U.S. News

- U.S. Population Growth

- The U.S. population grew 0.5% this year according to Census Bureau estimates

- The total U.S. population now stands at 334.9 million people, up 1.6 million people in the last year

- In the decade before the pandemic, the U.S. grew by an average of 2.1 million people per year

- Net migration to the U.S. was 1.1 million and there were 504,000 more births than deaths

- Home Builder Confidence Report

- Builder confidence rose in December for the first time in five months as mortgage rates fell

- The confidence index rose 3 points to 37 in December after rates fell roughly 50 basis points

- The index has averaged a reading of 47 since 2005

- Consumer Confidence

- Consumer confidence numbers increase to a five-month high of 110 in December, a fresh sign of optimism about the economy. The November reading was 101

- The new gauge in confidence seems to be driven by the Federal Reserve’s commentary about not raising rates any further and discussions on decreasing rates next year

- The top concern affecting consumers remains rising prices, while interest rates, global conflicts and politics all saw downticks as top concerns

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 205,000 in the week ended December 15, up 2,000 from the prior week

- The four-week moving average was 212,000, down 1500 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – decreased by 1,000 to 1.865 million in the week ended December 8. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.724 trillion in the week ended December 22, down $15.5 billion from the prior week

- Treasury holdings totaled $4.795 trillion, down $15.5 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.45 trillion in the week, down $0.7 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $33.87 trillion as of December 22, an increase of 8.1% from the previous year

- Debt held by the public was $24.49 trillion, and intragovernmental holdings were $7.03 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.1% in November year over year

- On a monthly basis, the CPI increased 0.1% in November on a seasonally adjusted basis, after increasing 0.0% in October

- The index for all items less food and energy (core CPI) rose 0.3% in November, after rising 0.2% in October

- Core CPI increased 4.0% for the 12 months ending November

- Food and Beverages:

- The food at home index increased 1.7% in November from the same month a year earlier, and increased 0.1% in November month over month

- The food away from home index increased 5.3% in November from the same month a year earlier, and increased 0.4% in November month over month

- Commodities:

- The energy commodities index decreased (5.8%) in November after decreasing (4.9%)

- The energy commodities index fell (9.8%) over the last 12 months

- The energy services index (0.7%) in November after decreasing (1.0%) in October

- The energy services index fell (0.1%) over the last 12 months

- The gasoline index fell (8.9%) over the last 12 months

- The fuel oil index fell (24.8%) over the last 12 months

- The index for electricity rose 3.4% over the last 12 months

- The index for natural gas fell (10.4%) over the last 12 months

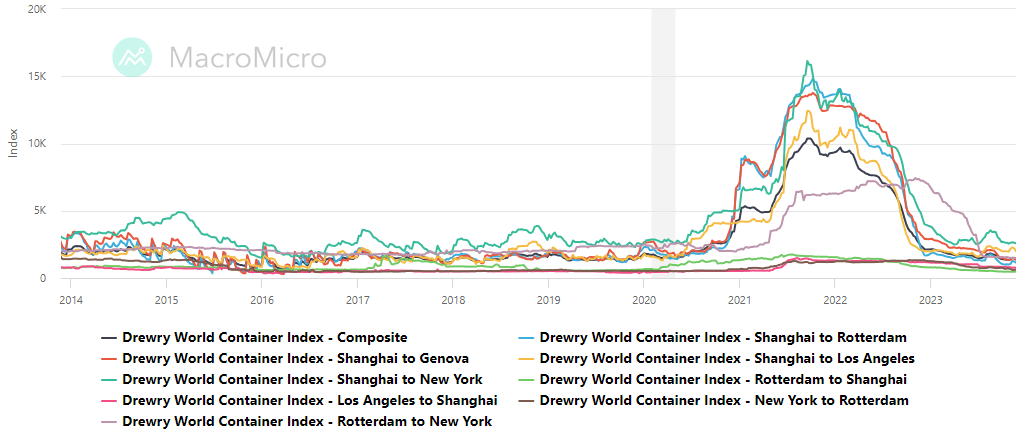

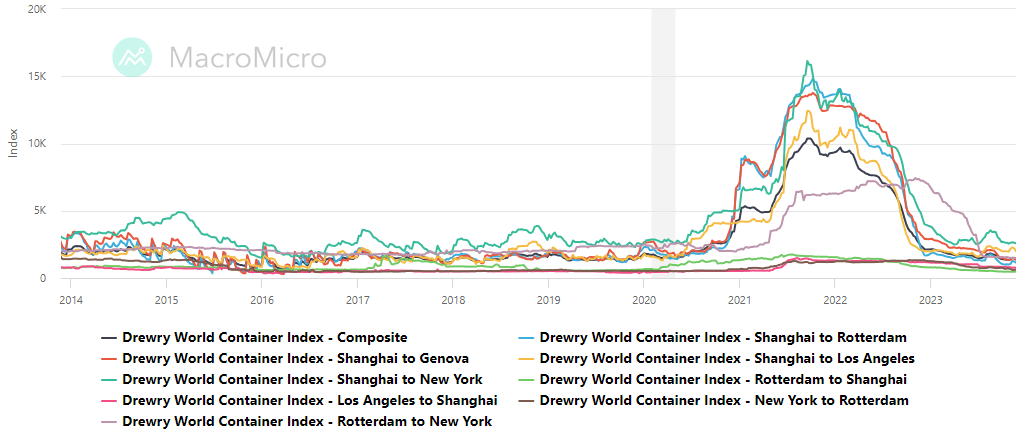

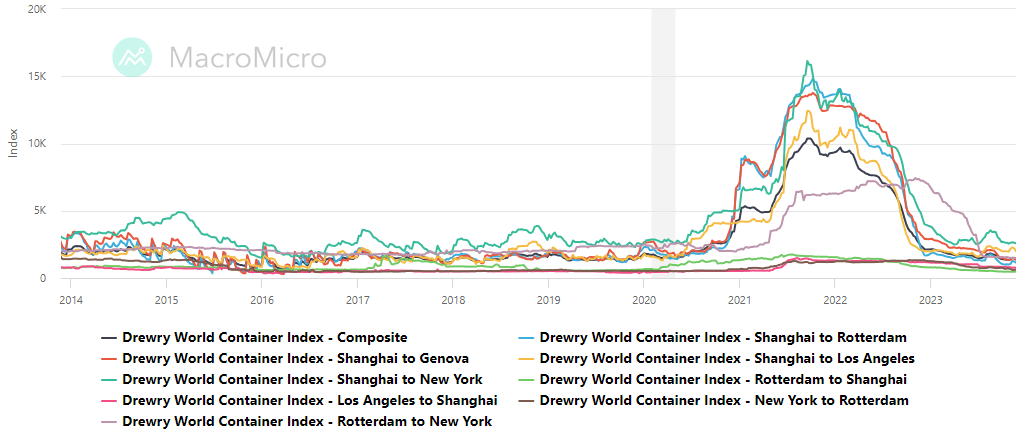

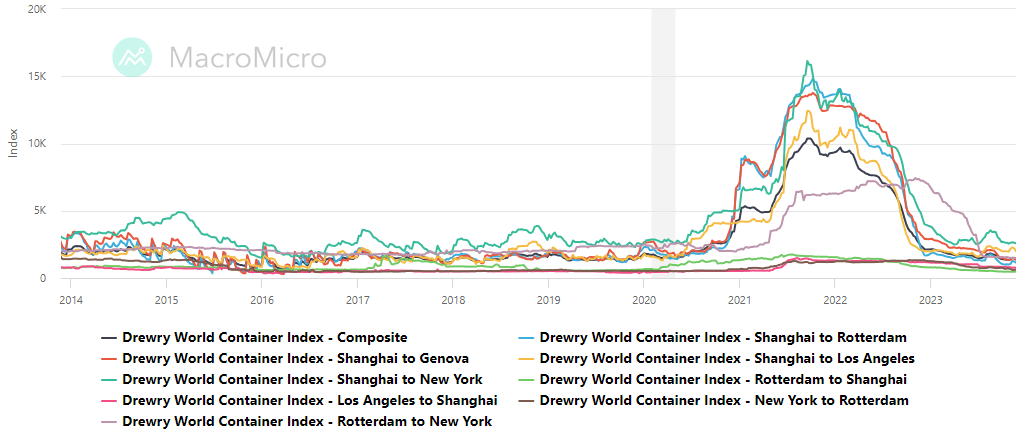

- Supply Chain:

- Drewry’s composite World Container Index increased to $1,660.95 per 40ft container for

- Drewry’s composite World Container Index has decreased by (21.7%) over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in November after increasing 0.3% in October

- The rent index increased 0.5% in November after increasing 0.3% in October

- The index for lodging away from home decreased (4.5%) in November after decreasing (6.1%) in October

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, up 1.00% year to date

World News

-

Israel/Middle East

- Hamas rejected an Israeli offer to stop fighting for one week in exchange for dozens of hostages, saying the group wouldn’t discuss releasing their Israeli captives until a cease-fire first goes into effect

- Israel had made the offer as Israeli forces stepped up operations in the southern Gaza city of Khan Younis, believed to be the hiding place of Hamas’s military leadership

- The proposed hostage negotiations were set to include, for the first time, representatives of Hamas ally Palestinian Islamic Jihad, which has demanded that Israel free all of its thousands of Palestinian prisoners in return for the over 100 hostages remaining in Gaza

-

Iran/Red Sea

- Iran’s paramilitary forces are providing real time intelligence to Yemen’s Houthis rebels that are using direct drones and missiles to target ships passing through the Red Sea

- The attacks have motivated shipping companies to divert vessels from the region and go around the Cap of Good Hope which adds an additional 9 days of travel from Singapore to Rotterdam

- The Pentagon has unveiled plans for a multinational naval force to protect merchant vessels in the Red Sea

-

Ukraine

- Ukraine said it shot down three Russian warplanes in one of its most-successful operations against Russian air power since the start of the war

- Ukraine’s air force said the three Russian Su-34 fighter bombers were down around midday Friday in the south of the country

-

China

- Rescue workers in northwestern China were racing to find missing survivors from an earthquake that has killed more than 100 people and injured many more

- The earthquake struck China’s Gansu province just before midnight on Monday night local time and was a 6.2 magnitude

-

North Korea

- North Korea appears to be operating a more powerful reactor for producing plutonium at its main nuclear site for the first time, the United Nations atomic agency said late Thursday

-

Czech Republic

- At least 14 people were killed and dozens more were injured in a mass shooting Thursday afternoon at a university in central Prague. The shooter was a student at the school, Charles University, according to a spokesman from the Czech Ministry of the Interior

-

India

- An Indian man accused by U.S. authorities of attempting to kill an American Sikh activist has petitioned India’s Supreme Court, saying he is a victim of mistaken identity and caught in the middle of political tensions between the U.S. and India

-

Germany

- German authorities detained four alleged members of Hamas suspected of planning to attack Jewish institutions in the region—the first suggestion that the Gaza conflict might be spilling over beyond the Middle East

-

Japan

- Japan said it had asked the U.S. to suspend all non-emergency V-22 Osprey flights over its territory after one fell into the sea in western Japan. One crew member is confirmed dead with seven missing

-

Indonesia

- Indonesia’s Mount Marapi volcano erupted on last week killing at least 11 climbers, according to the Associated Press. The volcano spewed ash nearly two miles high

-

Spain

- Amazon reached an agreement with most of its workers in Spain, averting the full impact of a strike that risked crippling its warehouses on one of the busiest days of the year

Commodities

-

Oil Prices

- WTI: $73.58 per barrel

- +3.01% WoW; (7.52%) YTD; (5.05%) YoY

- Brent: $79.07 per barrel

- +3.29% WoW; (5.78%) YTD; (2.36%) YoY

-

US Production

- U.S. oil production amounted to 13.3 million bpd for the week ended December 15, up 0.2 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 620, down 3 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 443.7 million barrels, up 6.1% YoY

- Refiners operated at a capacity utilization rate of 92.4% in the prior week, up from 90.2% in the prior week

- U.S. crude oil imports now amount to 6.517 million barrels per day, down (16.0%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.13 per gallon in the week of December 22,

up 1.1% YoY

- Gasoline prices on the East Coast amounted to $3.16,down (1.8%) YoY

- Gasoline prices in the Midwest amounted to $2.87, down (3.7%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.64, down (3.3%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $2.29, down (8.8%) YoY

- Gasoline prices on the West Coast amounted to $4.18, up 2.1% YoY

- Motor gasoline inventories were up by 2.7 million barrels from the prior week

- Motor gasoline inventories amounted to 226.7 million barrels, up 0.3% YoY

- Production of motor gasoline averaged 10.04 million bpd, up 5.1% YoY

- Demand for motor gasoline amounted to 8.754 million bpd, up 0.5% YoY

-

Distillates

- Distillate inventories decreased by 1.5 million in the week of December 22

- Total distillate inventories amounted to 115.0 million barrels, down (4.1%) YoY

- Distillate production averaged 4.873 million bpd, down (4.5%) YoY

- Demand for distillates averaged 3.823 million bpd in the week, down (4.8%) YoY

-

Natural Gas

- Natural gas inventories decreased by 87 billion cubic feet last week

- Total natural gas inventories now amount to 3,577 billion cubic feet, up 7.6% YoY

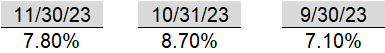

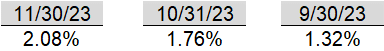

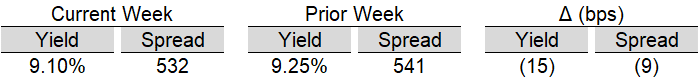

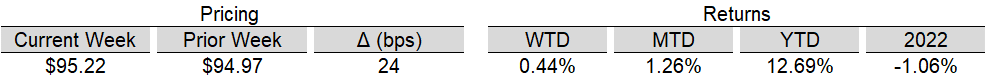

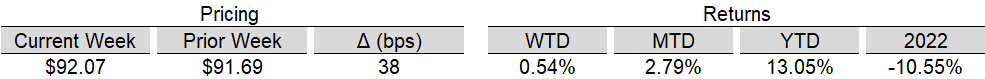

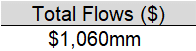

Credit News

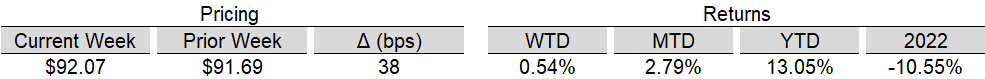

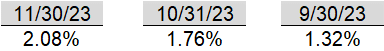

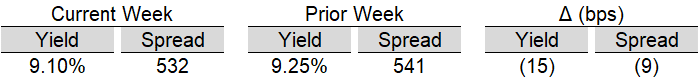

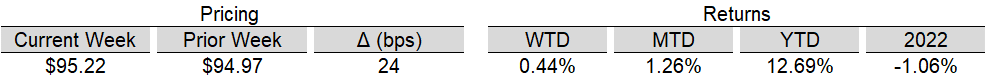

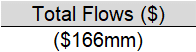

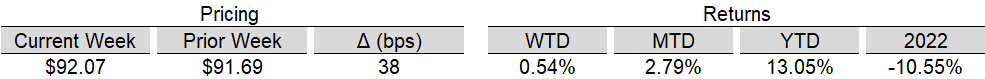

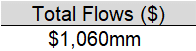

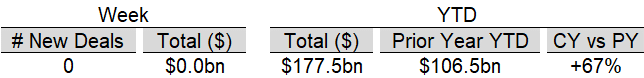

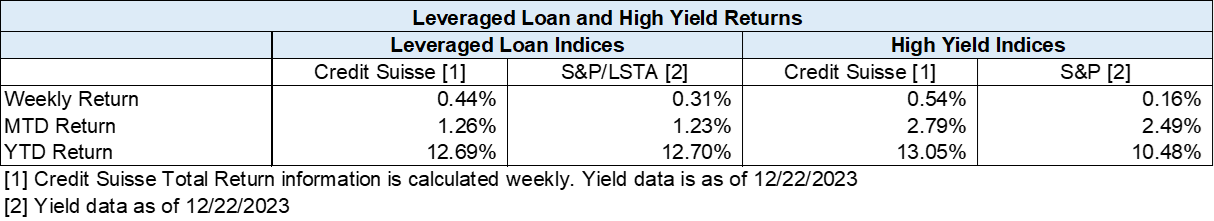

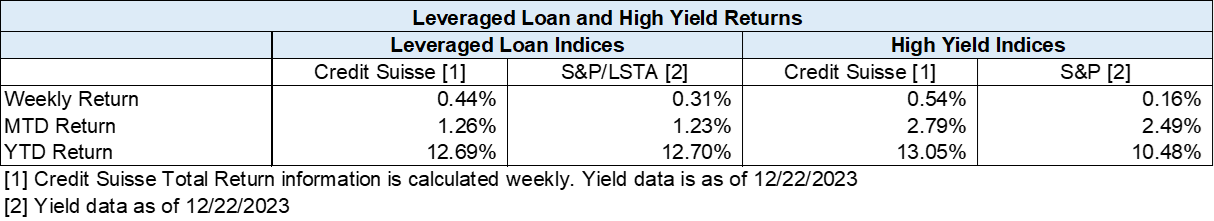

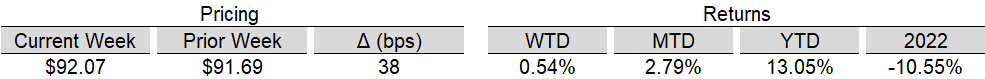

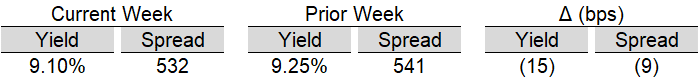

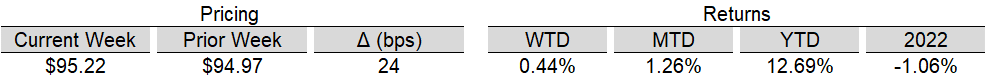

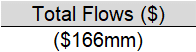

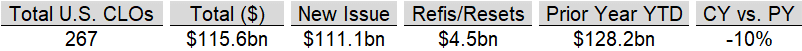

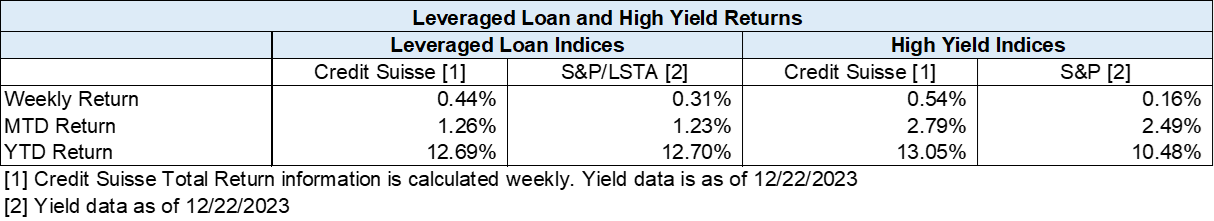

High yield bond yields decreased 8bps to 7.74% and spreads tightened 7bps to 368bps. Leveraged loan yields decreased 15bps to 9.10% and spreads tightened 9bps to 532bps. WTD Leveraged loan returns were positive 44bps. WTD high yield bond returns were positive 53bps. The path of least resistance was upward, as both bonds and loans continued to rally into a seasonally quiet week. For the year, both high yields bonds and loans are set to post strong double-digit returns.

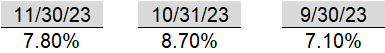

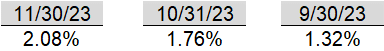

High-yield:

Week ended 12/22/2023

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

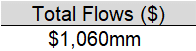

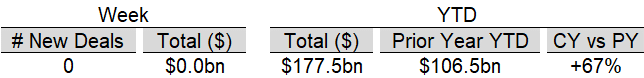

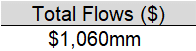

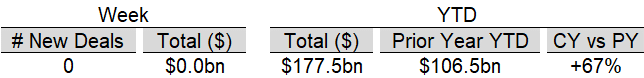

- New Issue2

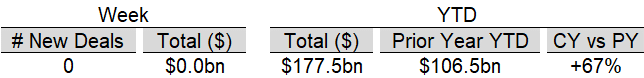

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 12/22/2023

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

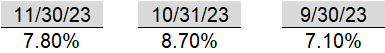

Default activity:

- Most recent defaults include: Ligado Networks ($4.2bn, 11/1/23), Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23), Mallinckrodt ($2.8bn 8/28/23), Yellow Corp ($485mm 8/8/23), Anchor Glass ($675mm 7/11/23), Instant Brands ($391mm 6/12/23), Cyxtera Technologies ($768mm 6/4/23), Diebold ($2.0bn 6/1/23), Envision Health ($7.7bn 5/14/23), Venator Materials ($1.1bn 5/12/23), Bed Bath & Beyond ($5.2bn 4/22/23), David’s Bridal ($254mn 4/17/23), Monitronics International ($794mm 4/15/23), Catalina ($222mn 3/29/23), Diamond Sports ($8.6bn, 2/15/23), Avaya ($2.9bn, 2/14/23), Heritage Power ($485mn, 1/24/23), Serta Simmons Bedding($1.9bn, 1/23/23), Party City Holdings ($1.0bn, 01/17/23), Exela Intermediate ($1.4bn, 1/15/23)

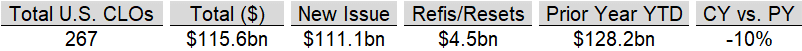

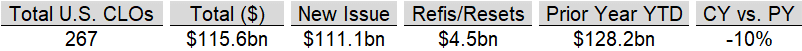

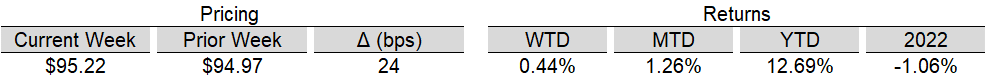

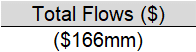

CLOs:

Week ended 12/22/2023

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

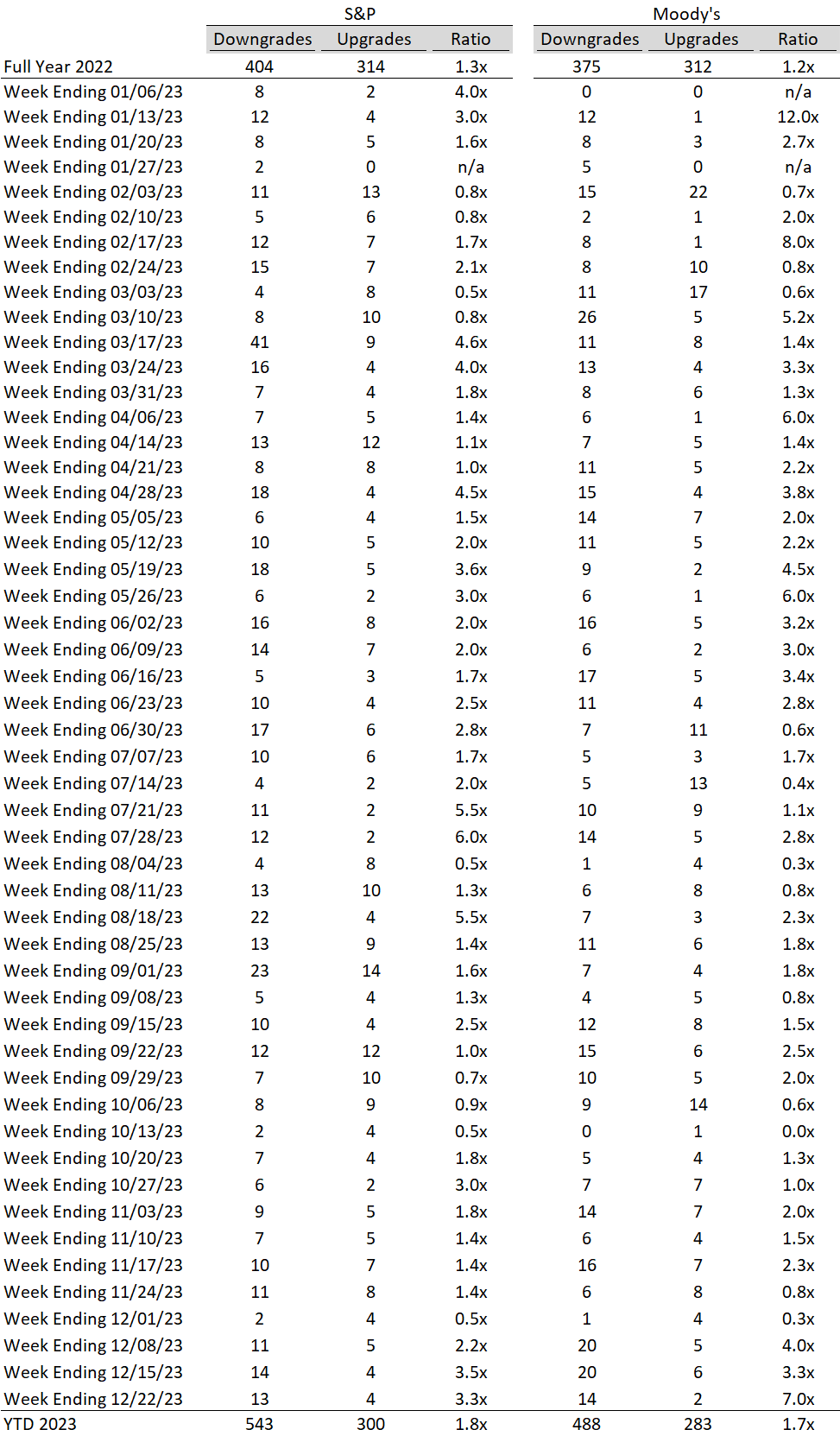

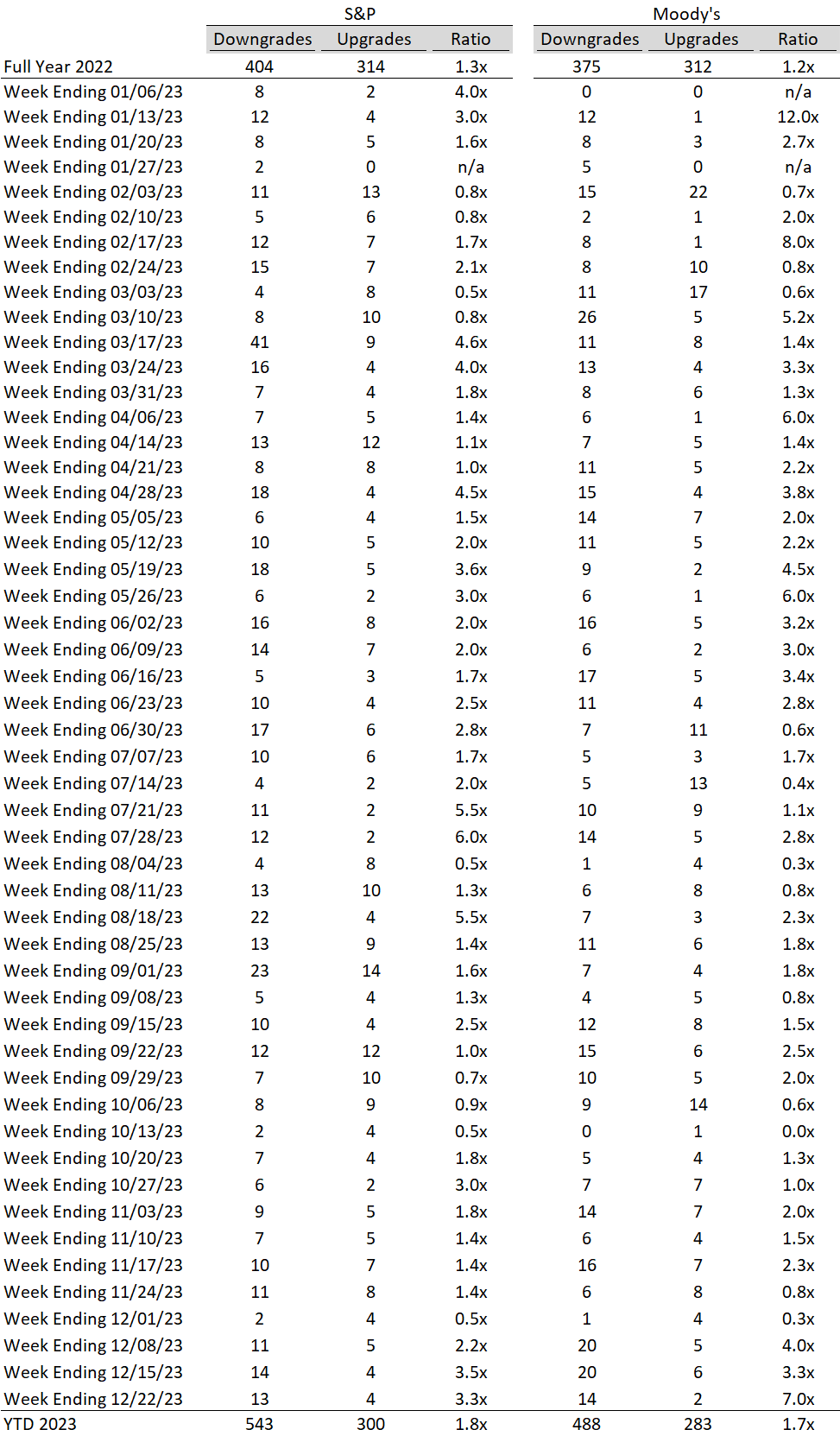

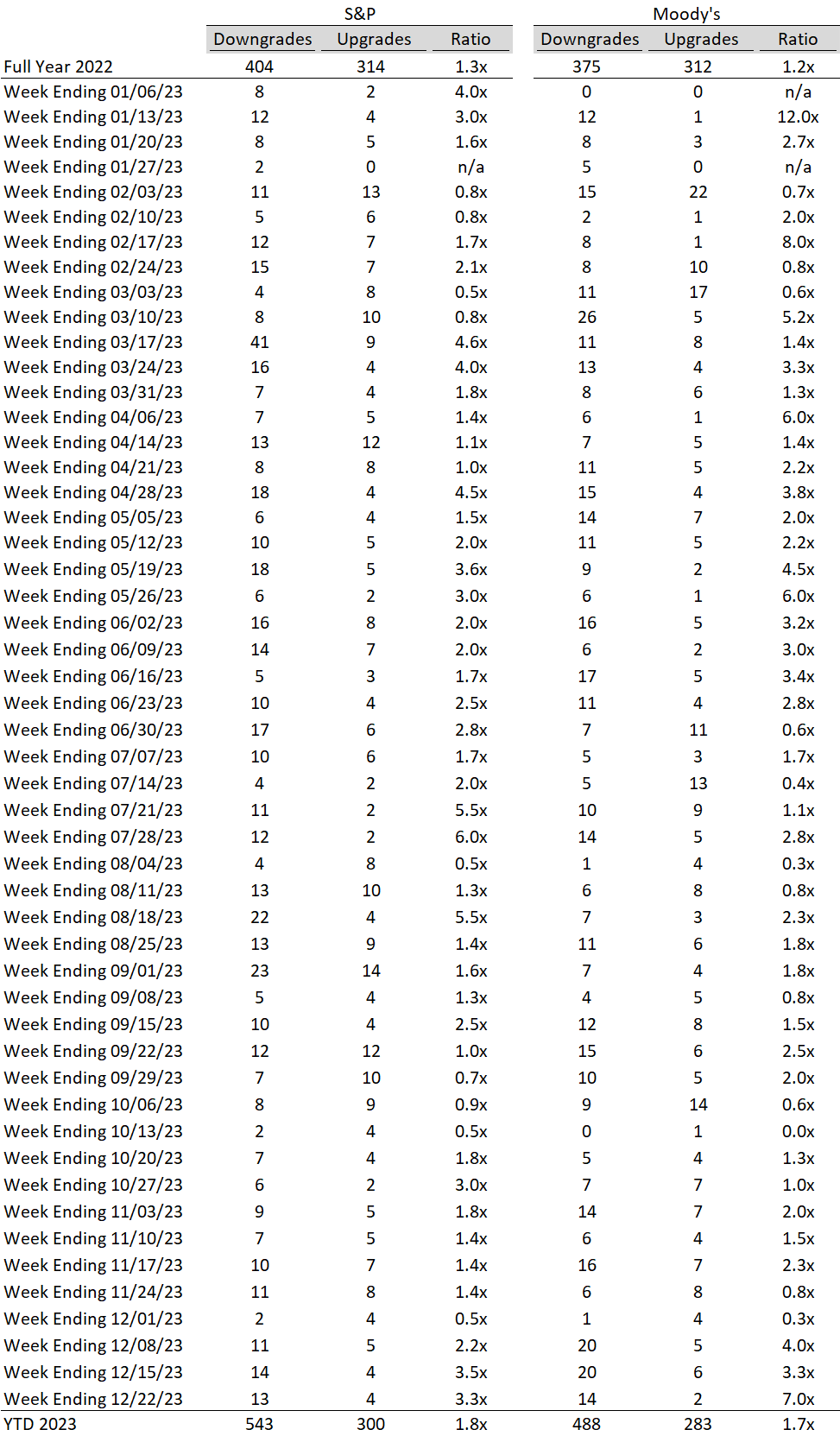

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

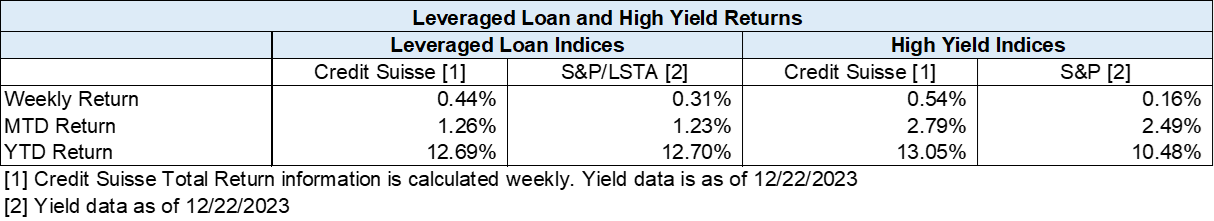

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

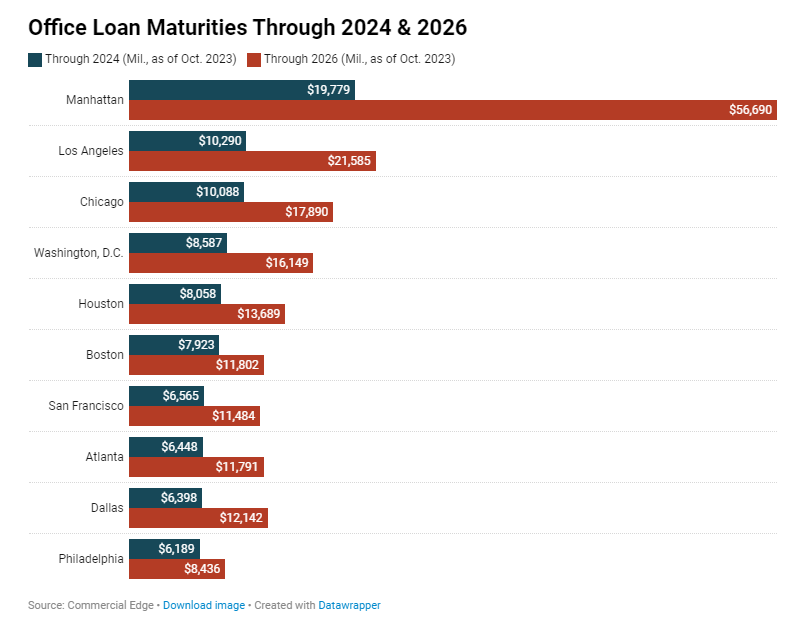

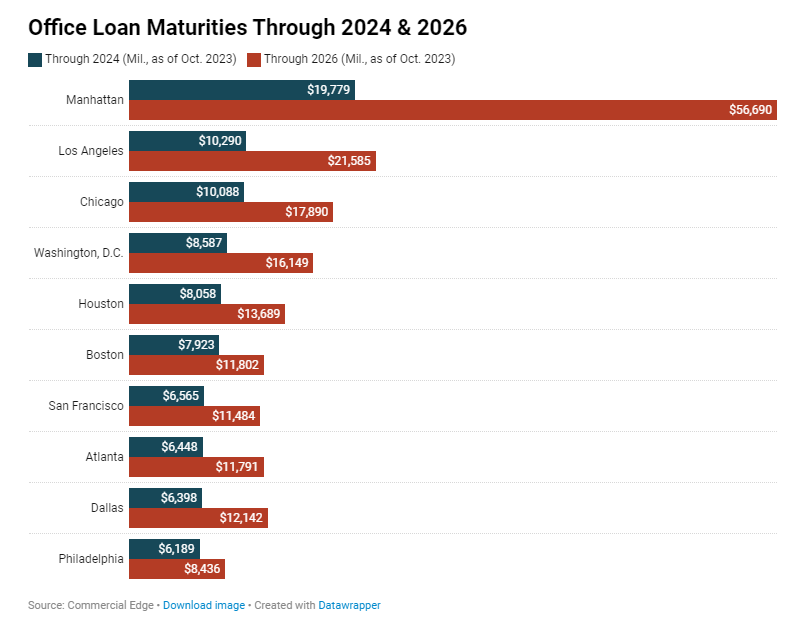

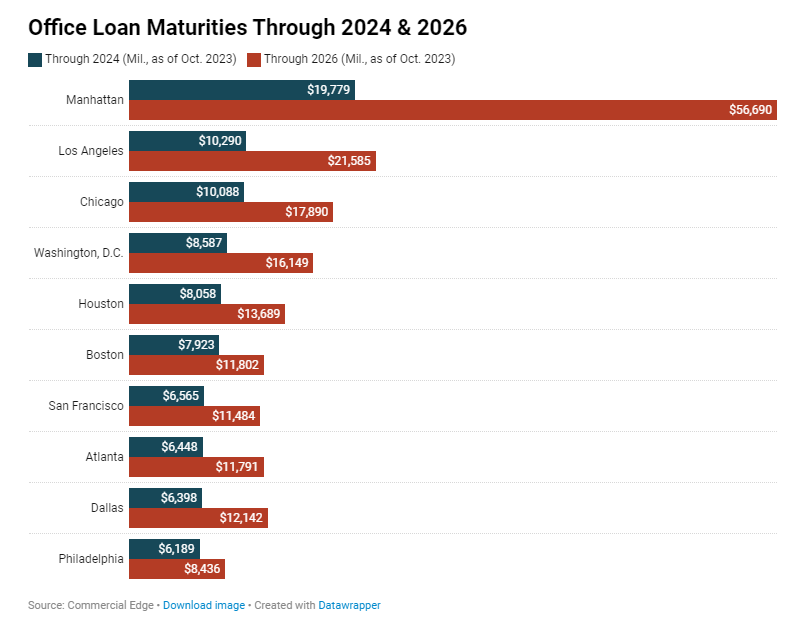

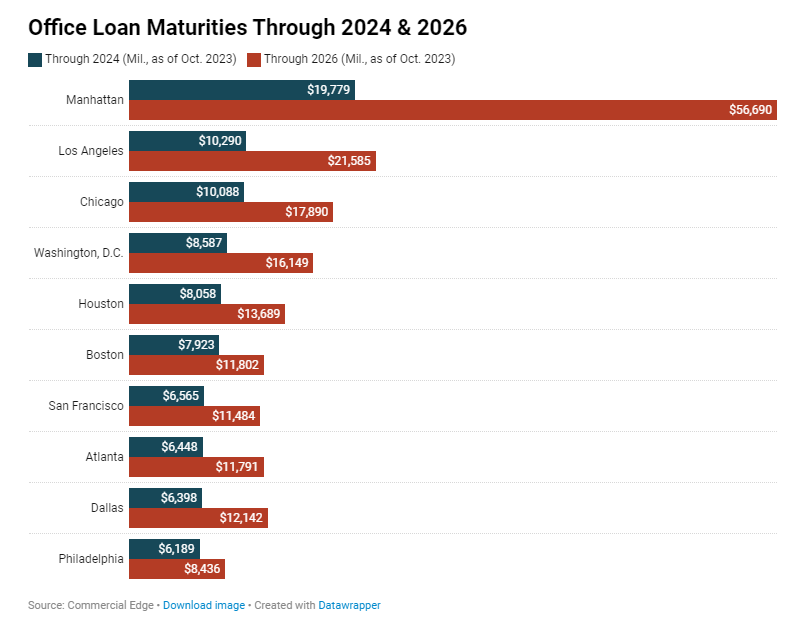

Manhattan Office Loan Maturities

- Notably, the center of this looming crisis is Manhattan, which leads the nation in distressed office properties

- For example, at the beginning of the pandemic, the market’s vacancy rate stood at 7.9%, whereas it had 17.7% of its office space available for lease this October.

- Manhattan Leads U.S. in Maturing Office Debt by Dollar Volume

- Manhattan Has Largest Volume of Maturing Class A & B Office Loans Through 2026

- CommercialEdge identified 1,159 office properties in Manhattan, out of which 136 hold $19.8 billion in loans that are set to mature by the end of 2024

- Manhattan leads the nation’s top markets with $56.7 billion in office loans due by the end of 2026.

- More than three quarters ($46.96 billion) of the maturing loans in Manhattan by the end of 2026 are backed by assets rated Class A+/A.

- Manhattan also leads the nation in maturing Class B and C office loans with $9.72 billion loans due by the end of 2026

- Manhattan stands at the forefront of growing distress in the office property market, signaling potential challenges that extend beyond 2026.

Nationwide:

- Office debt totaled $920 billion across the U.S. in October 2023

- Across the U.S., 32.7% of office loans are set to mature by the end of 2026

U.S. News

- U.S. Population Growth

- The U.S. population grew 0.5% this year according to Census Bureau estimates

- The total U.S. population now stands at 334.9 million people, up 1.6 million people in the last year

- In the decade before the pandemic, the U.S. grew by an average of 2.1 million people per year

- Net migration to the U.S. was 1.1 million and there were 504,000 more births than deaths

- Home Builder Confidence Report

- Builder confidence rose in December for the first time in five months as mortgage rates fell

- The confidence index rose 3 points to 37 in December after rates fell roughly 50 basis points

- The index has averaged a reading of 47 since 2005

- Consumer Confidence

- Consumer confidence numbers increase to a five-month high of 110 in December, a fresh sign of optimism about the economy. The November reading was 101

- The new gauge in confidence seems to be driven by the Federal Reserve’s commentary about not raising rates any further and discussions on decreasing rates next year

- The top concern affecting consumers remains rising prices, while interest rates, global conflicts and politics all saw downticks as top concerns

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 205,000 in the week ended December 15, up 2,000 from the prior week

- The four-week moving average was 212,000, down 1500 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – decreased by 1,000 to 1.865 million in the week ended December 8. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.724 trillion in the week ended December 22, down $15.5 billion from the prior week

- Treasury holdings totaled $4.795 trillion, down $15.5 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.45 trillion in the week, down $0.7 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $33.87 trillion as of December 22, an increase of 8.1% from the previous year

- Debt held by the public was $24.49 trillion, and intragovernmental holdings were $7.03 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.1% in November year over year

- On a monthly basis, the CPI increased 0.1% in November on a seasonally adjusted basis, after increasing 0.0% in October

- The index for all items less food and energy (core CPI) rose 0.3% in November, after rising 0.2% in October

- Core CPI increased 4.0% for the 12 months ending November

- Food and Beverages:

- The food at home index increased 1.7% in November from the same month a year earlier, and increased 0.1% in November month over month

- The food away from home index increased 5.3% in November from the same month a year earlier, and increased 0.4% in November month over month

- Commodities:

- The energy commodities index decreased (5.8%) in November after decreasing (4.9%)

- The energy commodities index fell (9.8%) over the last 12 months

- The energy services index (0.7%) in November after decreasing (1.0%) in October

- The energy services index fell (0.1%) over the last 12 months

- The gasoline index fell (8.9%) over the last 12 months

- The fuel oil index fell (24.8%) over the last 12 months

- The index for electricity rose 3.4% over the last 12 months

- The index for natural gas fell (10.4%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $1,660.95 per 40ft container for

- Drewry’s composite World Container Index has decreased by (21.7%) over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in November after increasing 0.3% in October

- The rent index increased 0.5% in November after increasing 0.3% in October

- The index for lodging away from home decreased (4.5%) in November after decreasing (6.1%) in October

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, up 1.00% year to date

World News

-

Israel/Middle East

- Hamas rejected an Israeli offer to stop fighting for one week in exchange for dozens of hostages, saying the group wouldn’t discuss releasing their Israeli captives until a cease-fire first goes into effect

- Israel had made the offer as Israeli forces stepped up operations in the southern Gaza city of Khan Younis, believed to be the hiding place of Hamas’s military leadership

- The proposed hostage negotiations were set to include, for the first time, representatives of Hamas ally Palestinian Islamic Jihad, which has demanded that Israel free all of its thousands of Palestinian prisoners in return for the over 100 hostages remaining in Gaza

-

Iran/Red Sea

- Iran’s paramilitary forces are providing real time intelligence to Yemen’s Houthis rebels that are using direct drones and missiles to target ships passing through the Red Sea

- The attacks have motivated shipping companies to divert vessels from the region and go around the Cap of Good Hope which adds an additional 9 days of travel from Singapore to Rotterdam

- The Pentagon has unveiled plans for a multinational naval force to protect merchant vessels in the Red Sea

-

Ukraine

- Ukraine said it shot down three Russian warplanes in one of its most-successful operations against Russian air power since the start of the war

- Ukraine’s air force said the three Russian Su-34 fighter bombers were down around midday Friday in the south of the country

-

China

- Rescue workers in northwestern China were racing to find missing survivors from an earthquake that has killed more than 100 people and injured many more

- The earthquake struck China’s Gansu province just before midnight on Monday night local time and was a 6.2 magnitude

-

North Korea

- North Korea appears to be operating a more powerful reactor for producing plutonium at its main nuclear site for the first time, the United Nations atomic agency said late Thursday

-

Czech Republic

- At least 14 people were killed and dozens more were injured in a mass shooting Thursday afternoon at a university in central Prague. The shooter was a student at the school, Charles University, according to a spokesman from the Czech Ministry of the Interior

-

India

- An Indian man accused by U.S. authorities of attempting to kill an American Sikh activist has petitioned India’s Supreme Court, saying he is a victim of mistaken identity and caught in the middle of political tensions between the U.S. and India

-

Germany

- German authorities detained four alleged members of Hamas suspected of planning to attack Jewish institutions in the region—the first suggestion that the Gaza conflict might be spilling over beyond the Middle East

-

Japan

- Japan said it had asked the U.S. to suspend all non-emergency V-22 Osprey flights over its territory after one fell into the sea in western Japan. One crew member is confirmed dead with seven missing

-

Indonesia

- Indonesia’s Mount Marapi volcano erupted on last week killing at least 11 climbers, according to the Associated Press. The volcano spewed ash nearly two miles high

-

Spain

- Amazon reached an agreement with most of its workers in Spain, averting the full impact of a strike that risked crippling its warehouses on one of the busiest days of the year

Commodities

-

Oil Prices

- WTI: $73.58 per barrel

- +3.01% WoW; (7.52%) YTD; (5.05%) YoY

- Brent: $79.07 per barrel

- +3.29% WoW; (5.78%) YTD; (2.36%) YoY

-

US Production

- U.S. oil production amounted to 13.3 million bpd for the week ended December 15, up 0.2 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 620, down 3 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 443.7 million barrels, up 6.1% YoY

- Refiners operated at a capacity utilization rate of 92.4% in the prior week, up from 90.2% in the prior week

- U.S. crude oil imports now amount to 6.517 million barrels per day, down (16.0%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.13 per gallon in the week of December 22,

up 1.1% YoY

- Gasoline prices on the East Coast amounted to $3.16,down (1.8%) YoY

- Gasoline prices in the Midwest amounted to $2.87, down (3.7%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.64, down (3.3%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $2.29, down (8.8%) YoY

- Gasoline prices on the West Coast amounted to $4.18, up 2.1% YoY

- Motor gasoline inventories were up by 2.7 million barrels from the prior week

- Motor gasoline inventories amounted to 226.7 million barrels, up 0.3% YoY

- Production of motor gasoline averaged 10.04 million bpd, up 5.1% YoY

- Demand for motor gasoline amounted to 8.754 million bpd, up 0.5% YoY

-

Distillates

- Distillate inventories decreased by 1.5 million in the week of December 22

- Total distillate inventories amounted to 115.0 million barrels, down (4.1%) YoY

- Distillate production averaged 4.873 million bpd, down (4.5%) YoY

- Demand for distillates averaged 3.823 million bpd in the week, down (4.8%) YoY

-

Natural Gas

- Natural gas inventories decreased by 87 billion cubic feet last week

- Total natural gas inventories now amount to 3,577 billion cubic feet, up 7.6% YoY

Credit News

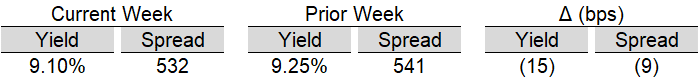

High yield bond yields decreased 8bps to 7.74% and spreads tightened 7bps to 368bps. Leveraged loan yields decreased 15bps to 9.10% and spreads tightened 9bps to 532bps. WTD Leveraged loan returns were positive 44bps. WTD high yield bond returns were positive 53bps. The path of least resistance was upward, as both bonds and loans continued to rally into a seasonally quiet week. For the year, both high yields bonds and loans are set to post strong double-digit returns.

High-yield:

Week ended 12/22/2023

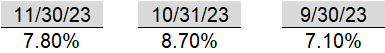

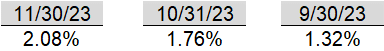

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 12/22/2023

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Ligado Networks ($4.2bn, 11/1/23), Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23), Mallinckrodt ($2.8bn 8/28/23), Yellow Corp ($485mm 8/8/23), Anchor Glass ($675mm 7/11/23), Instant Brands ($391mm 6/12/23), Cyxtera Technologies ($768mm 6/4/23), Diebold ($2.0bn 6/1/23), Envision Health ($7.7bn 5/14/23), Venator Materials ($1.1bn 5/12/23), Bed Bath & Beyond ($5.2bn 4/22/23), David’s Bridal ($254mn 4/17/23), Monitronics International ($794mm 4/15/23), Catalina ($222mn 3/29/23), Diamond Sports ($8.6bn, 2/15/23), Avaya ($2.9bn, 2/14/23), Heritage Power ($485mn, 1/24/23), Serta Simmons Bedding($1.9bn, 1/23/23), Party City Holdings ($1.0bn, 01/17/23), Exela Intermediate ($1.4bn, 1/15/23)

CLOs:

Week ended 12/22/2023

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

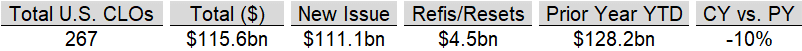

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

Manhattan Office Loan Maturities

- Notably, the center of this looming crisis is Manhattan, which leads the nation in distressed office properties

- For example, at the beginning of the pandemic, the market’s vacancy rate stood at 7.9%, whereas it had 17.7% of its office space available for lease this October.

- Manhattan Leads U.S. in Maturing Office Debt by Dollar Volume

- Manhattan Has Largest Volume of Maturing Class A & B Office Loans Through 2026

- CommercialEdge identified 1,159 office properties in Manhattan, out of which 136 hold $19.8 billion in loans that are set to mature by the end of 2024

- Manhattan leads the nation’s top markets with $56.7 billion in office loans due by the end of 2026.

- More than three quarters ($46.96 billion) of the maturing loans in Manhattan by the end of 2026 are backed by assets rated Class A+/A.

- Manhattan also leads the nation in maturing Class B and C office loans with $9.72 billion loans due by the end of 2026

- Manhattan stands at the forefront of growing distress in the office property market, signaling potential challenges that extend beyond 2026.

Nationwide:

- Office debt totaled $920 billion across the U.S. in October 2023

- Across the U.S., 32.7% of office loans are set to mature by the end of 2026