U.S. News

- U.S. Trade Deficit

- The U.S. trade deficit rose 5% in October to a three-month high of $64.3 billion largely because of a decline in exports of American-made cars and COVID-related drugs

- Imports inched up 0.2% in October to $323 billion, mostly because of higher demand for computers and equipment to drill for oil

- The U.S. is still on track to report the smallest annual increase in its trade deficit in three years

- November Job Report

- The unemployment rate fell to a four-month low of 3.7%, down from 3.9% in October

- Hourly wages increased 0.4%, the largest gain in four months

- November job growth was 199,000 with ~100,000 coming from the healthcare sector

- Consumer Credit

- Total consumer credit rose $5.2 billion in October, down from a $12.2 billion gain in the prior month

- Revolving credit, such as credit cards, slowed to a 2.7% rate in October after a 4.1% growth rate in the prior month

- Nonrevolving credit, typically auto and student loans, rose at 0.7% rate after a 2.5% rate in the prior month

- Jobless Claim

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 220,000 in the week ended December 1, up 1,000 from the prior week

- The four-week moving average was 220,750, up 500 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – decreased by 64,000 to 1.861 million in the week ended November 24. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.737 trillion in the week ended December 8, down $58.8 billion from the prior week

- Treasury holdings totaled $4.813 trillion, down $29.6 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.45 trillion in the week, down $14.5 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $33.82 trillion as of December 8, an increase of 8.0% from the previous year

- Debt held by the public was $26.58 trillion, and intragovernmental holdings were $7.03 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.2% in October year over year

- On a monthly basis, the CPI increased 0.0% in October on a seasonally adjusted basis, after increasing 0.4% in September

- The index for all items less food and energy (core CPI) rose 0.2% in October, after rising 0.3% in September

- Core CPI increased 4.0% for the 12 months ending October

- Food and Beverages:

- The food at home index increased 2.1% in October from the same month a year earlier, and increased 0.3% in October month over month

- The food away from home index increased 5.4% in October from the same month a year earlier, and increased 0.4% in October month over month

- Commodities:

- The energy commodities index decreased (4.9%) in October after increasing 2.3%

- The energy commodities index fell (6.2%) over the last 12 months

- The energy services index (1.0%) in October after increasing 0.1% in September

- The energy services index fell (2.3%) over the last 12 months

- The gasoline index fell (5.3%) over the last 12 months

- The fuel oil index fell (21.4%) over the last 12 months

- The index for electricity rose 2.4% over the last 12 months

- The index for natural gas fell (15.8%) over the last 12 months

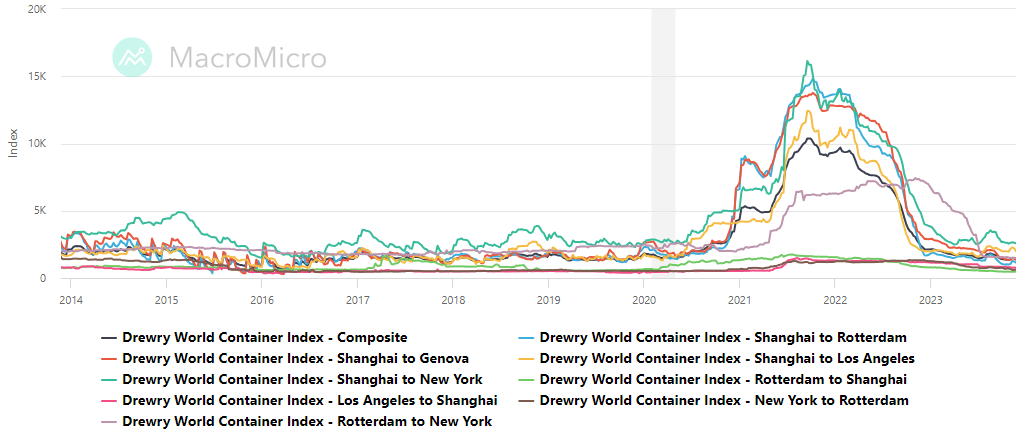

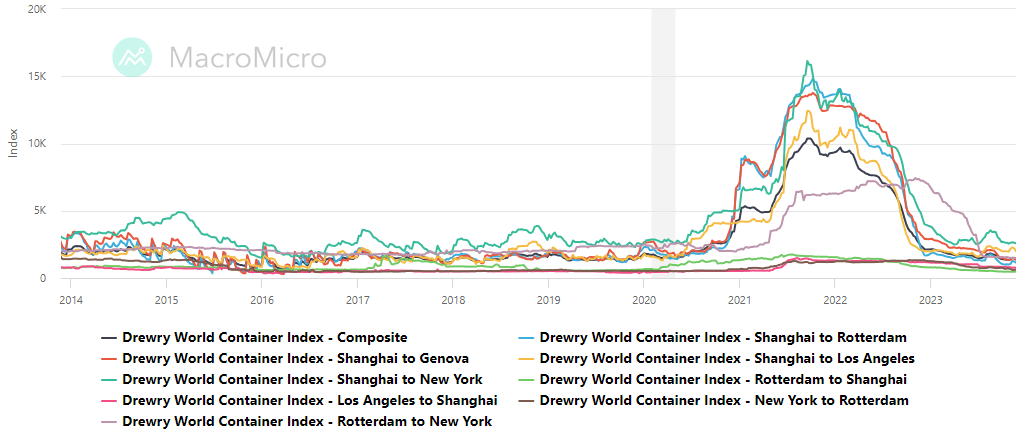

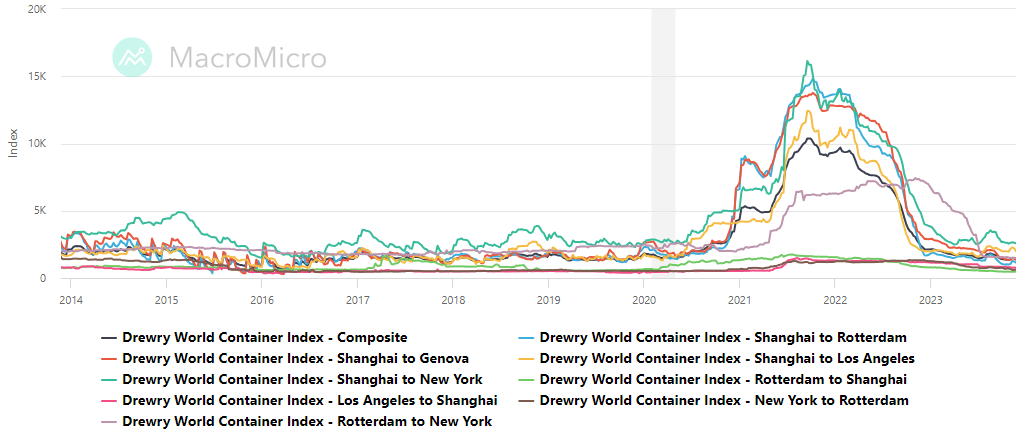

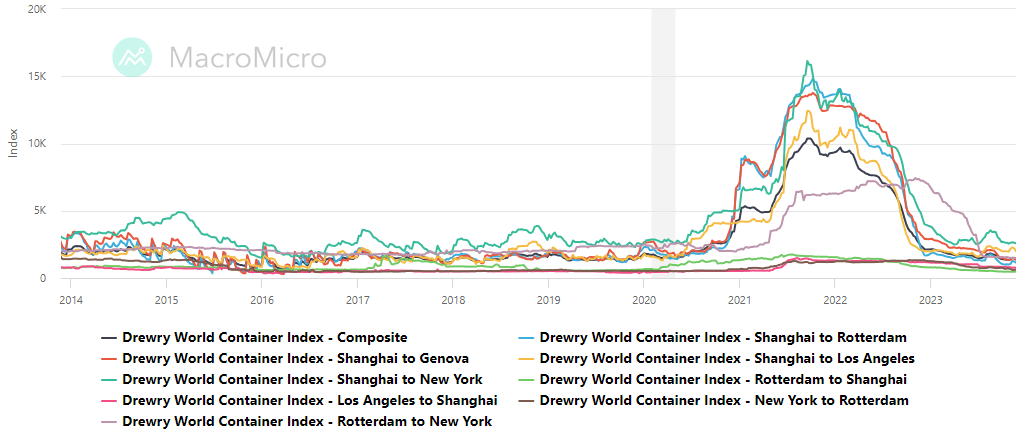

- Supply Chain:

- Drewry’s composite World Container Index increased to $1,460.98 per 40ft

- Drewry’s composite World Container Index has decreased by (31.7%) over the last 12 months

- Housing Market:

- The shelter index increased 0.3% in October after increasing 0.6% in September

- The rent index increased 0.3% in October after increasing 0.6% in September

- The index for lodging away from home decreased (6.1%) in October after increasing 0.7% in September

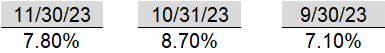

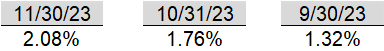

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, remaining flat since August and up 1% since the start of 2023

World News

-

Israel/Middle East

- The United States on Friday vetoed a U.N. resolution calling for an immediate ceasefire in Gaza. Thirteen countries were in favor of the resolution and the UK abstained

- The U.N. estimates about 1.9 million of Gaza’s 2.2 million population have been displaced, and the death toll has now surpassed 17,000 after weeks of fighting between Israel and Hamas

- Palestinians displaced from the north have begun to congregate in the city of Rafah, which borders Egypt. The U.N. warns that the city could soon host half of the Gaza’s 2.2 million population

- Aid groups have documented outbreaks of disease, including hepatitis, rabies and herpes, resulting from overcrowding, inadequate water and overextended sewage-treatment plants

- Israel estimates that at least 137 hostages, including 19 dead bodies, are still being held inside Gaza, after Hamas freed more than 100 captives in exchange for the release of Palestinian prisoners held in Israeli prisons

-

Ukraine

- The White House warned that the U.S. provision for military supplies to Ukraine will likely run out by the end of the year without the release of additional funds

- The Ukraine parliament approves four bills that are key for their upcoming discussions about joining the European Union. An EU summit next week is set to consider whether to start negotiations, which Ukraine sees as key to anchoring itself to western institutions

- Officials in Ukraine have reported heavy use of aerial attacks in eastern Ukraine as bombardments in Kyiv

-

China

- Moody’s is facing criticism from China after changing its credit outlook on the country to negative from stable

- The credit rater said the growing debt problems of some cities and provinces would force China’s central government to provide financial support and hurt its economy. The country is also grappling with a real estate slump

-

Russia

- Russian President Vladamir Putin confirmed he would run for re-election next year, a widely expected decision that would keep him in power until at least 2030

-

Japan

- Japan said it had asked the U.S. to suspend all non-emergency V-22 Osprey flights over its territory after one fell into the sea in western Japan. One crew member is confirmed dead with seven missing

-

Indonesia

- Indonesia’s Mount Marapi volcano erupted on Sunday killing at least 11 climbers, according to the Associated Press. The volcano spewed ash nearly two miles high

-

Spain

- Amazon reached an agreement with most of its workers in Spain, averting the full impact of a strike that risked crippling its warehouses on one of the busiest days of the year

-

Italy

- Pope Francis is punishing one of his most vocal conservative critics in the Catholic hierarchy, U.S. Cardinal Raymond Burke, by taking away his stipend and rent-free apartment in Rome

-

India

- An Indian government employee tried to have a vocal critic of New Delhi assassinated in New York earlier this year, U.S. prosecutors alleged, a development that threatens to cause new rifts in the deepening relationship between Washington and New Delhi

-

Argentina

- Argentina’s newly elected President, Javier Milei, wants to adopt the U.S. dollar as the national currency and strip the central bank’s power to print money. The country has been overcome with record inflation and low economic growth

-

United Kingdom

- The U.K. government has sanctioned 29 entities and individuals operating in and supporting Russia’s gold and oil sectors, in an effort to cut off revenue streams funding its war in Ukraine

Commodities

-

Oil Prices

- WTI: $71.20 per barrel

- (3.87%) WoW; (10.51%) YTD; (1.12%) YoY

- Brent: $75.84 per barrel

- (3.85%) WoW; (9.65%) YTD; (1.34%) YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended December 1, down 0.1 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 626, up 1 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 445.0 million barrels, up 7.5% YoY

- Refiners operated at a capacity utilization rate of 89.8% in the prior week

- U.S. crude oil imports now amount to 5.833 million barrels per day, down (24.9%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.19 per gallon in the week of December 8,

down (3.9%) YoY

- Gasoline prices on the East Coast amounted to $3.32,down (4.0%) YoY

- Gasoline prices in the Midwest amounted to $3.07, down (6.6%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.83, down (2.2%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.13, down (11.1%) YoY

- Gasoline prices on the West Coast amounted to $4.38, down (2.1%) YoY

- Motor gasoline inventories were up by 5.4 million barrels from the prior week

- Motor gasoline inventories amounted to 223.6 million barrels, up 2.1% YoY

- Production of motor gasoline averaged 9.52 million bpd, up 5.0% YoY

- Demand for motor gasoline amounted to 8.466 million bpd, up 1.3% YoY

-

Distillates

- Distillate inventories decreased by 1.3 million in the week of December 8

- Total distillate inventories amounted to 112.0 million barrels, down (5.7%)

- Distillate production averaged 5.070 million bpd, down (4.9%) YoY

- Demand for distillates averaged 3.756 million bpd in the week, up 5.8% YoY

-

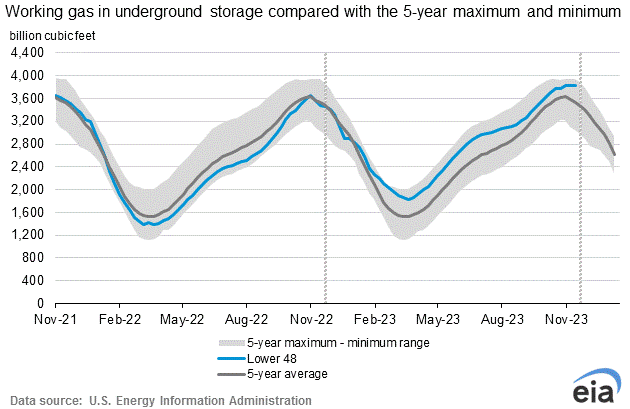

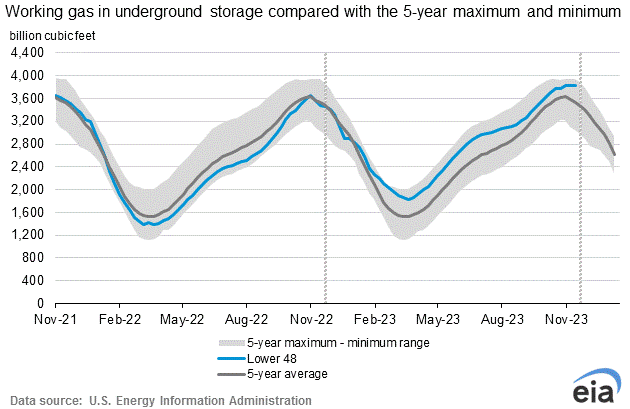

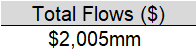

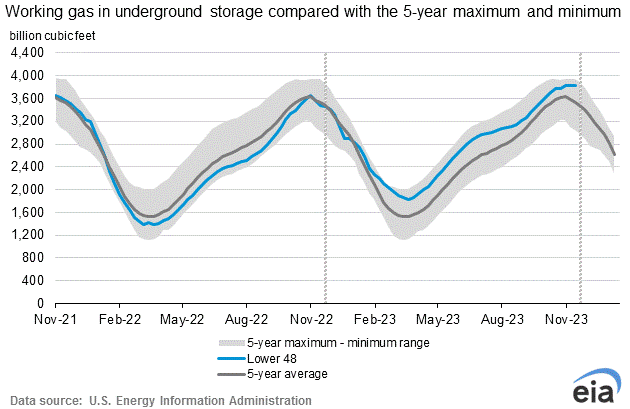

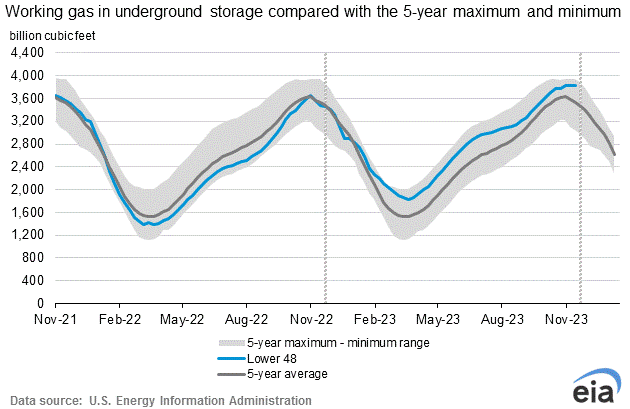

Natural Gas

- Natural gas inventories decreased by 117 billion cubic feet last week

- Total natural gas inventories now amount to 3,719 billion cubic feet, up 7.4% YoY

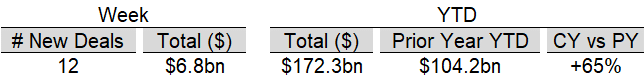

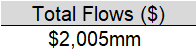

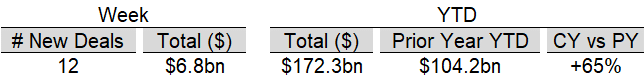

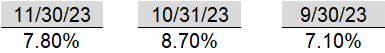

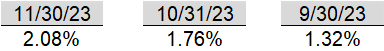

Credit News

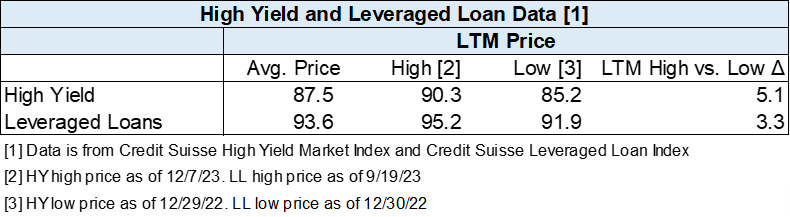

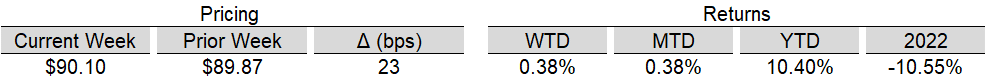

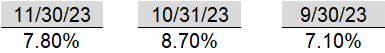

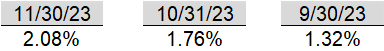

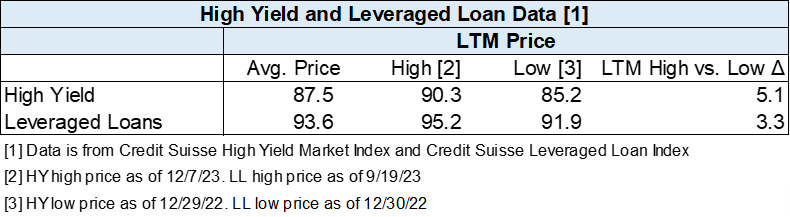

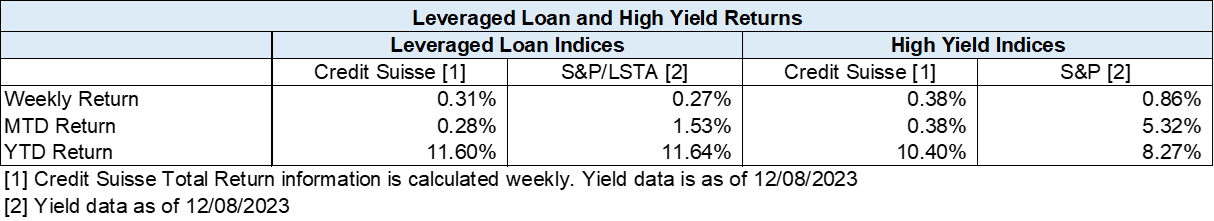

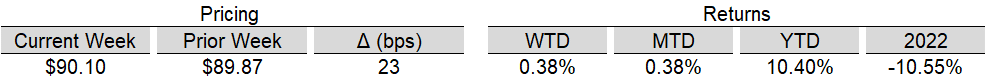

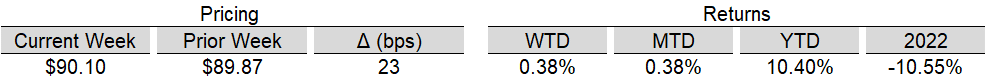

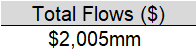

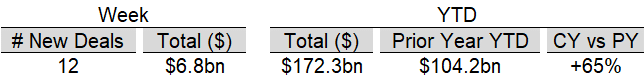

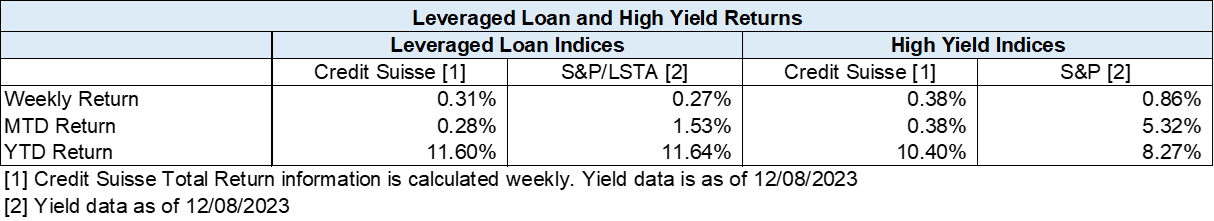

High yield bond yields decreased 6bps to 8.30% and spreads tightened 16bps to 390bps. Leveraged loan yields decreased 20bps to 9.58% and spreads decreased 3bps to 555bps. WTD Leveraged loan returns were positive 31bps. WTD high yield bond returns were positive 38bps. Bonds and Loans performed more evenly this week as risk on sentiment prevailed across markets – but with treasury yields pausing instead of falling further. Treasury yields generally increased for the week, with the benchmark 10yr yield increasing ~3bps. Over the past five weeks, equities have returned 9%+, high yield bonds have returned ~3%, and benchmark 10yr treasury yields have fallen 40bps+. Over the same period, leveraged loans posted a more modest 1%+ gain.

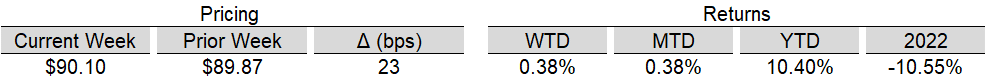

High-yield:

Week ended 12/8/2023

- Yields & Spreads1

- Pricing & Returns1

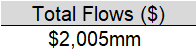

- Fund Flows2

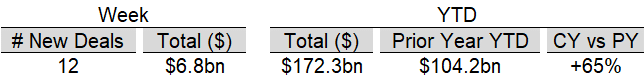

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

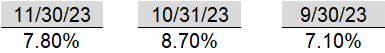

Leveraged loans:

Week ended 12/8/2023

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Ligado Networks ($4.2bn, 11/1/23), Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23), Mallinckrodt ($2.8bn 8/28/23), Yellow Corp ($485mm 8/8/23), Anchor Glass ($675mm 7/11/23), Instant Brands ($391mm 6/12/23), Cyxtera Technologies ($768mm 6/4/23), Diebold ($2.0bn 6/1/23), Envision Health ($7.7bn 5/14/23), Venator Materials ($1.1bn 5/12/23), Bed Bath & Beyond ($5.2bn 4/22/23), David’s Bridal ($254mn 4/17/23), Monitronics International ($794mm 4/15/23), Catalina ($222mn 3/29/23), Diamond Sports ($8.6bn, 2/15/23), Avaya ($2.9bn, 2/14/23), Heritage Power ($485mn, 1/24/23), Serta Simmons Bedding($1.9bn, 1/23/23), Party City Holdings ($1.0bn, 01/17/23), Exela Intermediate ($1.4bn, 1/15/23)

CLOs:

Week ended 12/8/2023

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

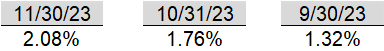

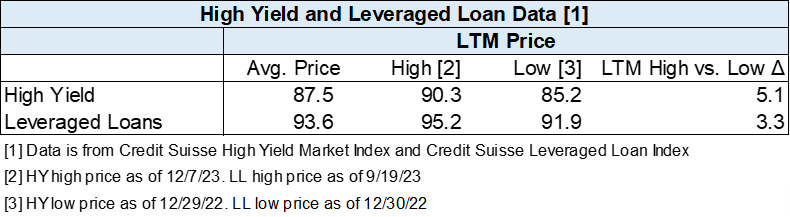

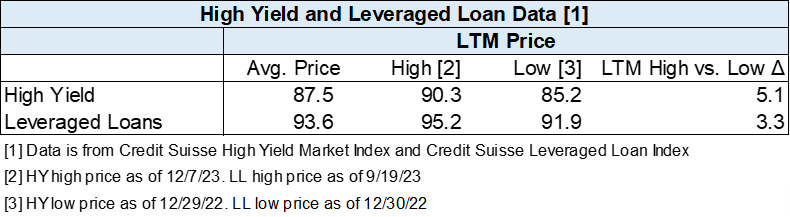

Diagram B: High Yield and Leveraged Loan LTM Price

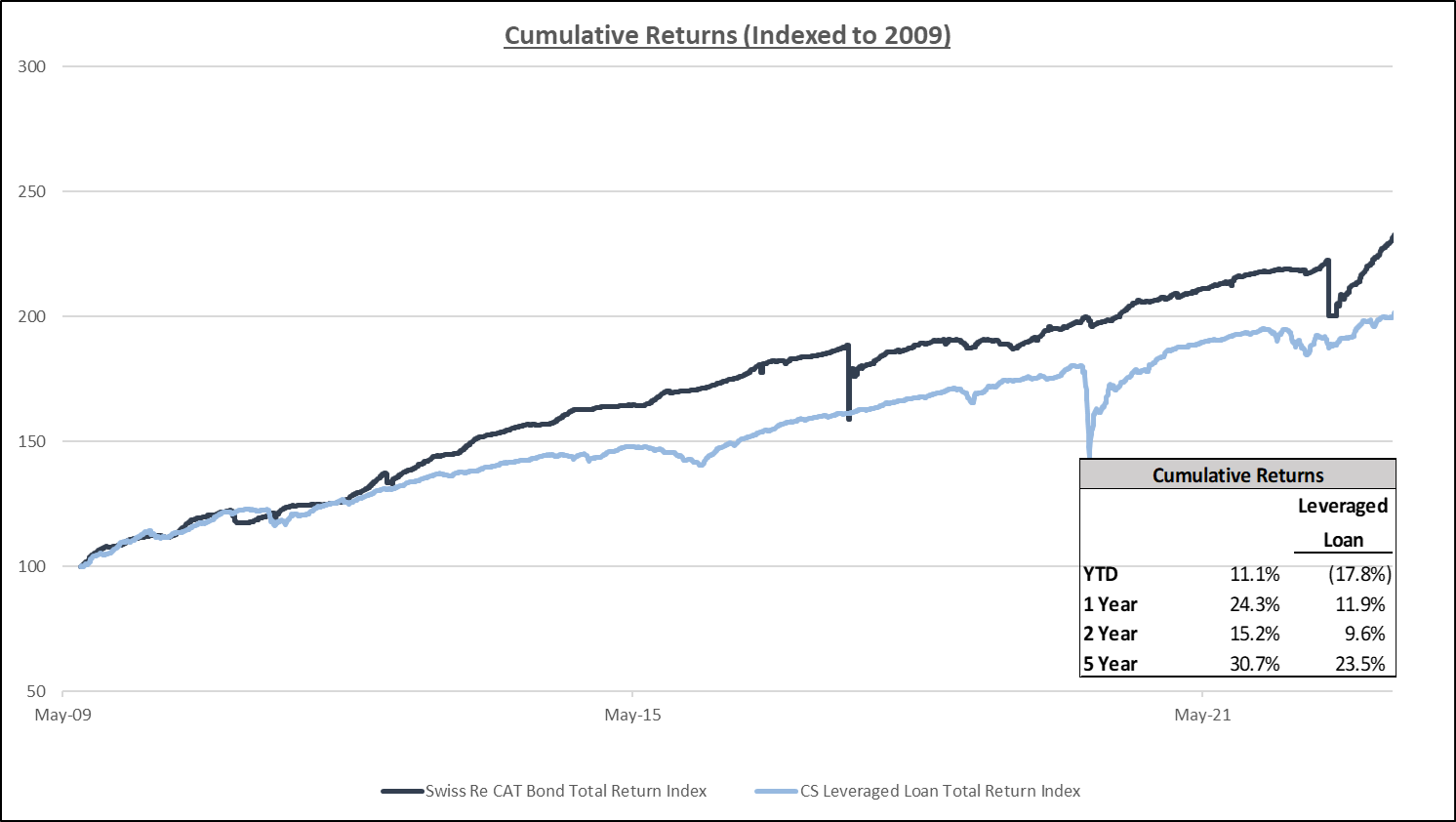

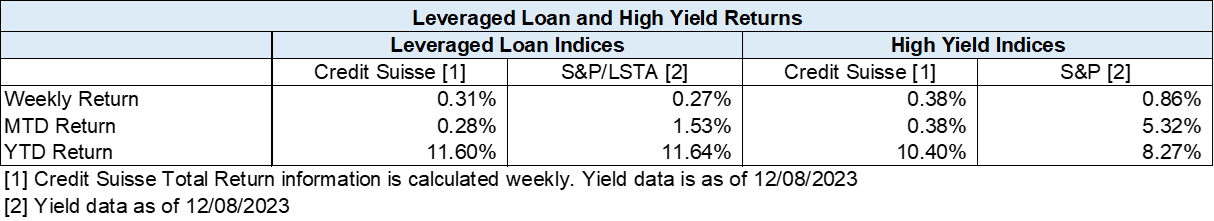

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

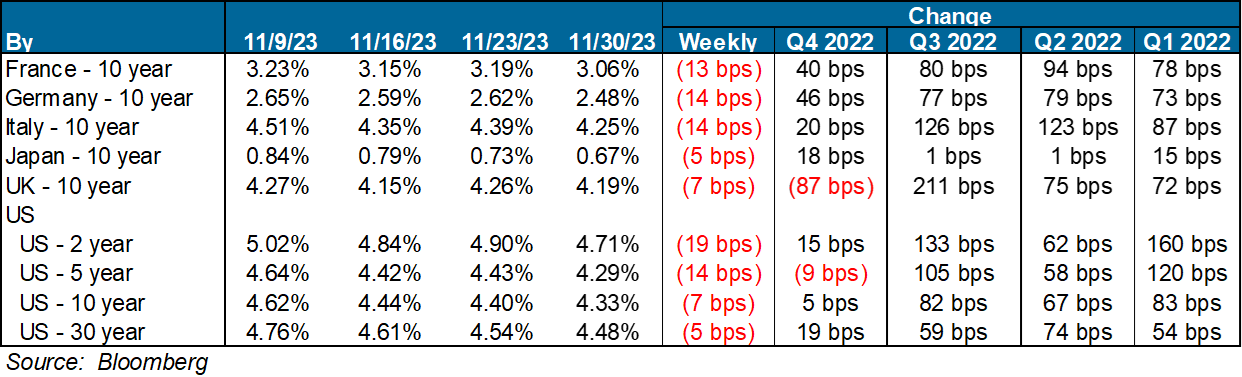

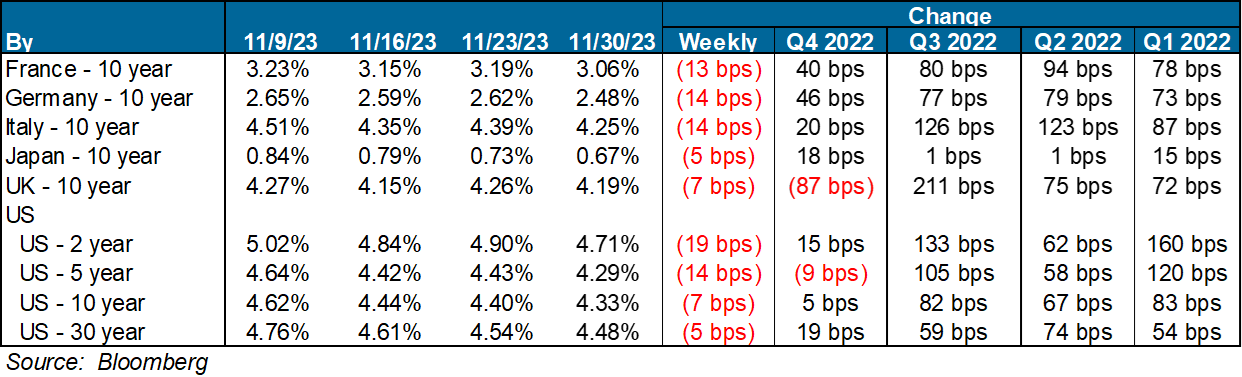

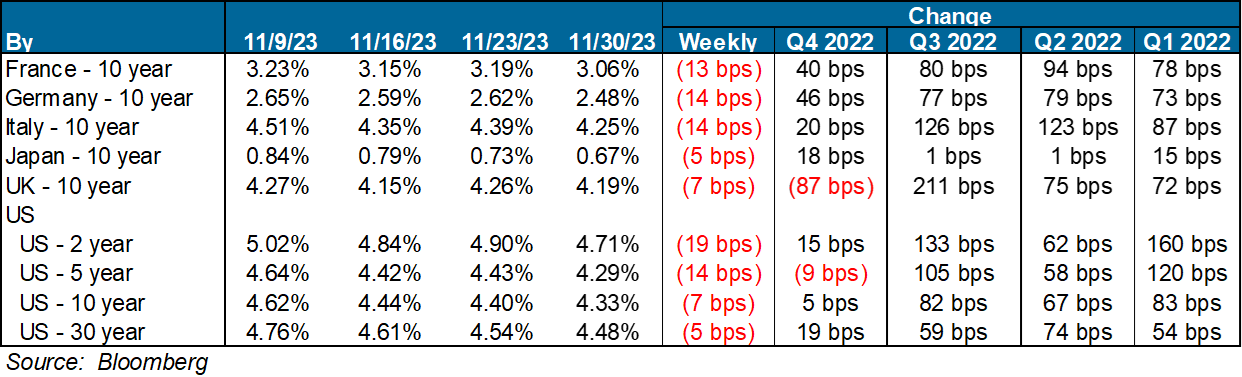

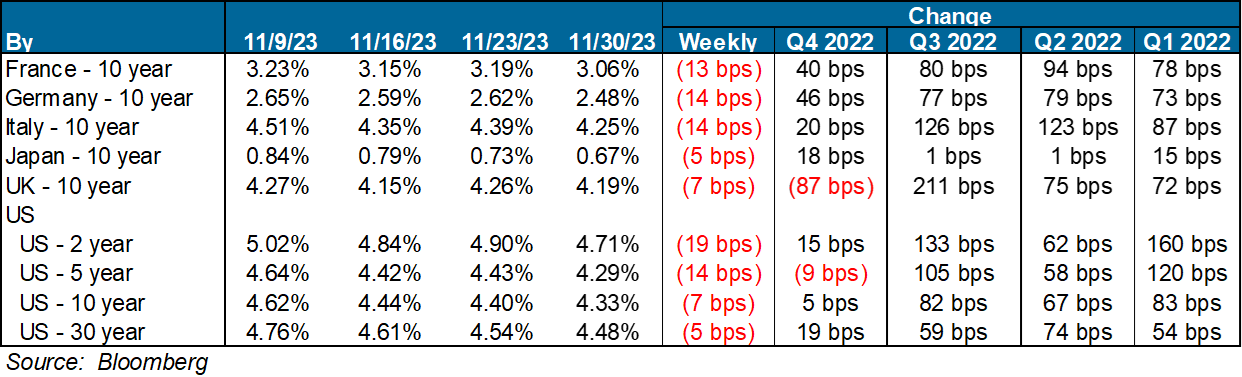

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

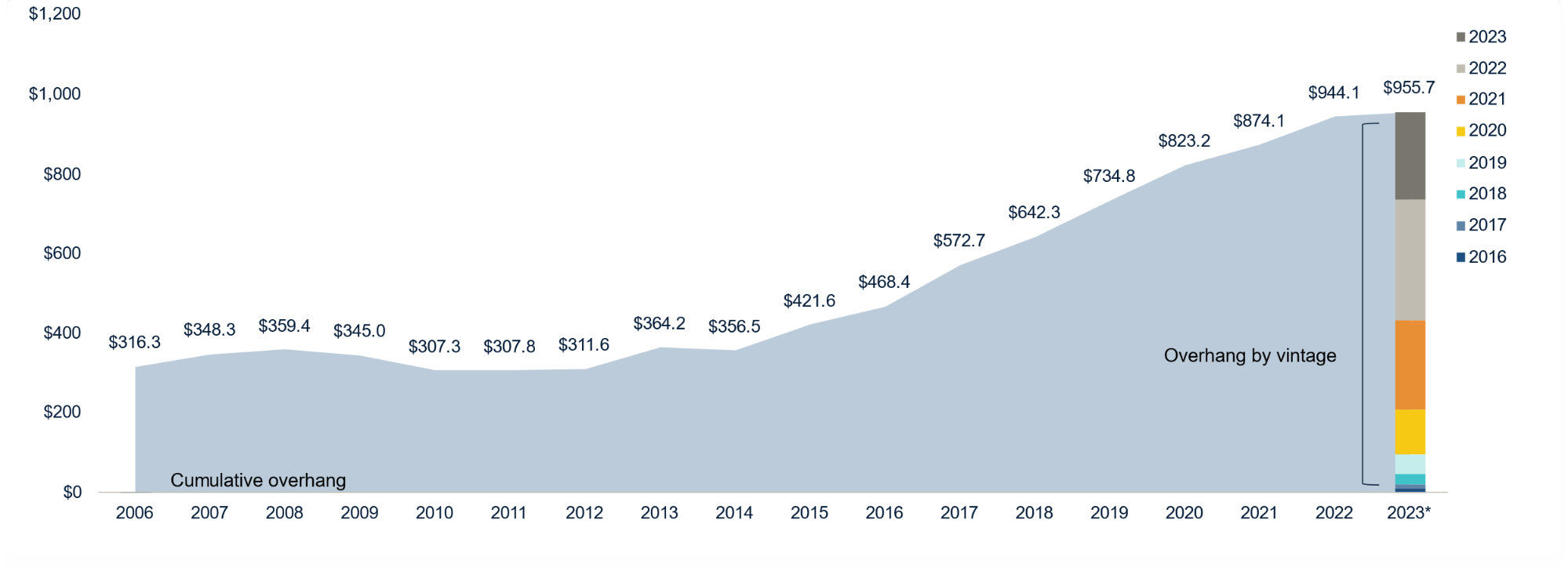

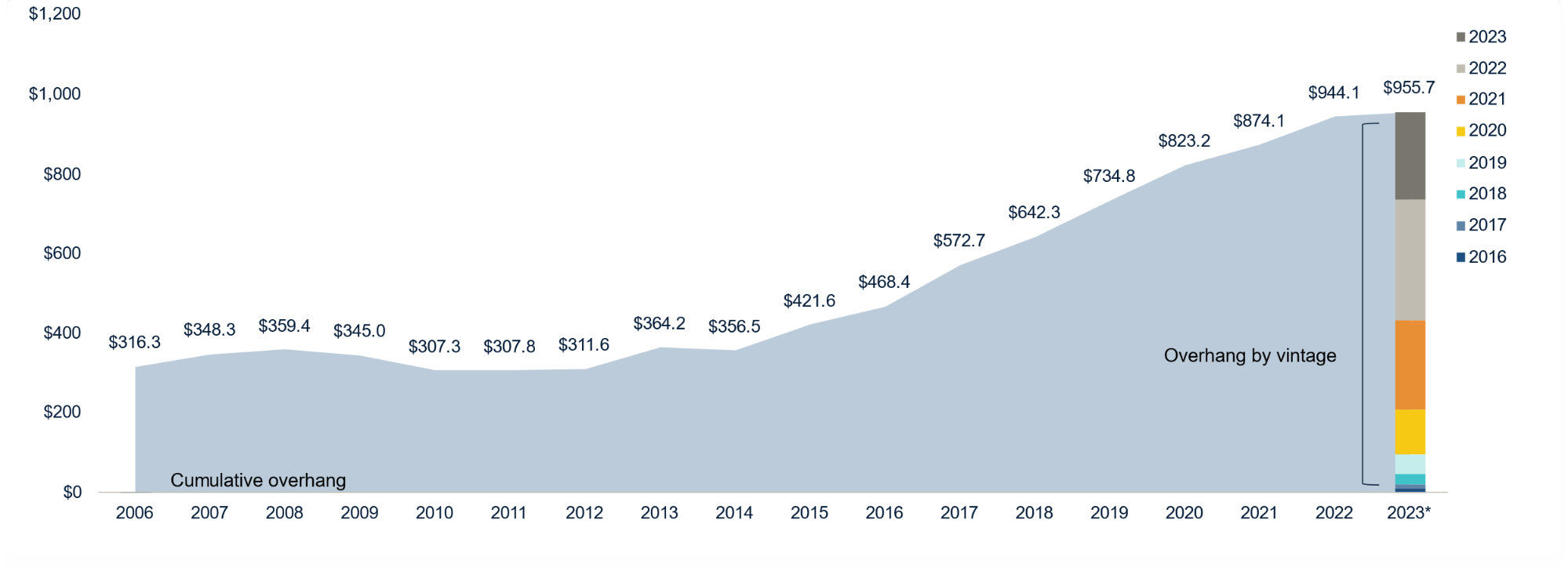

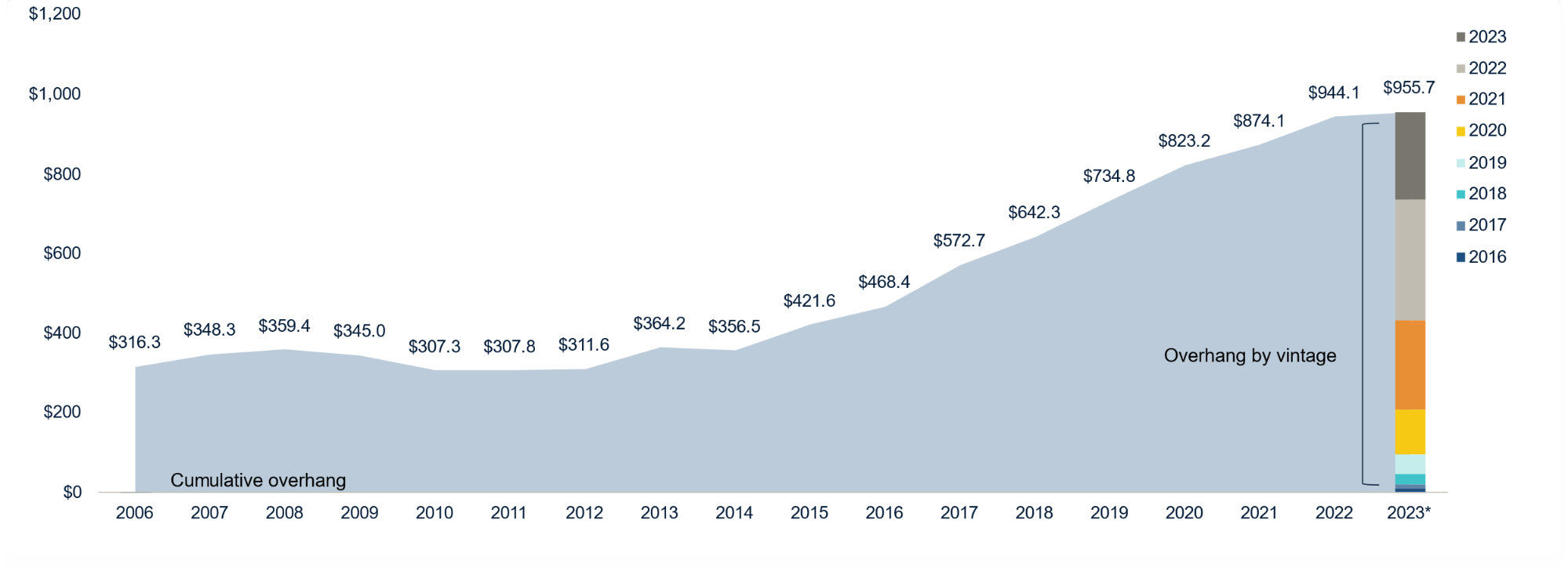

Diagram Q: Dry Powder for All Private Equity Buyouts

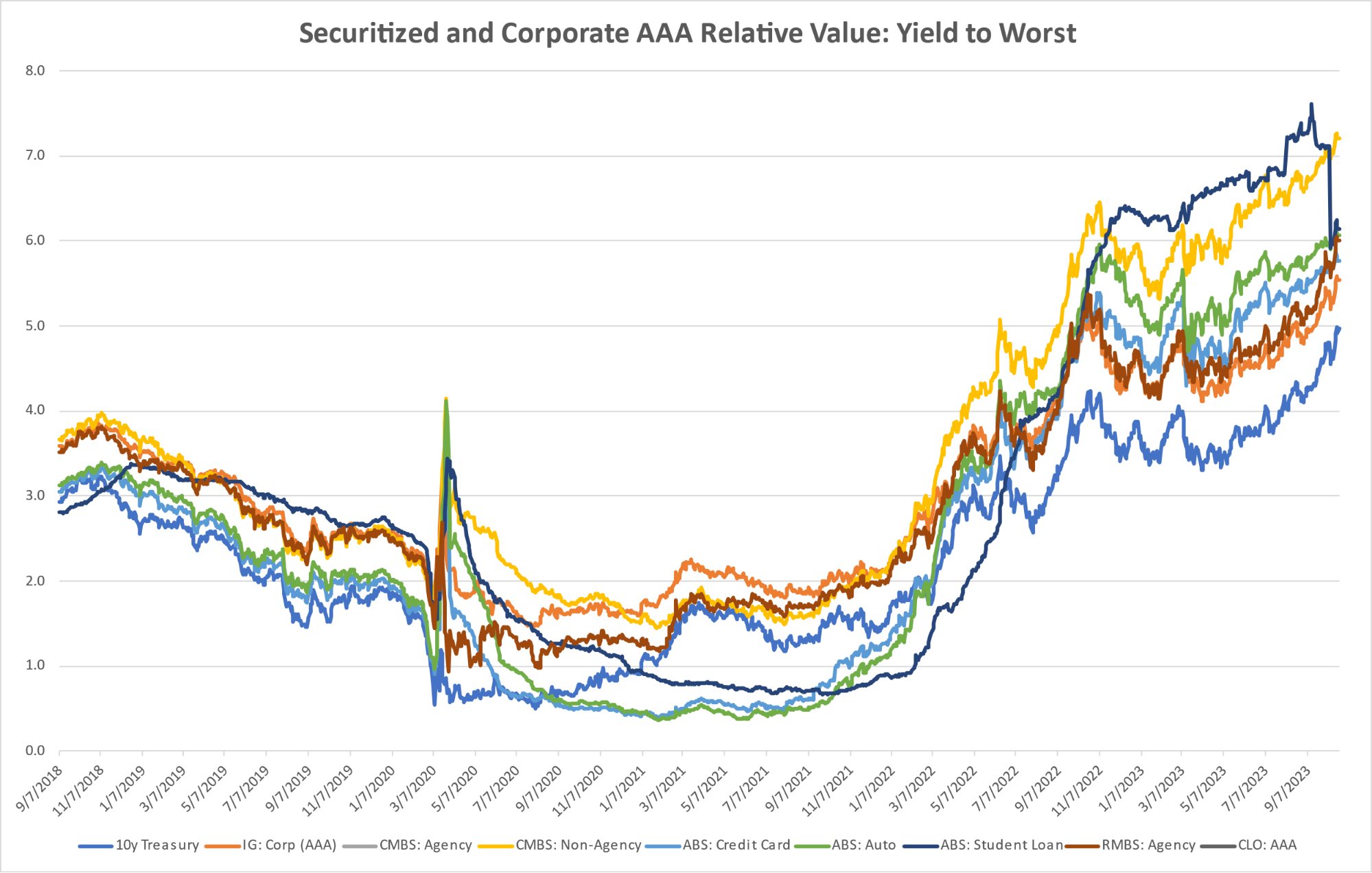

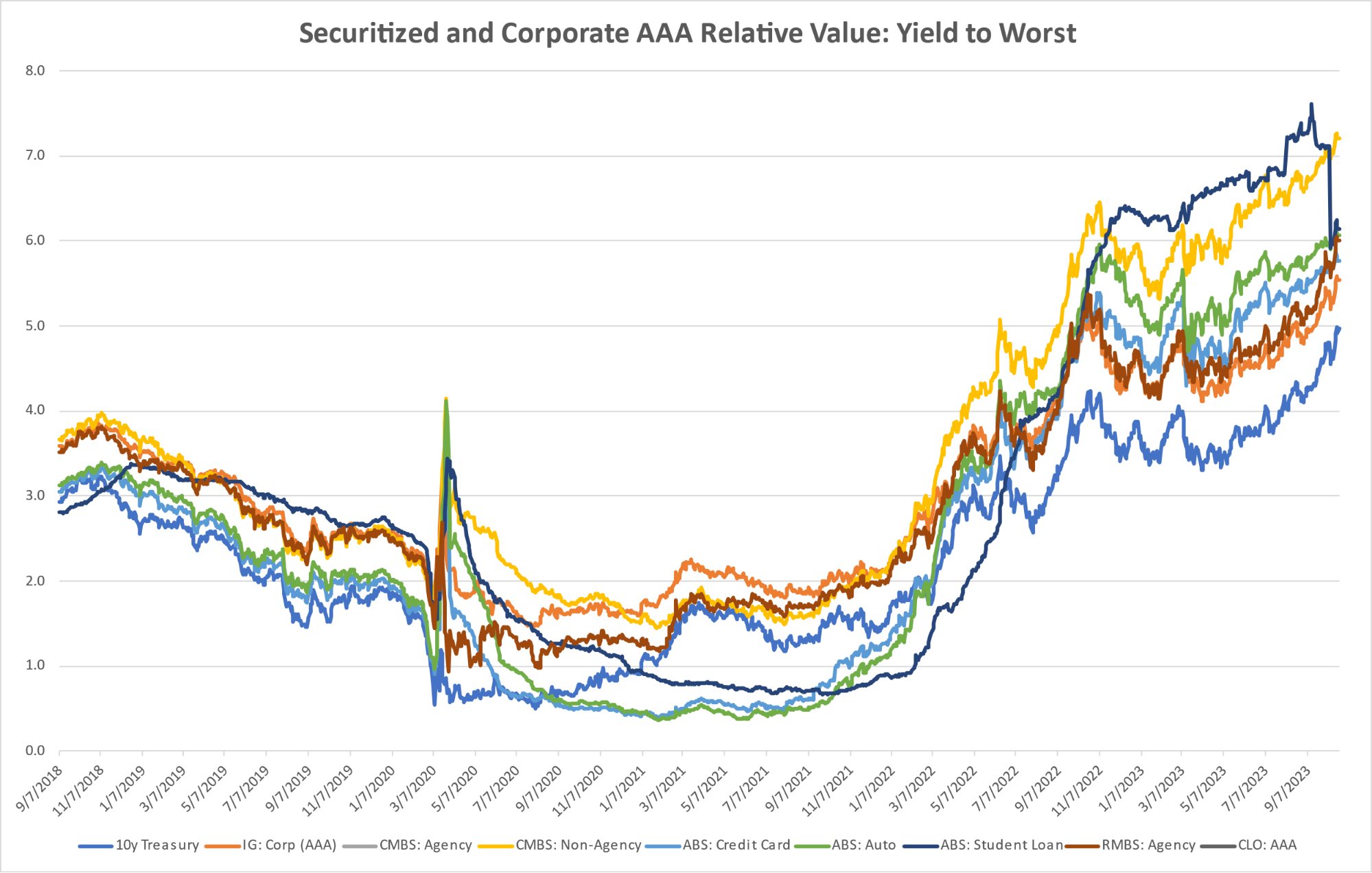

Diagram R: Structured Credit Spreads

Diagram S: Structured Credit Yield

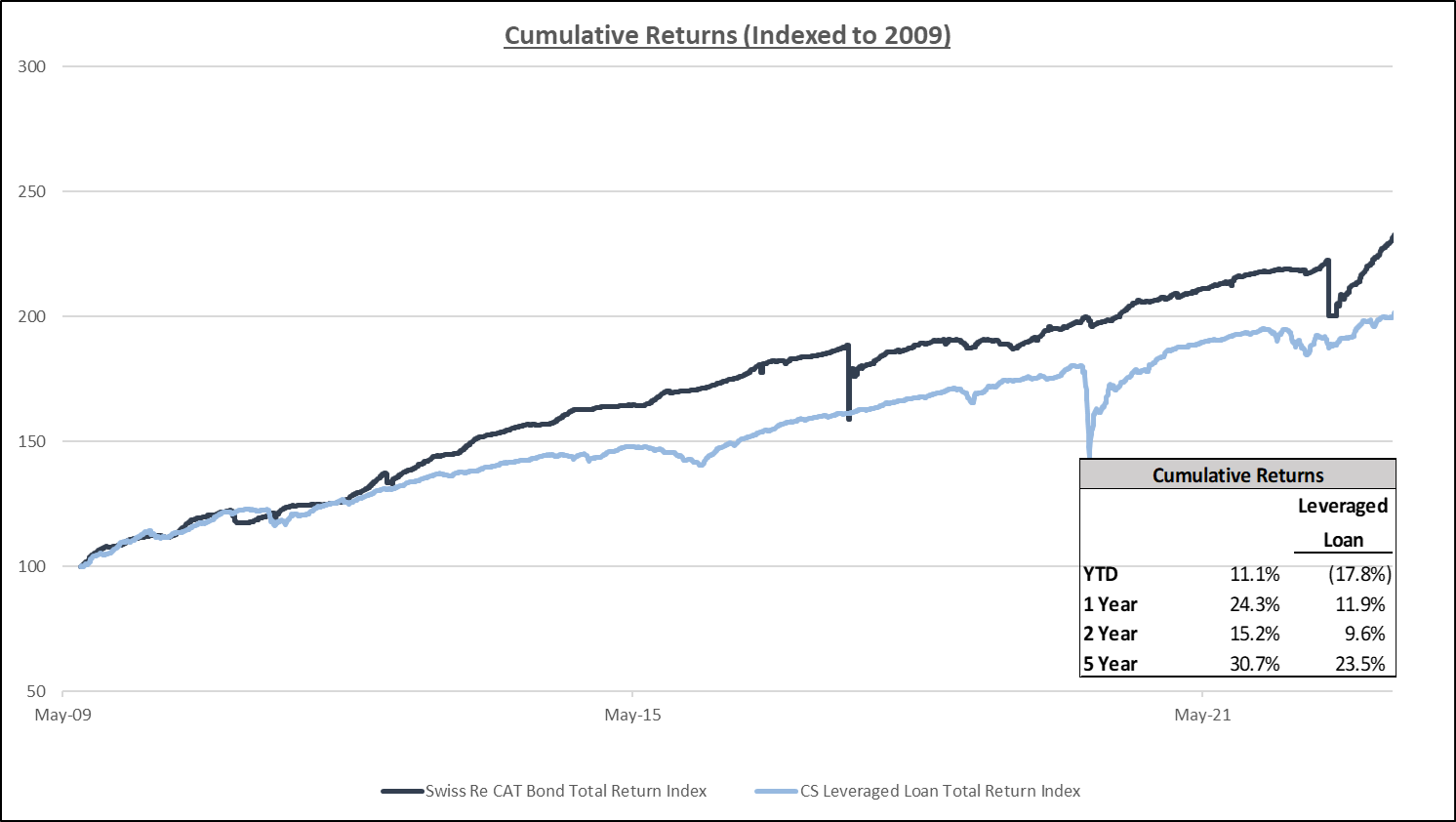

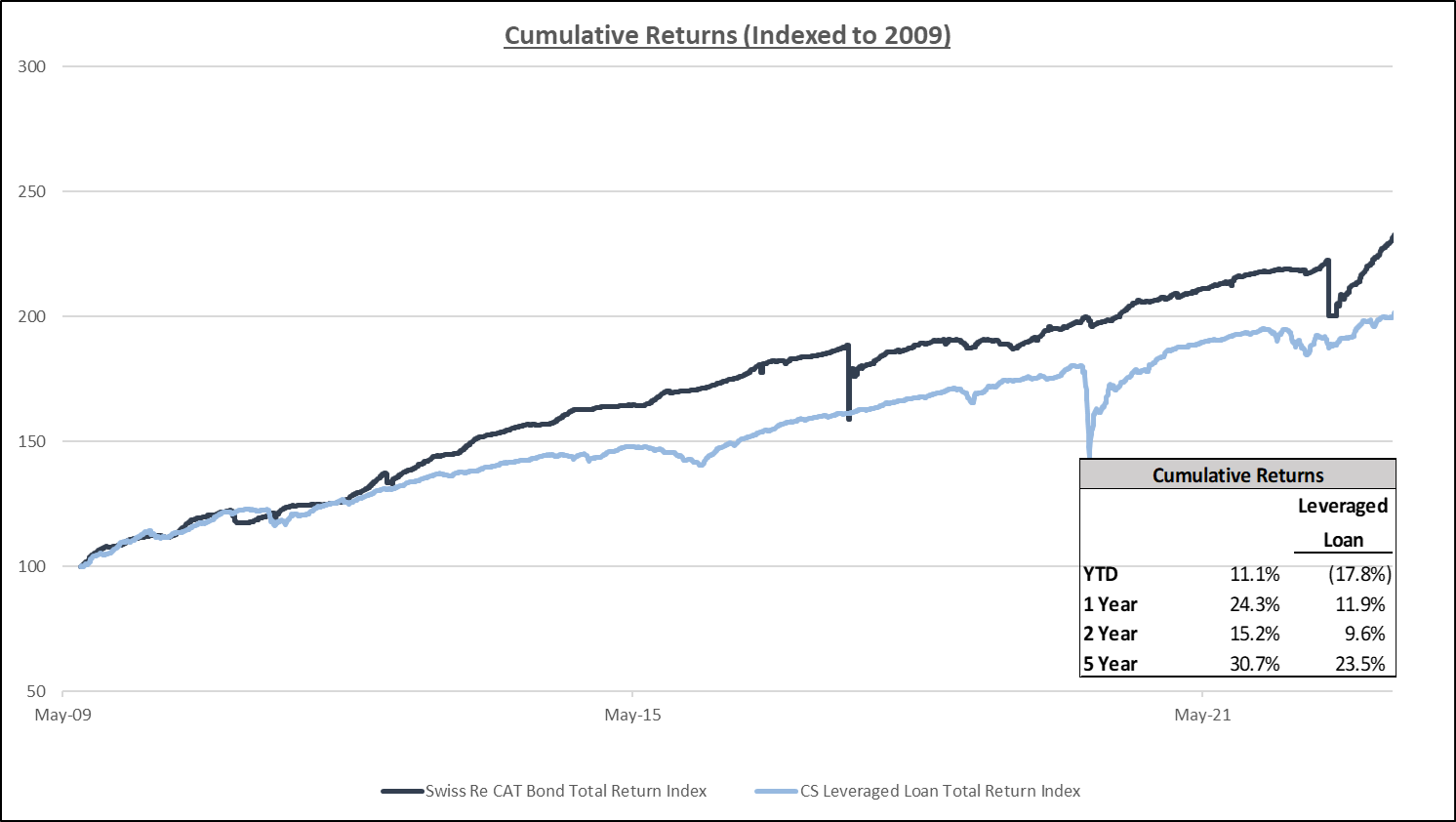

Diagram T: CAT Bonds – Cumulative Returns

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

Brightline West

Route:

- Las Vegas, Nevada to Rancho Cucamonga, California

- 218-mile passenger rail service

- 96% of alignment within the I-15 highway median

Project:

- Expected to break ground in early 2024

- Projected to serve over 11 million one-way passengers annually

- All-electric, zero-emission high-speed rail

Stations:

- Las Vegas, located off the Las Vegas Strip and close to I-15

- Victor Valley

- Rancho Cucamonga

Current Status:

- Awaiting final permits and approvals

- Environmental reviews underway

- Land acquisition process ongoing

- Community outreach and engagement activities planed

U.S. News

- U.S. Trade Deficit

- The U.S. trade deficit rose 5% in October to a three-month high of $64.3 billion largely because of a decline in exports of American-made cars and COVID-related drugs

- Imports inched up 0.2% in October to $323 billion, mostly because of higher demand for computers and equipment to drill for oil

- The U.S. is still on track to report the smallest annual increase in its trade deficit in three years

- November Job Report

- The unemployment rate fell to a four-month low of 3.7%, down from 3.9% in October

- Hourly wages increased 0.4%, the largest gain in four months

- November job growth was 199,000 with ~100,000 coming from the healthcare sector

- Consumer Credit

- Total consumer credit rose $5.2 billion in October, down from a $12.2 billion gain in the prior month

- Revolving credit, such as credit cards, slowed to a 2.7% rate in October after a 4.1% growth rate in the prior month

- Nonrevolving credit, typically auto and student loans, rose at 0.7% rate after a 2.5% rate in the prior month

- Jobless Claim

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 220,000 in the week ended December 1, up 1,000 from the prior week

- The four-week moving average was 220,750, up 500 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – decreased by 64,000 to 1.861 million in the week ended November 24. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.737 trillion in the week ended December 8, down $58.8 billion from the prior week

- Treasury holdings totaled $4.813 trillion, down $29.6 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.45 trillion in the week, down $14.5 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $33.82 trillion as of December 8, an increase of 8.0% from the previous year

- Debt held by the public was $26.58 trillion, and intragovernmental holdings were $7.03 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.2% in October year over year

- On a monthly basis, the CPI increased 0.0% in October on a seasonally adjusted basis, after increasing 0.4% in September

- The index for all items less food and energy (core CPI) rose 0.2% in October, after rising 0.3% in September

- Core CPI increased 4.0% for the 12 months ending October

- Food and Beverages:

- The food at home index increased 2.1% in October from the same month a year earlier, and increased 0.3% in October month over month

- The food away from home index increased 5.4% in October from the same month a year earlier, and increased 0.4% in October month over month

- Commodities:

- The energy commodities index decreased (4.9%) in October after increasing 2.3%

- The energy commodities index fell (6.2%) over the last 12 months

- The energy services index (1.0%) in October after increasing 0.1% in September

- The energy services index fell (2.3%) over the last 12 months

- The gasoline index fell (5.3%) over the last 12 months

- The fuel oil index fell (21.4%) over the last 12 months

- The index for electricity rose 2.4% over the last 12 months

- The index for natural gas fell (15.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $1,460.98 per 40ft

- Drewry’s composite World Container Index has decreased by (31.7%) over the last 12 months

- Housing Market:

- The shelter index increased 0.3% in October after increasing 0.6% in September

- The rent index increased 0.3% in October after increasing 0.6% in September

- The index for lodging away from home decreased (6.1%) in October after increasing 0.7% in September

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, remaining flat since August and up 1% since the start of 2023

World News

-

Israel/Middle East

- The United States on Friday vetoed a U.N. resolution calling for an immediate ceasefire in Gaza. Thirteen countries were in favor of the resolution and the UK abstained

- The U.N. estimates about 1.9 million of Gaza’s 2.2 million population have been displaced, and the death toll has now surpassed 17,000 after weeks of fighting between Israel and Hamas

- Palestinians displaced from the north have begun to congregate in the city of Rafah, which borders Egypt. The U.N. warns that the city could soon host half of the Gaza’s 2.2 million population

- Aid groups have documented outbreaks of disease, including hepatitis, rabies and herpes, resulting from overcrowding, inadequate water and overextended sewage-treatment plants

- Israel estimates that at least 137 hostages, including 19 dead bodies, are still being held inside Gaza, after Hamas freed more than 100 captives in exchange for the release of Palestinian prisoners held in Israeli prisons

-

Ukraine

- The White House warned that the U.S. provision for military supplies to Ukraine will likely run out by the end of the year without the release of additional funds

- The Ukraine parliament approves four bills that are key for their upcoming discussions about joining the European Union. An EU summit next week is set to consider whether to start negotiations, which Ukraine sees as key to anchoring itself to western institutions

- Officials in Ukraine have reported heavy use of aerial attacks in eastern Ukraine as bombardments in Kyiv

-

China

- Moody’s is facing criticism from China after changing its credit outlook on the country to negative from stable

- The credit rater said the growing debt problems of some cities and provinces would force China’s central government to provide financial support and hurt its economy. The country is also grappling with a real estate slump

-

Russia

- Russian President Vladamir Putin confirmed he would run for re-election next year, a widely expected decision that would keep him in power until at least 2030

-

Japan

- Japan said it had asked the U.S. to suspend all non-emergency V-22 Osprey flights over its territory after one fell into the sea in western Japan. One crew member is confirmed dead with seven missing

-

Indonesia

- Indonesia’s Mount Marapi volcano erupted on Sunday killing at least 11 climbers, according to the Associated Press. The volcano spewed ash nearly two miles high

-

Spain

- Amazon reached an agreement with most of its workers in Spain, averting the full impact of a strike that risked crippling its warehouses on one of the busiest days of the year

-

Italy

- Pope Francis is punishing one of his most vocal conservative critics in the Catholic hierarchy, U.S. Cardinal Raymond Burke, by taking away his stipend and rent-free apartment in Rome

-

India

- An Indian government employee tried to have a vocal critic of New Delhi assassinated in New York earlier this year, U.S. prosecutors alleged, a development that threatens to cause new rifts in the deepening relationship between Washington and New Delhi

-

Argentina

- Argentina’s newly elected President, Javier Milei, wants to adopt the U.S. dollar as the national currency and strip the central bank’s power to print money. The country has been overcome with record inflation and low economic growth

-

United Kingdom

- The U.K. government has sanctioned 29 entities and individuals operating in and supporting Russia’s gold and oil sectors, in an effort to cut off revenue streams funding its war in Ukraine

Commodities

-

Oil Prices

- WTI: $71.20 per barrel

- (3.87%) WoW; (10.51%) YTD; (1.12%) YoY

- Brent: $75.84 per barrel

- (3.85%) WoW; (9.65%) YTD; (1.34%) YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended December 1, down 0.1 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 626, up 1 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 445.0 million barrels, up 7.5% YoY

- Refiners operated at a capacity utilization rate of 89.8% in the prior week

- U.S. crude oil imports now amount to 5.833 million barrels per day, down (24.9%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.19 per gallon in the week of December 8,

down (3.9%) YoY

- Gasoline prices on the East Coast amounted to $3.32,down (4.0%) YoY

- Gasoline prices in the Midwest amounted to $3.07, down (6.6%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.83, down (2.2%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.13, down (11.1%) YoY

- Gasoline prices on the West Coast amounted to $4.38, down (2.1%) YoY

- Motor gasoline inventories were up by 5.4 million barrels from the prior week

- Motor gasoline inventories amounted to 223.6 million barrels, up 2.1% YoY

- Production of motor gasoline averaged 9.52 million bpd, up 5.0% YoY

- Demand for motor gasoline amounted to 8.466 million bpd, up 1.3% YoY

-

Distillates

- Distillate inventories decreased by 1.3 million in the week of December 8

- Total distillate inventories amounted to 112.0 million barrels, down (5.7%)

- Distillate production averaged 5.070 million bpd, down (4.9%) YoY

- Demand for distillates averaged 3.756 million bpd in the week, up 5.8% YoY

-

Natural Gas

- Natural gas inventories decreased by 117 billion cubic feet last week

- Total natural gas inventories now amount to 3,719 billion cubic feet, up 7.4% YoY

Credit News

High yield bond yields decreased 6bps to 8.30% and spreads tightened 16bps to 390bps. Leveraged loan yields decreased 20bps to 9.58% and spreads decreased 3bps to 555bps. WTD Leveraged loan returns were positive 31bps. WTD high yield bond returns were positive 38bps. Bonds and Loans performed more evenly this week as risk on sentiment prevailed across markets – but with treasury yields pausing instead of falling further. Treasury yields generally increased for the week, with the benchmark 10yr yield increasing ~3bps. Over the past five weeks, equities have returned 9%+, high yield bonds have returned ~3%, and benchmark 10yr treasury yields have fallen 40bps+. Over the same period, leveraged loans posted a more modest 1%+ gain.

High-yield:

Week ended 12/8/2023

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 12/8/2023

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Ligado Networks ($4.2bn, 11/1/23), Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23), Mallinckrodt ($2.8bn 8/28/23), Yellow Corp ($485mm 8/8/23), Anchor Glass ($675mm 7/11/23), Instant Brands ($391mm 6/12/23), Cyxtera Technologies ($768mm 6/4/23), Diebold ($2.0bn 6/1/23), Envision Health ($7.7bn 5/14/23), Venator Materials ($1.1bn 5/12/23), Bed Bath & Beyond ($5.2bn 4/22/23), David’s Bridal ($254mn 4/17/23), Monitronics International ($794mm 4/15/23), Catalina ($222mn 3/29/23), Diamond Sports ($8.6bn, 2/15/23), Avaya ($2.9bn, 2/14/23), Heritage Power ($485mn, 1/24/23), Serta Simmons Bedding($1.9bn, 1/23/23), Party City Holdings ($1.0bn, 01/17/23), Exela Intermediate ($1.4bn, 1/15/23)

CLOs:

Week ended 12/8/2023

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

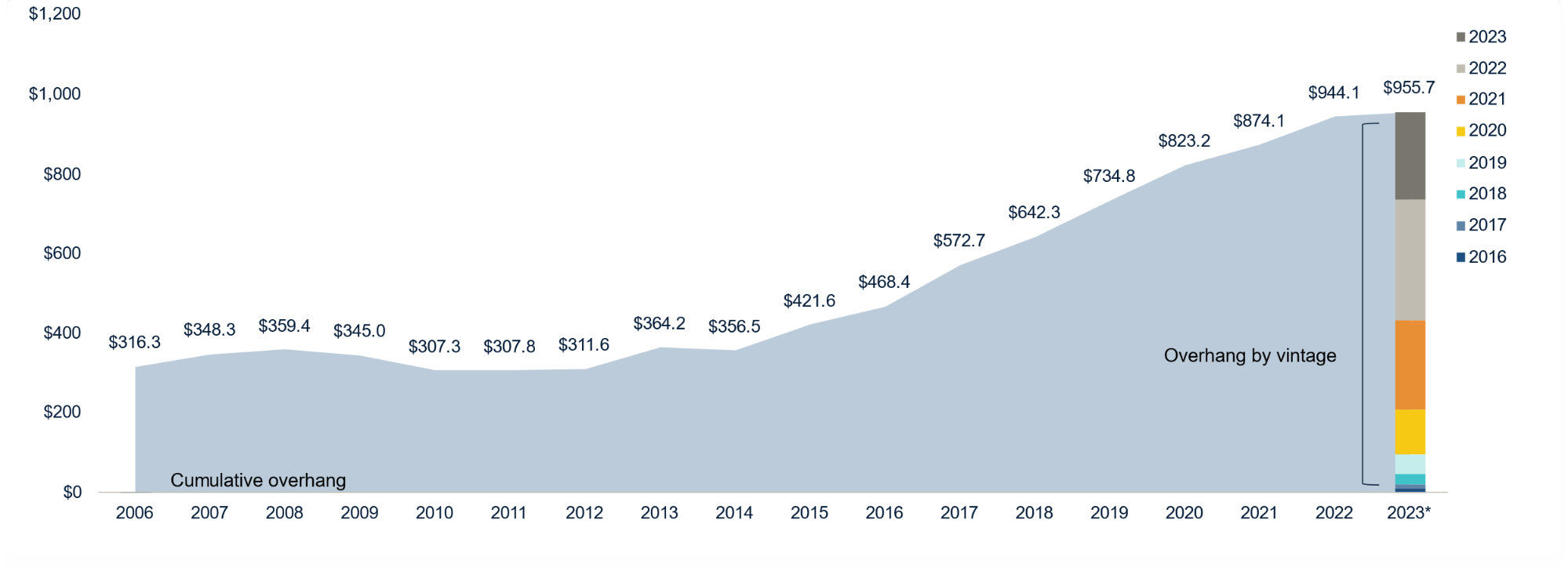

Diagram Q: Dry Powder for All Private Equity Buyouts

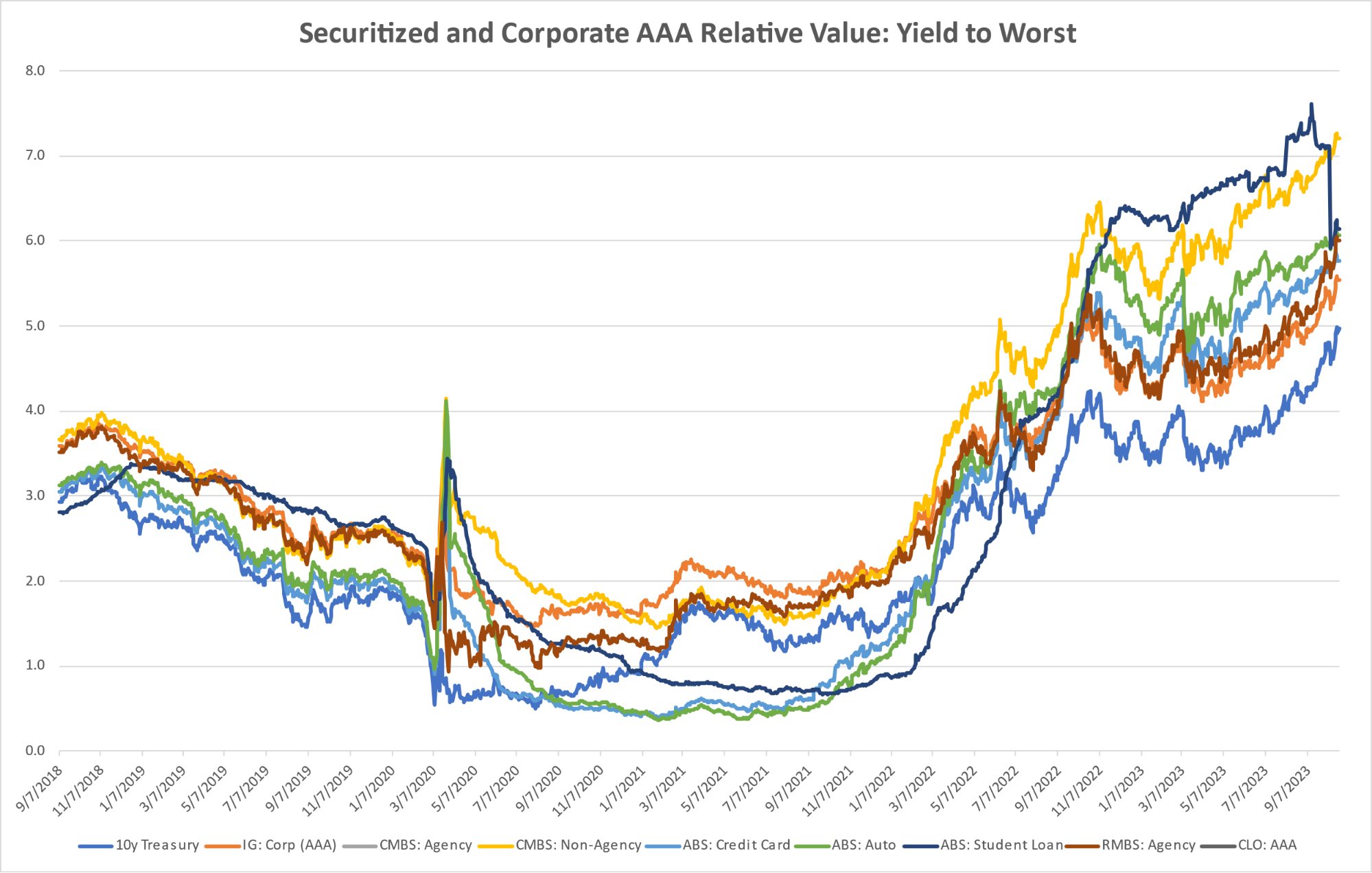

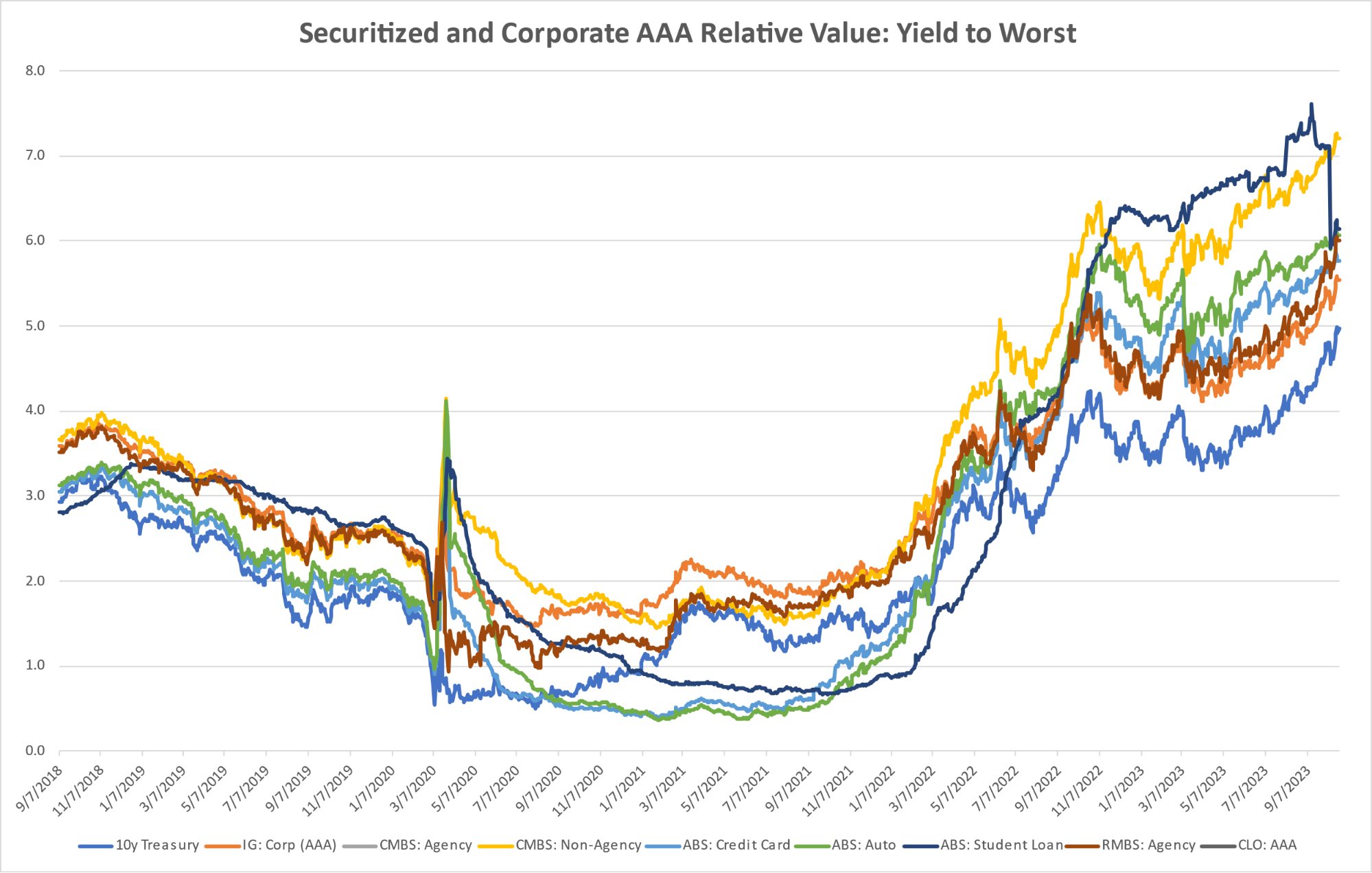

Diagram R: Structured Credit Spreads

Diagram S: Structured Credit Yield

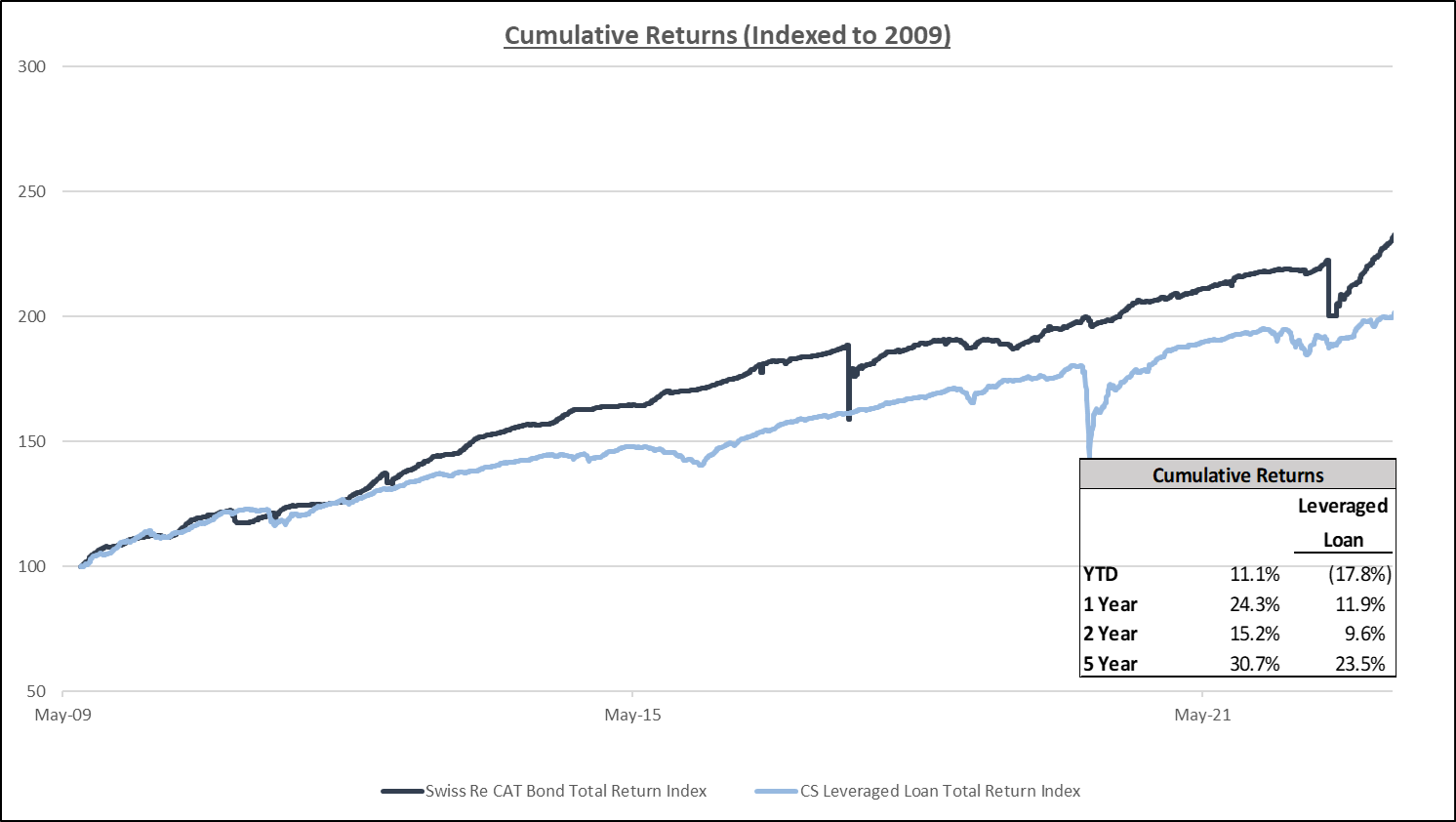

Diagram T: CAT Bonds – Cumulative Returns

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

Brightline West

Route:

- Las Vegas, Nevada to Rancho Cucamonga, California

- 218-mile passenger rail service

- 96% of alignment within the I-15 highway median

Project:

- Expected to break ground in early 2024

- Projected to serve over 11 million one-way passengers annually

- All-electric, zero-emission high-speed rail

Stations:

- Las Vegas, located off the Las Vegas Strip and close to I-15

- Victor Valley

- Rancho Cucamonga

Current Status:

- Awaiting final permits and approvals

- Environmental reviews underway

- Land acquisition process ongoing

- Community outreach and engagement activities planed