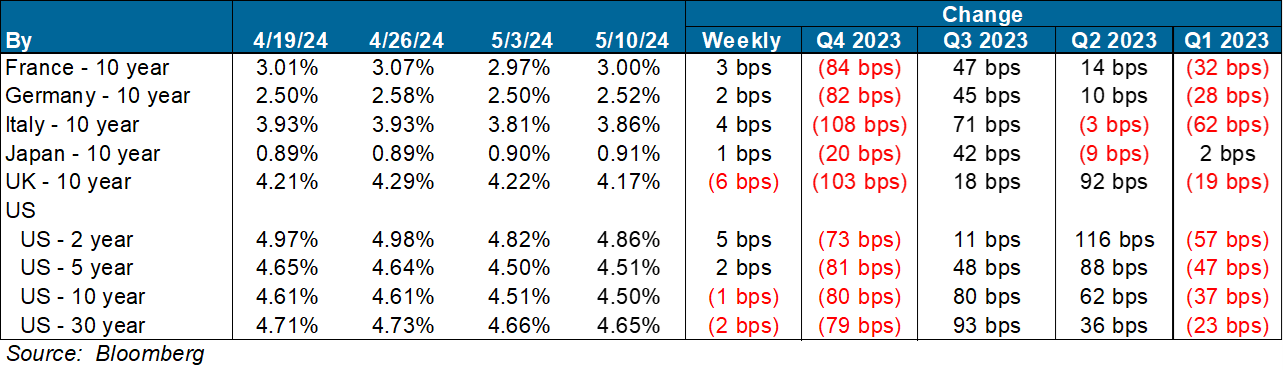

- S&P and Moody’s High Yield Ratings

Appendix:

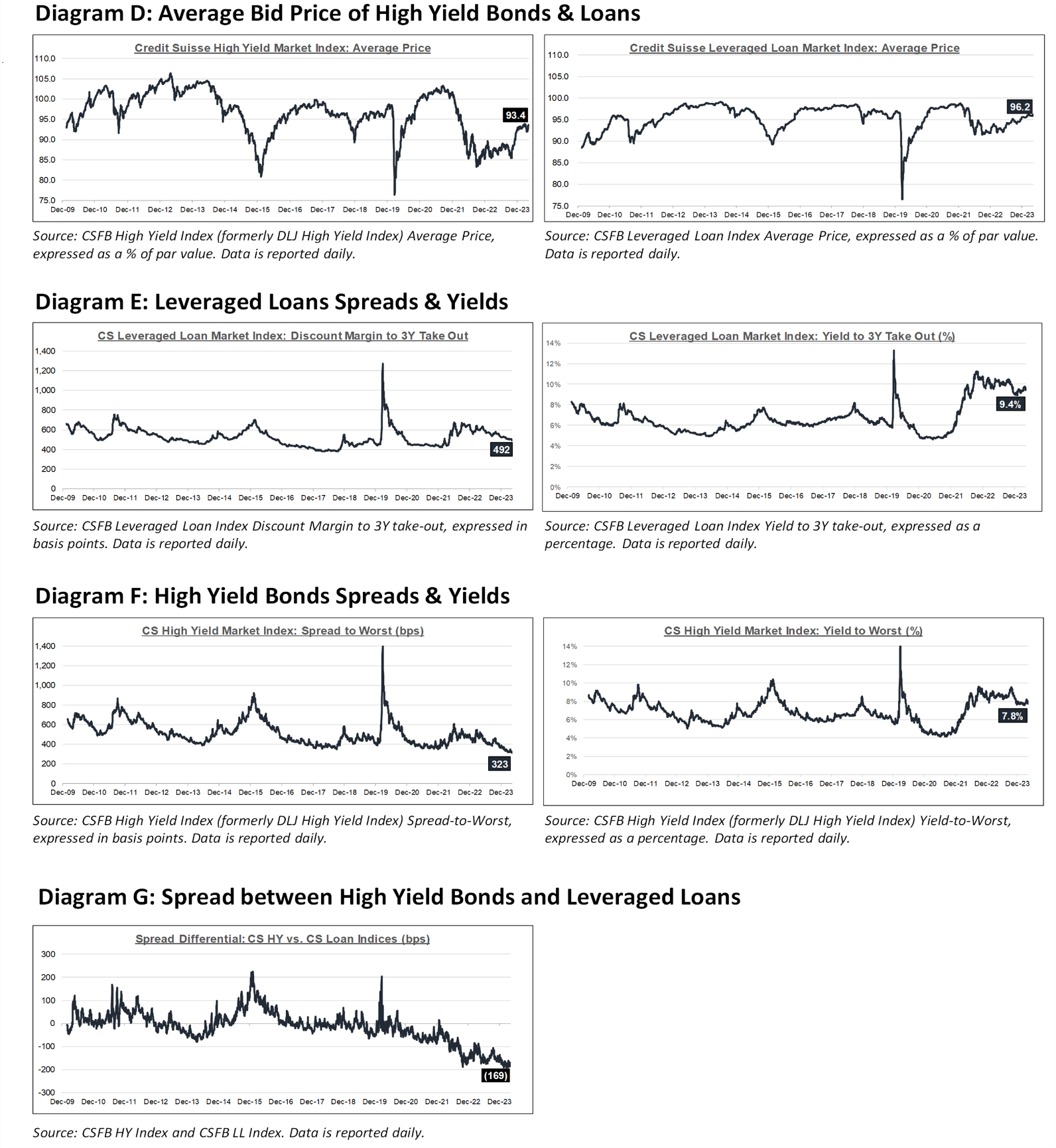

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

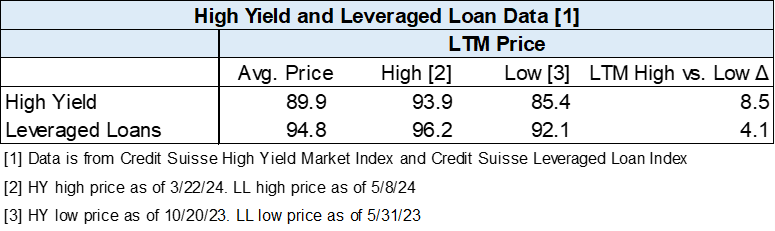

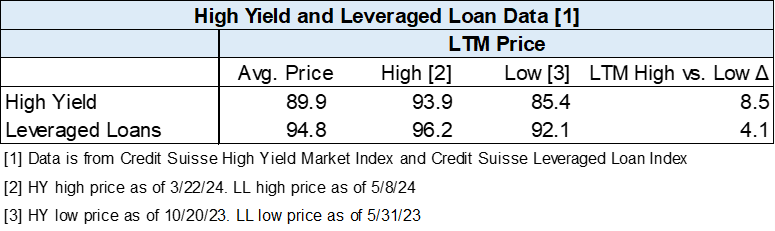

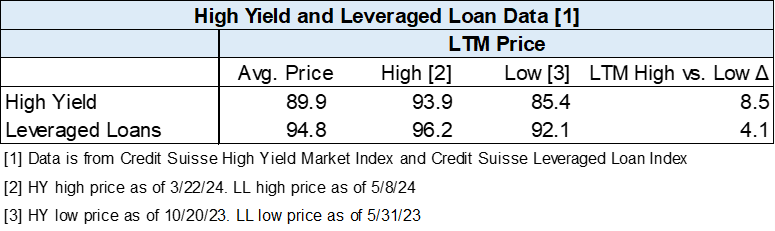

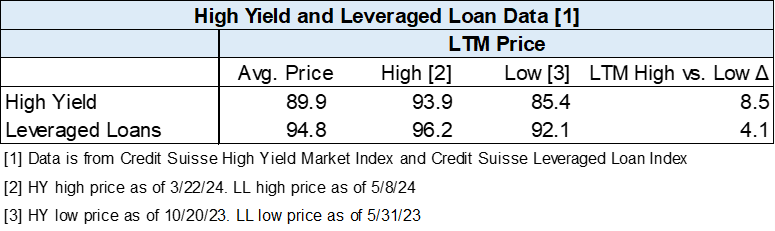

Diagram B: High Yield and Leveraged Loan LTM Price

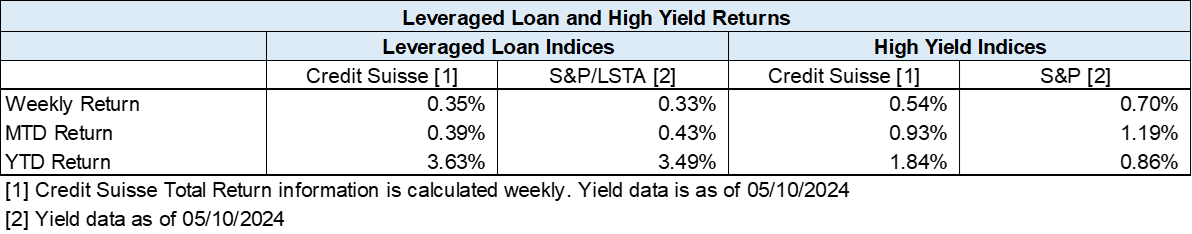

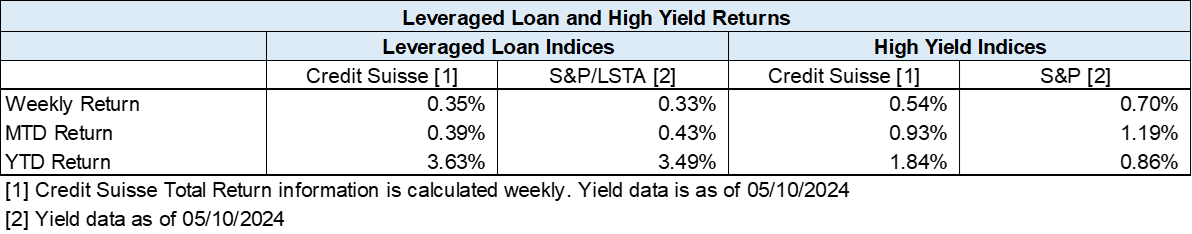

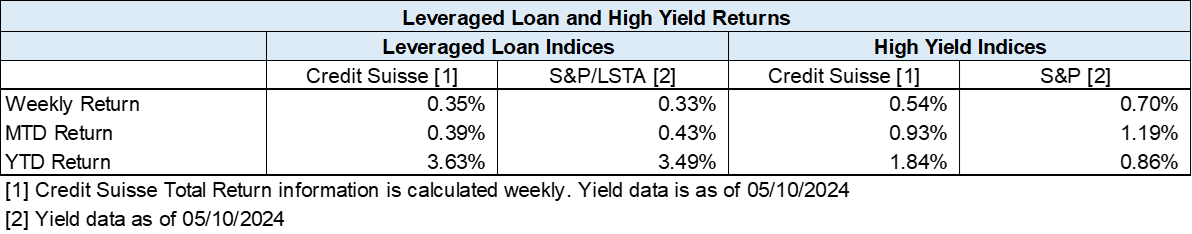

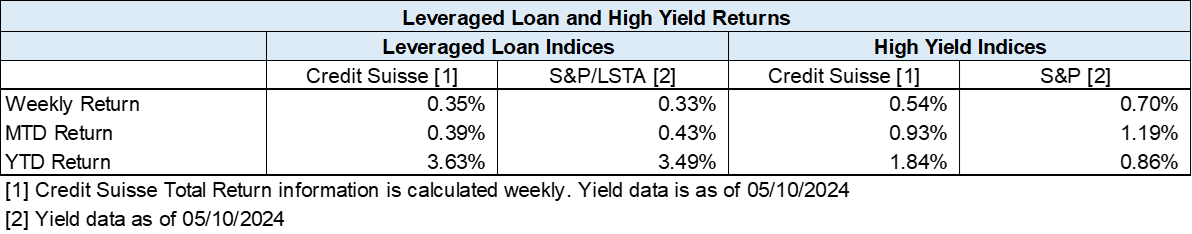

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

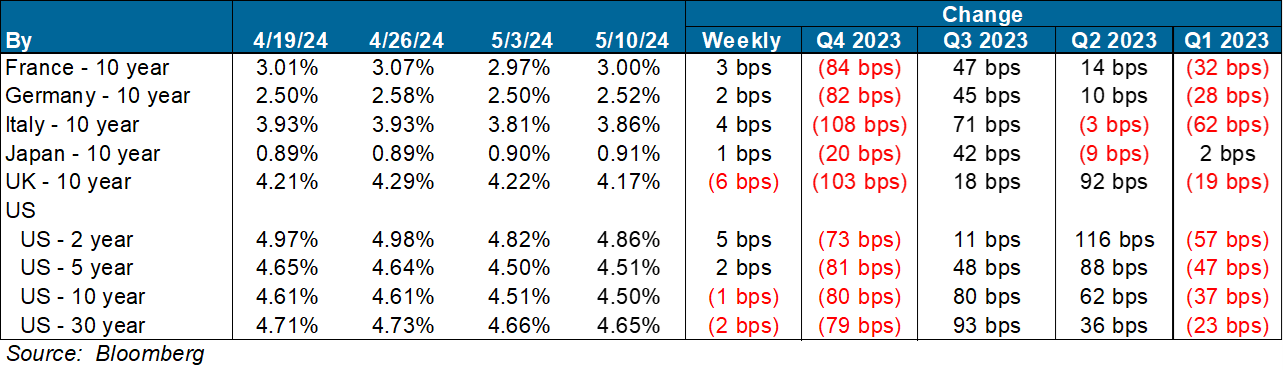

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: SOFR CURVE

ZCGC RE Research:

Section 1:

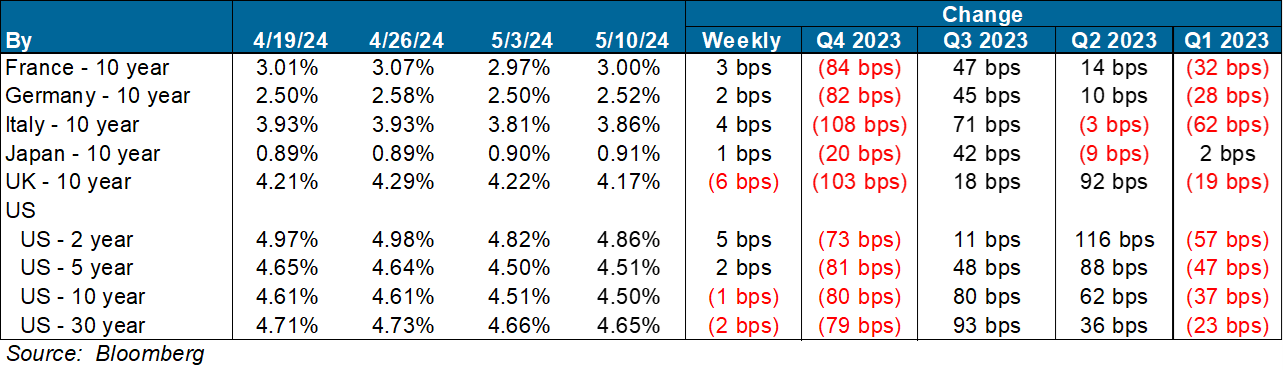

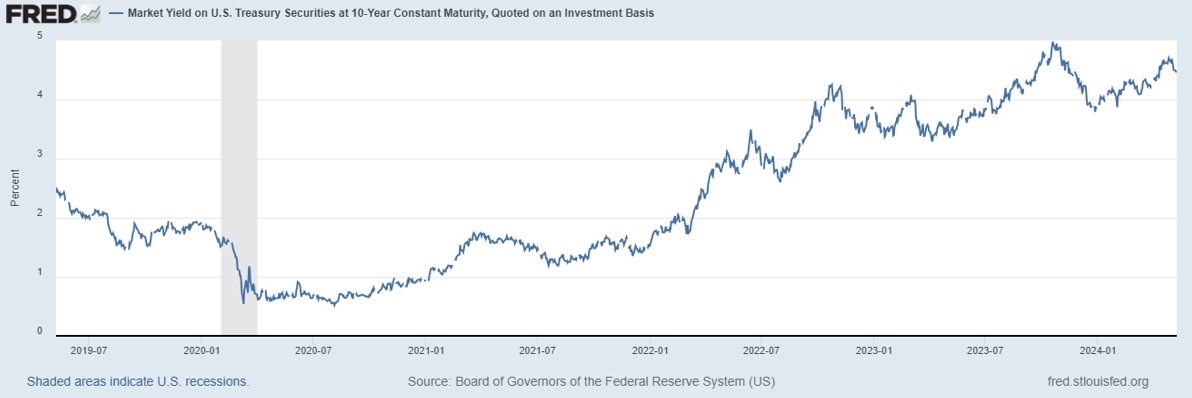

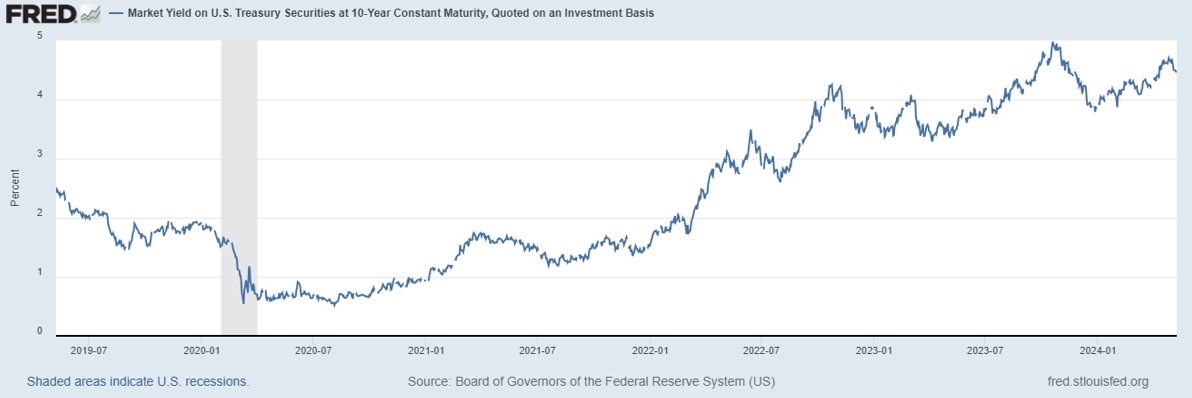

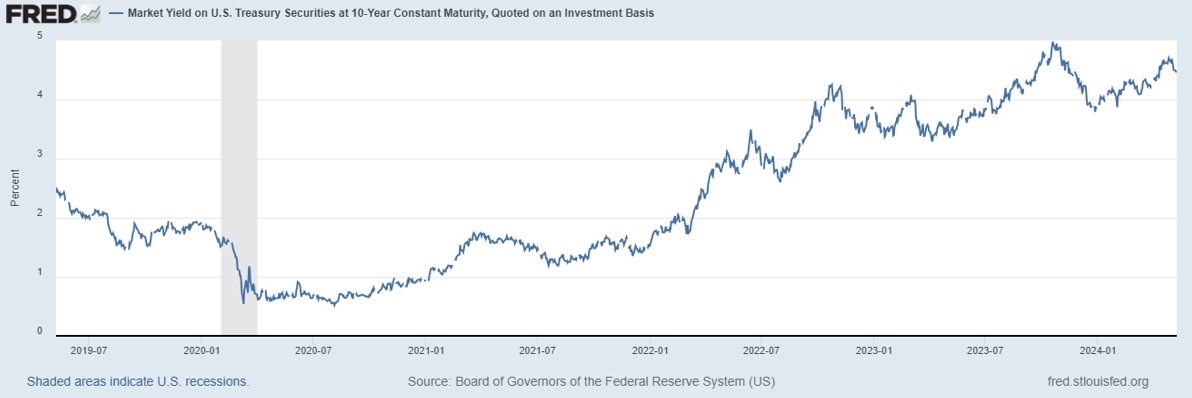

10-Year US Treasury

5/8/24: 4.48

30-Year Fixed Mortgage

5/9/24: 7.09

Section 2:

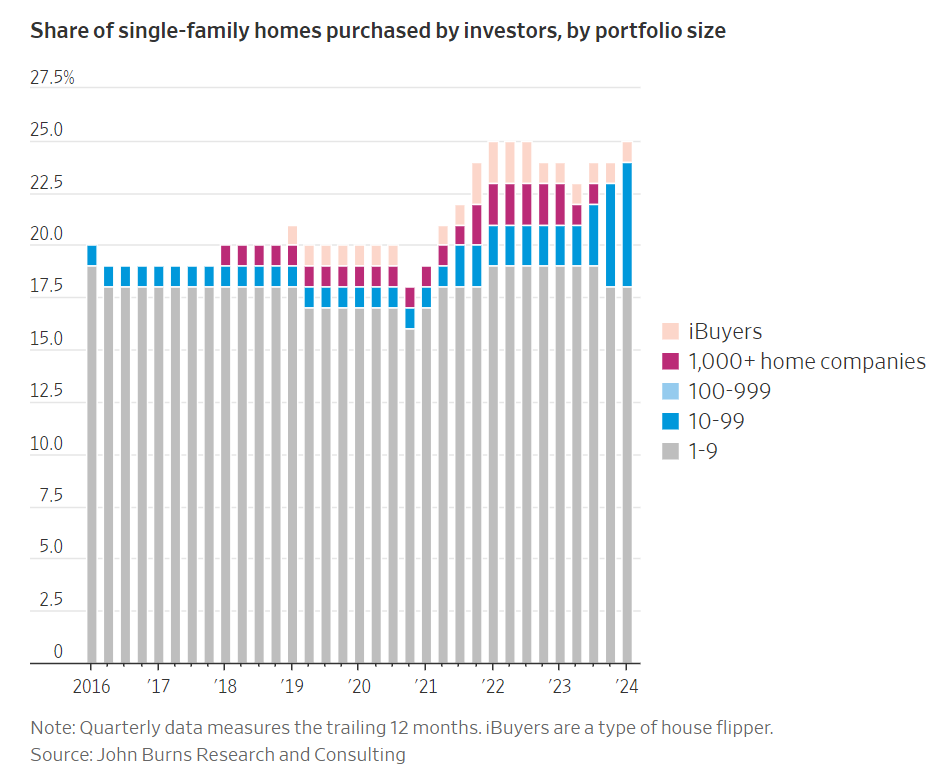

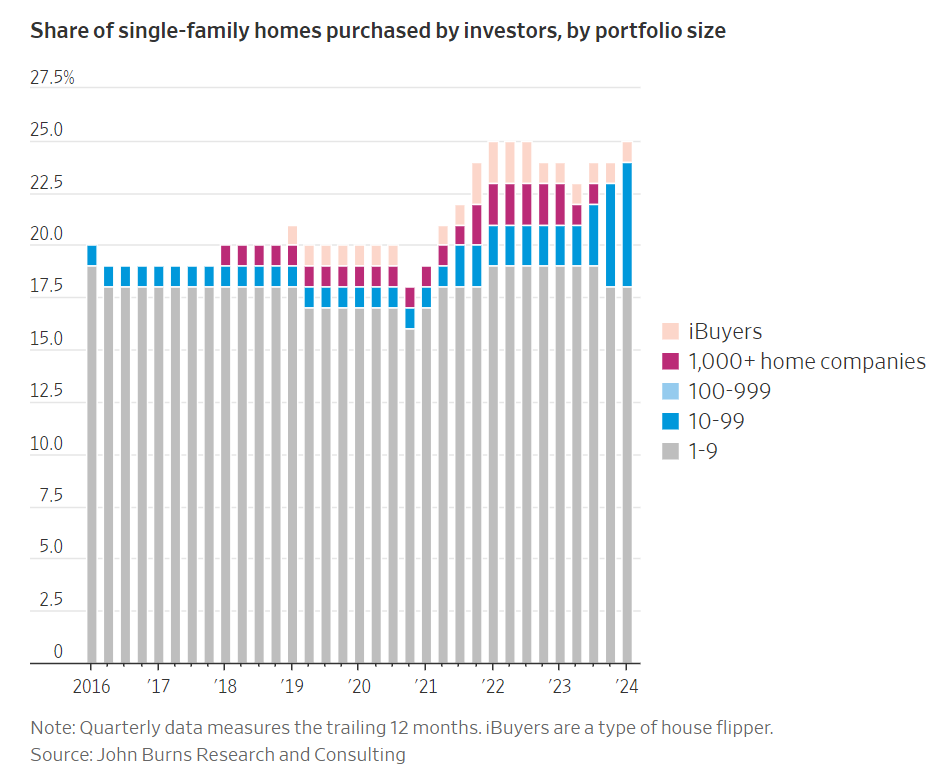

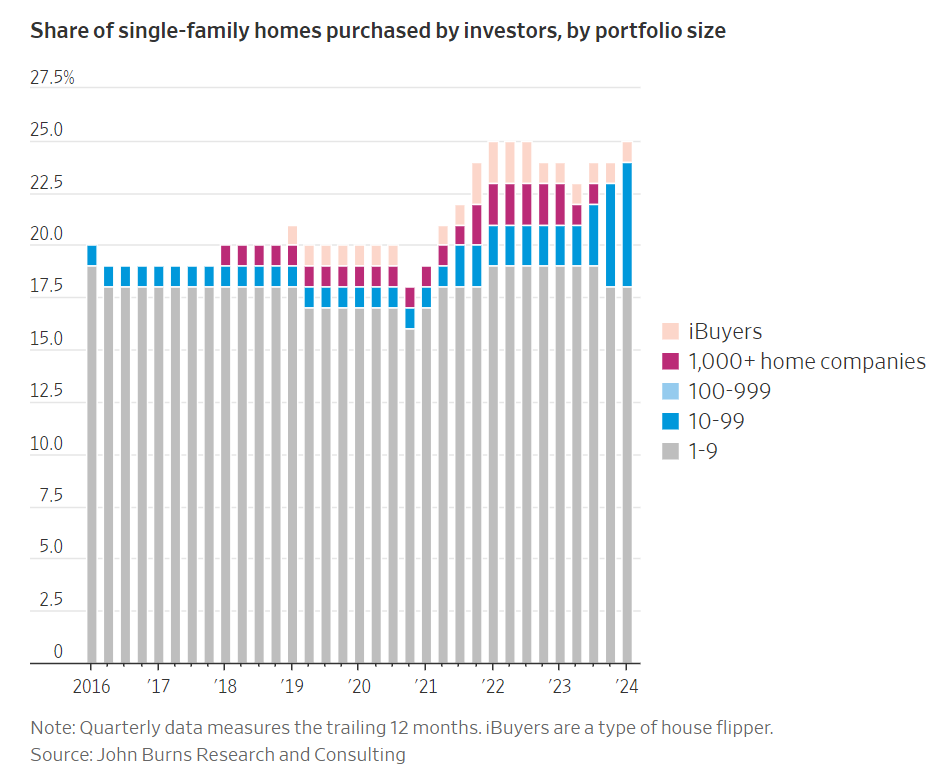

Institutional investors purchasing single family homes

U.S. News

- Stock Buy Backs

- S&P 500 companies that have reported first quarter results as of Monday have disclosed buying back $181.2 billion of shares in the first quarter

- The amount represents a 16% increase from last year’s first quarter

- Meta Platforms repurchased $14.5 billion of shares in the first quarter, up about $5 billion from a year earlier

- Consumer Credit

- Total consumer credit rose at a 1.5% annual rate in March, down from a 3.6% annual rate in February

- Credit card borrowing rose 0.1% in March after a 9.7% gain in February, the slowest pace since April 2021

- Nonrevolving loans, mainly student and auto loans, rose 2% after a 1.4% gain in February

- Wholesale Inventories

- Wholesale inventories in the U.S. fell 0.4% in March and are down 2.3% over the past year

- The inventory-to-sales ratio fell 1.35x in March, down from 1.4x a year ago

- Private inventory investment cut 0.4% from GDP growth in the first quarter

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 231,000 in the week ended May 3, up 22,000 from the prior week

- The four-week moving average was 215,000, up 4,750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 17,000 to 1.785 million in the week ended April 26. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.353 trillion in the week ended May 10, down $9.1 billion from the prior week

- Treasury holdings totaled $4.518 trillion, down $15.4 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.37 trillion in the week, down $14.7 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.54 trillion as of May 10, an increase of 9.8% from the previous year

- Debt held by the public was $24.64 trillion, and intragovernmental holdings were $7.14 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.5% in March year over year

- On a monthly basis, the CPI increased 0.4% in March on a seasonally adjusted basis, after increasing 0.4% in February

- The index for all items less food and energy (core CPI) rose 0.4% in March, after rising 0.4% in February

- Core CPI increased 3.8% for the 12 months ending March

- Food and Beverages:

- The food at home index increased 1.2% in March from the same month a year earlier, and decreased 0.0% in March month over month

- The food away from home index increased 4.2% in March from the same month a year earlier, and increased 0.3% in March month over month

- Commodities:

- The energy commodities index increased 1.5% in March after increasing 3.6%

- The energy commodities index fell 0.9% over the last 12 months

- The energy services index (0.0%) in March after increasing 0.1% in February

- The energy services index rose 3.1% over the last 12 months

- The gasoline index rose 1.3% over the last 12 months

- The fuel oil index fell (3.7%) over the last 12 months

- The index for electricity rose 5.0% over the last 12 months

- The index for natural gas fell (3.2%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $3,158.60 per 40ft

- Drewry’s composite World Container Index has increased by 81.4% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in March after increasing 0.4% in February

- The rent index increased 0.5% in March after increasing 0.4% in February

- The index for lodging away from home increased 5.6% in March after increasing 3.1% in February

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel

- President Biden is withholding weapon deliveries to Israel after Israel launched an assault on the southern Gaza city of Rafah, where more than one million Palestinians are sheltering from the war

- Israel’s military is pressing deeper into the outskirts of Rafah after negotiations between Israel and Hamas about a cease-fire and hostage release hit another impasse

- Israel forces have not launched an all-out offensive yet but have moved into areas east of Rafah, including seizing the main border crossing to Egypt

- The U.S. is close to finishing a $320 million floating pier to receive aid for the Gaza Strip. The pier will enable up to 150 aid trucks to enter into Gaza each day

-

China

- In a new push to boost the Chinese economy, China’s leaders are resurrecting a policy familiar to many Americans from the 2008-09 financial crisis: cash for clunkers

- The trade-in program is a stimulus package aimed at lifting gross domestic product by allowing households to swap out old home appliances for new ones and for factories replace old equipment

- Officials hope the policy will encourage Chinese factories to expand and churn out more goods to boost GDP

-

Russia

- Russia launched armored attacks across the border in Ukraine’s northeast on Friday, opening a new front against Ukrainian forces that are struggling to hold the line as they wait for U.S. aid

- Attacks will force Ukraine to make hard choices on where to deploy troops with limited weaponry

- The U.S. recently restarted shipments following the passage last month of funding legislation, but significant deliveries will take time to reach Ukraine’s front-line troops

-

U.K.

- The U.K. central bank left its key rate unchanged at a 16-year high but indicated that it is on course to cut rates over the coming months and possibly as early as June

- Two of the nine members voted to lower the rate. A lowering of the interest rate could weaken the pound sterling against the U.S. dollar and push prices of imported goods and services higher

-

UK

- The U.K. government expelled a Russian diplomat it says was a spy. Additionally, it is removing diplomatic protection from several Russian government owned properties that it said was being used for intelligence gathering

-

Chad

- Chad’s state election body said interim Pesident Mahamat Idriss Derby had won the election with 61% of the vote. His opponent has also declared himself the winner, citing vote-rigging concerns.

-

France

- French President Emmanuel Macron is rekindling debate over whether France’s nuclear arsenal should play a role in deterring attacks against European allies, igniting criticism across the political spectrum from lawmakers who say any move to extend the country’s nuclear umbrella risks compromising a linchpin of national sovereignty

-

Germany

- German inflation held steady this month, adding to signs that price pressures have cooled sustainably in the eurozone’s most important economy. Consumer prices were on average 2.2% higher than in April of last year, the same rate booked in March, according to national-standard figures set out Monday by German statistics authority Destatis

-

Japan

- Japan has intervened to prop up the yen after it hit a multidecade low against the dollar. The currency has plummeted against the dollar this year, hurt by increasing doubts among traders about the timing of U.S. interest rate cuts

-

Finland

- Finland, sharing NATO’s longest border with Russia at 830 miles, has escalated its security measures, including constructing new fences and enhancing surveillance, in response to increased Russian aggression and hybrid warfare tactics

-

South Korea

- SK Hynix plans to invest an additional $14.6 billion to expand its semiconductor production capacity in South Korea, aiming to meet the increasing demand for artificial intelligence chips

-

Canada

- Honda is nearing a deal to build an electric vehicle assembly plant in Ontario, Canada, with the Canadian government agreeing to offset some of the capital costs through newly introduced tax breaks

Commodities

-

Oil Prices

- WTI: $78.37 per barrel

- +0.33% WoW; +9.38% YTD; +10.58% YoY

- Brent: $82.91 per barrel

- (0.06%) WoW; +7.62% YTD; +10.58% YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended May 3, down 0.1 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 603, down 2 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 459.5 million barrels, down (0.7%) YoY

- Refiners operated at a capacity utilization rate of 88.5% for the week, up from 87.5% in the prior week

- U.S. crude oil imports now amount to 6.772 million barrels per day, down 25.5% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.64 per gallon in the week of May 10,

up 2.7% YoY

- Gasoline prices on the East Coast amounted to $3.65, up 3.6% YoY

- Gasoline prices in the Midwest amounted to $3.47, up 0.2% YoY

- Gasoline prices on the Gulf Coast amounted to $3.34, up 6.6% YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.58, down (2.1%) YoY

- Gasoline prices on the West Coast amounted to $4.88, up 5.5% YoY

- Motor gasoline inventories were up by 0.9 million barrels from the prior week

- Motor gasoline inventories amounted to 228.0 million barrels, up 3.8% YoY

- Production of motor gasoline averaged 9.50 million bpd, down (3.3%) YoY

- Demand for motor gasoline amounted to 8.797 million bpd, down (5.4%) YoY

-

Distillates

- Distillate inventories decreased by 0.6 million in the week of May 10

- Total distillate inventories amounted to 116.4 million barrels, up 9.7% YoY

- Distillate production averaged 4.783 million bpd, up 3.8% YoY

- Demand for distillates averaged 3.489 million bpd in the week, down (13.5%) YoY

-

Natural Gas

- Natural gas inventories increased by 79 billion cubic feet last week

- Total natural gas inventories now amount to 2,563 billion cubic feet, up 19.7% YoY

Credit News

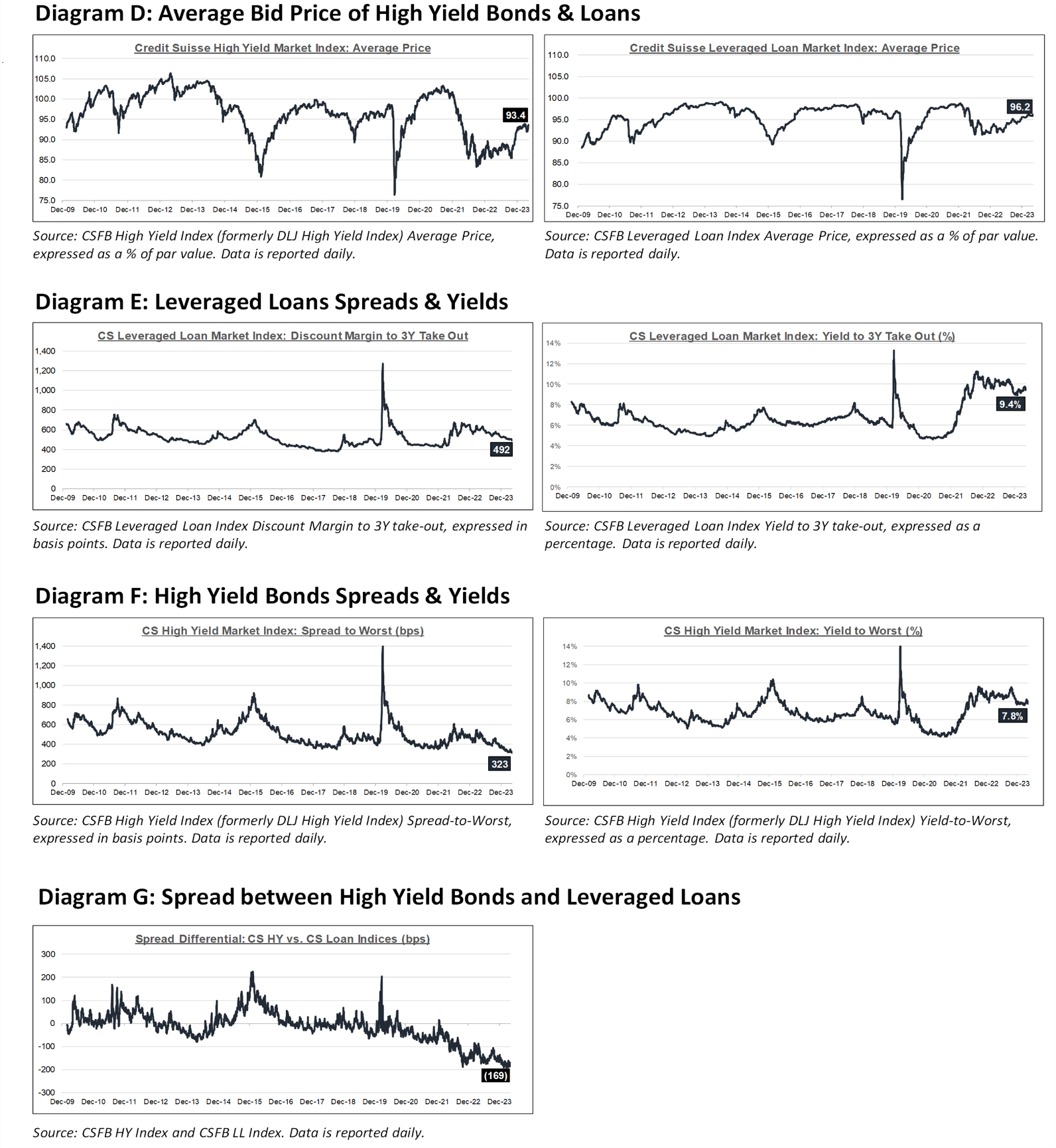

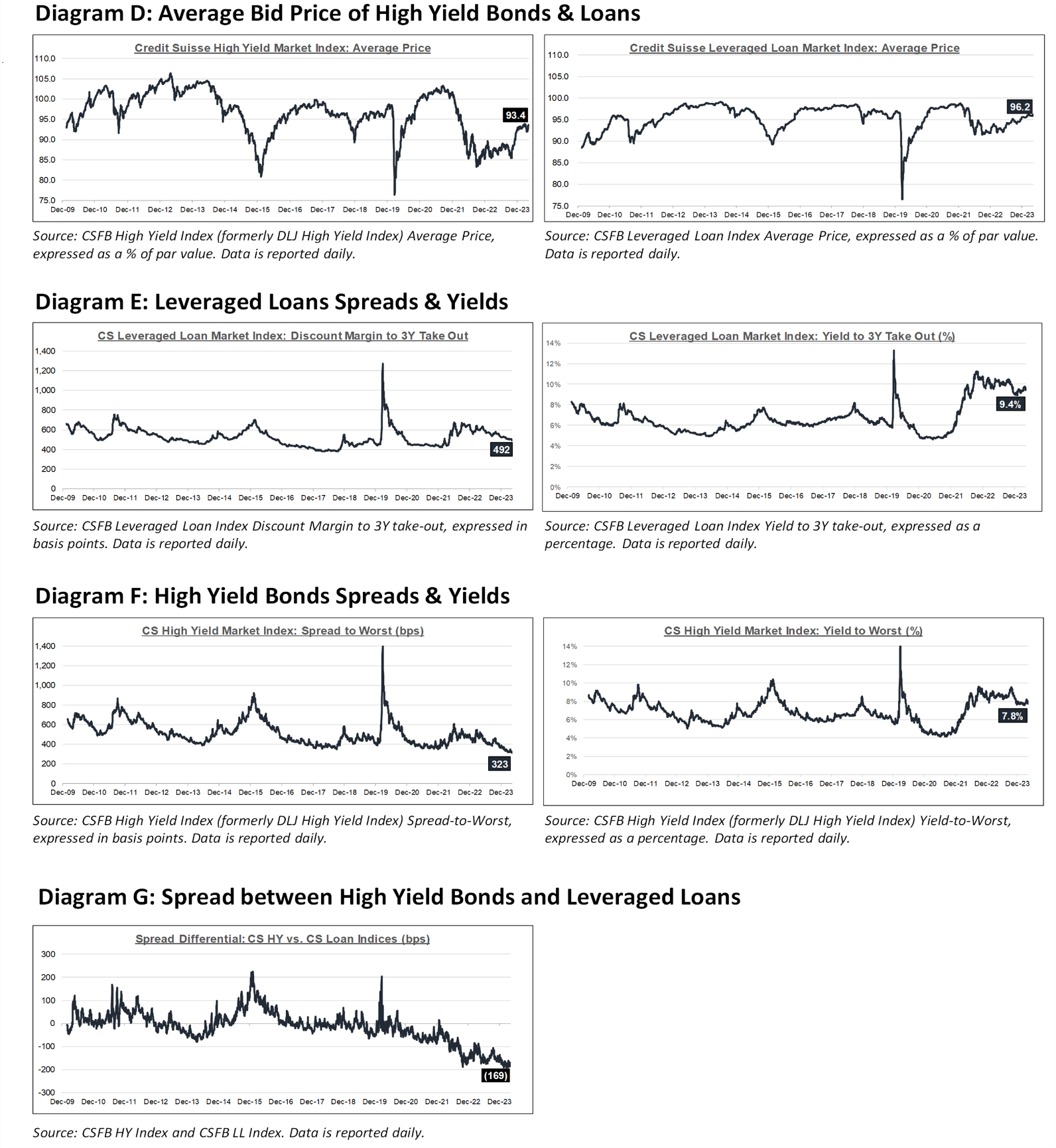

High yield bond yields decreased 12bps to 7.80% and spreads decreased 2bps to 323bps. Leveraged loan yields decreased 21bps to 9.41% and spreads decreased 9bps to 492bps. WTD Leveraged loan returns were positive 35bps. WTD high yield bond returns were positive 54bps. 10yr treasury yields decreased 12bps to 4.45%. For the week, yields and spreads tightened following last week’s less hawkish than expected FOMC meeting, softer payroll growth, this week’s rise in initial claims to a high since August, and one of the strongest earnings seasons in years continues.

High-yield:

Week ended 05/10/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 05/10/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: 99 Cents Only Stores ($350mn, 4/7/24), ConvergeOne ($1.3bn, 4/4/24), Xplornet Communications ($1.2bn, 3/31/24), JoAnn Stores ($658mn, 3/18/24), New Insight Holdings ($1.2bn, 3/13/24), Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), and Careismatic ($700mn, 1/22/24).

CLOs:

Week ended 05/10/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

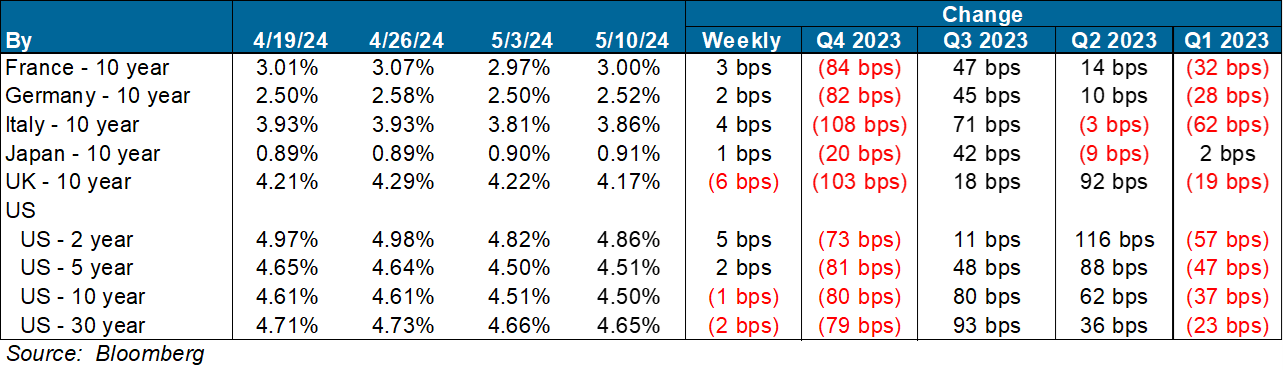

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: SOFR CURVE

ZCGC RE Research:

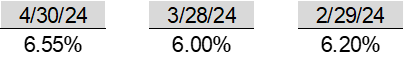

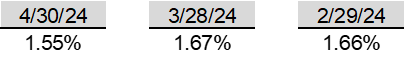

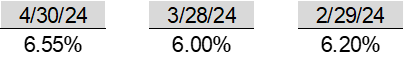

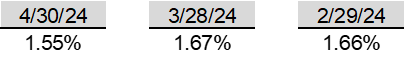

Section 1:

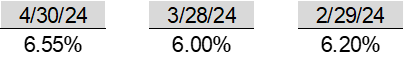

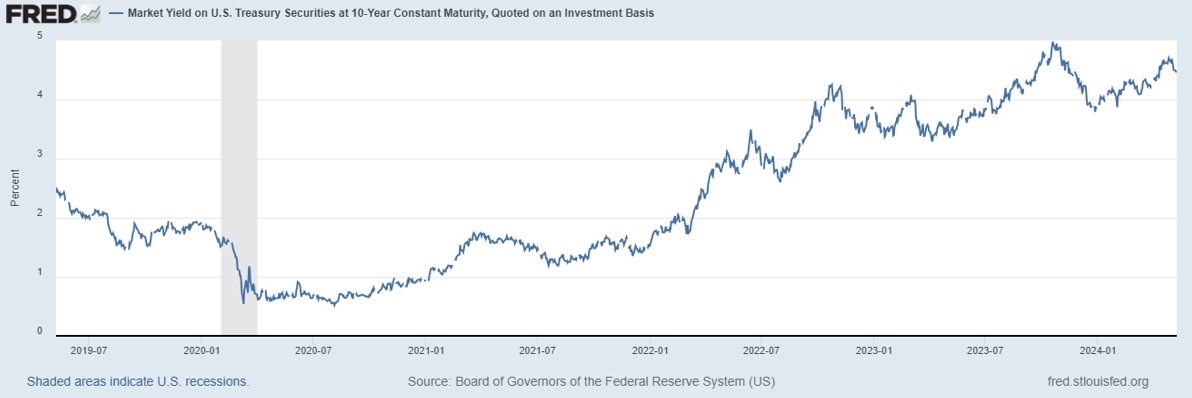

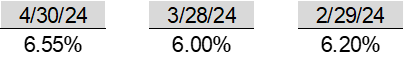

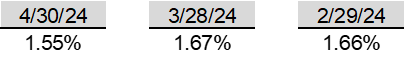

10-Year US Treasury

5/8/24: 4.48

30-Year Fixed Mortgage

5/9/24: 7.09

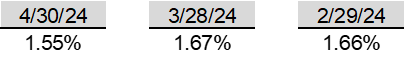

Section 2:

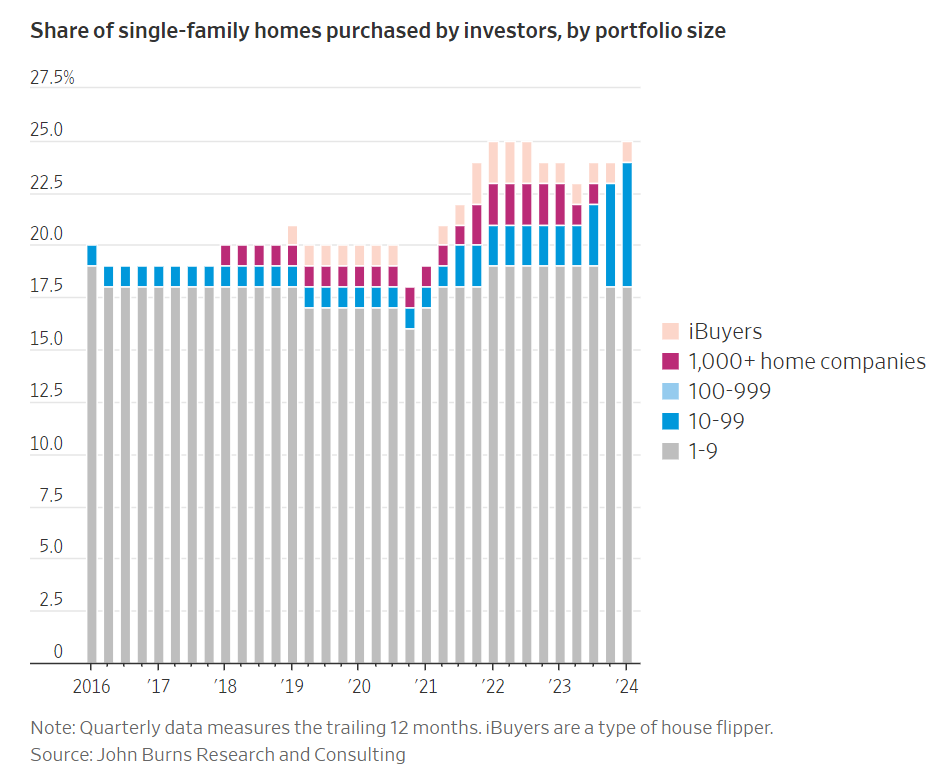

Institutional investors purchasing single family homes

- Investor purchases, often all-cash offers from Wall Street-backed firms, have intensified competition for first-time homebuyers.

- As shown in the above graph, during the pandemic, investors bought a significant number of homes, peaking in 2022 when they bought more than one in every four single-family homes sold.

- Despite a recent slowdown due to rising interest rates and limited supply, these investors still own 3% to 5% of U.S. rental properties.

- As home prices and rents approach record levels, U.S. legislators and officials at all levels of government are increasingly addressing housing issues.

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index