U.S. News

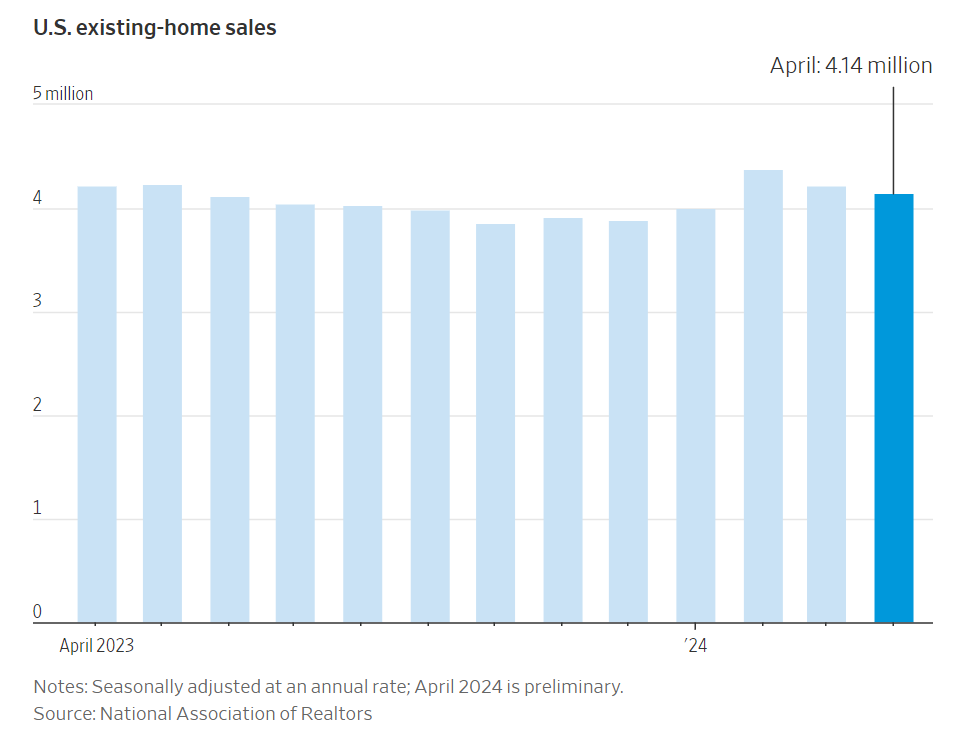

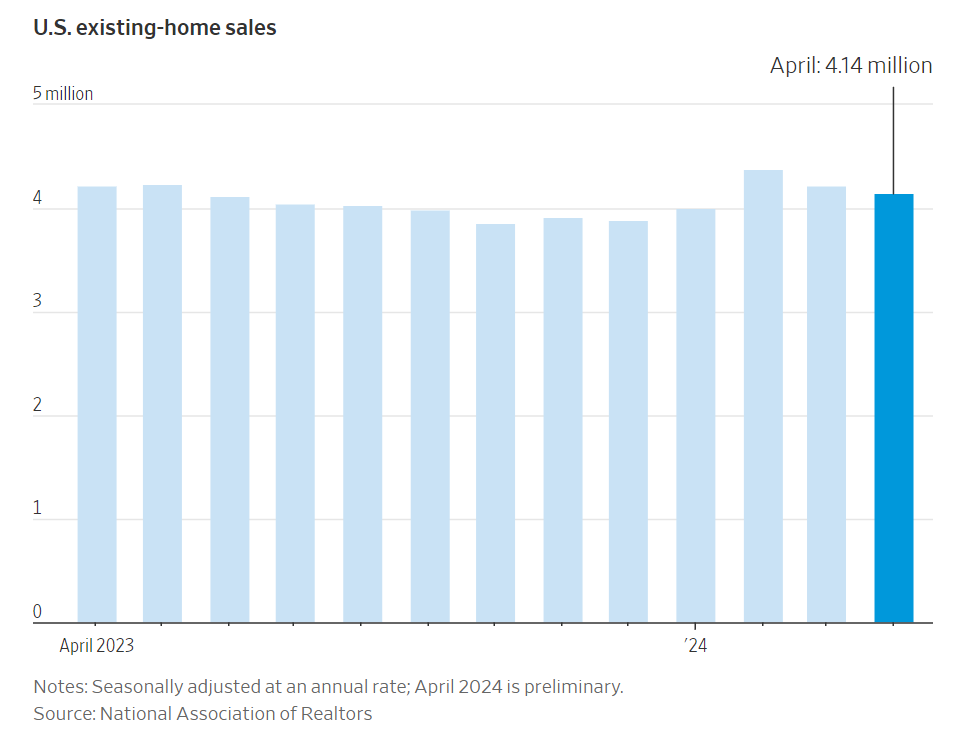

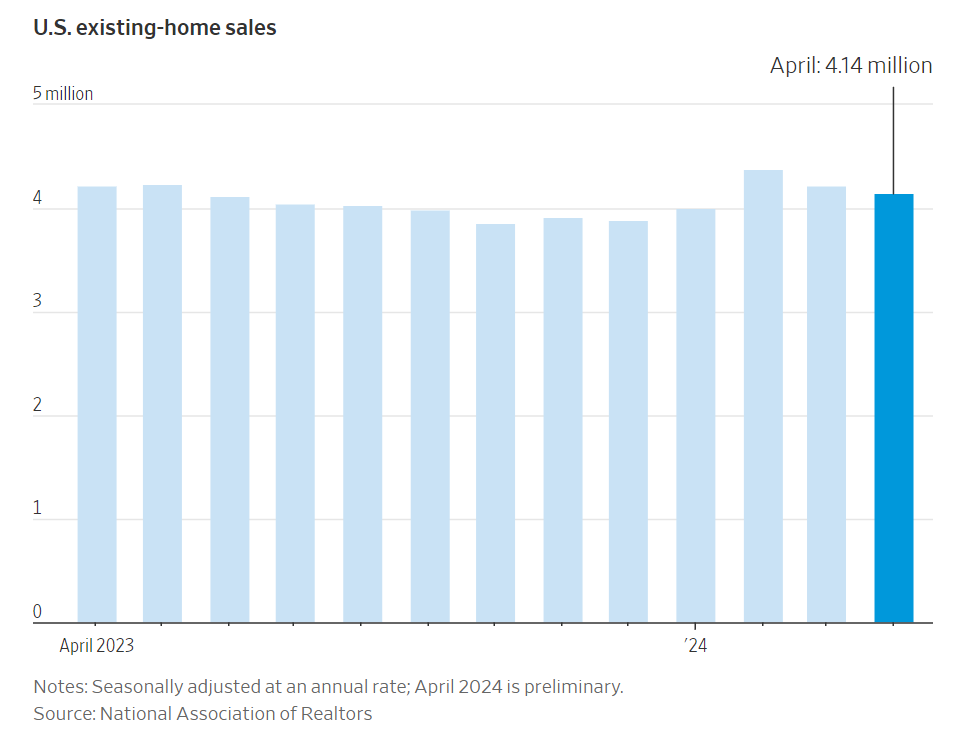

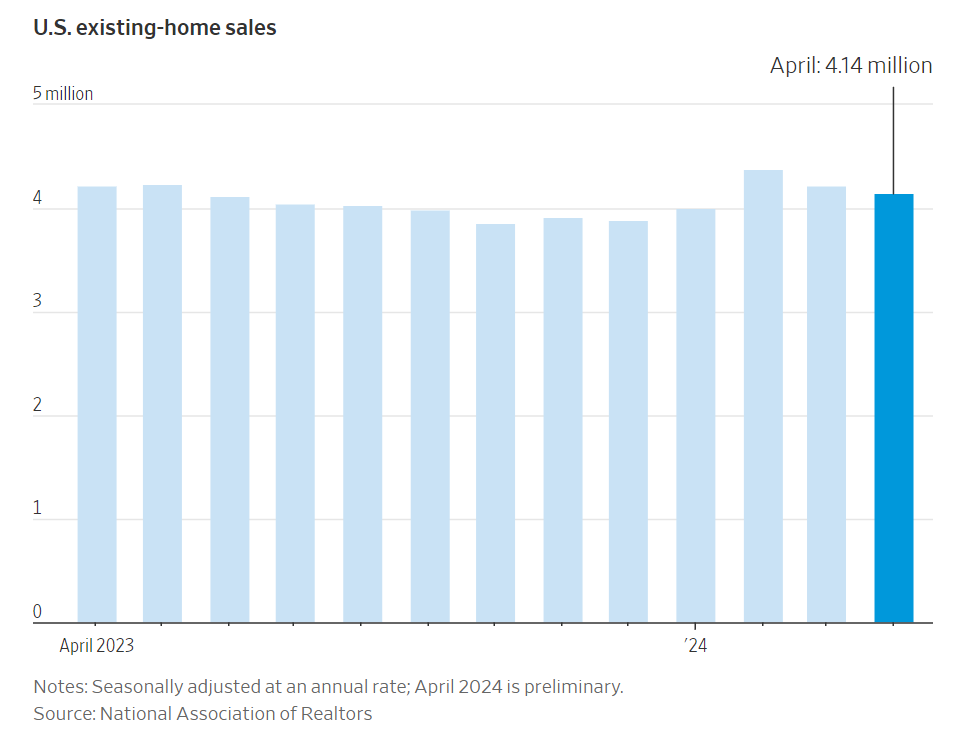

- Existing Home Sales

- Sales of previously owned homes fell by 1.9% to an annual rate of 4.14 million in April as home buyers struggled with an expensive housing market

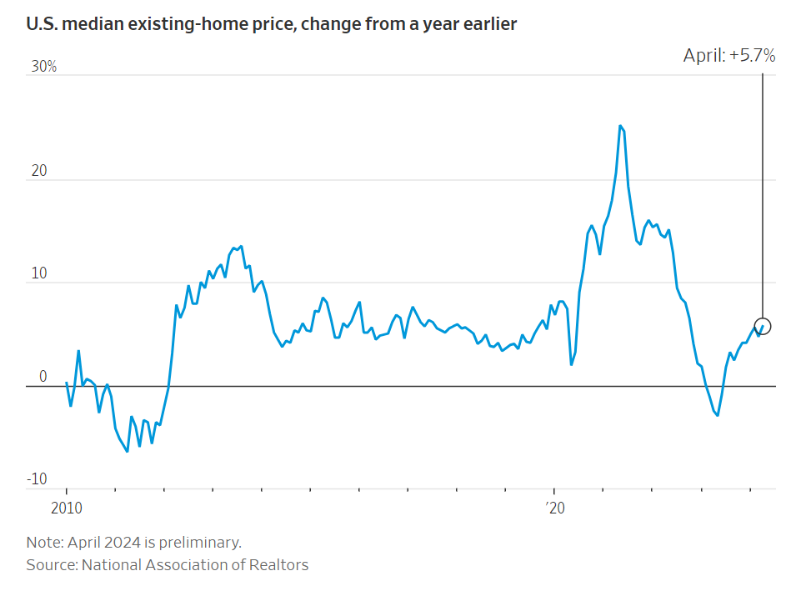

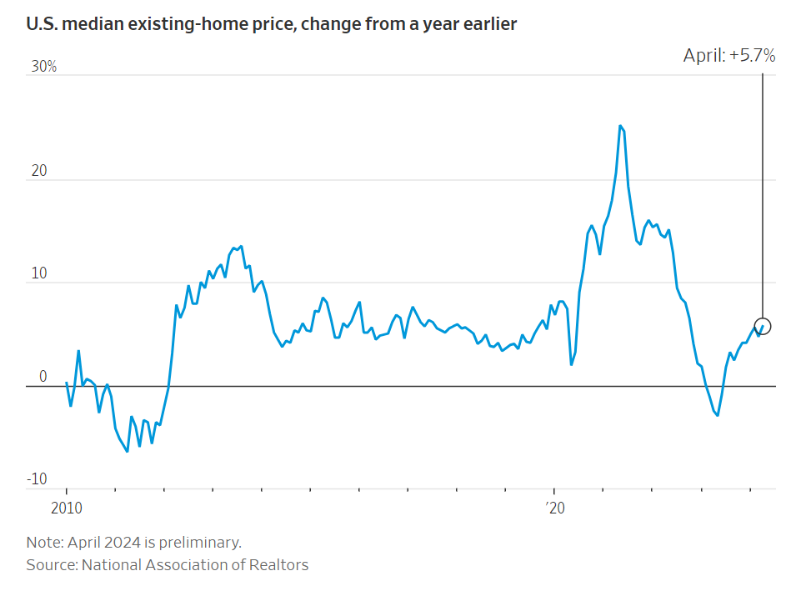

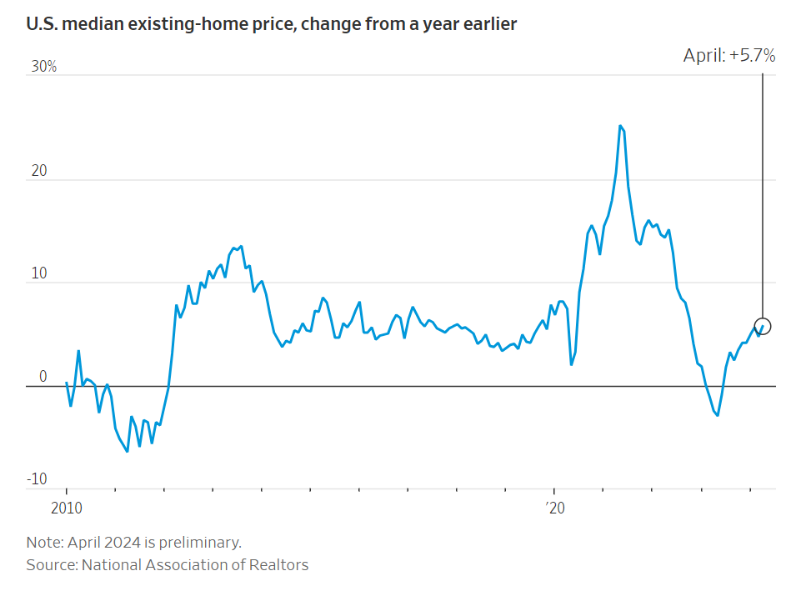

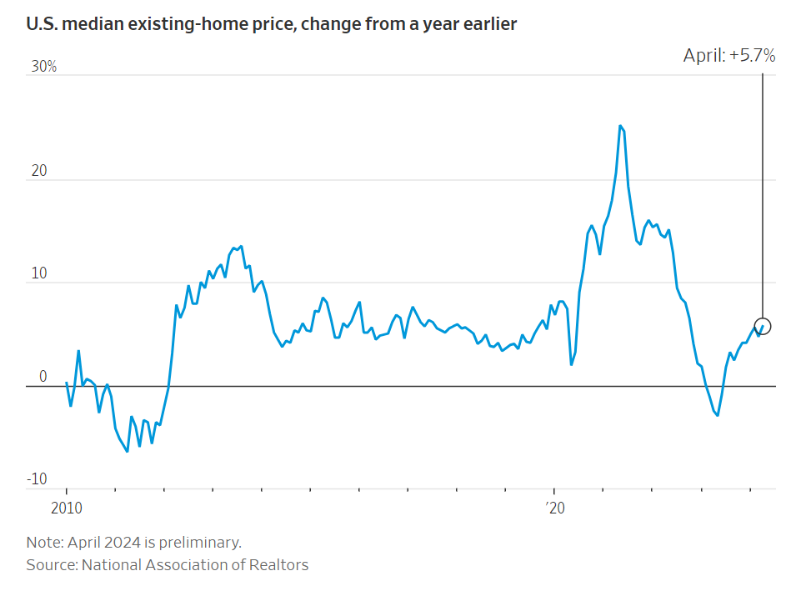

- The median price for an existing home in April rose 5.7% to $407,600, as compared with the year before

- The jump in home prices was the biggest since October 2022. Prices are still down from a peak in June 2022, when the median price of a resale home hit $413,800

- Consumer Sentiment

- The consumer sentiment index for the U.S. was 69.1 in May 2024, the lowest reading in six months

- The plunge in sentiment in May indicates that high prices, elevated interest rates, and concerns about the road ahead are weighing on consumers minds

- Consumers expressed particular concern over labor markets; they expect unemployment rates to rise and income growth to slow

- Purchasing Managers Index

- The US Purchasing Managers Index rose to 50.9 in May 2024, up from 50 in April

- The reading signaled an overall modest improvement in business conditions in the manufacturing sector, as both output and employment made positive contributions

- On the price front, manufacturers showed the largest cost rise in one-and-a-half years amid reports of higher supplier prices for a wide variety of inputs

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 215,000 in the week ended May 17, down 8,000 from the prior week

- The four-week moving average was 219,750, up 1,750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 8,000 to 1.794 million in the week ended May 10. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.300 trillion in the week ended May 24, down $4.7 billion from the prior week

- Treasury holdings totaled $4.489 trillion, down $26.1 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.37 trillion in the week, down $1.7 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.58 trillion as of May 24, an increase of 9.9% from the previous year

- Debt held by the public was $24.63 trillion, and intragovernmental holdings were $7.14 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.4% in April year over year

- On a monthly basis, the CPI increased 0.3% in April on a seasonally adjusted basis, after increasing 0.4% in March

- The index for all items less food and energy (core CPI) rose 0.3% in April, after rising 0.4% in March

- Core CPI increased 3.6% for the 12 months ending April

- Food and Beverages:

- The food at home index increased 1.1% in April from the same month a year earlier, and decreased -0.2% in April month over month

- The food away from home index increased 4.1% in April from the same month a year earlier, and increased 0.3% in April month over month

- Commodities:

- The energy commodities index increased 2.7% in April after increasing 1.5%

- The energy commodities index fell 1.1% over the last 12 months

- The energy services index (1.3%) in March after increasing (0.0%) in March

- The energy services index rose 3.6% over the last 12 months

- The gasoline index rose 1.2% over the last 12 months

- The fuel oil index fell (0.8%) over the last 12 months

- The index for electricity rose 5.1% over the last 12 months

- The index for natural gas fell (1.9%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $4,072.28 per 40ft

- Drewry’s composite World Container Index has increased by 141.6% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in April after increasing 0.4% in March

- The rent index increased 0.4% in April after increasing 0.5% in March

- The index for lodging away from home increased 0.9% in April after increasing 5.6% in March

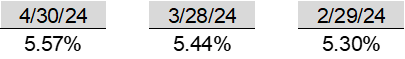

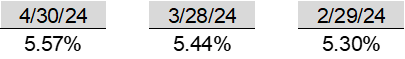

- Federal Funds Rate

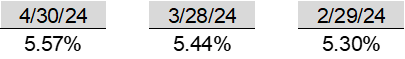

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Iran

- Western officials say they are braced for a period of increased volatility with Iran as the country prepares to choose a successor to President Ebrahim Raisi, who died in a helicopter crash two weekends ago. But they said they don’t expect Tehran to make major foreign-policy shifts

- Iran, where ultimate authority lies with Supreme Leader Ayatollah Ali Khamenei, is likely to stay on its current trajectory, deepening ties with China and Russia, supporting Hamas and other regional militias and pursuing its nuclear program, officials in Washington and European capitals said

- The coming election campaign, set to end in a vote on June 28, could generate momentum in Iran for a more assertive posture in the region, these officials said. The approach of U.S. elections and a possible White House transition could also be seen by Khamenei as an opportunity to push a tougher stance

-

Israel

- Biden administration officials said that a U.S.-brokered deal to normalize relations between Israel and Saudi Arabia was within reach, but that Prime Minister Benjamin Netanyahu’s government might balk at the historic agreement rather than accept Riyadh’s demands for a new commitment to a Palestinian state and a halt to the Gaza war

- For months, the administration has hoped Netanyahu would grab at the long-sought prize of normalization with Riyadh as part of a sweeping agreement aimed at halting the Gaza war and transforming the region’s long-static divisions

- But Netanyahu, under pressure from right-wing members of his governing coalition and fighting for his political survival, has yet to sign on to elements of the deal that are key to getting Saudi agreement

-

Ukraine

- At least seven people have been killed and more than a dozen injured in a Russian missile attack on Kharkiv, located in north-eastern Ukraine. A further two people remain missing after the attack, which saw Russian forces strike Ukraine’s second-largest city at least 15 time

- Earlier this month, Russian forces began a renewed offensive in the region in an attempt to break through a weakened Ukrainian front line

- China’s industrial output grew 6.7% in April, exceeding the 5.5% growth expected and up from 4.5% in March

-

China

- China’s youth unemployment rate declined in April, in what will likely be welcome news for Beijing as it steps up policy support for the economy

- The jobless rate among China’s 16- to 24-year-olds, excluding those enrolled in school, stood at 14.7% last month, down from March’s 15.3%, data from the National Bureau of Statistics showed this week

- That’s broadly in line with figures last week showing that overall headline unemployment stood at 5.0% in April, edging down from the prior month’s 5.2%

- The jobs numbers come after China reported mixed economic activity figures for April last week showing a lopsided recovery. While industrial production was robust, consumption was sluggish and property data continued to be downbeat

-

Canada

- Canadian police charged three men in the assassination of Hardeep Singh Nijjar, a Sikh activist who Canada’s prime minister has suggested was killed with the help of Indian government agents

-

UK

- British Prime Minister Rishi Sunak called a surprise summer election, a gamble by the British leader to galvanize his restive Conservative party as it trails the opposition Labour Party by double digits in the polls.

-

Germany

- In March 2024, German manufacturing orders decreased by 0.4%, contrary to the expected 0.5% rise, with significant declines in orders for aircraft, ships, trains, and metal products, despite a 1.1% increase in car industry orders and a 2.0% rise in foreign orders

-

France

- France is sending 1,000 police officers and deploying the army to New Caledonia after violent riots over proposed changes to voting rights, which have resulted in the deaths of at least five people and significant property damage

-

France

- Japan has intervened to prop up the yen after it hit a multidecade low against the dollar. The currency has plummeted against the dollar this year, hurt by increasing doubts among traders about the timing of U.S. interest rate cuts

-

Japan

- Japan has intervened to prop up the yen after it hit a multidecade low against the dollar. The currency has plummeted against the dollar this year, hurt by increasing doubts among traders about the timing of U.S. interest rate cuts

-

North Korea

- Kim Ki Nam, the architect of North Korea’s cult-of-personality propaganda and mentor to Kim Jong Un, died at 94; Kim Jong Un will lead his state funeral

-

Poland

- Russian missiles have breached Polish airspace several times since 2022, with the most recent incident occurring on March 24, 2024, when a Russian cruise missile entered Polish airspace for 39 seconds, posing a risk of wider conflict, according to Poland’s President Andrzej Duda

Commodities

-

Oil Prices

- WTI: $77.79 per barrel

- (2.84%) WoW; +8.57% YTD; +8.30% YoY

- Brent: $82.18 per barrel

- (2.14%) WoW; +6.67% YTD; +7.76% YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended May 17, down 0.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 600, down 4 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 458.0 million barrels, up 0.8% YoY

- Refiners operated at a capacity utilization rate of 91.7% for the week, up from 90.4% in the prior week

- U.S. crude oil imports now amount to 6.744 million barrels per day, down 13.9% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.61 per gallon in the week of May 24,

up 1.0% YoY

- Gasoline prices on the East Coast amounted to $3.58, up 2.8% YoY

- Gasoline prices in the Midwest amounted to $3.51, down (0.9%) YoY

- Gasoline prices on the Gulf Coast amounted to $3.21, up 2.7% YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.55, down (4.0%) YoY

- Gasoline prices on the West Coast amounted to $4.75, up 3.0% YoY

- Motor gasoline inventories were down by 0.9 million barrels from the prior week

- Motor gasoline inventories amounted to 226.8 million barrels, up 4.9% YoY

- Production of motor gasoline averaged 10.5 million bpd, down (2.6%) YoY

- Demand for motor gasoline amounted to 9.315 million bpd, down (1.3%) YoY

-

Distillates

- Distillate inventories decreased by 0.4 million in the week of May 24

- Total distillate inventories amounted to 116.7 million barrels, up 10.5% YoY

- Distillate production averaged 5.064 million bpd, down 3.9% YoY

- Demand for distillates averaged 3.883 million bpd in the week, down (7.5%) YoY

-

Natural Gas

- Natural gas inventories increased by 78 billion cubic feet last week

- Total natural gas inventories now amount to 2,711 billion cubic feet, up 16.1% YoY

Credit News

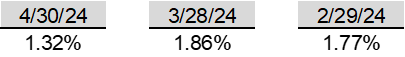

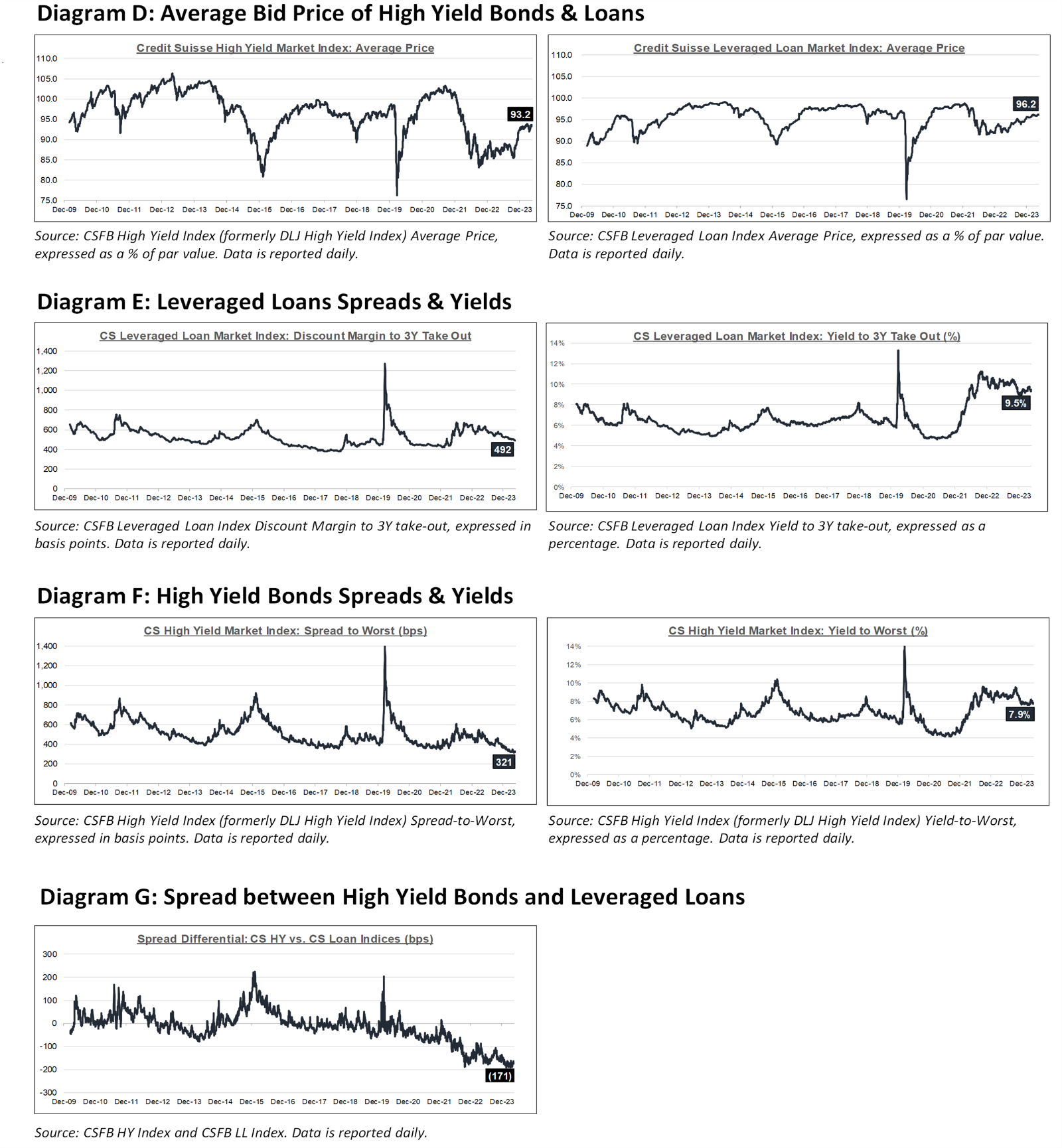

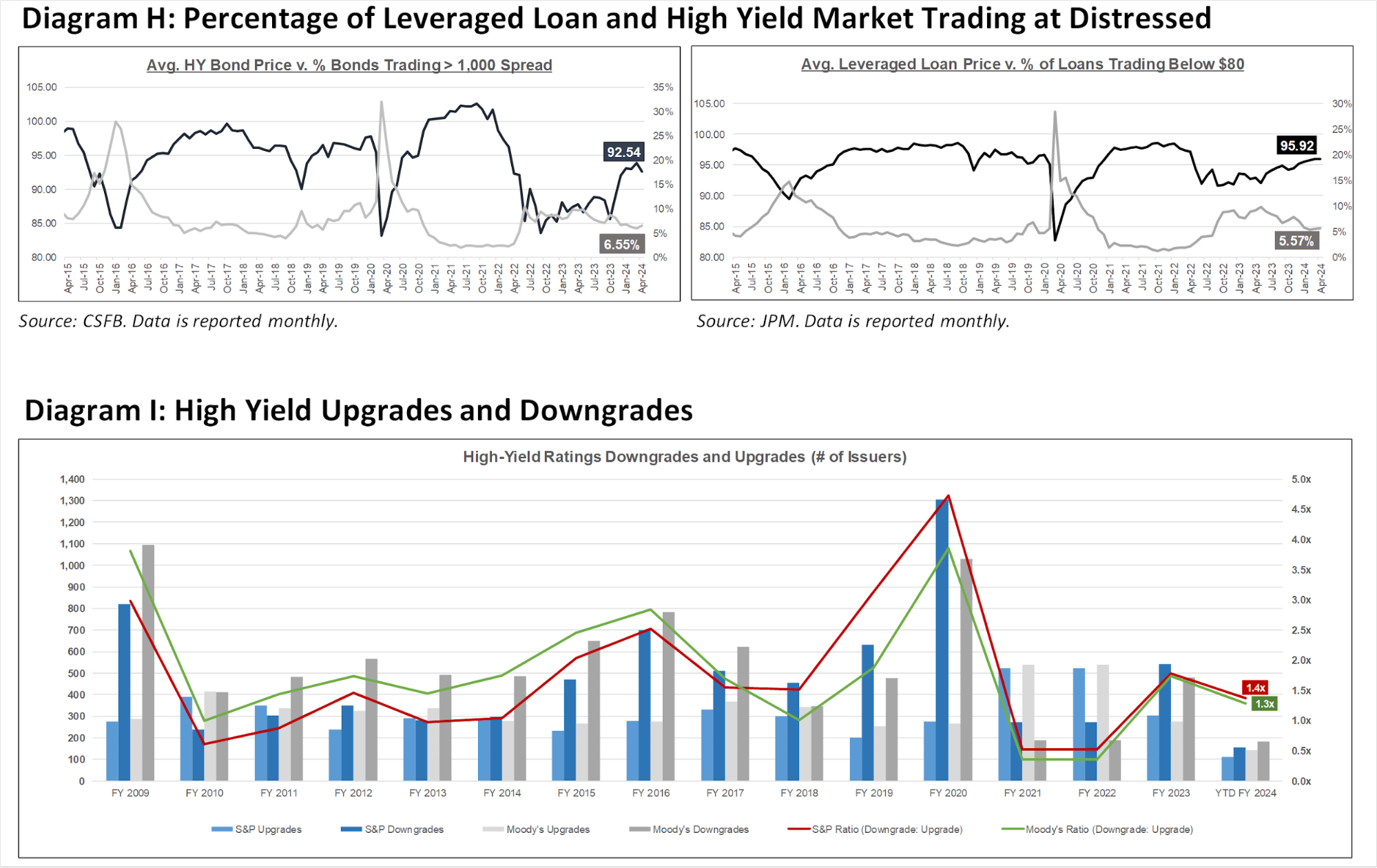

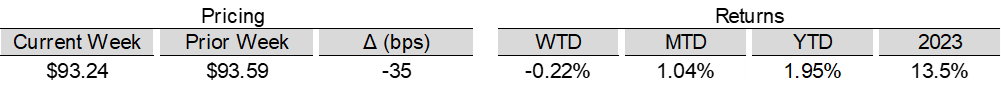

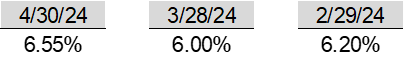

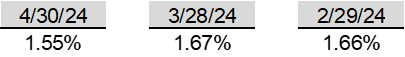

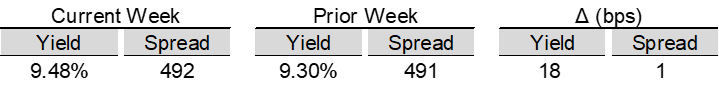

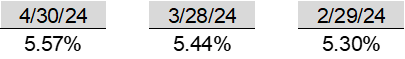

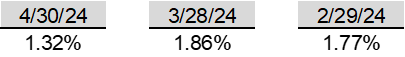

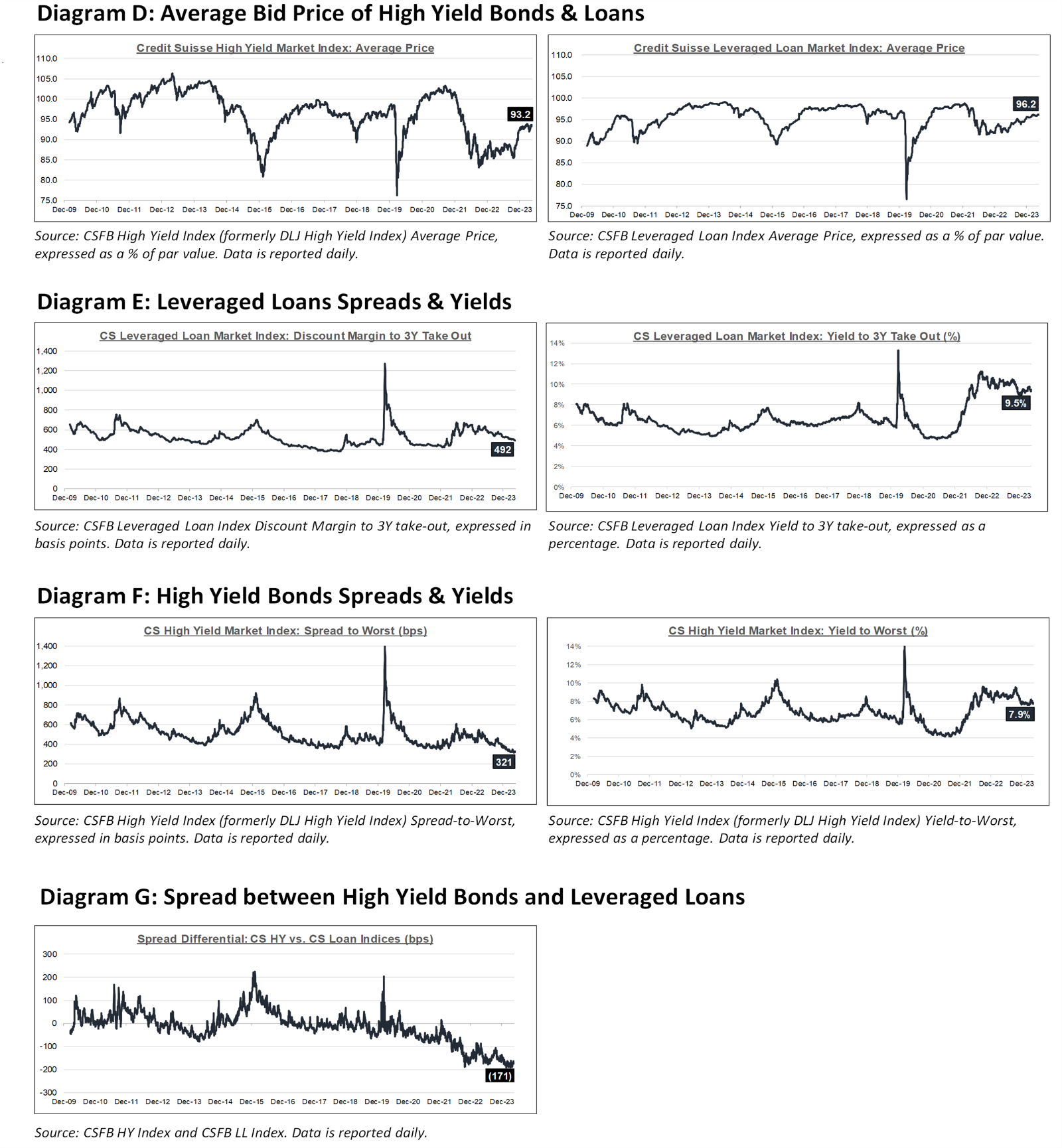

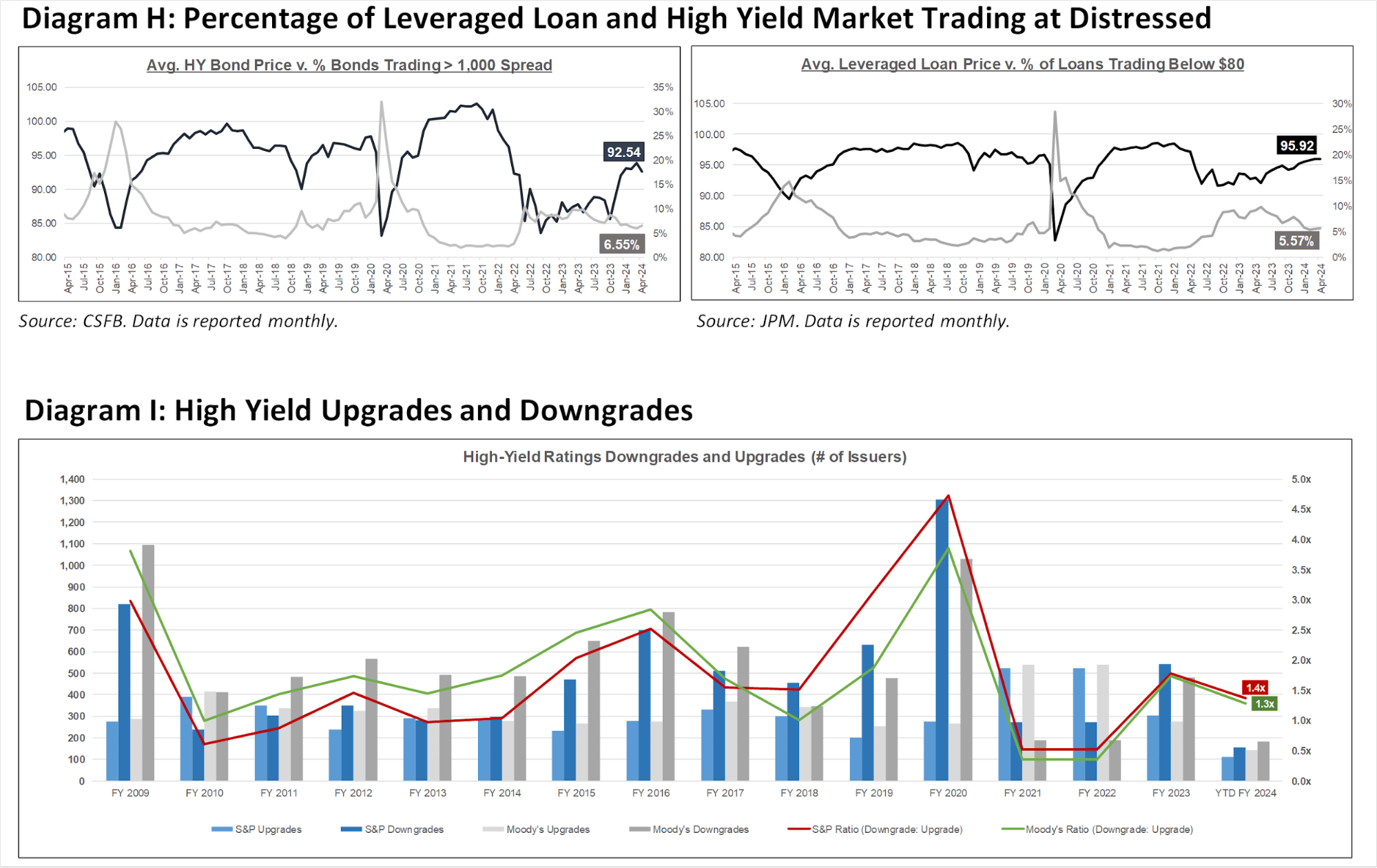

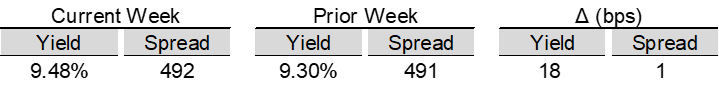

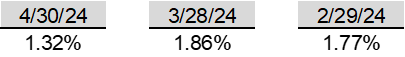

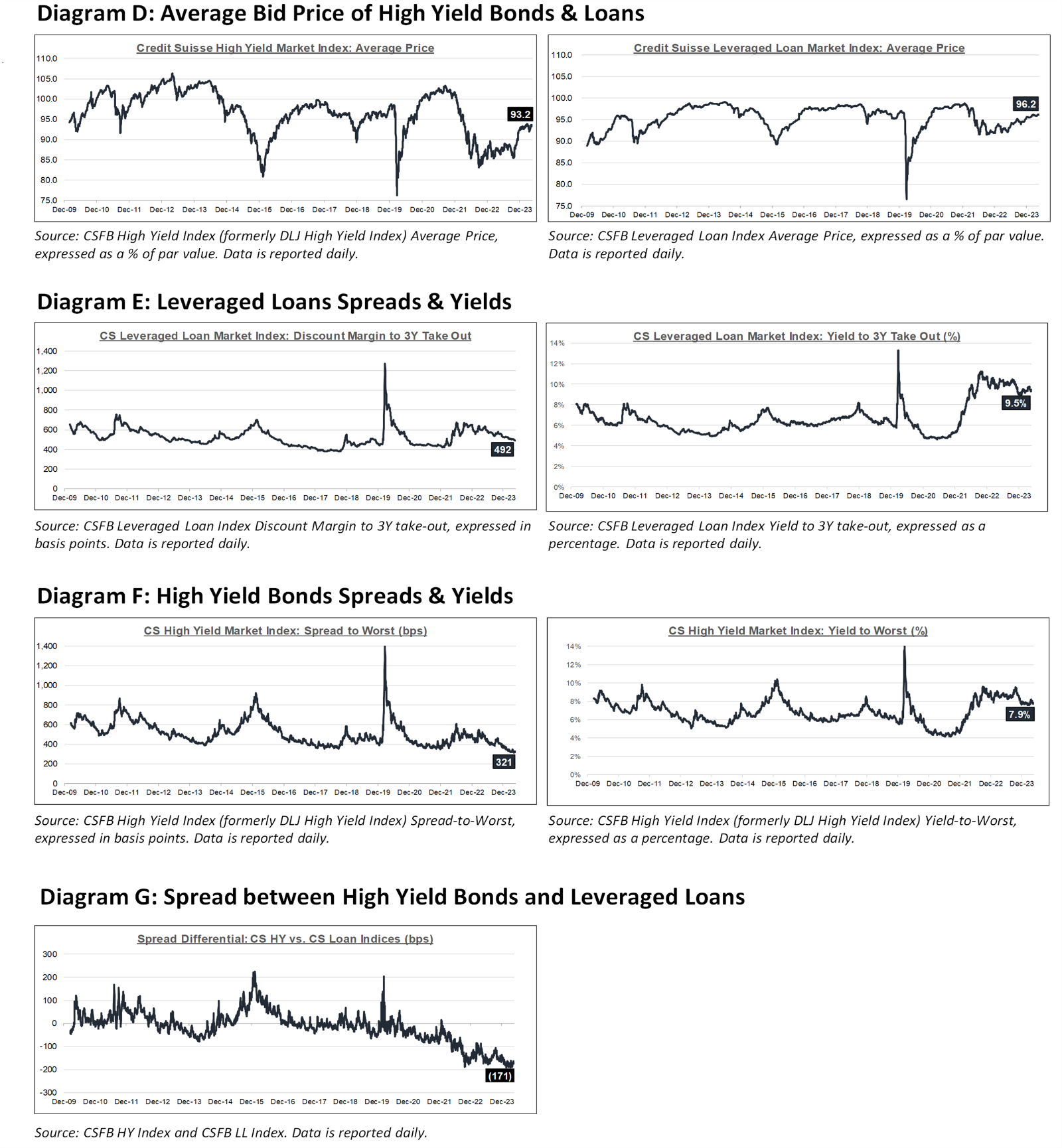

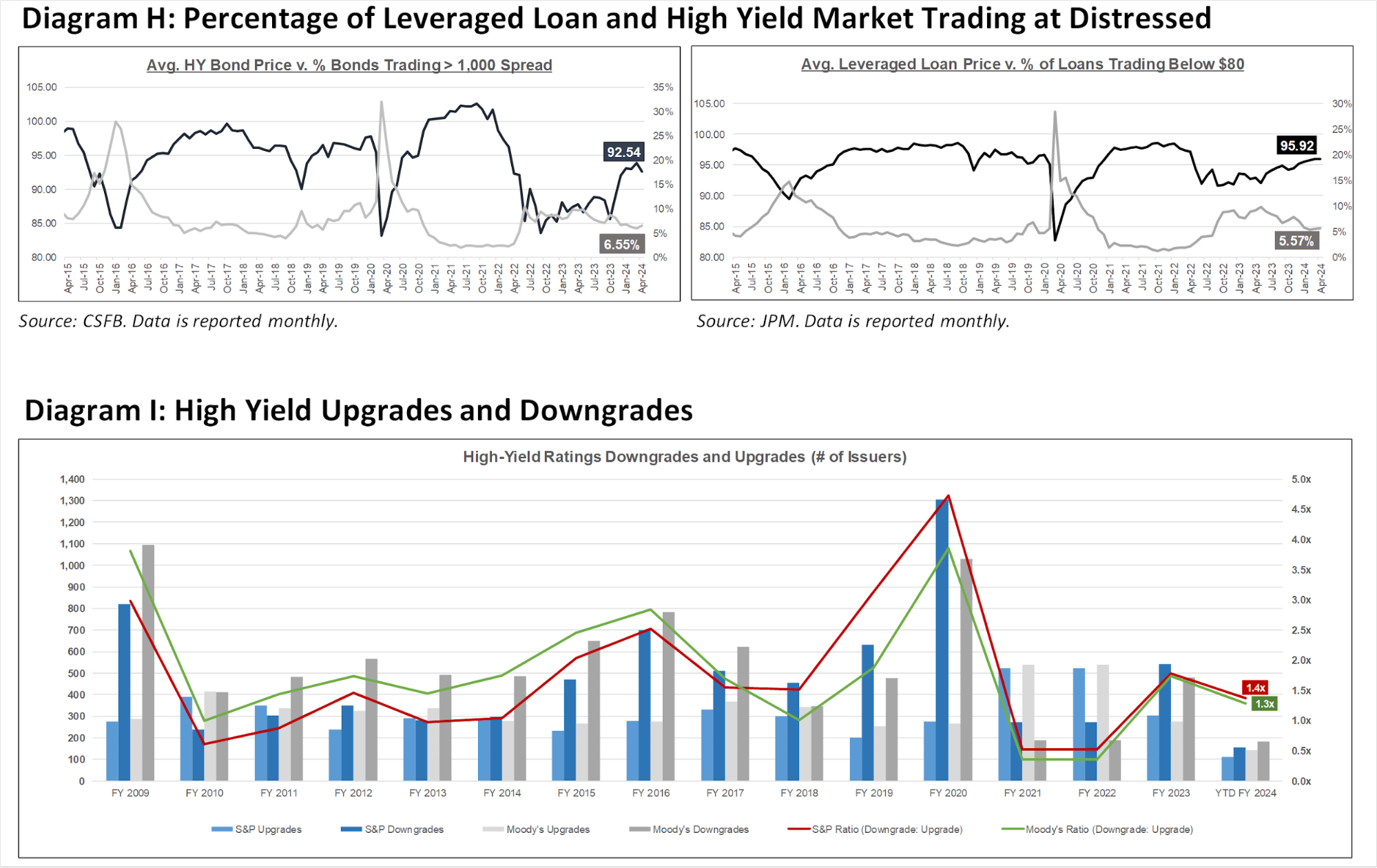

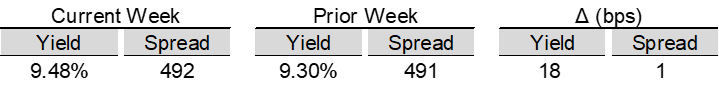

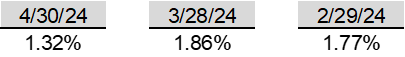

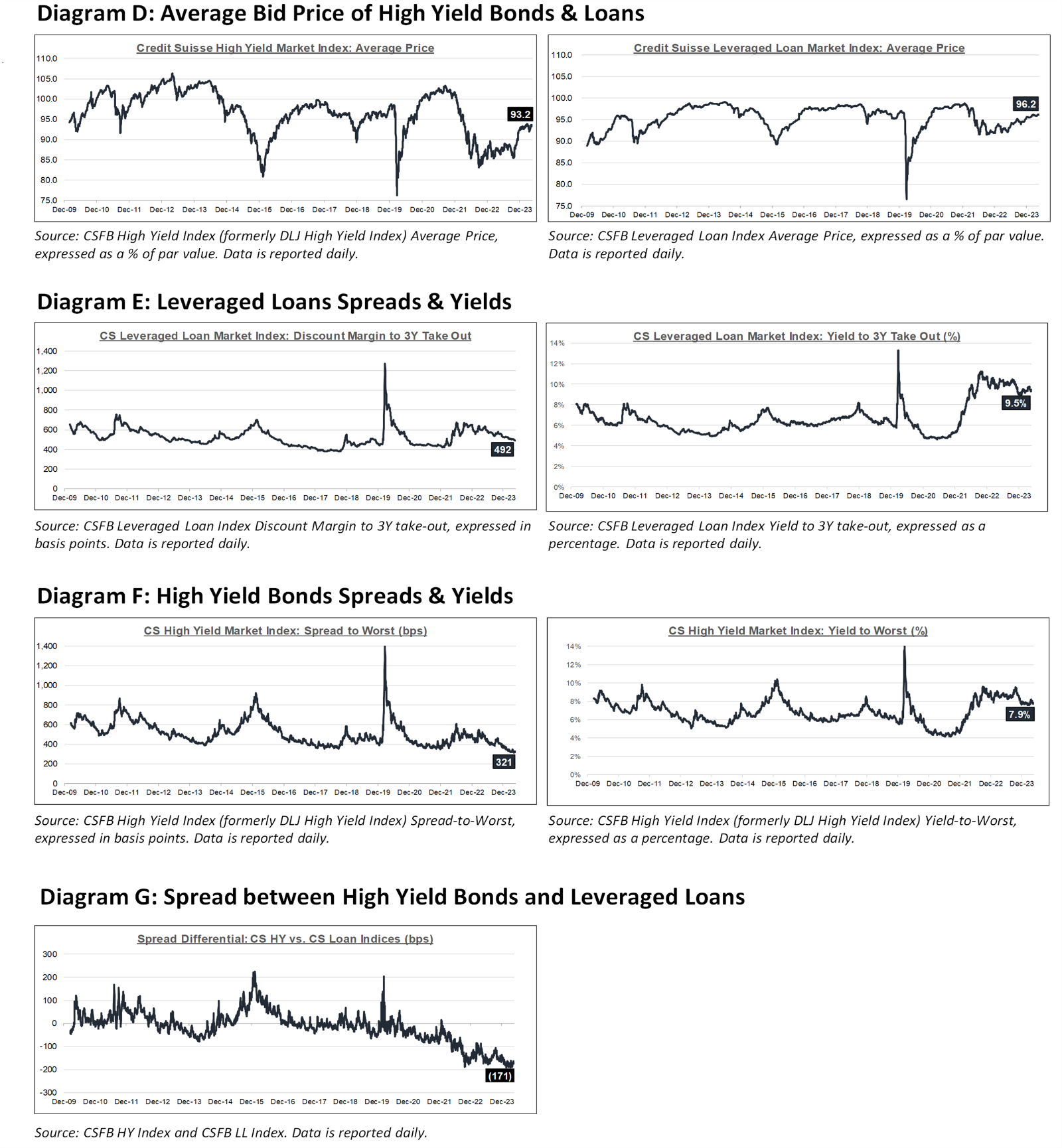

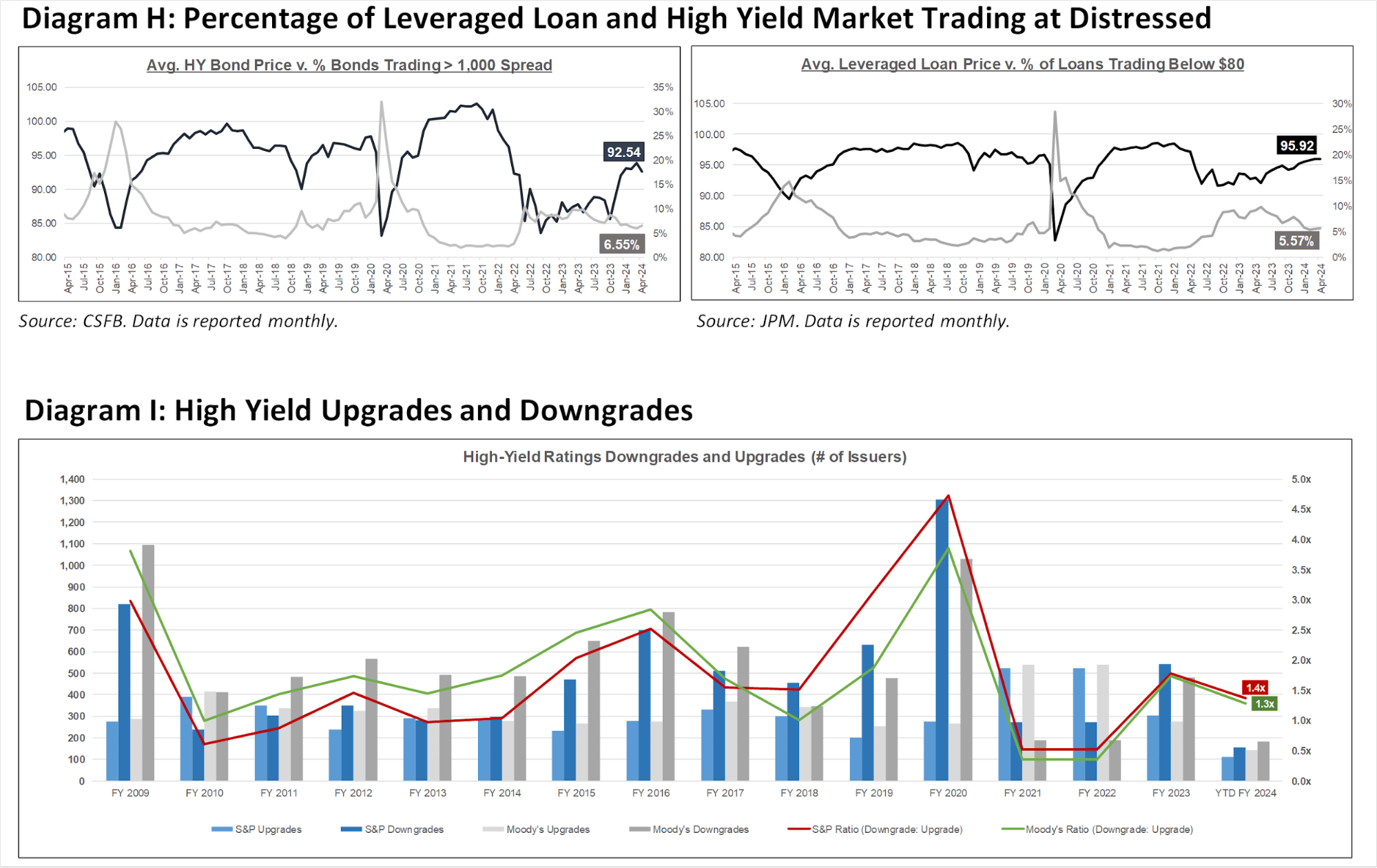

High yield bond yields increased 12bps to 7.85% and spreads decreased 1bps to 321bps. Leveraged loan yields increased 18bps to 9.48% and spreads increased 1bps to 492bps. WTD Leveraged loan returns were positive 16bps. WTD high yield bond returns were negative 22bps. 10yr treasury yields increased 10bps to 4.48%. For the week, yields and spreads increased amidst a more hawkish FOMC meeting, a strong jobless claims reading and a rebound in May flash PMI’s.

High-yield:

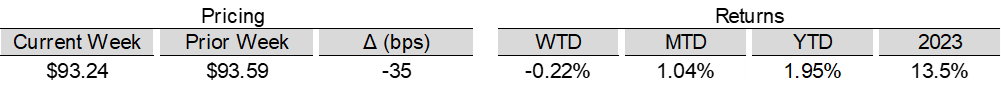

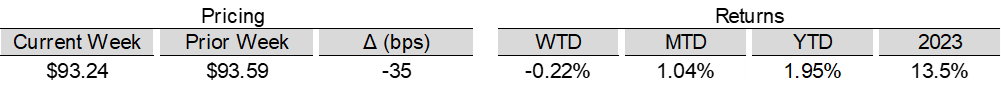

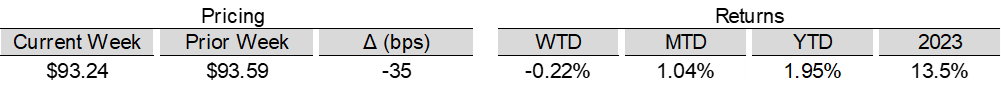

Week ended 05/24/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

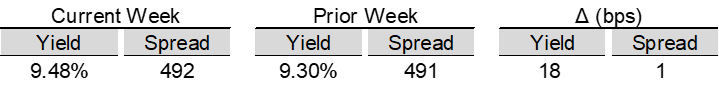

Leveraged loans:

Week ended 05/24/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: 99 Cents Only Stores ($350mn, 4/7/24), ConvergeOne ($1.3bn, 4/4/24), Xplornet Communications ($1.2bn, 3/31/24), JoAnn Stores ($658mn, 3/18/24), New Insight Holdings ($1.2bn, 3/13/24), Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), and Careismatic ($700mn, 1/22/24).

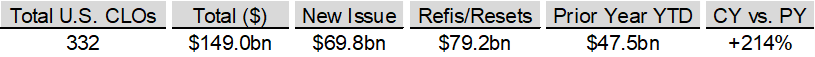

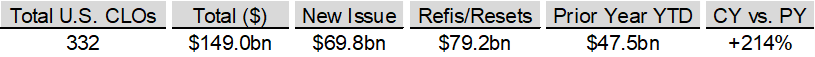

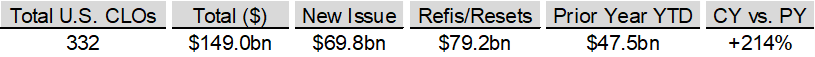

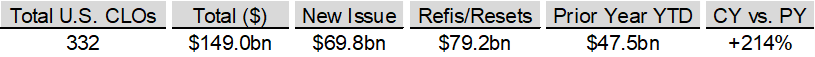

CLOs:

Week ended 05/24/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

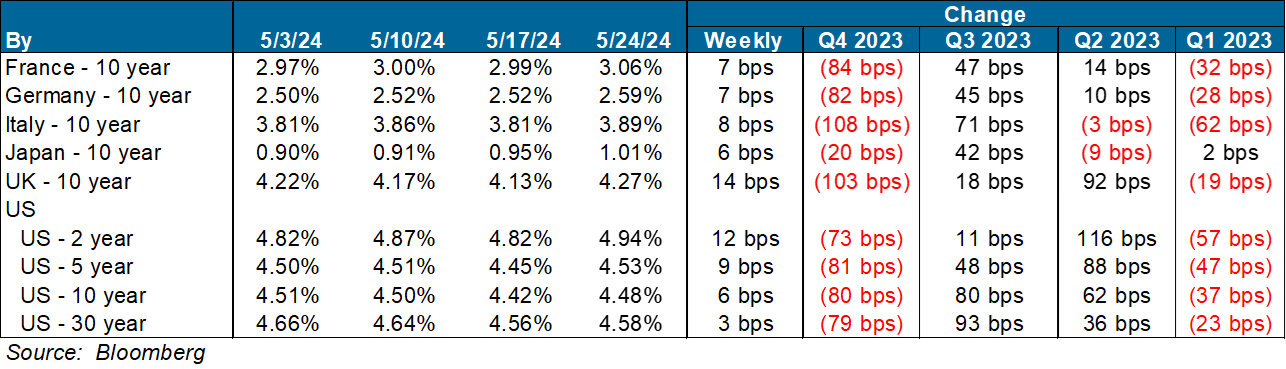

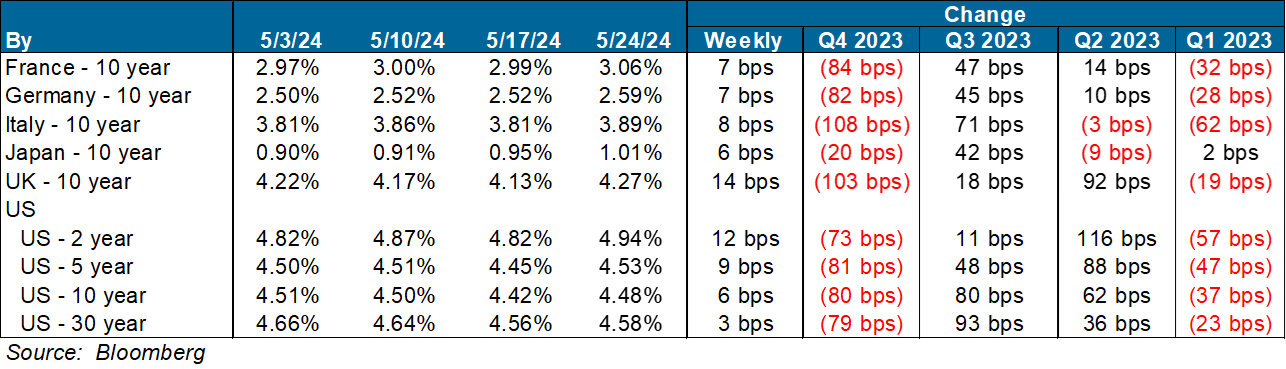

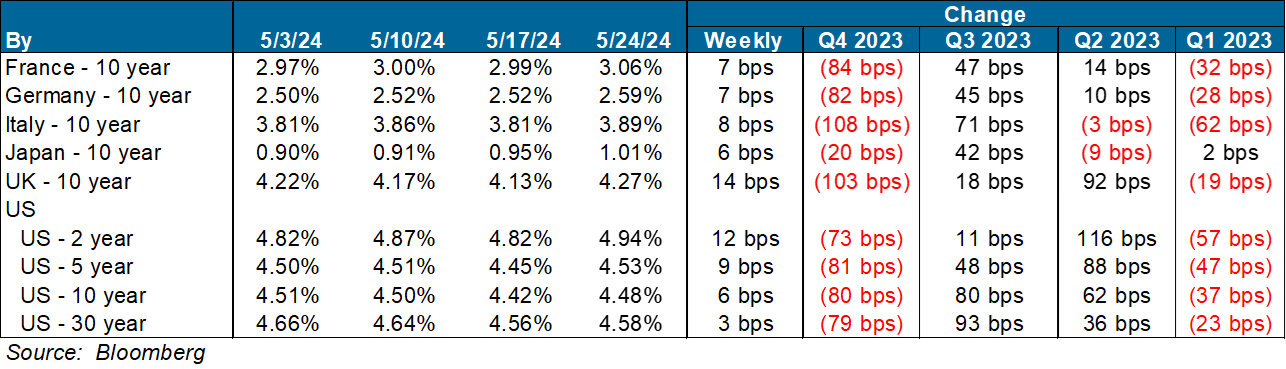

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

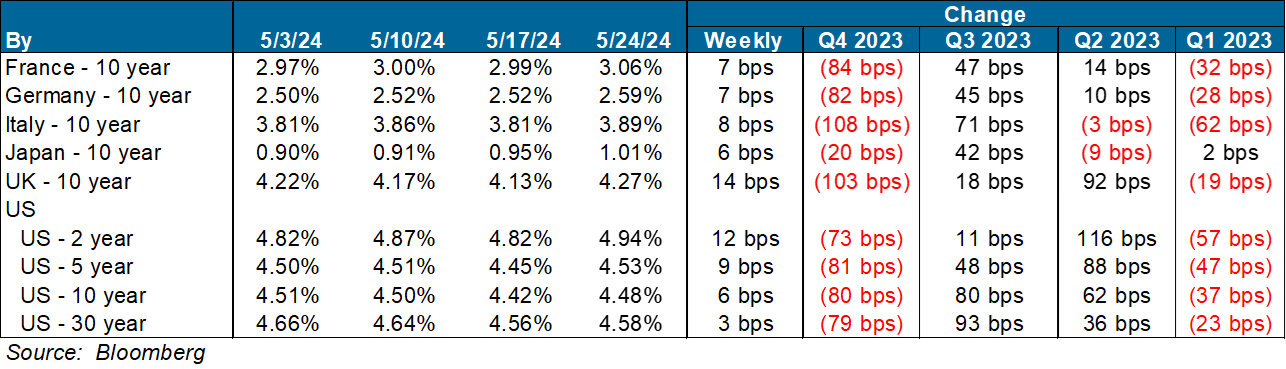

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

Real Estate

Home sales fell in April for the second consecutive month due to high mortgage rates and near-record home prices

- As seen in the above graph, sales of previously owned homes decreased 1.9% from the prior month to a seasonally adjusted annual rate of 4.14 million

- In March, existing-home sales posted their biggest monthly decline in more than a year

- high rates have prompted many homeowners to stay put

- The shortage of supply is pushing prices higher

- As seen above, the national median existing-home price rose 5.7% in April from a year earlier to $407,600

- This is the highest price for any April data going back to 1999 and approaching the record high of $413,800

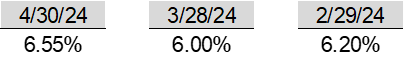

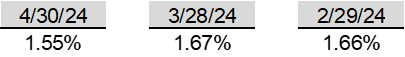

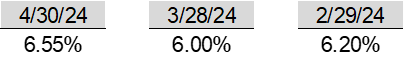

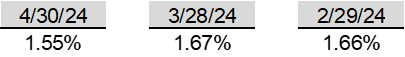

30 Year Fixed Mortgage

5/23/24: 6.49

10-year US Treasury

5/23/24: 4.47

U.S. News

- Existing Home Sales

- Sales of previously owned homes fell by 1.9% to an annual rate of 4.14 million in April as home buyers struggled with an expensive housing market

- The median price for an existing home in April rose 5.7% to $407,600, as compared with the year before

- The jump in home prices was the biggest since October 2022. Prices are still down from a peak in June 2022, when the median price of a resale home hit $413,800

- Consumer Sentiment

- The consumer sentiment index for the U.S. was 69.1 in May 2024, the lowest reading in six months

- The plunge in sentiment in May indicates that high prices, elevated interest rates, and concerns about the road ahead are weighing on consumers minds

- Consumers expressed particular concern over labor markets; they expect unemployment rates to rise and income growth to slow

- Purchasing Managers Index

- The US Purchasing Managers Index rose to 50.9 in May 2024, up from 50 in April

- The reading signaled an overall modest improvement in business conditions in the manufacturing sector, as both output and employment made positive contributions

- On the price front, manufacturers showed the largest cost rise in one-and-a-half years amid reports of higher supplier prices for a wide variety of inputs

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 215,000 in the week ended May 17, down 8,000 from the prior week

- The four-week moving average was 219,750, up 1,750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 8,000 to 1.794 million in the week ended May 10. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.300 trillion in the week ended May 24, down $4.7 billion from the prior week

- Treasury holdings totaled $4.489 trillion, down $26.1 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.37 trillion in the week, down $1.7 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.58 trillion as of May 24, an increase of 9.9% from the previous year

- Debt held by the public was $24.63 trillion, and intragovernmental holdings were $7.14 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.4% in April year over year

- On a monthly basis, the CPI increased 0.3% in April on a seasonally adjusted basis, after increasing 0.4% in March

- The index for all items less food and energy (core CPI) rose 0.3% in April, after rising 0.4% in March

- Core CPI increased 3.6% for the 12 months ending April

- Food and Beverages:

- The food at home index increased 1.1% in April from the same month a year earlier, and decreased -0.2% in April month over month

- The food away from home index increased 4.1% in April from the same month a year earlier, and increased 0.3% in April month over month

- Commodities:

- The energy commodities index increased 2.7% in April after increasing 1.5%

- The energy commodities index fell 1.1% over the last 12 months

- The energy services index (1.3%) in March after increasing (0.0%) in March

- The energy services index rose 3.6% over the last 12 months

- The gasoline index rose 1.2% over the last 12 months

- The fuel oil index fell (0.8%) over the last 12 months

- The index for electricity rose 5.1% over the last 12 months

- The index for natural gas fell (1.9%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $4,072.28 per 40ft

- Drewry’s composite World Container Index has increased by 141.6% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in April after increasing 0.4% in March

- The rent index increased 0.4% in April after increasing 0.5% in March

- The index for lodging away from home increased 0.9% in April after increasing 5.6% in March

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Iran

- Western officials say they are braced for a period of increased volatility with Iran as the country prepares to choose a successor to President Ebrahim Raisi, who died in a helicopter crash two weekends ago. But they said they don’t expect Tehran to make major foreign-policy shifts

- Iran, where ultimate authority lies with Supreme Leader Ayatollah Ali Khamenei, is likely to stay on its current trajectory, deepening ties with China and Russia, supporting Hamas and other regional militias and pursuing its nuclear program, officials in Washington and European capitals said

- The coming election campaign, set to end in a vote on June 28, could generate momentum in Iran for a more assertive posture in the region, these officials said. The approach of U.S. elections and a possible White House transition could also be seen by Khamenei as an opportunity to push a tougher stance

-

Israel

- Biden administration officials said that a U.S.-brokered deal to normalize relations between Israel and Saudi Arabia was within reach, but that Prime Minister Benjamin Netanyahu’s government might balk at the historic agreement rather than accept Riyadh’s demands for a new commitment to a Palestinian state and a halt to the Gaza war

- For months, the administration has hoped Netanyahu would grab at the long-sought prize of normalization with Riyadh as part of a sweeping agreement aimed at halting the Gaza war and transforming the region’s long-static divisions

- But Netanyahu, under pressure from right-wing members of his governing coalition and fighting for his political survival, has yet to sign on to elements of the deal that are key to getting Saudi agreement

-

Ukraine

- At least seven people have been killed and more than a dozen injured in a Russian missile attack on Kharkiv, located in north-eastern Ukraine. A further two people remain missing after the attack, which saw Russian forces strike Ukraine’s second-largest city at least 15 time

- Earlier this month, Russian forces began a renewed offensive in the region in an attempt to break through a weakened Ukrainian front line

- China’s industrial output grew 6.7% in April, exceeding the 5.5% growth expected and up from 4.5% in March

-

China

- China’s youth unemployment rate declined in April, in what will likely be welcome news for Beijing as it steps up policy support for the economy

- The jobless rate among China’s 16- to 24-year-olds, excluding those enrolled in school, stood at 14.7% last month, down from March’s 15.3%, data from the National Bureau of Statistics showed this week

- That’s broadly in line with figures last week showing that overall headline unemployment stood at 5.0% in April, edging down from the prior month’s 5.2%

- The jobs numbers come after China reported mixed economic activity figures for April last week showing a lopsided recovery. While industrial production was robust, consumption was sluggish and property data continued to be downbeat

-

Canada

- Canadian police charged three men in the assassination of Hardeep Singh Nijjar, a Sikh activist who Canada’s prime minister has suggested was killed with the help of Indian government agents

-

UK

- British Prime Minister Rishi Sunak called a surprise summer election, a gamble by the British leader to galvanize his restive Conservative party as it trails the opposition Labour Party by double digits in the polls.

-

Germany

- In March 2024, German manufacturing orders decreased by 0.4%, contrary to the expected 0.5% rise, with significant declines in orders for aircraft, ships, trains, and metal products, despite a 1.1% increase in car industry orders and a 2.0% rise in foreign orders

-

France

- France is sending 1,000 police officers and deploying the army to New Caledonia after violent riots over proposed changes to voting rights, which have resulted in the deaths of at least five people and significant property damage

-

France

- Japan has intervened to prop up the yen after it hit a multidecade low against the dollar. The currency has plummeted against the dollar this year, hurt by increasing doubts among traders about the timing of U.S. interest rate cuts

-

Japan

- Japan has intervened to prop up the yen after it hit a multidecade low against the dollar. The currency has plummeted against the dollar this year, hurt by increasing doubts among traders about the timing of U.S. interest rate cuts

-

North Korea

- Kim Ki Nam, the architect of North Korea’s cult-of-personality propaganda and mentor to Kim Jong Un, died at 94; Kim Jong Un will lead his state funeral

-

Poland

- Russian missiles have breached Polish airspace several times since 2022, with the most recent incident occurring on March 24, 2024, when a Russian cruise missile entered Polish airspace for 39 seconds, posing a risk of wider conflict, according to Poland’s President Andrzej Duda

Commodities

-

Oil Prices

- WTI: $77.79 per barrel

- (2.84%) WoW; +8.57% YTD; +8.30% YoY

- Brent: $82.18 per barrel

- (2.14%) WoW; +6.67% YTD; +7.76% YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended May 17, down 0.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 600, down 4 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 458.0 million barrels, up 0.8% YoY

- Refiners operated at a capacity utilization rate of 91.7% for the week, up from 90.4% in the prior week

- U.S. crude oil imports now amount to 6.744 million barrels per day, down 13.9% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.61 per gallon in the week of May 24,

up 1.0% YoY

- Gasoline prices on the East Coast amounted to $3.58, up 2.8% YoY

- Gasoline prices in the Midwest amounted to $3.51, down (0.9%) YoY

- Gasoline prices on the Gulf Coast amounted to $3.21, up 2.7% YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.55, down (4.0%) YoY

- Gasoline prices on the West Coast amounted to $4.75, up 3.0% YoY

- Motor gasoline inventories were down by 0.9 million barrels from the prior week

- Motor gasoline inventories amounted to 226.8 million barrels, up 4.9% YoY

- Production of motor gasoline averaged 10.5 million bpd, down (2.6%) YoY

- Demand for motor gasoline amounted to 9.315 million bpd, down (1.3%) YoY

-

Distillates

- Distillate inventories decreased by 0.4 million in the week of May 24

- Total distillate inventories amounted to 116.7 million barrels, up 10.5% YoY

- Distillate production averaged 5.064 million bpd, down 3.9% YoY

- Demand for distillates averaged 3.883 million bpd in the week, down (7.5%) YoY

-

Natural Gas

- Natural gas inventories increased by 78 billion cubic feet last week

- Total natural gas inventories now amount to 2,711 billion cubic feet, up 16.1% YoY

Credit News

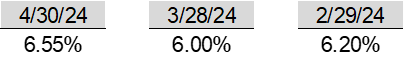

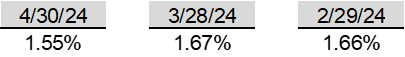

High yield bond yields increased 12bps to 7.85% and spreads decreased 1bps to 321bps. Leveraged loan yields increased 18bps to 9.48% and spreads increased 1bps to 492bps. WTD Leveraged loan returns were positive 16bps. WTD high yield bond returns were negative 22bps. 10yr treasury yields increased 10bps to 4.48%. For the week, yields and spreads increased amidst a more hawkish FOMC meeting, a strong jobless claims reading and a rebound in May flash PMI’s.

High-yield:

Week ended 05/24/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 05/24/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: 99 Cents Only Stores ($350mn, 4/7/24), ConvergeOne ($1.3bn, 4/4/24), Xplornet Communications ($1.2bn, 3/31/24), JoAnn Stores ($658mn, 3/18/24), New Insight Holdings ($1.2bn, 3/13/24), Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), and Careismatic ($700mn, 1/22/24).

CLOs:

Week ended 05/24/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

Real Estate

Home sales fell in April for the second consecutive month due to high mortgage rates and near-record home prices

- As seen in the above graph, sales of previously owned homes decreased 1.9% from the prior month to a seasonally adjusted annual rate of 4.14 million

- In March, existing-home sales posted their biggest monthly decline in more than a year

- high rates have prompted many homeowners to stay put

- The shortage of supply is pushing prices higher

- As seen above, the national median existing-home price rose 5.7% in April from a year earlier to $407,600

- This is the highest price for any April data going back to 1999 and approaching the record high of $413,800

30 Year Fixed Mortgage

5/23/24: 6.49

10-year US Treasury

5/23/24: 4.47