U.S. News

- U.S. Leading Economic Indicators

- The Leading Economic Index dropped by 0.4%, but 6 of its 10 components had positive results over six months

- The Conference Board anticipates no recession, hinting at economic stabilization despite the LEI’s decline

- The Coincident Economic Index increased by 0.2%, indicating steady growth fueled by employment and income gains.

- Initial Jobless Claims

- Initial jobless claims in the U.S. dropped to a five-week low of 201,000 in mid-February, indicating a strong labor market

- The decrease was partly influenced by a significant drop in unemployment filings in California due to processing delays related to the President’s Day holiday

- Continuing claims for unemployment benefits in the U.S. decreased by 27,000 to 1.86 million, reaching a level comparable to pre pandemic.

- S&P Flash US Manufacturing PMI

- The flash U.S. manufacturing PMI reached a 17-month peak of 51.5 in February, supported by the strongest increase in new orders seen in over 18 months

- Supply chain pressures eased, leading to the best supplier performance in seven months

- Firms increased stocks, marking the first pre-production inventory growth since August 2022.

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 201,000 in the week ended February 16, down 12,000 from the prior week

- The four-week moving average was 215,250, down 3500 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – decreased by 27,000 to 1.862 million in the week ended February 9. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.582 trillion in the week ended February 23, down $52.2 billion from the prior week

- Treasury holdings totaled $4.661 trillion, down $31.1 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.42 trillion in the week, down $0.8 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.33 trillion as of February 23, an increase of 9.1% from the previous year

- Debt held by the public was $24.62 trillion, and intragovernmental holdings were $7.12 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.1% in January year over year

- On a monthly basis, the CPI increased 0.3% in January on a seasonally adjusted basis, after increasing 0.2% in December

- The index for all items less food and energy (core CPI) rose 0.4% in January, after rising 0.3% in December

- Core CPI increased 3.9% for the 12 months ending January

- Food and Beverages:

- The food at home index increased 1.2% in January from the same month a year earlier, and increased 0.4% in January month over month

- The food away from home index increased 5.1% in January from the same month a year earlier, and increased 0.5% in January month over month

- Commodities:

- The energy commodities index decreased (3.2%) in January after decreasing (0.7%)

- The energy commodities index fell (6.8%) over the last 12 months

- The energy services index 2.5% in January after increasing 0.4% in January

- The energy services index fell (2.0%) over the last 12 months

- The gasoline index fell (6.4%) over the last 12 months

- The fuel oil index fell (14.2%) over the last 12 months

- The index for electricity rose 3.8% over the last 12 months

- The index for natural gas fell (17.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $3,659.41 per 40ft container

- Drewry’s composite World Container Index has increased by 92.8% over the last 12 months

- Housing Market:

- The shelter index increased 0.6% in January after increasing 0.4% in January

- The rent index increased 0.6% in January after increasing 0.4% in January

- The index for lodging away from home increased 4.3% in January after decreasing (1.1%) in January

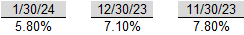

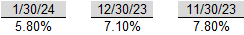

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Russia

- Alexei Navalny’s body has been handed over to his mother by Russian authorities following his death in an Arctic prison camp, after a period of uncertainty regarding the oversight of his burial

- Andrey Kostin, head of Russia’s VTB Bank, faces U.S. charges for allegedly violating sanctions through ownership of yachts and a sale of a Colorado mansion

- Western sanctions have not stopped Russia’s military actions in Ukraine, prompting new sanctions, including targeting entities in mainland China.

-

Israel

- CIA Director William Burns met with key international figures in Paris to discuss a ceasefire between Israel and Hamas

- The meeting aimed to negotiate a deal that would pause fighting in Gaza and secure the release of Israeli hostages in exchange for Palestinian prisoners

- More than 29,000 Palestinians have been killed since the beginning of the Israeli offensive, with the majority being women and children, according to Palestinian health authorities.

-

South Korea

- South Korean President Yoon Suk Yeol has targeted the “Korean discount” affecting the country’s stock market, leading to regulatory measures aimed at encouraging higher valuations, including a name-and-shame policy for undervalued companies

- Shares of Hyundai Motor and Kia have increased more than 30% in dollar terms since the president’s speech, with Hyundai trading at just 70% of net asset value (NAV)

- Hyundai is considering an initial public offering of its Indian business with a valuation of $30 billion, compared to its own market value of $48 billion.

-

China

- Wu Qing, the newly appointed head of the China Securities Regulatory Commission, held a two-day seminar with market participants to discuss policies for the capital market’s long-term development

- The seminar aimed to gather advice on addressing current market concerns and policy issues, with recommendations including stricter regulations for new equity offerings and improved supervision of listed companies

- China’s imports of copper ore and concentrate were over 20% higher in the last quarter compared to the first quarter of 2021, indicating solid demand growth driven by the electric vehicle and green power boom

- China’s iron ore imports reached a record of 1.18 billion metric tons in 2023, showcasing a surprisingly strong demand for steel in manufacturing and infrastructure, despite a significant downturn in the property sector.

-

Canada

- Lynx Air, a budget airline based in Calgary, is shutting down due to rising costs, unfavorable exchange rates, and competitive tension in the Canadian aviation market, ceasing operations from 12:01 am Mountain Time on Monday, 26 February

-

Japan

- Taiwanese chip giant TSMC officially opened an $8.6-billion chip plant in Japan to help assure global semiconductor supplies, marking a significant international investment by the company and aiming to strengthen the resilience of chip supply globally and in Japan

-

Argentina

- President Javier Milei of Argentina hosted U.S. Secretary of State Antony J. Blinken in Buenos Aires to discuss reshaping Argentina’s foreign policy in alignment with the United States, amidst economic challenges and the pursuit of stability

-

Argentina

- Argentina’s Chamber of Deputies on Friday approved in general terms a reform bill proposed by libertarian President Javier Milei to deregulate the economy, overcoming a hurdle for the sweeping initiative after three days of heated debate

-

Brazil

- Brazilian Federal Police seized the passport of former President Jair Bolsonaro and arrested four of his close allies as authorities narrowed in on the conservative and his aides over allegations that they plotted a military takeover as early as late-2022

-

Nicaragua

- Nicaragua’s authoritarian government, which has expelled religious leaders, political opponents and journalists, has granted asylum to a former Panamanian president convicted of money laundering, the third former leader from the region to find refuge in Managua

-

Sweden

- Hungarian Prime Minister Viktor Orban escalated a standoff with Western allies over Sweden’s NATO accession after a senior US lawmaker called for potential sanctions against the lone holdout

-

Ecuador

- Ecuador is at war with drug gangs, President Daniel Noboa said, as troops patrolled the country’s largest city, Guayaquil, a day after gunmen took over a TV studio and launched a series of attacks against the Andean nation’s new government

Commodities

-

Oil Prices

- WTI: $76.56 per barrel

- (3.32%) WoW; +6.85% YTD; +1.55% YoY

- Brent: $81.68 per barrel

- (2.14%) WoW; +6.02% YTD; (0.64%) YoY

-

US Production

- U.S. oil production amounted to 13.3 million bpd for the week ended February 16, down 0.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 626, up 5 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 443.0 million barrels, down (7.5%) YoY

- Refiners operated at a capacity utilization rate of 80.6% for the week, down from 80.6% in the prior week

- U.S. crude oil imports now amount to 6.470 million barrels per day, down 5.2% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.27 per gallon in the week of February 23,

down (3.5%) YoY

- Gasoline prices on the East Coast amounted to $3.34, down (1.7%) YoY

- Gasoline prices in the Midwest amounted to $3.20, down (2.9%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.99, down (3.2%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.05, down (22.8%) YoY

- Gasoline prices on the West Coast amounted to $4.19, down (2.9%) YoY

- Motor gasoline inventories were down by 0.3 million barrels from the prior week

- Motor gasoline inventories amounted to 247.0 million barrels, up 2.9% YoY

- Production of motor gasoline averaged 9.03 million bpd, down (4.2%) YoY

- Demand for motor gasoline amounted to 8.200 million bpd, down (8.0%) YoY

-

Distillates

- Distillate inventories decreased by -4.0 million in the week of February 23

- Total distillate inventories amounted to 121.7 million barrels, down (0.2%) YoY

- Distillate production averaged 4.171 million bpd, down (11.3%) YoY

- Demand for distillates averaged 3.940 million bpd in the week, up (4.5%) YoY

-

Natural Gas

- Natural gas inventories decreased by 60 billion cubic feet last week

- Total natural gas inventories now amount to 2,470 billion cubic feet, up 12.5% YoY

Credit News

High yield bond yields decreased 8bps to 7.79% and spreads decreased 16bps to 333bps. Leveraged loan yields increased 1bps to 9.48% and spreads decreased 5bps to 522bps. WTD Leveraged loan returns were positive 33bps. WTD high yield bond returns were positive 43bps. 10yr treasury yields increased 9bp to 4.33%. For the week, spreads and yields tightened due to resilient growth, earnings, and rapidly improving capital market access continue to support valuations.

High-yield:

Week ended 02/23/2024

- Yields & Spreads1

- Pricing & Returns1

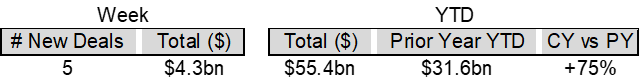

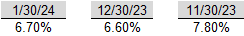

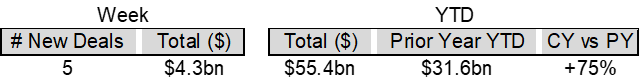

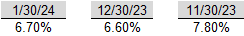

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 02/23/2024

- Yields & Spreads1

- Leveraged Loan Index1

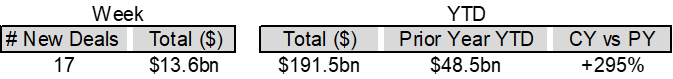

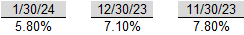

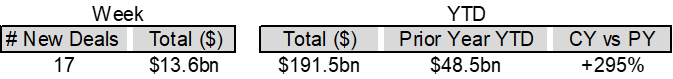

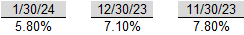

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Careismatic ($700mn, 1/22/24), Enviva Partners ($750mn, 1/15/24), Mobileum ($538mm, 12/1/23), Ligado Networks ($4.2bn, 11/1/23), Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23)

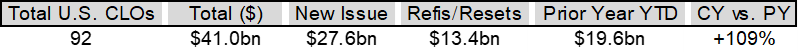

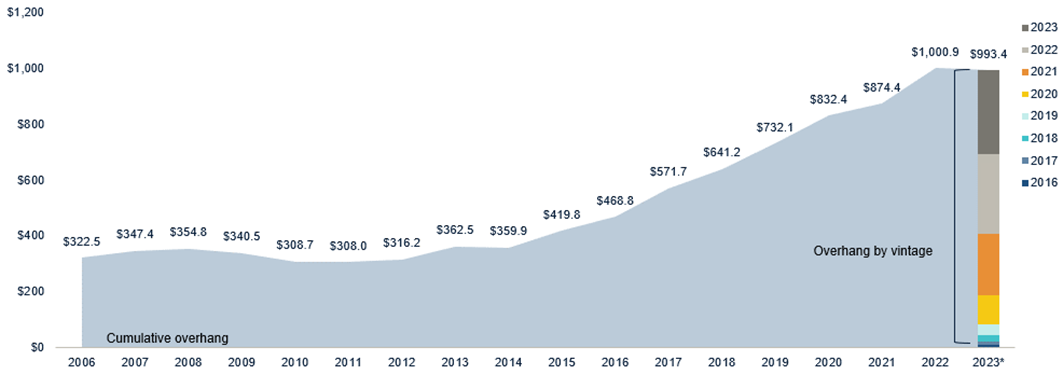

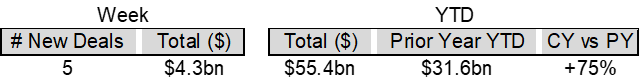

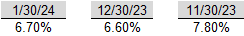

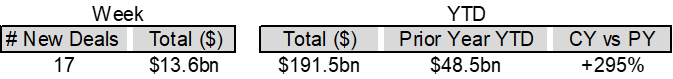

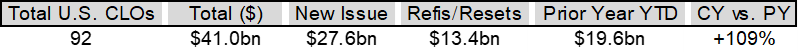

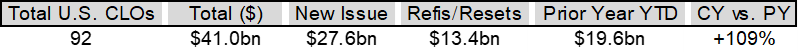

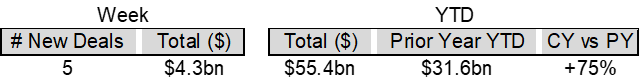

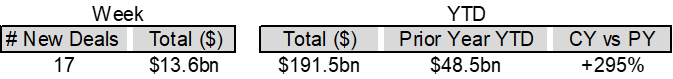

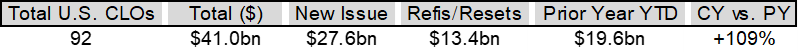

CLOs:

Week ended 02/23/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

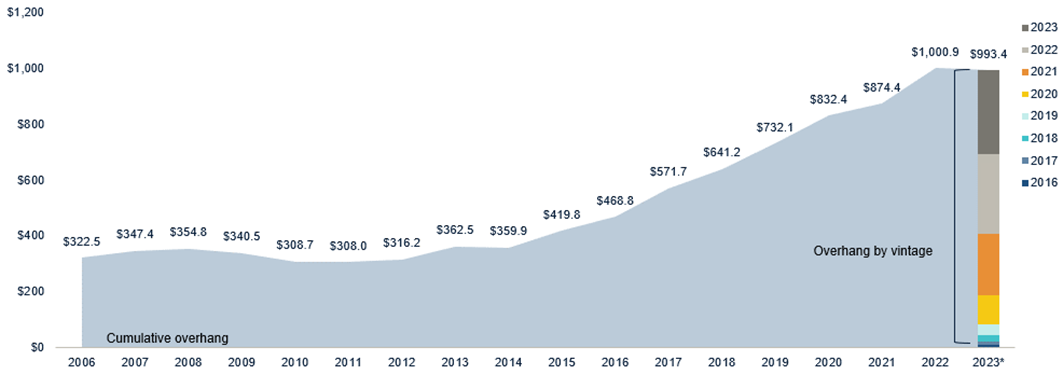

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

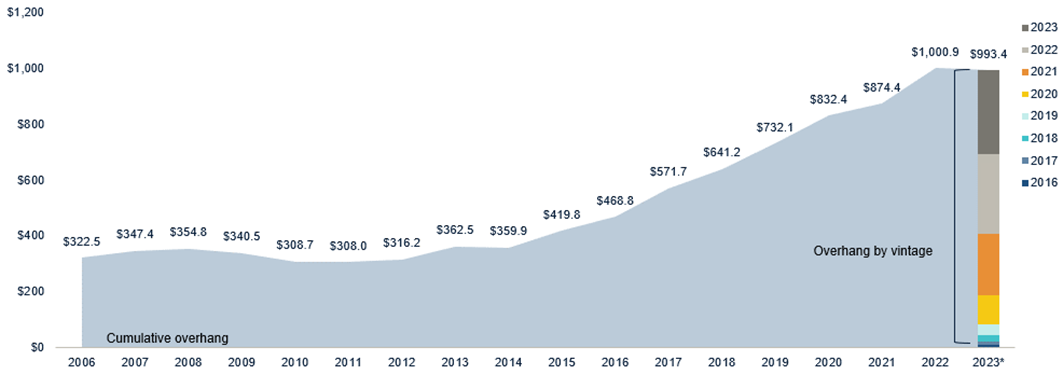

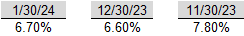

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

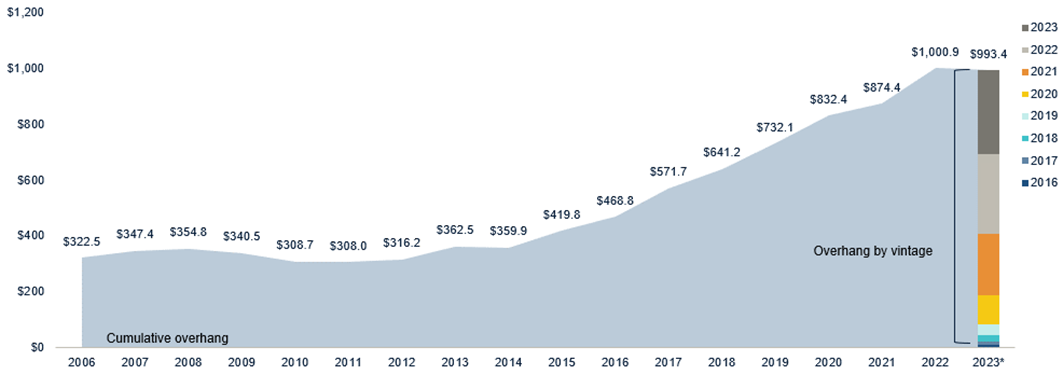

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Diagram V: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

Real Estate Views & Trends

- Related Companies filed plans with the City Planning Department on 2/20 with a three-tower project, including more than 1,500 apartments, a resort hotel, two million square feet of office space, a public school, a day care and the casino, on which Related is partnering with Wynn Resorts.

- The casino would span 2.7 million square feet on the north side of the lot, at the bottom of the tower, spanning five floors.

- The plans are among the final ones to emerge among the roughly dozen bidders for one of three downstate gaming licenses to be awarded by the state.

- Other contenders for the gaming licenses:

- Resorts World/Genting at Aqueduct in Queens

- Larry Silverstein in Midtown West

- Empire City/MGM at Yonkers

- SL Green, Caesars and Jay-Z in Times Square

- Vornado Realty Trust at Herald Square

- Soloviev Group in Midtown East

- Steve Cohen and Hard Rock in Flushing, Queens

- Thor and Saratoga Casino Holdings in Coney Island, Brooklyn

U.S. News

- U.S. Leading Economic Indicators

- The Leading Economic Index dropped by 0.4%, but 6 of its 10 components had positive results over six months

- The Conference Board anticipates no recession, hinting at economic stabilization despite the LEI’s decline

- The Coincident Economic Index increased by 0.2%, indicating steady growth fueled by employment and income gains.

- Initial Jobless Claims

- Initial jobless claims in the U.S. dropped to a five-week low of 201,000 in mid-February, indicating a strong labor market

- The decrease was partly influenced by a significant drop in unemployment filings in California due to processing delays related to the President’s Day holiday

- Continuing claims for unemployment benefits in the U.S. decreased by 27,000 to 1.86 million, reaching a level comparable to pre pandemic.

- S&P Flash US Manufacturing PMI

- The flash U.S. manufacturing PMI reached a 17-month peak of 51.5 in February, supported by the strongest increase in new orders seen in over 18 months

- Supply chain pressures eased, leading to the best supplier performance in seven months

- Firms increased stocks, marking the first pre-production inventory growth since August 2022.

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 201,000 in the week ended February 16, down 12,000 from the prior week

- The four-week moving average was 215,250, down 3500 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – decreased by 27,000 to 1.862 million in the week ended February 9. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.582 trillion in the week ended February 23, down $52.2 billion from the prior week

- Treasury holdings totaled $4.661 trillion, down $31.1 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.42 trillion in the week, down $0.8 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.33 trillion as of February 23, an increase of 9.1% from the previous year

- Debt held by the public was $24.62 trillion, and intragovernmental holdings were $7.12 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.1% in January year over year

- On a monthly basis, the CPI increased 0.3% in January on a seasonally adjusted basis, after increasing 0.2% in December

- The index for all items less food and energy (core CPI) rose 0.4% in January, after rising 0.3% in December

- Core CPI increased 3.9% for the 12 months ending January

- Food and Beverages:

- The food at home index increased 1.2% in January from the same month a year earlier, and increased 0.4% in January month over month

- The food away from home index increased 5.1% in January from the same month a year earlier, and increased 0.5% in January month over month

- Commodities:

- The energy commodities index decreased (3.2%) in January after decreasing (0.7%)

- The energy commodities index fell (6.8%) over the last 12 months

- The energy services index 2.5% in January after increasing 0.4% in January

- The energy services index fell (2.0%) over the last 12 months

- The gasoline index fell (6.4%) over the last 12 months

- The fuel oil index fell (14.2%) over the last 12 months

- The index for electricity rose 3.8% over the last 12 months

- The index for natural gas fell (17.8%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $3,659.41 per 40ft container

- Drewry’s composite World Container Index has increased by 92.8% over the last 12 months

- Housing Market:

- The shelter index increased 0.6% in January after increasing 0.4% in January

- The rent index increased 0.6% in January after increasing 0.4% in January

- The index for lodging away from home increased 4.3% in January after decreasing (1.1%) in January

- Fed Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Russia

- Alexei Navalny’s body has been handed over to his mother by Russian authorities following his death in an Arctic prison camp, after a period of uncertainty regarding the oversight of his burial

- Andrey Kostin, head of Russia’s VTB Bank, faces U.S. charges for allegedly violating sanctions through ownership of yachts and a sale of a Colorado mansion

- Western sanctions have not stopped Russia’s military actions in Ukraine, prompting new sanctions, including targeting entities in mainland China.

-

Israel

- CIA Director William Burns met with key international figures in Paris to discuss a ceasefire between Israel and Hamas

- The meeting aimed to negotiate a deal that would pause fighting in Gaza and secure the release of Israeli hostages in exchange for Palestinian prisoners

- More than 29,000 Palestinians have been killed since the beginning of the Israeli offensive, with the majority being women and children, according to Palestinian health authorities.

-

South Korea

- South Korean President Yoon Suk Yeol has targeted the “Korean discount” affecting the country’s stock market, leading to regulatory measures aimed at encouraging higher valuations, including a name-and-shame policy for undervalued companies

- Shares of Hyundai Motor and Kia have increased more than 30% in dollar terms since the president’s speech, with Hyundai trading at just 70% of net asset value (NAV)

- Hyundai is considering an initial public offering of its Indian business with a valuation of $30 billion, compared to its own market value of $48 billion.

-

China

- Wu Qing, the newly appointed head of the China Securities Regulatory Commission, held a two-day seminar with market participants to discuss policies for the capital market’s long-term development

- The seminar aimed to gather advice on addressing current market concerns and policy issues, with recommendations including stricter regulations for new equity offerings and improved supervision of listed companies

- China’s imports of copper ore and concentrate were over 20% higher in the last quarter compared to the first quarter of 2021, indicating solid demand growth driven by the electric vehicle and green power boom

- China’s iron ore imports reached a record of 1.18 billion metric tons in 2023, showcasing a surprisingly strong demand for steel in manufacturing and infrastructure, despite a significant downturn in the property sector.

-

Canada

- Lynx Air, a budget airline based in Calgary, is shutting down due to rising costs, unfavorable exchange rates, and competitive tension in the Canadian aviation market, ceasing operations from 12:01 am Mountain Time on Monday, 26 February

-

Japan

- Taiwanese chip giant TSMC officially opened an $8.6-billion chip plant in Japan to help assure global semiconductor supplies, marking a significant international investment by the company and aiming to strengthen the resilience of chip supply globally and in Japan

-

Argentina

- President Javier Milei of Argentina hosted U.S. Secretary of State Antony J. Blinken in Buenos Aires to discuss reshaping Argentina’s foreign policy in alignment with the United States, amidst economic challenges and the pursuit of stability

-

Argentina

- Argentina’s Chamber of Deputies on Friday approved in general terms a reform bill proposed by libertarian President Javier Milei to deregulate the economy, overcoming a hurdle for the sweeping initiative after three days of heated debate

-

Brazil

- Brazilian Federal Police seized the passport of former President Jair Bolsonaro and arrested four of his close allies as authorities narrowed in on the conservative and his aides over allegations that they plotted a military takeover as early as late-2022

-

Nicaragua

- Nicaragua’s authoritarian government, which has expelled religious leaders, political opponents and journalists, has granted asylum to a former Panamanian president convicted of money laundering, the third former leader from the region to find refuge in Managua

-

Sweden

- Hungarian Prime Minister Viktor Orban escalated a standoff with Western allies over Sweden’s NATO accession after a senior US lawmaker called for potential sanctions against the lone holdout

-

Ecuador

- Ecuador is at war with drug gangs, President Daniel Noboa said, as troops patrolled the country’s largest city, Guayaquil, a day after gunmen took over a TV studio and launched a series of attacks against the Andean nation’s new government

Commodities

-

Oil Prices

- WTI: $76.56 per barrel

- (3.32%) WoW; +6.85% YTD; +1.55% YoY

- Brent: $81.68 per barrel

- (2.14%) WoW; +6.02% YTD; (0.64%) YoY

-

US Production

- U.S. oil production amounted to 13.3 million bpd for the week ended February 16, down 0.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 626, up 5 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 443.0 million barrels, down (7.5%) YoY

- Refiners operated at a capacity utilization rate of 80.6% for the week, down from 80.6% in the prior week

- U.S. crude oil imports now amount to 6.470 million barrels per day, down 5.2% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.27 per gallon in the week of February 23,

down (3.5%) YoY

- Gasoline prices on the East Coast amounted to $3.34, down (1.7%) YoY

- Gasoline prices in the Midwest amounted to $3.20, down (2.9%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.99, down (3.2%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.05, down (22.8%) YoY

- Gasoline prices on the West Coast amounted to $4.19, down (2.9%) YoY

- Motor gasoline inventories were down by 0.3 million barrels from the prior week

- Motor gasoline inventories amounted to 247.0 million barrels, up 2.9% YoY

- Production of motor gasoline averaged 9.03 million bpd, down (4.2%) YoY

- Demand for motor gasoline amounted to 8.200 million bpd, down (8.0%) YoY

-

Distillates

- Distillate inventories decreased by -4.0 million in the week of February 23

- Total distillate inventories amounted to 121.7 million barrels, down (0.2%) YoY

- Distillate production averaged 4.171 million bpd, down (11.3%) YoY

- Demand for distillates averaged 3.940 million bpd in the week, up (4.5%) YoY

-

Natural Gas

- Natural gas inventories decreased by 60 billion cubic feet last week

- Total natural gas inventories now amount to 2,470 billion cubic feet, up 12.5% YoY

Credit News

High yield bond yields decreased 8bps to 7.79% and spreads decreased 16bps to 333bps. Leveraged loan yields increased 1bps to 9.48% and spreads decreased 5bps to 522bps. WTD Leveraged loan returns were positive 33bps. WTD high yield bond returns were positive 43bps. 10yr treasury yields increased 9bp to 4.33%. For the week, spreads and yields tightened due to resilient growth, earnings, and rapidly improving capital market access continue to support valuations.

High-yield:

Week ended 02/23/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 02/23/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Careismatic ($700mn, 1/22/24), Enviva Partners ($750mn, 1/15/24), Mobileum ($538mm, 12/1/23), Ligado Networks ($4.2bn, 11/1/23), Air Methods ($1.7bn, 10/24/23), WeWork ($1.6bn, 10/15/23), Rite Aid ($3.0bn 10/16/23)

CLOs:

Week ended 02/23/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: CAT Bonds – Cumulative Returns

Diagram V: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

Real Estate Views & Trends

- Related Companies filed plans with the City Planning Department on 2/20 with a three-tower project, including more than 1,500 apartments, a resort hotel, two million square feet of office space, a public school, a day care and the casino, on which Related is partnering with Wynn Resorts.

- The casino would span 2.7 million square feet on the north side of the lot, at the bottom of the tower, spanning five floors.

- The plans are among the final ones to emerge among the roughly dozen bidders for one of three downstate gaming licenses to be awarded by the state.

- Other contenders for the gaming licenses:

- Resorts World/Genting at Aqueduct in Queens

- Larry Silverstein in Midtown West

- Empire City/MGM at Yonkers

- SL Green, Caesars and Jay-Z in Times Square

- Vornado Realty Trust at Herald Square

- Soloviev Group in Midtown East

- Steve Cohen and Hard Rock in Flushing, Queens

- Thor and Saratoga Casino Holdings in Coney Island, Brooklyn