U.S. News

- Housing Prices

- Home prices in the 20 major U.S. metropolitan markets were up an average of 4.9 percent in the 12 months ending in October

- This marked the ninth month in a row that home prices have risen due to a persistent lack of homes for sale

- Detroit posted the biggest year-over-year home-price gains in October, up 8.1 percent year over year

- Trade Deficit

- The US international goods deficit widened more than expected to $90.3 billion in November from $89.6 billion in October

- Exports fell 3.6 percent in November, resulting from broad declines across categories such as industrial supplies, vehicles and consumer goods

- Imports contracted 2.1 percent after edging up 0.1 percent in October

- Holiday Sales

- Holiday sales rose this year during the shopping season even with Americans wrestling with higher prices

- Holiday sales from the beginning of November through Christmas Eve climbed 3.1 percent, a slower pace than the 7.6 percent increase from a year earlier

- Online sales jumped 6.3 percent from a year ago and in-person spending rose a modest 2.2 percent

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 218,000 in the week ended December 22, up 12,000 from the prior week

- The four-week moving average was 212,000, down 250 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 14,000 to 1.875 million in the week ended December 15. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.713 trillion in the week ended December 29, down $11.3 billion from the prior week

- Treasury holdings totaled $4.791 trillion, down $3.7 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.44 trillion in the week, down $6.9 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $33.91 trillion as of December 29, an increase of 8.3% from the previous year

- Debt held by the public was $24.48 trillion, and intragovernmental holdings were $7.03 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.1% in November year over year

- On a monthly basis, the CPI increased 0.1% in November on a seasonally adjusted basis, after increasing 0.0% in October

- The index for all items less food and energy (core CPI) rose 0.3% in November, after rising 0.2% in October

- Core CPI increased 4.0% for the 12 months ending November

- Food and Beverages:

- The food at home index increased 1.7% i n November from the same month a year earlier, and increased 0.1% in November month over month

- The food away from home index increased 5.3% in November from the same month a year earlier, and increased 0.4% in November month over month

- Commodities:

- The energy commodities index decreased (5.8%) in November after decreasing

- The energy commodities index fell (9.8%) over the last 12 months

- The energy services index 0.7% in November after decreasing (1.0%) in October

- The energy services index fell (0.1%) over the last 12 months

- The gasoline index fell (8.9%) over the last 12 months

- The fuel oil index fell (24.8%) over the last 12 months

- The index for electricity rose 3.4% over the last 12 months

- The index for natural gas fell (10.4%) over the last 12 months

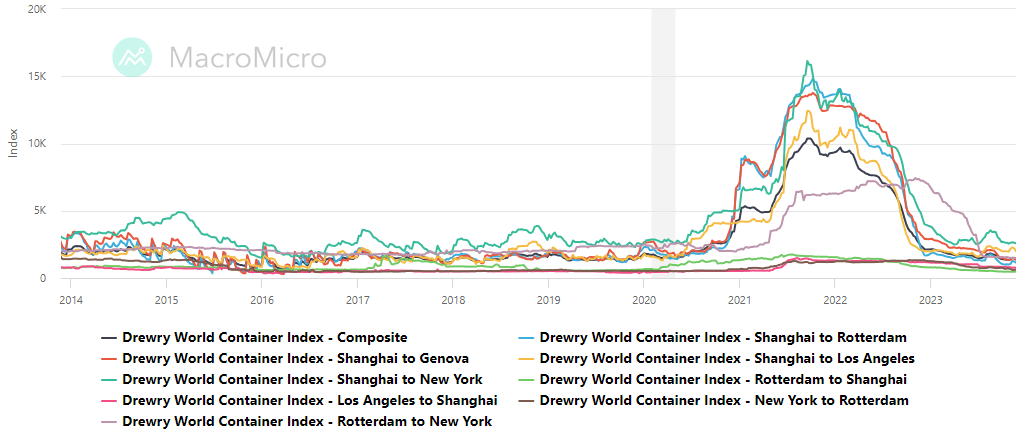

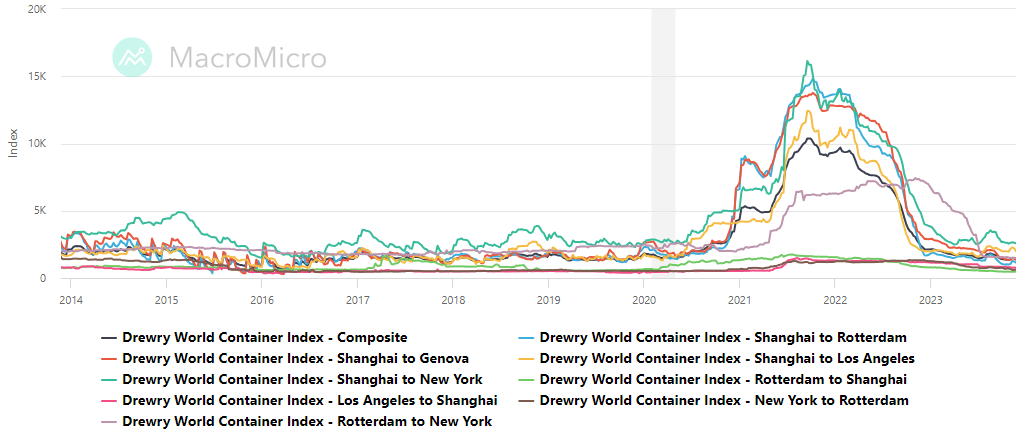

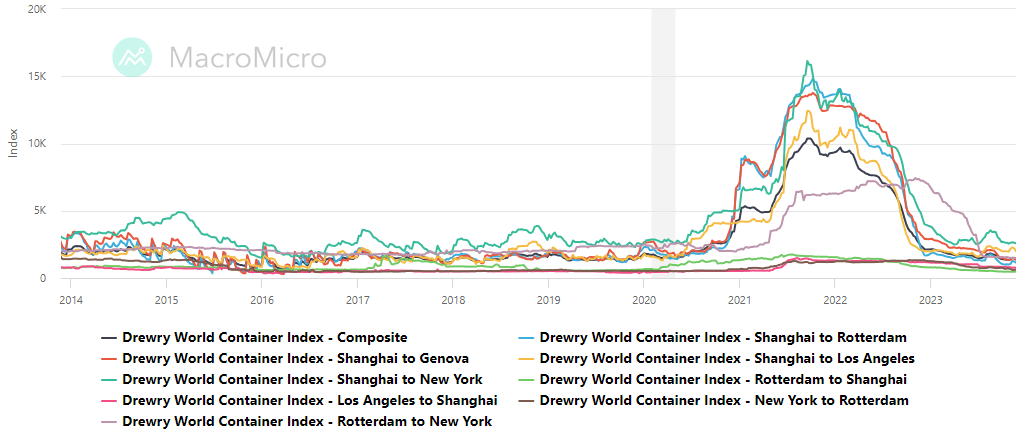

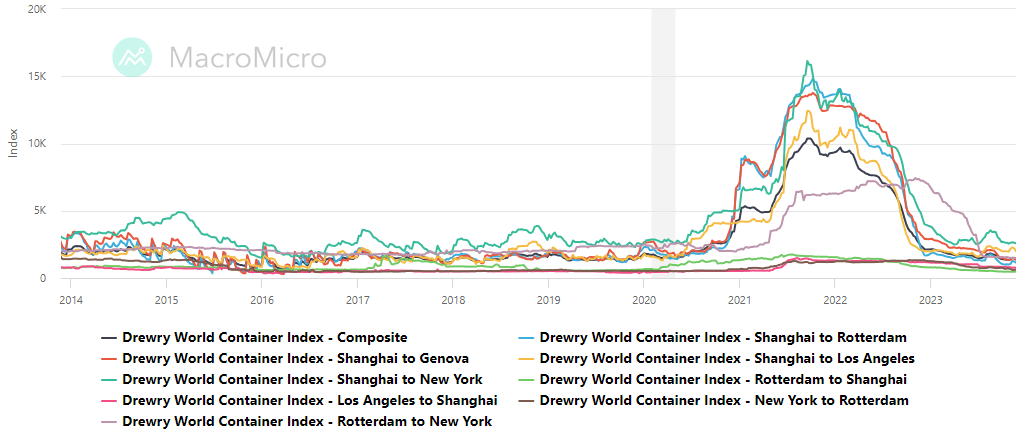

- Supply Chain:

- Drewry’s composite World Container Index decreased to $1,660.95 per 40ft

- Drewry’s composite World Container Index has decreased by (21.7%) over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in November after increasing 0.3% in October

- The rent index increased 0.5% in November after increasing 0.3% in October

- The index for lodging away from home decreased (4.5%) in November after decreasing (6.1%) in October

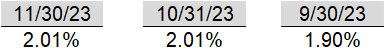

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, up 1.00% year to date

World News

-

Israel/Middle East

- Israeli forces intensified their ground offensive in refugee camps in the central Gaza Strip, as fighting continued to drive Palestinian civilians into shrinking and overcrowded areas in search of safety

- Meanwhile, Egyptian officials worked with Qatar to advance a multiphased proposal to end the war – a plan that neither Hamas nor Israel is likely to accept in its current form

- Since the launch of its military operation in October, Israel has struck several refugee camps in Gaza as it seeks to eradicate Hamas

-

Iran/Red Sea

- The U.S. Navy shot down three anti-ship ballistic missiles on Tuesday launched by incoming Iran-backed Houthi missiles in the Red Sea. It was the first time the Navy shot down an incoming anti-ship ballistic missile in combat, officials say

- The number of commercial ships attacked near the crucial passageway between the Horn of Africa and the Middle East is now at 15. The shipping attacks are part of a broader regional confrontation between Iran’s allies and the U.S. and Israel, and are increasing

- A declassified document from the Defense Department shows Houthi attacks on ships escalated during the first half of December to eight incidents, compared with just three during the last half of November

-

Ukraine

- Ukraine claimed on Tuesday to have carried out an airstrike in Crimea that destroyed a Russian Navy tank landing ship in what would be, if confirmed, the third instance of major losses of Russian military hardware in less than a week

- In a post on Telegram, Ukrainian Air Force commander Mykola Oleshchuk thanked personnel involved in “the destruction of the Novocherkassk large landing ship” while it was in the port of Feodosia in Crimea, the Ukrainian peninsula illegally annexed by Russia in 2014

-

Russia

- A debt-fueled surge in housing prices, along with fast-rising inflation, has exposed stark divisions among Russia’s leaders even as the battle rages on in Ukraine. On one side is the hidebound central bank, tasked with maintaining financial stability. On the other is the Kremlin, which is trying to shore up popular support ahead of the 2024 presidential election

- President Vladimir Putin last week said he planned to extend a popular mortgage program, which offers discounted rates to families with children, through the end of next year

-

China

- President Xi Jinping vowed on Tuesday to resolutely prevent anyone from “splitting Taiwan from China in any way”, a little more than two weeks before Taiwan elects a new leader

- China views democratically-governed Taiwan as its own territory, despite the strong objections of the government in Taipei, and has ramped up military and political pressure to assert its sovereignty claims

-

Indonesia

- At a Chinese nickel smelter in Indonesia, workers were undertaking routine maintenance at dawn when a massive explosion rocked the facility. Waste from a furnace had flowed out and hit flammable material, resulting in the deaths of at least 19 workers and injuring dozens more as hot steam hissed out and fire ripped through the building

-

India

- The Indian navy has dispatched three guided-missile destroyers to protect commercial vessels in the Arabian Sea, after an attack last week on a chemical tanker off the Indian coast

-

North Korea

- North Korea appears to be operating a more powerful reactor for producing plutonium at its main nuclear site for the first time, the United Nations atomic agency said late Thursday

-

Czech Republic

- At least 14 people were killed and dozens more were injured in a mass shooting at a university in central Prague. The shooter was a student at the school, Charles University, according to a spokesman from the Czech Ministry of the Interior

-

Germany

- German authorities detained four alleged members of Hamas suspected of planning to attack Jewish institutions in the region—the first suggestion that the Gaza conflict might be spilling over beyond the Middle East

-

Japan

- Japan said it had asked the U.S. to suspend all non-emergency V-22 Osprey flights over its territory after one fell into the sea in western Japan. One crew member is confirmed dead with seven missing

-

Spain

- Amazon reached an agreement with most of its workers in Spain, averting the full impact of a strike that risked crippling its warehouses on one of the busiest days of the year

Commodities

-

Oil Prices

- WTI: $71.65 per barrel

- (2.60%) WoW; (9.94%) YTD; (8.61%) YoY

- Brent: $77.04 per barrel

- (2.57%) WoW; (8.20%) YTD; (6.35%) YoY

-

US Production

- U.S. oil production amounted to 13.3 million bpd for the week ended December 22, down 0.2 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 622, up 2 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 436.6 million barrels, up 4.2% YoY

- Refiners operated at a capacity utilization rate of 93.3% in the prior week, up from 92.4% in the prior week

- U.S. crude oil imports now amount to 6.750 million barrels per day, down 0.4% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.12 per gallon in the week of December 29,

down (1.9%) YoY

- Gasoline prices on the East Coast amounted to $3.23, up 1.7% YoY

- Gasoline prices in the Midwest amounted to $2.93, down (1.3%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.78, up 0.3% YoY

- Gasoline prices in the Rocky Mountain region amounted to $2.98, down (4.7%) YoY

- Gasoline prices on the West Coast amounted to $4.18, up 3.8% YoY

- Motor gasoline inventories were down by 0.7 million barrels from the prior week

- Motor gasoline inventories amounted to 226.1 million barrels, up 1.4% YoY

- Production of motor gasoline averaged 10.03 million bpd, down (1.1%) YoY

- Demand for motor gasoline amounted to 9.168 million bpd, down (1.7%) YoY

-

Distillates

- Distillate inventories decreased by 0.7 million in the week of December 29

- Total distillate inventories amounted to 115.8 million barrels, down (3.7%) YoY

- Distillate production averaged 5.116 million bpd, up 0.6% YoY

- Demand for distillates averaged 3.977 million bpd in the week, up 2.5% YoY

-

Natural Gas

- Natural gas inventories decreased by 87 billion cubic feet last week

- Total natural gas inventories now amount to 3,490 billion cubic feet, up 12.1% YoY

Credit News

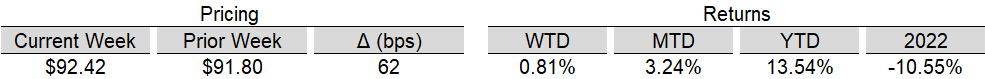

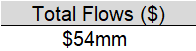

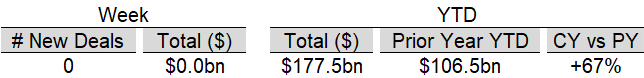

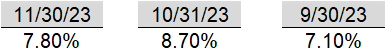

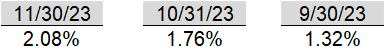

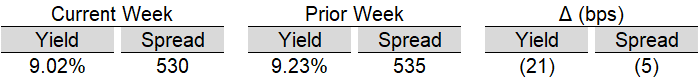

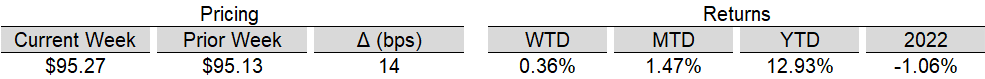

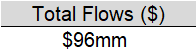

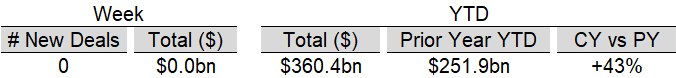

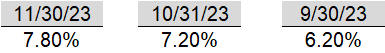

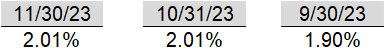

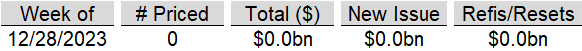

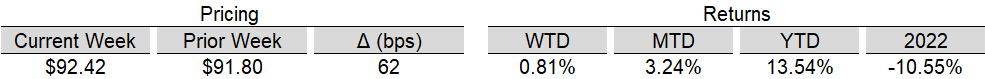

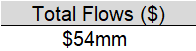

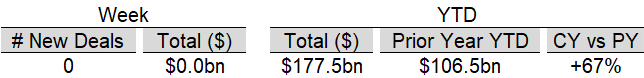

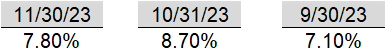

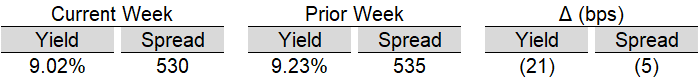

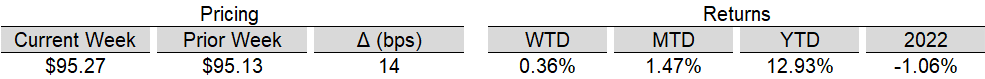

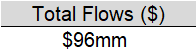

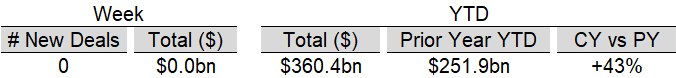

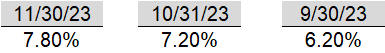

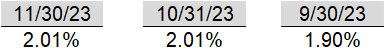

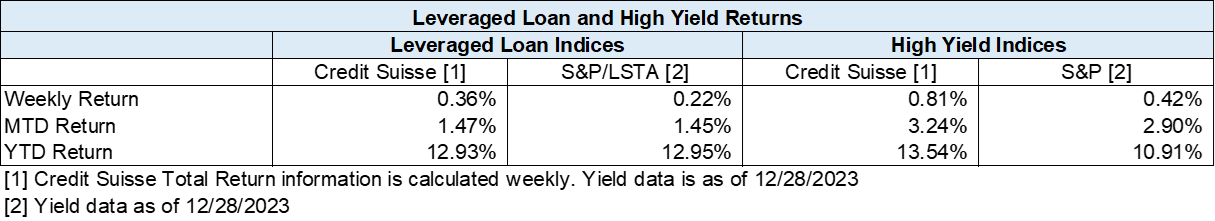

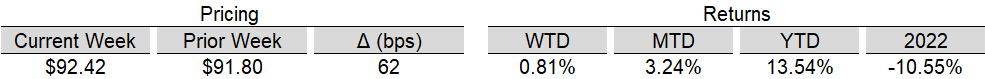

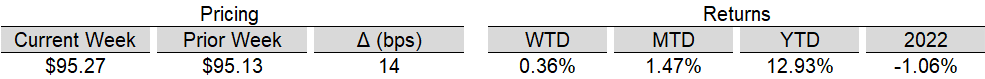

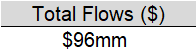

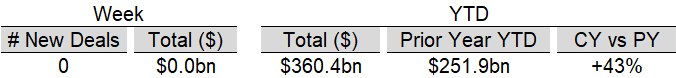

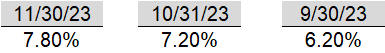

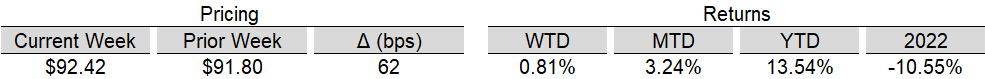

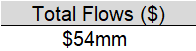

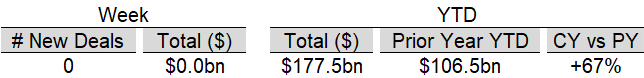

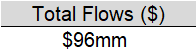

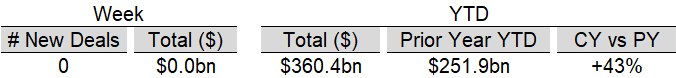

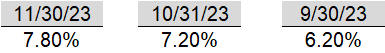

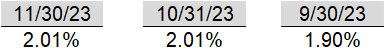

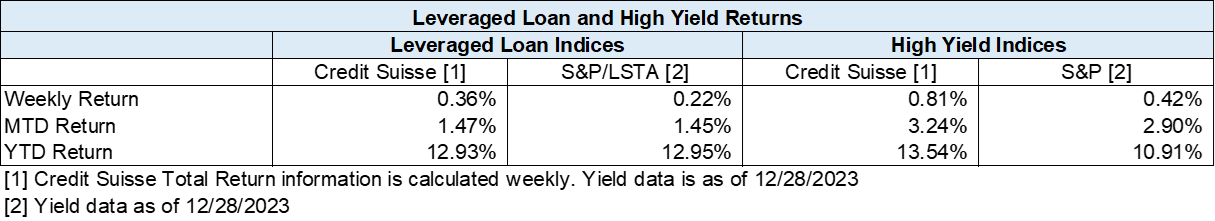

High yield bond yields decreased 20bps to 7.62% and spreads tightened 7bps to 364bps. Leveraged loan yields decreased 21bps to 9.02% and spreads tightened 5bps to 530bps. WTD Leveraged loan returns were positive 36bps. WTD high yield bond returns were positive 81bps. The path of least resistance was upward, as both bonds and loans continued to rally in another seasonally quiet week. For the year, both high yields bonds and loans are set to post similar double-digit returns of ~13%.

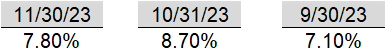

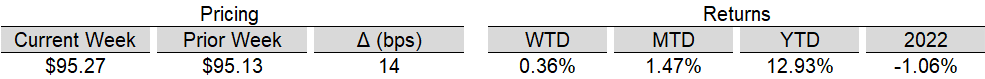

High-yield:

Week ended 12/29/2023

- Yields & Spreads1

- Pricing & Returns1

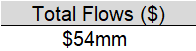

- Fund Flows2

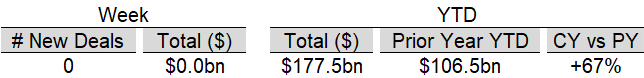

- New Issue2

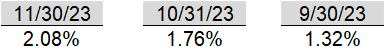

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

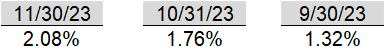

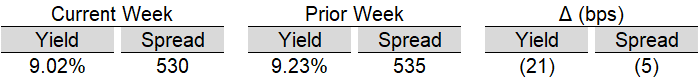

Leveraged loans:

Week ended 12/29/2023

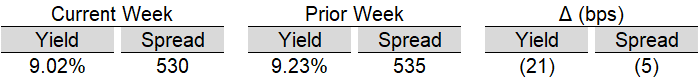

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Ligado Networks ($4.2bn, 11/1/23), Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23), Mallinckrodt ($2.8bn 8/28/23), Yellow Corp ($485mm 8/8/23), Anchor Glass ($675mm 7/11/23), Instant Brands ($391mm 6/12/23), Cyxtera Technologies ($768mm 6/4/23), Diebold ($2.0bn 6/1/23), Envision Health ($7.7bn 5/14/23), Venator Materials ($1.1bn 5/12/23), Bed Bath & Beyond ($5.2bn 4/22/23), David’s Bridal ($254mn 4/17/23), Monitronics International ($794mm 4/15/23), Catalina ($222mn 3/29/23), Diamond Sports ($8.6bn, 2/15/23), Avaya ($2.9bn, 2/14/23), Heritage Power ($485mn, 1/24/23), Serta Simmons Bedding($1.9bn, 1/23/23), Party City Holdings ($1.0bn, 01/17/23), Exela Intermediate ($1.4bn, 1/15/23)

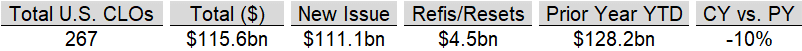

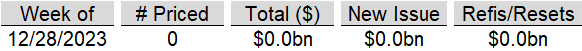

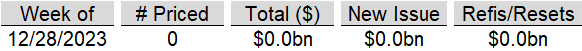

CLOs:

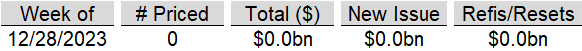

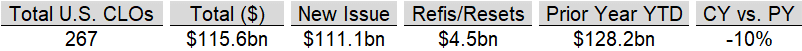

Week ended 12/29/2023

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

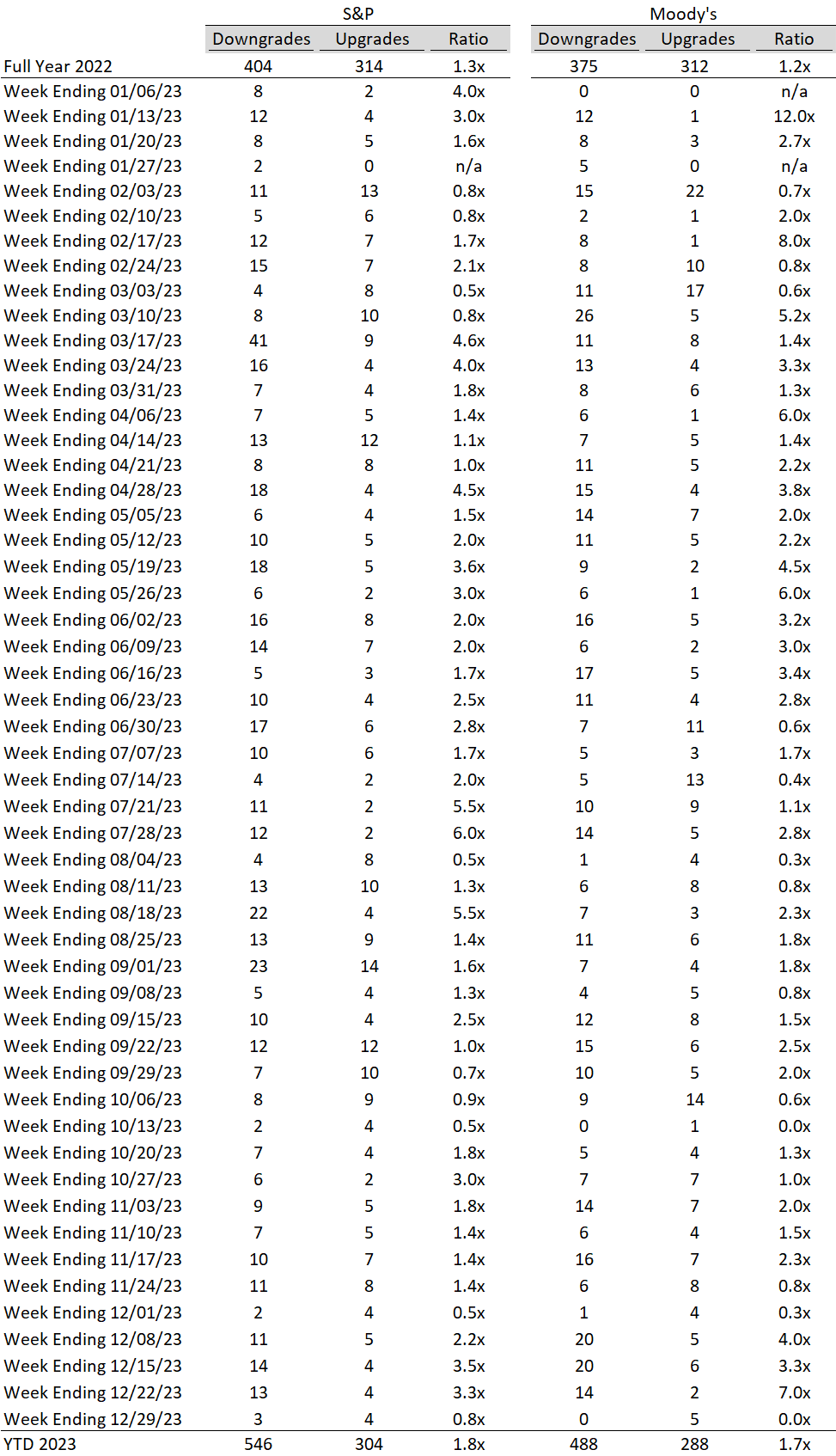

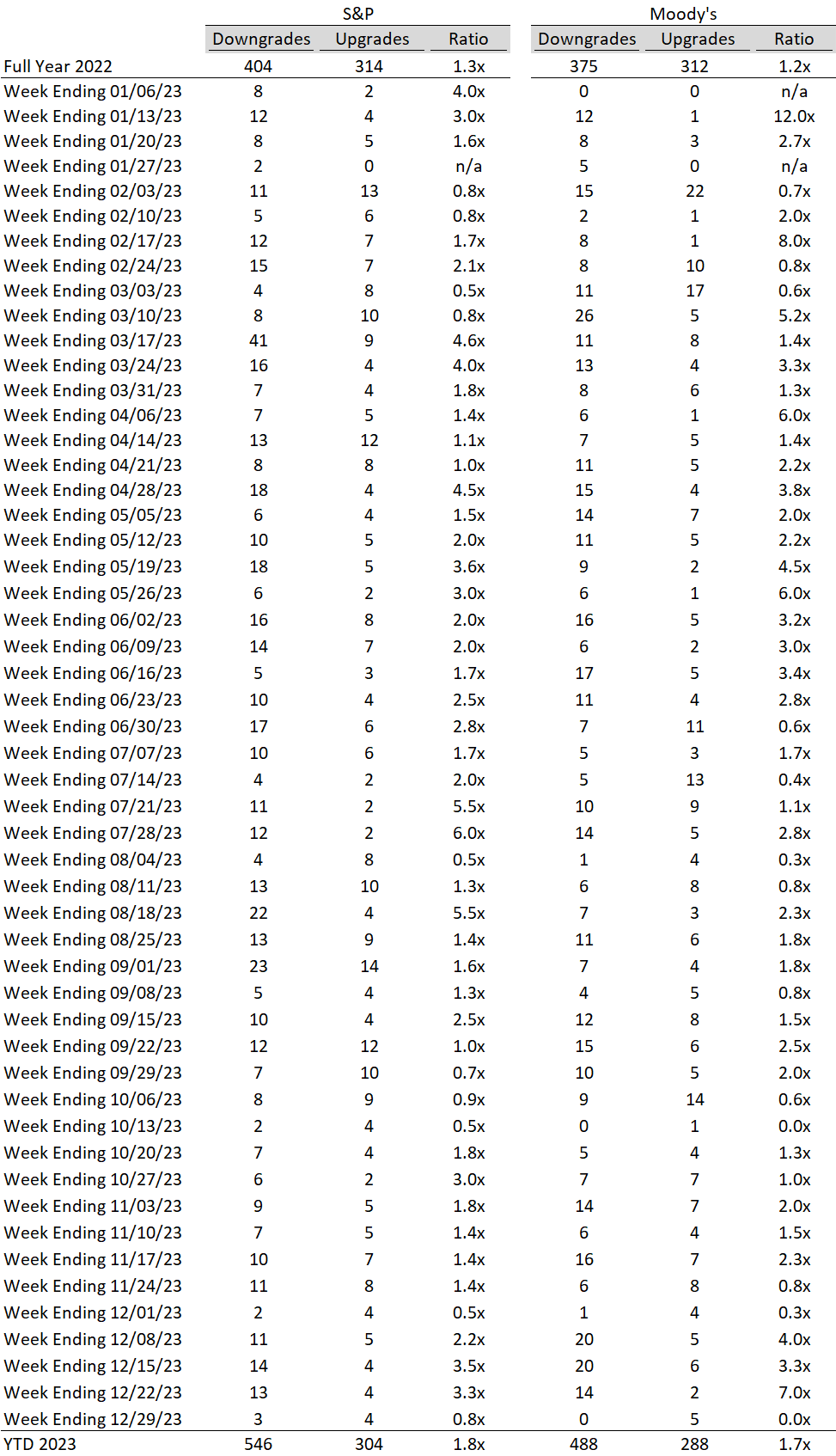

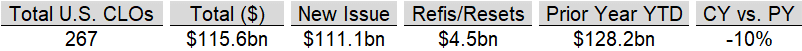

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

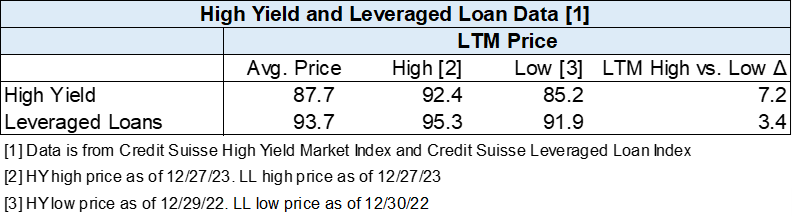

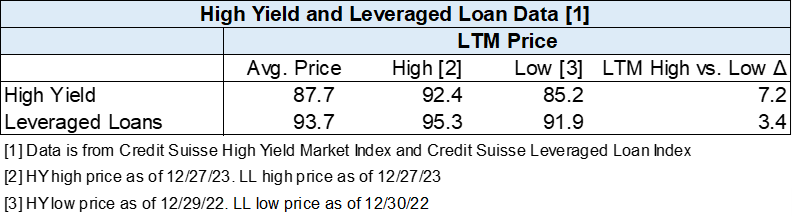

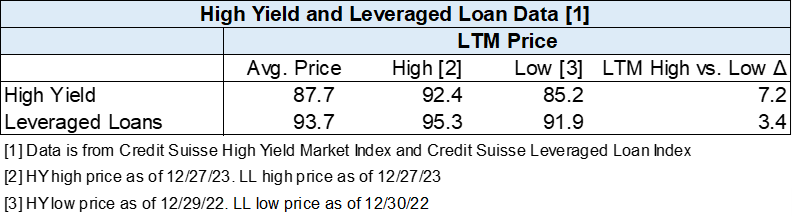

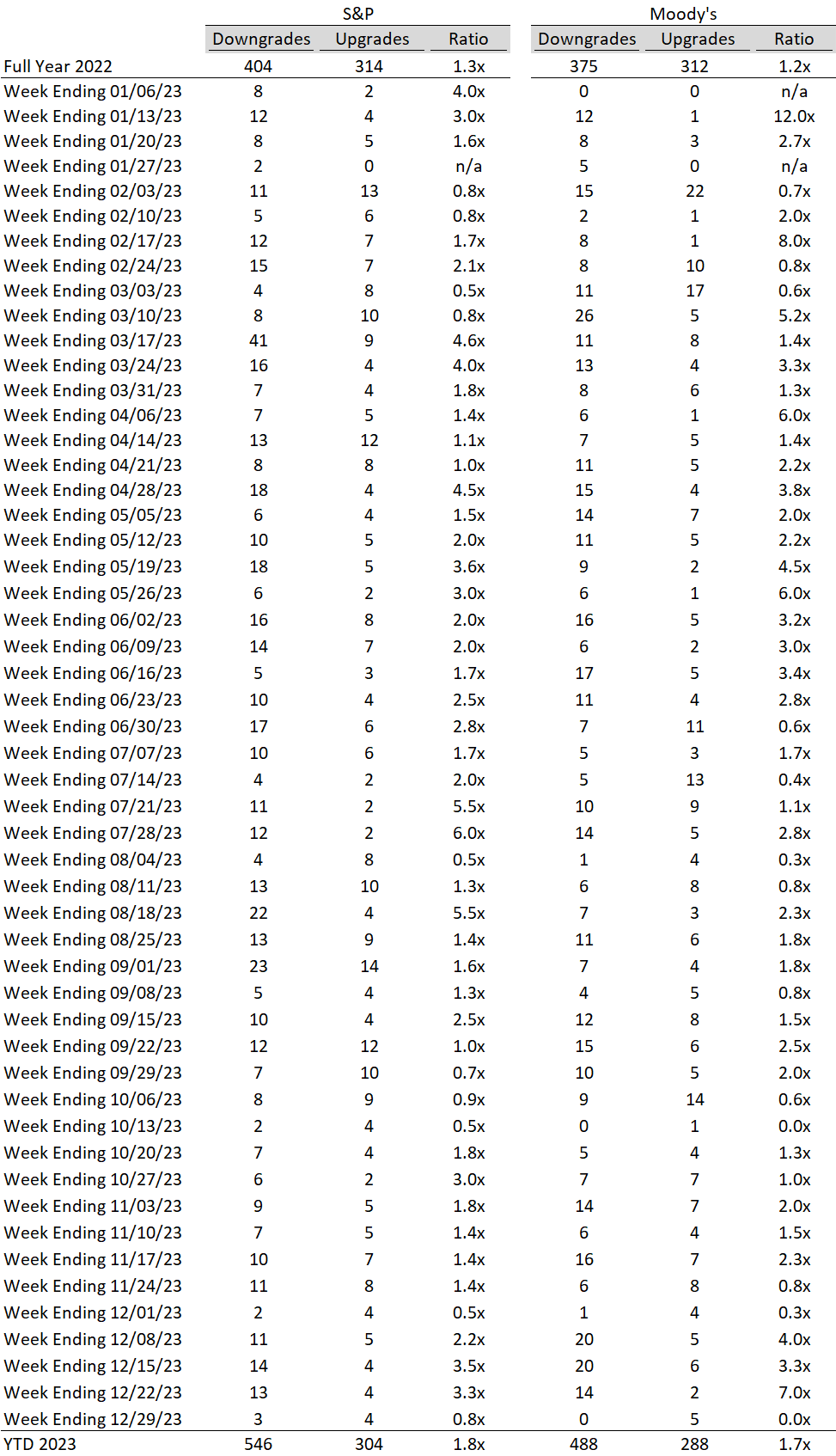

Diagram B: High Yield and Leveraged Loan LTM Price

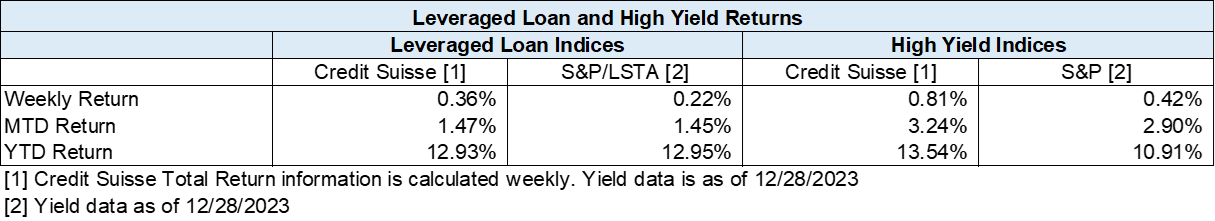

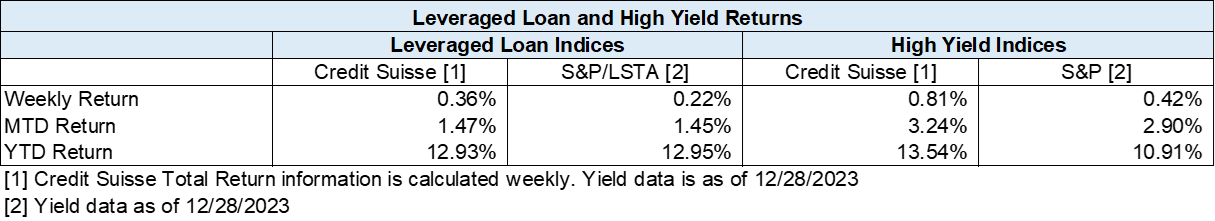

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

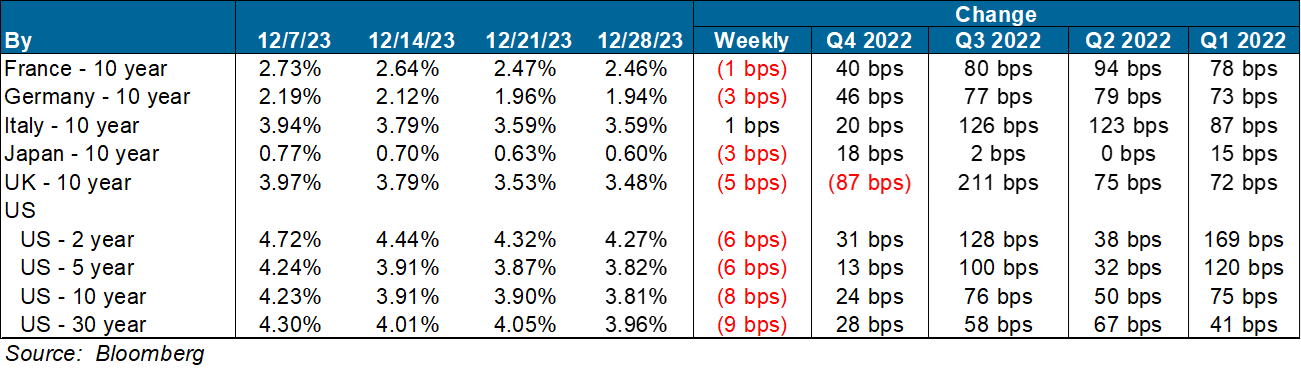

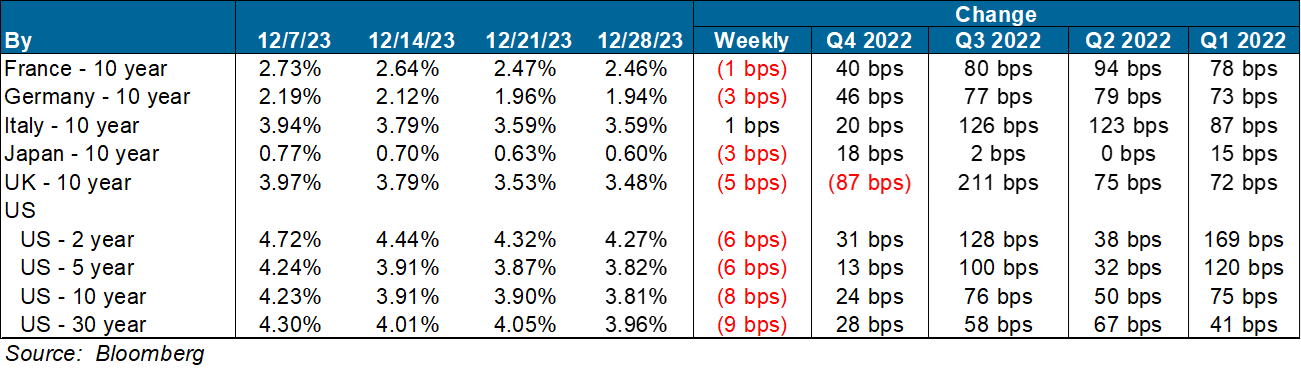

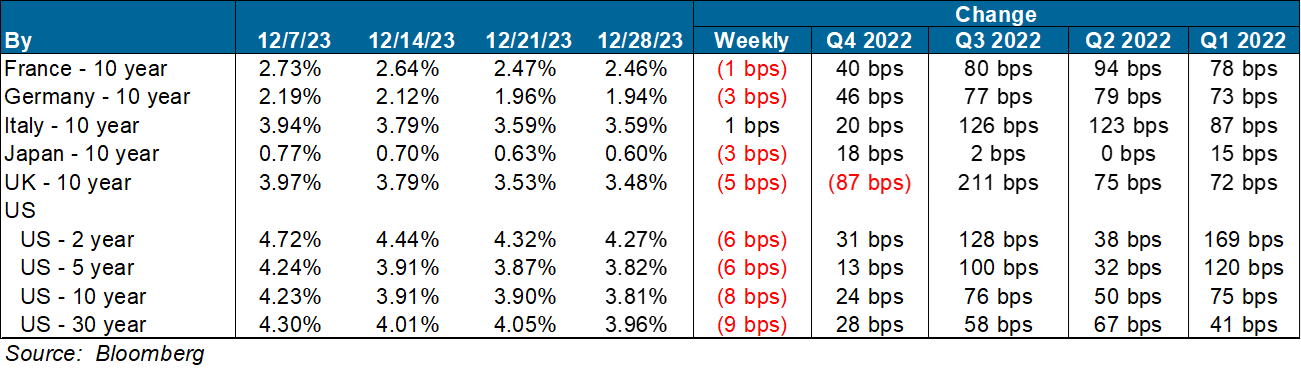

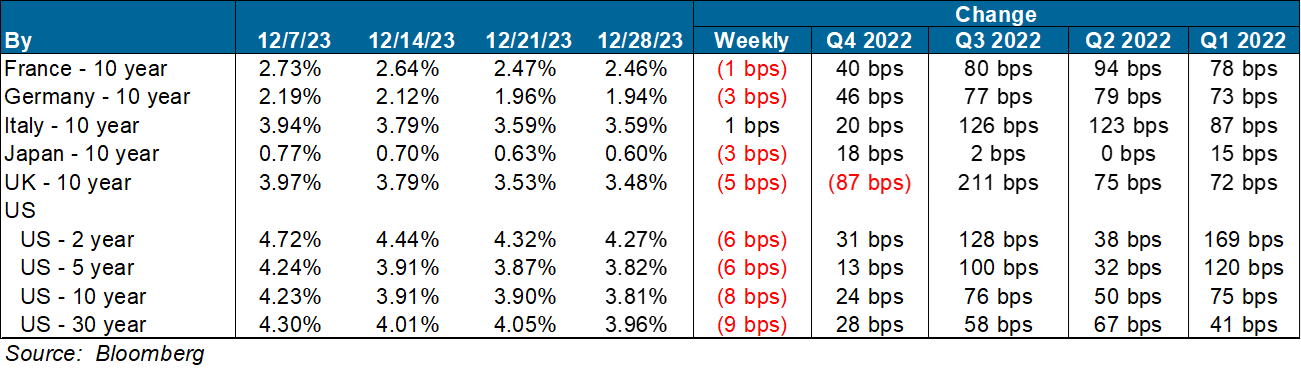

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

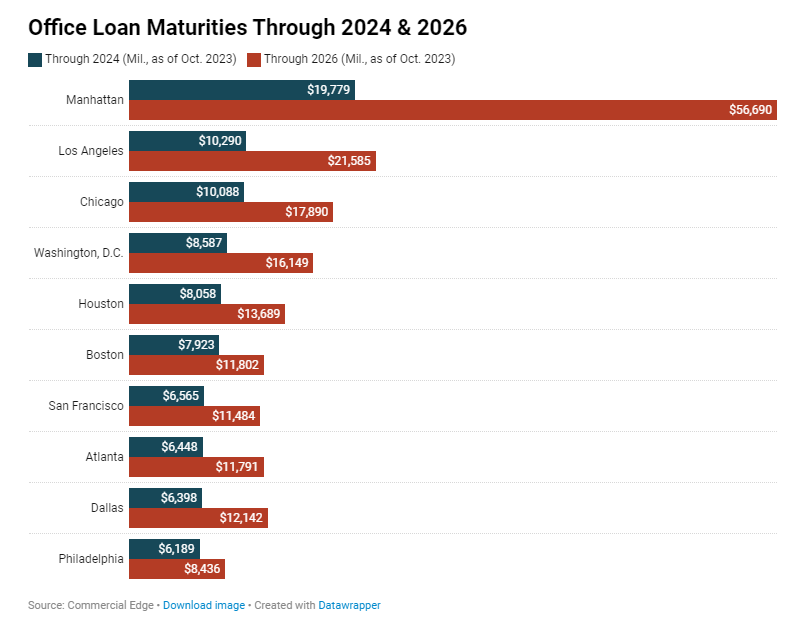

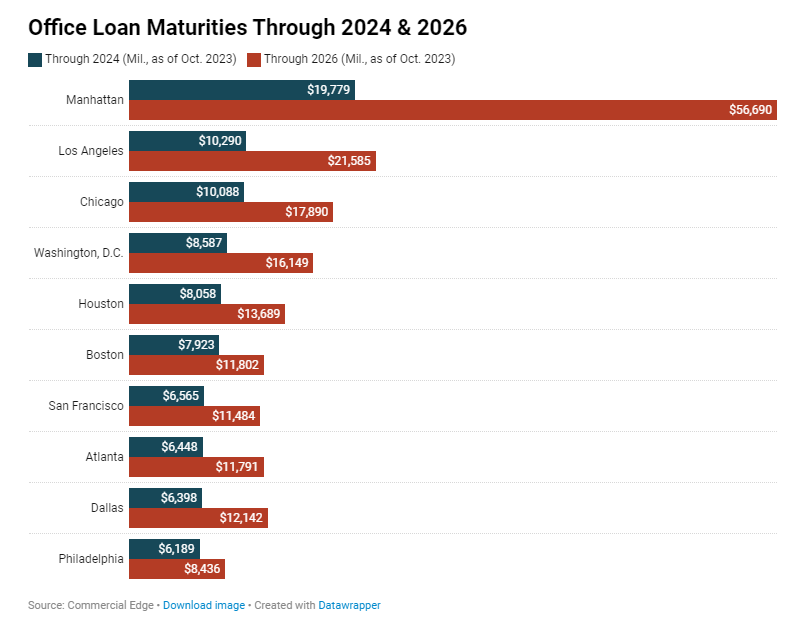

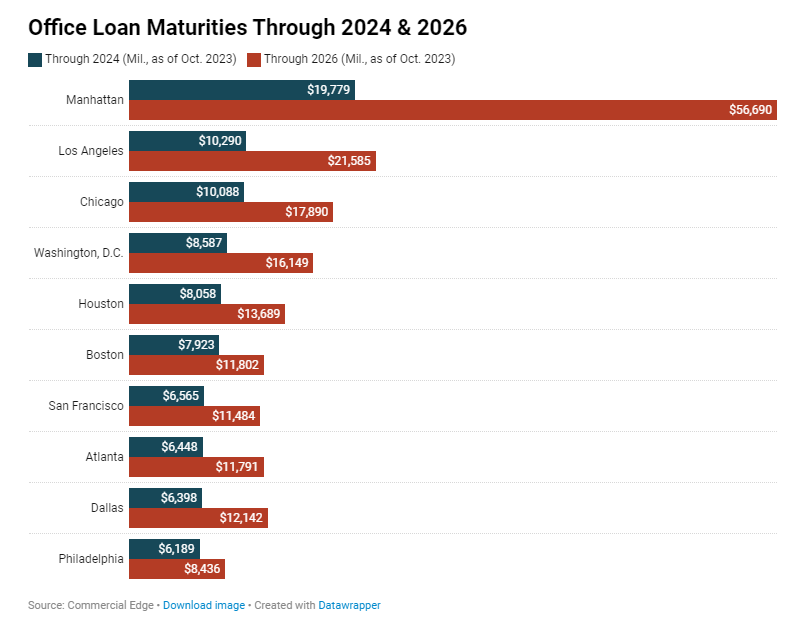

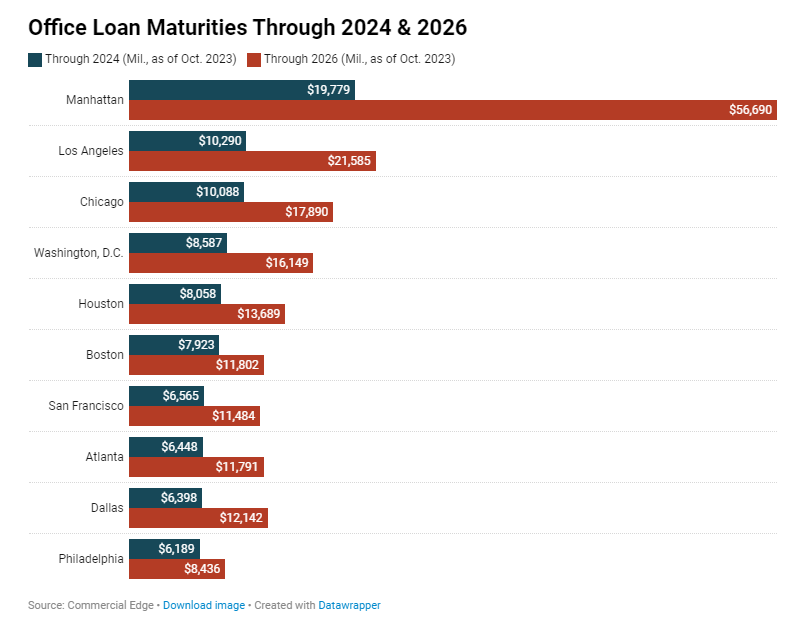

Manhattan Office Loan Maturities

- Notably, the center of this looming crisis is Manhattan, which leads the nation in distressed office properties

- For example, at the beginning of the pandemic, the market’s vacancy rate stood at 7.9%, whereas it had 17.7% of its office space available for lease this October.

- Manhattan Leads U.S. in Maturing Office Debt by Dollar Volume

- Manhattan Has Largest Volume of Maturing Class A & B Office Loans Through 2026

- CommercialEdge identified 1,159 office properties in Manhattan, out of which 136 hold $19.8 billion in loans that are set to mature by the end of 2024

- Manhattan leads the nation’s top markets with $56.7 billion in office loans due by the end of 2026.

- More than three quarters ($46.96 billion) of the maturing loans in Manhattan by the end of 2026 are backed by assets rated Class A+/A.

- Manhattan also leads the nation in maturing Class B and C office loans with $9.72 billion loans due by the end of 2026

- Manhattan stands at the forefront of growing distress in the office property market, signaling potential challenges that extend beyond 2026.

Nationwide:

- Office debt totaled $920 billion across the U.S. in October 2023

- Across the U.S., 32.7% of office loans are set to mature by the end of 2026

U.S. News

- Housing Prices

- Home prices in the 20 major U.S. metropolitan markets were up an average of 4.9 percent in the 12 months ending in October

- This marked the ninth month in a row that home prices have risen due to a persistent lack of homes for sale

- Detroit posted the biggest year-over-year home-price gains in October, up 8.1 percent year over year

- Trade Deficit

- The US international goods deficit widened more than expected to $90.3 billion in November from $89.6 billion in October

- Exports fell 3.6 percent in November, resulting from broad declines across categories such as industrial supplies, vehicles and consumer goods

- Imports contracted 2.1 percent after edging up 0.1 percent in October

- Holiday Sales

- Holiday sales rose this year during the shopping season even with Americans wrestling with higher prices

- Holiday sales from the beginning of November through Christmas Eve climbed 3.1 percent, a slower pace than the 7.6 percent increase from a year earlier

- Online sales jumped 6.3 percent from a year ago and in-person spending rose a modest 2.2 percent

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 218,000 in the week ended December 22, up 12,000 from the prior week

- The four-week moving average was 212,000, down 250 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 14,000 to 1.875 million in the week ended December 15. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.713 trillion in the week ended December 29, down $11.3 billion from the prior week

- Treasury holdings totaled $4.791 trillion, down $3.7 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.44 trillion in the week, down $6.9 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $33.91 trillion as of December 29, an increase of 8.3% from the previous year

- Debt held by the public was $24.48 trillion, and intragovernmental holdings were $7.03 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.1% in November year over year

- On a monthly basis, the CPI increased 0.1% in November on a seasonally adjusted basis, after increasing 0.0% in October

- The index for all items less food and energy (core CPI) rose 0.3% in November, after rising 0.2% in October

- Core CPI increased 4.0% for the 12 months ending November

- Food and Beverages:

- The food at home index increased 1.7% i n November from the same month a year earlier, and increased 0.1% in November month over month

- The food away from home index increased 5.3% in November from the same month a year earlier, and increased 0.4% in November month over month

- Commodities:

- The energy commodities index decreased (5.8%) in November after decreasing

- The energy commodities index fell (9.8%) over the last 12 months

- The energy services index 0.7% in November after decreasing (1.0%) in October

- The energy services index fell (0.1%) over the last 12 months

- The gasoline index fell (8.9%) over the last 12 months

- The fuel oil index fell (24.8%) over the last 12 months

- The index for electricity rose 3.4% over the last 12 months

- The index for natural gas fell (10.4%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $1,660.95 per 40ft

- Drewry’s composite World Container Index has decreased by (21.7%) over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in November after increasing 0.3% in October

- The rent index increased 0.5% in November after increasing 0.3% in October

- The index for lodging away from home decreased (4.5%) in November after decreasing (6.1%) in October

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, up 1.00% year to date

World News

-

Israel/Middle East

- Israeli forces intensified their ground offensive in refugee camps in the central Gaza Strip, as fighting continued to drive Palestinian civilians into shrinking and overcrowded areas in search of safety

- Meanwhile, Egyptian officials worked with Qatar to advance a multiphased proposal to end the war – a plan that neither Hamas nor Israel is likely to accept in its current form

- Since the launch of its military operation in October, Israel has struck several refugee camps in Gaza as it seeks to eradicate Hamas

-

Iran/Red Sea

- The U.S. Navy shot down three anti-ship ballistic missiles on Tuesday launched by incoming Iran-backed Houthi missiles in the Red Sea. It was the first time the Navy shot down an incoming anti-ship ballistic missile in combat, officials say

- The number of commercial ships attacked near the crucial passageway between the Horn of Africa and the Middle East is now at 15. The shipping attacks are part of a broader regional confrontation between Iran’s allies and the U.S. and Israel, and are increasing

- A declassified document from the Defense Department shows Houthi attacks on ships escalated during the first half of December to eight incidents, compared with just three during the last half of November

-

Ukraine

- Ukraine claimed on Tuesday to have carried out an airstrike in Crimea that destroyed a Russian Navy tank landing ship in what would be, if confirmed, the third instance of major losses of Russian military hardware in less than a week

- In a post on Telegram, Ukrainian Air Force commander Mykola Oleshchuk thanked personnel involved in “the destruction of the Novocherkassk large landing ship” while it was in the port of Feodosia in Crimea, the Ukrainian peninsula illegally annexed by Russia in 2014

-

Russia

- A debt-fueled surge in housing prices, along with fast-rising inflation, has exposed stark divisions among Russia’s leaders even as the battle rages on in Ukraine. On one side is the hidebound central bank, tasked with maintaining financial stability. On the other is the Kremlin, which is trying to shore up popular support ahead of the 2024 presidential election

- President Vladimir Putin last week said he planned to extend a popular mortgage program, which offers discounted rates to families with children, through the end of next year

-

China

- President Xi Jinping vowed on Tuesday to resolutely prevent anyone from “splitting Taiwan from China in any way”, a little more than two weeks before Taiwan elects a new leader

- China views democratically-governed Taiwan as its own territory, despite the strong objections of the government in Taipei, and has ramped up military and political pressure to assert its sovereignty claims

-

Indonesia

- At a Chinese nickel smelter in Indonesia, workers were undertaking routine maintenance at dawn when a massive explosion rocked the facility. Waste from a furnace had flowed out and hit flammable material, resulting in the deaths of at least 19 workers and injuring dozens more as hot steam hissed out and fire ripped through the building

-

India

- The Indian navy has dispatched three guided-missile destroyers to protect commercial vessels in the Arabian Sea, after an attack last week on a chemical tanker off the Indian coast

-

North Korea

- North Korea appears to be operating a more powerful reactor for producing plutonium at its main nuclear site for the first time, the United Nations atomic agency said late Thursday

-

Czech Republic

- At least 14 people were killed and dozens more were injured in a mass shooting at a university in central Prague. The shooter was a student at the school, Charles University, according to a spokesman from the Czech Ministry of the Interior

-

Germany

- German authorities detained four alleged members of Hamas suspected of planning to attack Jewish institutions in the region—the first suggestion that the Gaza conflict might be spilling over beyond the Middle East

-

Japan

- Japan said it had asked the U.S. to suspend all non-emergency V-22 Osprey flights over its territory after one fell into the sea in western Japan. One crew member is confirmed dead with seven missing

-

Spain

- Amazon reached an agreement with most of its workers in Spain, averting the full impact of a strike that risked crippling its warehouses on one of the busiest days of the year

Commodities

-

Oil Prices

- WTI: $71.65 per barrel

- (2.60%) WoW; (9.94%) YTD; (8.61%) YoY

- Brent: $77.04 per barrel

- (2.57%) WoW; (8.20%) YTD; (6.35%) YoY

-

US Production

- U.S. oil production amounted to 13.3 million bpd for the week ended December 22, down 0.2 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 622, up 2 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 436.6 million barrels, up 4.2% YoY

- Refiners operated at a capacity utilization rate of 93.3% in the prior week, up from 92.4% in the prior week

- U.S. crude oil imports now amount to 6.750 million barrels per day, down 0.4% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.12 per gallon in the week of December 29,

down (1.9%) YoY

- Gasoline prices on the East Coast amounted to $3.23, up 1.7% YoY

- Gasoline prices in the Midwest amounted to $2.93, down (1.3%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.78, up 0.3% YoY

- Gasoline prices in the Rocky Mountain region amounted to $2.98, down (4.7%) YoY

- Gasoline prices on the West Coast amounted to $4.18, up 3.8% YoY

- Motor gasoline inventories were down by 0.7 million barrels from the prior week

- Motor gasoline inventories amounted to 226.1 million barrels, up 1.4% YoY

- Production of motor gasoline averaged 10.03 million bpd, down (1.1%) YoY

- Demand for motor gasoline amounted to 9.168 million bpd, down (1.7%) YoY

-

Distillates

- Distillate inventories decreased by 0.7 million in the week of December 29

- Total distillate inventories amounted to 115.8 million barrels, down (3.7%) YoY

- Distillate production averaged 5.116 million bpd, up 0.6% YoY

- Demand for distillates averaged 3.977 million bpd in the week, up 2.5% YoY

-

Natural Gas

- Natural gas inventories decreased by 87 billion cubic feet last week

- Total natural gas inventories now amount to 3,490 billion cubic feet, up 12.1% YoY

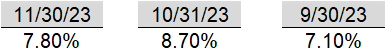

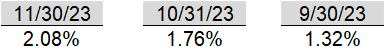

Credit News

High yield bond yields decreased 20bps to 7.62% and spreads tightened 7bps to 364bps. Leveraged loan yields decreased 21bps to 9.02% and spreads tightened 5bps to 530bps. WTD Leveraged loan returns were positive 36bps. WTD high yield bond returns were positive 81bps. The path of least resistance was upward, as both bonds and loans continued to rally in another seasonally quiet week. For the year, both high yields bonds and loans are set to post similar double-digit returns of ~13%.

High-yield:

Week ended 12/29/2023

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 12/29/2023

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Ligado Networks ($4.2bn, 11/1/23), Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23), Mallinckrodt ($2.8bn 8/28/23), Yellow Corp ($485mm 8/8/23), Anchor Glass ($675mm 7/11/23), Instant Brands ($391mm 6/12/23), Cyxtera Technologies ($768mm 6/4/23), Diebold ($2.0bn 6/1/23), Envision Health ($7.7bn 5/14/23), Venator Materials ($1.1bn 5/12/23), Bed Bath & Beyond ($5.2bn 4/22/23), David’s Bridal ($254mn 4/17/23), Monitronics International ($794mm 4/15/23), Catalina ($222mn 3/29/23), Diamond Sports ($8.6bn, 2/15/23), Avaya ($2.9bn, 2/14/23), Heritage Power ($485mn, 1/24/23), Serta Simmons Bedding($1.9bn, 1/23/23), Party City Holdings ($1.0bn, 01/17/23), Exela Intermediate ($1.4bn, 1/15/23)

CLOs:

Week ended 12/29/2023

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

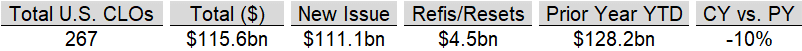

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

Manhattan Office Loan Maturities

- Notably, the center of this looming crisis is Manhattan, which leads the nation in distressed office properties

- For example, at the beginning of the pandemic, the market’s vacancy rate stood at 7.9%, whereas it had 17.7% of its office space available for lease this October.

- Manhattan Leads U.S. in Maturing Office Debt by Dollar Volume

- Manhattan Has Largest Volume of Maturing Class A & B Office Loans Through 2026

- CommercialEdge identified 1,159 office properties in Manhattan, out of which 136 hold $19.8 billion in loans that are set to mature by the end of 2024

- Manhattan leads the nation’s top markets with $56.7 billion in office loans due by the end of 2026.

- More than three quarters ($46.96 billion) of the maturing loans in Manhattan by the end of 2026 are backed by assets rated Class A+/A.

- Manhattan also leads the nation in maturing Class B and C office loans with $9.72 billion loans due by the end of 2026

- Manhattan stands at the forefront of growing distress in the office property market, signaling potential challenges that extend beyond 2026.

Nationwide:

- Office debt totaled $920 billion across the U.S. in October 2023

- Across the U.S., 32.7% of office loans are set to mature by the end of 2026