U.S. News

- Consumer Confidence

- The consumer confidence index rebounded in November from a 15-month low to 102

- However, Americans remain concerned about the economy despite the best job market in decades

- Consumers are preoccupied with rising prices in general, the conflicts in Ukraine and the Middle East, and higher interest rates

- New Home Sales

- U.S. new-home sales fell 5.6% to a seasonally adjusted annual rate of 679,000 in October

- The median sales price of new houses sold in October dropped to $409,300, down from $422,300 in the prior month and down 17.6% from the same month last year

- This represents the lowest level since August 2021

- Construction Spending

- Construction spending rose in October for the 10th month in a row, largely because of work on commercial buildings and government-funded public projects

- High interest rates have tempered demand for new homes and apartments, but they have had less effect on other forms of construction

- Government-funded construction has jumped 16% in the past year

- Jobless Claim

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 218,000 in

the week ended November 24, up 7,000 from the prior week

- The four-week moving average was 220,000, up 500 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 86,000 to 1.927

million in the week ended November 17. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.796 trillion in the week ended December 1, down $14.7 billion from

the prior week

- Treasury holdings totaled $4.843 trillion, up $0.3 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.45 trillion in the week, down $8.7 billion from the

prior week

- Total Public Debt

- Total public debt outstanding was $33.85 trillion as of December 1, an increase of 7.9% from the previous

year

- Debt held by the public was $26.58 trillion, and intragovernmental holdings were $7.12 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.2% in October year over year

- On a monthly basis, the CPI increased 0.0% in October on a seasonally adjusted basis, after increasing

0.4% in September

- The index for all items less food and energy (core CPI) rose 0.2% in October, after rising 0.3% in

September

- Core CPI increased 4.0% for the 12 months ending October

- Food and Beverages:

- The food at home index increased 2.1% in October from the same month a year earlier, and increased

0.3% in October month over month

- The food away from home index increased 5.4% in October from the same month a year earlier, and

increased 0.4% in October month over month

- Commodities:

- The energy commodities index decreased (4.9%) in October after increasing 2.3%

- The energy commodities index fell (6.2%) over the last 12 months

- The energy services index (1.0%) in October after increasing 0.1% in September

- The energy services index fell (2.3%) over the last 12 months

- The gasoline index fell (5.3%) over the last 12 months

- The fuel oil index fell (21.4%) over the last 12 months

- The index for electricity rose 2.4% over the last 12 months

- The index for natural gas fell (15.8%) over the last 12 months

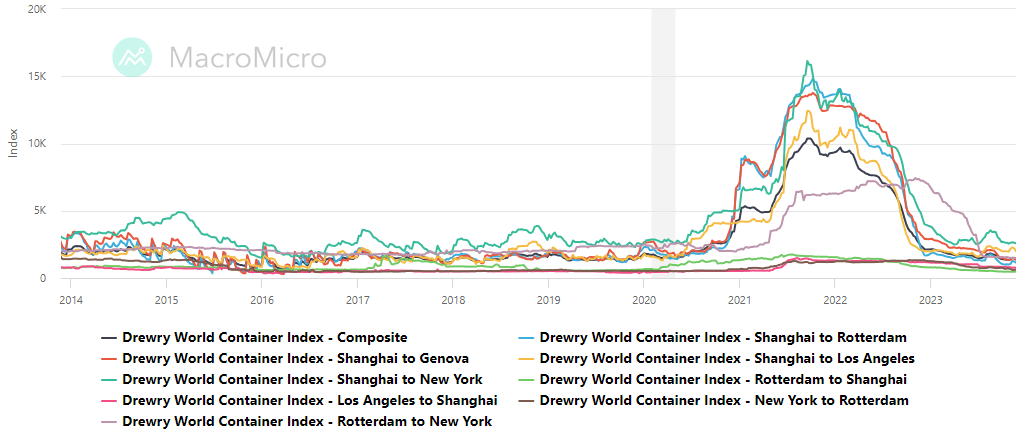

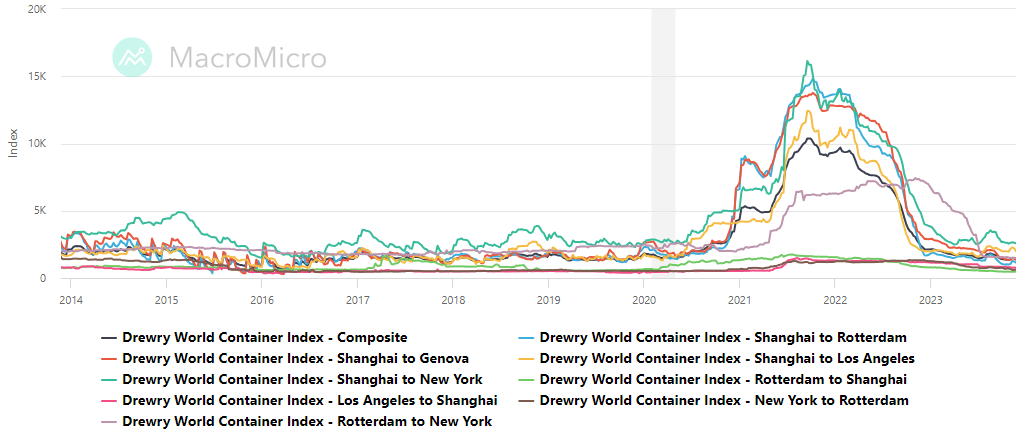

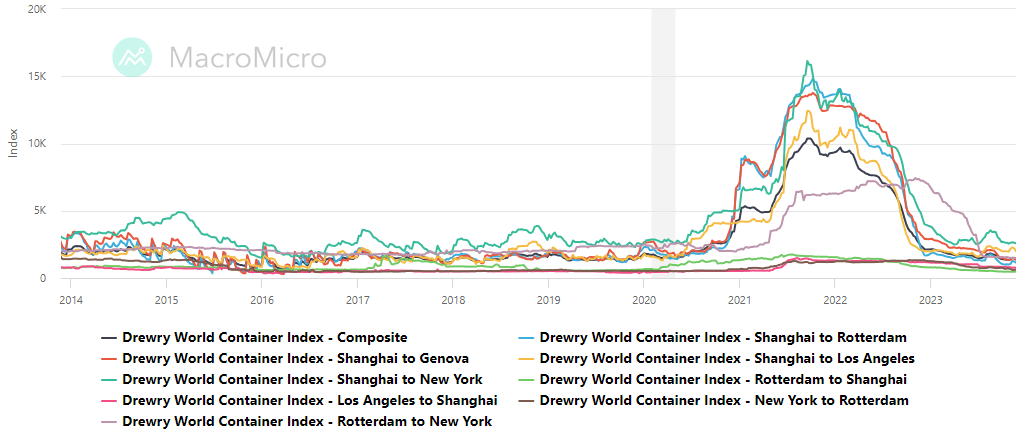

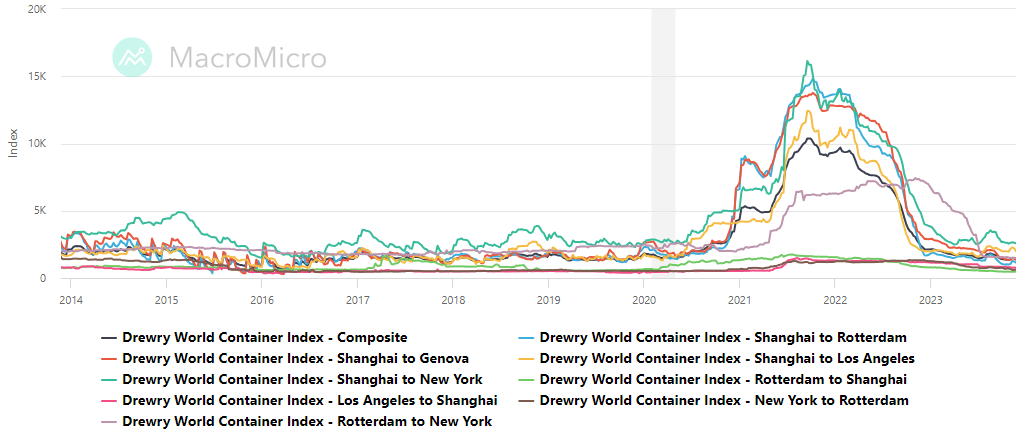

- Supply Chain:

- Drewry’s composite World Container Index decreased to $1,381.82 per 40ft

- Drewry’s composite World Container Index has decreased by (39.5%) over the last 12 months

- Housing Market:

- The shelter index increased 0.3% in October after increasing 0.6% in September

- The rent index increased 0.3% in October after increasing 0.6% in September

- The index for lodging away from home decreased (6.1%) in October after increasing 0.7% in September

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, remaining flat since August and up 1% since the start of 2023

World News

-

Israel/Middle East

- A weeklong truce between Israel and Hamas expired early Friday morning, prompting Israel to renew combat operations in Gaza after it said Hamas fired toward Israeli territory

- The end of the cease-fire came as mediators engaged in intense talks in which Hamas didn’t provide a list of hostages needed for an extension, Egyptian officials said. Hamas said it was struggling to access some hostages held by other groups

- Israel’s resumed offensive is expected to focus on southern Gaza, where it claims many of Hamas’s senior leaders are hiding. It published a map it says will be used to guide Gazans away from areas of fighting

- Secretary of State Antony Blinken, visiting the region for the third time since Hamas’s Oct. 7 attack, had urged Israel to extend the pause and reduce civilian casualties if the fighting resumes

- Hamas released two hostages late on Thursday and six more around midnight. Thirty Palestinians – seven women and 23 minors – were released from Israeli prisons as part of a swap deal

-

Ukraine

- Ukraine’s security service carried out an overnight explosion on a key rail route between Russia and China on Thursday

- Four explosive devices were detonated while a freight train was traveling. Currently, the Russian security service is working at the site as Russian railway workers deal with the consequences of the Ukrainian special operation

-

China

- Factory activity in China slid deeper into contraction in November as domestic and foreign orders dried up, while activity in the services sector shrank for the first time this year

- China’s real-estate sector is mired in a protracted downturn, putting the squeeze on consumer confidence and households’ willingness to spend. House prices fell in 70 major cities at a faster clip in October than a month earlier, while nationwide the amount of new home sales measured in floor space was around 20% lower than a year earlier

- China’s new home sales continued to drop in November, according to private data released on Thursday by China Real Estate Information Corp. The sales of China’s 100 largest real-estate developers totaled the equivalent of $54.7 billion for the month, down 30% from a year ago, when many parts of China were under Covid-19 lockdowns and business activities were restricted

- China’s economy is in need of more government help to avoid a pronounced year-end slowdown, economists say. Businesses are finding few buyers for their goods overseas as growth slows in the U.S. and other major economies

-

Spain

- Amazon reached an agreement with most of its workers in Spain, averting the full impact of a strike that risked crippling its warehouses on one of the busiest days of the year

-

Italy

- Pope Francis is punishing one of his most vocal conservative critics in the Catholic hierarchy, U.S. Cardinal Raymond Burke, by taking away his stipend and rent-free apartment in Rome

-

India

- An Indian government employee tried to have a vocal critic of New Delhi assassinated in New York earlier this year, U.S. prosecutors alleged, a development that threatens to cause new rifts in the deepening relationship between Washington and New Delhi

-

Argentina

- Argentina’s newly elected President, Javier Milei, wants to adopt the U.S. dollar as the national currency and strip the central bank’s power to print money. The country has been overcome with record inflation and low economic growth

-

India

- India races to recuse 40 workers trapped in an Indian mountain tunnel following a landslide on Sunday. The men have received food, oxygen and medicine through a small pipe that was undamaged

-

North Korea

- North Korea said it had successfully placed its homegrown spy satellite into orbit, a much anticipated attempt after a pair of failed tries earlier this year

-

United Kingdom

- The U.K. government has sanctioned 29 entities and individuals operating in and supporting Russia’s gold and oil sectors, in an effort to cut off revenue streams funding its war in Ukraine

Commodities

-

Oil Prices

- WTI: $74.24 per barrel

- (1.72%) WoW; (6.65%) YTD; (4.45%)YoY

- Brent: $79.02 per barrel

- (1.94%) WoW; (5.82%) YTD; (2.71%)YoY

-

US Production

- U.S. oil production amounted to 13.2 million bpd for the week ended November 24, down 0.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 625, up 3 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 449.7 million barrels, up 7.3% YoY

- Refiners operated at a capacity utilization rate of 89.8% for the week, up from 87.0% in the

prior week

- U.S. crude oil imports now amount to 6.529 million barrels per day, down (3.4%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.25 per gallon in the week of December 1,

down (5.8%) YoY

- Gasoline prices on the East Coast amounted to $3.27,down (8.5%) YoY

- Gasoline prices in the Midwest amounted to $3.11, down (9.9%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.80, down (6.6%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.22, down (11.8%) YoY

- Gasoline prices on the West Coast amounted to $4.49, down (4.5%) YoY

- Motor gasoline inventories were up by 1.8 million barrels from the prior

- Motor gasoline inventories amounted to 218.2 million barrels, up 2.1%

- Production of motor gasoline averaged 9.34 million bpd, down (0.2%) YoY

- Demand for motor gasoline amounted to 8.206 million bpd, down (1.3%) YoY

-

Distillates

- Distillate inventories decreased by 5.2 million in the week of December 1

- Total distillate inventories amounted to 110.8 million barrels, down (1.7%)

- Distillate production averaged 4.998 million bpd, down (5.9%) YoY

- Demand for distillates averaged 3.014 million bpd in the week, down (17.6%) YoY

-

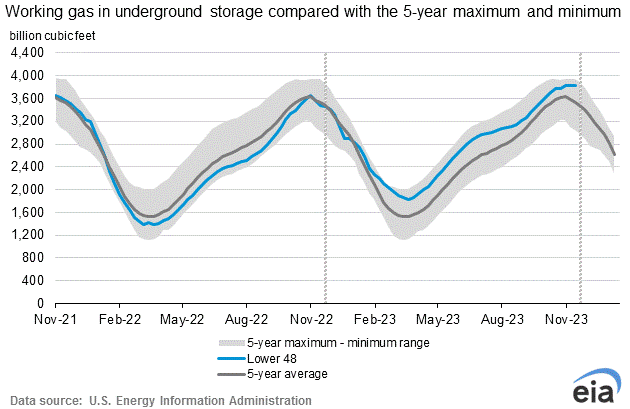

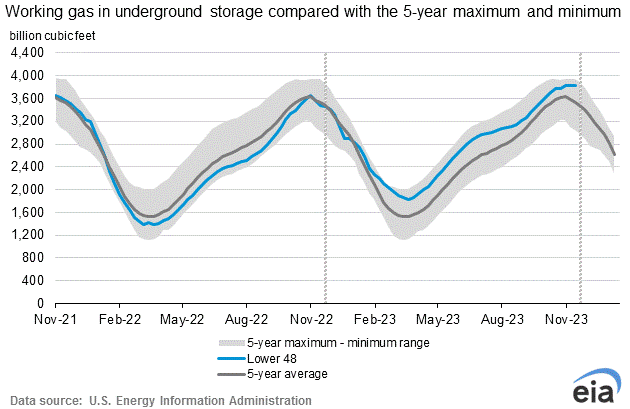

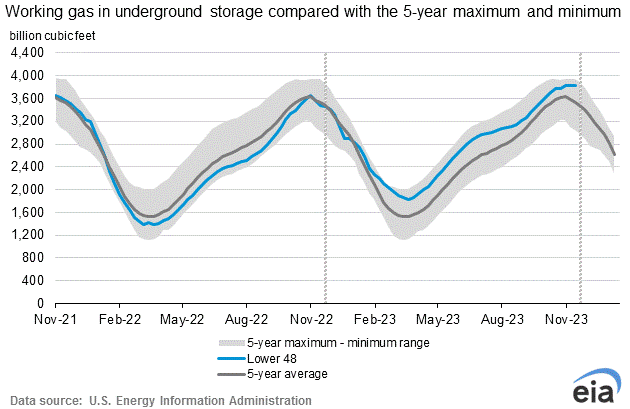

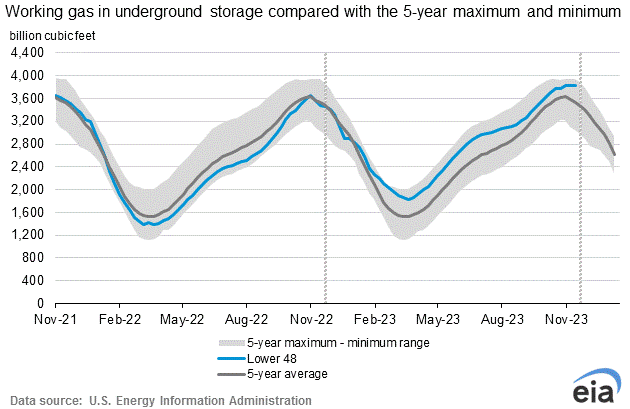

Natural Gas

- Natural gas inventories increased by 10 billion cubic feet last week

- Total natural gas inventories now amount to 3,836 billion cubic feet, up 10.1% YoY

Credit News

High yield bond yields decreased 30bps to 8.36% and spreads tightened 2bps to 400bps. Leveraged loan yields decreased 21bps to 9.74% and spreads were flat at 560bps. WTD Leveraged loan returns were positive 19bps. WTD high yield bond returns were positive 119bps. Bonds continue to outperform loans in a falling rate environment, with the 10yr treasury yield falling from ~4.45% on the eve of Thanksgiving to ~4.3%. Credit markets are reacting to tame inflation data and favorable Fed Speak. Voting FOMC Member Waller spoke about rates cuts in early 24 if inflation continues to decline.

High-yield:

Week ended 12/1/2023

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 12/1/2023

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23), Mallinckrodt ($2.8bn 8/28/23), Yellow Corp ($485mm 8/8/23), Anchor Glass ($675mm 7/11/23), Instant Brands ($391mm 6/12/23), Cyxtera Technologies ($768mm 6/4/23), Diebold ($2.0bn 6/1/23), Envision Health ($7.7bn 5/14/23), Venator Materials ($1.1bn 5/12/23), Bed Bath & Beyond ($5.2bn 4/22/23), David’s Bridal ($254mn 4/17/23), Monitronics International ($794mm 4/15/23), Catalina ($222mn 3/29/23), Diamond Sports ($8.6bn, 2/15/23), Avaya ($2.9bn, 2/14/23), Heritage Power ($485mn, 1/24/23), Serta Simmons Bedding($1.9bn, 1/23/23), Party City Holdings ($1.0bn, 01/17/23), Exela Intermediate ($1.4bn, 1/15/23)

CLOs:

Week ended 12/1/2023

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

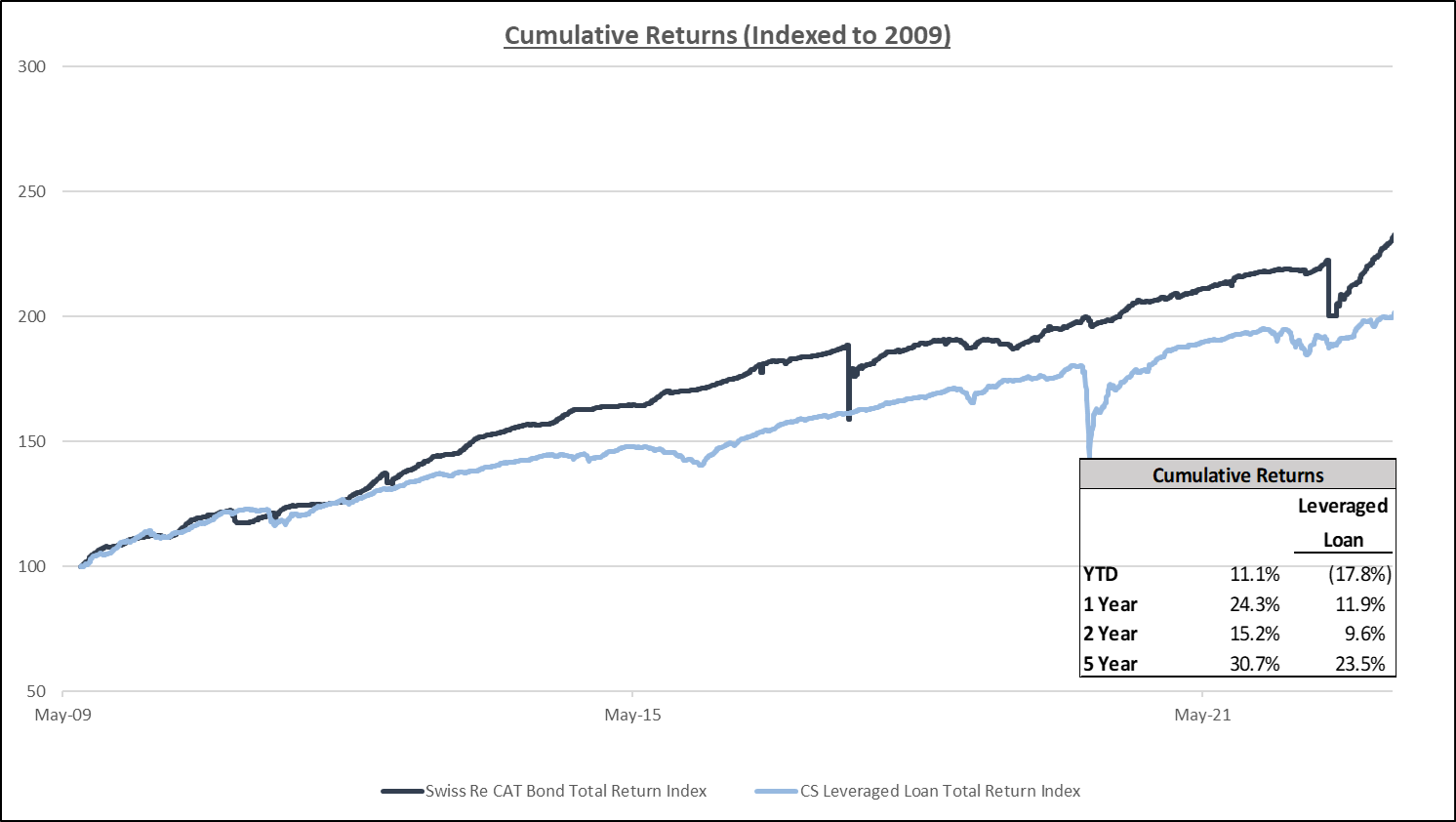

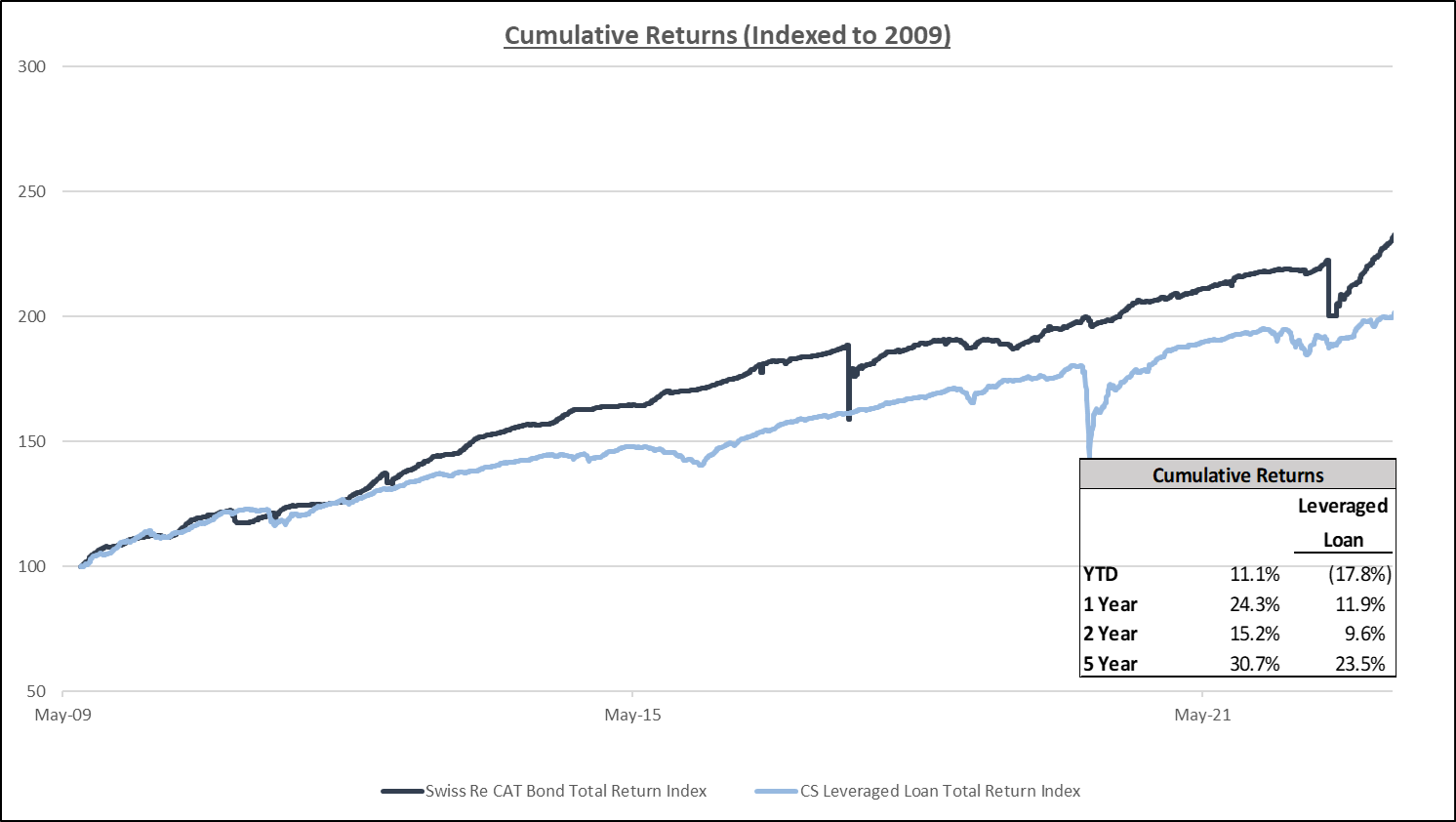

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

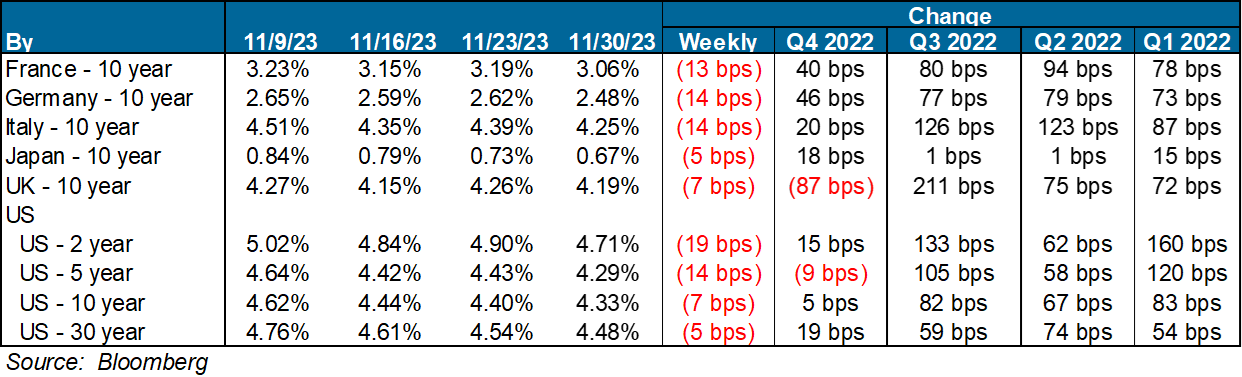

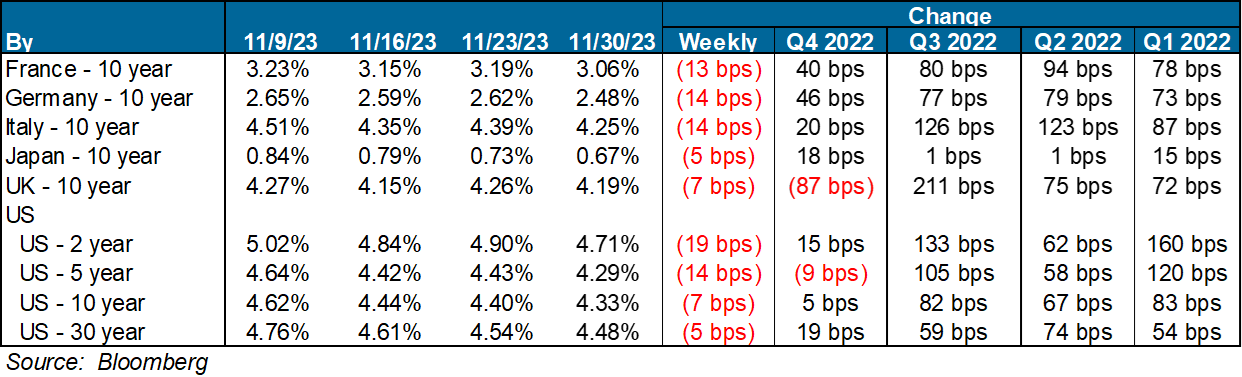

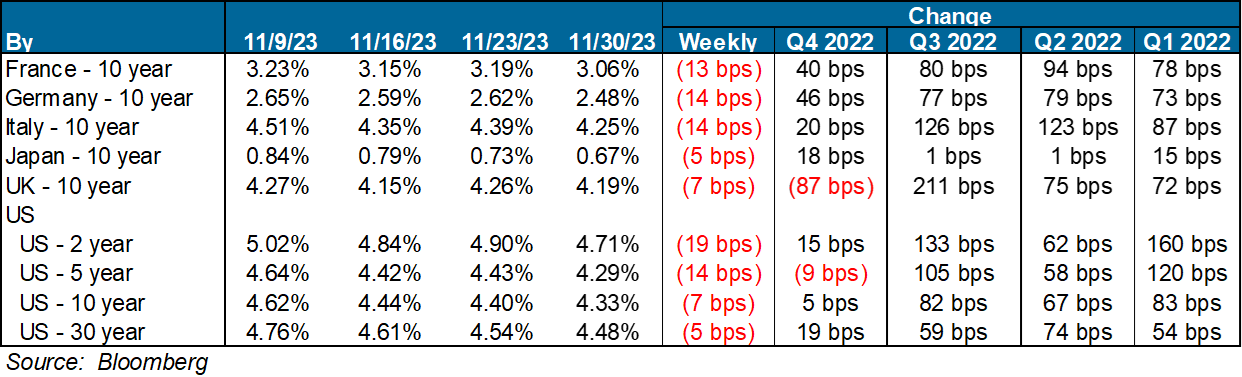

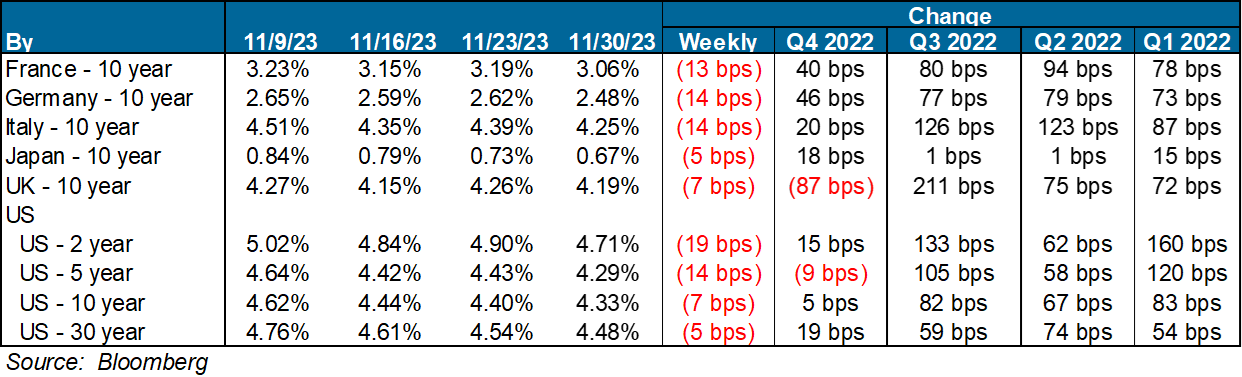

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

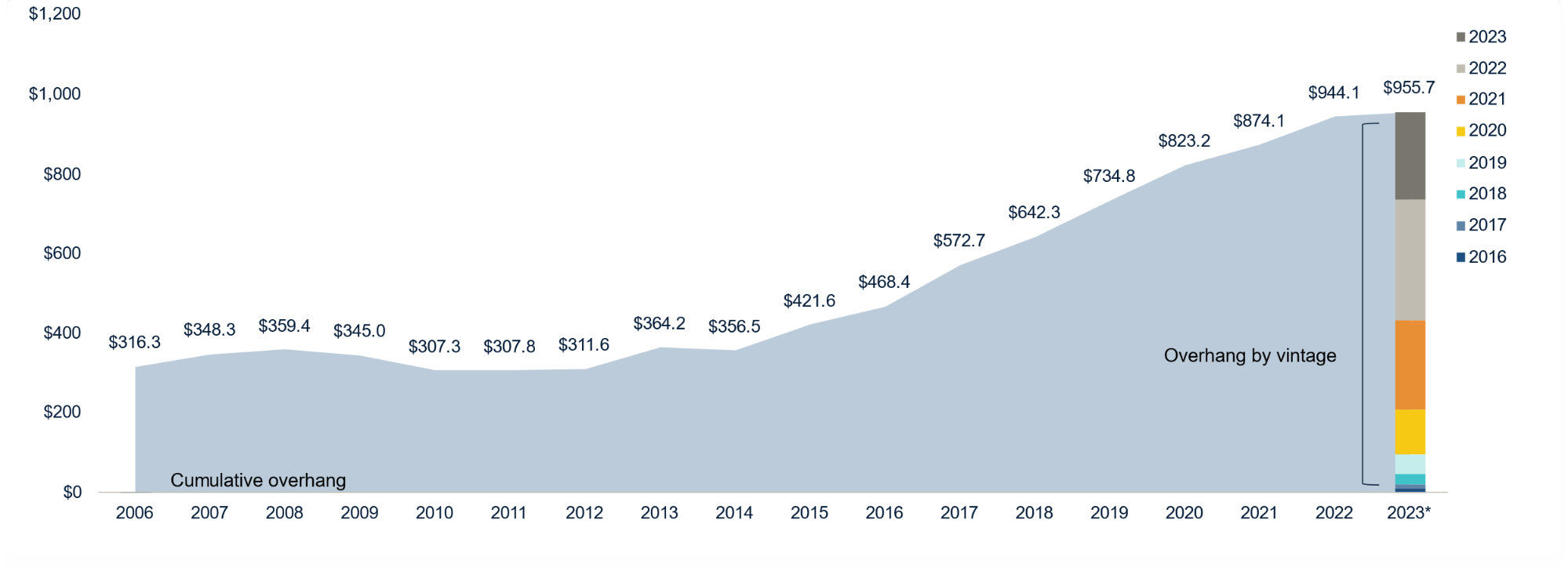

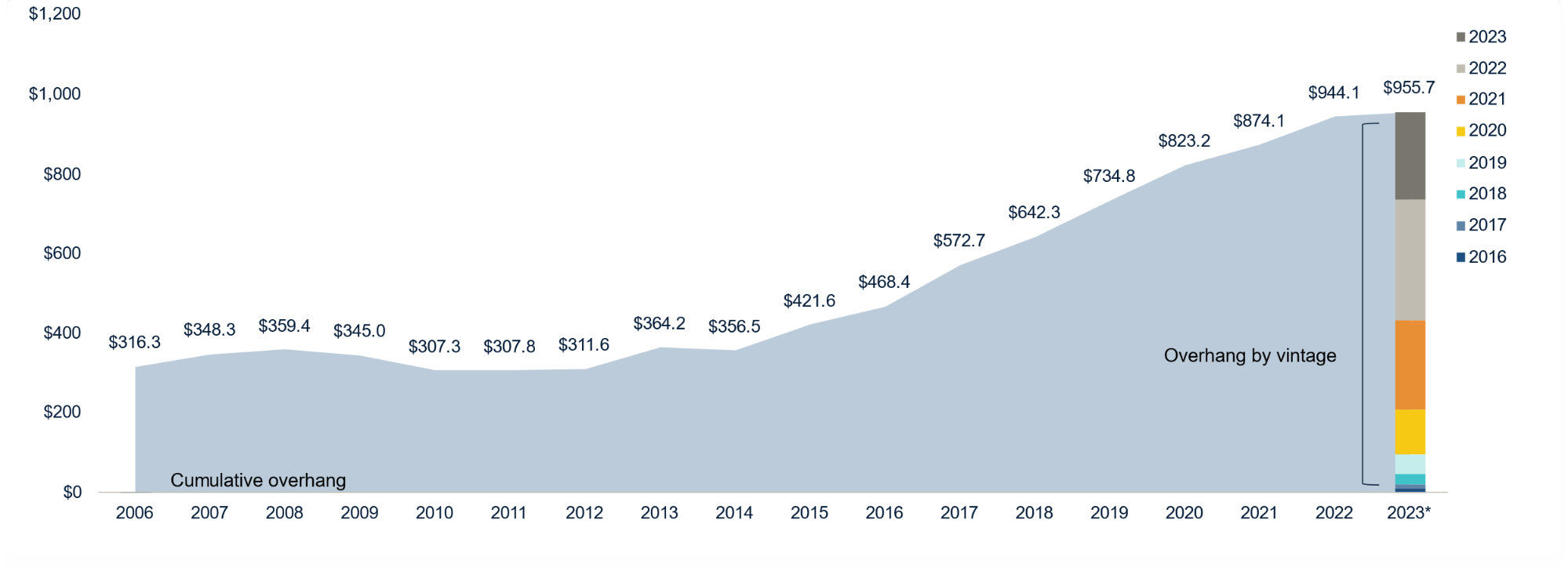

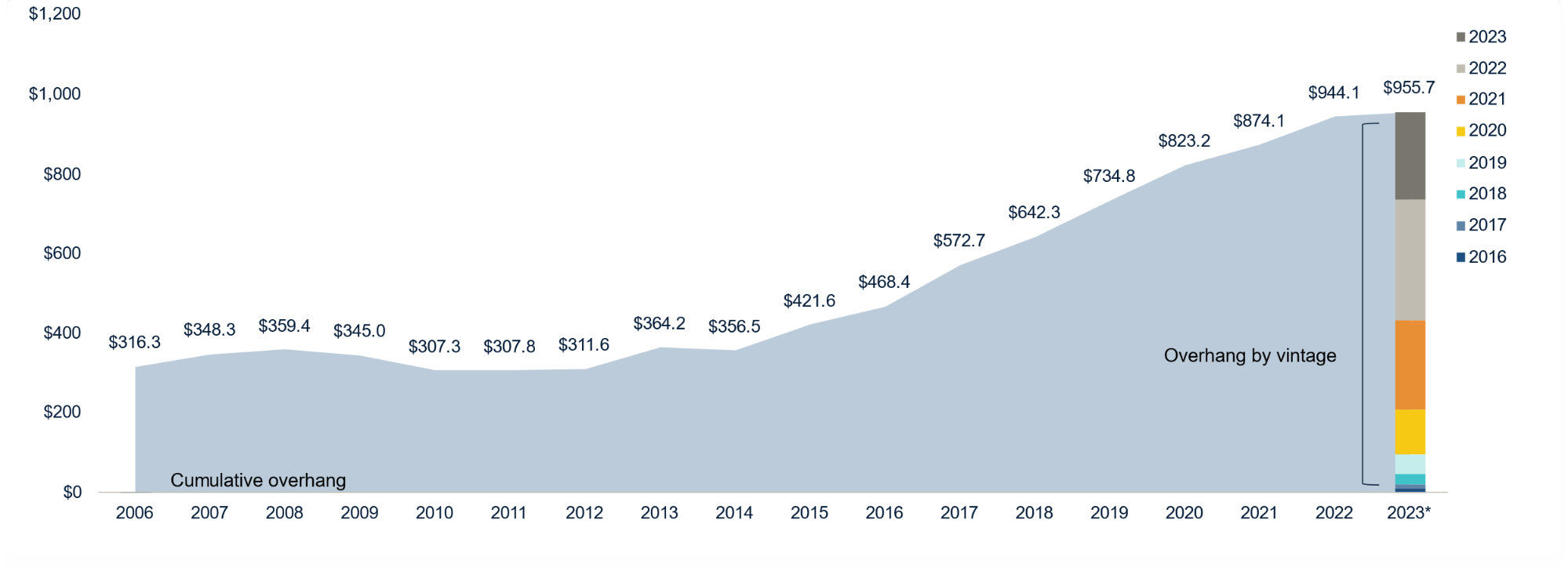

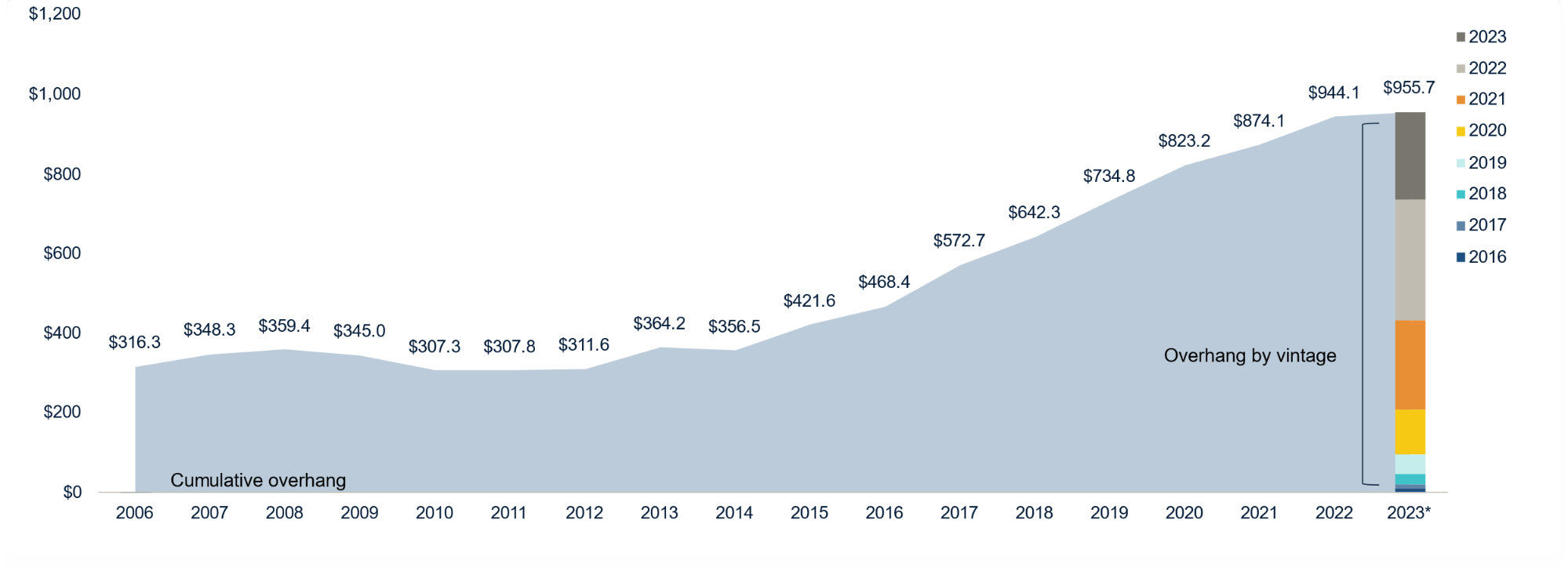

Diagram Q: Dry Powder for All Private Equity Buyouts

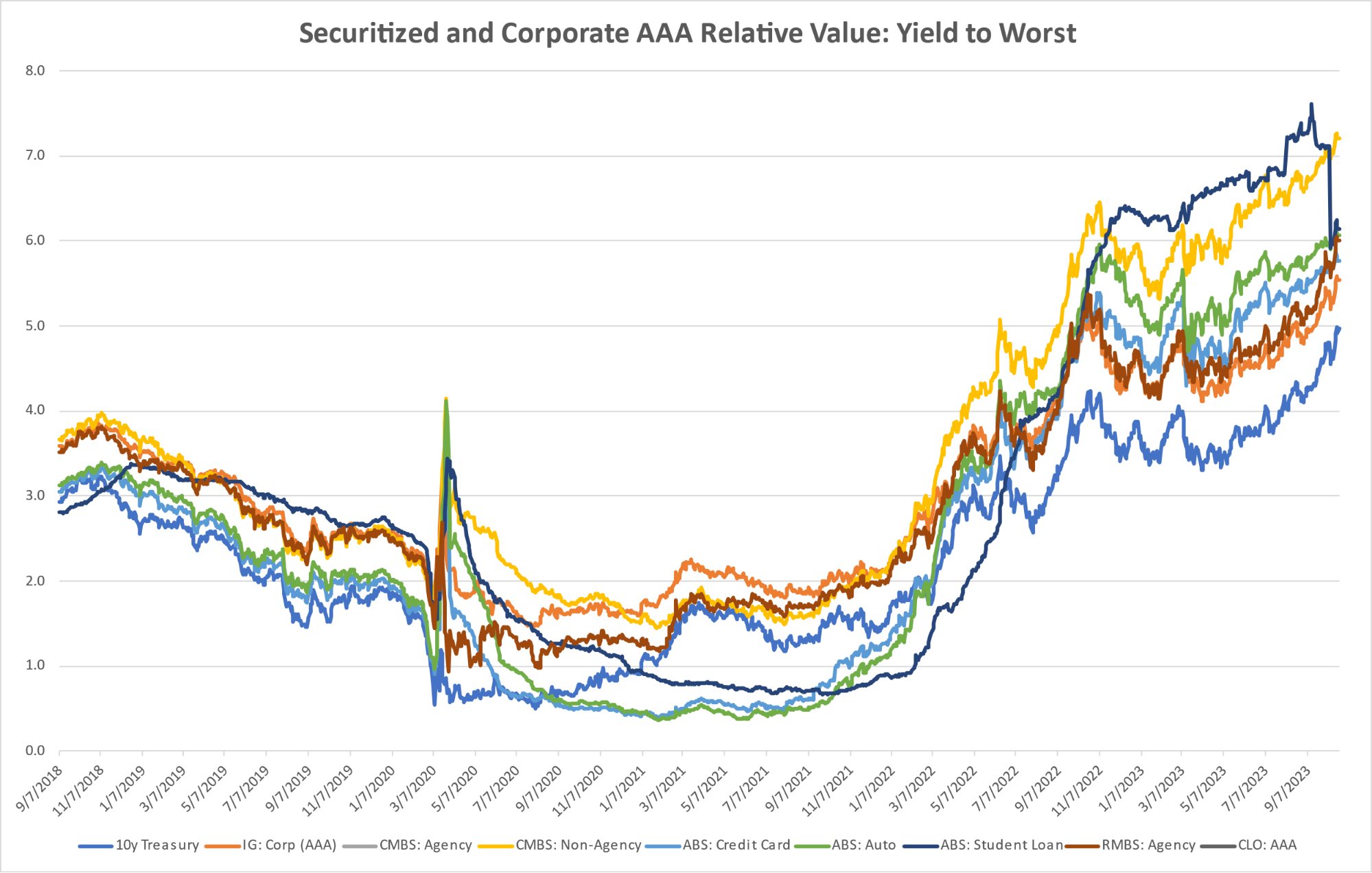

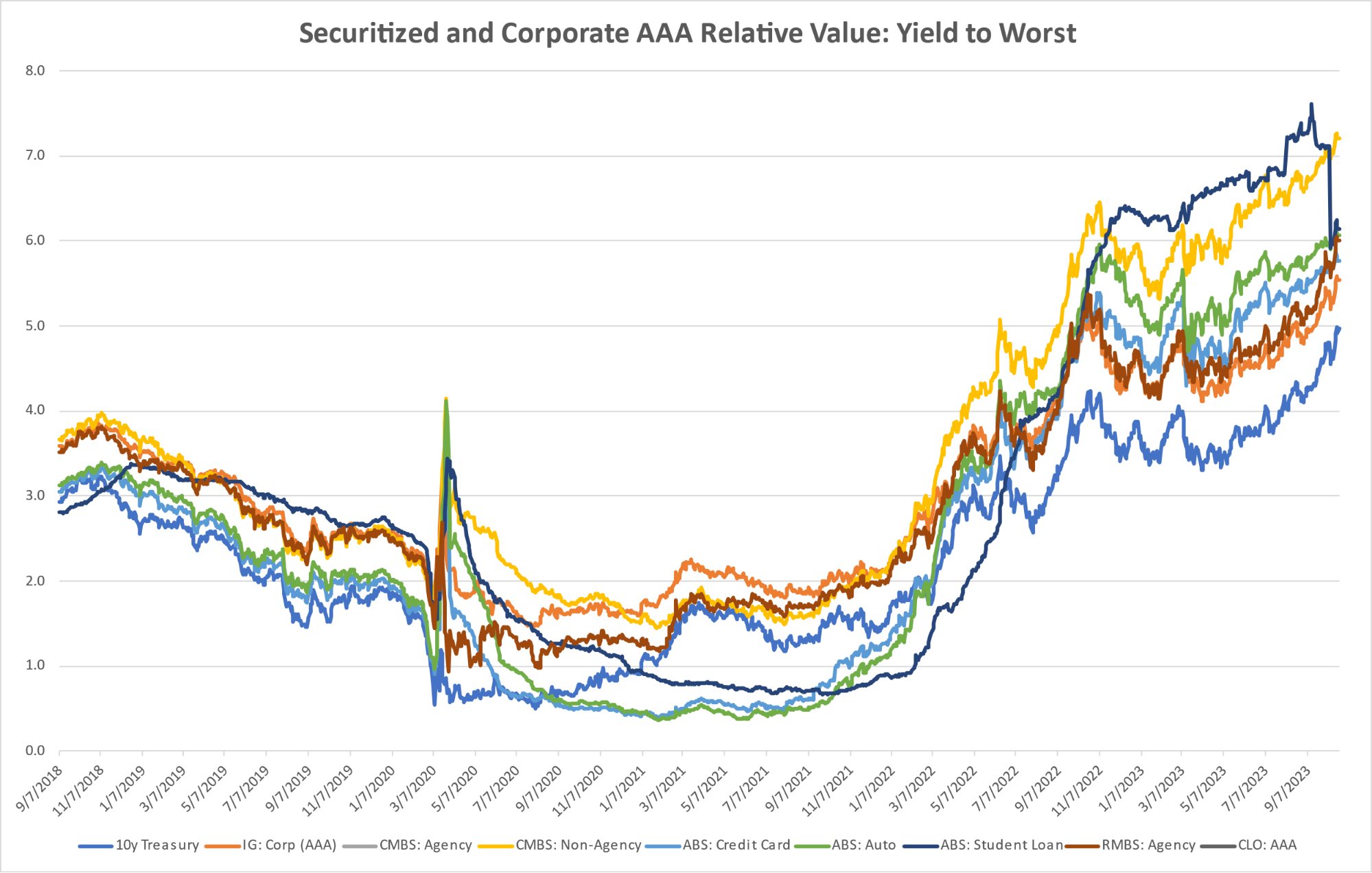

Diagram R: Structured Credit Spreads

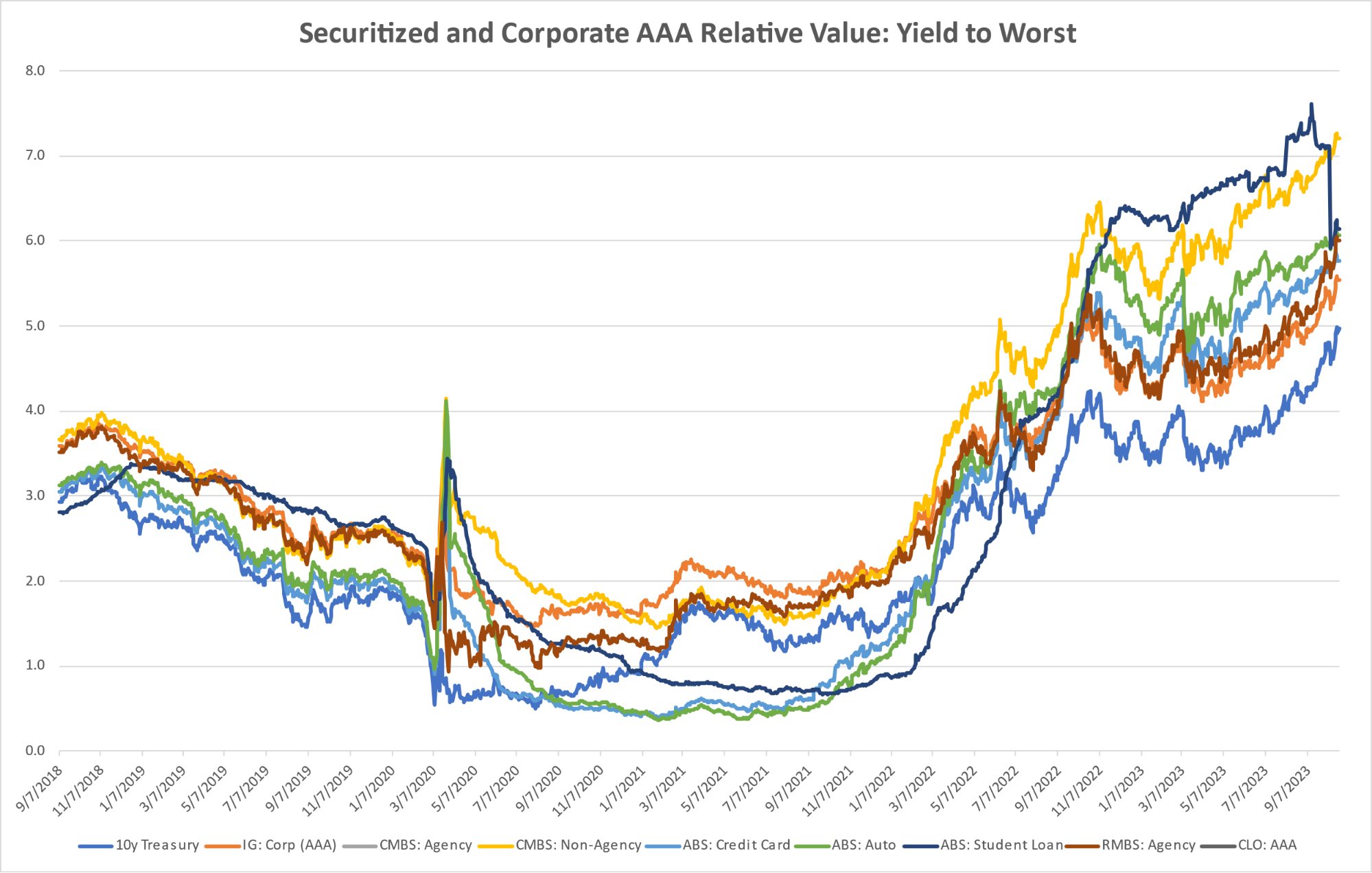

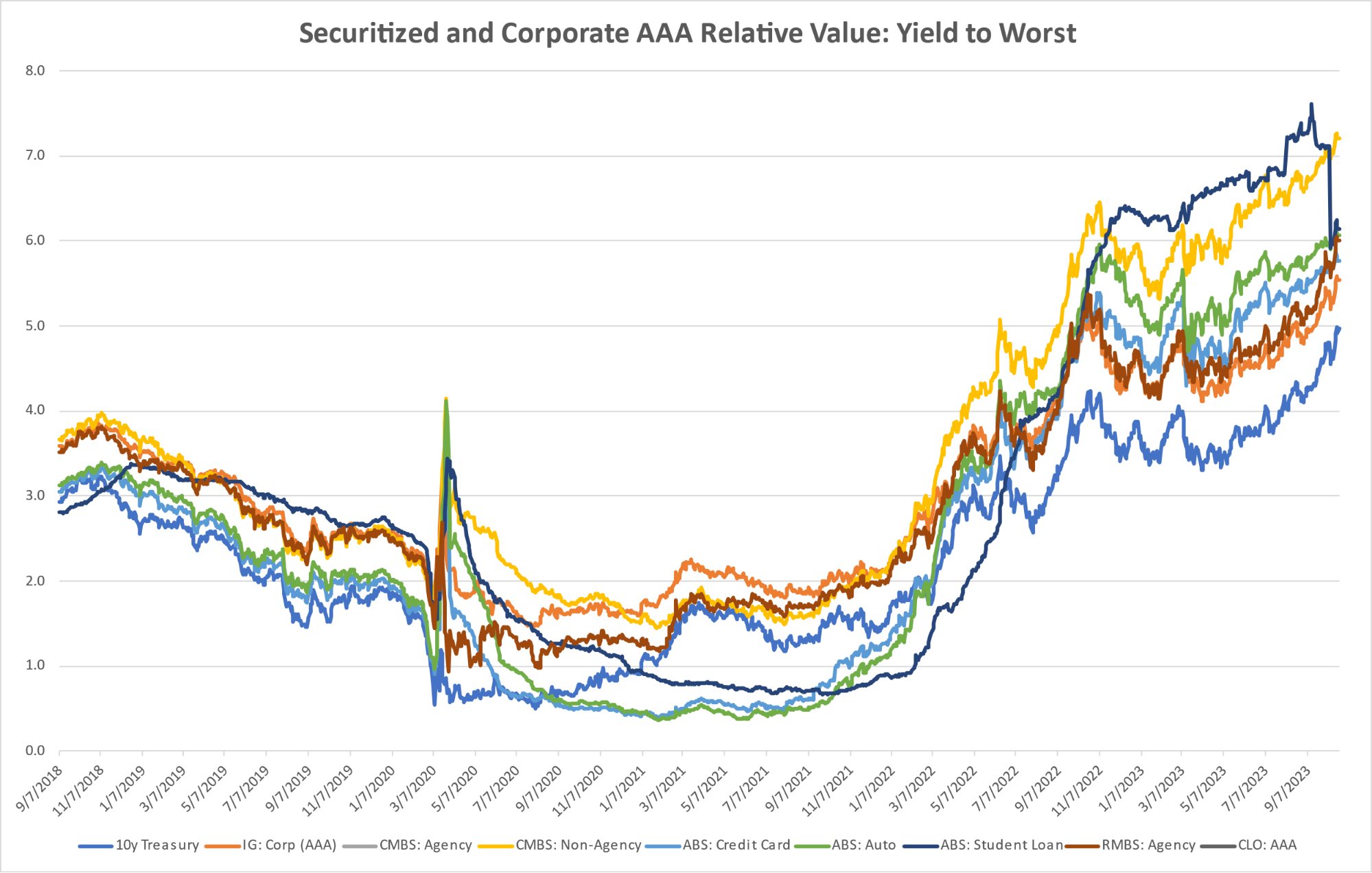

Diagram S: Structured Credit Yield

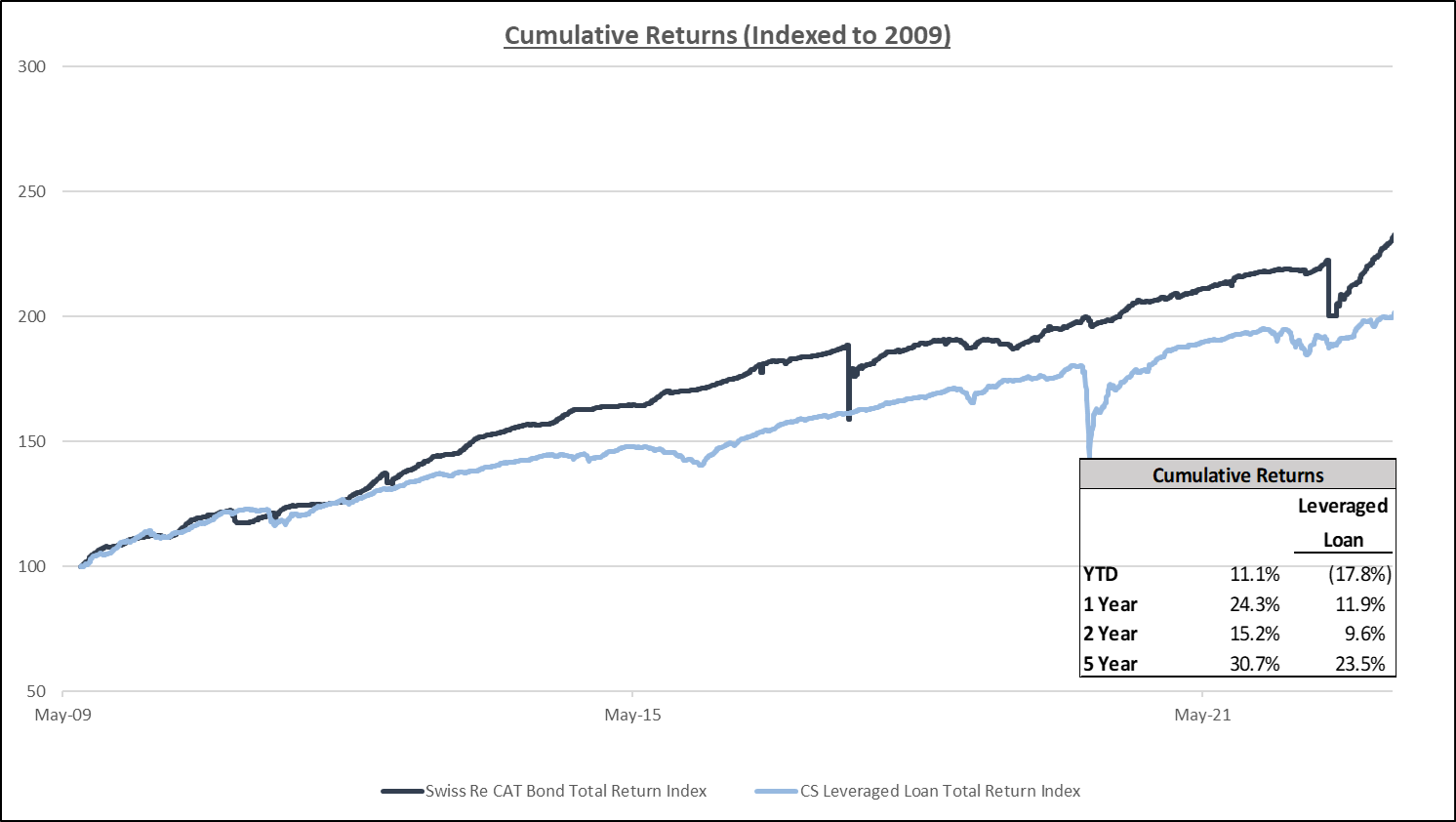

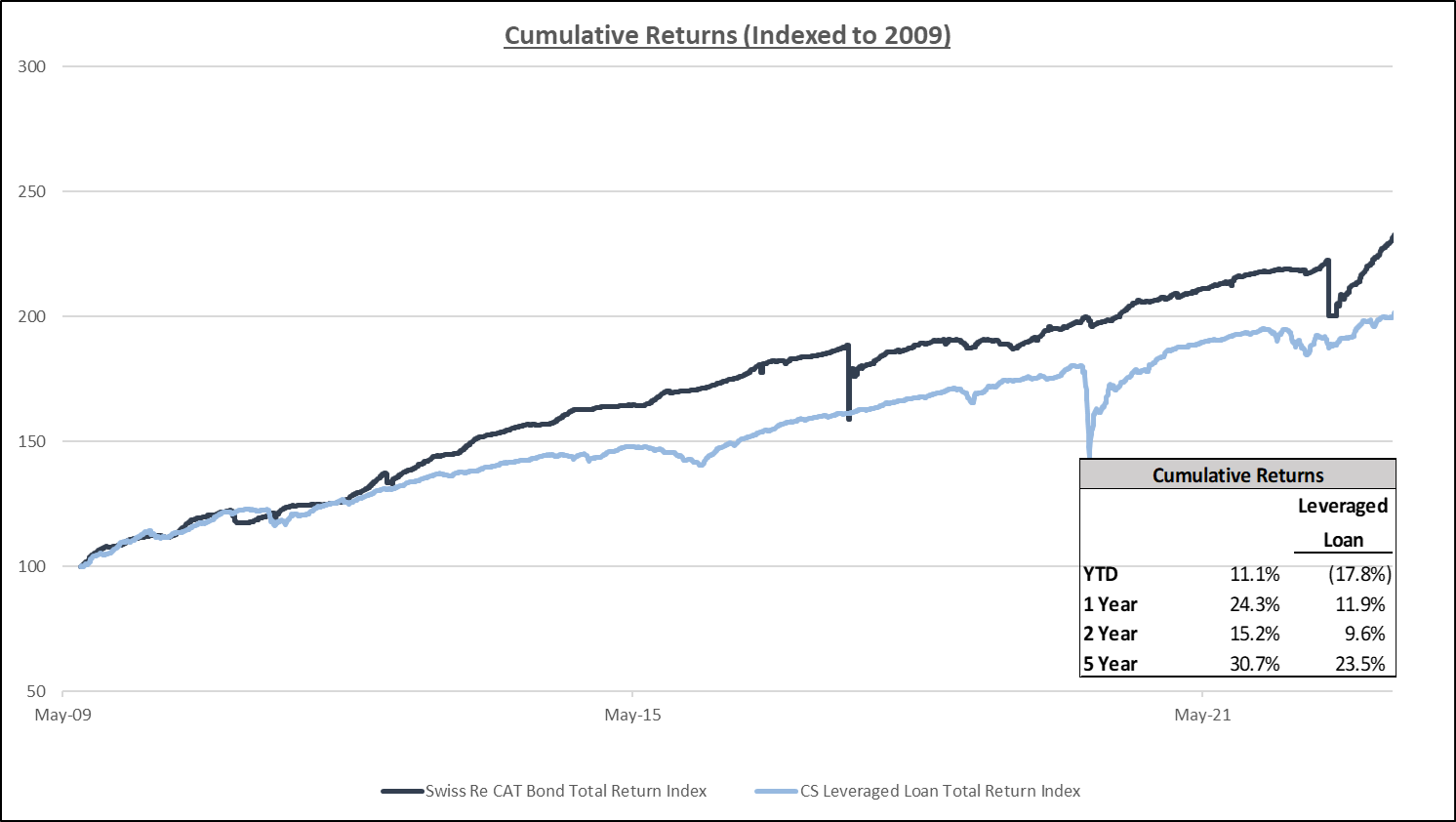

Diagram T: CAT Bonds – Cumulative Returns

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

US Construction Material Prices Outlook

- Construction prices experienced a rapid increase from February 2020 onwards of 40% change due to two leading

factors, geopolitical issues and COVID-19 impacting supply chains. A downward trend initiated in April 2023.

- Construction input prices decreased 1.2% in October 2023 due to declining inflation.

- Overall construction costs remain 1.1% lower than October 2022, a year ago.

- While the decline in construction input prices offers some relief for contractors, it doesn’t signal an end to

all industry challenges.

- While cost pressures have eased, they haven’t fully dissipated.

The Result:

- Despite the cooling inflation, the slowing economy is also a risk to the construction industry, as it could lead

to decreased demand for construction services in the future.

- Nevertheless, the current cooling inflation supports an improving project financing environment, which, in turn,

could lead to increased demand for construction services.

These takeaways suggest that the construction industry is in a state of flux. While there are some positive signs,

such as the decline in construction input prices, there are also some risks that could impact the industry in the

future.

U.S. News

- Consumer Confidence

- The consumer confidence index rebounded in November from a 15-month low to 102

- However, Americans remain concerned about the economy despite the best job market in decades

- Consumers are preoccupied with rising prices in general, the conflicts in Ukraine and the Middle East, and higher interest rates

- New Home Sales

- U.S. new-home sales fell 5.6% to a seasonally adjusted annual rate of 679,000 in October

- The median sales price of new houses sold in October dropped to $409,300, down from $422,300 in the prior month and down 17.6% from the same month last year

- This represents the lowest level since August 2021

- Construction Spending

- Construction spending rose in October for the 10th month in a row, largely because of work on commercial buildings and government-funded public projects

- High interest rates have tempered demand for new homes and apartments, but they have had less effect on other forms of construction

- Government-funded construction has jumped 16% in the past year

- Jobless Claim

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 218,000 in

the week ended November 24, up 7,000 from the prior week

- The four-week moving average was 220,000, up 500 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 86,000 to 1.927

million in the week ended November 17. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.796 trillion in the week ended December 1, down $14.7 billion from

the prior week

- Treasury holdings totaled $4.843 trillion, up $0.3 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.45 trillion in the week, down $8.7 billion from the

prior week

- Total Public Debt

- Total public debt outstanding was $33.85 trillion as of December 1, an increase of 7.9% from the previous

year

- Debt held by the public was $26.58 trillion, and intragovernmental holdings were $7.12 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.2% in October year over year

- On a monthly basis, the CPI increased 0.0% in October on a seasonally adjusted basis, after increasing

0.4% in September

- The index for all items less food and energy (core CPI) rose 0.2% in October, after rising 0.3% in

September

- Core CPI increased 4.0% for the 12 months ending October

- Food and Beverages:

- The food at home index increased 2.1% in October from the same month a year earlier, and increased

0.3% in October month over month

- The food away from home index increased 5.4% in October from the same month a year earlier, and

increased 0.4% in October month over month

- Commodities:

- The energy commodities index decreased (4.9%) in October after increasing 2.3%

- The energy commodities index fell (6.2%) over the last 12 months

- The energy services index (1.0%) in October after increasing 0.1% in September

- The energy services index fell (2.3%) over the last 12 months

- The gasoline index fell (5.3%) over the last 12 months

- The fuel oil index fell (21.4%) over the last 12 months

- The index for electricity rose 2.4% over the last 12 months

- The index for natural gas fell (15.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $1,381.82 per 40ft

- Drewry’s composite World Container Index has decreased by (39.5%) over the last 12 months

- Housing Market:

- The shelter index increased 0.3% in October after increasing 0.6% in September

- The rent index increased 0.3% in October after increasing 0.6% in September

- The index for lodging away from home decreased (6.1%) in October after increasing 0.7% in September

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, remaining flat since August and up 1% since the start of 2023

World News

-

Israel/Middle East

- A weeklong truce between Israel and Hamas expired early Friday morning, prompting Israel to renew combat operations in Gaza after it said Hamas fired toward Israeli territory

- The end of the cease-fire came as mediators engaged in intense talks in which Hamas didn’t provide a list of hostages needed for an extension, Egyptian officials said. Hamas said it was struggling to access some hostages held by other groups

- Israel’s resumed offensive is expected to focus on southern Gaza, where it claims many of Hamas’s senior leaders are hiding. It published a map it says will be used to guide Gazans away from areas of fighting

- Secretary of State Antony Blinken, visiting the region for the third time since Hamas’s Oct. 7 attack, had urged Israel to extend the pause and reduce civilian casualties if the fighting resumes

- Hamas released two hostages late on Thursday and six more around midnight. Thirty Palestinians – seven women and 23 minors – were released from Israeli prisons as part of a swap deal

-

Ukraine

- Ukraine’s security service carried out an overnight explosion on a key rail route between Russia and China on Thursday

- Four explosive devices were detonated while a freight train was traveling. Currently, the Russian security service is working at the site as Russian railway workers deal with the consequences of the Ukrainian special operation

-

China

- Factory activity in China slid deeper into contraction in November as domestic and foreign orders dried up, while activity in the services sector shrank for the first time this year

- China’s real-estate sector is mired in a protracted downturn, putting the squeeze on consumer confidence and households’ willingness to spend. House prices fell in 70 major cities at a faster clip in October than a month earlier, while nationwide the amount of new home sales measured in floor space was around 20% lower than a year earlier

- China’s new home sales continued to drop in November, according to private data released on Thursday by China Real Estate Information Corp. The sales of China’s 100 largest real-estate developers totaled the equivalent of $54.7 billion for the month, down 30% from a year ago, when many parts of China were under Covid-19 lockdowns and business activities were restricted

- China’s economy is in need of more government help to avoid a pronounced year-end slowdown, economists say. Businesses are finding few buyers for their goods overseas as growth slows in the U.S. and other major economies

-

Spain

- Amazon reached an agreement with most of its workers in Spain, averting the full impact of a strike that risked crippling its warehouses on one of the busiest days of the year

-

Italy

- Pope Francis is punishing one of his most vocal conservative critics in the Catholic hierarchy, U.S. Cardinal Raymond Burke, by taking away his stipend and rent-free apartment in Rome

-

India

- An Indian government employee tried to have a vocal critic of New Delhi assassinated in New York earlier this year, U.S. prosecutors alleged, a development that threatens to cause new rifts in the deepening relationship between Washington and New Delhi

-

Argentina

- Argentina’s newly elected President, Javier Milei, wants to adopt the U.S. dollar as the national currency and strip the central bank’s power to print money. The country has been overcome with record inflation and low economic growth

-

India

- India races to recuse 40 workers trapped in an Indian mountain tunnel following a landslide on Sunday. The men have received food, oxygen and medicine through a small pipe that was undamaged

-

North Korea

- North Korea said it had successfully placed its homegrown spy satellite into orbit, a much anticipated attempt after a pair of failed tries earlier this year

-

United Kingdom

- The U.K. government has sanctioned 29 entities and individuals operating in and supporting Russia’s gold and oil sectors, in an effort to cut off revenue streams funding its war in Ukraine

Commodities

-

Oil Prices

- WTI: $74.24 per barrel

- (1.72%) WoW; (6.65%) YTD; (4.45%)YoY

- Brent: $79.02 per barrel

- (1.94%) WoW; (5.82%) YTD; (2.71%)YoY

-

US Production

- U.S. oil production amounted to 13.2 million bpd for the week ended November 24, down 0.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 625, up 3 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 449.7 million barrels, up 7.3% YoY

- Refiners operated at a capacity utilization rate of 89.8% for the week, up from 87.0% in the

prior week

- U.S. crude oil imports now amount to 6.529 million barrels per day, down (3.4%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.25 per gallon in the week of December 1,

down (5.8%) YoY

- Gasoline prices on the East Coast amounted to $3.27,down (8.5%) YoY

- Gasoline prices in the Midwest amounted to $3.11, down (9.9%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.80, down (6.6%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.22, down (11.8%) YoY

- Gasoline prices on the West Coast amounted to $4.49, down (4.5%) YoY

- Motor gasoline inventories were up by 1.8 million barrels from the prior

- Motor gasoline inventories amounted to 218.2 million barrels, up 2.1%

- Production of motor gasoline averaged 9.34 million bpd, down (0.2%) YoY

- Demand for motor gasoline amounted to 8.206 million bpd, down (1.3%) YoY

-

Distillates

- Distillate inventories decreased by 5.2 million in the week of December 1

- Total distillate inventories amounted to 110.8 million barrels, down (1.7%)

- Distillate production averaged 4.998 million bpd, down (5.9%) YoY

- Demand for distillates averaged 3.014 million bpd in the week, down (17.6%) YoY

-

Natural Gas

- Natural gas inventories increased by 10 billion cubic feet last week

- Total natural gas inventories now amount to 3,836 billion cubic feet, up 10.1% YoY

Credit News

High yield bond yields decreased 30bps to 8.36% and spreads tightened 2bps to 400bps. Leveraged loan yields decreased 21bps to 9.74% and spreads were flat at 560bps. WTD Leveraged loan returns were positive 19bps. WTD high yield bond returns were positive 119bps. Bonds continue to outperform loans in a falling rate environment, with the 10yr treasury yield falling from ~4.45% on the eve of Thanksgiving to ~4.3%. Credit markets are reacting to tame inflation data and favorable Fed Speak. Voting FOMC Member Waller spoke about rates cuts in early 24 if inflation continues to decline.

High-yield:

Week ended 12/1/2023

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 12/1/2023

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23), Mallinckrodt ($2.8bn 8/28/23), Yellow Corp ($485mm 8/8/23), Anchor Glass ($675mm 7/11/23), Instant Brands ($391mm 6/12/23), Cyxtera Technologies ($768mm 6/4/23), Diebold ($2.0bn 6/1/23), Envision Health ($7.7bn 5/14/23), Venator Materials ($1.1bn 5/12/23), Bed Bath & Beyond ($5.2bn 4/22/23), David’s Bridal ($254mn 4/17/23), Monitronics International ($794mm 4/15/23), Catalina ($222mn 3/29/23), Diamond Sports ($8.6bn, 2/15/23), Avaya ($2.9bn, 2/14/23), Heritage Power ($485mn, 1/24/23), Serta Simmons Bedding($1.9bn, 1/23/23), Party City Holdings ($1.0bn, 01/17/23), Exela Intermediate ($1.4bn, 1/15/23)

CLOs:

Week ended 12/1/2023

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: Dry Powder for All Private Equity Buyouts

Diagram R: Structured Credit Spreads

Diagram S: Structured Credit Yield

Diagram T: CAT Bonds – Cumulative Returns

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

US Construction Material Prices Outlook

- Construction prices experienced a rapid increase from February 2020 onwards of 40% change due to two leading

factors, geopolitical issues and COVID-19 impacting supply chains. A downward trend initiated in April 2023.

- Construction input prices decreased 1.2% in October 2023 due to declining inflation.

- Overall construction costs remain 1.1% lower than October 2022, a year ago.

- While the decline in construction input prices offers some relief for contractors, it doesn’t signal an end to

all industry challenges.

- While cost pressures have eased, they haven’t fully dissipated.

The Result:

- Despite the cooling inflation, the slowing economy is also a risk to the construction industry, as it could lead

to decreased demand for construction services in the future.

- Nevertheless, the current cooling inflation supports an improving project financing environment, which, in turn,

could lead to increased demand for construction services.

These takeaways suggest that the construction industry is in a state of flux. While there are some positive signs,

such as the decline in construction input prices, there are also some risks that could impact the industry in the

future.