U.S. News

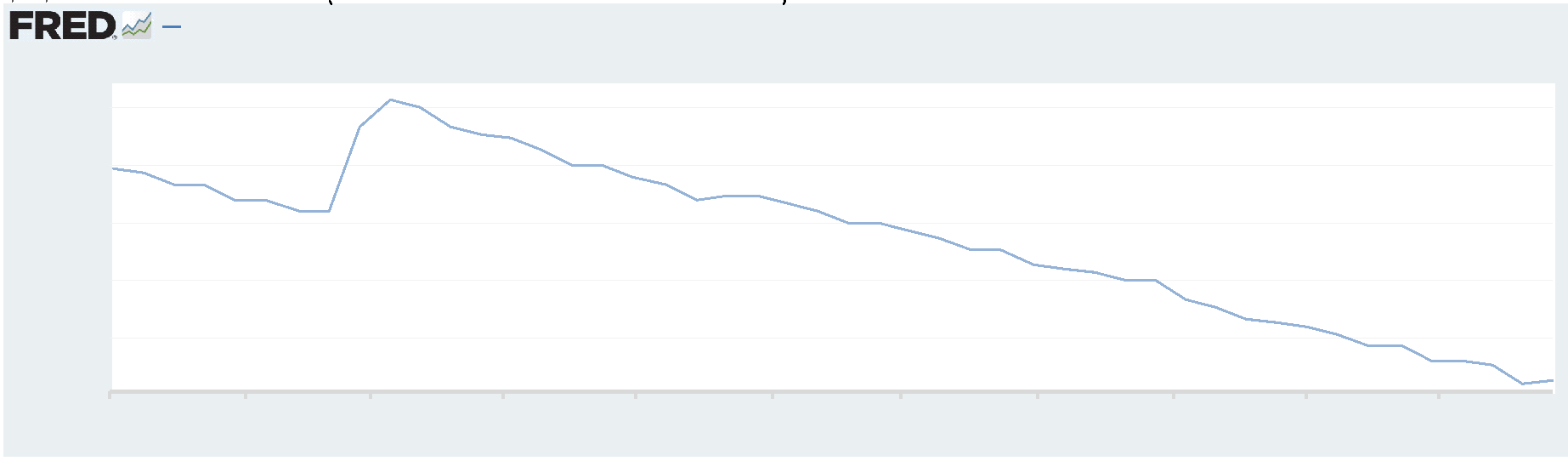

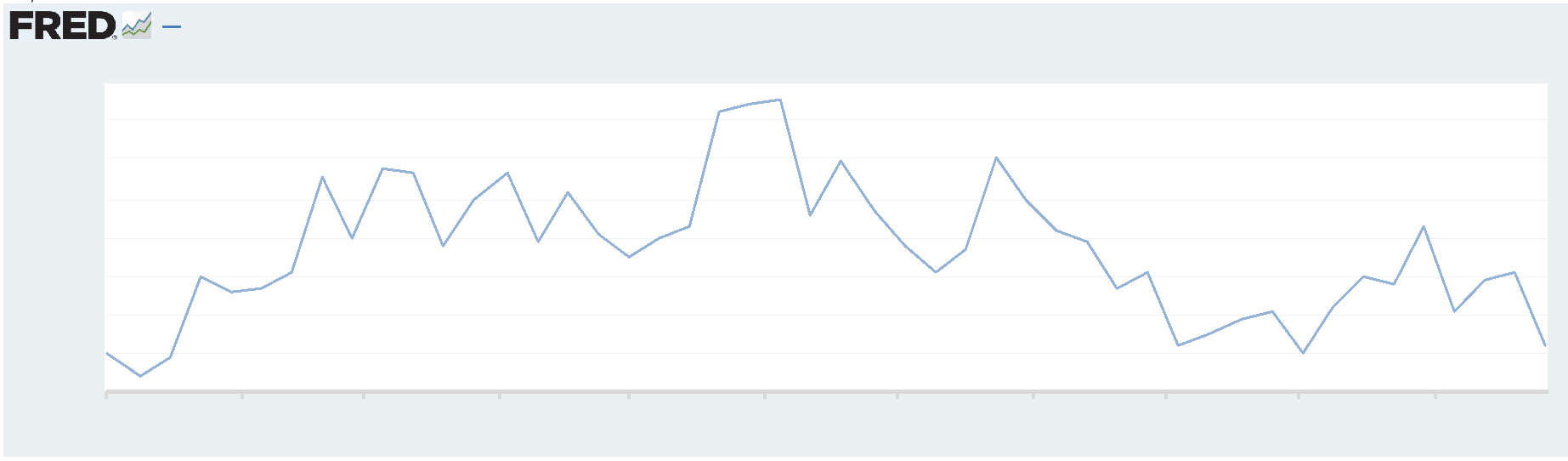

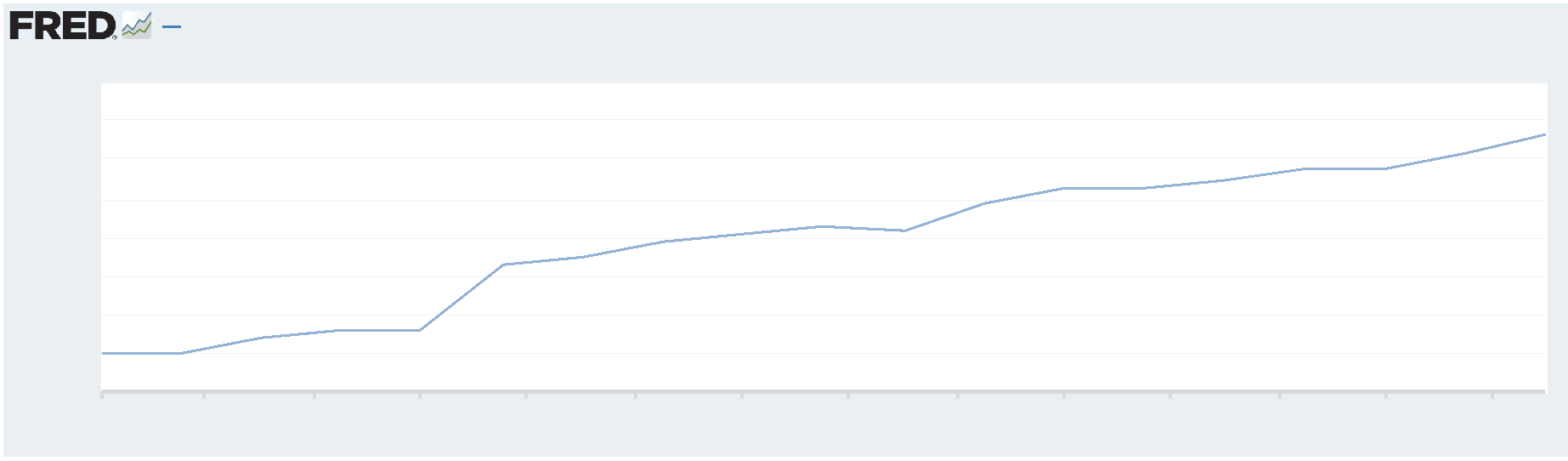

- Federal Funds Target Rate

- Federal Reserve officials left interest rates unchanged at a target rate of 5.25 to 5.5 percent in their final policy decision of 2023 on Wednesday

- The Federal Reserve also forecast that they will cut borrowing costs three times in the coming year, a sign that the central bank is shifting toward the next phase in its fight against rapid inflation

- The interest rate target has now remained unchanged since July

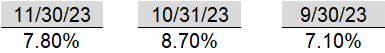

- Consumer Price Index

- The annual rate of inflation slowed to 3.1% in November from 3.2% in the prior month, matching the lowest level since early 2021

- Core inflation, which has been has remained at 4% for the past several months, was unchanged at 4%, which is still twice as high as the Federal reserve’s 2% goal

- The cost of gasoline dropped 6% last month and held down the headline CPI reading

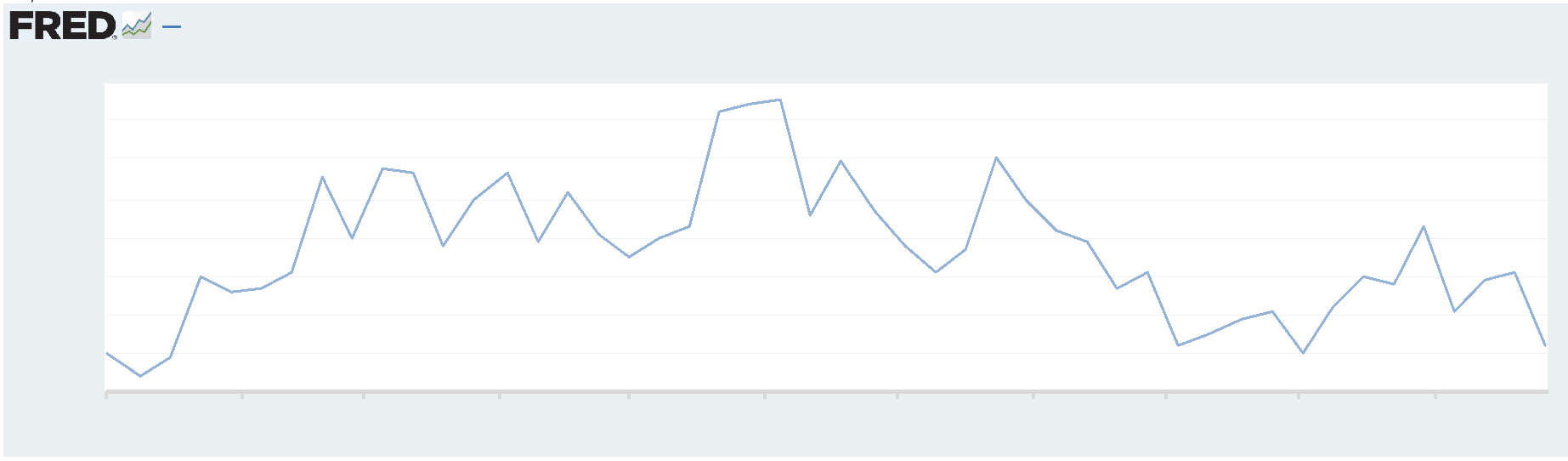

- Retail Sales

- Sales at U.S. retailers rose 0.3% in November in a good start to the holiday shopping season suggesting the economy might not be cooling off all that much

- Sales particularly surged at internet retailers such as Amazon, as well as stores that sell books, music and other hobby item

- Americans also spent more on clothes, furniture, health-care items and new cars

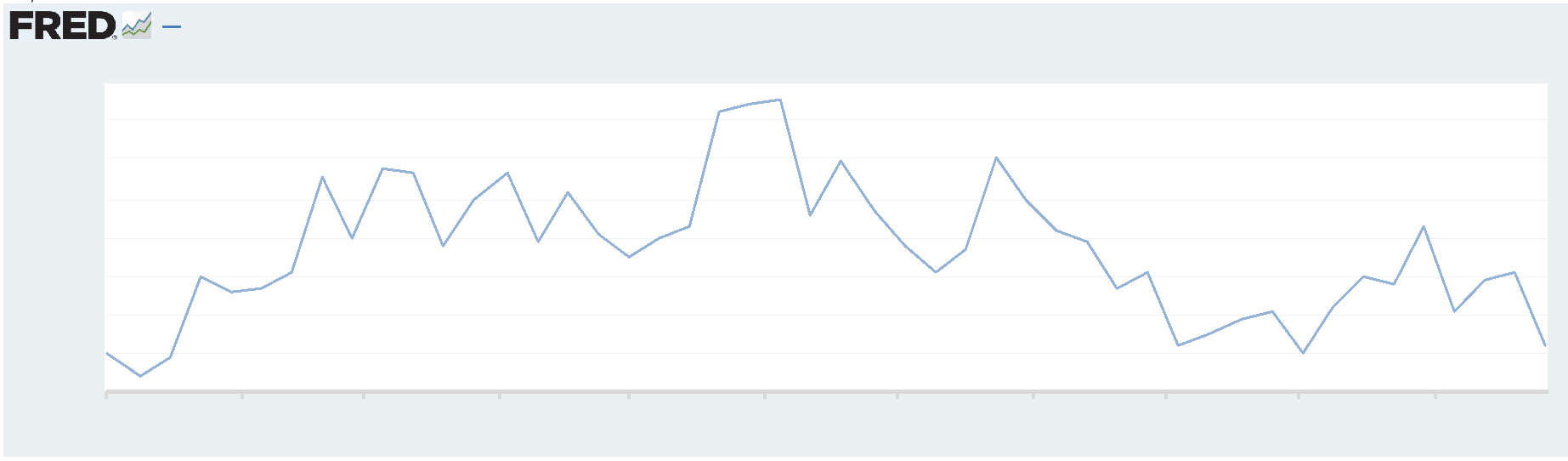

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 202,000 in the week ended December 8, down 19,000 from the prior week

- The four-week moving average was 213,250, down 7750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 20,000 to 1.861 million in the week ended December 1. This figure is reported with a one-week lag

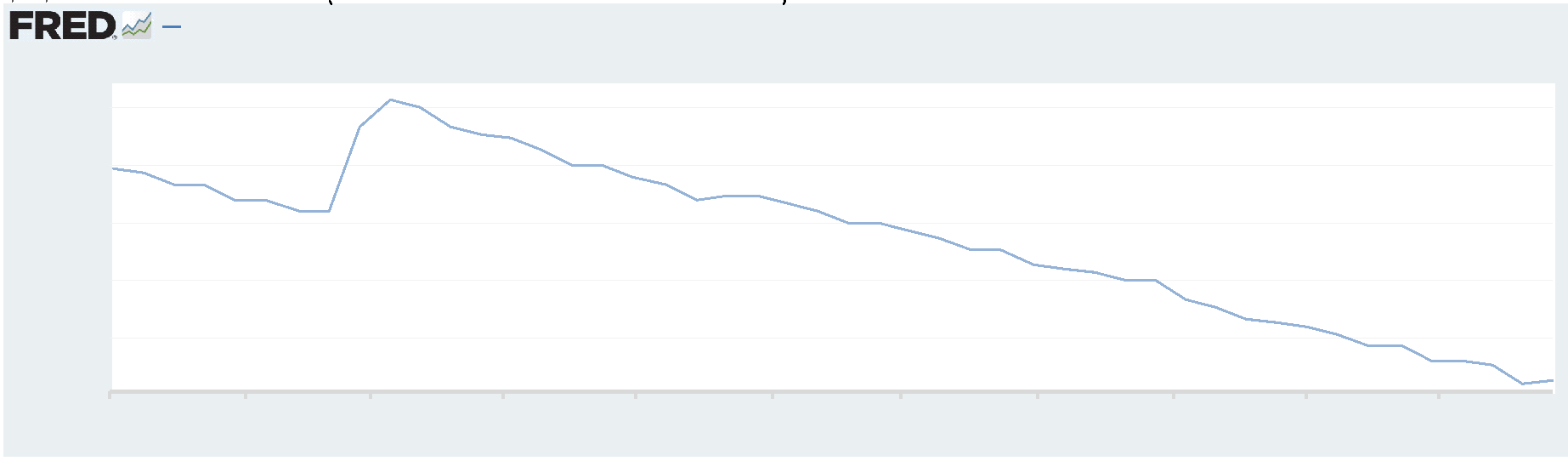

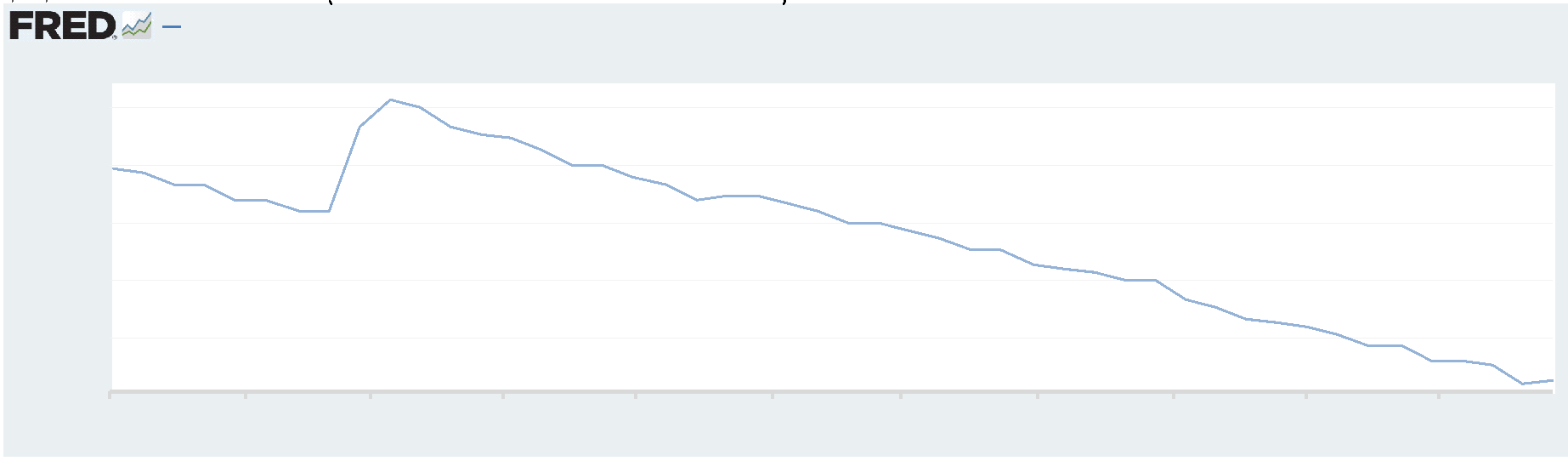

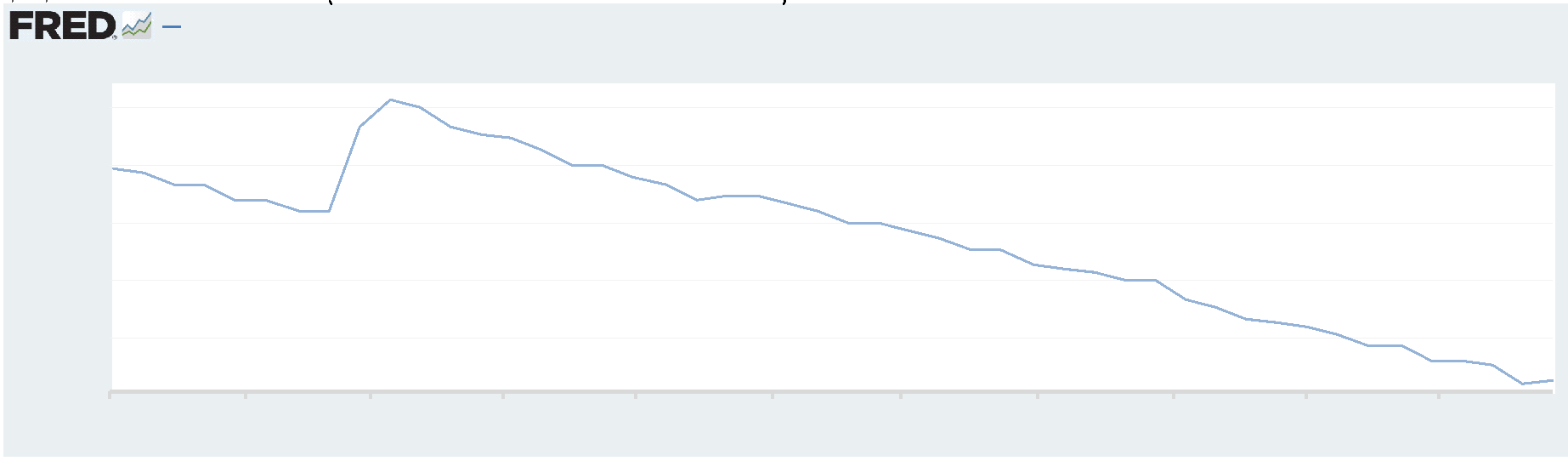

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.740 trillion in the week ended December 15, up $2.2 billion from the prior week

- Treasury holdings totaled $4.810 trillion, down $3.1 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.45 trillion in the week, down $7.2 billion from the prior week

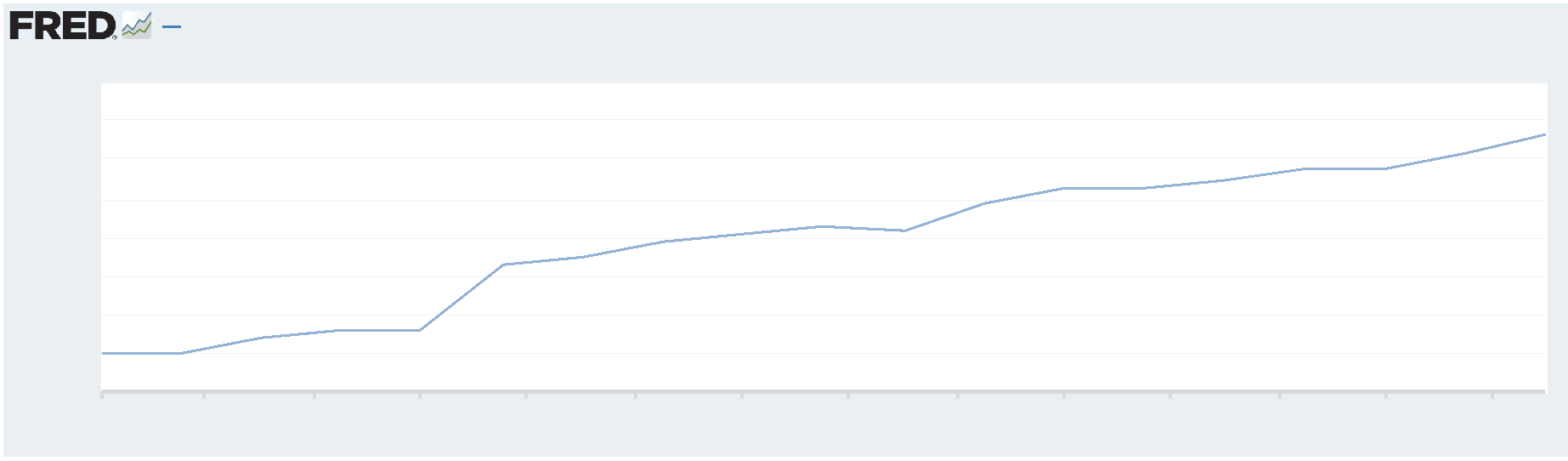

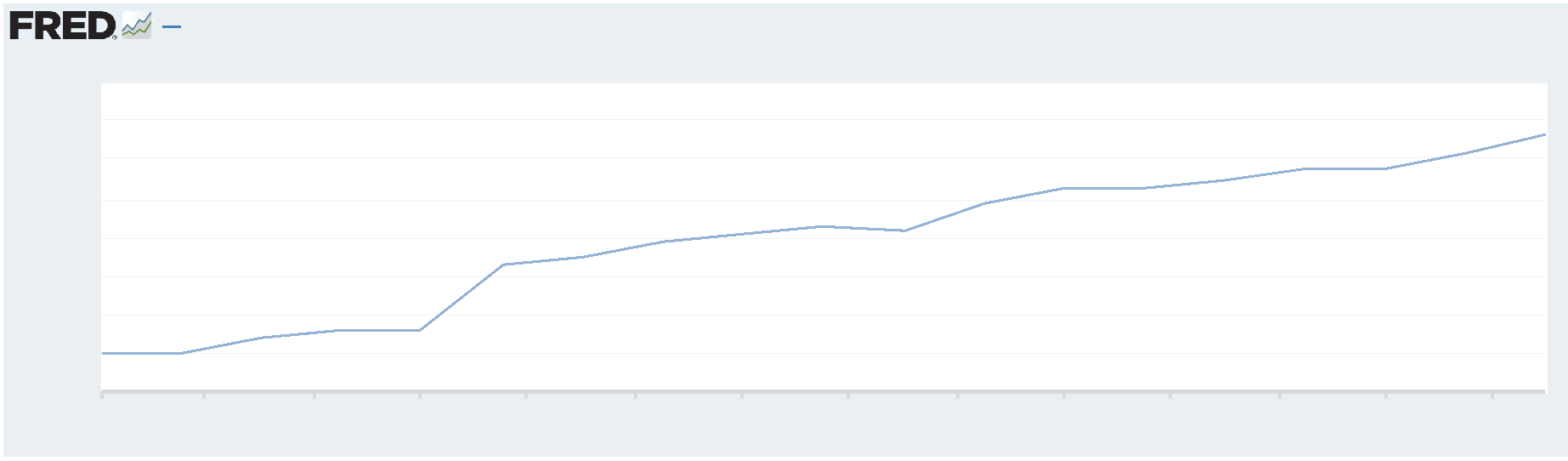

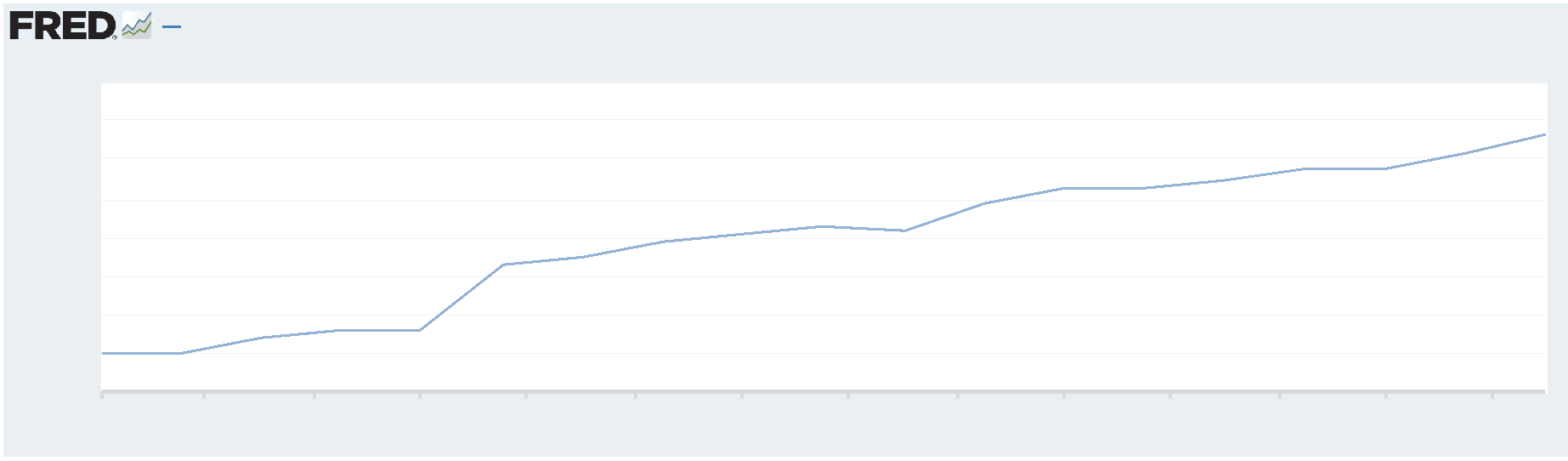

- Total Public Debt

- Total public debt outstanding was $33.83 trillion as of December 15, an increase of 8.0% from the previous year

- Debt held by the public was $26.58 trillion, and intragovernmental holdings were $7.03 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.1% in November year over year

- On a monthly basis, the CPI increased 0.1% in November on a seasonally adjusted basis, after increasing 0.0% in October

- The index for all items less food and energy (core CPI) rose 0.3% in November, after rising 0.2% in October

- Core CPI increased 4.0% for the 12 months ending November

- Food and Beverages:

- The food at home index increased 1.7% in November from the same month a year earlier, and increased 0.1% in November month over month

- The food away from home index increased 5.3% in November from the same month a year earlier, and increased 0.4% in November month over month

- Commodities:

- The energy commodities index decreased (5.8%) in November after decreasing

- The energy commodities index fell (9.8%) over the last 12 months

- The energy services index (0.7%) in November after decreasing (1.0%) in October

- The energy services index fell (0.1%) over the last 12 months

- The gasoline index fell (8.9%) over the last 12 months

- The fuel oil index fell (24.8%) over the last 12 months

- The index for electricity rose 3.4% over the last 12 months

- The index for natural gas fell (10.4%) over the last 12 months

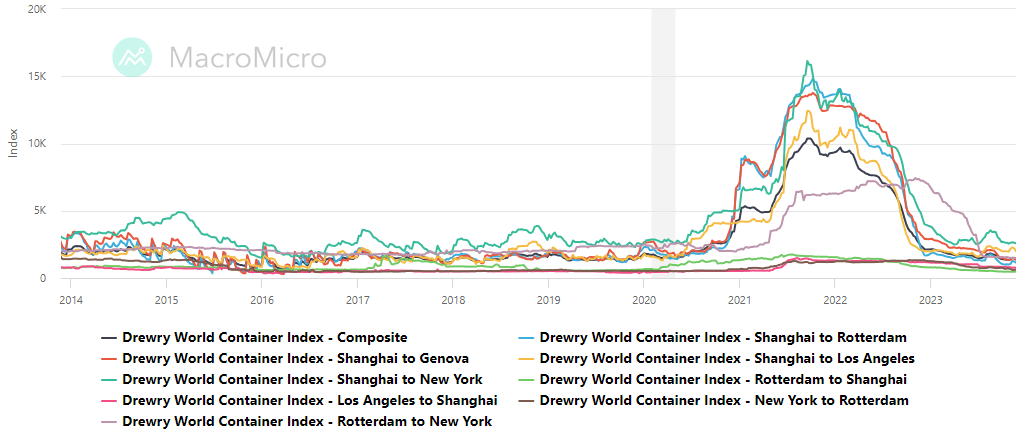

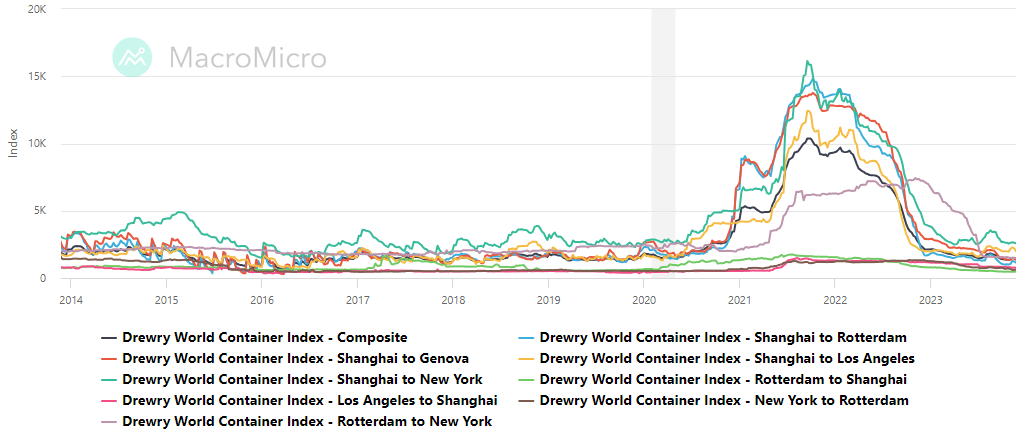

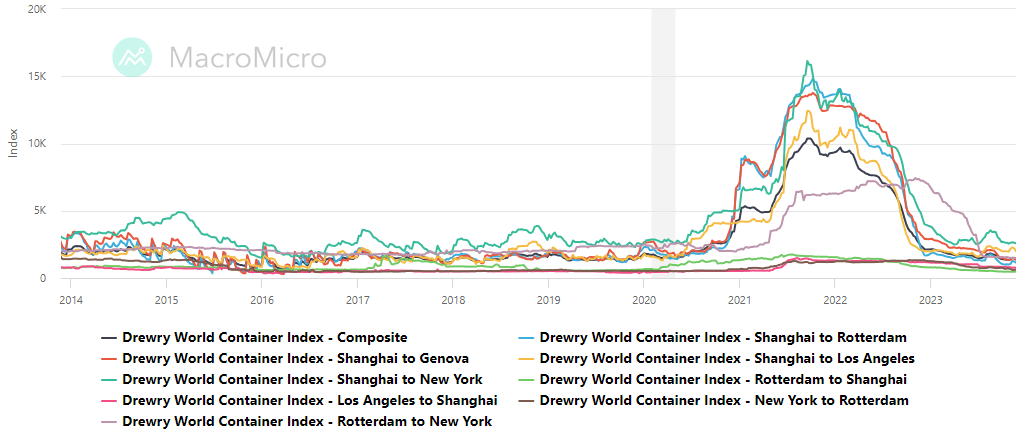

- Supply Chain:

- Drewry’s composite World Container Index increased to $1,521.06 per 40ft

- Drewry’s composite World Container Index has decreased by (28.5%) over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in November after increasing 0.3% in October

- The rent index increased 0.5% in November after increasing 0.3% in October

- The index for lodging away from home decreased (4.5%) in November after decreasing (6.1%) in October

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, up 1.00% year to date

World News

-

Israel/Middle East

- Residents of the Gaza Strip are facing starvation for the first time in recent history, according to United Nations agencies, as aid deliveries fall short of soaring needs in the enclave, where the food-supply system has collapsed

- Israeli officials said they are ready to double the daily number of aid trucks they process for entry into Gaza, provided international organizations can distribute the increased aid

- The overwhelming majority of Gaza’s 2.2 million people don’t have enough food, with residents often skipping meals and sometimes going several days without any, according to the World Food Program, a U.N. agency. The U.N. said it is assessing whether Gaza already meets the formal definition of famine, meaning two out of every 10,000 inhabitants die from hunger a day and around one in three children is acutely malnourished

-

Ukraine

- The European Union on Thursday agreed to start membership talks with Ukraine in a major political victory for Zelensky, but the negotiations will take years and it is unclear when they will start. The bloc failed to agree on a long-term package of budget support for the country

- In the U.S., a $110 billion aid package failed to pass Congress last week, while Hungary on Thursday blocked an EU package for Ukraine worth more than $50 billion. Ukrainian forces, which are heavily dependent on Western arms, are now running low on ammunition

-

China

- Consumer prices in China fell for the second straight month, a deepening bout of deflation that shows Beijing’s efforts to reignite faltering growth are falling short

- China’s top leaders telegraphed Friday that more support is coming for the economy, with pledges of new fiscal stimulus and supportive central-bank policy in the months ahead

- Still, the Communist Party signaled that stimulus will be measured rather than aggressive, reinforcing expectations for steady if unspectacular growth in 2024 as the economy grapples with a drawn-out property bust and a global backdrop darkened by war and slowdowns in the U.S. and Europe

-

Russia

- Russian President Vladimir Putin vowed to press on with his war in Ukraine during an end-of-year audience in which he showed no sign of seeking a swift conclusion to the devastating conflict, saying there would only be peace once Russia had achieved its goals

- For the first time since launching the war, Putin fielded questions from the international media and ordinary Russians for more than four hours on Thursday, in a stage-managed event that cast the president as listening to his people, spotlighted Moscow’s invasion of Ukraine and sought to present Russia as resilient to the impacts of the conflict

-

India

- An Indian man accused by U.S. authorities of attempting to kill an American Sikh activist has petitioned India’s Supreme Court, saying he is a victim of mistaken identity and caught in the middle of political tensions between the U.S. and India

-

Germany

- German authorities detained four alleged members of Hamas suspected of planning to attack Jewish institutions in the region—the first suggestion that the Gaza conflict might be spilling over beyond the Middle East

-

Japan

- Japan said it had asked the U.S. to suspend all non-emergency V-22 Osprey flights over its territory after one fell into the sea in western Japan. One crew member is confirmed dead with seven missing

-

Indonesia

- Indonesia’s Mount Marapi volcano erupted on Sunday killing at least 11 climbers, according to the Associated Press. The volcano spewed ash nearly two miles high

-

Spain

- Amazon reached an agreement with most of its workers in Spain, averting the full impact of a strike that risked crippling its warehouses on one of the busiest days of the year

-

Italy

- Pope Francis is punishing one of his most vocal conservative critics in the Catholic hierarchy, U.S. Cardinal Raymond Burke, by taking away his stipend and rent-free apartment in Rome

-

Argentina

- Argentina’s newly elected President, Javier Milei, wants to adopt the U.S. dollar as the national currency and strip the central bank’s power to print money. The country has been overcome with record inflation and low economic growth

Commodities

-

Oil Prices

- WTI: $71.66 per barrel

- 0.60% WoW; (9.93%) YTD; (5.85%) YoY

- Brent: $76.79 per barrel

- 1.25% WoW; (8.50%) YTD; (5.44%) YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended December 8, down 0.1 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 623, up 3 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 440.8 million barrels, up 3.9% YoY

- Refiners operated at a capacity utilization rate of 90.2% in the prior week, down from 90.5% in the prior week

- U.S. crude oil imports now amount to 7.508 million barrels per day, down (5.1%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.09 per gallon in the week of December 15,

down (2.9%) YoY

- Gasoline prices on the East Coast amounted to $3.23,down (2.8%) YoY

- Gasoline prices in the Midwest amounted to $2.98, down (4.2%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.71, down (3.6%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.01, down (9.9%) YoY

- Gasoline prices on the West Coast amounted to $4.27, up 0.3% YoY

- Motor gasoline inventories were up by 0.4 million barrels from the prior week

- Motor gasoline inventories amounted to 224.0 million barrels, up 0.2% YoY

- Production of motor gasoline averaged 9.54 million bpd, up 3.8% YoY

- Demand for motor gasoline amounted to 8.859 million bpd, up 7.3% YoY

-

Distillates

- Distillate inventories decreased by 1.5 million in the week of December 15

- Total distillate inventories amounted to 113.5 million barrels, down (5.5%)

- Distillate production averaged 4.987 million bpd, down (3.5%) YoY

- Demand for distillates averaged 3.770 million bpd in the week, up 0.1% YoY

-

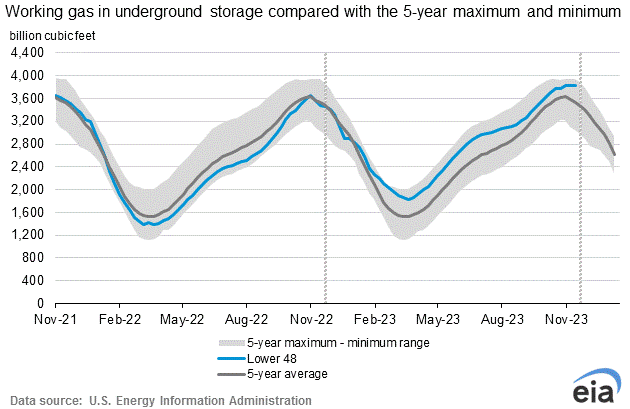

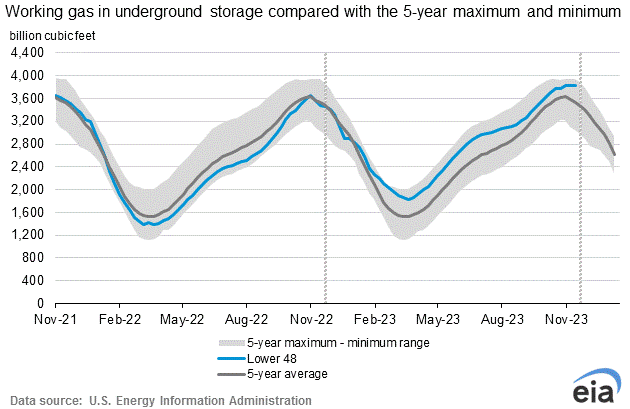

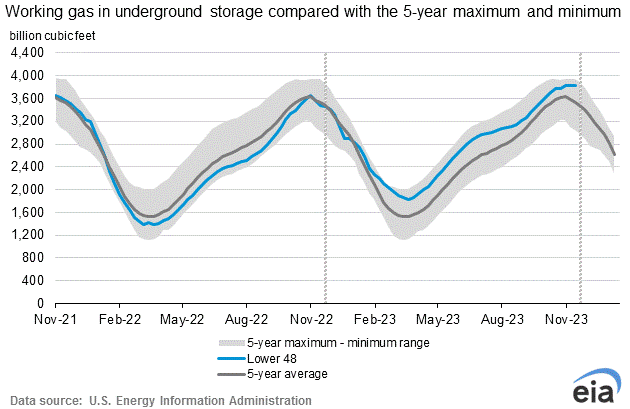

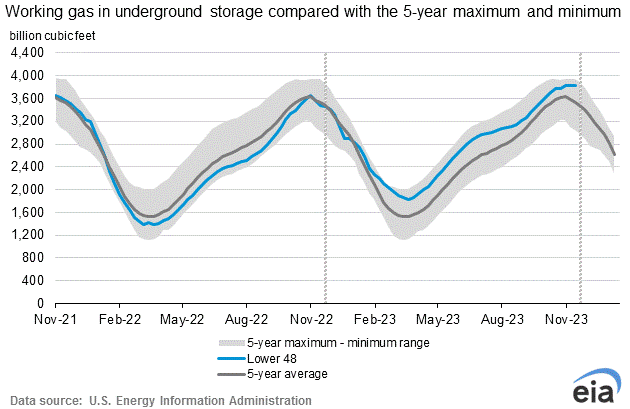

Natural Gas

- Natural gas inventories decreased by 55 billion cubic feet last week

- Total natural gas inventories now amount to 3,664 billion cubic feet, up 7.4% YoY

Credit News

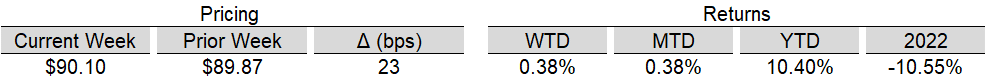

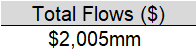

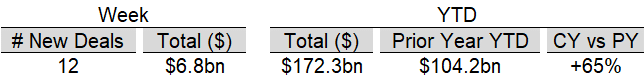

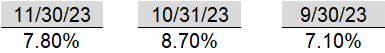

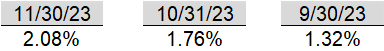

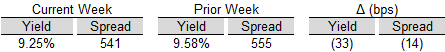

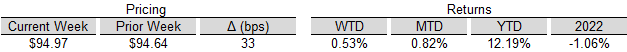

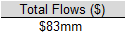

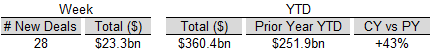

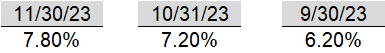

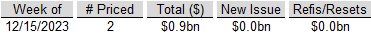

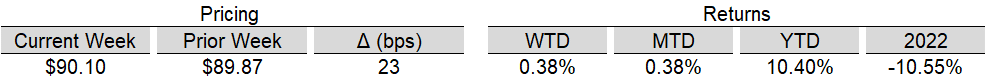

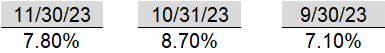

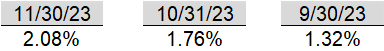

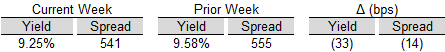

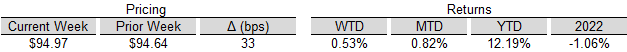

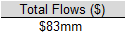

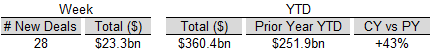

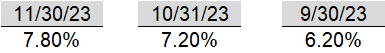

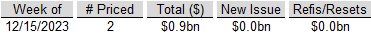

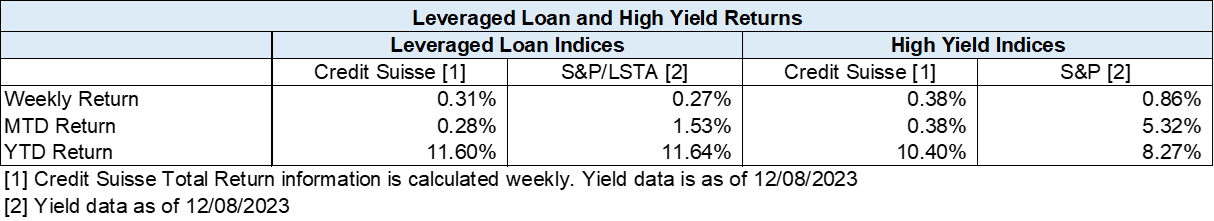

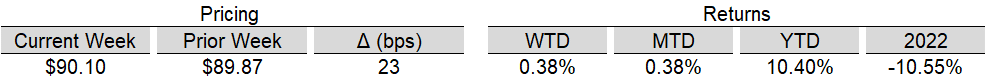

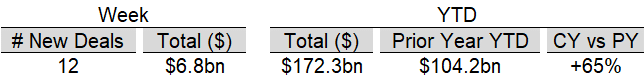

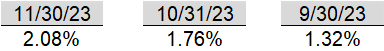

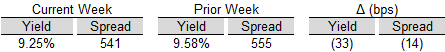

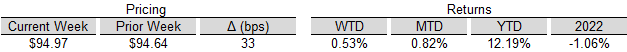

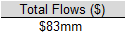

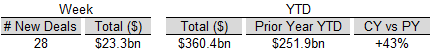

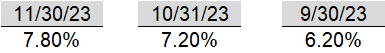

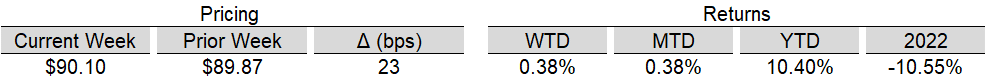

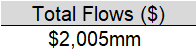

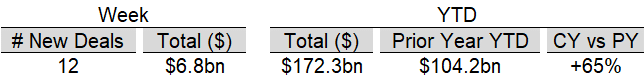

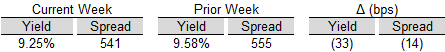

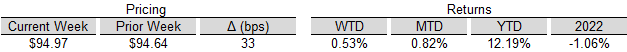

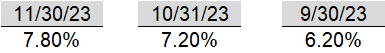

High yield bond yields decreased 42bps to 7.82% and spreads tightened 20bps to 375bps. Leveraged loan yields decreased 33bps to 9.25% and spreads decreased 14bps to 541bps. WTD Leveraged loan returns were positive 53bps. WTD high yield bond returns were positive 166bps. Bonds outperformed loans in a market with rapidly falling treasury yields. Benchmark 10yr treasury yields fell 33bps over the last week. Treasury yields reacted to a new set of FED “dots” projections that showed ~80bps of average rate cuts in 2024. The rates market is now pricing a first rate cut in March 2024.

High-yield:

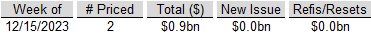

Week ended 12/15/2023

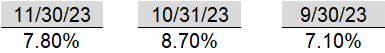

- Yields & Spreads1

- Pricing & Returns1

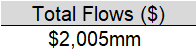

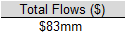

- Fund Flows2

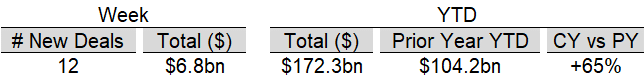

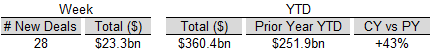

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 12/15/2023

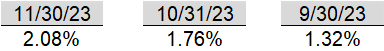

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Ligado Networks ($4.2bn, 11/1/23), Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23), Mallinckrodt ($2.8bn 8/28/23), Yellow Corp ($485mm 8/8/23), Anchor Glass ($675mm 7/11/23), Instant Brands ($391mm 6/12/23), Cyxtera Technologies ($768mm 6/4/23), Diebold ($2.0bn 6/1/23), Envision Health ($7.7bn 5/14/23), Venator Materials ($1.1bn 5/12/23), Bed Bath & Beyond ($5.2bn 4/22/23), David’s Bridal ($254mn 4/17/23), Monitronics International ($794mm 4/15/23), Catalina ($222mn 3/29/23), Diamond Sports ($8.6bn, 2/15/23), Avaya ($2.9bn, 2/14/23), Heritage Power ($485mn, 1/24/23), Serta Simmons Bedding($1.9bn, 1/23/23), Party City Holdings ($1.0bn, 01/17/23), Exela Intermediate ($1.4bn, 1/15/23)

CLOs:

Week ended 12/15/2023

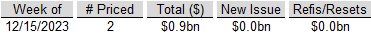

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

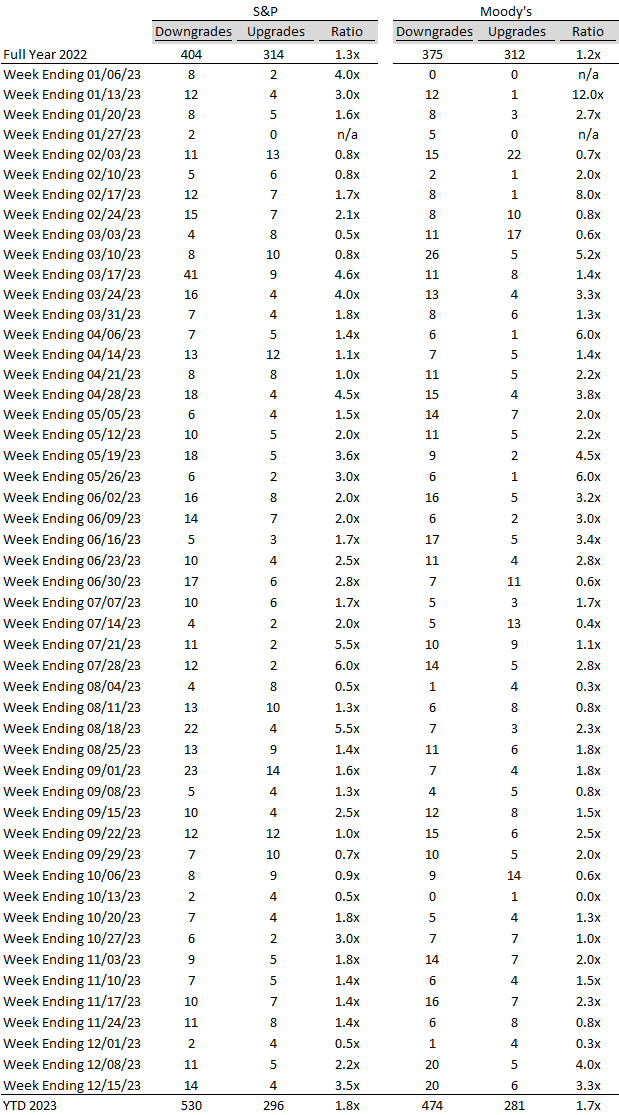

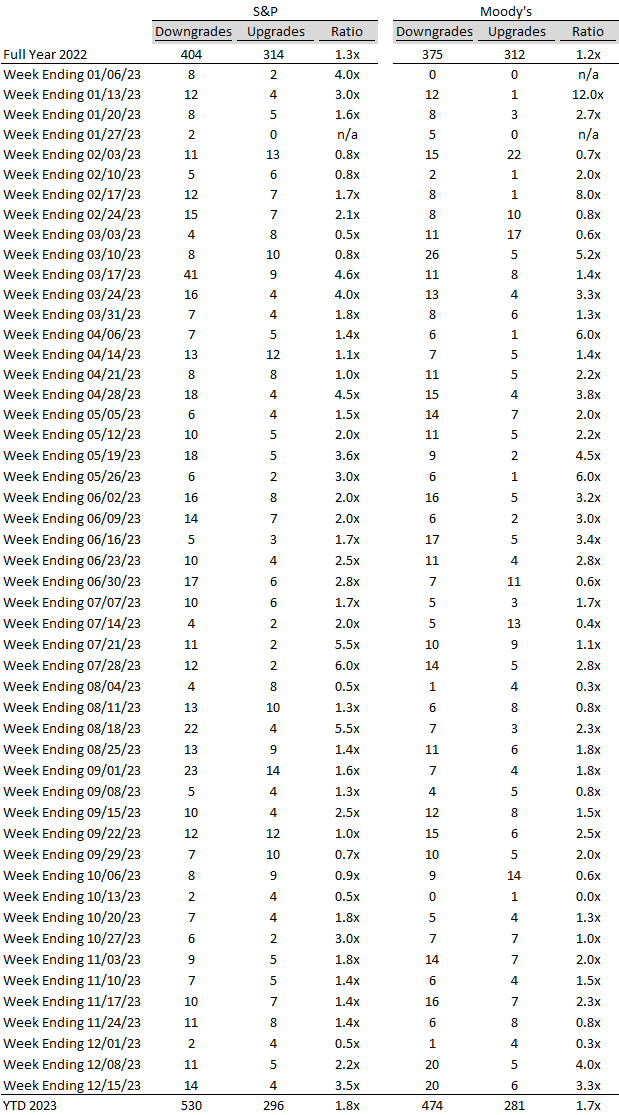

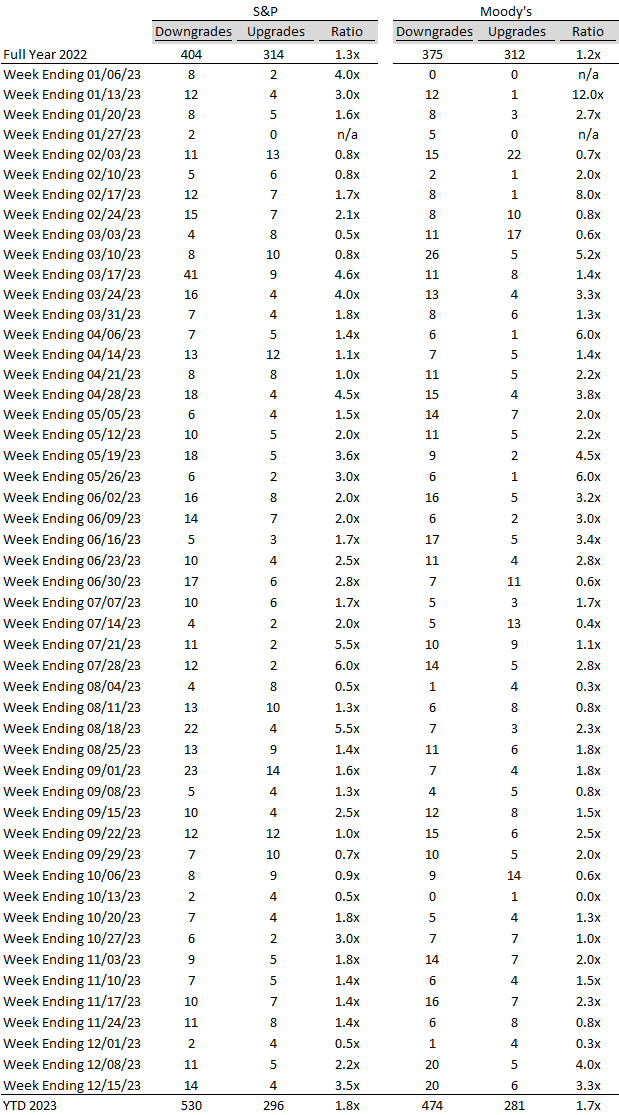

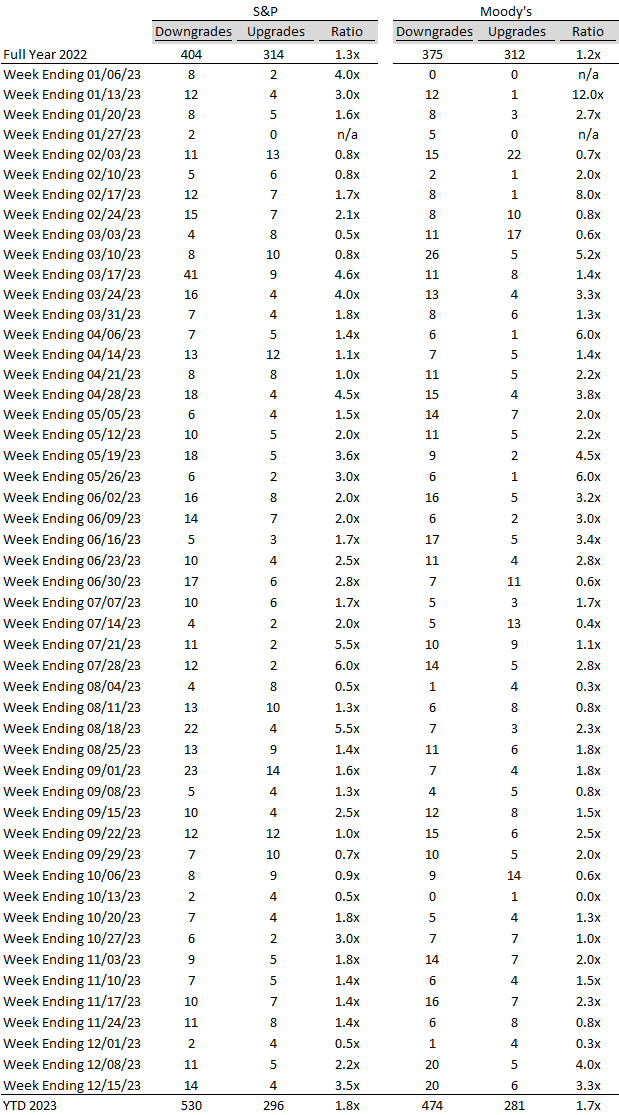

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

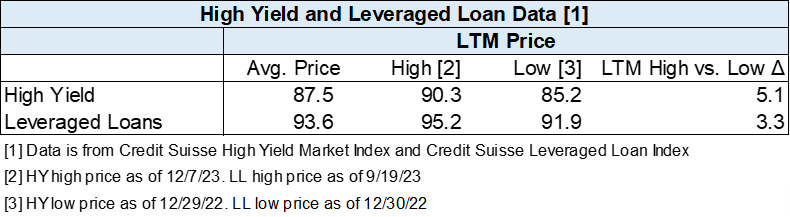

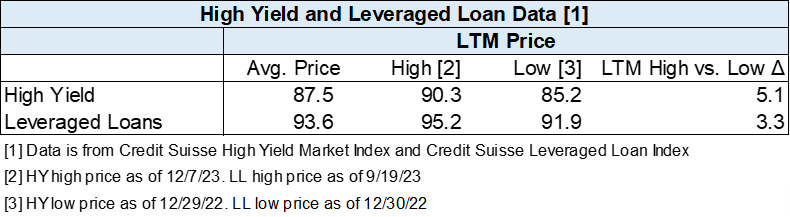

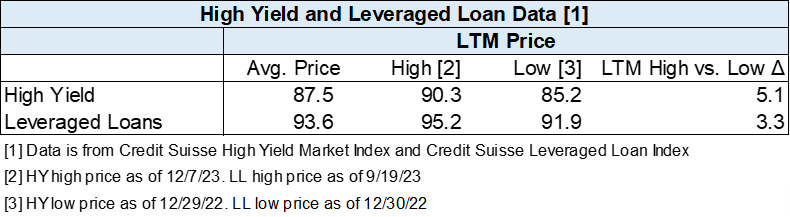

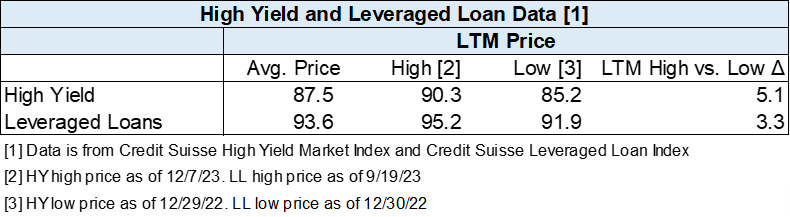

Diagram B: High Yield and Leveraged Loan LTM Price

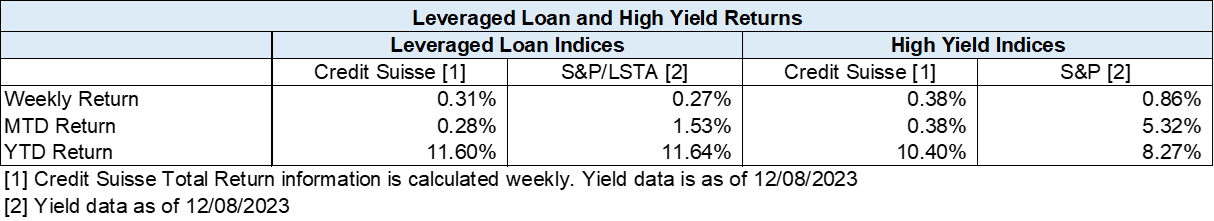

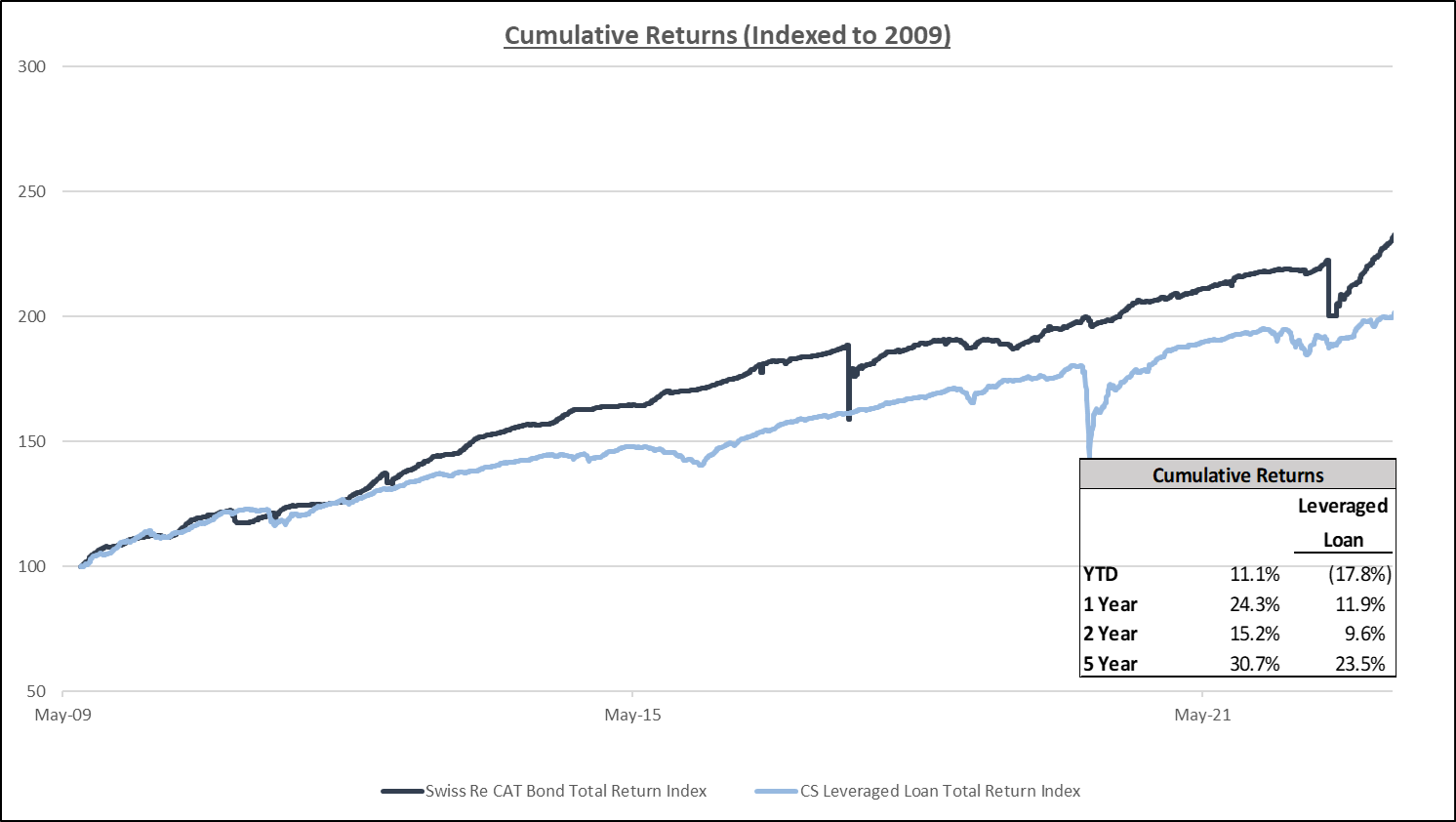

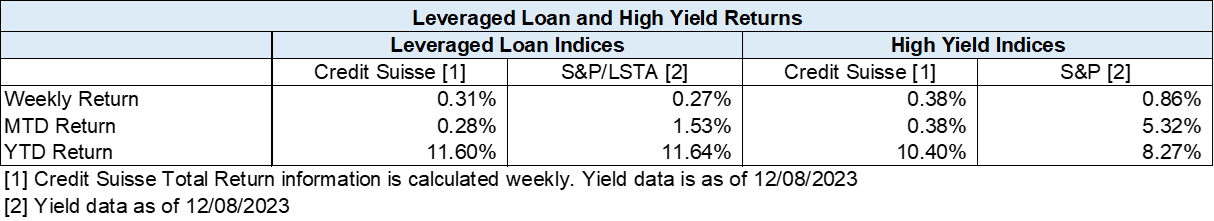

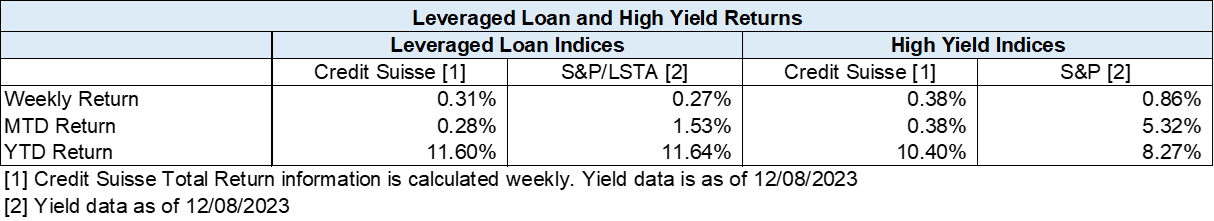

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

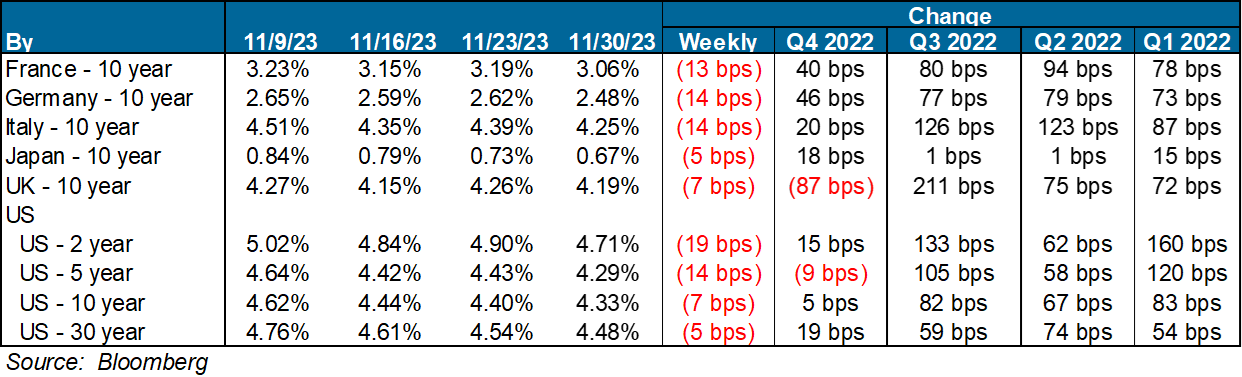

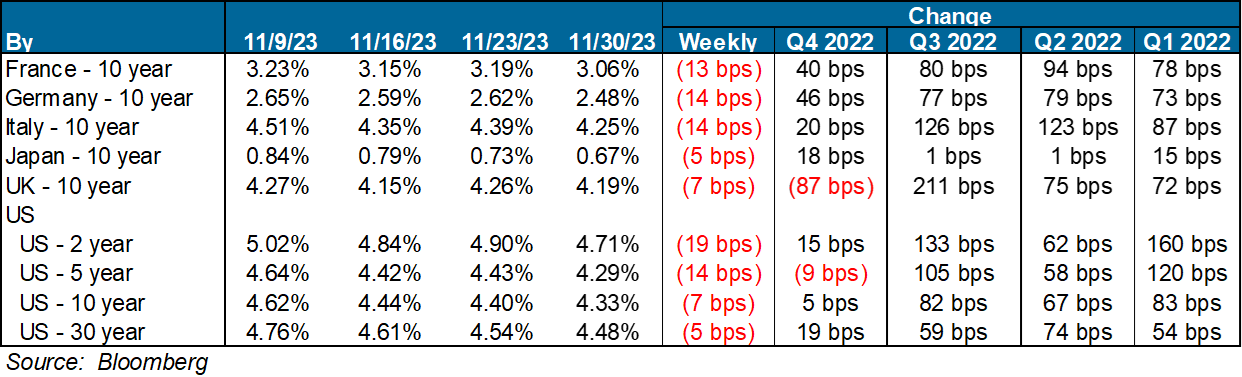

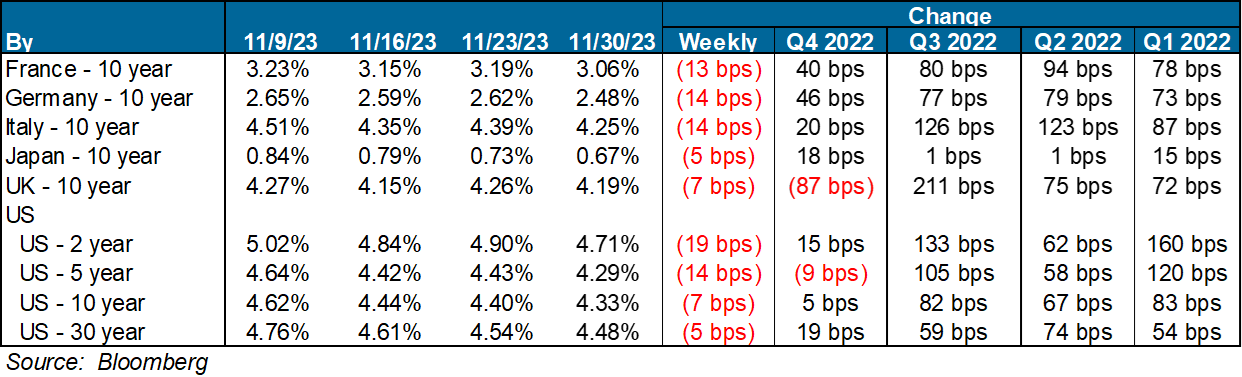

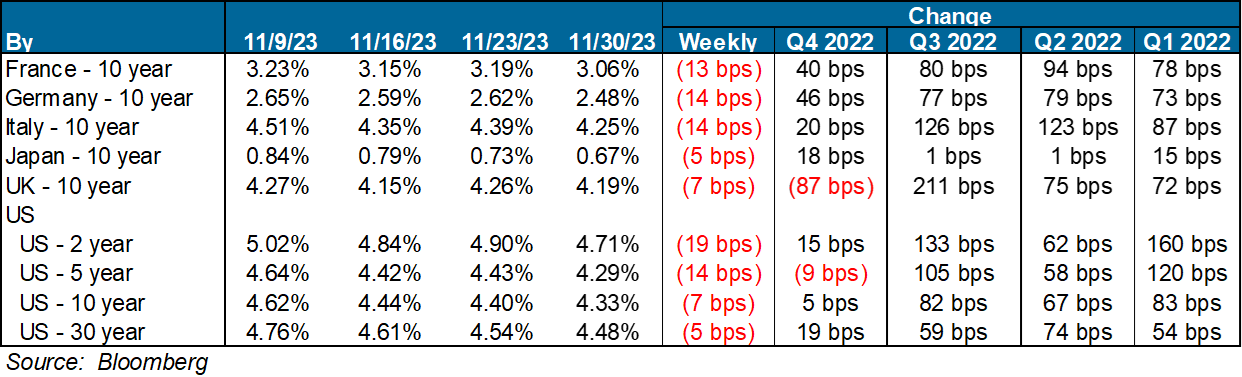

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

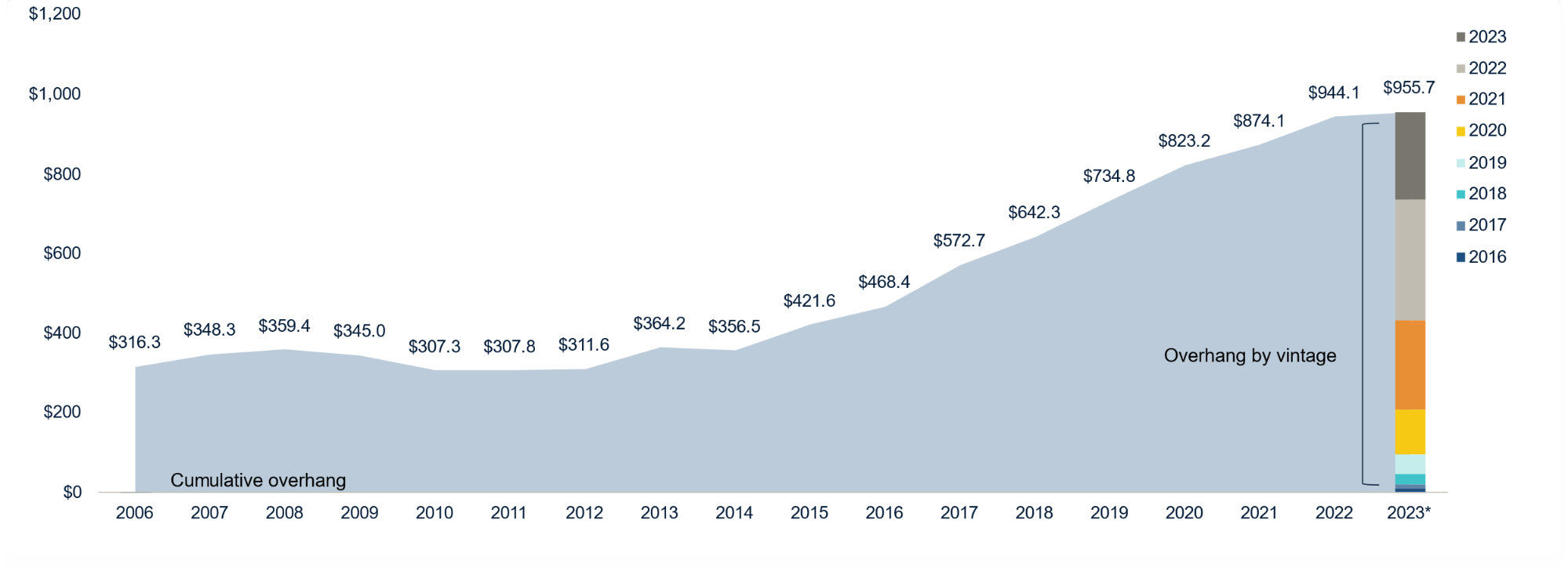

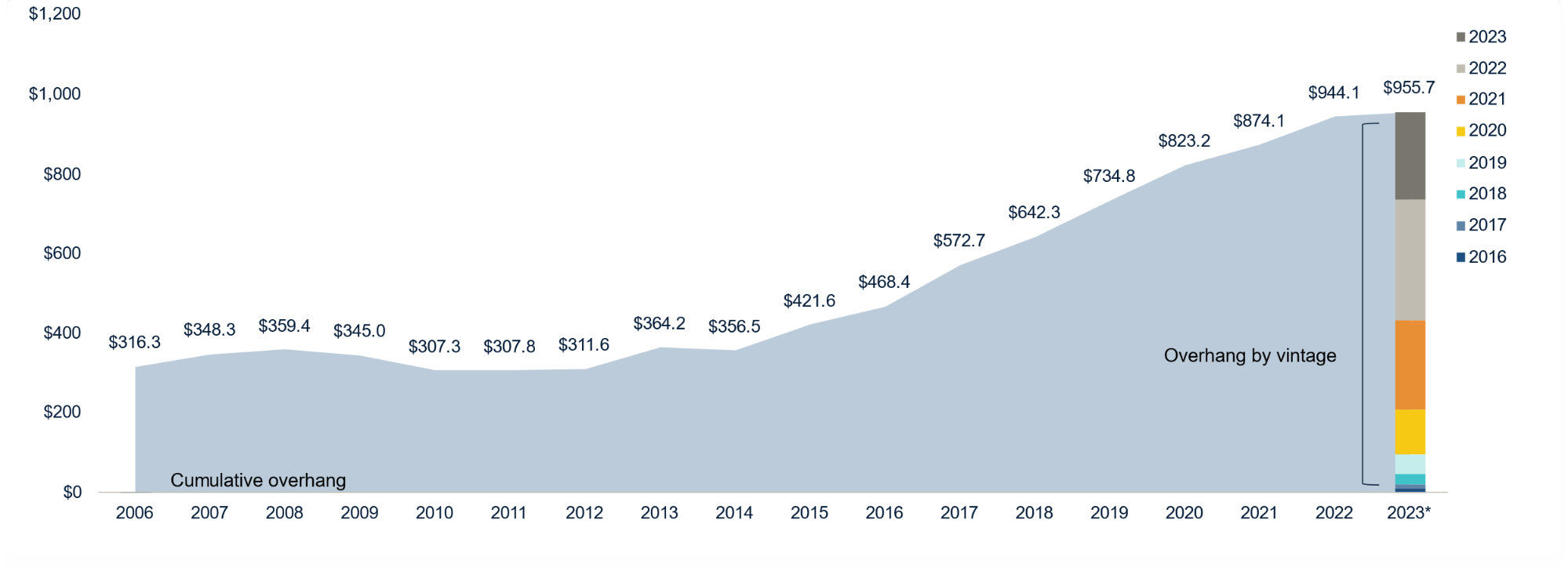

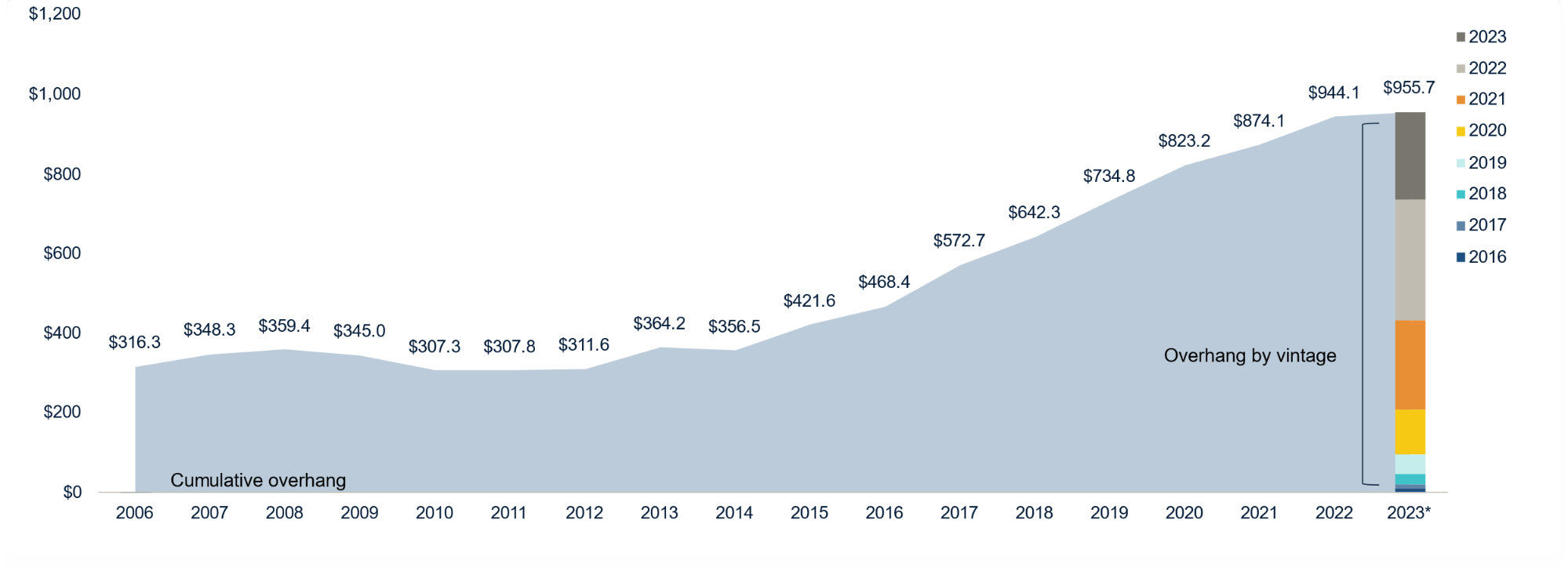

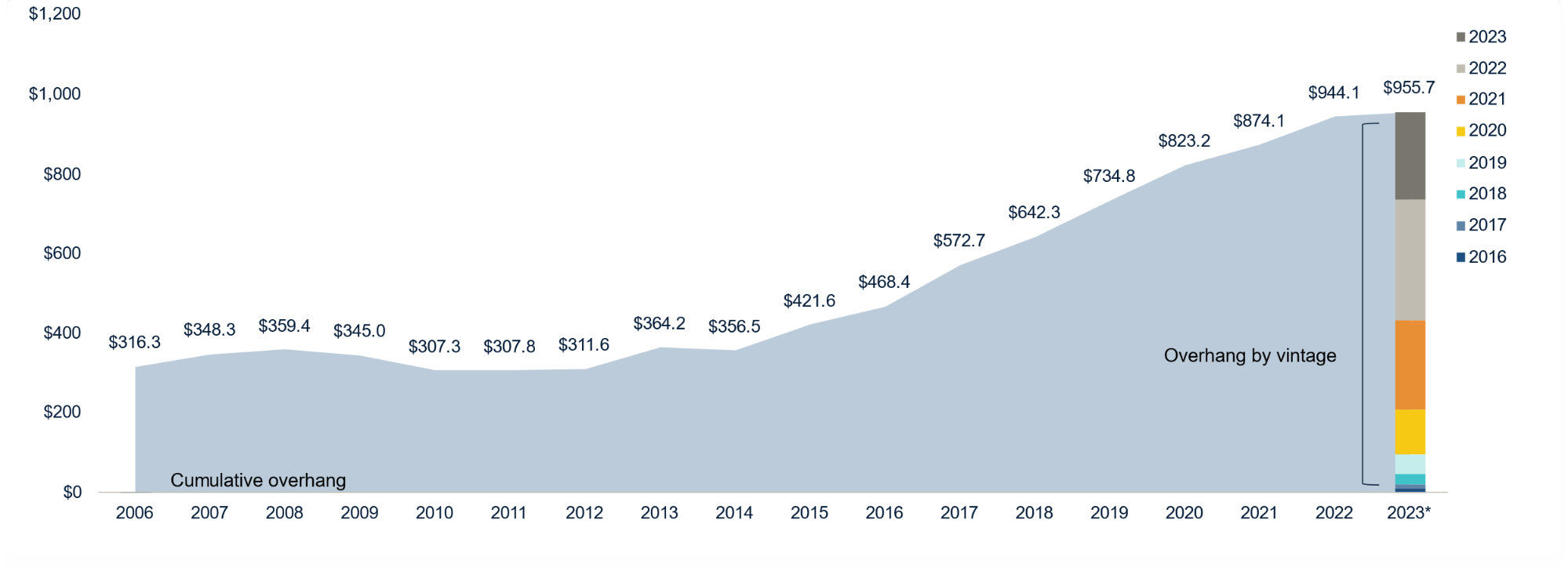

Diagram Q: Dry Powder for All Private Equity Buyouts

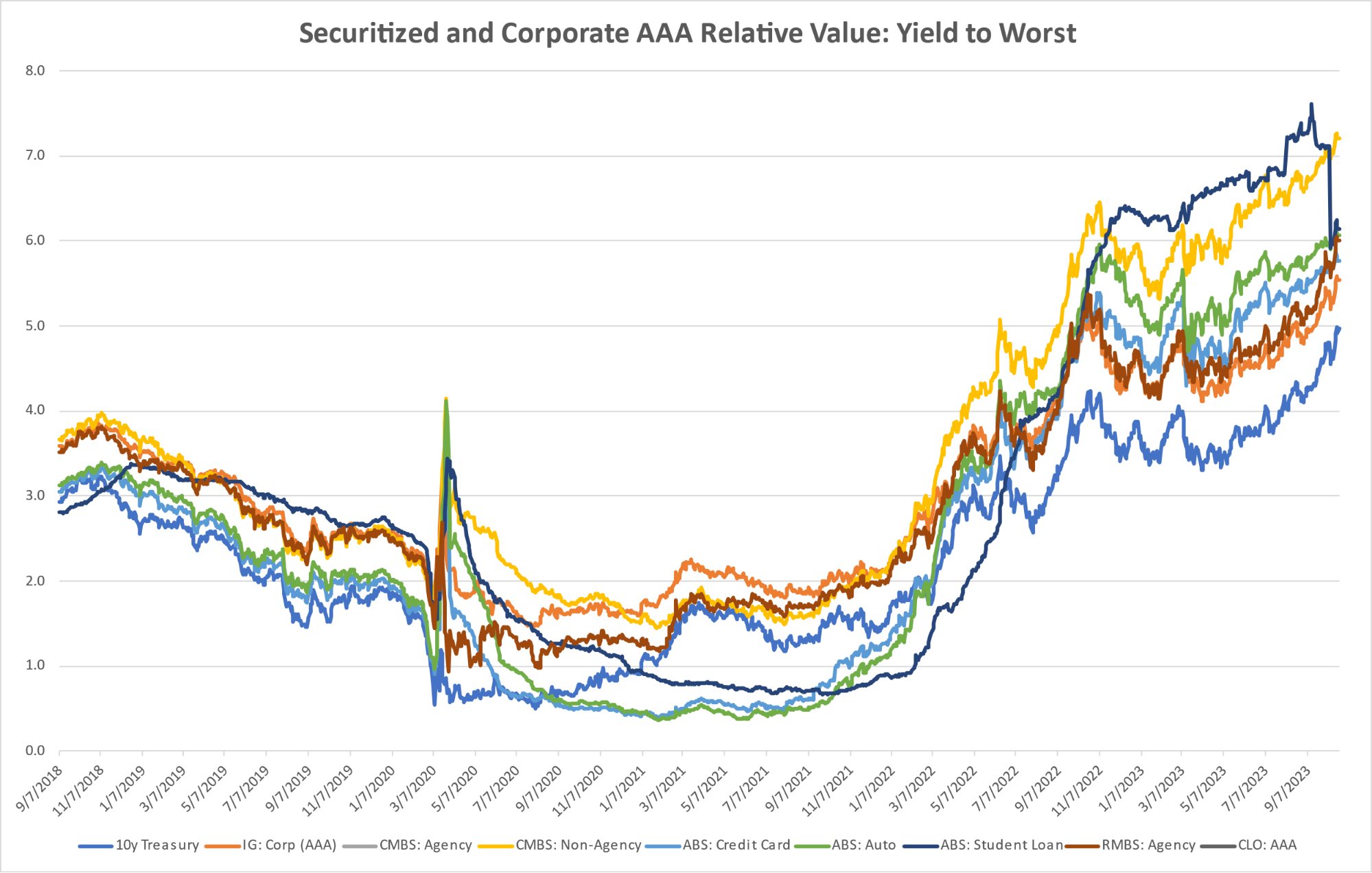

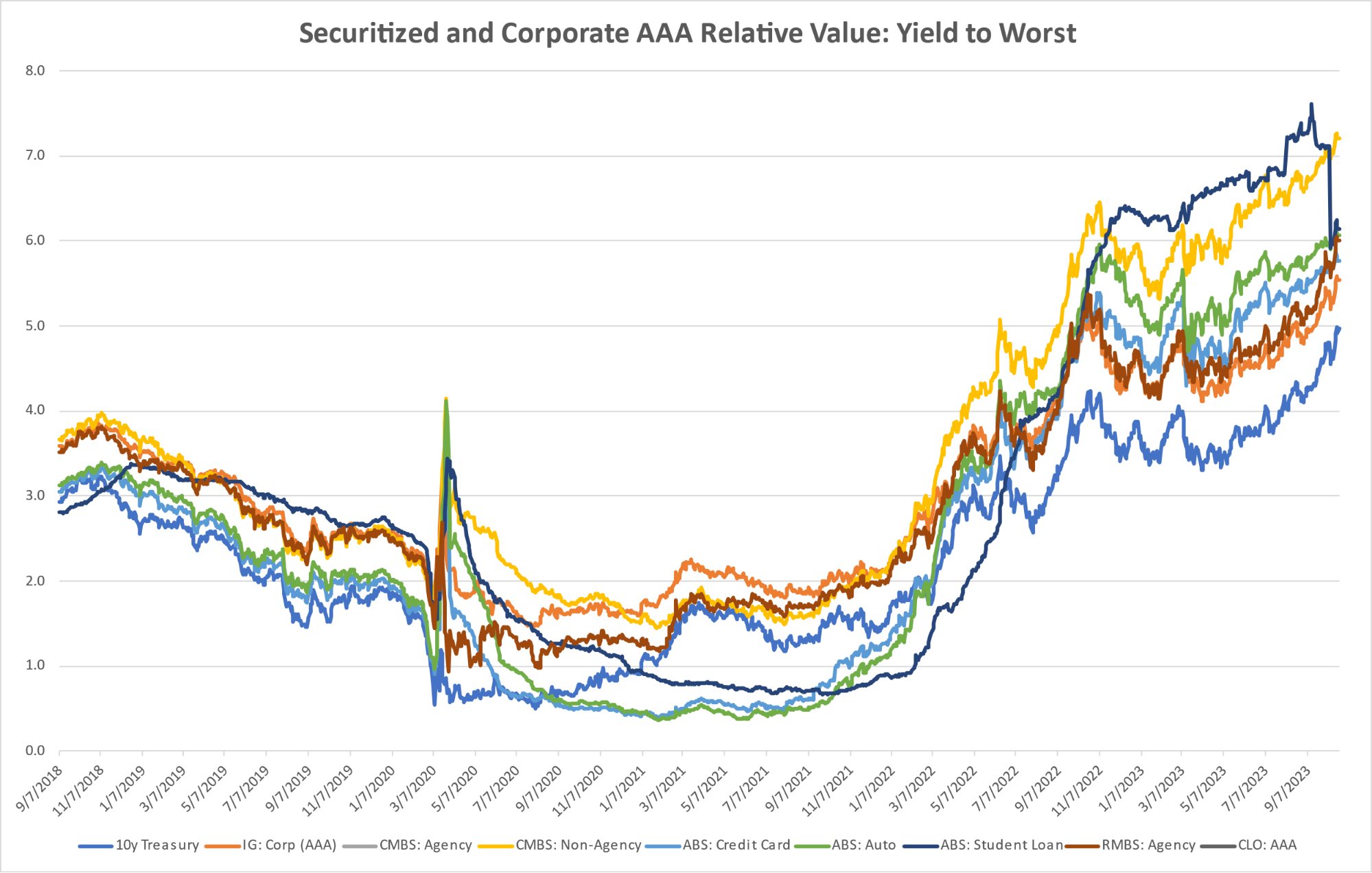

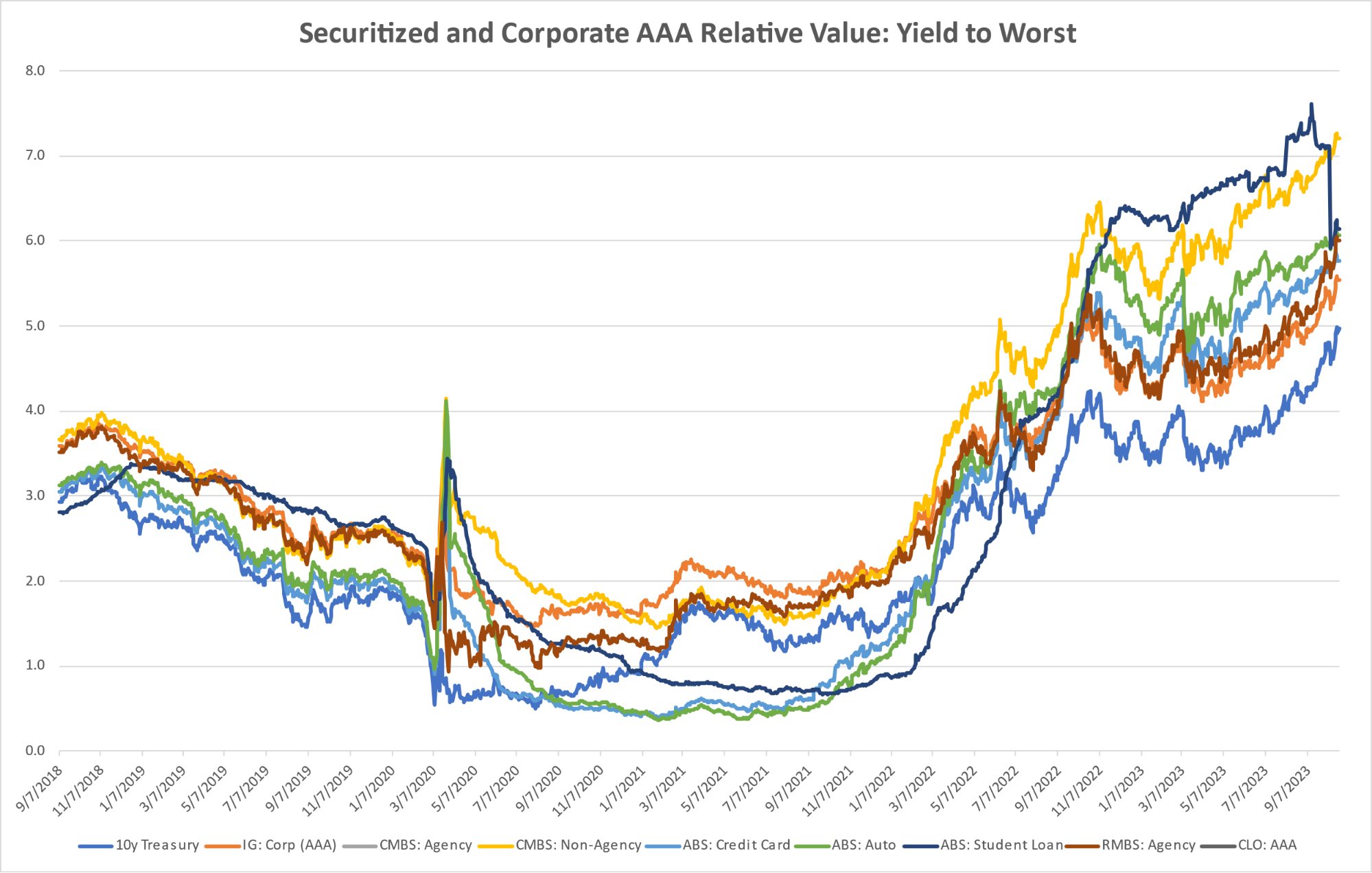

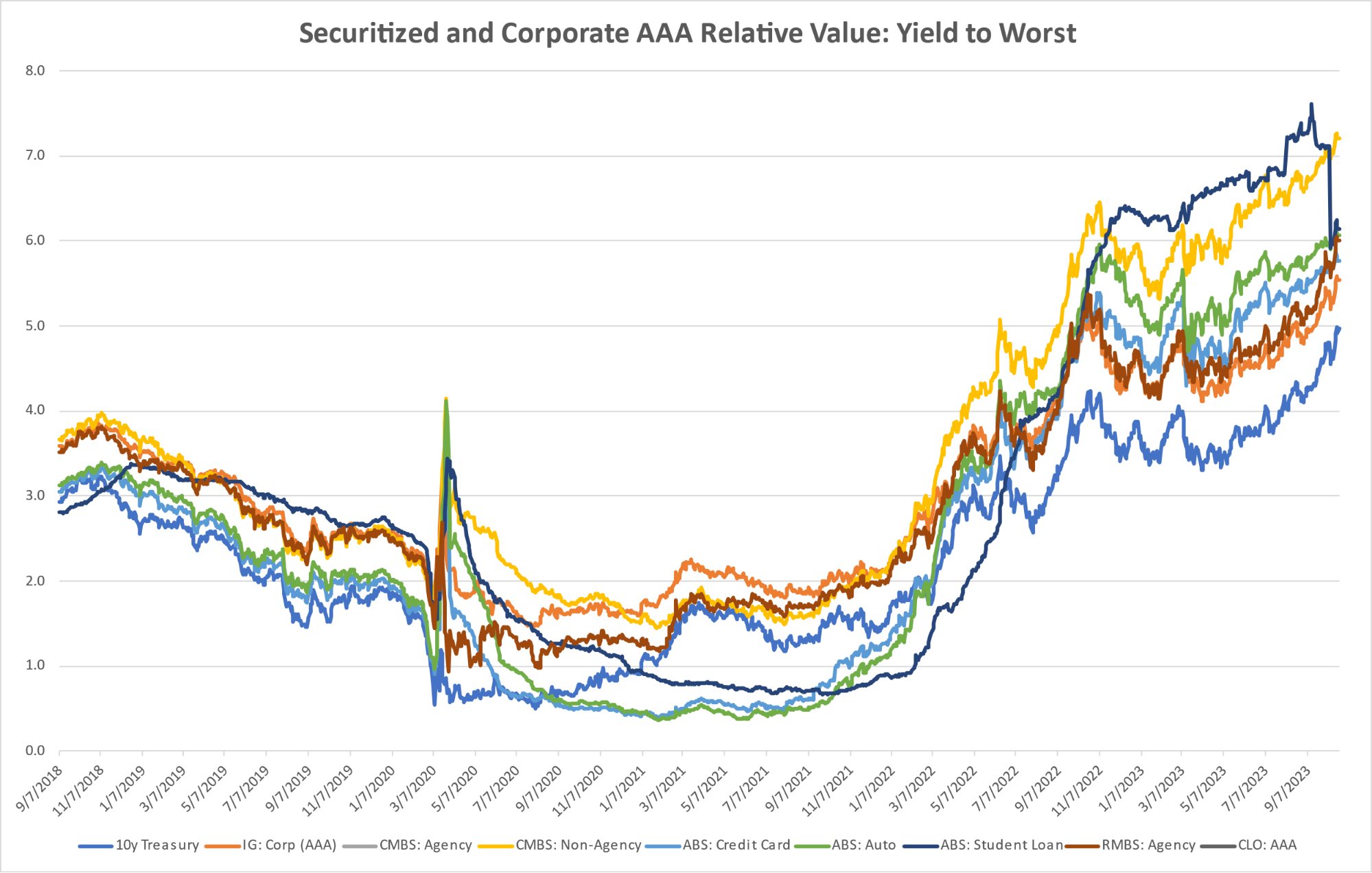

Diagram R: Structured Credit Spreads

Diagram S: Structured Credit Yield

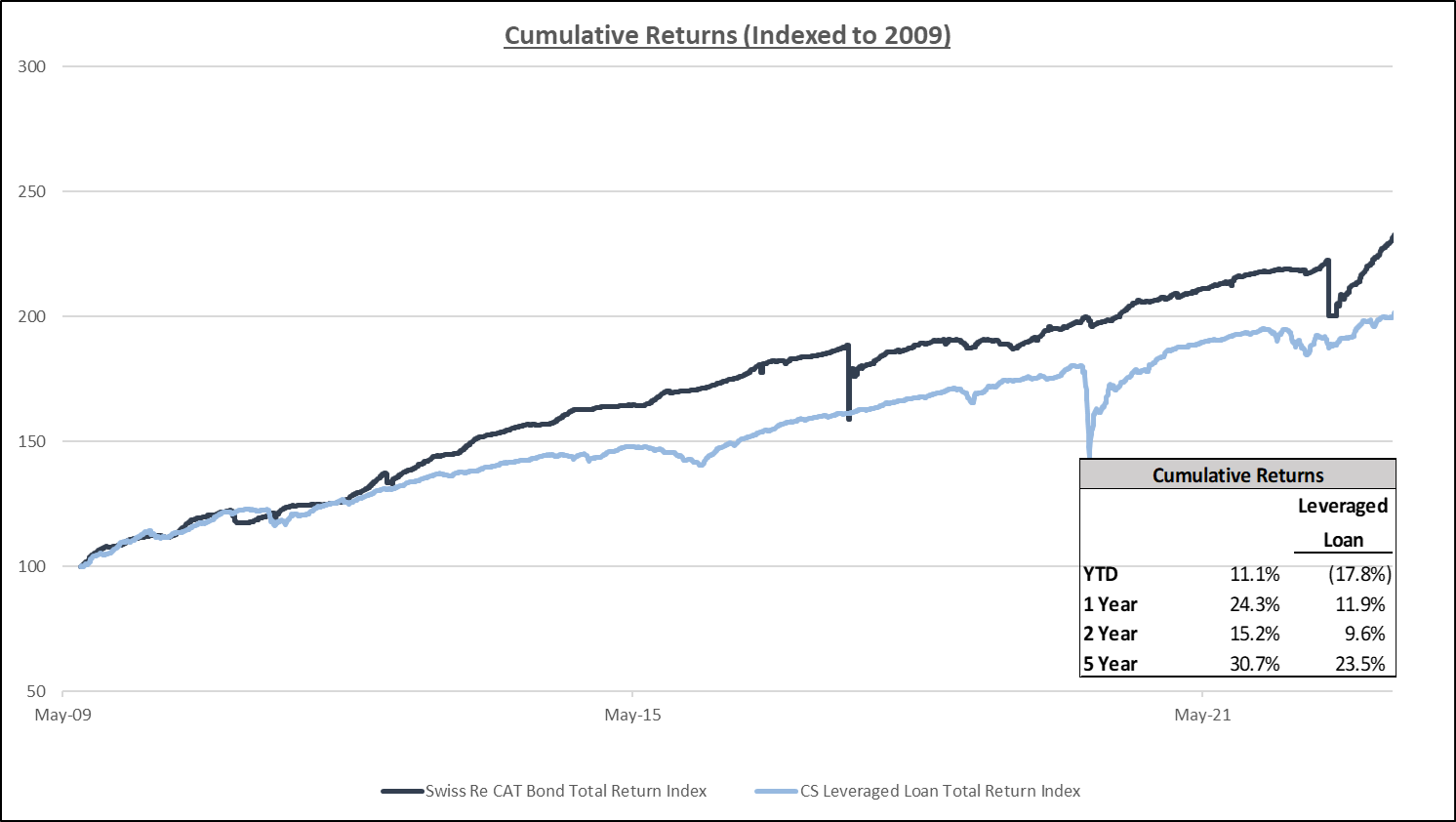

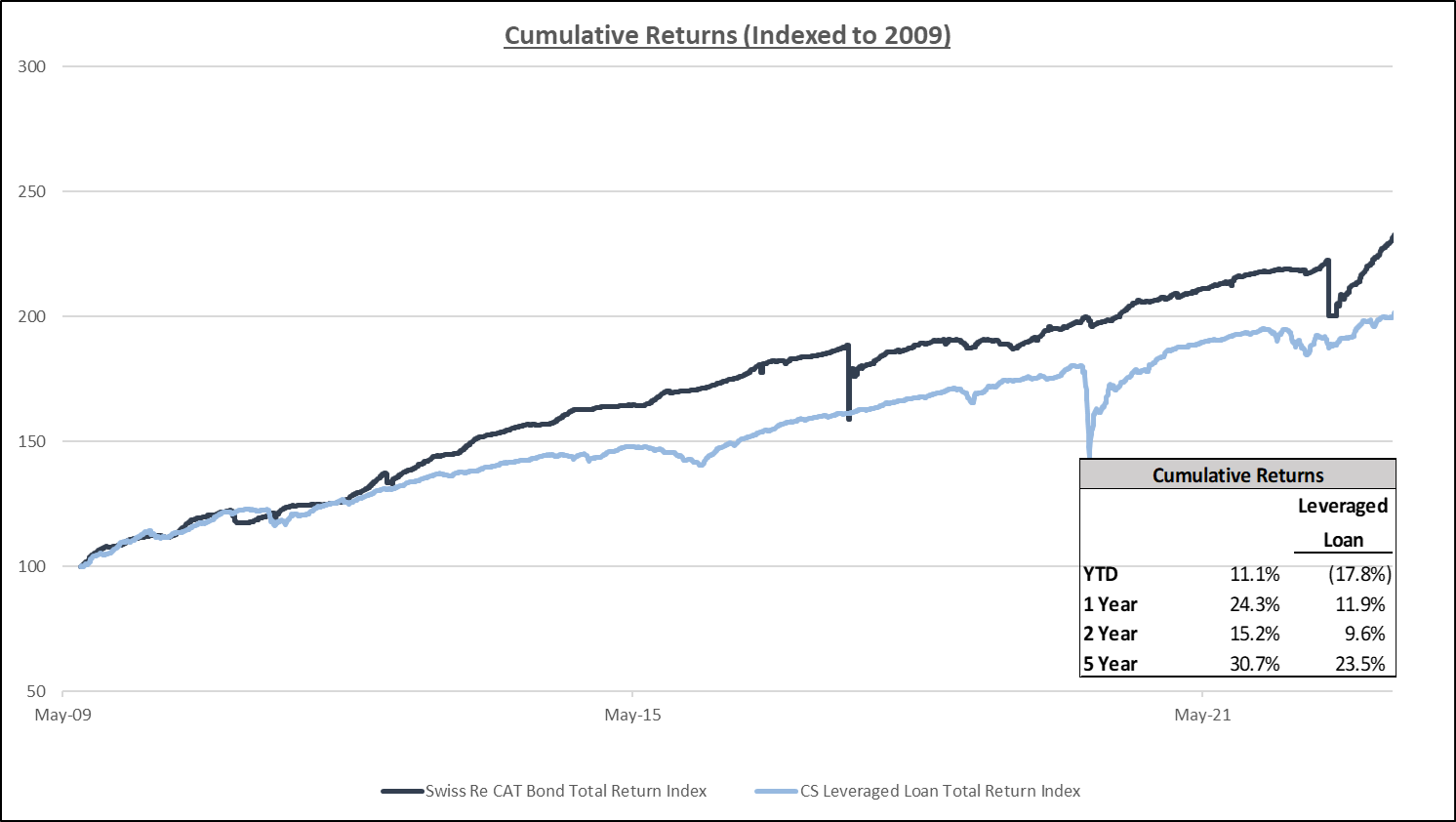

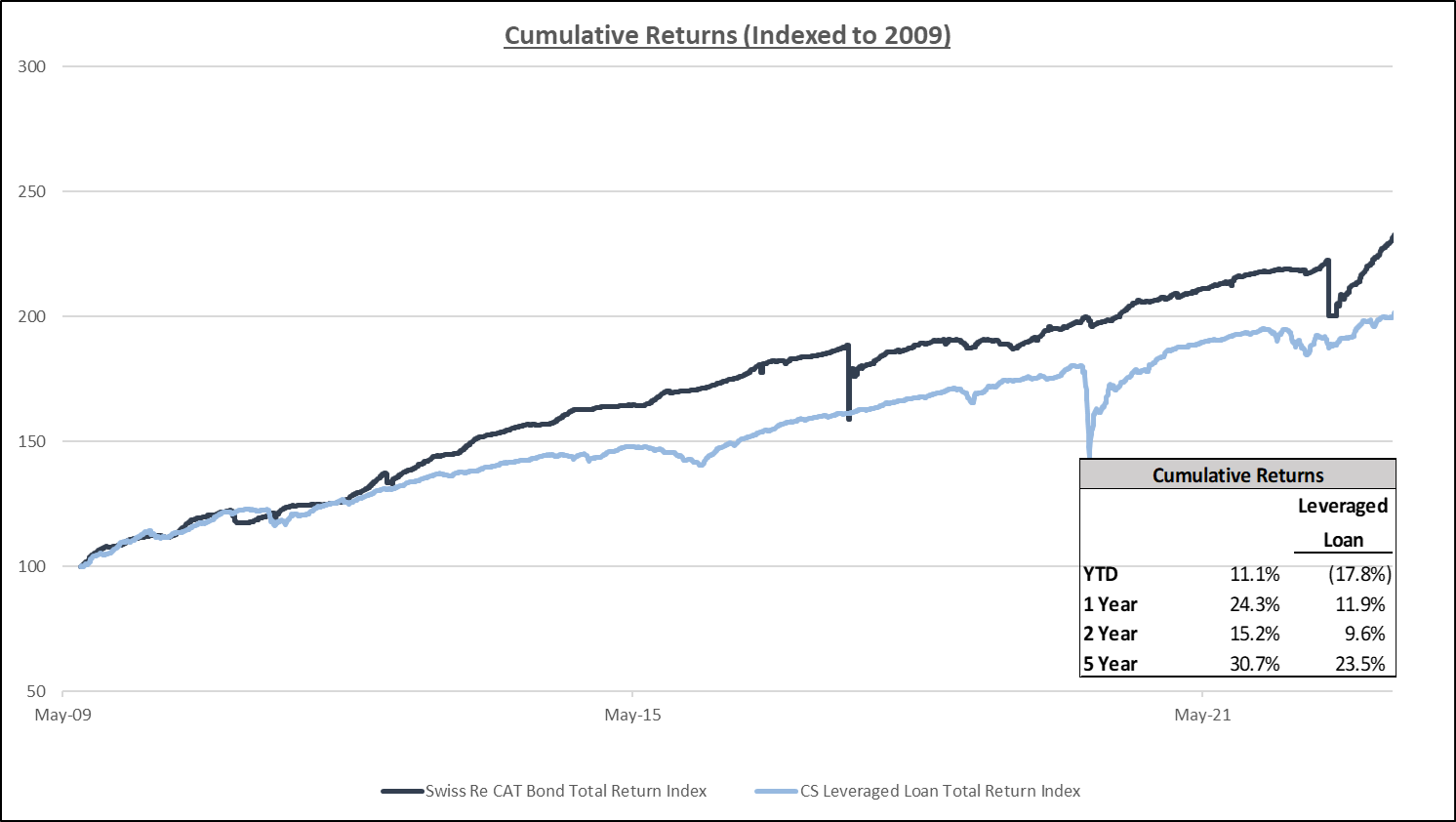

Diagram T: CAT Bonds – Cumulative Returns

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

U.S. News

- Federal Funds Target Rate

- Federal Reserve officials left interest rates unchanged at a target rate of 5.25 to 5.5 percent in their final policy decision of 2023 on Wednesday

- The Federal Reserve also forecast that they will cut borrowing costs three times in the coming year, a sign that the central bank is shifting toward the next phase in its fight against rapid inflation

- The interest rate target has now remained unchanged since July

- Consumer Price Index

- The annual rate of inflation slowed to 3.1% in November from 3.2% in the prior month, matching the lowest level since early 2021

- Core inflation, which has been has remained at 4% for the past several months, was unchanged at 4%, which is still twice as high as the Federal reserve’s 2% goal

- The cost of gasoline dropped 6% last month and held down the headline CPI reading

- Retail Sales

- Sales at U.S. retailers rose 0.3% in November in a good start to the holiday shopping season suggesting the economy might not be cooling off all that much

- Sales particularly surged at internet retailers such as Amazon, as well as stores that sell books, music and other hobby item

- Americans also spent more on clothes, furniture, health-care items and new cars

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 202,000 in the week ended December 8, down 19,000 from the prior week

- The four-week moving average was 213,250, down 7750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 20,000 to 1.861 million in the week ended December 1. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.740 trillion in the week ended December 15, up $2.2 billion from the prior week

- Treasury holdings totaled $4.810 trillion, down $3.1 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.45 trillion in the week, down $7.2 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $33.83 trillion as of December 15, an increase of 8.0% from the previous year

- Debt held by the public was $26.58 trillion, and intragovernmental holdings were $7.03 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.1% in November year over year

- On a monthly basis, the CPI increased 0.1% in November on a seasonally adjusted basis, after increasing 0.0% in October

- The index for all items less food and energy (core CPI) rose 0.3% in November, after rising 0.2% in October

- Core CPI increased 4.0% for the 12 months ending November

- Food and Beverages:

- The food at home index increased 1.7% in November from the same month a year earlier, and increased 0.1% in November month over month

- The food away from home index increased 5.3% in November from the same month a year earlier, and increased 0.4% in November month over month

- Commodities:

- The energy commodities index decreased (5.8%) in November after decreasing

- The energy commodities index fell (9.8%) over the last 12 months

- The energy services index (0.7%) in November after decreasing (1.0%) in October

- The energy services index fell (0.1%) over the last 12 months

- The gasoline index fell (8.9%) over the last 12 months

- The fuel oil index fell (24.8%) over the last 12 months

- The index for electricity rose 3.4% over the last 12 months

- The index for natural gas fell (10.4%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $1,521.06 per 40ft

- Drewry’s composite World Container Index has decreased by (28.5%) over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in November after increasing 0.3% in October

- The rent index increased 0.5% in November after increasing 0.3% in October

- The index for lodging away from home decreased (4.5%) in November after decreasing (6.1%) in October

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, up 1.00% year to date

World News

-

Israel/Middle East

- Residents of the Gaza Strip are facing starvation for the first time in recent history, according to United Nations agencies, as aid deliveries fall short of soaring needs in the enclave, where the food-supply system has collapsed

- Israeli officials said they are ready to double the daily number of aid trucks they process for entry into Gaza, provided international organizations can distribute the increased aid

- The overwhelming majority of Gaza’s 2.2 million people don’t have enough food, with residents often skipping meals and sometimes going several days without any, according to the World Food Program, a U.N. agency. The U.N. said it is assessing whether Gaza already meets the formal definition of famine, meaning two out of every 10,000 inhabitants die from hunger a day and around one in three children is acutely malnourished

-

Ukraine

- The European Union on Thursday agreed to start membership talks with Ukraine in a major political victory for Zelensky, but the negotiations will take years and it is unclear when they will start. The bloc failed to agree on a long-term package of budget support for the country

- In the U.S., a $110 billion aid package failed to pass Congress last week, while Hungary on Thursday blocked an EU package for Ukraine worth more than $50 billion. Ukrainian forces, which are heavily dependent on Western arms, are now running low on ammunition

-

China

- Consumer prices in China fell for the second straight month, a deepening bout of deflation that shows Beijing’s efforts to reignite faltering growth are falling short

- China’s top leaders telegraphed Friday that more support is coming for the economy, with pledges of new fiscal stimulus and supportive central-bank policy in the months ahead

- Still, the Communist Party signaled that stimulus will be measured rather than aggressive, reinforcing expectations for steady if unspectacular growth in 2024 as the economy grapples with a drawn-out property bust and a global backdrop darkened by war and slowdowns in the U.S. and Europe

-

Russia

- Russian President Vladimir Putin vowed to press on with his war in Ukraine during an end-of-year audience in which he showed no sign of seeking a swift conclusion to the devastating conflict, saying there would only be peace once Russia had achieved its goals

- For the first time since launching the war, Putin fielded questions from the international media and ordinary Russians for more than four hours on Thursday, in a stage-managed event that cast the president as listening to his people, spotlighted Moscow’s invasion of Ukraine and sought to present Russia as resilient to the impacts of the conflict

-

India

- An Indian man accused by U.S. authorities of attempting to kill an American Sikh activist has petitioned India’s Supreme Court, saying he is a victim of mistaken identity and caught in the middle of political tensions between the U.S. and India

-

Germany

- German authorities detained four alleged members of Hamas suspected of planning to attack Jewish institutions in the region—the first suggestion that the Gaza conflict might be spilling over beyond the Middle East

-

Japan

- Japan said it had asked the U.S. to suspend all non-emergency V-22 Osprey flights over its territory after one fell into the sea in western Japan. One crew member is confirmed dead with seven missing

-

Indonesia

- Indonesia’s Mount Marapi volcano erupted on Sunday killing at least 11 climbers, according to the Associated Press. The volcano spewed ash nearly two miles high

-

Spain

- Amazon reached an agreement with most of its workers in Spain, averting the full impact of a strike that risked crippling its warehouses on one of the busiest days of the year

-

Italy

- Pope Francis is punishing one of his most vocal conservative critics in the Catholic hierarchy, U.S. Cardinal Raymond Burke, by taking away his stipend and rent-free apartment in Rome

-

Argentina

- Argentina’s newly elected President, Javier Milei, wants to adopt the U.S. dollar as the national currency and strip the central bank’s power to print money. The country has been overcome with record inflation and low economic growth

Commodities

-

Oil Prices

- WTI: $71.66 per barrel

- 0.60% WoW; (9.93%) YTD; (5.85%) YoY

- Brent: $76.79 per barrel

- 1.25% WoW; (8.50%) YTD; (5.44%) YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended December 8, down 0.1 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 623, up 3 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 440.8 million barrels, up 3.9% YoY

- Refiners operated at a capacity utilization rate of 90.2% in the prior week, down from 90.5% in the prior week

- U.S. crude oil imports now amount to 7.508 million barrels per day, down (5.1%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.09 per gallon in the week of December 15,

down (2.9%) YoY

- Gasoline prices on the East Coast amounted to $3.23,down (2.8%) YoY

- Gasoline prices in the Midwest amounted to $2.98, down (4.2%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.71, down (3.6%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.01, down (9.9%) YoY

- Gasoline prices on the West Coast amounted to $4.27, up 0.3% YoY

- Motor gasoline inventories were up by 0.4 million barrels from the prior week

- Motor gasoline inventories amounted to 224.0 million barrels, up 0.2% YoY

- Production of motor gasoline averaged 9.54 million bpd, up 3.8% YoY

- Demand for motor gasoline amounted to 8.859 million bpd, up 7.3% YoY

-

Distillates

- Distillate inventories decreased by 1.5 million in the week of December 15

- Total distillate inventories amounted to 113.5 million barrels, down (5.5%)

- Distillate production averaged 4.987 million bpd, down (3.5%) YoY

- Demand for distillates averaged 3.770 million bpd in the week, up 0.1% YoY

-

Natural Gas

- Natural gas inventories decreased by 55 billion cubic feet last week

- Total natural gas inventories now amount to 3,664 billion cubic feet, up 7.4% YoY

Credit News

High yield bond yields decreased 42bps to 7.82% and spreads tightened 20bps to 375bps. Leveraged loan yields decreased 33bps to 9.25% and spreads decreased 14bps to 541bps. WTD Leveraged loan returns were positive 53bps. WTD high yield bond returns were positive 166bps. Bonds outperformed loans in a market with rapidly falling treasury yields. Benchmark 10yr treasury yields fell 33bps over the last week. Treasury yields reacted to a new set of FED “dots” projections that showed ~80bps of average rate cuts in 2024. The rates market is now pricing a first rate cut in March 2024.

High-yield:

Week ended 12/15/2023

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 12/15/2023

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Ligado Networks ($4.2bn, 11/1/23), Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23), Mallinckrodt ($2.8bn 8/28/23), Yellow Corp ($485mm 8/8/23), Anchor Glass ($675mm 7/11/23), Instant Brands ($391mm 6/12/23), Cyxtera Technologies ($768mm 6/4/23), Diebold ($2.0bn 6/1/23), Envision Health ($7.7bn 5/14/23), Venator Materials ($1.1bn 5/12/23), Bed Bath & Beyond ($5.2bn 4/22/23), David’s Bridal ($254mn 4/17/23), Monitronics International ($794mm 4/15/23), Catalina ($222mn 3/29/23), Diamond Sports ($8.6bn, 2/15/23), Avaya ($2.9bn, 2/14/23), Heritage Power ($485mn, 1/24/23), Serta Simmons Bedding($1.9bn, 1/23/23), Party City Holdings ($1.0bn, 01/17/23), Exela Intermediate ($1.4bn, 1/15/23)

CLOs:

Week ended 12/15/2023

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: Dry Powder for All Private Equity Buyouts

Diagram R: Structured Credit Spreads

Diagram S: Structured Credit Yield

Diagram T: CAT Bonds – Cumulative Returns

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index