U.S. News

- Consumer Credit

- U.S. consumer credit rose by $1.5 billion in December, representing a 0.4% annual growth rate

- This represents the slowest pace of credit growth since an outright drop in August

- During the fourth quarter, credit-card and car-loan delinquencies were at their highest point in more than a decade

- Trade Deficit

- In December, the U.S. trade gap widened by 0.5% to $62.2 billion

- Imports fell 1.3% in December to $320.4 billion, which is largely reflective of the lower cost of oil and less household demand for consumer goods

- Exports rose 1.2% in December to $258.2 billion, representing a record high in 2023

- Wholesale Inventories

- Wholesale inventories in the U.S. rose 0.4% in December, adding to strong gross domestic product in the fourth quarter

- The inventory-to-sales ratio, which reflects how long it would take a company to sell all the goods sitting on warehouse shelves, was flat at 1.34 months

- A year ago the ratio was higher at 1.40

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 218,000 in the week ended February 2, down 9,000 from the prior week

- The four-week moving average was 212,250, up 3750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – decreased by 23,000 to 1.871 million in the week ended January 26. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.631 trillion in the week ended February 9, up $1.2 billion from the prior week

- Treasury holdings totaled $4.693 trillion, down $23.8 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.42 trillion in the week, down $13.2 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.20 trillion as of February 9, an increase of 8.7% from the previous year

- Debt held by the public was $24.63 trillion, and intragovernmental holdings were $7.12 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.4% in December year over year

- On a monthly basis, the CPI increased 0.2% in December on a seasonally adjusted basis, after increasing 0.2% in November

- The index for all items less food and energy (core CPI) rose 0.3% in December, after rising 0.3% in November

- Core CPI increased 3.9% for the 12 months ending December

- Food and Beverages:

- The food at home index increased 1.3% i n December from the same month a year earlier, and increased 0.1% in December month over month

- The food away from home index increased 5.2% in December from the same month a year earlier, and increased 0.3% in December month over month

- Commodities:

- The energy commodities index decreased (0.7%) in December after decreasing

- The energy commodities index fell (2.6%) over the last 12 months

- The energy services index 0.4% in December after increasing 0.7% in November

- The energy services index fell (1.1%) over the last 12 months

- The gasoline index fell (1.9%) over the last 12 months

- The fuel oil index fell (14.7%) over the last 12 months

- The index for electricity rose 3.3% over the last 12 months

- The index for natural gas fell (13.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $3,785.82 per 40ft container

- Drewry’s composite World Container Index has increased by 89.6% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in December after increasing 0.4% in November

- The rent index increased 0.4% in December after increasing 0.4% in November

- The index for lodging away from home decreased (1.1%) in December after decreasing (4.5%) in November

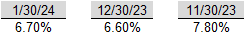

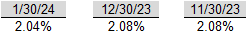

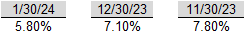

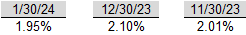

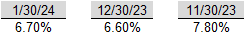

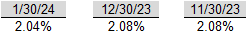

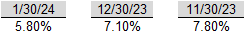

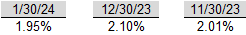

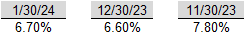

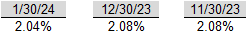

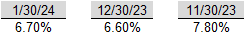

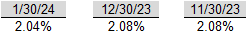

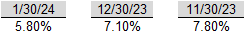

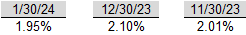

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel

- On Friday, Israeli Prime Minister Benjamin Netanyahu ordered his military to prepare a plan for the evacuation of Rafah, laying the groundwork for Israeli troops to take their fight against Hamas into a city where more than a million people are currently taking refuge

- Netanyahu’s office said Israel can’t achieve its stated war aim of destroying Hamas without pushing into Rafah, where Israeli officials say there are Hamas battalions and smuggling routes. “It is clear that a massive operation in Rafah requires the evacuation of the civilian population from the combat zones,” the prime minister’s office said

- Fresh airstrikes on the city hit homes and killed at least eight people, Gaza residents and the Palestinian Authority’s information agency said Friday. Many of the Gaza residents currently in Rafah fled fighting in the northern part of the enclave earlier in the war

-

Russia / Ukraine

- Ukrainian President Volodymyr Zelensky removed his top general in the most significant shake-up of the country’s leadership since the full-scale Russian invasion began nearly two years ago

- Zelensky said in a video address Thursday that urgent changes were needed to overhaul the military as he announced his dismissal of General Valeriy Zaluzhniy, the popular commander in chief of Ukraine’s armed forces

- The removal of Zaluzhniy, widely admired by Ukraine’s public and military, comes as the country faces rising challenges on the battlefield. Its manpower and equipment are depleted after a failed counteroffensive last year and Russia is on the attack, while additional military funding from the U.S. is in doubt amid deadlock in Congress

-

China

- China’s 100 largest developers recorded a deep slump in new-home sales in January, according to data from China Real Estate Information. They sold homes valued at $32.83 billion, down 34% from a year earlier. It was the worst month of sales since at least July 2020, when the data provider changed how it calculates them

- The sharp contraction in home sales shows just how big the hurdles are for Chinese government officials trying to turn around an economy that is faltering on multiple fronts

- The property data was released on the same day as more bad news: A contraction in Chinese manufacturing activity for the fourth straight month, another alarming sign for a country that has often been called the world’s factory floor

-

Brazil

- Brazilian Federal Police seized the passport of former President Jair Bolsonaro and arrested four of his close allies as authorities narrowed in on the conservative and his aides over allegations that they plotted a military takeover as early as late-2022

-

Nicaragua

- Nicaragua’s authoritarian government, which has expelled religious leaders, political opponents and journalists, has granted asylum to a former Panamanian president convicted of money laundering, the third former leader from the region to find refuge in Managua

-

Argentina

- Argentina’s Chamber of Deputies on Friday approved in general terms a reform bill proposed by libertarian President Javier Milei to deregulate the economy, overcoming a hurdle for the sweeping initiative after three days of heated debate

-

Sweden

- Hungarian Prime Minister Viktor Orban escalated a standoff with Western allies over Sweden’s NATO accession after a senior US lawmaker called for potential sanctions against the lone holdout

-

Canada

- Prime Minister Justin Trudeau has confirmed that his government is considering imposing sanctions on Israeli settlers in the West Bank

-

Ecuador

- Ecuador is at war with drug gangs, President Daniel Noboa said, as troops patrolled the country’s largest city, Guayaquil, a day after gunmen took over a TV studio and launched a series of attacks against the Andean nation’s new government

Commodities

-

Oil Prices

- WTI: $76.51 per barrel

- 5.85% WoW; 6.78% YTD; (1.99%) YoY

- Brent: $81.90 per barrel

- 5.91% WoW; 6.31% YTD; (3.08%) YoY

-

US Production

- U.S. oil production amounted to 13.3 million bpd for the week ended February 2, up 1.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 623, up 4 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 427.4 million barrels, down (6.1%) YoY

- Refiners operated at a capacity utilization rate of 82.4% for the week, down from 82.9% in the prior week

- U.S. crude oil imports now amount to 5.605 million barrels per day, down (2.1%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.17 per gallon in the week of February 9,

down (7.7%) YoY

- Gasoline prices on the East Coast amounted to $3.23, down (8.0%) YoY

- Gasoline prices in the Midwest amounted to $2.99, down (11.4%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.91, down (8.3%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $2.86, down (24.9%) YoY

- Gasoline prices on the West Coast amounted to $4.12, down (2.6%) YoY

- Motor gasoline inventories were up by 3.1 million barrels from the prior week

- Motor gasoline inventories amounted to 251.0 million barrels, up 4.8% YoY

- Production of motor gasoline averaged 9.01 million bpd, down (0.9%) YoY

- Demand for motor gasoline amounted to 8.807 million bpd, up (4.5%) YoY

-

Distillates

- Distillate inventories decreased by -3.2 million in the week of February 9

- Total distillate inventories amounted to 127.6 million barrels, up 5.9% YoY

- Distillate production averaged 4.357 million bpd, down (6.6%) YoY

- Demand for distillates averaged 3.817 million bpd in the week, up 1.5% YoY

-

Natural Gas

- Natural gas inventories decreased by 75 billion cubic feet last week

- Total natural gas inventories now amount to 2,584 billion cubic feet, up 9.2% YoY

Credit News

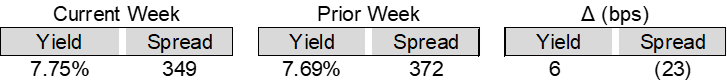

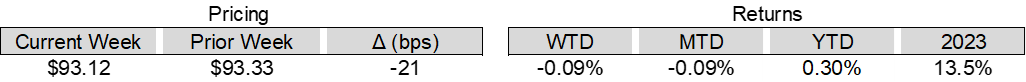

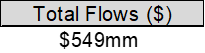

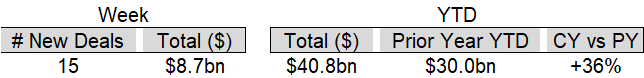

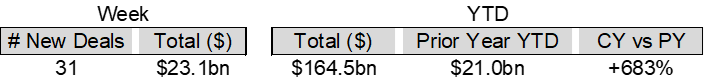

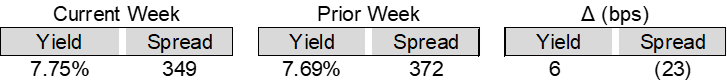

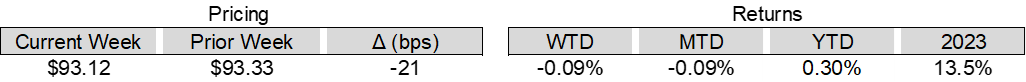

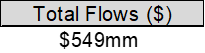

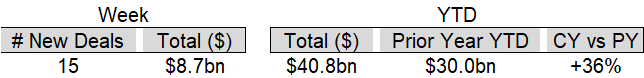

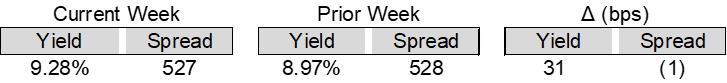

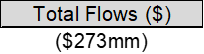

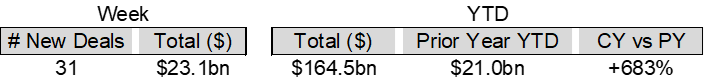

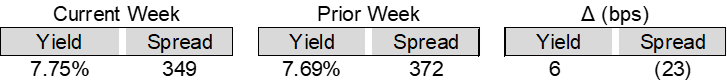

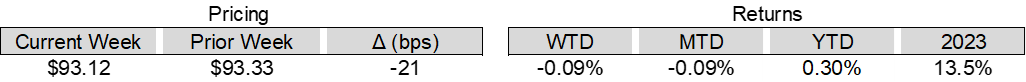

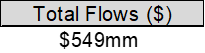

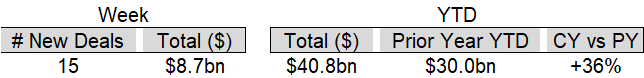

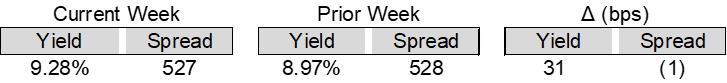

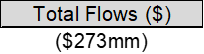

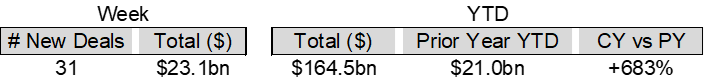

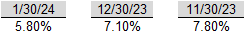

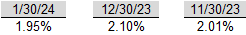

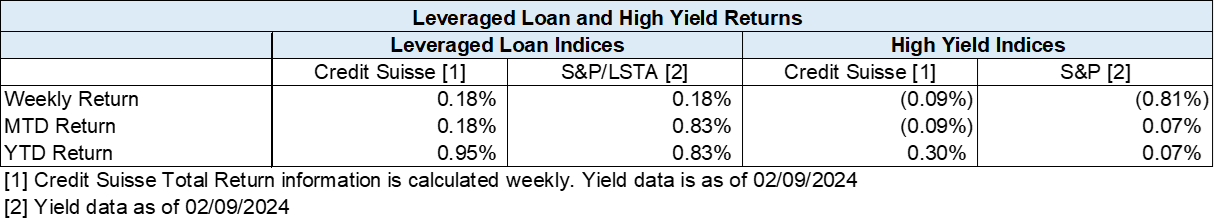

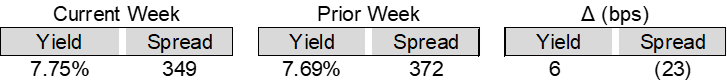

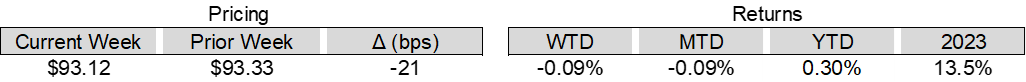

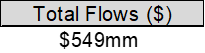

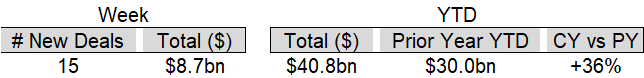

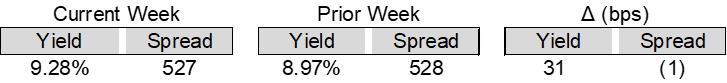

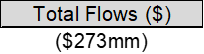

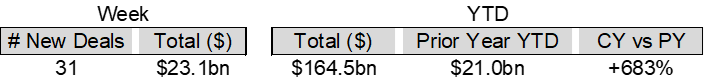

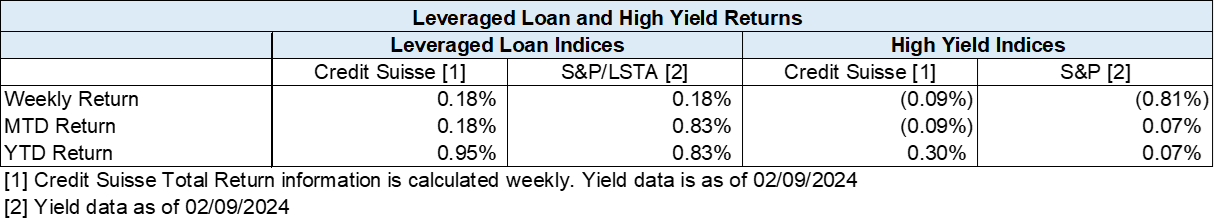

High yield bond yields increased 6bps to 7.75% and spreads decreased 23bps to 349bps. Leveraged loan yields increased 31bps to 9.28% and spreads decreased 1bps to 527bps. WTD Leveraged loan returns were positive 18bps. WTD high yield bond returns were negative 9bps. 10yr treasury yields were 12bps higher on week pushing the yield back above 4%. For the week, spreads and yields generally moved in different directions. Yields rose as markets priced in a less aggressive path of interest rate cuts due to stronger economic data. Spreads decreased as the ongoing solid economic data increased confidence the US economy will achieve a soft landing.

High-yield:

Week ended 02/09/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 02/09/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Enviva Partners ($750mn, 1/15/24, Mobileum ($538mm, 12/1/23) Ligado Networks ($4.2bn, 11/1/23), Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23)

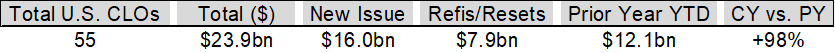

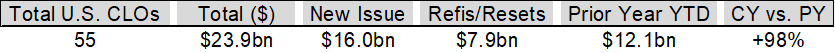

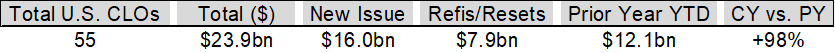

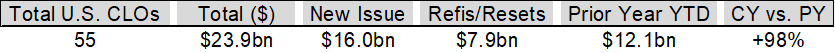

CLOs:

Week ended 02/09/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

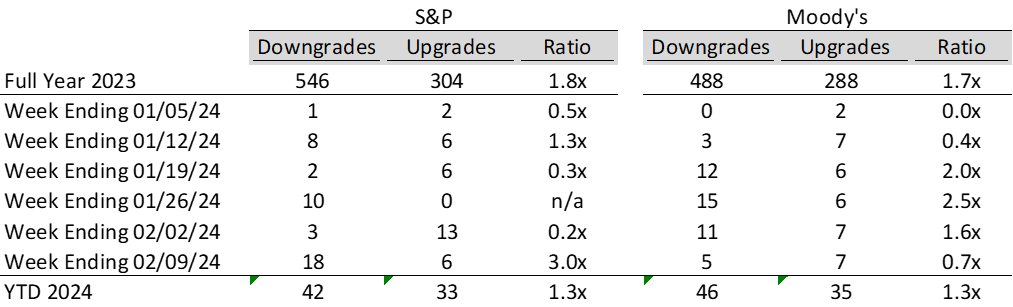

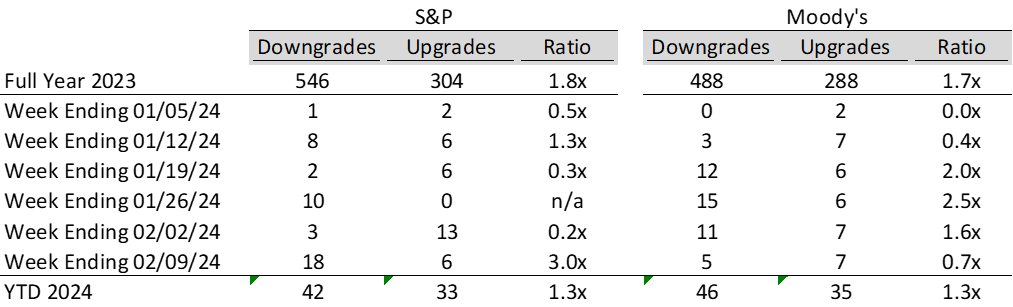

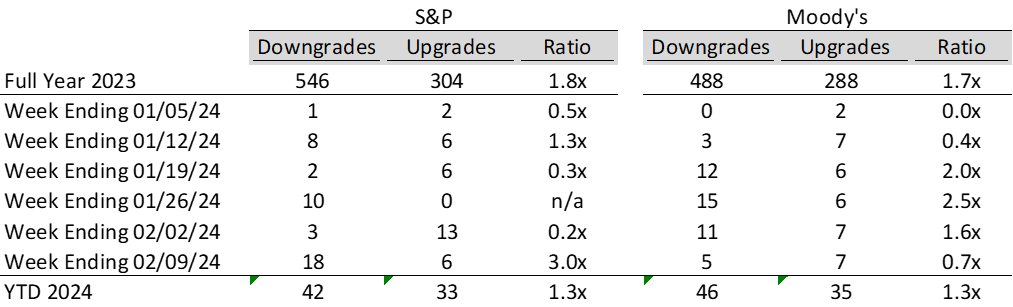

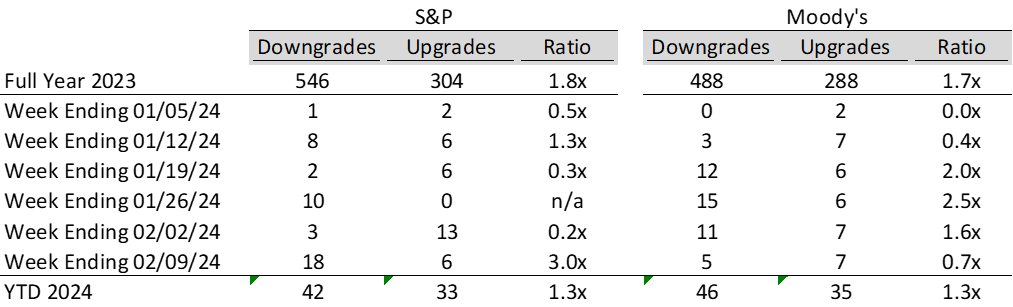

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

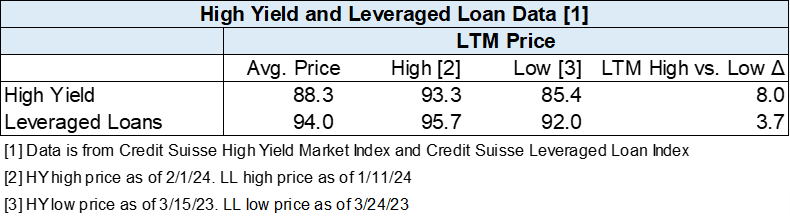

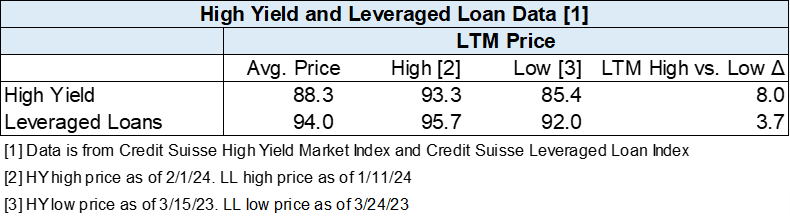

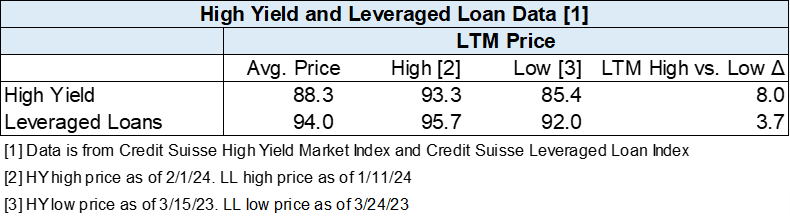

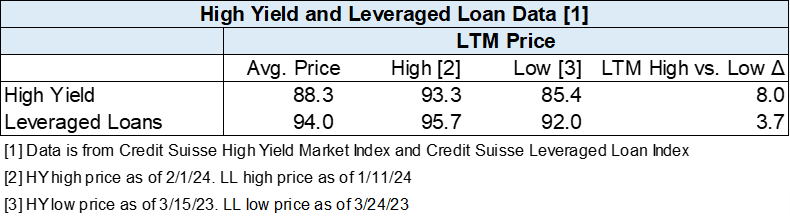

Diagram B: High Yield and Leveraged Loan LTM Price

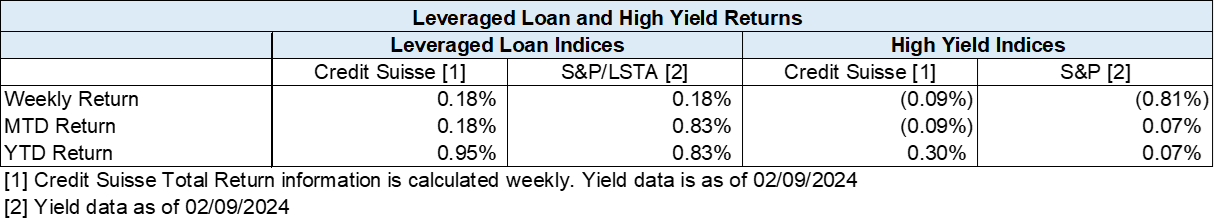

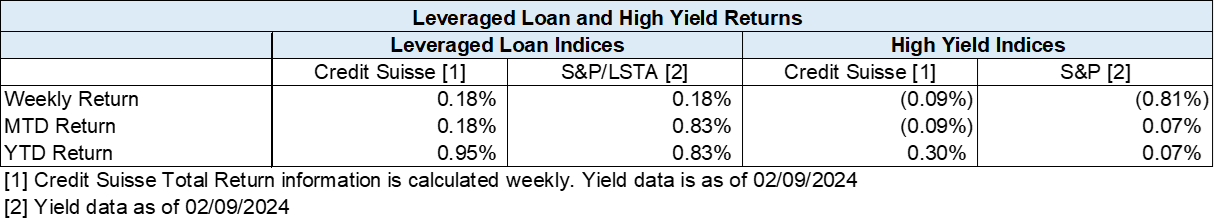

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

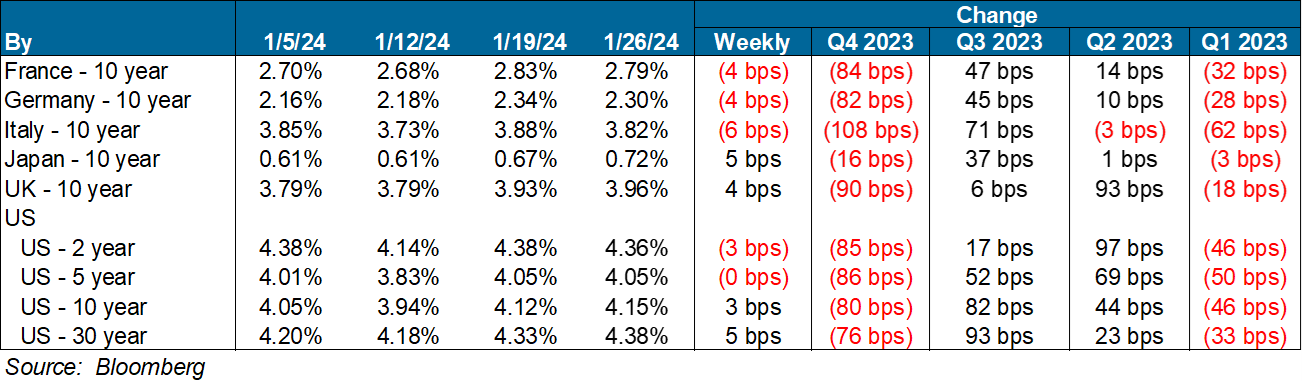

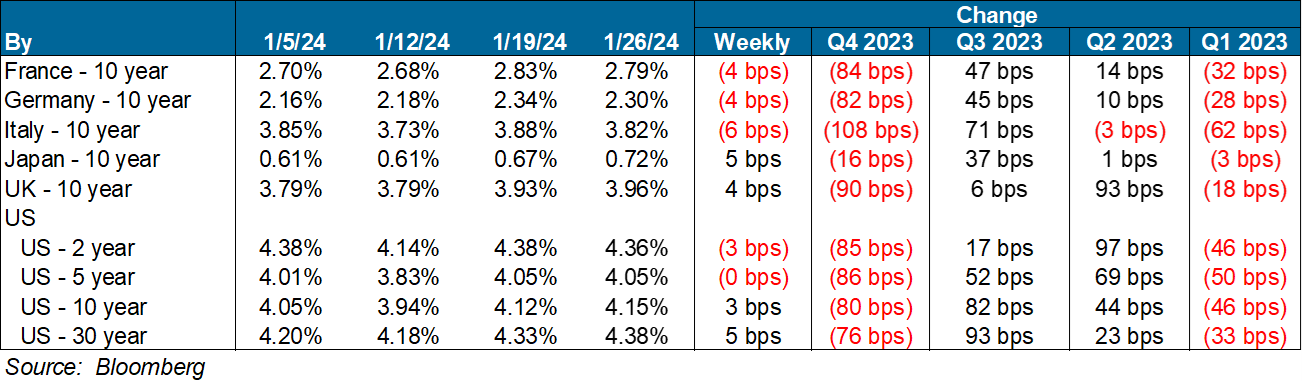

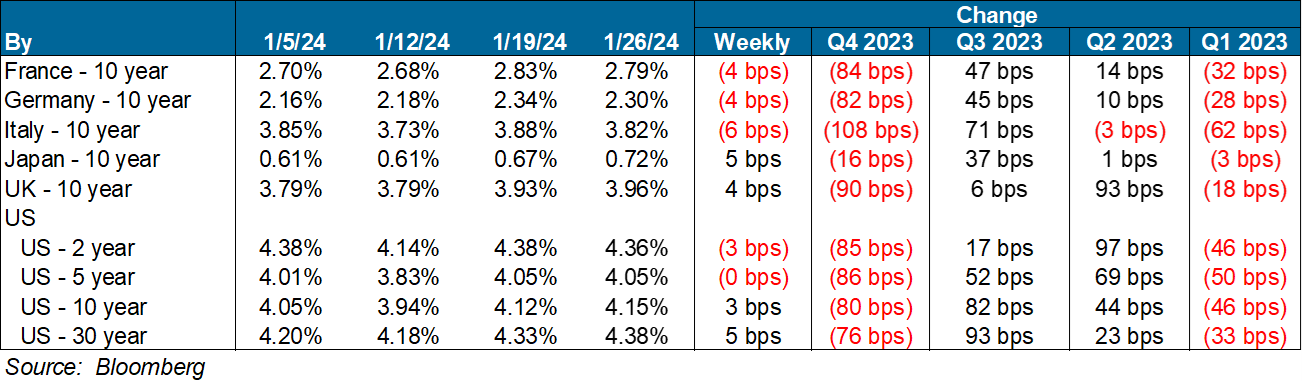

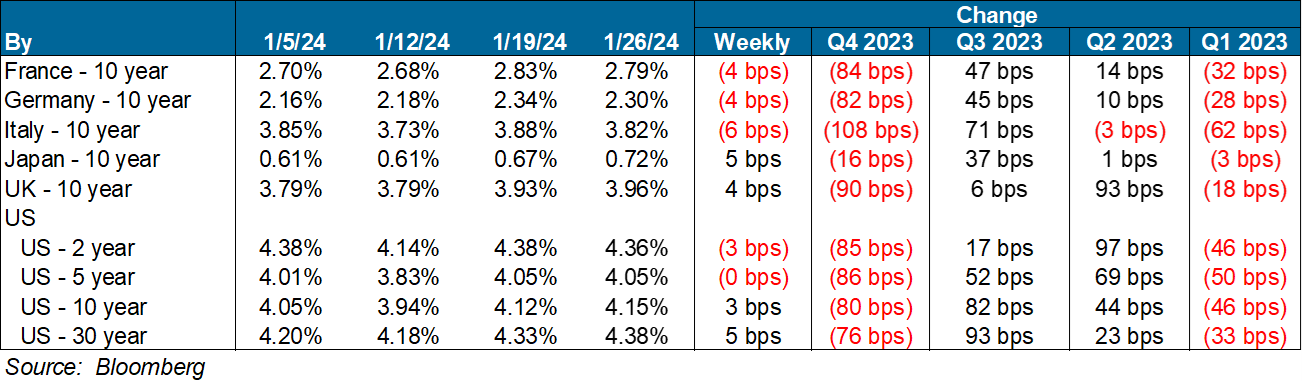

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

U.S. News

- Consumer Credit

- U.S. consumer credit rose by $1.5 billion in December, representing a 0.4% annual growth rate

- This represents the slowest pace of credit growth since an outright drop in August

- During the fourth quarter, credit-card and car-loan delinquencies were at their highest point in more than a decade

- Trade Deficit

- In December, the U.S. trade gap widened by 0.5% to $62.2 billion

- Imports fell 1.3% in December to $320.4 billion, which is largely reflective of the lower cost of oil and less household demand for consumer goods

- Exports rose 1.2% in December to $258.2 billion, representing a record high in 2023

- Wholesale Inventories

- Wholesale inventories in the U.S. rose 0.4% in December, adding to strong gross domestic product in the fourth quarter

- The inventory-to-sales ratio, which reflects how long it would take a company to sell all the goods sitting on warehouse shelves, was flat at 1.34 months

- A year ago the ratio was higher at 1.40

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 218,000 in the week ended February 2, down 9,000 from the prior week

- The four-week moving average was 212,250, up 3750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – decreased by 23,000 to 1.871 million in the week ended January 26. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.631 trillion in the week ended February 9, up $1.2 billion from the prior week

- Treasury holdings totaled $4.693 trillion, down $23.8 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.42 trillion in the week, down $13.2 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.20 trillion as of February 9, an increase of 8.7% from the previous year

- Debt held by the public was $24.63 trillion, and intragovernmental holdings were $7.12 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.4% in December year over year

- On a monthly basis, the CPI increased 0.2% in December on a seasonally adjusted basis, after increasing 0.2% in November

- The index for all items less food and energy (core CPI) rose 0.3% in December, after rising 0.3% in November

- Core CPI increased 3.9% for the 12 months ending December

- Food and Beverages:

- The food at home index increased 1.3% i n December from the same month a year earlier, and increased 0.1% in December month over month

- The food away from home index increased 5.2% in December from the same month a year earlier, and increased 0.3% in December month over month

- Commodities:

- The energy commodities index decreased (0.7%) in December after decreasing

- The energy commodities index fell (2.6%) over the last 12 months

- The energy services index 0.4% in December after increasing 0.7% in November

- The energy services index fell (1.1%) over the last 12 months

- The gasoline index fell (1.9%) over the last 12 months

- The fuel oil index fell (14.7%) over the last 12 months

- The index for electricity rose 3.3% over the last 12 months

- The index for natural gas fell (13.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $3,785.82 per 40ft container

- Drewry’s composite World Container Index has increased by 89.6% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in December after increasing 0.4% in November

- The rent index increased 0.4% in December after increasing 0.4% in November

- The index for lodging away from home decreased (1.1%) in December after decreasing (4.5%) in November

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel

- On Friday, Israeli Prime Minister Benjamin Netanyahu ordered his military to prepare a plan for the evacuation of Rafah, laying the groundwork for Israeli troops to take their fight against Hamas into a city where more than a million people are currently taking refuge

- Netanyahu’s office said Israel can’t achieve its stated war aim of destroying Hamas without pushing into Rafah, where Israeli officials say there are Hamas battalions and smuggling routes. “It is clear that a massive operation in Rafah requires the evacuation of the civilian population from the combat zones,” the prime minister’s office said

- Fresh airstrikes on the city hit homes and killed at least eight people, Gaza residents and the Palestinian Authority’s information agency said Friday. Many of the Gaza residents currently in Rafah fled fighting in the northern part of the enclave earlier in the war

-

Russia / Ukraine

- Ukrainian President Volodymyr Zelensky removed his top general in the most significant shake-up of the country’s leadership since the full-scale Russian invasion began nearly two years ago

- Zelensky said in a video address Thursday that urgent changes were needed to overhaul the military as he announced his dismissal of General Valeriy Zaluzhniy, the popular commander in chief of Ukraine’s armed forces

- The removal of Zaluzhniy, widely admired by Ukraine’s public and military, comes as the country faces rising challenges on the battlefield. Its manpower and equipment are depleted after a failed counteroffensive last year and Russia is on the attack, while additional military funding from the U.S. is in doubt amid deadlock in Congress

-

China

- China’s 100 largest developers recorded a deep slump in new-home sales in January, according to data from China Real Estate Information. They sold homes valued at $32.83 billion, down 34% from a year earlier. It was the worst month of sales since at least July 2020, when the data provider changed how it calculates them

- The sharp contraction in home sales shows just how big the hurdles are for Chinese government officials trying to turn around an economy that is faltering on multiple fronts

- The property data was released on the same day as more bad news: A contraction in Chinese manufacturing activity for the fourth straight month, another alarming sign for a country that has often been called the world’s factory floor

-

Brazil

- Brazilian Federal Police seized the passport of former President Jair Bolsonaro and arrested four of his close allies as authorities narrowed in on the conservative and his aides over allegations that they plotted a military takeover as early as late-2022

-

Nicaragua

- Nicaragua’s authoritarian government, which has expelled religious leaders, political opponents and journalists, has granted asylum to a former Panamanian president convicted of money laundering, the third former leader from the region to find refuge in Managua

-

Argentina

- Argentina’s Chamber of Deputies on Friday approved in general terms a reform bill proposed by libertarian President Javier Milei to deregulate the economy, overcoming a hurdle for the sweeping initiative after three days of heated debate

-

Sweden

- Hungarian Prime Minister Viktor Orban escalated a standoff with Western allies over Sweden’s NATO accession after a senior US lawmaker called for potential sanctions against the lone holdout

-

Canada

- Prime Minister Justin Trudeau has confirmed that his government is considering imposing sanctions on Israeli settlers in the West Bank

-

Ecuador

- Ecuador is at war with drug gangs, President Daniel Noboa said, as troops patrolled the country’s largest city, Guayaquil, a day after gunmen took over a TV studio and launched a series of attacks against the Andean nation’s new government

Commodities

-

Oil Prices

- WTI: $76.51 per barrel

- 5.85% WoW; 6.78% YTD; (1.99%) YoY

- Brent: $81.90 per barrel

- 5.91% WoW; 6.31% YTD; (3.08%) YoY

-

US Production

- U.S. oil production amounted to 13.3 million bpd for the week ended February 2, up 1.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 623, up 4 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 427.4 million barrels, down (6.1%) YoY

- Refiners operated at a capacity utilization rate of 82.4% for the week, down from 82.9% in the prior week

- U.S. crude oil imports now amount to 5.605 million barrels per day, down (2.1%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.17 per gallon in the week of February 9,

down (7.7%) YoY

- Gasoline prices on the East Coast amounted to $3.23, down (8.0%) YoY

- Gasoline prices in the Midwest amounted to $2.99, down (11.4%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.91, down (8.3%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $2.86, down (24.9%) YoY

- Gasoline prices on the West Coast amounted to $4.12, down (2.6%) YoY

- Motor gasoline inventories were up by 3.1 million barrels from the prior week

- Motor gasoline inventories amounted to 251.0 million barrels, up 4.8% YoY

- Production of motor gasoline averaged 9.01 million bpd, down (0.9%) YoY

- Demand for motor gasoline amounted to 8.807 million bpd, up (4.5%) YoY

-

Distillates

- Distillate inventories decreased by -3.2 million in the week of February 9

- Total distillate inventories amounted to 127.6 million barrels, up 5.9% YoY

- Distillate production averaged 4.357 million bpd, down (6.6%) YoY

- Demand for distillates averaged 3.817 million bpd in the week, up 1.5% YoY

-

Natural Gas

- Natural gas inventories decreased by 75 billion cubic feet last week

- Total natural gas inventories now amount to 2,584 billion cubic feet, up 9.2% YoY

Credit News

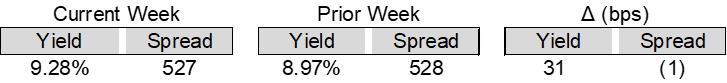

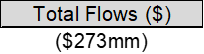

High yield bond yields increased 6bps to 7.75% and spreads decreased 23bps to 349bps. Leveraged loan yields increased 31bps to 9.28% and spreads decreased 1bps to 527bps. WTD Leveraged loan returns were positive 18bps. WTD high yield bond returns were negative 9bps. 10yr treasury yields were 12bps higher on week pushing the yield back above 4%. For the week, spreads and yields generally moved in different directions. Yields rose as markets priced in a less aggressive path of interest rate cuts due to stronger economic data. Spreads decreased as the ongoing solid economic data increased confidence the US economy will achieve a soft landing.

High-yield:

Week ended 02/09/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 02/09/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Enviva Partners ($750mn, 1/15/24, Mobileum ($538mm, 12/1/23) Ligado Networks ($4.2bn, 11/1/23), Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23)

CLOs:

Week ended 02/09/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index