U.S. News

- Retail Sales

- Sales at retailers jumped 0.6% in December to cap off a fairly robust holiday-shopping season

- Sales rose 3% in December at department stores, 1.5% at internet retailers and clothing stores, and 1.1% at auto dealers

- Sales fell at stores that sell furniture and appliances, likely because of slower home buying

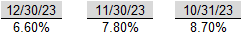

- Home Builders Confidence Index

- The Home Builders Confidence Index surged 8 points to 44 in January as falling mortgage rates drew in home buyers from the sidelines

- The U.S. housing market is warming up as rates stay below 7%, and buyers are eager to jump back in

- Even though rates are lower, many builders are still cutting prices to attract buyers and boost sales. About 31% of builders cut prices in January, down from 36% in December, with the average price cut at 6%

- Industrial Production

- Industrial production rose 0.1% in December, the Federal Reserve reported Wednesday

- Motor vehicles and parts output rose 1.6% after a 7.4% jump in the prior month due to the return of striking auto workers

- Excluding autos, total industrial output was flat and manufacturing output was down 0.1%

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 187,000 in the week ended January 12, down 16,000 from the prior week

- The four-week moving average was 203,250, down 4750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – decreased by 26,000 to 1.806 million in the week ended January 5. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.674 trillion in the week ended January 19, down $13.0 billion from the prior week

- Treasury holdings totaled $4.743 trillion, down $9.0 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.43 trillion in the week, down $0.0 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.07 trillion as of January 19, an increase of 8.3% from the previous year

- Debt held by the public was $24.60 trillion, and intragovernmental holdings were $7.06 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.4% in December year over year

- On a monthly basis, the CPI increased 0.3% in December on a seasonally adjusted basis, after increasing 0.1% in November

- The index for all items less food and energy (core CPI) rose 0.3% in December, after rising 0.3% in November

- Core CPI increased 3.9% for the 12 months ending December

- Food and Beverages:

- The food at home index increased 1.3% i n December from the same month a year earlier, and increased 0.1% in December month over month

- The food away from home index increased 5.2% in December from the same month a year earlier, and increased 0.3% in December month over month

- Commodities:

- The energy commodities index decreased (0.1%) in December after decreasing

- The energy commodities index fell (2.9%) over the last 12 months

- The energy services index 0.4% in December after increasing 0.7% in November

- The energy services index fell (1.1%) over the last 12 months

- The gasoline index fell (1.9%) over the last 12 months

- The fuel oil index fell (14.7%) over the last 12 months

- The index for electricity rose 3.3% over the last 12 months

- The index for natural gas fell (13.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $3,776.78 per 40ft container

- Drewry’s composite World Container Index has increased by 81.7% over the last 12 months

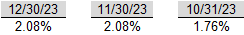

- Housing Market:

- The shelter index increased 0.5% in December after increasing 0.4% in November

- The rent index increased 0.4% in December after increasing 0.5% in November

- The index for lodging away from home decreased (1.1%) in December after decreasing (4.5%) in November

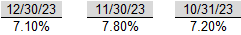

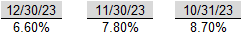

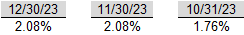

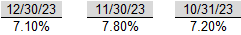

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel

- Israel’s prime minister Benjamin Netanyahu has told the Biden White House that he rejects any moves to establish a Palestinian state when Israel ends its offensive against Gaza, and that all territory west of the Jordan River would be under Israeli security control.

- His public statement on Thursday represents a rebuttal of US foreign policy. The White House responded by saying the US would continue working towards a two-state solution and that there could be no Israeli reoccupation of Gaza when the war concluded.

-

Yemen

- The U.S. military said it struck Houthi weaponry in Yemen that threatened merchant and U.S. Navy vessels in the Red Sea, America’s fourth strike on Houthi-held territory in recent weeks, as rising tensions across the region threaten to pull more parties into a widening war.

- A Pentagon official said it estimates that about a fourth of the Houthi arsenal has now been destroyed.

- President Biden said Thursday that the U.S. would continue to target Houthi weaponry until the group ceases its attacks on shipping vessels, after being asked whether the strikes were working.

-

Russia

- Russia has rejected an American proposal to reopen an arms-control dialogue with Washington, saying the U.S. was pursuing a hostile policy toward Moscow, U.S. officials said Thursday.

- The absence of talks between the two sides on reducing nuclear risks and potential arms-control steps comes during the worst downturn in U.S.-Russia relations since the end of the Cold War and has raised fears of a new arms race.

- U.S. national security adviser Jake Sullivan said in a speech in June that the U.S. was prepared to begin the talks without preconditions. And the Biden administration followed up with a confidential paper a few months later proposing such talks and outlining ideas on how to manage nuclear risks.

- But Moscow responded with its own diplomatic paper in late December, saying that it wasn’t interested in resuming arms-control talks, complaining that the U.S. was seeking the strategic defeat of Russia through its support of Ukraine, U.S. officials say.

-

China

- Births in China dropped by more than 500,000 last year to just over 9 million in total, accelerating the decline in the country’s population.

- The number of newborns has gone into free fall over the past several years. Official figures released Wednesday showed that China had fewer than half the number of births in 2023 than the country did in 2016, after China abolished the one-child policy.

- The worsening demographic gloom has taken on increasing urgency for Beijing. The country hit a historic turning point in 2022, marking the first year the population shrank since the starvation years in the early 1960s.

-

Nicaragua

- Nicaragua released 19 clergymen from prison, including Bishop Rolando Álvarez, the country’s most prominent political prisoner, and expelled them to the Vatican.

-

Ecuador

- Ecuador is at war with drug gangs, President Daniel Noboa said, as troops patrolled the country’s largest city, Guayaquil, a day after gunmen took over a TV studio and launched a series of attacks against the Andean nation’s new government.

-

Argentina

- Argentines long battered by galloping inflation were hit even harder in December as food, fuel and drug prices skyrocketed during President Javier Milei’s first month in office as he embarked on pro-market shock therapy to revive an economy in shambles.

-

Canada

- Armed with a multibillion-dollar war chest, Canada is offering money to cities to ditch zoning restrictions that thwart residential construction as the country deals with an acute housing shortage.

-

South Korea

- South Korea’s opposition party leader was stabbed in the neck in an attack that left him hospitalized in an incentive care unit.

-

North Korea

- North Korea has fired more than 200 rounds of artillery shells of its west coast, towards the South Korea’s Yeonpyeong Island, Seoul’s military has said.

-

Indonesia

- At a Chinese nickel smelter in Indonesia, workers were undertaking routine maintenance at dawn when a massive explosion rocked the facility. Waste from a furnace had flowed out and hit flammable material, resulting in the deaths of at least 19 workers and injuring dozens more as hot steam hissed out and fire ripped through the building.

Commodities

-

Oil Prices

- WTI: $73.77 per barrel

- 1.50% WoW; 2.96% YTD; (8.17%) YoY

- Brent: $78.82 per barrel

- 0.68% WoW; 2.31% YTD; (8.52%) YoY

-

US Production

- U.S. oil production amounted to 13.3 million bpd for the week ended January 12, up 0.1 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 620, up 1 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 429.9 million barrels, down (4.0%) YoY

- Refiners operated at a capacity utilization rate of 92.6% for the week, down from 92.9% in the prior week

- U.S. crude oil imports now amount to 6.241 million barrels per day, down 8.1% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.09 per gallon in the week of January 19,

down (9.0%) YoY

- Gasoline prices on the East Coast amounted to $3.15, down (6.3%) YoY

- Gasoline prices in the Midwest amounted to $2.90, down (11.5%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.76, down (9.6%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $2.85, down (16.5%) YoY

- Gasoline prices on the West Coast amounted to $4.11, up 0.6% YoY

- Motor gasoline inventories were up by 3.1 million barrels from the prior week

- Motor gasoline inventories amounted to 248.1 million barrels, up 7.7% YoY

- Production of motor gasoline averaged 9.37 million bpd, up 5.6% YoY

- Demand for motor gasoline amounted to 8.269 million bpd, up 2.7% YoY

-

Distillates

- Distillate inventories decreased by 2.4 million in the week of January 19

- Total distillate inventories amounted to 134.8 million barrels, up 16.4% YoY

- Distillate production averaged 4.902 million bpd, up 6.5% YoY

- Demand for distillates averaged 3.645 million bpd in the week, down (9.4%) YoY

-

Natural Gas

- Natural gas inventories decreased by 154 billion cubic feet last week

- Total natural gas inventories now amount to 3,182 billion cubic feet, up 12.8% YoY

Credit News

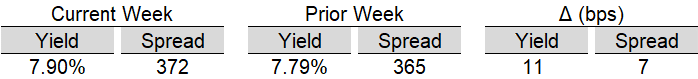

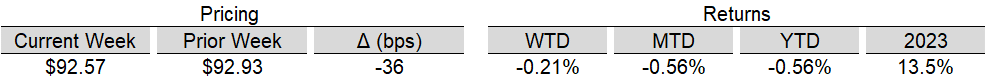

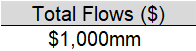

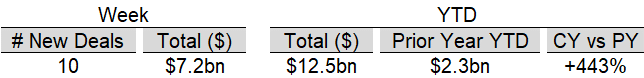

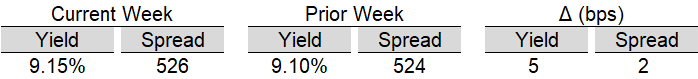

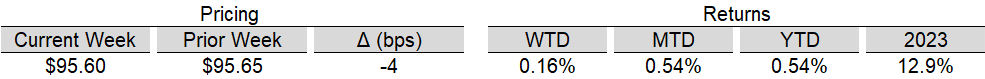

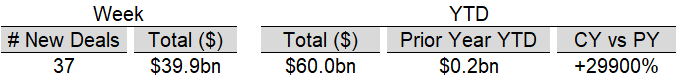

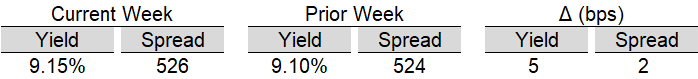

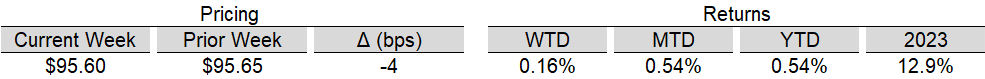

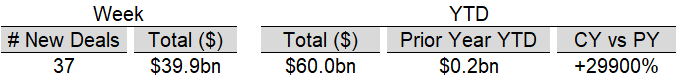

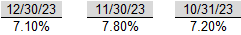

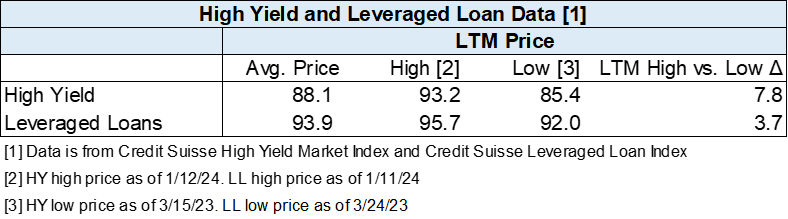

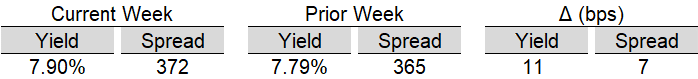

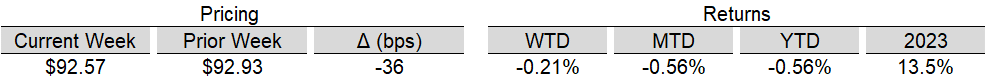

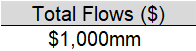

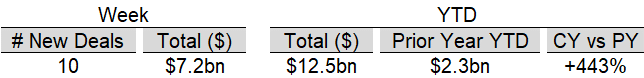

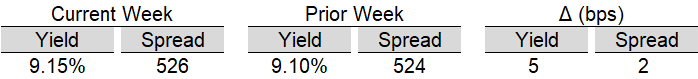

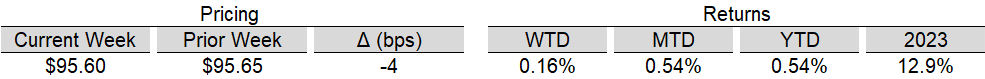

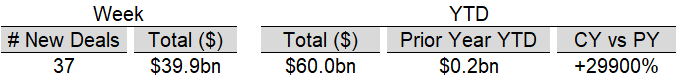

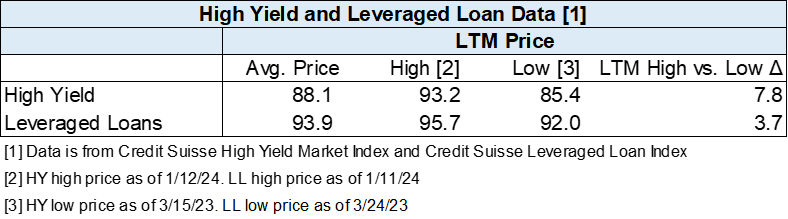

High yield bond yields increased 11bps to 7.9% and spreads widened 7bps to 372bps. Leveraged loan yields increased 5bps to 9.15% and spreads widened 2bps to 526bps. WTD Leveraged loan returns were positive 16bps. WTD high yield bond returns were negative 16bps. 10yr treasury yields increased 20bps+ during the week hurting fixed rate instruments. Loans again outperformed bonds as investors debated the timing and scale of Fed rate cuts in the face of generally better economic data.

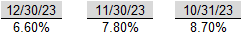

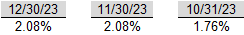

High-yield:

Week ended 1/19/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

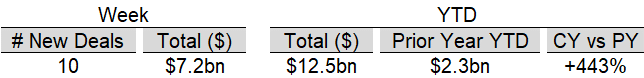

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 1/19/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Ligado Networks ($4.2bn, 11/1/23), Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23)

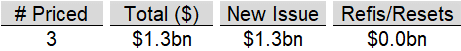

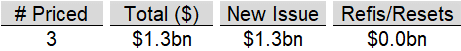

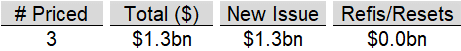

CLOs:

Week ended 1/19/2024

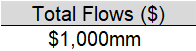

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

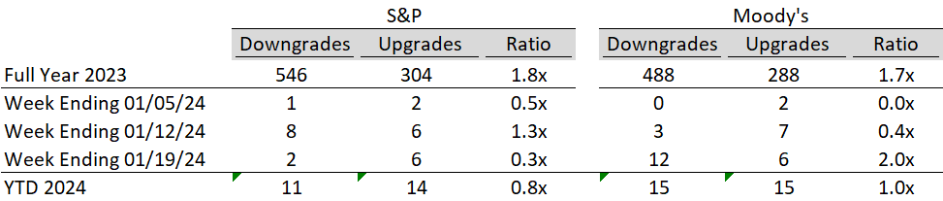

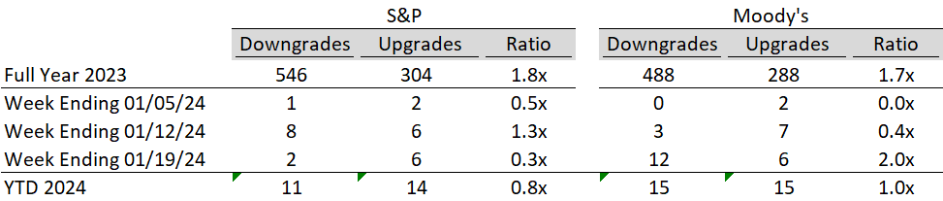

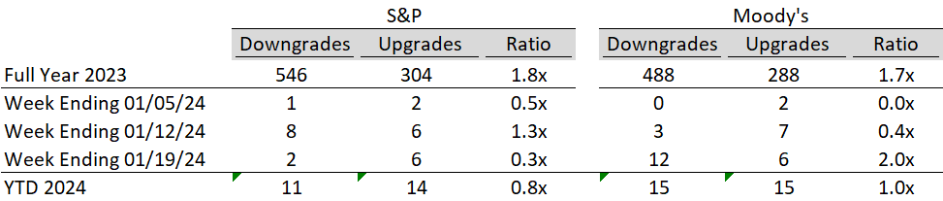

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

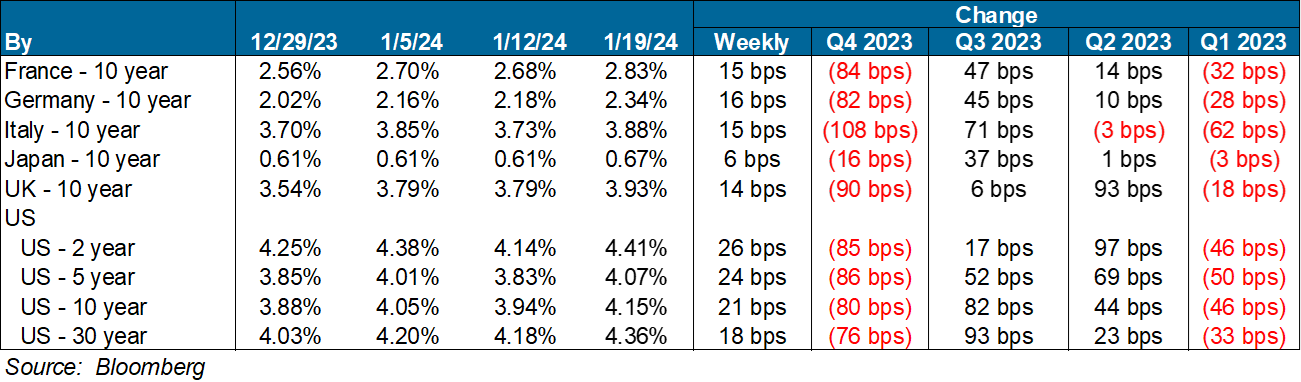

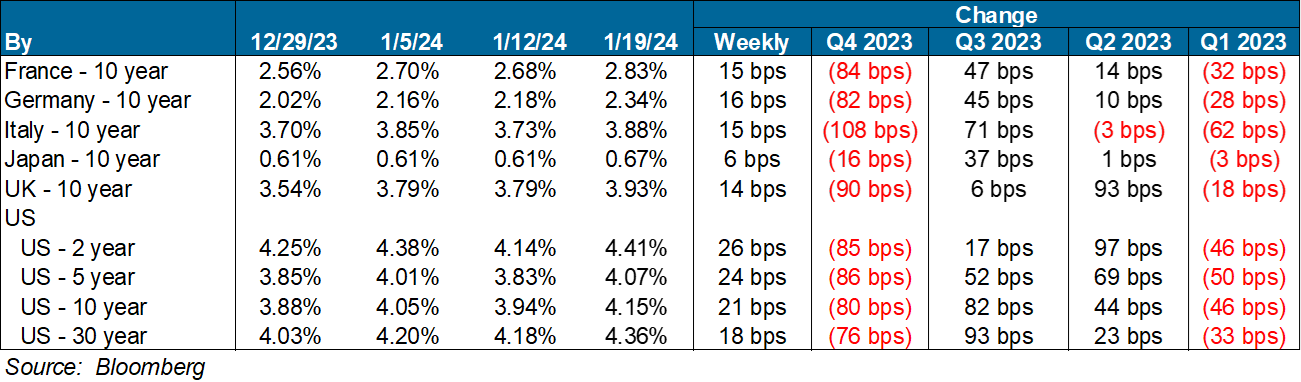

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

Real Estate Views & Trends:

U.S. News

- Retail Sales

- Sales at retailers jumped 0.6% in December to cap off a fairly robust holiday-shopping season

- Sales rose 3% in December at department stores, 1.5% at internet retailers and clothing stores, and 1.1% at auto dealers

- Sales fell at stores that sell furniture and appliances, likely because of slower home buying

- Home Builders Confidence Index

- The Home Builders Confidence Index surged 8 points to 44 in January as falling mortgage rates drew in home buyers from the sidelines

- The U.S. housing market is warming up as rates stay below 7%, and buyers are eager to jump back in

- Even though rates are lower, many builders are still cutting prices to attract buyers and boost sales. About 31% of builders cut prices in January, down from 36% in December, with the average price cut at 6%

- Industrial Production

- Industrial production rose 0.1% in December, the Federal Reserve reported Wednesday

- Motor vehicles and parts output rose 1.6% after a 7.4% jump in the prior month due to the return of striking auto workers

- Excluding autos, total industrial output was flat and manufacturing output was down 0.1%

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 187,000 in the week ended January 12, down 16,000 from the prior week

- The four-week moving average was 203,250, down 4750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – decreased by 26,000 to 1.806 million in the week ended January 5. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.674 trillion in the week ended January 19, down $13.0 billion from the prior week

- Treasury holdings totaled $4.743 trillion, down $9.0 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.43 trillion in the week, down $0.0 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.07 trillion as of January 19, an increase of 8.3% from the previous year

- Debt held by the public was $24.60 trillion, and intragovernmental holdings were $7.06 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.4% in December year over year

- On a monthly basis, the CPI increased 0.3% in December on a seasonally adjusted basis, after increasing 0.1% in November

- The index for all items less food and energy (core CPI) rose 0.3% in December, after rising 0.3% in November

- Core CPI increased 3.9% for the 12 months ending December

- Food and Beverages:

- The food at home index increased 1.3% i n December from the same month a year earlier, and increased 0.1% in December month over month

- The food away from home index increased 5.2% in December from the same month a year earlier, and increased 0.3% in December month over month

- Commodities:

- The energy commodities index decreased (0.1%) in December after decreasing

- The energy commodities index fell (2.9%) over the last 12 months

- The energy services index 0.4% in December after increasing 0.7% in November

- The energy services index fell (1.1%) over the last 12 months

- The gasoline index fell (1.9%) over the last 12 months

- The fuel oil index fell (14.7%) over the last 12 months

- The index for electricity rose 3.3% over the last 12 months

- The index for natural gas fell (13.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $3,776.78 per 40ft container

- Drewry’s composite World Container Index has increased by 81.7% over the last 12 months

- Housing Market:

- The shelter index increased 0.5% in December after increasing 0.4% in November

- The rent index increased 0.4% in December after increasing 0.5% in November

- The index for lodging away from home decreased (1.1%) in December after decreasing (4.5%) in November

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel

- Israel’s prime minister Benjamin Netanyahu has told the Biden White House that he rejects any moves to establish a Palestinian state when Israel ends its offensive against Gaza, and that all territory west of the Jordan River would be under Israeli security control.

- His public statement on Thursday represents a rebuttal of US foreign policy. The White House responded by saying the US would continue working towards a two-state solution and that there could be no Israeli reoccupation of Gaza when the war concluded.

-

Yemen

- The U.S. military said it struck Houthi weaponry in Yemen that threatened merchant and U.S. Navy vessels in the Red Sea, America’s fourth strike on Houthi-held territory in recent weeks, as rising tensions across the region threaten to pull more parties into a widening war.

- A Pentagon official said it estimates that about a fourth of the Houthi arsenal has now been destroyed.

- President Biden said Thursday that the U.S. would continue to target Houthi weaponry until the group ceases its attacks on shipping vessels, after being asked whether the strikes were working.

-

Russia

- Russia has rejected an American proposal to reopen an arms-control dialogue with Washington, saying the U.S. was pursuing a hostile policy toward Moscow, U.S. officials said Thursday.

- The absence of talks between the two sides on reducing nuclear risks and potential arms-control steps comes during the worst downturn in U.S.-Russia relations since the end of the Cold War and has raised fears of a new arms race.

- U.S. national security adviser Jake Sullivan said in a speech in June that the U.S. was prepared to begin the talks without preconditions. And the Biden administration followed up with a confidential paper a few months later proposing such talks and outlining ideas on how to manage nuclear risks.

- But Moscow responded with its own diplomatic paper in late December, saying that it wasn’t interested in resuming arms-control talks, complaining that the U.S. was seeking the strategic defeat of Russia through its support of Ukraine, U.S. officials say.

-

China

- Births in China dropped by more than 500,000 last year to just over 9 million in total, accelerating the decline in the country’s population.

- The number of newborns has gone into free fall over the past several years. Official figures released Wednesday showed that China had fewer than half the number of births in 2023 than the country did in 2016, after China abolished the one-child policy.

- The worsening demographic gloom has taken on increasing urgency for Beijing. The country hit a historic turning point in 2022, marking the first year the population shrank since the starvation years in the early 1960s.

-

Nicaragua

- Nicaragua released 19 clergymen from prison, including Bishop Rolando Álvarez, the country’s most prominent political prisoner, and expelled them to the Vatican.

-

Ecuador

- Ecuador is at war with drug gangs, President Daniel Noboa said, as troops patrolled the country’s largest city, Guayaquil, a day after gunmen took over a TV studio and launched a series of attacks against the Andean nation’s new government.

-

Argentina

- Argentines long battered by galloping inflation were hit even harder in December as food, fuel and drug prices skyrocketed during President Javier Milei’s first month in office as he embarked on pro-market shock therapy to revive an economy in shambles.

-

Canada

- Armed with a multibillion-dollar war chest, Canada is offering money to cities to ditch zoning restrictions that thwart residential construction as the country deals with an acute housing shortage.

-

South Korea

- South Korea’s opposition party leader was stabbed in the neck in an attack that left him hospitalized in an incentive care unit.

-

North Korea

- North Korea has fired more than 200 rounds of artillery shells of its west coast, towards the South Korea’s Yeonpyeong Island, Seoul’s military has said.

-

Indonesia

- At a Chinese nickel smelter in Indonesia, workers were undertaking routine maintenance at dawn when a massive explosion rocked the facility. Waste from a furnace had flowed out and hit flammable material, resulting in the deaths of at least 19 workers and injuring dozens more as hot steam hissed out and fire ripped through the building.

Commodities

-

Oil Prices

- WTI: $73.77 per barrel

- 1.50% WoW; 2.96% YTD; (8.17%) YoY

- Brent: $78.82 per barrel

- 0.68% WoW; 2.31% YTD; (8.52%) YoY

-

US Production

- U.S. oil production amounted to 13.3 million bpd for the week ended January 12, up 0.1 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 620, up 1 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 429.9 million barrels, down (4.0%) YoY

- Refiners operated at a capacity utilization rate of 92.6% for the week, down from 92.9% in the prior week

- U.S. crude oil imports now amount to 6.241 million barrels per day, down 8.1% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.09 per gallon in the week of January 19,

down (9.0%) YoY

- Gasoline prices on the East Coast amounted to $3.15, down (6.3%) YoY

- Gasoline prices in the Midwest amounted to $2.90, down (11.5%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.76, down (9.6%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $2.85, down (16.5%) YoY

- Gasoline prices on the West Coast amounted to $4.11, up 0.6% YoY

- Motor gasoline inventories were up by 3.1 million barrels from the prior week

- Motor gasoline inventories amounted to 248.1 million barrels, up 7.7% YoY

- Production of motor gasoline averaged 9.37 million bpd, up 5.6% YoY

- Demand for motor gasoline amounted to 8.269 million bpd, up 2.7% YoY

-

Distillates

- Distillate inventories decreased by 2.4 million in the week of January 19

- Total distillate inventories amounted to 134.8 million barrels, up 16.4% YoY

- Distillate production averaged 4.902 million bpd, up 6.5% YoY

- Demand for distillates averaged 3.645 million bpd in the week, down (9.4%) YoY

-

Natural Gas

- Natural gas inventories decreased by 154 billion cubic feet last week

- Total natural gas inventories now amount to 3,182 billion cubic feet, up 12.8% YoY

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

Real Estate Views & Trends: