U.S. News

- Personnel Consumption index

- The Personnel Consumption index rose 0.3% in April, representing a 2.7% increase over the last 12 months

- The Core Personnel Consumption index, which excludes food and energy, increased 0.2% or 2.8% over the last 12 months

- The index is still higher than the 2.0% rate the Fed is targeting before reducing interest rates

- Revised GDP Data

- U.S. gross domestic product, adjusted for inflation, grew at a 1.3% annual rate in the first three months of the year, down from 3.4% in the final quarter of 2023

- The revised GDP data is below the 1.6% growth rate reported last month in its preliminary estimate

- The slower than expected pace was driven by a surge in imports and a reduction in business inventories

- Case-Shiller Index

- Home prices in the 20 biggest U.S. metros hit another all-time high, rising 0.3% in March compared to the previous month and up 7.4% in the last 12 months

- The housing market remains hampered by a low numbers of properties for sale, such as San Diego, which posted the largest increase, rising 11.1% over the last 12 months

- The median price of a resale home was $392,900 in March, and newly built home was $439,500

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 219,000 in the week ended May 24, up 3,000 from the prior week

- The four-week moving average was 222,500, up 2,500 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 4,000 to 1.791 million in the week ended May 17. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.284 trillion in the week ended May 31, down $15.2 billion from the prior week

- Treasury holdings totaled $4.489 trillion, up $0.7 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.36 trillion in the week, down $7.7 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.62 trillion as of May 31, an increase of 10.0% from the previous year

- Debt held by the public was $24.69 trillion, and intragovernmental holdings were $7.14 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.4% in April year over year

- On a monthly basis, the CPI increased 0.3% in April on a seasonally adjusted basis, after increasing 0.4% in March

- The index for all items less food and energy (core CPI) rose 0.3% in April, after rising 0.4% in March

- Core CPI increased 3.6% for the 12 months ending April

- Food and Beverages:

- The food at home index increased 1.1% in April from the same month a year earlier, and decreased -0.2% in April month over month

- The food away from home index increased 4.1% in April from the same month a year earlier, and increased 0.3% in April month over month

- Commodities:

- The energy commodities index increased 2.7% in April after increasing 1.5% in March

- The energy commodities index fell 1.1% over the last 12 months

- The energy services index (1.3%) in March after increasing (0.0%) in March

- The energy services index rose 3.6% over the last 12 months

- The gasoline index rose 1.2% over the last 12 months

- The fuel oil index fell (0.8%) over the last 12 months

- The index for electricity rose 5.1% over the last 12 months

- The index for natural gas fell (1.9%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $4,226.49 per 40ft container for

- Drewry’s composite World Container Index has increased by 151.3% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in April after increasing 0.4% in March

- The rent index increased 0.4% in April after increasing 0.5% in March

- The index for lodging away from home increased 0.9% in April after increasing 5.6% in March

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel/Gaza

- Israel has secured control of Gaza’s southern border with Egypt, achieving a key goal of the Rafah offensive as it seeks to eliminate Hamas without upsetting the U.S.

- Israel says taking control of the 9-mile border will allow Israel to prevent Hamas from rearming by smuggling weapons through tunnels that reach into Egypt. Israel last controlled the corridor in 2005 before giving up control of the enclave to the Palestinians

- An Israel military official said it had found 20 cross-border tunnels in the area. The findings and Israel’s advance risk sparking new tensions between Israel and Egypt

- The U.S. military has suspended the use of its temporary pier on the coast of Gaza because it was damaged during severe storms, a setback in the U.S. effort to deliver humanitarian by sea to the strip. It will take at least a week for the U.S. to repair the pier

-

Russia

- Israel has secured control of Gaza’s southern border with Egypt, achieving a key goal of the Rafah offensive as it seeks to eliminate Hamas without upsetting the U.S.

- Israel says taking control of the 9-mile border will allow Israel to prevent Hamas from rearming by smuggling weapons through tunnels that reach into Egypt. Israel last controlled the corridor in 2005 before giving up control of the enclave to the Palestinians

- An Israel military official said it had found 20 cross-border tunnels in the area. The findings and Israel’s advance risk sparking new tensions between Israel and Egypt

- The U.S. military has suspended the use of its temporary pier on the coast of Gaza because it was damaged during severe storms, a setback in the U.S. effort to deliver humanitarian by sea to the strip. It will take at least a week for the U.S. to repair the pier

-

Ukraine

- The Biden administration on Thursday said that it would allow Ukrainian forces to do limited targeting with American-supplied weapons inside Russia

- The new policy would allow Ukrainian forces to use artillery and short-range rockets against command posts, armed depots, and other assets on Russian territory that are being used by Russian troops to carry out attacks on Kharkiv in northeastern Ukraine

- The narrow geographic scope is an effort to help Ukraine better defend against Russia’s offensive while limiting the risk that the conflict in Ukraine could escalate into a direct conflict between Russia and the United States

-

China

- China’s official manufacturing purchasing managers index fell to 49.5 in May from 50.4 in April. The change index below the 50 mark that separates activity from contraction

- Exports fell sharply from 118 to 113 in May, with a score of 100 representing export levels in June 2020

-

India

- India’s economy grew at 8.2% for its full fiscal year compared with 7.0% a year earlier. The growth was fueld by government spending on infrastructure, and increased spend on manufacturing and construction

-

Canada

- Canadian police charged three men in the assassination of Hardeep Singh Nijjar, a Sikh activist who Canada’s prime minister has suggested was killed with the help of Indian government agents

-

UK

- British Prime Minister Rishi Sunak called a surprise summer election, a gamble by the British leader to galvanize his restive Conservative party as it trails the opposition Labour Party by double digits in the polls.

-

Germany

- In March 2024, German manufacturing orders decreased by 0.4%, contrary to the expected 0.5% rise, with significant declines in orders for aircraft, ships, trains, and metal products, despite a 1.1% increase in car industry orders and a 2.0% rise in foreign orders

-

France

- France is sending 1,000 police officers and deploying the army to New Caledonia after violent riots over proposed changes to voting rights, which have resulted in the deaths of at least five people and significant property damage

-

Japan

- Japan has intervened to prop up the yen after it hit a multidecade low against the dollar. The currency has plummeted against the dollar this year, hurt by increasing doubts among traders about the timing of U.S. interest rate cuts

-

North Korea

- Kim Ki Nam, the architect of North Korea’s cult-of-personality propaganda and mentor to Kim Jong Un, died at 94; Kim Jong Un will lead his state funeral

Commodities

-

Oil Prices

- WTI: $77.13 per barrel

- (0.76%) WoW; +7.65% YTD; +10.03% YoY

- Brent: $81.62 per barrel

- (0.61%) WoW; +5.94% YTD; +9.88% YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended May 24, up 0.2 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 600, down 4 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 454.7 million barrels, down (1.1%) YoY

- Refiners operated at a capacity utilization rate of 94.3% for the week, up from 91.7% in the prior week

- U.S. crude oil imports now amount to 6.663 million barrels per day, down (6.2%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.56 per gallon in the week of May 31,

down (0.2%) YoY

- Gasoline prices on the East Coast amounted to $3.59, up 1.8% YoY

- Gasoline prices in the Midwest amounted to $3.54, down (0.5%) YoY

- Gasoline prices on the Gulf Coast amounted to $3.21, up 0.0% YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.47, down (7.3%) YoY

- Gasoline prices on the West Coast amounted to $4.70, up 1.2% YoY

- Motor gasoline inventories were down by 2.0 million barrels from the prior week

- Motor gasoline inventories amounted to 228.8 million barrels, up 5.9% YoY

- Production of motor gasoline averaged 10.1 million bpd, up 0.4% YoY

- Demand for motor gasoline amounted to 9.148 million bpd, up 0.5% YoY

-

Distillates

- Distillate inventories decreased by 2.5 million in the week of May 31

- Total distillate inventories amounted to 119.3 million barrels, up 11.8% YoY

- Distillate production averaged 5.030 million bpd, down (0.2%) YoY

- Demand for distillates averaged 3.795 million bpd in the week, up 4.1% YoY

-

Natural Gas

- Natural gas inventories increased by 84 billion cubic feet last week

- Total natural gas inventories now amount to 2,795 billion cubic feet, up 14.3% YoY

Credit News

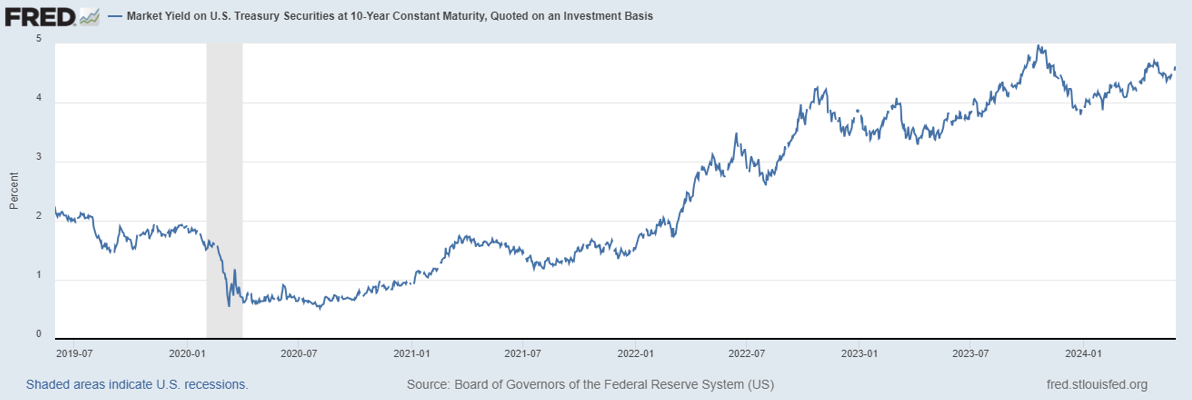

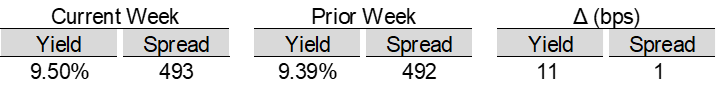

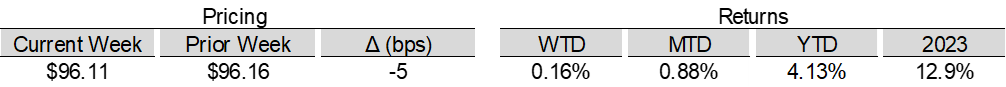

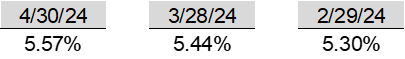

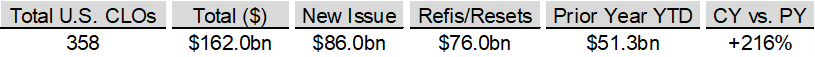

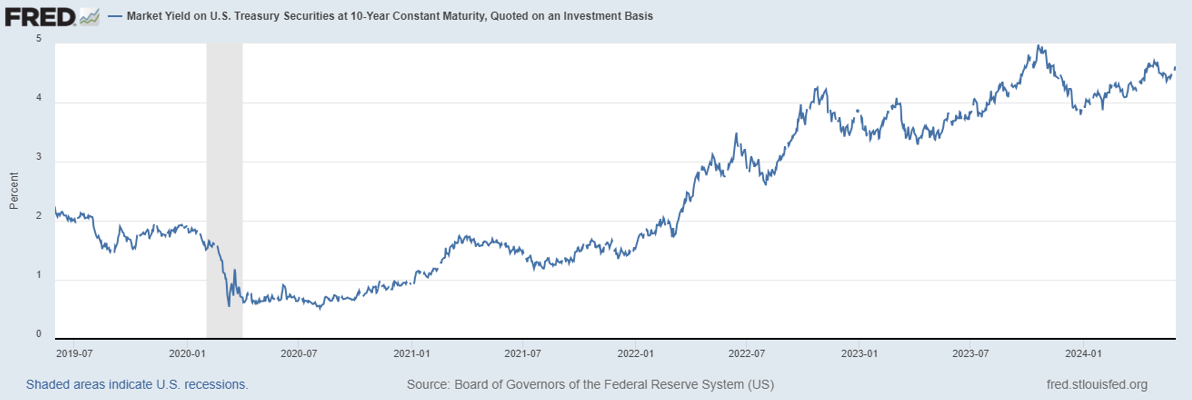

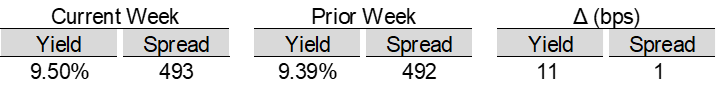

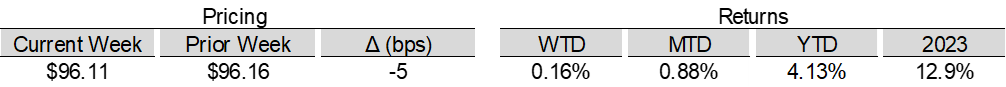

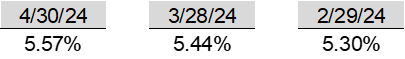

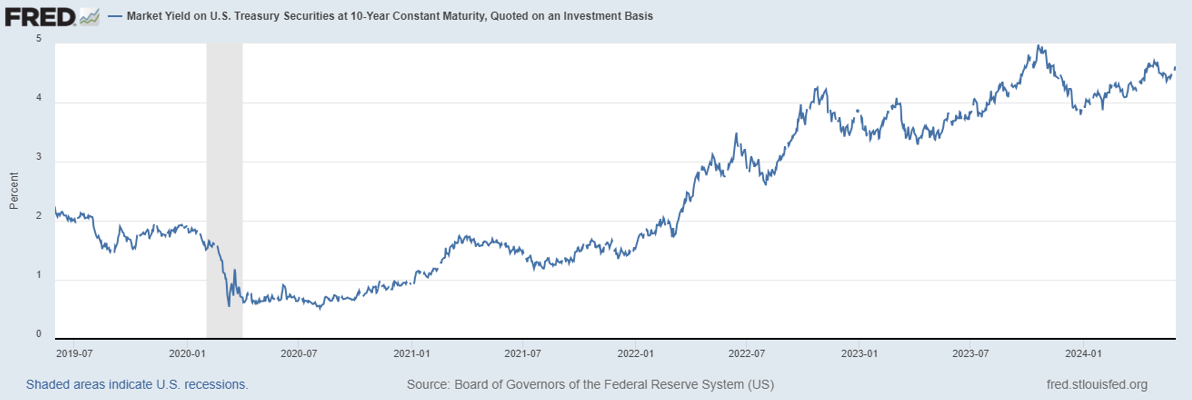

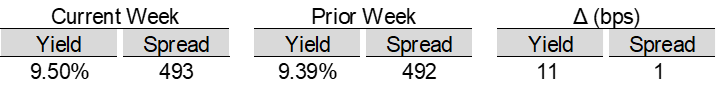

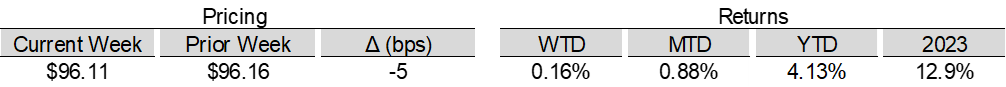

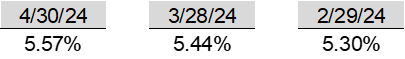

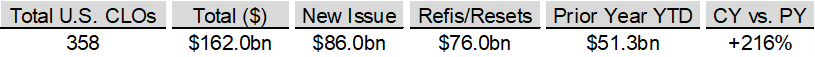

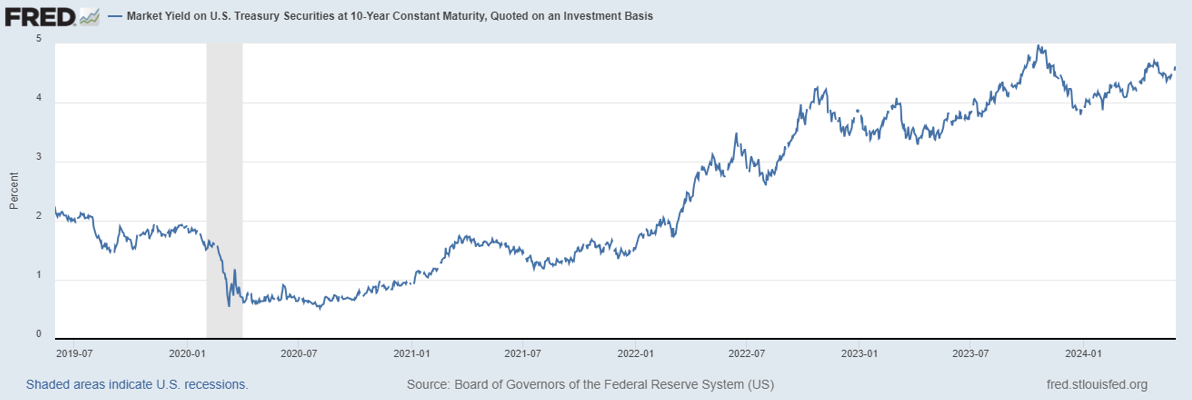

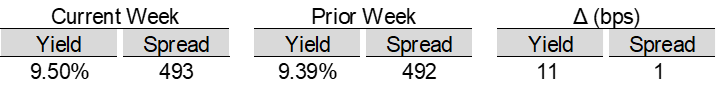

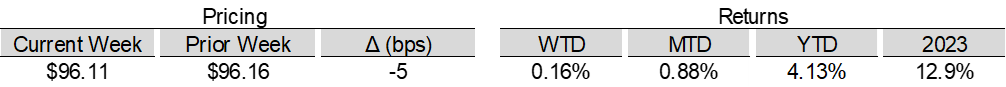

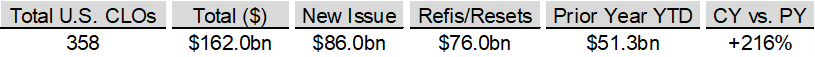

High yield bond yields increased 15bps to 7.95% and spreads increased 7bps to 328bps. Leveraged loan yields increased 11bps to 9.50% and spreads increased 1bps to 493bps. WTD Leveraged loan returns were positive 16bps. WTD high yield bond returns were negative 44bps. 10yr treasury yields increased 8bps to 4.55%. The loan asset class is benefiting from elevated coupons and Fed now expected to remain on hold until December. In addition, issuers are delivering solid earnings alongside a robust technical supported by retail inflows, a record pace of CLO origination, and very little net new supply.

High-yield:

Week ended 05/31/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 05/31/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: 99 Cents Only Stores ($350mn, 4/7/24), ConvergeOne ($1.3bn, 4/4/24), Xplornet Communications ($1.2bn, 3/31/24), JoAnn Stores ($658mn, 3/18/24), New Insight Holdings ($1.2bn, 3/13/24), Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), and Careismatic ($700mn, 1/22/24).

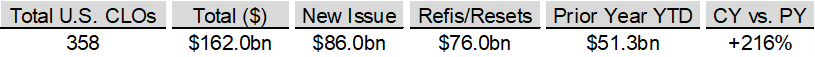

CLOs:

Week ended 05/31/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

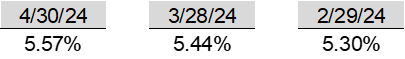

Diagram U: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

Real Estate

Section 1:

- Demand for homes continues to far outpace the available supply pushing prices higher. Most of the newly built units were rentals.

- Rental vacancy rate flatlined at 6.6%, but homeowner vacancy rate dropped to 0.8%.

- The U.S. needs at least 1.5 million additional homes (Rental and For-Sale) to bring vacancy rates back in line with historical averages.

Section 2:

30 Year Fixed Mortgage

5/30/24: 7.03

10-year US Treasury

5/30/24: 4.55

U.S. News

- Personnel Consumption index

- The Personnel Consumption index rose 0.3% in April, representing a 2.7% increase over the last 12 months

- The Core Personnel Consumption index, which excludes food and energy, increased 0.2% or 2.8% over the last 12 months

- The index is still higher than the 2.0% rate the Fed is targeting before reducing interest rates

- Revised GDP Data

- U.S. gross domestic product, adjusted for inflation, grew at a 1.3% annual rate in the first three months of the year, down from 3.4% in the final quarter of 2023

- The revised GDP data is below the 1.6% growth rate reported last month in its preliminary estimate

- The slower than expected pace was driven by a surge in imports and a reduction in business inventories

- Case-Shiller Index

- Home prices in the 20 biggest U.S. metros hit another all-time high, rising 0.3% in March compared to the previous month and up 7.4% in the last 12 months

- The housing market remains hampered by a low numbers of properties for sale, such as San Diego, which posted the largest increase, rising 11.1% over the last 12 months

- The median price of a resale home was $392,900 in March, and newly built home was $439,500

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 219,000 in the week ended May 24, up 3,000 from the prior week

- The four-week moving average was 222,500, up 2,500 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 4,000 to 1.791 million in the week ended May 17. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.284 trillion in the week ended May 31, down $15.2 billion from the prior week

- Treasury holdings totaled $4.489 trillion, up $0.7 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.36 trillion in the week, down $7.7 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.62 trillion as of May 31, an increase of 10.0% from the previous year

- Debt held by the public was $24.69 trillion, and intragovernmental holdings were $7.14 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.4% in April year over year

- On a monthly basis, the CPI increased 0.3% in April on a seasonally adjusted basis, after increasing 0.4% in March

- The index for all items less food and energy (core CPI) rose 0.3% in April, after rising 0.4% in March

- Core CPI increased 3.6% for the 12 months ending April

- Food and Beverages:

- The food at home index increased 1.1% in April from the same month a year earlier, and decreased -0.2% in April month over month

- The food away from home index increased 4.1% in April from the same month a year earlier, and increased 0.3% in April month over month

- Commodities:

- The energy commodities index increased 2.7% in April after increasing 1.5% in March

- The energy commodities index fell 1.1% over the last 12 months

- The energy services index (1.3%) in March after increasing (0.0%) in March

- The energy services index rose 3.6% over the last 12 months

- The gasoline index rose 1.2% over the last 12 months

- The fuel oil index fell (0.8%) over the last 12 months

- The index for electricity rose 5.1% over the last 12 months

- The index for natural gas fell (1.9%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $4,226.49 per 40ft container for

- Drewry’s composite World Container Index has increased by 151.3% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in April after increasing 0.4% in March

- The rent index increased 0.4% in April after increasing 0.5% in March

- The index for lodging away from home increased 0.9% in April after increasing 5.6% in March

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel/Gaza

- Israel has secured control of Gaza’s southern border with Egypt, achieving a key goal of the Rafah offensive as it seeks to eliminate Hamas without upsetting the U.S.

- Israel says taking control of the 9-mile border will allow Israel to prevent Hamas from rearming by smuggling weapons through tunnels that reach into Egypt. Israel last controlled the corridor in 2005 before giving up control of the enclave to the Palestinians

- An Israel military official said it had found 20 cross-border tunnels in the area. The findings and Israel’s advance risk sparking new tensions between Israel and Egypt

- The U.S. military has suspended the use of its temporary pier on the coast of Gaza because it was damaged during severe storms, a setback in the U.S. effort to deliver humanitarian by sea to the strip. It will take at least a week for the U.S. to repair the pier

-

Russia

- Israel has secured control of Gaza’s southern border with Egypt, achieving a key goal of the Rafah offensive as it seeks to eliminate Hamas without upsetting the U.S.

- Israel says taking control of the 9-mile border will allow Israel to prevent Hamas from rearming by smuggling weapons through tunnels that reach into Egypt. Israel last controlled the corridor in 2005 before giving up control of the enclave to the Palestinians

- An Israel military official said it had found 20 cross-border tunnels in the area. The findings and Israel’s advance risk sparking new tensions between Israel and Egypt

- The U.S. military has suspended the use of its temporary pier on the coast of Gaza because it was damaged during severe storms, a setback in the U.S. effort to deliver humanitarian by sea to the strip. It will take at least a week for the U.S. to repair the pier

-

Ukraine

- The Biden administration on Thursday said that it would allow Ukrainian forces to do limited targeting with American-supplied weapons inside Russia

- The new policy would allow Ukrainian forces to use artillery and short-range rockets against command posts, armed depots, and other assets on Russian territory that are being used by Russian troops to carry out attacks on Kharkiv in northeastern Ukraine

- The narrow geographic scope is an effort to help Ukraine better defend against Russia’s offensive while limiting the risk that the conflict in Ukraine could escalate into a direct conflict between Russia and the United States

-

China

- China’s official manufacturing purchasing managers index fell to 49.5 in May from 50.4 in April. The change index below the 50 mark that separates activity from contraction

- Exports fell sharply from 118 to 113 in May, with a score of 100 representing export levels in June 2020

-

India

- India’s economy grew at 8.2% for its full fiscal year compared with 7.0% a year earlier. The growth was fueld by government spending on infrastructure, and increased spend on manufacturing and construction

-

Canada

- Canadian police charged three men in the assassination of Hardeep Singh Nijjar, a Sikh activist who Canada’s prime minister has suggested was killed with the help of Indian government agents

-

UK

- British Prime Minister Rishi Sunak called a surprise summer election, a gamble by the British leader to galvanize his restive Conservative party as it trails the opposition Labour Party by double digits in the polls.

-

Germany

- In March 2024, German manufacturing orders decreased by 0.4%, contrary to the expected 0.5% rise, with significant declines in orders for aircraft, ships, trains, and metal products, despite a 1.1% increase in car industry orders and a 2.0% rise in foreign orders

-

France

- France is sending 1,000 police officers and deploying the army to New Caledonia after violent riots over proposed changes to voting rights, which have resulted in the deaths of at least five people and significant property damage

-

Japan

- Japan has intervened to prop up the yen after it hit a multidecade low against the dollar. The currency has plummeted against the dollar this year, hurt by increasing doubts among traders about the timing of U.S. interest rate cuts

-

North Korea

- Kim Ki Nam, the architect of North Korea’s cult-of-personality propaganda and mentor to Kim Jong Un, died at 94; Kim Jong Un will lead his state funeral

Commodities

-

Oil Prices

- WTI: $77.13 per barrel

- (0.76%) WoW; +7.65% YTD; +10.03% YoY

- Brent: $81.62 per barrel

- (0.61%) WoW; +5.94% YTD; +9.88% YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended May 24, up 0.2 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 600, down 4 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 454.7 million barrels, down (1.1%) YoY

- Refiners operated at a capacity utilization rate of 94.3% for the week, up from 91.7% in the prior week

- U.S. crude oil imports now amount to 6.663 million barrels per day, down (6.2%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.56 per gallon in the week of May 31,

down (0.2%) YoY

- Gasoline prices on the East Coast amounted to $3.59, up 1.8% YoY

- Gasoline prices in the Midwest amounted to $3.54, down (0.5%) YoY

- Gasoline prices on the Gulf Coast amounted to $3.21, up 0.0% YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.47, down (7.3%) YoY

- Gasoline prices on the West Coast amounted to $4.70, up 1.2% YoY

- Motor gasoline inventories were down by 2.0 million barrels from the prior week

- Motor gasoline inventories amounted to 228.8 million barrels, up 5.9% YoY

- Production of motor gasoline averaged 10.1 million bpd, up 0.4% YoY

- Demand for motor gasoline amounted to 9.148 million bpd, up 0.5% YoY

-

Distillates

- Distillate inventories decreased by 2.5 million in the week of May 31

- Total distillate inventories amounted to 119.3 million barrels, up 11.8% YoY

- Distillate production averaged 5.030 million bpd, down (0.2%) YoY

- Demand for distillates averaged 3.795 million bpd in the week, up 4.1% YoY

-

Natural Gas

- Natural gas inventories increased by 84 billion cubic feet last week

- Total natural gas inventories now amount to 2,795 billion cubic feet, up 14.3% YoY

Credit News

High yield bond yields increased 15bps to 7.95% and spreads increased 7bps to 328bps. Leveraged loan yields increased 11bps to 9.50% and spreads increased 1bps to 493bps. WTD Leveraged loan returns were positive 16bps. WTD high yield bond returns were negative 44bps. 10yr treasury yields increased 8bps to 4.55%. The loan asset class is benefiting from elevated coupons and Fed now expected to remain on hold until December. In addition, issuers are delivering solid earnings alongside a robust technical supported by retail inflows, a record pace of CLO origination, and very little net new supply.

High-yield:

Week ended 05/31/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 05/31/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: 99 Cents Only Stores ($350mn, 4/7/24), ConvergeOne ($1.3bn, 4/4/24), Xplornet Communications ($1.2bn, 3/31/24), JoAnn Stores ($658mn, 3/18/24), New Insight Holdings ($1.2bn, 3/13/24), Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), and Careismatic ($700mn, 1/22/24).

CLOs:

Week ended 05/31/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

Real Estate

Section 1:

- Demand for homes continues to far outpace the available supply pushing prices higher. Most of the newly built units were rentals.

- Rental vacancy rate flatlined at 6.6%, but homeowner vacancy rate dropped to 0.8%.

- The U.S. needs at least 1.5 million additional homes (Rental and For-Sale) to bring vacancy rates back in line with historical averages.

Section 2:

30 Year Fixed Mortgage

5/30/24: 7.03

10-year US Treasury

5/30/24: 4.55