U.S. News

- Consumer Credit

- Total consumer credit rose $23.7 billion in November, up from a $5.8 billion increase in the prior month. Total consumer credit is above $5 trillion for the first time ever.

- Revolving credit, like credit cards, rose sharply at a 17.7% rate after a 2.7% gain in the prior month. That was the biggest gain since March 2022.

- Nonrevolving credit, typically auto and student loans, rose at a 1.5% rate after a 0.9% rise in the prior month.

- U.S. Trade Deficit

- The U.S. trade deficit narrowed 2% to $63.2 billion in November after a decline in imports, in a potential lift to gross domestic product in the fourth quarter.

- Both imports and exports decreased by 1.9%.

- The U.S. trade deficit in 2023 is likely to be the smallest in three years.

- Consumer Price Index

- The rate of inflation moved up to 3.4% in December from 3.1% in the prior month.

- The annual rate of core inflation ticked down to 3.9% from 4% in the prior month. That’s the first time the rate has dropped below 4% since the middle of 2021.

- Americans paid more for rent, auto insurance and dentist visits in December, but less for furniture, toys, and sporting goods.

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 202,000 in the week ended January 5, down 1,000 from the prior week

- The four-week moving average was 207,750, down 250 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – decreased by 34,000 to 1.834 million in the week ended December 29. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.687 trillion in the week ended January 12, up $5.7 billion from the prior week

- Treasury holdings totaled $4.752 trillion, down $24.3 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.43 trillion in the week, down $8.4 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.06 trillion as of January 12, an increase of 8.5% from the previous year

- Debt held by the public was $24.51 trillion, and intragovernmental holdings were $7.06 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.4% in December year over year

- On a monthly basis, the CPI increased 0.3% in December on a seasonally adjusted basis, after increasing 0.1% in November

- The index for all items less food and energy (core CPI) rose 0.3% in December, after rising 0.3% in November

- Core CPI increased 3.9% for the 12 months ending December

- Food and Beverages:

- The food at home index increased 1.3% i n December from the same month a year earlier, and increased 0.1% in December month over month

- The food away from home index increased 5.2% in December from the same month a year earlier, and increased 0.3% in December month over month

- Commodities:

- The energy commodities index decreased (0.1%) in December after decreasing (5.8%)

- The energy commodities index fell (2.9%) over the last 12 months

- The energy services index 0.4% in December after increasing (0.7%) in November

- The energy services index fell (1.1%) over the last 12 months

- The gasoline index fell (1.9%) over the last 12 months

- The fuel oil index fell (14.7%) over the last 12 months

- The index for electricity rose 3.3% over the last 12 months

- The index for natural gas fell (13.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $3,072.37 per 40ft container

- Drewry’s composite World Container Index has increased by 44.1% over the last 12 months

- Housing Market:

- The shelter index increased 0.5% in December after increasing 0.4% in November

- The rent index increased 0.4% in December after increasing 0.3% in November

- The index for lodging away from home decreased (1.1%) in December after decreasing (4.5%) in November

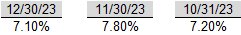

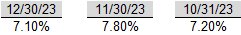

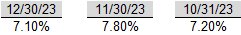

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel/Middle East

- The U.S.-led coalition has launched strikes on multiple Houthi rebel targets in Yemen, including the capital, Sanaa. The strikes come after repeated Houthi attacks on Red Sea shipping.

- The UN has called for a cease-fire in Gaza as conditions deteriorate.

- South Africa has brought a case against Israel, accusing it of genocide in Gaza, which is being heard at the International Court of Justice

- Suspected Israeli drone strike kills a senior Hezbollah commander in southern Lebanon, escalating tensions.

-

Iran

- Iran’s navy has seized an oil tanker in the Gulf of Oman that was at the center of a major crisis between Tehran and Washington.

- The Islamic State group has claimed responsibility for two suicide bombings that killed at least 84 people. The bombings target a commemoration for an Iranian general killed by a U.S. drone strike in 2020.

- In response to these attacks, over 35 individuals have been arrested across several Iranian provinces for alleged links to the bombings.

- Iran-backed militants have targeted U.S. troops at a base in Syria’s Conoco gas field.

-

Russia

- Russia and Ukraine have exchanged hundreds of prisoners of war in the biggest single release since Russia’s full-scale invasion in February 2022.

- Polish Prime Minister Donald Tusk announced his intention to visit Kyiv in the coming days.

- UK Prime Minister Rishi Sunak visited Kyiv, announcing 2.5 billion pounds ($3.2 billion) in military aid for Ukraine for 2024-25, an increase of £200 million on the previous two years.

- The World Bank forecasts Russia’s GDP to grow by 1.3% in 2024, a slowdown compared to the 2.6% growth in 2023.

-

China

- In talks with US military officials, China reiterated its firm stance on Taiwan, stating it will never compromise on the issue.

- China has sanctioned five US arms manufacturers over Taiwan’s weapons sales. This comes after the US approved $300 million in military aid for Taiwan.

- US and Chinese officials met this week at the Pentagon to discuss relations between the two countries.

- The People’s Bank of China is expected to lower the rate on its one-year policy loans — called the medium-term lending facility — by 10 basis points to 2.4%.

-

Argentina

- Argentines long battered by galloping inflation were hit even harder in December as food, fuel and drug prices skyrocketed during President Javier Milei’s first month in office as he embarked on pro-market shock therapy to revive an economy in shambles.

-

Canada

- Armed with a multibillion-dollar war chest, Canada is offering money to cities to ditch zoning restrictions that thwart residential construction as the country deals with an acute housing shortage.

-

South Korea

- South Korea’s opposition party leader was stabbed in the neck in an attack that left him hospitalized in an incentive care unit.

-

North Korea

- North Korea has fired more than 200 rounds of artillery shells of its west coast, towards the South Korea’s Yeonpyeong Island, Seoul’s military has said.

-

Indonesia

- At a Chinese nickel smelter in Indonesia, workers were undertaking routine maintenance at dawn when a massive explosion rocked the facility. Waste from a furnace had flowed out and hit flammable material, resulting in the deaths of at least 19 workers and injuring dozens more as hot steam hissed out and fire ripped through the building.

-

India

- India’s Supreme Court on Monday upheld one of the most controversial decisions of Prime Minister Narendra Modi’s government, the 2019 move to scrap the autonomy accorded to the disputed Himalayan state of Jammu and Kashmir.

-

Czech Republic

- At least 14 people were killed and dozens more were injured in a mass shooting at a university in central Prague. The shooter was a student at the school, Charles University, according to a spokesman from the Czech Ministry of the Interior

-

Czech Republic

- At least 14 people were killed and dozens more were injured in a mass shooting at a university in central Prague. The shooter was a student at the school, Charles University, according to a spokesman from the Czech Ministry of the Interior

Commodities

-

Oil Prices

- WTI: $72.68 per barrel

- (1.53%) WoW; 1.44% YTD; (7.28%) YoY

- Brent: $78.29 per barrel

- (0.60%) WoW; 1.62% YTD; (6.83%) YoY

-

US Production

- U.S. oil production amounted to 13.2 million bpd for the week ended January 5, down 0.1 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 619, down 2 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 432.4 million barrels, down (1.6%) YoY

- Refiners operated at a capacity utilization rate of 92.9% for the week, down from 93.5% in the prior week

- U.S. crude oil imports now amount to 6.895 million barrels per day, down (1.7%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.07 per gallon in the week of January 12,

down (6.5%) YoY

- Gasoline prices on the East Coast amounted to $3.19, down (4.0%) YoY

- Gasoline prices in the Midwest amounted to $2.84, down (11.5%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.77, down (6.9%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $2.88, down (11.0%) YoY

- Gasoline prices on the West Coast amounted to $4.21, up 3.1% YoY

- Motor gasoline inventories were up by 8.0 million barrels from the prior week

- Motor gasoline inventories amounted to 245.0 million barrels, up 8.0% YoY

- Production of motor gasoline averaged 9.66 million bpd, up 13.2% YoY

- Demand for motor gasoline amounted to 8.325 million bpd, up 10.1% YoY

-

Distillates

- Distillate inventories decreased by 6.5 million in the week of January 12

- Total distillate inventories amounted to 132.4 million barrels, up 12.5% YoY

- Distillate production averaged 5.167 million bpd, up 13.7% YoY

- Demand for distillates averaged 3.432 million bpd in the week, down (10.2%) YoY

-

Natural Gas

- Natural gas inventories decreased by 140 billion cubic feet last week

- Total natural gas inventories now amount to 3,336 billion cubic feet, up 15.0% YoY

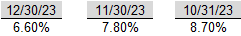

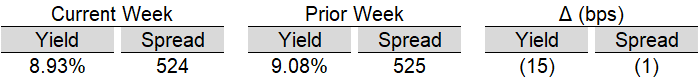

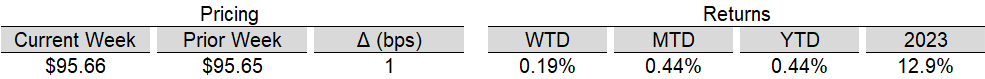

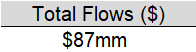

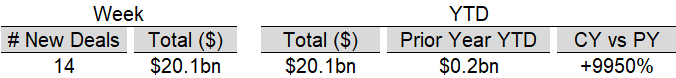

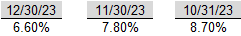

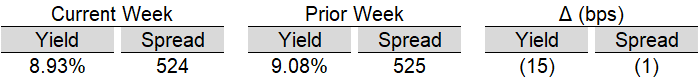

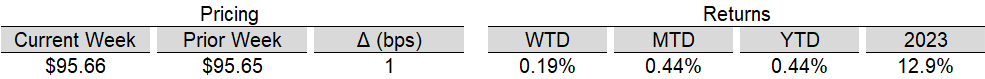

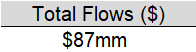

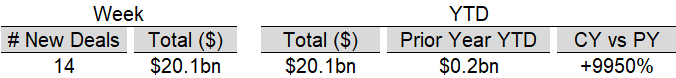

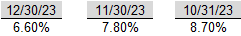

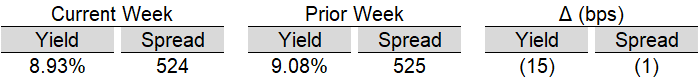

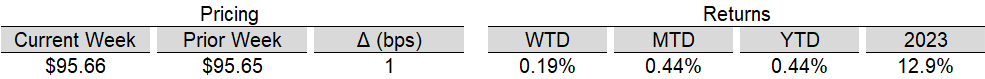

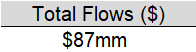

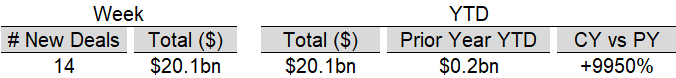

Credit News

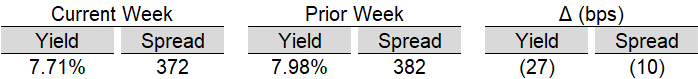

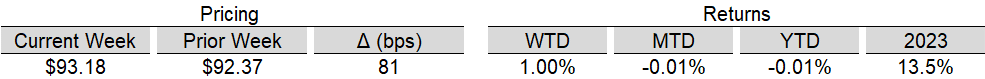

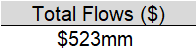

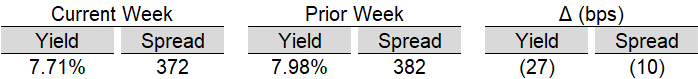

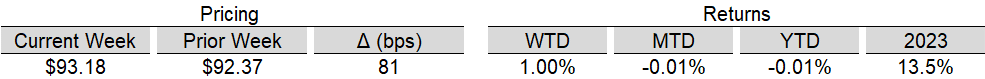

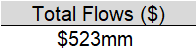

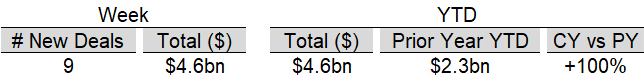

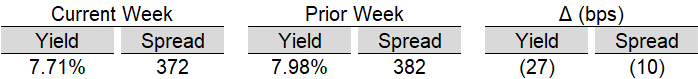

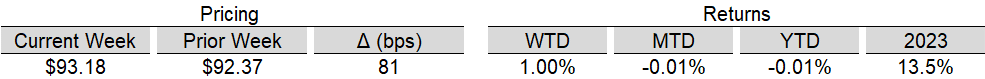

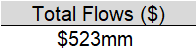

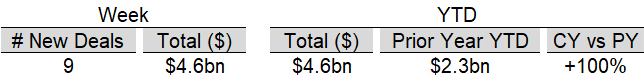

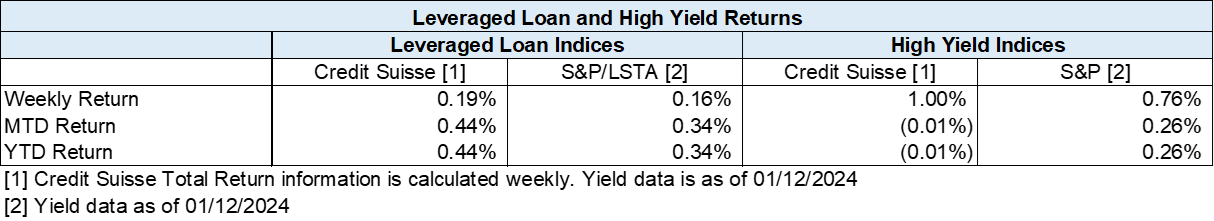

High yield bond yields decreased 27bps to 7.71% and spreads tightened 10bps to 382bps. Leveraged loan yields decreased 15bps to 8.93% and spreads tightened 1bps to 524bps. WTD Leveraged loan returns were positive 19bps. WTD high yield bond returns were positive 100bps. Markets recouped the bulk of the prior week’s spread widening as investors debate the timing of the Fed’s first policy ease. 10yr treasury yields decreased 11bps during the week supporting fixed rate bonds.

High-yield:

Week ended 1/12/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

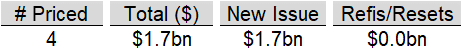

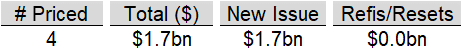

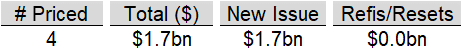

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 1/12/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Ligado Networks ($4.2bn, 11/1/23), Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23)

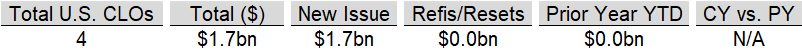

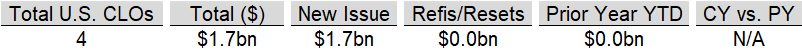

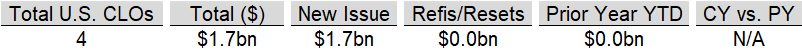

CLOs:

Week ended 1/12/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

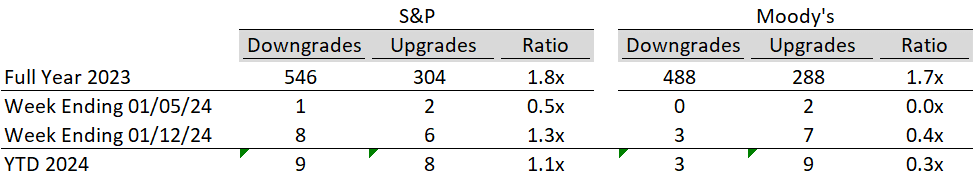

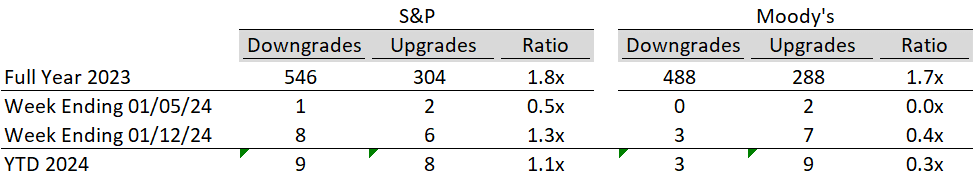

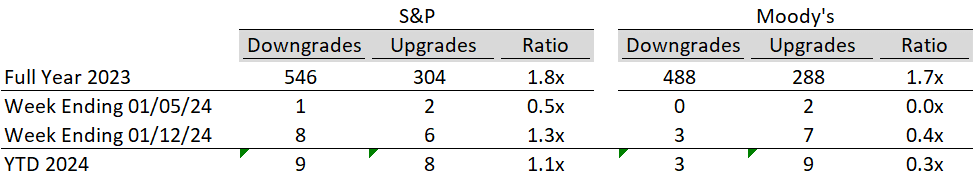

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

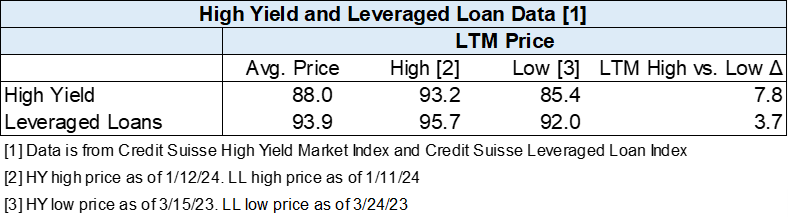

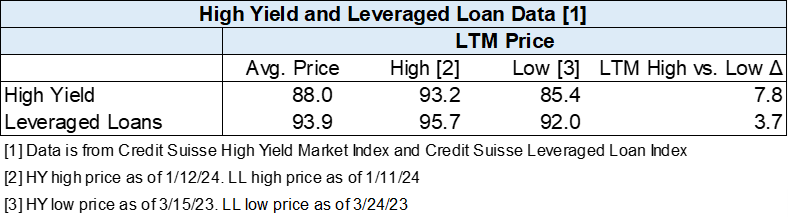

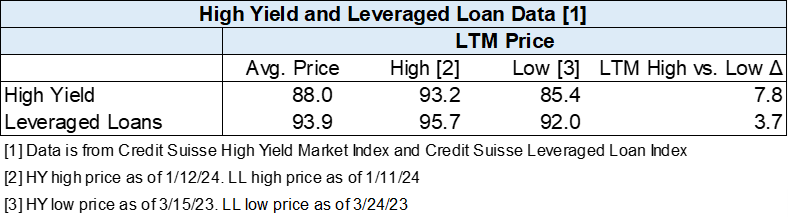

Diagram B: High Yield and Leveraged Loan LTM Price

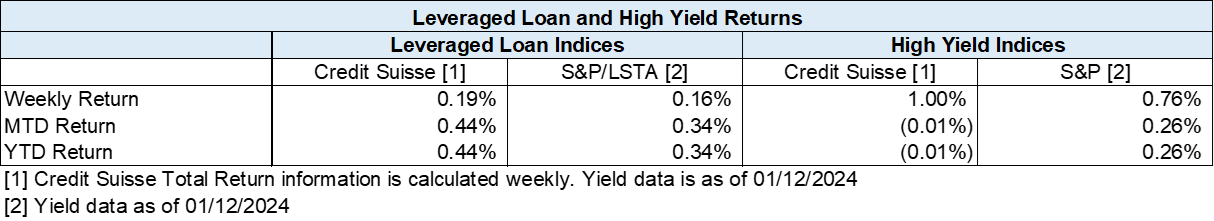

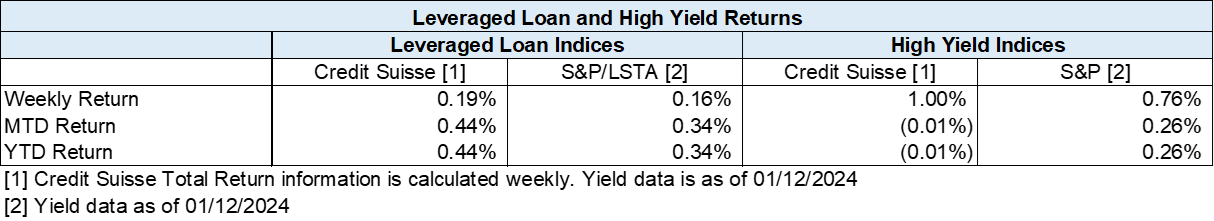

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

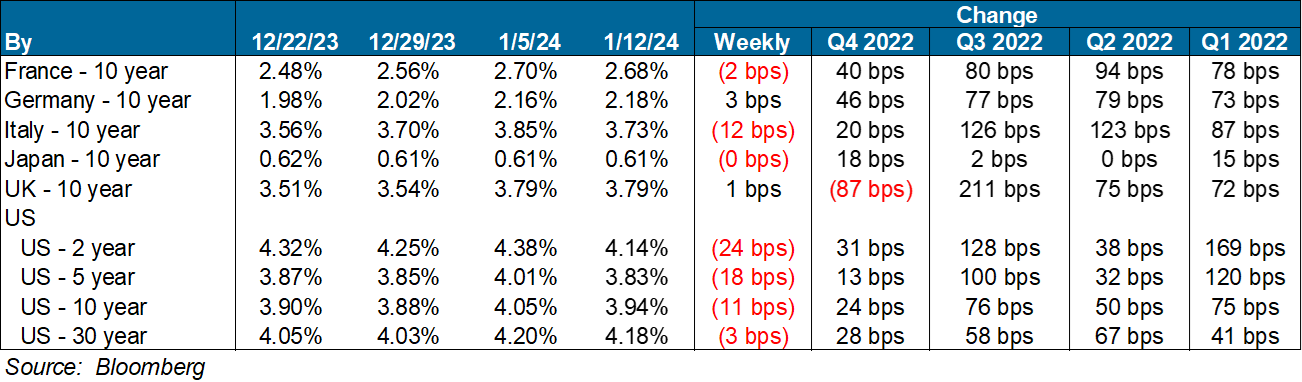

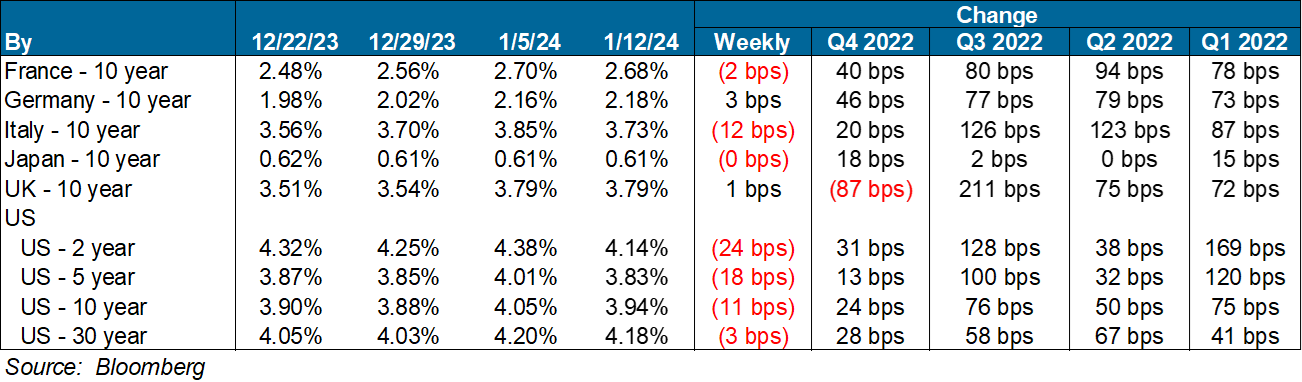

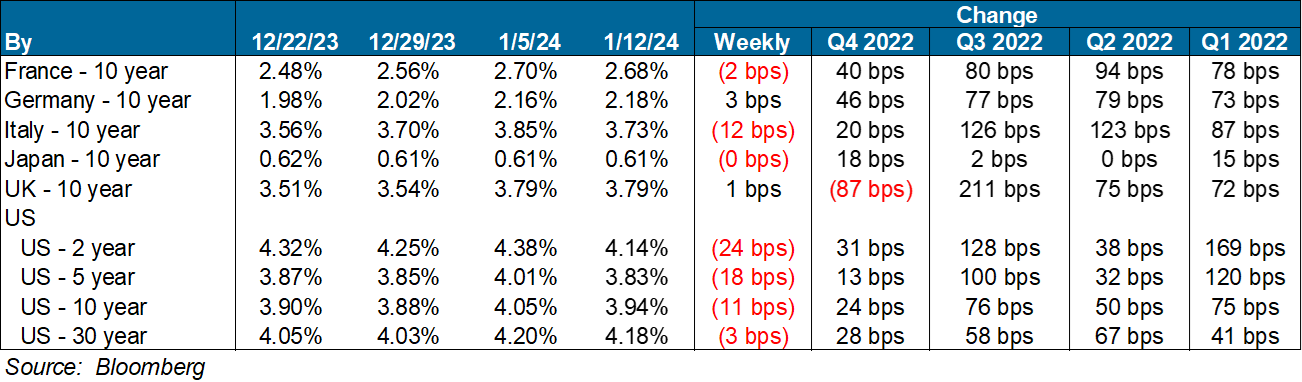

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

Real Estate Views & Trends:

U.S. News

- Consumer Credit

- Total consumer credit rose $23.7 billion in November, up from a $5.8 billion increase in the prior month. Total consumer credit is above $5 trillion for the first time ever.

- Revolving credit, like credit cards, rose sharply at a 17.7% rate after a 2.7% gain in the prior month. That was the biggest gain since March 2022.

- Nonrevolving credit, typically auto and student loans, rose at a 1.5% rate after a 0.9% rise in the prior month.

- U.S. Trade Deficit

- The U.S. trade deficit narrowed 2% to $63.2 billion in November after a decline in imports, in a potential lift to gross domestic product in the fourth quarter.

- Both imports and exports decreased by 1.9%.

- The U.S. trade deficit in 2023 is likely to be the smallest in three years.

- Consumer Price Index

- The rate of inflation moved up to 3.4% in December from 3.1% in the prior month.

- The annual rate of core inflation ticked down to 3.9% from 4% in the prior month. That’s the first time the rate has dropped below 4% since the middle of 2021.

- Americans paid more for rent, auto insurance and dentist visits in December, but less for furniture, toys, and sporting goods.

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 202,000 in the week ended January 5, down 1,000 from the prior week

- The four-week moving average was 207,750, down 250 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – decreased by 34,000 to 1.834 million in the week ended December 29. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.687 trillion in the week ended January 12, up $5.7 billion from the prior week

- Treasury holdings totaled $4.752 trillion, down $24.3 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.43 trillion in the week, down $8.4 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.06 trillion as of January 12, an increase of 8.5% from the previous year

- Debt held by the public was $24.51 trillion, and intragovernmental holdings were $7.06 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.4% in December year over year

- On a monthly basis, the CPI increased 0.3% in December on a seasonally adjusted basis, after increasing 0.1% in November

- The index for all items less food and energy (core CPI) rose 0.3% in December, after rising 0.3% in November

- Core CPI increased 3.9% for the 12 months ending December

- Food and Beverages:

- The food at home index increased 1.3% i n December from the same month a year earlier, and increased 0.1% in December month over month

- The food away from home index increased 5.2% in December from the same month a year earlier, and increased 0.3% in December month over month

- Commodities:

- The energy commodities index decreased (0.1%) in December after decreasing (5.8%)

- The energy commodities index fell (2.9%) over the last 12 months

- The energy services index 0.4% in December after increasing (0.7%) in November

- The energy services index fell (1.1%) over the last 12 months

- The gasoline index fell (1.9%) over the last 12 months

- The fuel oil index fell (14.7%) over the last 12 months

- The index for electricity rose 3.3% over the last 12 months

- The index for natural gas fell (13.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $3,072.37 per 40ft container

- Drewry’s composite World Container Index has increased by 44.1% over the last 12 months

- Housing Market:

- The shelter index increased 0.5% in December after increasing 0.4% in November

- The rent index increased 0.4% in December after increasing 0.3% in November

- The index for lodging away from home decreased (1.1%) in December after decreasing (4.5%) in November

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel/Middle East

- The U.S.-led coalition has launched strikes on multiple Houthi rebel targets in Yemen, including the capital, Sanaa. The strikes come after repeated Houthi attacks on Red Sea shipping.

- The UN has called for a cease-fire in Gaza as conditions deteriorate.

- South Africa has brought a case against Israel, accusing it of genocide in Gaza, which is being heard at the International Court of Justice

- Suspected Israeli drone strike kills a senior Hezbollah commander in southern Lebanon, escalating tensions.

-

Iran

- Iran’s navy has seized an oil tanker in the Gulf of Oman that was at the center of a major crisis between Tehran and Washington.

- The Islamic State group has claimed responsibility for two suicide bombings that killed at least 84 people. The bombings target a commemoration for an Iranian general killed by a U.S. drone strike in 2020.

- In response to these attacks, over 35 individuals have been arrested across several Iranian provinces for alleged links to the bombings.

- Iran-backed militants have targeted U.S. troops at a base in Syria’s Conoco gas field.

-

Russia

- Russia and Ukraine have exchanged hundreds of prisoners of war in the biggest single release since Russia’s full-scale invasion in February 2022.

- Polish Prime Minister Donald Tusk announced his intention to visit Kyiv in the coming days.

- UK Prime Minister Rishi Sunak visited Kyiv, announcing 2.5 billion pounds ($3.2 billion) in military aid for Ukraine for 2024-25, an increase of £200 million on the previous two years.

- The World Bank forecasts Russia’s GDP to grow by 1.3% in 2024, a slowdown compared to the 2.6% growth in 2023.

-

China

- In talks with US military officials, China reiterated its firm stance on Taiwan, stating it will never compromise on the issue.

- China has sanctioned five US arms manufacturers over Taiwan’s weapons sales. This comes after the US approved $300 million in military aid for Taiwan.

- US and Chinese officials met this week at the Pentagon to discuss relations between the two countries.

- The People’s Bank of China is expected to lower the rate on its one-year policy loans — called the medium-term lending facility — by 10 basis points to 2.4%.

-

Argentina

- Argentines long battered by galloping inflation were hit even harder in December as food, fuel and drug prices skyrocketed during President Javier Milei’s first month in office as he embarked on pro-market shock therapy to revive an economy in shambles.

-

Canada

- Armed with a multibillion-dollar war chest, Canada is offering money to cities to ditch zoning restrictions that thwart residential construction as the country deals with an acute housing shortage.

-

South Korea

- South Korea’s opposition party leader was stabbed in the neck in an attack that left him hospitalized in an incentive care unit.

-

North Korea

- North Korea has fired more than 200 rounds of artillery shells of its west coast, towards the South Korea’s Yeonpyeong Island, Seoul’s military has said.

-

Indonesia

- At a Chinese nickel smelter in Indonesia, workers were undertaking routine maintenance at dawn when a massive explosion rocked the facility. Waste from a furnace had flowed out and hit flammable material, resulting in the deaths of at least 19 workers and injuring dozens more as hot steam hissed out and fire ripped through the building.

-

India

- India’s Supreme Court on Monday upheld one of the most controversial decisions of Prime Minister Narendra Modi’s government, the 2019 move to scrap the autonomy accorded to the disputed Himalayan state of Jammu and Kashmir.

-

Czech Republic

- At least 14 people were killed and dozens more were injured in a mass shooting at a university in central Prague. The shooter was a student at the school, Charles University, according to a spokesman from the Czech Ministry of the Interior

-

Czech Republic

- At least 14 people were killed and dozens more were injured in a mass shooting at a university in central Prague. The shooter was a student at the school, Charles University, according to a spokesman from the Czech Ministry of the Interior

Commodities

-

Oil Prices

- WTI: $72.68 per barrel

- (1.53%) WoW; 1.44% YTD; (7.28%) YoY

- Brent: $78.29 per barrel

- (0.60%) WoW; 1.62% YTD; (6.83%) YoY

-

US Production

- U.S. oil production amounted to 13.2 million bpd for the week ended January 5, down 0.1 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 619, down 2 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 432.4 million barrels, down (1.6%) YoY

- Refiners operated at a capacity utilization rate of 92.9% for the week, down from 93.5% in the prior week

- U.S. crude oil imports now amount to 6.895 million barrels per day, down (1.7%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.07 per gallon in the week of January 12,

down (6.5%) YoY

- Gasoline prices on the East Coast amounted to $3.19, down (4.0%) YoY

- Gasoline prices in the Midwest amounted to $2.84, down (11.5%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.77, down (6.9%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $2.88, down (11.0%) YoY

- Gasoline prices on the West Coast amounted to $4.21, up 3.1% YoY

- Motor gasoline inventories were up by 8.0 million barrels from the prior week

- Motor gasoline inventories amounted to 245.0 million barrels, up 8.0% YoY

- Production of motor gasoline averaged 9.66 million bpd, up 13.2% YoY

- Demand for motor gasoline amounted to 8.325 million bpd, up 10.1% YoY

-

Distillates

- Distillate inventories decreased by 6.5 million in the week of January 12

- Total distillate inventories amounted to 132.4 million barrels, up 12.5% YoY

- Distillate production averaged 5.167 million bpd, up 13.7% YoY

- Demand for distillates averaged 3.432 million bpd in the week, down (10.2%) YoY

-

Natural Gas

- Natural gas inventories decreased by 140 billion cubic feet last week

- Total natural gas inventories now amount to 3,336 billion cubic feet, up 15.0% YoY

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

Real Estate Views & Trends: