U.S. News

- U.S. GDP

- The U.S. grew at a robust 3.3% annual pace in the 4th quarter

- The growth rate is down from the 4.9% rate in Q3 2023 but stronger than the 2% expectation

- Consumer spending on goods drove the increase, accounting for about 70% of the U.S. economic activity

- Personal-Consumption Expenditures

- The PCE inflation index, the Federal Reserve’s preferred gauge of inflation, rose 0.2% in December and 2.6% year over year

- The yearly rate of core inflation slowed to 2.9% from 3.2% to mark the lowest level in almost three years

- On a six-month annualized basis, core PCE rose

- New Home Sales

- U.S new home sales rose 8% to an annual rate of 664,000 in December, up 615,000 from November

- The increase in new home sales is driven by mortgage rates, which have dipped below 7% in early December 2023

- New home sales are still far below a recent peak of over 1 million in August 2020

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 214,000 in the week ended January 19, up 25,000 from the prior week

- The four-week moving average was 202,250, down 1500 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 27,000 to 1.833 million in the week ended January 12. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.677 trillion in the week ended January 26, up $3.5 billion from the prior week

- Treasury holdings totaled $4.723 trillion, down $20.0 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.43 trillion in the week, down $1.4 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.09 trillion as of January 26, an increase of 8.4% from the previous year

- Debt held by the public was $24.60 trillion, and intragovernmental holdings were $7.06 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.4% in December year over year

- On a monthly basis, the CPI increased 0.3% in December on a seasonally adjusted basis, after increasing 0.1% in November

- The index for all items less food and energy (core CPI) rose 0.3% in December, after rising 0.3% in November

- Core CPI increased 3.9% for the 12 months ending December

- Food and Beverages:

- The food at home index increased 1.3% i n December from the same month a year earlier, and increased 0.1% in December month over month

- The food away from home index increased 5.2% in December from the same month a year earlier, and increased 0.3% in December month over month

- Commodities:

- The energy commodities index decreased (0.1%) in December after decreasing

- The energy commodities index fell (2.9%) over the last 12 months

- The energy services index 0.4% in December after increasing 0.7% in November

- The energy services index fell (1.1%) over the last 12 months

- The gasoline index fell (1.9%) over the last 12 months

- The fuel oil index fell (14.7%) over the last 12 months

- The index for electricity rose 3.3% over the last 12 months

- The index for natural gas fell (13.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $3,964.18 per 40ft container

- Drewry’s composite World Container Index has increased by 93.7% over the last 12 months

- Housing Market:

- The shelter index increased 0.5% in December after increasing 0.4% in November

- The rent index increased 0.4% in December after increasing 0.5% in November

- The index for lodging away from home decreased (1.1%) in December after decreasing (4.5%) in November

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel

- Israel has been working to build a 1-kilometer-wide border security zone just inside Gaza to ensure the safety of its citizens near the Gaza border

- U.S. officials warn that turning the border along the 25-mile-long Gaza strip into a no man’s land would deepen Palestinian fears that Israel intends to occupy part of Gaza

- U.S. Secretary of State Anthony Blinken voiced opposition to the concept on Tuesday after the Israeli military said 21 soldiers had been killed during the demolitions of a building while attempting to create a security zone

- Israeli officials agree the buffer zone could be temporary but have not given a timetable for how long it might be necessary

-

Yemen

- The Houthis launched an attack on a U.S. destroyer and a British tanker owned by Trafigura this week

- The Chinese approached Iran to lean on the Houthis to halt their attacks in the Red Sea. However, Iran officials told the Chinese officials that they were not in control of the group but that the turmoil in the region would end if Israel agreed to a cease-fire

- The meeting between the Chinese and Iran came after a meeting between White House national security advisor Jake Sullivan and Beijing’s top foreign policy office Wang Li to discuss the situation in the middle east

- The U.S. says Iran supplies the Houthis with weapons, funding and other logistical support

- The U.S. led a coalition that has launched two major assaults on Houthi-controlled parts of Yemen, including one last week, while the U.S. alone has launched at least six other limited strikers

-

Russia

- 74 people aboard a Russian military plane, including dozens of prisoners of war, died when it crashed near the border of Ukraine. The plane crash was one of the deadliest incidents since the start of the war

- Russia accused Ukraine of shooting the plane, killing 65 Ukrainian soldiers heading to a prearranged prisoner exchange site

-

China

- Chinese officials cut the amount of reserves banks must hold in order to stimulate lending. They also pledged to lower interest rates for rural enterprises and small businesses, in addition to relaxing regulations to allow property developers to dip into commercial property loans to repay other outstanding debt

- The moves triggered a stock-market selloff due to deepening concerns about the economy

-

Sweden

- Turkey has approved Sweden’s bid to join NATO. Sweden now only needs Hungarian approval to join the alliance

-

Nicaragua

- Nicaragua released 19 clergymen from prison, including Bishop Rolando Álvarez, the country’s most prominent political prisoner, and expelled them to the Vatican.

-

Ecuador

- Ecuador is at war with drug gangs, President Daniel Noboa said, as troops patrolled the country’s largest city, Guayaquil, a day after gunmen took over a TV studio and launched a series of attacks against the Andean nation’s new government.

-

Argentina

- Argentines long battered by galloping inflation were hit even harder in December as food, fuel and drug prices skyrocketed during President Javier Milei’s first month in office as he embarked on pro-market shock therapy to revive an economy in shambles.

-

Canada

- Armed with a multibillion-dollar war chest, Canada is offering money to cities to ditch zoning restrictions that thwart residential construction as the country deals with an acute housing shortage.

-

South Korea

- South Korea’s opposition party leader was stabbed in the neck in an attack that left him hospitalized in an incentive care unit.

Commodities

-

Oil Prices

- WTI: $78.12 per barrel

- 6.42% WoW; 9.03% YTD; (3.57%) YoY

- Brent: $83.73 per barrel

- 6.58% WoW; 8.68% YTD; (4.28%) YoY

-

US Production

- U.S. oil production amounted to 12.3 million bpd for the week ended January 19, down 0.9 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 621, up 1 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 420.7 million barrels, down (6.2%) YoY

- Refiners operated at a capacity utilization rate of 85.5% for the week, down from 92.6% in the prior week

- U.S. crude oil imports now amount to 7.420 million barrels per day, down (5.5%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.10 per gallon in the week of January 26,

down (11.6%) YoY

- Gasoline prices on the East Coast amounted to $3.13, down (10.0%) YoY

- Gasoline prices in the Midwest amounted to $2.97, down (12.1%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.77, down (12.5%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $2.79, down (21.7%) YoY

- Gasoline prices on the West Coast amounted to $4.06, down (1.6%) YoY

- Motor gasoline inventories were up by 4.9 million barrels from the prior week

- Motor gasoline inventories amounted to 253.0 million barrels, up 9.0% YoY

- Production of motor gasoline averaged 8.33 million bpd, down (5.7%) YoY

- Demand for motor gasoline amounted to 7.880 million bpd, down (3.2%) YoY

-

Distillates

- Distillate inventories decreased by -1.4 million in the week of January 26

- Total distillate inventories amounted to 133.3 million barrels, up 15.7% YoY

- Distillate production averaged 4.500 million bpd, down (2.0%) YoY

- Demand for distillates averaged 3.784 million bpd in the week, down (2.4%) YoY

-

Natural Gas

- Natural gas inventories decreased by 326 billion cubic feet last week

- Total natural gas inventories now amount to 2,856 billion cubic feet, up 4.5% YoY

Credit News

High yield bond yields decreased 17bps to 7.73% and spreads tightened 14bps to 358bps. Leveraged loan yields increased 1bps to 9.16% and spreads were unchanged at 526bps. WTD Leveraged loan returns were positive 17bps. WTD high yield bond returns were positive 61bps. 10yr treasury yields were mostly flat for the week. High yield bonds made back all the losses of the last two weeks, outperforming loans as credit markets took a risk on tone. On a MTD basis, Loans have outperformed bonds by ~65bps.

High-yield:

Week ended 1/26/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 1/26/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Enviva Partners ($750mn, 1/15/24, Ligado Networks ($4.2bn, 11/1/23), Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23)

CLOs:

Week ended 1/26/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

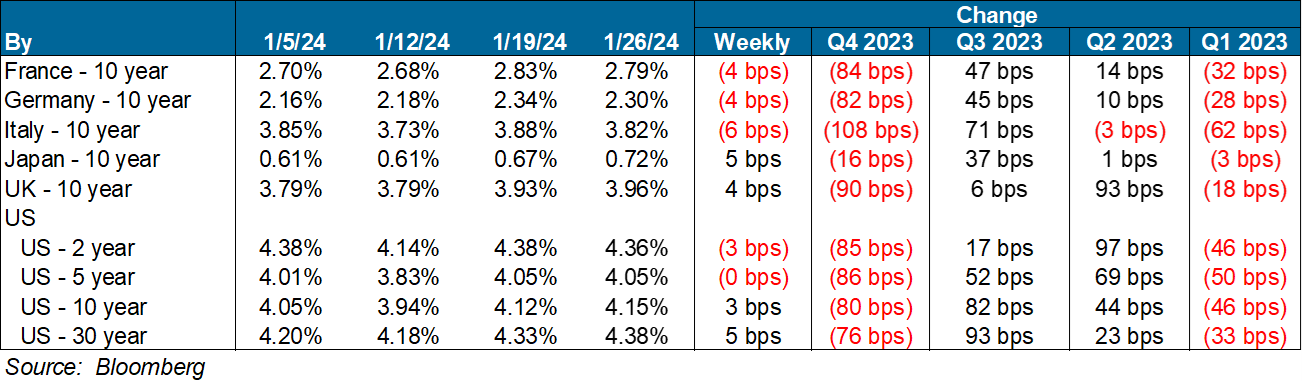

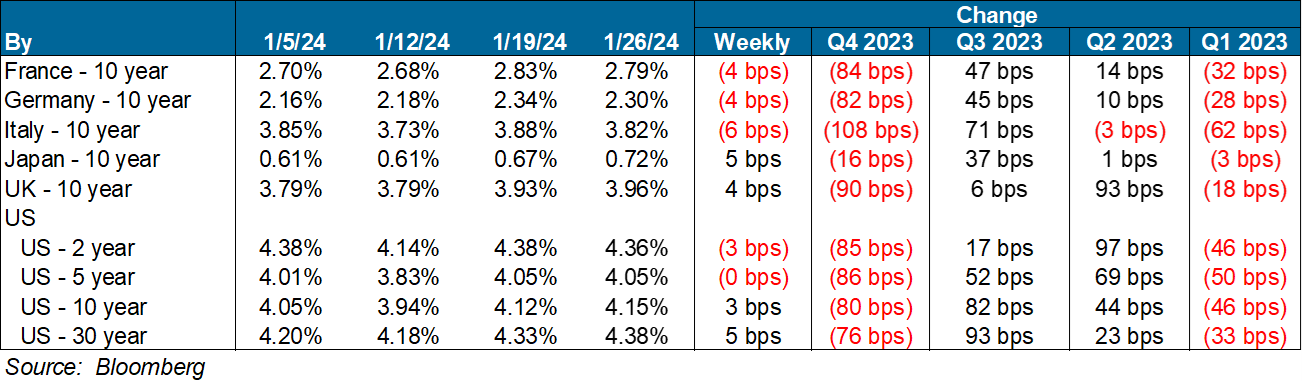

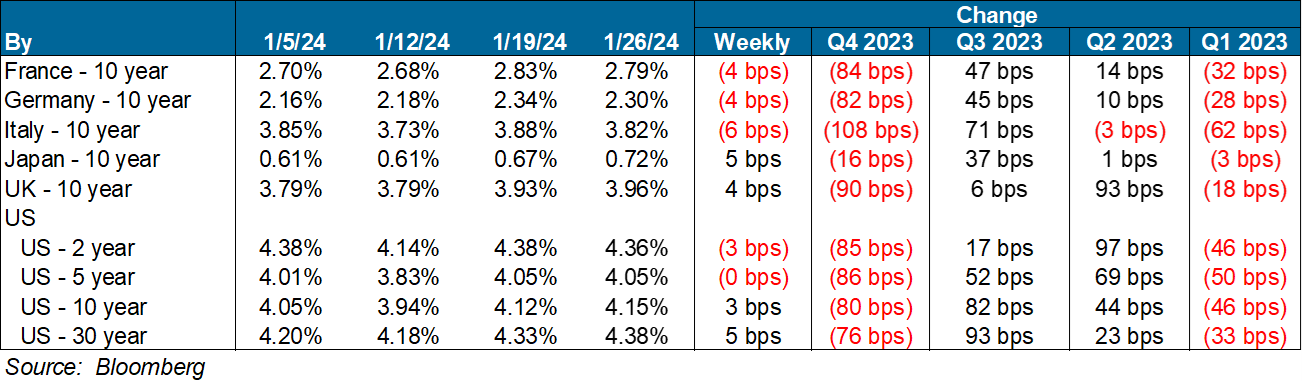

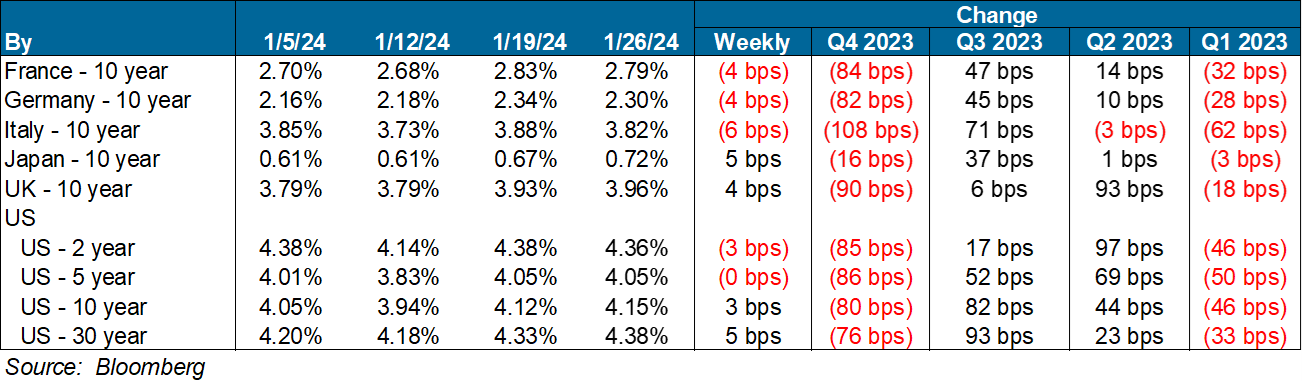

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

US Industrial Market Overview:

Absorption totals and vacancy rates reverting to pre-pandemic levels, driven by high interest rates, normalized demand, and a surge in construction deliveries.

- Across the nation, most of the positive absorption stemmed from newly delivered, pre-leased industrial facilities, with the South region accounting for 58.5%.

- Q4 2023 marked the completion of an additional 156.3 million square feet, the second-highest quarterly total on record.

- Despite the robust completion figures, new construction starts experienced a 20.8% quarter-over-quarter decline, signaling a shift in industry momentum.

- Vacancy rates increased by 70 bps, reaching 5.2%, surpassing the 5% mark for the first time since Q3 2020.

- Asking rents inched higher to $9.79 per square foot, reflecting a 0.5% quarterly increase.

U.S. News

- U.S. GDP

- The U.S. grew at a robust 3.3% annual pace in the 4th quarter

- The growth rate is down from the 4.9% rate in Q3 2023 but stronger than the 2% expectation

- Consumer spending on goods drove the increase, accounting for about 70% of the U.S. economic activity

- Personal-Consumption Expenditures

- The PCE inflation index, the Federal Reserve’s preferred gauge of inflation, rose 0.2% in December and 2.6% year over year

- The yearly rate of core inflation slowed to 2.9% from 3.2% to mark the lowest level in almost three years

- On a six-month annualized basis, core PCE rose

- New Home Sales

- U.S new home sales rose 8% to an annual rate of 664,000 in December, up 615,000 from November

- The increase in new home sales is driven by mortgage rates, which have dipped below 7% in early December 2023

- New home sales are still far below a recent peak of over 1 million in August 2020

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 214,000 in the week ended January 19, up 25,000 from the prior week

- The four-week moving average was 202,250, down 1500 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 27,000 to 1.833 million in the week ended January 12. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.677 trillion in the week ended January 26, up $3.5 billion from the prior week

- Treasury holdings totaled $4.723 trillion, down $20.0 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.43 trillion in the week, down $1.4 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.09 trillion as of January 26, an increase of 8.4% from the previous year

- Debt held by the public was $24.60 trillion, and intragovernmental holdings were $7.06 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.4% in December year over year

- On a monthly basis, the CPI increased 0.3% in December on a seasonally adjusted basis, after increasing 0.1% in November

- The index for all items less food and energy (core CPI) rose 0.3% in December, after rising 0.3% in November

- Core CPI increased 3.9% for the 12 months ending December

- Food and Beverages:

- The food at home index increased 1.3% i n December from the same month a year earlier, and increased 0.1% in December month over month

- The food away from home index increased 5.2% in December from the same month a year earlier, and increased 0.3% in December month over month

- Commodities:

- The energy commodities index decreased (0.1%) in December after decreasing

- The energy commodities index fell (2.9%) over the last 12 months

- The energy services index 0.4% in December after increasing 0.7% in November

- The energy services index fell (1.1%) over the last 12 months

- The gasoline index fell (1.9%) over the last 12 months

- The fuel oil index fell (14.7%) over the last 12 months

- The index for electricity rose 3.3% over the last 12 months

- The index for natural gas fell (13.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $3,964.18 per 40ft container

- Drewry’s composite World Container Index has increased by 93.7% over the last 12 months

- Housing Market:

- The shelter index increased 0.5% in December after increasing 0.4% in November

- The rent index increased 0.4% in December after increasing 0.5% in November

- The index for lodging away from home decreased (1.1%) in December after decreasing (4.5%) in November

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel

- Israel has been working to build a 1-kilometer-wide border security zone just inside Gaza to ensure the safety of its citizens near the Gaza border

- U.S. officials warn that turning the border along the 25-mile-long Gaza strip into a no man’s land would deepen Palestinian fears that Israel intends to occupy part of Gaza

- U.S. Secretary of State Anthony Blinken voiced opposition to the concept on Tuesday after the Israeli military said 21 soldiers had been killed during the demolitions of a building while attempting to create a security zone

- Israeli officials agree the buffer zone could be temporary but have not given a timetable for how long it might be necessary

-

Yemen

- The Houthis launched an attack on a U.S. destroyer and a British tanker owned by Trafigura this week

- The Chinese approached Iran to lean on the Houthis to halt their attacks in the Red Sea. However, Iran officials told the Chinese officials that they were not in control of the group but that the turmoil in the region would end if Israel agreed to a cease-fire

- The meeting between the Chinese and Iran came after a meeting between White House national security advisor Jake Sullivan and Beijing’s top foreign policy office Wang Li to discuss the situation in the middle east

- The U.S. says Iran supplies the Houthis with weapons, funding and other logistical support

- The U.S. led a coalition that has launched two major assaults on Houthi-controlled parts of Yemen, including one last week, while the U.S. alone has launched at least six other limited strikers

-

Russia

- 74 people aboard a Russian military plane, including dozens of prisoners of war, died when it crashed near the border of Ukraine. The plane crash was one of the deadliest incidents since the start of the war

- Russia accused Ukraine of shooting the plane, killing 65 Ukrainian soldiers heading to a prearranged prisoner exchange site

-

China

- Chinese officials cut the amount of reserves banks must hold in order to stimulate lending. They also pledged to lower interest rates for rural enterprises and small businesses, in addition to relaxing regulations to allow property developers to dip into commercial property loans to repay other outstanding debt

- The moves triggered a stock-market selloff due to deepening concerns about the economy

-

Sweden

- Turkey has approved Sweden’s bid to join NATO. Sweden now only needs Hungarian approval to join the alliance

-

Nicaragua

- Nicaragua released 19 clergymen from prison, including Bishop Rolando Álvarez, the country’s most prominent political prisoner, and expelled them to the Vatican.

-

Ecuador

- Ecuador is at war with drug gangs, President Daniel Noboa said, as troops patrolled the country’s largest city, Guayaquil, a day after gunmen took over a TV studio and launched a series of attacks against the Andean nation’s new government.

-

Argentina

- Argentines long battered by galloping inflation were hit even harder in December as food, fuel and drug prices skyrocketed during President Javier Milei’s first month in office as he embarked on pro-market shock therapy to revive an economy in shambles.

-

Canada

- Armed with a multibillion-dollar war chest, Canada is offering money to cities to ditch zoning restrictions that thwart residential construction as the country deals with an acute housing shortage.

-

South Korea

- South Korea’s opposition party leader was stabbed in the neck in an attack that left him hospitalized in an incentive care unit.

Commodities

-

Oil Prices

- WTI: $78.12 per barrel

- 6.42% WoW; 9.03% YTD; (3.57%) YoY

- Brent: $83.73 per barrel

- 6.58% WoW; 8.68% YTD; (4.28%) YoY

-

US Production

- U.S. oil production amounted to 12.3 million bpd for the week ended January 19, down 0.9 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 621, up 1 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 420.7 million barrels, down (6.2%) YoY

- Refiners operated at a capacity utilization rate of 85.5% for the week, down from 92.6% in the prior week

- U.S. crude oil imports now amount to 7.420 million barrels per day, down (5.5%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.10 per gallon in the week of January 26,

down (11.6%) YoY

- Gasoline prices on the East Coast amounted to $3.13, down (10.0%) YoY

- Gasoline prices in the Midwest amounted to $2.97, down (12.1%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.77, down (12.5%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $2.79, down (21.7%) YoY

- Gasoline prices on the West Coast amounted to $4.06, down (1.6%) YoY

- Motor gasoline inventories were up by 4.9 million barrels from the prior week

- Motor gasoline inventories amounted to 253.0 million barrels, up 9.0% YoY

- Production of motor gasoline averaged 8.33 million bpd, down (5.7%) YoY

- Demand for motor gasoline amounted to 7.880 million bpd, down (3.2%) YoY

-

Distillates

- Distillate inventories decreased by -1.4 million in the week of January 26

- Total distillate inventories amounted to 133.3 million barrels, up 15.7% YoY

- Distillate production averaged 4.500 million bpd, down (2.0%) YoY

- Demand for distillates averaged 3.784 million bpd in the week, down (2.4%) YoY

-

Natural Gas

- Natural gas inventories decreased by 326 billion cubic feet last week

- Total natural gas inventories now amount to 2,856 billion cubic feet, up 4.5% YoY

Credit News

High yield bond yields decreased 17bps to 7.73% and spreads tightened 14bps to 358bps. Leveraged loan yields increased 1bps to 9.16% and spreads were unchanged at 526bps. WTD Leveraged loan returns were positive 17bps. WTD high yield bond returns were positive 61bps. 10yr treasury yields were mostly flat for the week. High yield bonds made back all the losses of the last two weeks, outperforming loans as credit markets took a risk on tone. On a MTD basis, Loans have outperformed bonds by ~65bps.

High-yield:

Week ended 1/26/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 1/26/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Enviva Partners ($750mn, 1/15/24, Ligado Networks ($4.2bn, 11/1/23), Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23)

CLOs:

Week ended 1/26/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

US Industrial Market Overview:

Absorption totals and vacancy rates reverting to pre-pandemic levels, driven by high interest rates, normalized demand, and a surge in construction deliveries.

- Across the nation, most of the positive absorption stemmed from newly delivered, pre-leased industrial facilities, with the South region accounting for 58.5%.

- Q4 2023 marked the completion of an additional 156.3 million square feet, the second-highest quarterly total on record.

- Despite the robust completion figures, new construction starts experienced a 20.8% quarter-over-quarter decline, signaling a shift in industry momentum.

- Vacancy rates increased by 70 bps, reaching 5.2%, surpassing the 5% mark for the first time since Q3 2020.

- Asking rents inched higher to $9.79 per square foot, reflecting a 0.5% quarterly increase.