U.S. News

- Feds Interest-rate Decision

- The Federal Reserve said Wednesday that it “does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably towards 2%

- Federal-funds-futures now point to a 37.5% chance of a March rate cut of at least 25 basis points

- U.S. stocks logged their biggest daily drop of 2024 on Wednesday

- Consumer Confidence

- Consumer confidence reached a two-year high of 114.8, the highest level since December 2021

- This increase is due to slower inflation, a strong stock market, and anticipation of lower interest rates

- The White House has indicated that the U.S. economy is gaining momentum going into 2024, citing higher consumer spending during the holiday season, real wage gains over the past nine months, and the jump in consumer confidence

- Construction Spending

- Spending on construction projects rose 0.9% in December to $2.1 trillion

- In terms of residential real estate, private residential construction rose 1.4% in December, with single-family rising 1.6% and multi-family construction rising 0.3%

- Over the past year, construction spending is up 13.9%

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 224,000 in the week ended January 26, up 9,000 from the prior week

- The four-week moving average was 207,750, down 5250 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 70,000 to 1.898 million in the week ended January 19. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.630 trillion in the week ended February 2, down $47.1 billion from the prior week

- Treasury holdings totaled $4.716 trillion, down $6.1 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.42 trillion in the week, down $14.6 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.16 trillion as of February 2, an increase of 8.6% from the previous year

- Debt held by the public was $24.61 trillion, and intragovernmental holdings were $7.06 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.4% in December year over year

- On a monthly basis, the CPI increased 0.3% in December on a seasonally adjusted basis, after increasing 0.1% in November

- The index for all items less food and energy (core CPI) rose 0.3% in December, after rising 0.3% in November

- Core CPI increased 3.9% for the 12 months ending December

- Food and Beverages:

- The food at home index increased 1.3% i n December from the same month a year earlier, and increased 0.1% in December month over month

- The food away from home index increased 5.2% in December from the same month a year earlier, and increased 0.3% in December month over month

- Commodities:

- The energy commodities index decreased (0.1%) in December after decreasing

- The energy commodities index fell (2.9%) over the last 12 months

- The energy services index 0.4% in December after increasing 0.7% in November

- The energy services index fell (1.1%) over the last 12 months

- The gasoline index fell (1.9%) over the last 12 months

- The fuel oil index fell (14.7%) over the last 12 months

- The index for electricity rose 3.3% over the last 12 months

- The index for natural gas fell (13.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $3,823.53 per 40ft container

- Drewry’s composite World Container Index has increased by 88.0% over the last 12 months

- Housing Market:

- The shelter index increased 0.5% in December after increasing 0.4% in November

- The rent index increased 0.4% in December after increasing 0.5% in November

- The index for lodging away from home decreased (1.1%) in December after decreasing (4.5%) in November

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel

- US launched airstrikes against Iranian forces and allied militias in Iraq and Syria on Friday as it began its retaliation for a drone attack that killed three US soldiers in Jordan last week

- The UN warns that Rafah is becoming a humanitarian crisis with 17,000 children separated from their families as the conflict between Israel and Hamas continues

- More than 800 officials from the United States and Europe have endorsed a strong critique of Western policy towards Israel and Gaza, accusing their governments of potential complicity in war crimes

- Hamas has received a new proposal for a three-stage truce, amid international efforts to end the ongoing conflict, while Israel seeks a total victory

-

Yemen

- Houthi rebels escalated tensions by attacking a U.S. warship and a British vessel in the Gulf of Aden, marking a significant escalation in maritime conflicts in the Middle East.

- The U.S. military targeted Houthi military assets in Yemen, destroying a ground control station and 10 drones in response to threats to merchant and Navy ships in the Red Sea.

- The UN and partners announced a $2.7 billion humanitarian package to support millions of civilians in Yemen, addressing the severe humanitarian crisis from a new decade of conflict

- Ongoing attacks on commercial shipping in the Red Sea by Houthi rebels have heightened global trade risks and increased geopolitical tensions, prompting counterstrikes from the United States, United Kingdom, and other nations

-

Russia

- Russia and Ukraine exchanged hundreds of prisoners of war, including 195 soldiers on each side. This came a week after a Russian military transport plane crashed, with Moscow claiming the plane was carrying Ukrainian prisoners

- The European Commission is set to discuss a new set of sanctions against Russia with EU countries, focusing on closing loopholes and potentially banning imports of Russian aluminum and liquefied natural gas

-

China

- Property developer China Evergrande Group has been ordered to liquidate by a Hong Kong court. It comes more than two years after the company defaulted on its dollar bonds

- For the fourth consecutive month, China’s manufacturing activity contracted in January. This persistent shrinkage is attributed to weak demand, signaling ongoing challenges in the sector

- Several prominent commentaries by economists and journalists in China have vanished from the internet in recent weeks, raising concerns that Beijing is stepping up its censorship efforts as it tries to put a positive spin on a struggling economy

-

Argentina

- Argentina’s Chamber of Deputies on Friday approved in general terms a reform bill proposed by libertarian President Javier Milei to deregulate the economy, overcoming a hurdle for the sweeping initiative after three days of heated debate

-

Sweden

- Hungarian Prime Minister Viktor Orban escalated a standoff with Western allies over Sweden’s NATO accession after a senior US lawmaker called for potential sanctions against the lone holdout

-

Canada

- Prime Minister Justin Trudeau has confirmed that his government is considering imposing sanctions on Israeli settlers in the West Bank

-

Nicaragua

- Nicaragua released 19 clergymen from prison, including Bishop Rolando Álvarez, the country’s most prominent political prisoner, and expelled them to the Vatican

-

Ecuador

- Ecuador is at war with drug gangs, President Daniel Noboa said, as troops patrolled the country’s largest city, Guayaquil, a day after gunmen took over a TV studio and launched a series of attacks against the Andean nation’s new government

-

South Korea

- South Korea’s opposition party leader was stabbed in the neck in an attack that left him hospitalized in an incentive care unit

Commodities

-

Oil Prices

- WTI: $72.28 per barrel

- (7.35%) WoW; 0.88% YTD; (4.74%) YoY

- Brent: $77.33 per barrel

- (7.44%) WoW; 0.38% YTD; (5.89%) YoY

-

US Production

- U.S. oil production amounted to 13.0 million bpd for the week ended January 26, up 0.3 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 619, down 2 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 421.9 million barrels, down (6.8%) YoY

- Refiners operated at a capacity utilization rate of 82.9% for the week, down from 85.5% in the prior week

- U.S. crude oil imports now amount to 5.580 million barrels per day, down (23.0%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.15 per gallon in the week of February 2,

down (9.7%) YoY

- Gasoline prices on the East Coast amounted to $3.19, down (10.4%) YoY

- Gasoline prices in the Midwest amounted to $2.95, down (14.6%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.84, down (11.5%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $2.85, down (22.2%) YoY

- Gasoline prices on the West Coast amounted to $4.07, down (3.1%) YoY

- Motor gasoline inventories were up by 1.2 million barrels from the prior week

- Motor gasoline inventories amounted to 254.1 million barrels, up 8.3% YoY

- Production of motor gasoline averaged 9.28 million bpd, down (1.7%) YoY

- Demand for motor gasoline amounted to 8.144 million bpd, down (4.1%) YoY

-

Distillates

- Distillate inventories decreased by -2.5 million in the week of February 2

- Total distillate inventories amounted to 130.8 million barrels, up 11.2% YoY

- Distillate production averaged 4.385 million bpd, down (6.5%) YoY

- Demand for distillates averaged 3.757 million bpd in the week, up 1.8% YoY

-

Natural Gas

- Natural gas inventories decreased by 197 billion cubic feet last week

- Total natural gas inventories now amount to 2,659 billion cubic feet, up 2.9% YoY

Credit News

High yield bond yields decreased 4bps to 7.69% and spreads widened 14bps to 372bps. Leveraged loan yields decreased 19bps to 8.97% and spreads increased 2bps to 528bps. WTD Leveraged loan returns were positive 6bps. WTD high yield bond returns were positive 34bps. 10yr treasury yields were 12bps lower on week. Markets generally had a positive tone as positive economic data and earnings were weighed against a less aggressive path of interest rate cuts.

High-yield:

Week ended 02/02/2024.

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 02/02/2024.

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Enviva Partners ($750mn, 1/15/24, Mobileum ($538mm, 12/1/23) Ligado Networks ($4.2bn, 11/1/23), Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23)

CLOs:

Week ended 02/02/2024.

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

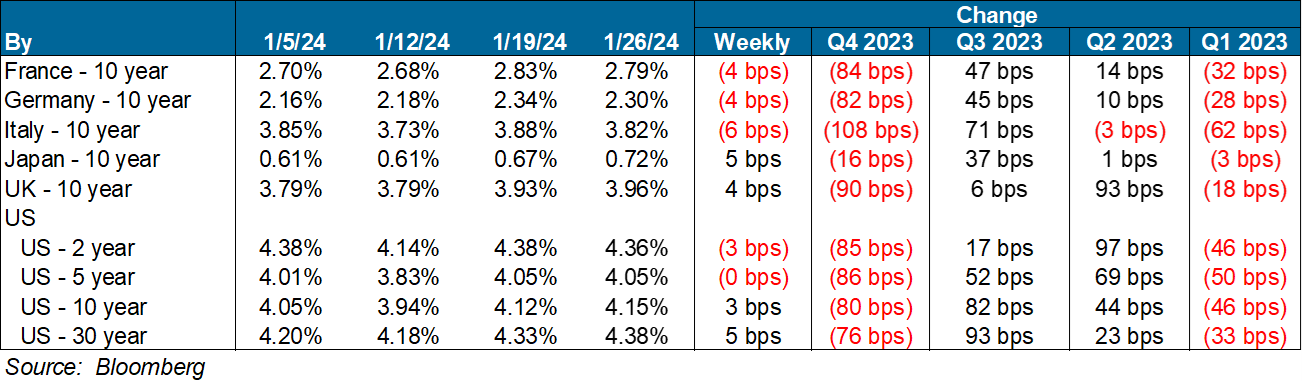

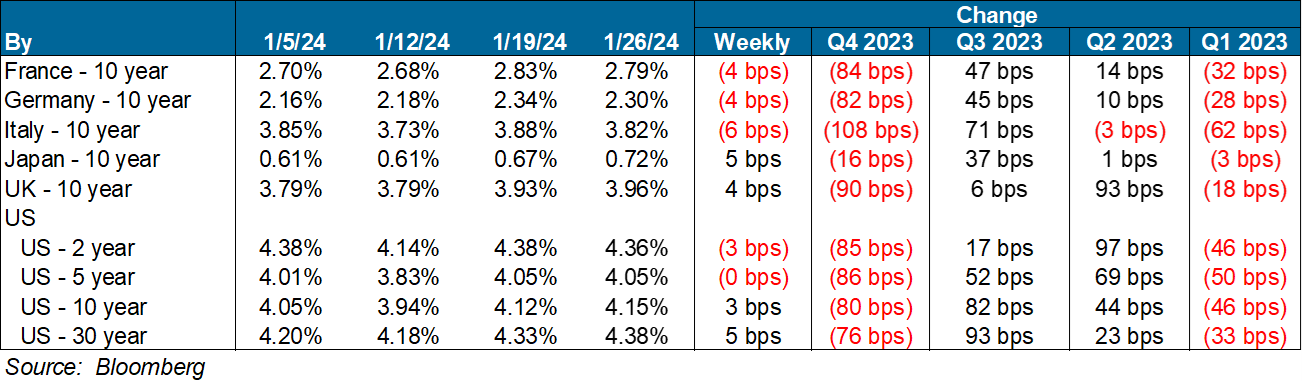

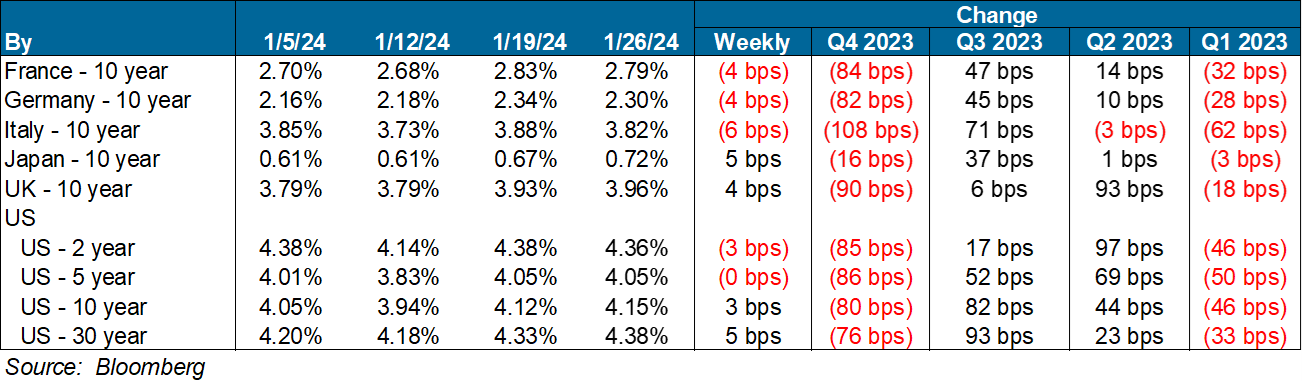

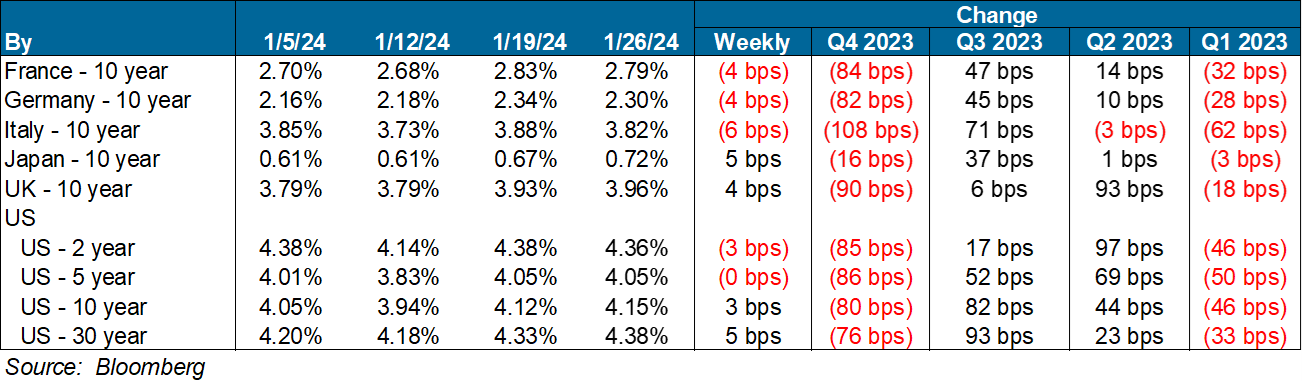

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

Manhattan Office Q4 2023:

Manhattan office saw increase leasing activity and higher rents in Q4 2023, signaling positive trends in the midst of challenges such as rising vacancy rates.

- Manhattan overall vacancy rate increased by 70 basis points (bps) during the quarter to 22.8%, as three newly developed and renovated construction projects were completed totaling 2.2 msf.

- Manhattan overall asking rents increased by $1.51 per square foot (psf) to $73.33, with Class A rents rising by $1.80 psf to $80.98 in the fourth quarter, fueled by the availability of more high-end space.

- Manhattan new leasing increased to nearly 5.3 million square feet (msf) in the fourth quarter of 2023, fueled by a surge in December leasing, which registered a 16-month high of 2.6 msf

U.S. News

- Feds Interest-rate Decision

- The Federal Reserve said Wednesday that it “does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably towards 2%

- Federal-funds-futures now point to a 37.5% chance of a March rate cut of at least 25 basis points

- U.S. stocks logged their biggest daily drop of 2024 on Wednesday

- Consumer Confidence

- Consumer confidence reached a two-year high of 114.8, the highest level since December 2021

- This increase is due to slower inflation, a strong stock market, and anticipation of lower interest rates

- The White House has indicated that the U.S. economy is gaining momentum going into 2024, citing higher consumer spending during the holiday season, real wage gains over the past nine months, and the jump in consumer confidence

- Construction Spending

- Spending on construction projects rose 0.9% in December to $2.1 trillion

- In terms of residential real estate, private residential construction rose 1.4% in December, with single-family rising 1.6% and multi-family construction rising 0.3%

- Over the past year, construction spending is up 13.9%

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 224,000 in the week ended January 26, up 9,000 from the prior week

- The four-week moving average was 207,750, down 5250 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 70,000 to 1.898 million in the week ended January 19. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.630 trillion in the week ended February 2, down $47.1 billion from the prior week

- Treasury holdings totaled $4.716 trillion, down $6.1 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.42 trillion in the week, down $14.6 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.16 trillion as of February 2, an increase of 8.6% from the previous year

- Debt held by the public was $24.61 trillion, and intragovernmental holdings were $7.06 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.4% in December year over year

- On a monthly basis, the CPI increased 0.3% in December on a seasonally adjusted basis, after increasing 0.1% in November

- The index for all items less food and energy (core CPI) rose 0.3% in December, after rising 0.3% in November

- Core CPI increased 3.9% for the 12 months ending December

- Food and Beverages:

- The food at home index increased 1.3% i n December from the same month a year earlier, and increased 0.1% in December month over month

- The food away from home index increased 5.2% in December from the same month a year earlier, and increased 0.3% in December month over month

- Commodities:

- The energy commodities index decreased (0.1%) in December after decreasing

- The energy commodities index fell (2.9%) over the last 12 months

- The energy services index 0.4% in December after increasing 0.7% in November

- The energy services index fell (1.1%) over the last 12 months

- The gasoline index fell (1.9%) over the last 12 months

- The fuel oil index fell (14.7%) over the last 12 months

- The index for electricity rose 3.3% over the last 12 months

- The index for natural gas fell (13.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $3,823.53 per 40ft container

- Drewry’s composite World Container Index has increased by 88.0% over the last 12 months

- Housing Market:

- The shelter index increased 0.5% in December after increasing 0.4% in November

- The rent index increased 0.4% in December after increasing 0.5% in November

- The index for lodging away from home decreased (1.1%) in December after decreasing (4.5%) in November

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel

- US launched airstrikes against Iranian forces and allied militias in Iraq and Syria on Friday as it began its retaliation for a drone attack that killed three US soldiers in Jordan last week

- The UN warns that Rafah is becoming a humanitarian crisis with 17,000 children separated from their families as the conflict between Israel and Hamas continues

- More than 800 officials from the United States and Europe have endorsed a strong critique of Western policy towards Israel and Gaza, accusing their governments of potential complicity in war crimes

- Hamas has received a new proposal for a three-stage truce, amid international efforts to end the ongoing conflict, while Israel seeks a total victory

-

Yemen

- Houthi rebels escalated tensions by attacking a U.S. warship and a British vessel in the Gulf of Aden, marking a significant escalation in maritime conflicts in the Middle East.

- The U.S. military targeted Houthi military assets in Yemen, destroying a ground control station and 10 drones in response to threats to merchant and Navy ships in the Red Sea.

- The UN and partners announced a $2.7 billion humanitarian package to support millions of civilians in Yemen, addressing the severe humanitarian crisis from a new decade of conflict

- Ongoing attacks on commercial shipping in the Red Sea by Houthi rebels have heightened global trade risks and increased geopolitical tensions, prompting counterstrikes from the United States, United Kingdom, and other nations

-

Russia

- Russia and Ukraine exchanged hundreds of prisoners of war, including 195 soldiers on each side. This came a week after a Russian military transport plane crashed, with Moscow claiming the plane was carrying Ukrainian prisoners

- The European Commission is set to discuss a new set of sanctions against Russia with EU countries, focusing on closing loopholes and potentially banning imports of Russian aluminum and liquefied natural gas

-

China

- Property developer China Evergrande Group has been ordered to liquidate by a Hong Kong court. It comes more than two years after the company defaulted on its dollar bonds

- For the fourth consecutive month, China’s manufacturing activity contracted in January. This persistent shrinkage is attributed to weak demand, signaling ongoing challenges in the sector

- Several prominent commentaries by economists and journalists in China have vanished from the internet in recent weeks, raising concerns that Beijing is stepping up its censorship efforts as it tries to put a positive spin on a struggling economy

-

Argentina

- Argentina’s Chamber of Deputies on Friday approved in general terms a reform bill proposed by libertarian President Javier Milei to deregulate the economy, overcoming a hurdle for the sweeping initiative after three days of heated debate

-

Sweden

- Hungarian Prime Minister Viktor Orban escalated a standoff with Western allies over Sweden’s NATO accession after a senior US lawmaker called for potential sanctions against the lone holdout

-

Canada

- Prime Minister Justin Trudeau has confirmed that his government is considering imposing sanctions on Israeli settlers in the West Bank

-

Nicaragua

- Nicaragua released 19 clergymen from prison, including Bishop Rolando Álvarez, the country’s most prominent political prisoner, and expelled them to the Vatican

-

Ecuador

- Ecuador is at war with drug gangs, President Daniel Noboa said, as troops patrolled the country’s largest city, Guayaquil, a day after gunmen took over a TV studio and launched a series of attacks against the Andean nation’s new government

-

South Korea

- South Korea’s opposition party leader was stabbed in the neck in an attack that left him hospitalized in an incentive care unit

Commodities

-

Oil Prices

- WTI: $72.28 per barrel

- (7.35%) WoW; 0.88% YTD; (4.74%) YoY

- Brent: $77.33 per barrel

- (7.44%) WoW; 0.38% YTD; (5.89%) YoY

-

US Production

- U.S. oil production amounted to 13.0 million bpd for the week ended January 26, up 0.3 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 619, down 2 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 421.9 million barrels, down (6.8%) YoY

- Refiners operated at a capacity utilization rate of 82.9% for the week, down from 85.5% in the prior week

- U.S. crude oil imports now amount to 5.580 million barrels per day, down (23.0%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.15 per gallon in the week of February 2,

down (9.7%) YoY

- Gasoline prices on the East Coast amounted to $3.19, down (10.4%) YoY

- Gasoline prices in the Midwest amounted to $2.95, down (14.6%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.84, down (11.5%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $2.85, down (22.2%) YoY

- Gasoline prices on the West Coast amounted to $4.07, down (3.1%) YoY

- Motor gasoline inventories were up by 1.2 million barrels from the prior week

- Motor gasoline inventories amounted to 254.1 million barrels, up 8.3% YoY

- Production of motor gasoline averaged 9.28 million bpd, down (1.7%) YoY

- Demand for motor gasoline amounted to 8.144 million bpd, down (4.1%) YoY

-

Distillates

- Distillate inventories decreased by -2.5 million in the week of February 2

- Total distillate inventories amounted to 130.8 million barrels, up 11.2% YoY

- Distillate production averaged 4.385 million bpd, down (6.5%) YoY

- Demand for distillates averaged 3.757 million bpd in the week, up 1.8% YoY

-

Natural Gas

- Natural gas inventories decreased by 197 billion cubic feet last week

- Total natural gas inventories now amount to 2,659 billion cubic feet, up 2.9% YoY

Credit News

High yield bond yields decreased 4bps to 7.69% and spreads widened 14bps to 372bps. Leveraged loan yields decreased 19bps to 8.97% and spreads increased 2bps to 528bps. WTD Leveraged loan returns were positive 6bps. WTD high yield bond returns were positive 34bps. 10yr treasury yields were 12bps lower on week. Markets generally had a positive tone as positive economic data and earnings were weighed against a less aggressive path of interest rate cuts.

High-yield:

Week ended 02/02/2024.

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 02/02/2024.

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Enviva Partners ($750mn, 1/15/24, Mobileum ($538mm, 12/1/23) Ligado Networks ($4.2bn, 11/1/23), Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23)

CLOs:

Week ended 02/02/2024.

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

Manhattan Office Q4 2023:

Manhattan office saw increase leasing activity and higher rents in Q4 2023, signaling positive trends in the midst of challenges such as rising vacancy rates.

- Manhattan overall vacancy rate increased by 70 basis points (bps) during the quarter to 22.8%, as three newly developed and renovated construction projects were completed totaling 2.2 msf.

- Manhattan overall asking rents increased by $1.51 per square foot (psf) to $73.33, with Class A rents rising by $1.80 psf to $80.98 in the fourth quarter, fueled by the availability of more high-end space.

- Manhattan new leasing increased to nearly 5.3 million square feet (msf) in the fourth quarter of 2023, fueled by a surge in December leasing, which registered a 16-month high of 2.6 msf